Key Insights

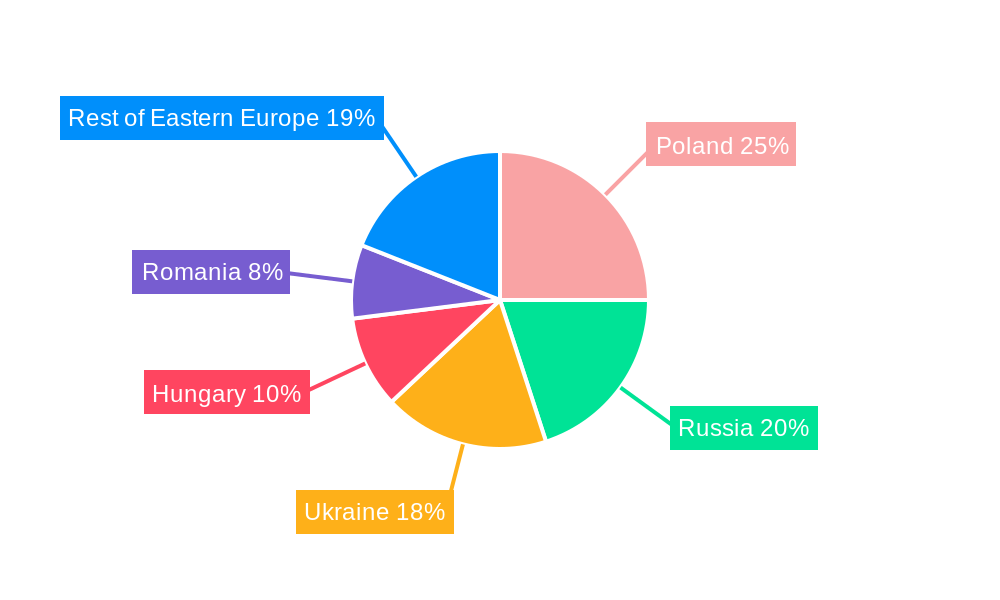

The Eastern European defense market, valued at $3.93 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions and increasing defense budgets across the region. A Compound Annual Growth Rate (CAGR) exceeding 3.91% from 2025 to 2033 indicates a significant expansion of this market. Key drivers include modernization of armed forces, particularly within nations like Poland and Ukraine (impacted significantly by the ongoing conflict), and a heightened focus on cybersecurity and counter-terrorism measures. The market is segmented by type (personnel training and protection, communication systems, weapons and ammunition, vehicles) and by country (Poland, Russia, Hungary, Romania, and the Rest of Eastern Europe). Poland and Ukraine are expected to be the largest contributors to market growth due to their significant investments in military capabilities. Russia, despite facing economic sanctions, will continue to be a significant player, although growth will likely be constrained. The segment for weapons and ammunition will likely be the largest in terms of revenue, driven by continued procurement of advanced weaponry and modernization programs.

Competition in the Eastern European defense market is intense, with major global players like Thales, Rheinmetall AG, Lockheed Martin, Rostec, and General Dynamics competing alongside regional players. While technological advancements and innovation in defense technologies will continue to shape the market, constraints such as budgetary limitations in certain countries and potential disruptions to supply chains may pose challenges to sustained growth. The market is also expected to see an increase in demand for unmanned aerial vehicles (UAVs), cyber warfare capabilities, and advanced surveillance systems. The long-term outlook for the Eastern European defense market remains positive, fueled by ongoing geopolitical instability and a determination by many nations to strengthen their defensive capabilities. The market's evolution will likely be influenced by evolving geopolitical landscapes, the impacts of sanctions and other geopolitical actions, and collaborative efforts within the region.

Eastern Europe Defense Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Eastern Europe defense market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. It delves into market dynamics, key segments, leading players, and emerging opportunities, offering actionable intelligence to navigate this complex and evolving landscape.

Eastern Europe Defense Market Market Concentration & Dynamics

The Eastern European defense market presents a dynamic and complex landscape shaped by a multitude of interacting factors. While Russia maintains a substantial market share due to its extensive domestic defense industry and significant defense expenditure, the market is experiencing increasing fragmentation. This is driven by the rise of other regional players and a notable surge in foreign investment. Market concentration remains moderate, with a few dominant players like Rostec wielding considerable influence alongside a substantial number of smaller, specialized companies. This creates a competitive environment with opportunities for both established and emerging players.

- Market Share: Russia commands the largest market share, estimated at [Insert precise percentage]%, followed by Poland at [Insert precise percentage]%, with the remaining [Insert precise percentage]% distributed among other nations. These figures reflect the ongoing shifts in regional power dynamics and defense priorities.

- Innovation Ecosystems: The region exhibits a diverse innovation landscape. Russia possesses well-established defense industrial complexes, while countries like Poland are actively cultivating innovation through strategic collaborations and targeted investments in cutting-edge technologies. This fosters a competitive environment driving technological advancements.

- Regulatory Frameworks: National regulatory frameworks vary significantly across Eastern European countries, reflecting differing levels of government involvement and oversight in defense procurement. This creates a complex regulatory environment that companies must navigate.

- Substitute Products: The specialized nature of defense products limits the availability of direct substitutes. However, cost-effective solutions and technological advancements are influencing market dynamics, creating pressure for efficiency and innovation.

- End-User Trends: A clear trend toward modernization and technological enhancement is evident across the region. This is characterized by a strong focus on bolstering cybersecurity capabilities and developing advanced asymmetric warfare technologies.

- M&A Activities: Merger and acquisition (M&A) activity within the Eastern European defense sector, while relatively moderate, demonstrates a clear upward trajectory. This is fueled by increasing foreign investment and a trend toward sector consolidation, with an estimated [Insert precise number] deals concluded in the last five years.

Eastern Europe Defense Market Industry Insights & Trends

The Eastern European defense market is experiencing significant growth fueled by geopolitical instability, rising defense budgets, and modernization initiatives. The market size in 2025 is estimated at USD xx Billion, projected to reach USD xx Billion by 2033 with a CAGR of xx%. Several factors contribute to this growth:

- Geopolitical Instability: Increased tensions and conflicts in the region have triggered substantial defense spending increases across various countries.

- Modernization Initiatives: Many Eastern European nations are actively upgrading their military capabilities, resulting in increased demand for advanced defense technologies and systems.

- Technological Disruptions: The integration of AI, unmanned systems, and cyber warfare capabilities is transforming the defense landscape, pushing innovation and market expansion.

- Evolving Consumer Behaviors: National governments are increasingly prioritizing the acquisition of cutting-edge technology to achieve operational advantage, leading to a shift in demand.

Key Markets & Segments Leading Eastern Europe Defense Market

By Country:

- Russia: Remains the dominant market, driven by its substantial defense budget and robust indigenous defense industry. However, its influence is increasingly challenged by other nations' growing capabilities and investments.

- Poland: Experiencing significant growth fueled by enhanced NATO commitments and substantial investments in military modernization. This reflects Poland's strategic importance within the region.

- Romania: Shows strong growth, exemplified by increased investment in modernizing its air defense capabilities, as highlighted by the recent Rheinmetall contract. This demonstrates a commitment to strengthening national security.

- Hungary: Exhibits moderate growth, largely focused on meeting its specific national defense requirements.

- Rest of Eastern Europe: This segment encompasses a developing market characterized by varying levels of defense spending, reflecting diverse national priorities and security concerns.

By Type:

- Weapons and Ammunition: This segment currently holds a leading position, driven by significant demand for modernized artillery and missile systems. Recent large-scale contracts, such as Poland's USD 2.75 Billion agreement, underscore this market's strength.

- Vehicles: A substantial market driven by the ongoing need for armored vehicles and advanced transportation systems capable of meeting modern battlefield demands.

- Communication Systems: Experiences consistent growth as countries prioritize securing their communication infrastructure and enhancing their command and control capabilities.

- Personnel Training and Protection: This segment shows steady growth, driven by modernization initiatives and advancements in training technologies and protective equipment designed to enhance military readiness.

Key Market Drivers:

- Increased defense budgets across the region

- Heightened geopolitical instability and regional security concerns

- Comprehensive military modernization programs aiming to enhance capabilities

- Rapid technological advancements in defense technologies

- Strategic partnerships and collaborations fostering technological exchange and capacity building

Eastern Europe Defense Market Product Developments

The Eastern European defense market is witnessing notable advancements in various product categories. There's a strong focus on developing and integrating advanced technologies, such as AI-powered systems, unmanned aerial vehicles (UAVs), and cyber defense capabilities. This focus on technological superiority aims to enhance operational effectiveness and counter emerging threats. These innovations are creating new opportunities for market players who can effectively leverage and integrate these advanced technologies into their offerings, giving them a strong competitive advantage.

Challenges in the Eastern Europe Defense Market Market

The Eastern European defense market faces a number of significant challenges. These include regulatory hurdles within procurement processes, vulnerabilities within the supply chain, and intense competition from international defense companies. Sanctions and export controls also pose a significant impediment, restricting the availability of certain technologies and equipment, potentially impacting annual market growth by an estimated [Insert precise percentage]%. Overcoming these challenges requires adaptability and strategic planning.

Forces Driving Eastern Europe Defense Market Growth

Several factors are driving the growth of the Eastern European defense market. Increased geopolitical instability, rising defense budgets (particularly in countries like Poland and Romania), and the modernization of national defense forces significantly boost demand. Technological advancements in areas such as AI and cyber warfare also fuel continuous investment and development.

Long-Term Growth Catalysts in the Eastern Europe Defense Market

Long-term growth will be driven by the continued implementation of large-scale modernization programs across the region. Strategic partnerships between Eastern European countries and leading global defense contractors will foster technology transfer and capability building. Continued investment in R&D and innovation will create new opportunities for growth and expansion.

Emerging Opportunities in Eastern Europe Defense Market

Emerging opportunities lie in providing cyber security solutions, integrating AI and machine learning into defense systems, and developing advanced UAV technology. The growing focus on interoperability amongst allied forces creates significant demand for standardized systems and collaborative technologies. Regional collaboration in the defense industry offers potential for new partnerships and market expansions.

Leading Players in the Eastern Europe Defense Market Sector

- THALES

- Rheinmetall AG

- Lockheed Martin Corporation

- Rostec

- General Dynamics Corporation

- Airbus SE

- RTX Corporation

- BAE Systems plc

- United Shipbuilding Corporation

- Northrop Grumman Corporation

- MESKO

Key Milestones in Eastern Europe Defense Market Industry

- December 2023: The PGZ-Amunicja Consortium (Poland) signed a USD 2.75 Billion contract for 300,000 155-mm artillery ammunition units, representing a major boost for the ammunition segment and highlighting Poland's commitment to strengthening its defense capabilities.

- December 2023: Romania awarded a USD 350 Million contract to Rheinmetall for the modernization of its Oerlikon GDF 103 air defense systems, underscoring its dedication to enhancing its air defense capabilities and national security.

Strategic Outlook for Eastern Europe Defense Market Market

The Eastern European defense market possesses substantial long-term growth potential. The continued presence of geopolitical uncertainties, sustained increases in defense spending, and ongoing technological advancements will collectively drive market expansion. Strategic partnerships and collaborations will play a pivotal role in shaping the future of the regional defense landscape. Companies demonstrating a strong focus on innovation, adaptability, and a deep understanding of the regional dynamics are best positioned to capitalize on the numerous opportunities presented by this dynamic and evolving market.

Eastern Europe Defense Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Eastern Europe Defense Market Segmentation By Geography

-

1. Eastern Europe

- 1.1. Poland

- 1.2. Czech Republic

- 1.3. Hungary

- 1.4. Romania

- 1.5. Bulgaria

- 1.6. Slovakia

- 1.7. Ukraine

- 1.8. Serbia

- 1.9. Croatia

Eastern Europe Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Vehicles Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 7. France Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Eastern Europe Defense Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 THALES

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rheinmetall AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lockheed Martin Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rostec

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 General Dynamics Corporatio

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Airbus SE

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 RTX Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BAE Systems plc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 United Shipbuilding Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Northrop Grumman Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 MESKO

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 THALES

List of Figures

- Figure 1: Eastern Europe Defense Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Eastern Europe Defense Market Share (%) by Company 2024

List of Tables

- Table 1: Eastern Europe Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Eastern Europe Defense Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Eastern Europe Defense Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Eastern Europe Defense Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Eastern Europe Defense Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Eastern Europe Defense Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Eastern Europe Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Eastern Europe Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Eastern Europe Defense Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Eastern Europe Defense Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Eastern Europe Defense Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Eastern Europe Defense Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Eastern Europe Defense Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Eastern Europe Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Poland Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Czech Republic Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Hungary Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Romania Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Bulgaria Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Slovakia Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Ukraine Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Serbia Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Croatia Eastern Europe Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eastern Europe Defense Market?

The projected CAGR is approximately > 3.91%.

2. Which companies are prominent players in the Eastern Europe Defense Market?

Key companies in the market include THALES, Rheinmetall AG, Lockheed Martin Corporation, Rostec, General Dynamics Corporatio, Airbus SE, RTX Corporation, BAE Systems plc, United Shipbuilding Corporation, Northrop Grumman Corporation, MESKO.

3. What are the main segments of the Eastern Europe Defense Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.93 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Vehicles Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

December 2023: PGZ-Amunicja Consortium (Poland's state-owned group) and the Armament Agency signed an agreement for 300,000 155-mm artillery ammunition units as part of the National Ammunition Reserve initiative. This particular contract stood out historically due to its substantial order size and estimated worth of close to PLN 11 billion (USD 2.75 billion). The scheduled delivery of ammunition is set to occur between 2024 and 2029.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eastern Europe Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eastern Europe Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eastern Europe Defense Market?

To stay informed about further developments, trends, and reports in the Eastern Europe Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence