Key Insights

The French aviation industry, encompassing commercial, general, and helicopter manufacturing, presents a dynamic market. With a Compound Annual Growth Rate (CAGR) of 1.96% from 2025 to 2033, the market is projected to reach 6.57 billion by 2033. France's robust aerospace engineering and its significant role in the European Union are key drivers. Growth is fueled by rising air travel demand, government support for sustainable aviation, and infrastructure enhancements. Major French aerospace companies, including Dassault Aviation and Airbus SE, are pivotal to domestic and international market trends. However, potential challenges such as fluctuating fuel prices, global economic instability, and stringent environmental regulations may influence growth trajectories. The "Other" aviation segment, likely including Maintenance, Repair, and Overhaul (MRO) services, air traffic management, and support industries, is anticipated to experience robust expansion due to its resilience against direct passenger volume fluctuations. A detailed segmentation analysis is crucial for a comprehensive market understanding.

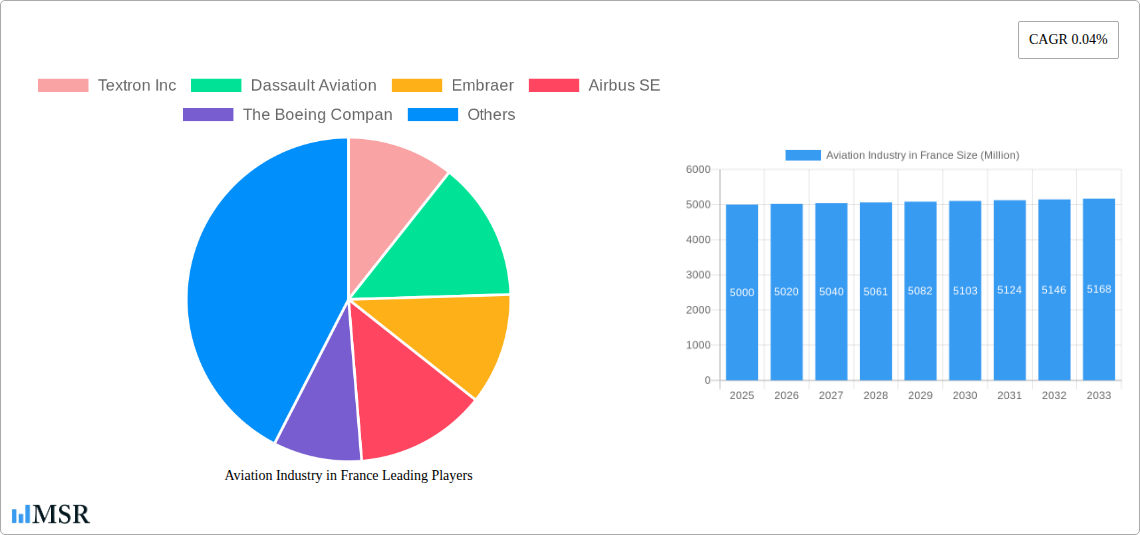

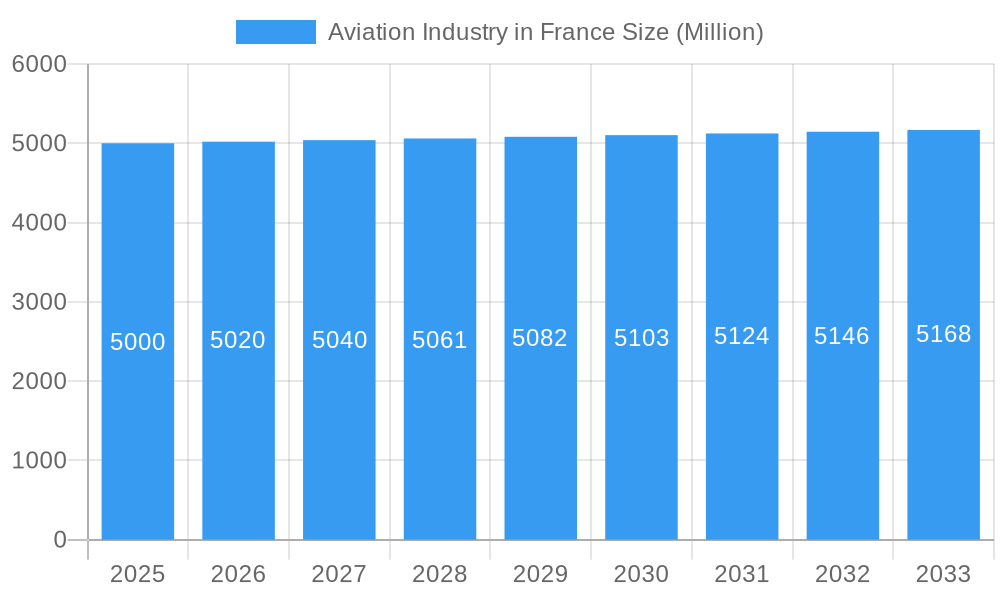

Aviation Industry in France Market Size (In Billion)

The forecast period of 2025-2033 anticipates steady market value increase, influenced by leading companies like Airbus and a strong emphasis on technological innovation. Advancements such as electric and hybrid-electric aircraft are expected to gain traction, particularly in general aviation. The competitive environment, featuring both domestic and international players, fosters continuous innovation and potential consolidation through mergers and acquisitions. While this analysis focuses on France, its deep integration into the European aviation network underscores the industry's interconnectedness. Future projections must account for external influences like global supply chain disruptions and geopolitical events.

Aviation Industry in France Company Market Share

Aviation Industry in France: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Aviation Industry in France, covering market dynamics, key segments, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and policymakers. The report utilizes data from 2019-2024 as the historical period and projects trends to 2033, encompassing crucial market aspects such as market concentration, technological advancements, and emerging opportunities. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period.

Aviation Industry in France Market Concentration & Dynamics

The French aviation market exhibits a concentrated landscape, with key players like Airbus SE holding significant market share. The innovative ecosystem is robust, driven by government initiatives promoting aerospace research and development. Stringent regulatory frameworks, aligned with EU aviation regulations, ensure safety and operational efficiency. Substitute products, such as high-speed rail, pose a challenge, particularly for short-haul flights. End-user trends lean towards increased demand for sustainable aviation practices and enhanced passenger experience. Mergers and acquisitions (M&A) activities have been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Share: Airbus SE holds a dominant market share of approximately xx%, followed by Dassault Aviation with xx%.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024, mostly involving smaller companies.

- Regulatory Framework: Stringent safety regulations and environmental standards govern the market.

- Substitute Products: High-speed rail competes with short-haul air travel.

Aviation Industry in France Industry Insights & Trends

The French aviation industry is driven by factors such as increasing passenger traffic, growth in tourism, and government investments in airport infrastructure. Technological advancements, such as the adoption of more fuel-efficient aircraft and improved air traffic management systems, are reshaping the industry. Evolving consumer behavior favors enhanced in-flight connectivity and personalized travel experiences. The market size is estimated at xx Million in 2025, expected to grow to xx Million by 2033, driven primarily by increasing demand for air travel and continuous innovation.

Key Markets & Segments Leading Aviation Industry in France

The commercial aviation segment dominates the French aviation market, driven by strong domestic and international passenger traffic. Growth is further fueled by the expanding tourism sector and increased business travel. The “Others” segment includes general aviation, maintenance, repair, and overhaul (MRO), and aviation training.

- Commercial Aviation:

- Drivers: Growing passenger traffic, tourism boom, expansion of airport infrastructure, government initiatives to enhance connectivity.

- Others:

- Drivers: Increasing demand for specialized services, growth in maintenance and repair needs, technological advancements in training.

France's strategic location in Europe and its established aviation infrastructure contribute significantly to the dominance of this segment.

Aviation Industry in France Product Developments

Recent product innovations focus on fuel efficiency, reduced emissions, and enhanced passenger comfort. Technological advancements include the integration of advanced materials, improved aerodynamics, and the incorporation of advanced avionics. These innovations provide competitive advantages and cater to the growing demand for sustainable and technologically advanced aircraft.

Challenges in the Aviation Industry in France Market

The French aviation industry faces challenges such as high operating costs, increased competition, and the need to comply with stringent environmental regulations. Supply chain disruptions and labor shortages can further impact operational efficiency. These factors can cumulatively reduce profitability, necessitating strategic adaptations for sustained growth. The industry is striving to balance sustainability goals with economic viability in the face of increasing fuel prices.

Forces Driving Aviation Industry in France Growth

Key growth drivers include technological advancements in aircraft design and manufacturing, economic growth leading to increased disposable income and travel, and supportive government policies that promote the aviation sector. These factors collectively contribute to a positive outlook for the French aviation industry, with significant growth potential in the coming years.

Long-Term Growth Catalysts in the Aviation Industry in France

Long-term growth hinges on continued innovation in sustainable aviation technologies, strategic partnerships between industry players and research institutions, and expansion into new markets both domestically and internationally. Investment in advanced training programs and skilled labor force development will also contribute substantially.

Emerging Opportunities in Aviation Industry in France

Emerging opportunities lie in the development and adoption of sustainable aviation fuels (SAFs), advancements in unmanned aerial vehicles (UAVs), and the expansion of air cargo services. The increasing demand for air travel coupled with technological advancements presents a favorable environment for growth in these areas.

Leading Players in the Aviation Industry in France Sector

Key Milestones in Aviation Industry in France Industry

- June 2023: Airbus Flight Academy Europe signed an MoU with AURA AERO, boosting training capabilities.

- December 2022: Textron Inc.'s Bell unit secured a US Army contract for next-generation helicopters, potentially impacting future sales and technology transfer.

- November 2022: Bell Textron Inc. sold 10 Bell 505 helicopters to the Royal Jordanian Air Force, showcasing international market penetration.

Strategic Outlook for Aviation Industry in France Market

The French aviation market exhibits promising growth potential, driven by strong domestic and international demand, technological innovations, and supportive government policies. Strategic opportunities exist in embracing sustainable aviation practices, expanding into new market segments, and fostering collaborative partnerships to drive innovation and enhance competitiveness on a global scale. The market is well-positioned for continued expansion in the coming years.

Aviation Industry in France Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Aviation Industry in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in France Regional Market Share

Geographic Coverage of Aviation Industry in France

Aviation Industry in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in France Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in France Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in France Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in France Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in France Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in France Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Embraer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Robinson Helicopter Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pilatus Aircraft Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leonardo S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Aviation Industry in France Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aviation Industry in France Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 3: North America Aviation Industry in France Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Aviation Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Aviation Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aviation Industry in France Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 7: South America Aviation Industry in France Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: South America Aviation Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Aviation Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aviation Industry in France Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 11: Europe Aviation Industry in France Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Aviation Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aviation Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aviation Industry in France Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa Aviation Industry in France Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa Aviation Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aviation Industry in France Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aviation Industry in France Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific Aviation Industry in France Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific Aviation Industry in France Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Aviation Industry in France Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Industry in France Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Aviation Industry in France Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Industry in France Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aviation Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Aviation Industry in France Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 9: Global Aviation Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Aviation Industry in France Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aviation Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Industry in France Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Aviation Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Aviation Industry in France Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Aviation Industry in France Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aviation Industry in France Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in France?

The projected CAGR is approximately 1.96%.

2. Which companies are prominent players in the Aviation Industry in France?

Key companies in the market include Textron Inc, Dassault Aviation, Embraer, Airbus SE, The Boeing Compan, Robinson Helicopter Company Inc, Pilatus Aircraft Ltd, Leonardo S p A, Bombardier Inc.

3. What are the main segments of the Aviation Industry in France?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.57 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Airbus Flight Academy Europe, a subsidiary of Airbus that supplies training services for the pilots and civilian cadets of the French Armed Forces, signed a memorandum of understanding (MoU) with AURA AERO.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.November 2022: Bell Textron Inc., a company of Textron Inc., forged an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF) at the Forces Exhibition and Conference. Combat Air Force (SOFEX) in Aqaba, Jordan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in France?

To stay informed about further developments, trends, and reports in the Aviation Industry in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence