Key Insights

The global Non-Aeronautical market is projected for substantial growth, reaching an estimated market size of 9.17 billion by 2025. This expansion is driven by a significant Compound Annual Growth Rate (CAGR) of 14.75%, fueled by evolving passenger expectations for enhanced airport experiences and the strategic imperative for airports to diversify revenue streams. Key growth factors include a robust travel sector, rising global disposable incomes, and continuous airport infrastructure development to accommodate increasing passenger volumes. Passengers are prioritizing convenience and comfort, leading to increased investment in retail, food and beverage, and premium lounge services. Digital transformation within airports, including seamless baggage handling and advanced passenger processing, further enhances operational efficiency and revenue generation. The "Other Services" segment, encompassing hospitality, car rentals, business lounges, and experiential retail, is anticipated to experience particularly strong growth as airports evolve into comprehensive travel and lifestyle hubs.

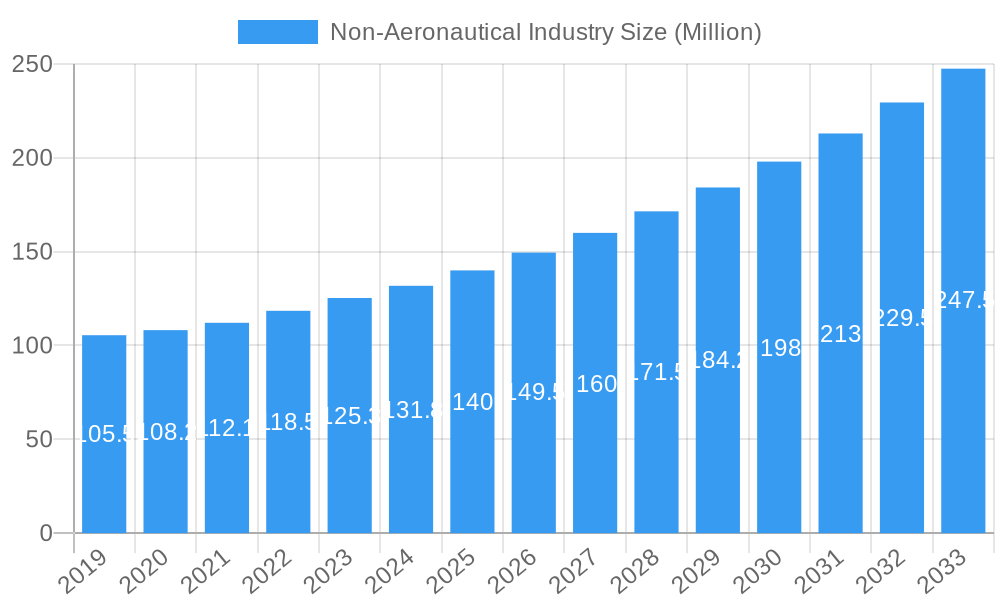

Non-Aeronautical Industry Market Size (In Billion)

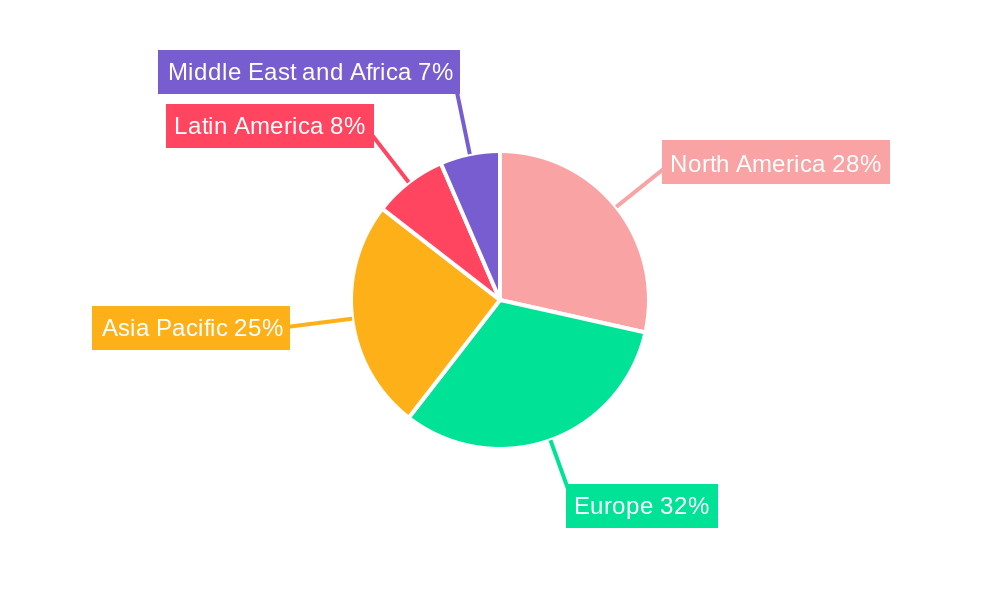

Market trends include the integration of technology for personalized passenger services, growing demand for sustainable retail options, and strategic brand partnerships. However, the industry faces challenges such as stringent regulatory frameworks and the need for substantial capital investment in infrastructure and amenity upgrades. Geographically, the Asia Pacific region, driven by rapid economic development and a growing middle class, is expected to be a major growth engine. North America and Europe, with mature aviation markets, will remain significant contributors. The Middle East and Africa present considerable untapped potential due to ambitious tourism development projects. Key players like Airports de Paris SA (GROUPE ADP), AENA SME SA, and London Heathrow Airports Limited are actively investing in these regions to capitalize on non-aeronautical revenue opportunities.

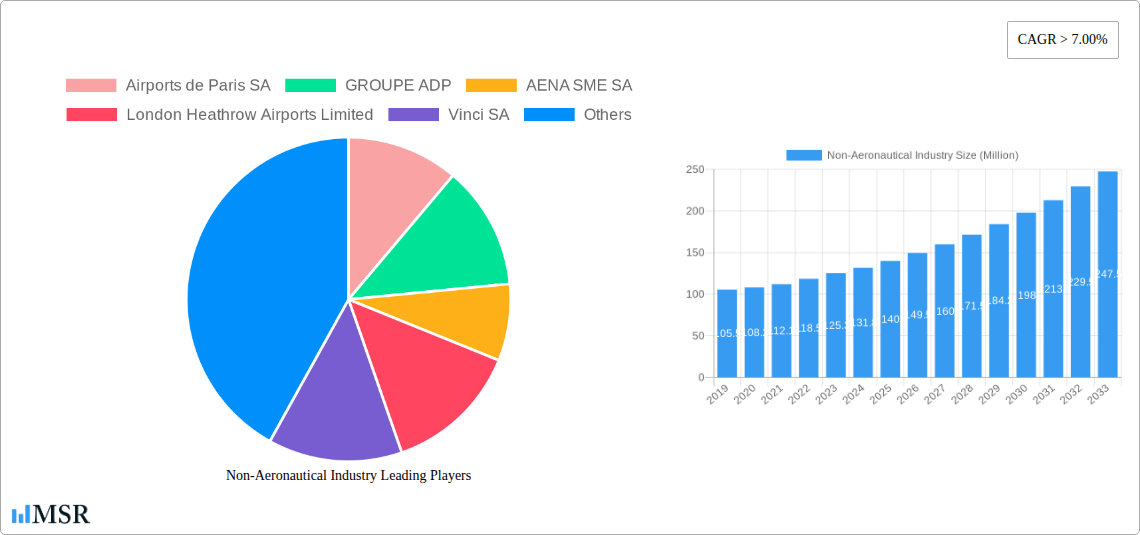

Non-Aeronautical Industry Company Market Share

This report provides comprehensive analysis of the Non-Aeronautical market, examining services, trends, and opportunities from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, it offers critical insights into market dynamics and growth drivers. The analysis includes historical data from 2019-2024, covering key segments such as Food Services, Car Rentals, Baggage Handling Systems, and Other Services, alongside crucial industry developments.

Non-Aeronautical Industry Market Concentration & Dynamics

The global non-aeronautical industry exhibits moderate to high market concentration, driven by significant capital investment requirements and economies of scale inherent in airport operations. Leading entities like Airports de Paris SA (GROUPE ADP), AENA SME SA, and London Heathrow Airports Limited command substantial market shares, fostering intricate innovation ecosystems. Regulatory frameworks, encompassing airport concessions and consumer protection, significantly influence market entry and operational strategies. Substitute products, such as off-site retail and transportation alternatives, present a constant competitive challenge, necessitating continuous innovation in airport offerings. End-user trends, particularly the demand for seamless passenger experiences and digitally integrated services, are reshaping market strategies. Merger and acquisition (M&A) activities are notable, with approximately 30 major deals projected within the forecast period (2025-2033), aiming to consolidate market presence and expand service portfolios. These M&A activities are crucial for achieving optimal market share, estimated to see key players holding over 60% of the total market value by 2033.

Non-Aeronautical Industry Industry Insights & Trends

The non-aeronautical industry is poised for substantial growth, driven by increasing global air passenger traffic and the strategic imperative for airports to diversify revenue streams beyond traditional aviation charges. The market size is projected to reach an estimated $750 Billion in 2025, with a Compound Annual Growth Rate (CAGR) of XX% projected for the forecast period 2025–2033. Technological disruptions, including the implementation of AI-powered analytics for personalized retail offers, contactless payment systems, and advanced baggage tracking, are revolutionizing service delivery. Evolving consumer behaviors, characterized by a growing demand for experiential retail, sustainable options, and on-demand services, are compelling airport operators to enhance their non-aeronautical offerings. This includes the expansion of curated F&B outlets, diversified retail portfolios, and integrated mobility solutions. The increasing reliance on digital platforms for booking and pre-ordering services further fuels market expansion, creating new avenues for revenue generation and customer engagement. The growth is also bolstered by significant infrastructure investments in new and expanded airport terminals worldwide, creating larger captive audiences for non-aeronautical services.

Key Markets & Segments Leading Non-Aeronautical Industry

The Asia-Pacific region is emerging as a dominant force in the non-aeronautical industry, propelled by rapid economic growth, burgeoning middle-class populations, and substantial investments in airport infrastructure across countries like China and India. This dominance is further amplified by the robust performance of key segments within the non-aeronautical domain.

Food Services: Experiencing immense growth, driven by evolving passenger preferences for diverse and high-quality culinary options. Major airport operators are collaborating with renowned international and local F&B brands, offering a wide spectrum from quick-service to fine dining. The increasing dwell times at airports, due to enhanced passenger amenities and air travel efficiency, further boost demand. Airport Authority Hong Kong and Japan Airport Terminal Co Ltd are prime examples of entities actively expanding their F&B portfolios to cater to a global clientele.

Car Rentals: While a mature segment, car rentals continue to be a vital service, particularly for business travelers and those connecting to onward journeys. The integration of digital booking platforms and partnerships with ride-sharing services are enhancing convenience and accessibility. Companies like London Heathrow Airports Limited are investing in streamlined rental processes and improved on-site facilities to maintain competitive advantage.

Baggage Handling Systems: Though an operational necessity, advancements in Baggage Handling Systems (BHS) have direct implications for passenger experience and airport efficiency, indirectly impacting the non-aeronautical revenue streams by reducing delays and improving overall service flow. Investments in smart and automated BHS are crucial for handling increasing passenger volumes and enabling seamless transfers, supporting other commercial activities. Fraport Group's focus on technological upgrades in this area exemplifies this trend.

Other Services: This broad category encompasses a vast array of revenue-generating activities, including retail (duty-free and branded outlets), lounges, financial services, and Wi-Fi access. The expansion of luxury retail and the integration of experiential services are key drivers. The increasing focus on creating an "airport city" concept, with retail, entertainment, and business hubs, underscores the immense potential of this segment. Vinci SA and GROUPE ADP are actively developing these comprehensive service ecosystems.

Non-Aeronautical Industry Product Developments

Product development in the non-aeronautical industry is heavily focused on enhancing the passenger journey through technological integration and personalized offerings. Innovations in mobile applications are central, enabling passengers to pre-order food, book rental cars, and access retail promotions seamlessly. Furthermore, advancements in AI and data analytics are being leveraged to provide hyper-personalized retail experiences and targeted marketing. The introduction of smart retail concepts, integrating augmented reality (AR) for virtual try-ons and interactive displays, is gaining traction. In baggage handling, developments are geared towards greater automation, real-time tracking, and improved security screening, indirectly contributing to a smoother overall airport experience that encourages commercial spending.

Challenges in the Non-Aeronautical Industry Market

Key challenges in the non-aeronautical industry include intense competition from off-airport retail and service providers, leading to price pressures and margin erosion. Regulatory hurdles and varying concession agreements across different jurisdictions can create operational complexities and limit flexibility. Supply chain disruptions, particularly impacting the retail and food services sectors, can affect product availability and pricing. Furthermore, the high capital expenditure required for infrastructure development and service upgrades presents a significant barrier to entry and expansion for smaller players. Cybersecurity threats targeting passenger data and payment systems also pose a substantial risk.

Forces Driving Non-Aeronautical Industry Growth

Several forces are propelling the growth of the non-aeronautical industry. The sustained increase in global air passenger traffic is a fundamental driver, expanding the captive customer base for airport services. Economic growth in emerging markets is leading to a rise in disposable incomes, empowering more people to travel and spend on ancillary services. Technological advancements, such as the proliferation of smartphones and the adoption of digital payment systems, facilitate seamless transactions and personalized service delivery. Government initiatives promoting tourism and infrastructure development also play a crucial role in creating a conducive environment for growth.

Challenges in the Non-Aeronautical Industry Market

Long-term growth catalysts for the non-aeronautical industry lie in strategic innovations and market expansions. The continuous development of personalized passenger experiences, leveraging big data analytics for tailored retail and F&B offerings, will be paramount. Partnerships between airports, airlines, and third-party service providers will foster integrated travel solutions, enhancing convenience and revenue streams. Exploring new market segments, such as dedicated airport logistics hubs and MICE (Meetings, Incentives, Conferences, and Exhibitions) facilities, presents significant untapped potential. The ongoing digital transformation of airport operations, including the implementation of IoT (Internet of Things) for enhanced customer engagement and operational efficiency, will also fuel sustained growth.

Emerging Opportunities in Non-Aeronautical Industry

Emerging opportunities in the non-aeronautical industry are diverse and lucrative. The increasing demand for sustainable and eco-friendly products and services presents a significant market opening, with consumers actively seeking out brands with strong environmental credentials. The expansion of the "airport as a destination" concept, incorporating entertainment, wellness, and unique cultural experiences, offers substantial revenue potential. The growth of e-commerce and the integration of click-and-collect services at airports are creating new retail models. Furthermore, the development of smart airport technologies, including AI-driven customer service bots and personalized wayfinding, will enhance passenger satisfaction and drive commercial engagement.

Leading Players in the Non-Aeronautical Industry Sector

- Airports de Paris SA

- GROUPE ADP

- AENA SME SA

- London Heathrow Airports Limited

- Vinci SA

- Fraport Group

- Korea Airports Cor

- Airports of Thailand Plc

- Airport Authority Hong Kong

- Japan Airport Terminal Co Ltd

Key Milestones in Non-Aeronautical Industry Industry

- 2019: Increased focus on sustainability initiatives across retail and F&B sectors, with major airports implementing waste reduction programs.

- 2020: Acceleration of digital transformation due to the pandemic, with a surge in demand for contactless payment and online ordering.

- 2021: Strategic partnerships between airports and technology providers to enhance passenger experience through AI and IoT.

- 2022: Significant M&A activity as companies sought to consolidate market share and expand service portfolios in a recovering travel market.

- 2023: Expansion of experiential retail offerings and immersive entertainment zones within airport terminals.

- 2024: Growing investment in advanced baggage handling systems and logistics solutions to improve efficiency and passenger flow.

Strategic Outlook for Non-Aeronautical Industry Market

The strategic outlook for the non-aeronautical industry market is exceptionally positive, driven by a confluence of factors including the rebound in air travel and a persistent focus on enhancing passenger experience as a core revenue driver. Future growth will be significantly accelerated by the pervasive adoption of digital technologies for personalized service delivery, seamless payment solutions, and integrated loyalty programs. Airports that successfully cultivate a diverse ecosystem of retail, dining, and lifestyle services, catering to evolving consumer preferences for convenience, sustainability, and unique experiences, will be well-positioned for sustained success. Strategic collaborations and ongoing investments in infrastructure modernization will further solidify market expansion, making the non-aeronautical sector an increasingly vital contributor to the overall aviation industry.

Non-Aeronautical Industry Segmentation

-

1. Services

- 1.1. Food Services

- 1.2. Car Rentals

- 1.3. Baggage Handling Systems

- 1.4. Other Services

Non-Aeronautical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Non-Aeronautical Industry Regional Market Share

Geographic Coverage of Non-Aeronautical Industry

Non-Aeronautical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Ground Handling Systems Will Showcase Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Food Services

- 5.1.2. Car Rentals

- 5.1.3. Baggage Handling Systems

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Food Services

- 6.1.2. Car Rentals

- 6.1.3. Baggage Handling Systems

- 6.1.4. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Food Services

- 7.1.2. Car Rentals

- 7.1.3. Baggage Handling Systems

- 7.1.4. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Food Services

- 8.1.2. Car Rentals

- 8.1.3. Baggage Handling Systems

- 8.1.4. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Food Services

- 9.1.2. Car Rentals

- 9.1.3. Baggage Handling Systems

- 9.1.4. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East and Africa Non-Aeronautical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Food Services

- 10.1.2. Car Rentals

- 10.1.3. Baggage Handling Systems

- 10.1.4. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Airports de Paris SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GROUPE ADP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AENA SME SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 London Heathrow Airports Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vinci SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fraport Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Korea Airports Cor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Airports of Thailand Plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Airport Authority Hong Kong

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Japan Airport Terminal Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Airports de Paris SA

List of Figures

- Figure 1: Global Non-Aeronautical Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 3: North America Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 7: Europe Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 8: Europe Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 11: Asia Pacific Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 12: Asia Pacific Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 15: Latin America Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 16: Latin America Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Non-Aeronautical Industry Revenue (billion), by Services 2025 & 2033

- Figure 19: Middle East and Africa Non-Aeronautical Industry Revenue Share (%), by Services 2025 & 2033

- Figure 20: Middle East and Africa Non-Aeronautical Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Non-Aeronautical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Global Non-Aeronautical Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 4: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 8: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 15: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: India Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 21: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Brazil Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Non-Aeronautical Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 25: Global Non-Aeronautical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: United Arab Emirates Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Africa Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Non-Aeronautical Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Aeronautical Industry?

The projected CAGR is approximately 14.75%.

2. Which companies are prominent players in the Non-Aeronautical Industry?

Key companies in the market include Airports de Paris SA, GROUPE ADP, AENA SME SA, London Heathrow Airports Limited, Vinci SA, Fraport Group, Korea Airports Cor, Airports of Thailand Plc, Airport Authority Hong Kong, Japan Airport Terminal Co Ltd.

3. What are the main segments of the Non-Aeronautical Industry?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.17 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Ground Handling Systems Will Showcase Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Aeronautical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Aeronautical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Aeronautical Industry?

To stay informed about further developments, trends, and reports in the Non-Aeronautical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence