Key Insights

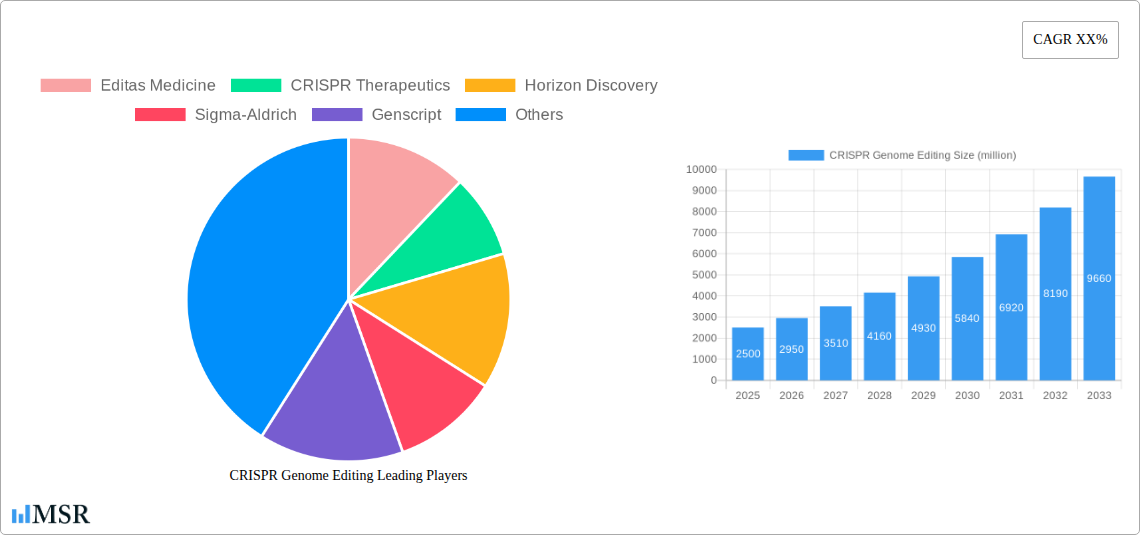

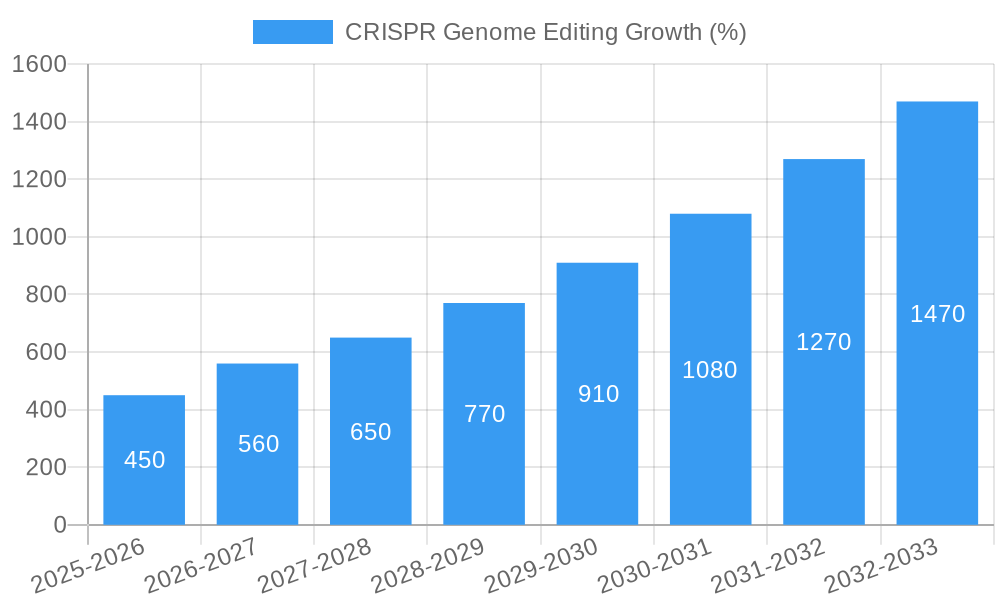

The CRISPR genome editing market is experiencing rapid growth, driven by advancements in gene editing technologies and their increasing application across diverse therapeutic areas. The market, estimated at $2.5 billion in 2025, is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033, reaching approximately $12 billion by 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of genetic disorders and the limitations of conventional treatments are creating a significant unmet medical need that CRISPR technology aims to address. Secondly, continuous technological advancements are enhancing the precision, efficiency, and safety of CRISPR-based therapies, leading to a growing number of clinical trials and regulatory approvals. The market is also benefiting from significant investments in research and development by both established pharmaceutical companies and emerging biotechnology firms.

Furthermore, the market's segmentation reflects its diverse applications. Therapeutic applications, particularly in oncology and hematological disorders, are currently dominating the market share. However, significant growth potential exists in agricultural biotechnology, where CRISPR is being employed to develop disease-resistant and high-yield crops. Challenges remain, however, including ethical concerns surrounding gene editing, potential off-target effects, and the high costs associated with developing and manufacturing CRISPR-based therapies. The regulatory landscape also plays a crucial role, with varying approval processes and timelines across different geographies impacting market growth. Despite these challenges, the continued investment and technological advancements suggest a strong trajectory for the CRISPR genome editing market in the coming years. The involvement of numerous key players such as Editas Medicine, CRISPR Therapeutics, and Intellia Therapeutics underscores the significant industry attention and competitive landscape.

CRISPR Genome Editing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the CRISPR genome editing market, projecting a market value exceeding $XX million by 2033. The study period covers 2019-2033, with 2025 serving as both the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is essential for industry stakeholders, investors, and researchers seeking a clear understanding of this rapidly evolving field.

CRISPR Genome Editing Market Concentration & Dynamics

The CRISPR genome editing market is characterized by a dynamic interplay of established players and emerging innovators. Market concentration is moderate, with a few key players holding significant market share, while numerous smaller companies contribute to innovation. The market share of the top 5 companies (estimated in 2025) is approximately 45%, indicating a moderately consolidated landscape. However, the high level of R&D activity and the frequent emergence of new technologies suggest that the market's dynamics are likely to change in the near future.

Innovation Ecosystems: Strong collaboration exists between academic institutions, research organizations, and commercial entities, fostering rapid innovation. This is driven by significant funding from both public and private sources, exceeding $XX million annually.

Regulatory Frameworks: Varying regulatory landscapes across different regions create both opportunities and challenges. Stricter regulations in some regions may lead to slower market penetration, while more lenient regulations can accelerate growth, but also pose some challenges in terms of safety concerns.

Substitute Products: Currently, limited viable substitutes exist for the precision offered by CRISPR technology, granting it a strong competitive edge. However, other gene editing technologies, like TALENs and ZFNs, remain potential competitors.

End-User Trends: The primary end-users are pharmaceutical companies, biotechnology firms, and academic research institutions, with a growing interest from agricultural biotech companies. The demand is growing, driven by the increased need for customized therapeutics.

M&A Activities: The number of M&A deals in the CRISPR genome editing space has increased significantly over the past few years. More than xx M&A deals (2019-2024) indicate a highly dynamic competitive landscape with major players consolidating their positions and acquiring promising technologies.

CRISPR Genome Editing Industry Insights & Trends

The CRISPR genome editing market is experiencing exponential growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). In 2025, the market size is estimated to be $XX million, poised to reach $XX million by 2033. This remarkable expansion is fueled by several factors. Technological advancements continue to refine the precision and efficiency of CRISPR technology. Advancements in delivery mechanisms, such as viral vectors, are simplifying its application. Furthermore, the growing understanding of gene-related diseases and the increasing demand for personalized medicine are driving substantial investments and market penetration. The rising prevalence of genetic disorders globally increases the market's potential to treat millions with life-threatening diseases. Consumer preferences are shifting towards targeted and personalized therapies, further augmenting market demand.

Key Markets & Segments Leading CRISPR Genome Editing

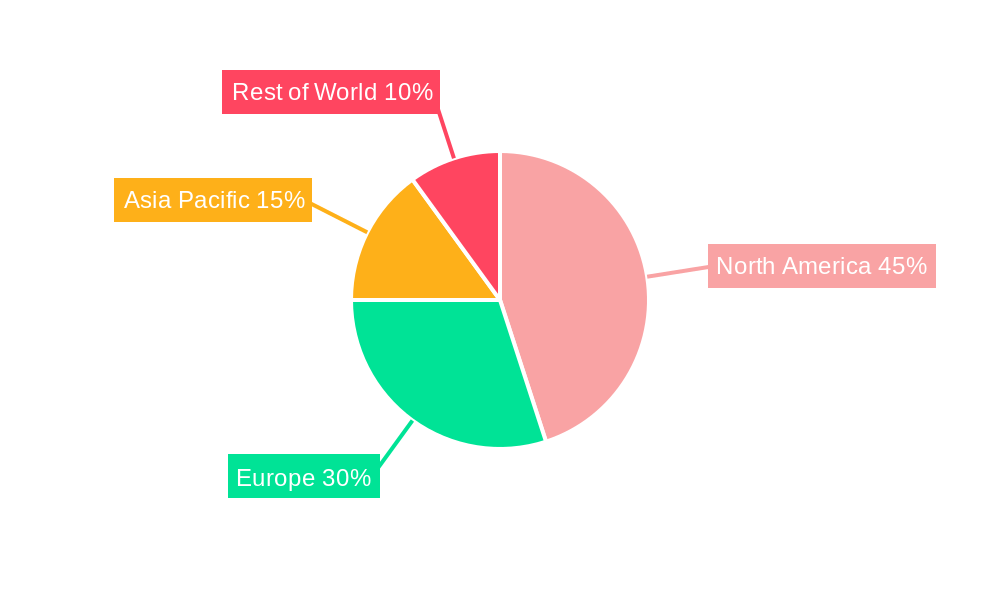

North America currently dominates the CRISPR genome editing market, holding the largest market share in 2025 at approximately xx%. This dominance is primarily due to:

- Robust funding for research and development: The US government, venture capitalists, and pharmaceutical companies invest significantly in CRISPR research.

- Presence of key players: Numerous leading CRISPR companies are headquartered in North America.

- Well-established regulatory framework: Although rigorous, the regulatory framework allows for a fairly efficient process for clinical trials and drug approvals.

- Strong Intellectual Property protection: A well established legal framework protects patents and intellectual properties.

Other key markets, including Europe and Asia, show promising growth potential, driven by increasing research activities and government initiatives. However, regulatory hurdles and varying levels of healthcare infrastructure pose challenges in several countries.

CRISPR Genome Editing Product Developments

Recent product innovations include improved CRISPR-Cas systems with enhanced specificity and efficiency, novel delivery methods, and multiplex editing tools. The applications span therapeutic areas, including oncology, hematology, and genetic disorders, expanding into agricultural biotechnology for improved crop yields and disease resistance. These advancements translate to improved treatment outcomes and competitiveness within the market.

Challenges in the CRISPR Genome Editing Market

The CRISPR genome editing market faces several significant challenges. Stringent regulatory approval processes can create delays and increase development costs. The cost of manufacturing and clinical trials for CRISPR-based therapies remains substantial, which acts as a barrier to accessibility. Supply chain disruptions impacting essential reagents and materials also affect production and cost efficiency. Finally, intense competition among numerous players with competing technologies creates pressure on prices and profitability.

Forces Driving CRISPR Genome Editing Growth

Several factors contribute to the significant growth trajectory of the CRISPR genome editing market. Technological advancements, like improved Cas enzymes and delivery systems, are enhancing both accuracy and efficiency. Growing investments from both public and private sources demonstrate a strong belief in the transformative potential of the technology. Favorable regulatory environments in several key markets also facilitate faster clinical trial processes and market entry. The increasing demand for personalized medicine, specifically tailored therapies, adds additional momentum to the market's growth.

Long-Term Growth Catalysts in CRISPR Genome Editing

Long-term growth is fueled by ongoing innovations in CRISPR technology itself, such as base editing and prime editing, which offer refined targeting and less off-target effects. Strategic partnerships between leading biotech and pharmaceutical companies are accelerating the translation of research findings into clinical applications. The expansion into new markets, particularly in developing countries with high rates of genetic diseases, presents substantial opportunities for future growth.

Emerging Opportunities in CRISPR Genome Editing

Emerging opportunities exist in the development of next-generation CRISPR tools with enhanced precision and reduced off-target effects. Expansion into novel therapeutic areas, such as regenerative medicine and infectious disease treatment, presents significant potential for growth. Increasing adoption of CRISPR technology in agricultural biotechnology for improving crop yields and disease resistance will significantly expand the market. Finally, advances in gene therapy delivery methods will improve the efficiency and effectiveness of CRISPR-based therapies.

Leading Players in the CRISPR Genome Editing Sector

- Editas Medicine

- CRISPR Therapeutics

- Horizon Discovery

- Sigma-Aldrich

- Genscript

- Sangamo Biosciences

- Lonza Group

- Integrated DNA Technologies

- New England Biolabs

- Origene Technologies

- Transposagen Biopharmaceuticals

- Thermo Fisher Scientific

- Caribou Biosciences

- Precision Biosciences

- Cellectis

- Intellia Therapeutics

Key Milestones in CRISPR Genome Editing Industry

- 2012: CRISPR-Cas9 system adapted for genome editing.

- 2013: First successful CRISPR-Cas9 gene editing in human cells reported.

- 2015: First clinical trial using CRISPR-Cas9 for cancer treatment initiated.

- 2016: Several companies launch dedicated CRISPR-based drug discovery and development programs.

- 2017: Significant funding rounds for several leading CRISPR companies.

- 2018: First successful in vivo CRISPR therapy demonstrated.

- 2019 - 2024: Numerous clinical trials initiated and various patents filed.

- 2025 (ongoing): Continued advancements in CRISPR technology and expansion into various applications.

Strategic Outlook for CRISPR Genome Editing Market

The CRISPR genome editing market holds immense future potential, driven by continuous technological advancements, expanding therapeutic applications, and increasing investment. Strategic partnerships and collaborations will play a crucial role in accelerating the translation of research discoveries into commercially successful therapies. The market is poised for substantial growth, with opportunities for both established players and emerging companies to shape its future trajectory. The long-term outlook remains extremely positive, anticipating substantial market expansion across various sectors, impacting healthcare, agriculture, and industrial applications.

CRISPR Genome Editing Segmentation

-

1. Application

- 1.1. Biotechnology Companies

- 1.2. Pharmaceutical Companies

- 1.3. Others

-

2. Types

- 2.1. Genetic Engineering

- 2.2. Gene Library

- 2.3. Human Stem Cells

- 2.4. Others

CRISPR Genome Editing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

CRISPR Genome Editing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CRISPR Genome Editing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biotechnology Companies

- 5.1.2. Pharmaceutical Companies

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Genetic Engineering

- 5.2.2. Gene Library

- 5.2.3. Human Stem Cells

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America CRISPR Genome Editing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biotechnology Companies

- 6.1.2. Pharmaceutical Companies

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Genetic Engineering

- 6.2.2. Gene Library

- 6.2.3. Human Stem Cells

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America CRISPR Genome Editing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biotechnology Companies

- 7.1.2. Pharmaceutical Companies

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Genetic Engineering

- 7.2.2. Gene Library

- 7.2.3. Human Stem Cells

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe CRISPR Genome Editing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biotechnology Companies

- 8.1.2. Pharmaceutical Companies

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Genetic Engineering

- 8.2.2. Gene Library

- 8.2.3. Human Stem Cells

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa CRISPR Genome Editing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biotechnology Companies

- 9.1.2. Pharmaceutical Companies

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Genetic Engineering

- 9.2.2. Gene Library

- 9.2.3. Human Stem Cells

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific CRISPR Genome Editing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biotechnology Companies

- 10.1.2. Pharmaceutical Companies

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Genetic Engineering

- 10.2.2. Gene Library

- 10.2.3. Human Stem Cells

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Editas Medicine

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CRISPR Therapeutics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Horizon Discovery

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sigma-Aldrich

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genscript

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sangamo Biosciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lonza Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Integrated DNA Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 New England Biolabs

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Origene Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Transposagen Biopharmaceuticals

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Thermo Fisher Scientific

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Caribou Biosciences

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Precision Biosciences

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Cellectis

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Intellia Therapeutics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Editas Medicine

List of Figures

- Figure 1: Global CRISPR Genome Editing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America CRISPR Genome Editing Revenue (million), by Application 2024 & 2032

- Figure 3: North America CRISPR Genome Editing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America CRISPR Genome Editing Revenue (million), by Types 2024 & 2032

- Figure 5: North America CRISPR Genome Editing Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America CRISPR Genome Editing Revenue (million), by Country 2024 & 2032

- Figure 7: North America CRISPR Genome Editing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America CRISPR Genome Editing Revenue (million), by Application 2024 & 2032

- Figure 9: South America CRISPR Genome Editing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America CRISPR Genome Editing Revenue (million), by Types 2024 & 2032

- Figure 11: South America CRISPR Genome Editing Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America CRISPR Genome Editing Revenue (million), by Country 2024 & 2032

- Figure 13: South America CRISPR Genome Editing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe CRISPR Genome Editing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe CRISPR Genome Editing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe CRISPR Genome Editing Revenue (million), by Types 2024 & 2032

- Figure 17: Europe CRISPR Genome Editing Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe CRISPR Genome Editing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe CRISPR Genome Editing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa CRISPR Genome Editing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa CRISPR Genome Editing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa CRISPR Genome Editing Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa CRISPR Genome Editing Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa CRISPR Genome Editing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa CRISPR Genome Editing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific CRISPR Genome Editing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific CRISPR Genome Editing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific CRISPR Genome Editing Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific CRISPR Genome Editing Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific CRISPR Genome Editing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific CRISPR Genome Editing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CRISPR Genome Editing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global CRISPR Genome Editing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global CRISPR Genome Editing Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global CRISPR Genome Editing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global CRISPR Genome Editing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global CRISPR Genome Editing Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global CRISPR Genome Editing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global CRISPR Genome Editing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global CRISPR Genome Editing Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global CRISPR Genome Editing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global CRISPR Genome Editing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global CRISPR Genome Editing Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global CRISPR Genome Editing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global CRISPR Genome Editing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global CRISPR Genome Editing Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global CRISPR Genome Editing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global CRISPR Genome Editing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global CRISPR Genome Editing Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global CRISPR Genome Editing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific CRISPR Genome Editing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CRISPR Genome Editing?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the CRISPR Genome Editing?

Key companies in the market include Editas Medicine, CRISPR Therapeutics, Horizon Discovery, Sigma-Aldrich, Genscript, Sangamo Biosciences, Lonza Group, Integrated DNA Technologies, New England Biolabs, Origene Technologies, Transposagen Biopharmaceuticals, Thermo Fisher Scientific, Caribou Biosciences, Precision Biosciences, Cellectis, Intellia Therapeutics.

3. What are the main segments of the CRISPR Genome Editing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CRISPR Genome Editing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CRISPR Genome Editing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CRISPR Genome Editing?

To stay informed about further developments, trends, and reports in the CRISPR Genome Editing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence