Key Insights

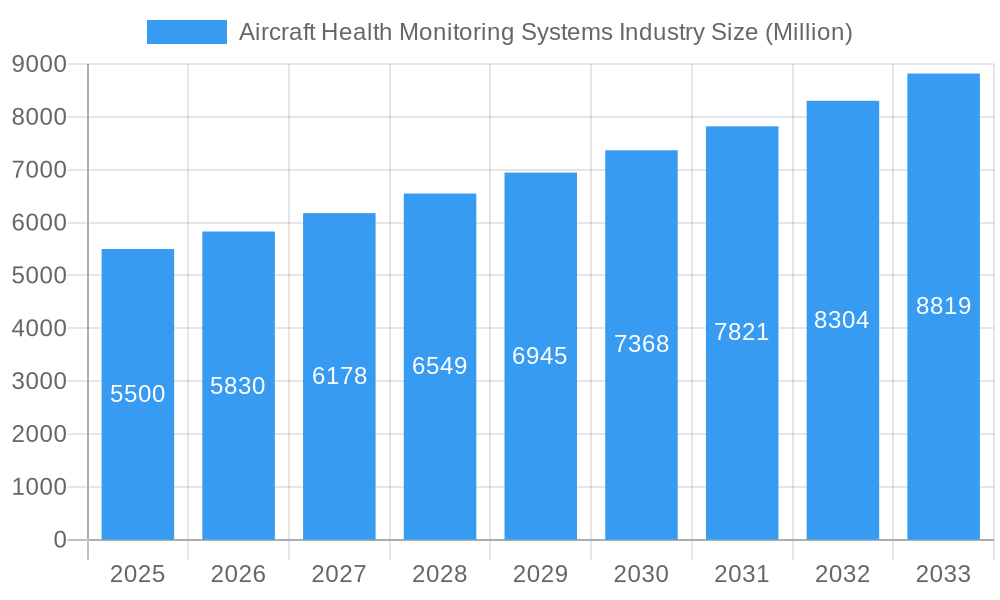

The global Aircraft Health Monitoring Systems (AHMS) market is projected for substantial growth, driven by a heightened focus on operational efficiency, safety, and predictive maintenance in commercial and military aviation. With a current market size of $5.5 billion in 2025, the industry is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 7.96% from 2025 to 2033. Key growth drivers include the increasing complexity of modern aircraft, the necessity to minimize unscheduled downtime, and the integration of AI and machine learning for advanced diagnostics and prognostics. These intelligent systems facilitate proactive issue identification, reducing repair costs and enhancing fleet readiness. Stringent aviation regulations and the pursuit of fuel efficiency further bolster demand for sophisticated AHMS solutions.

Aircraft Health Monitoring Systems Industry Market Size (In Billion)

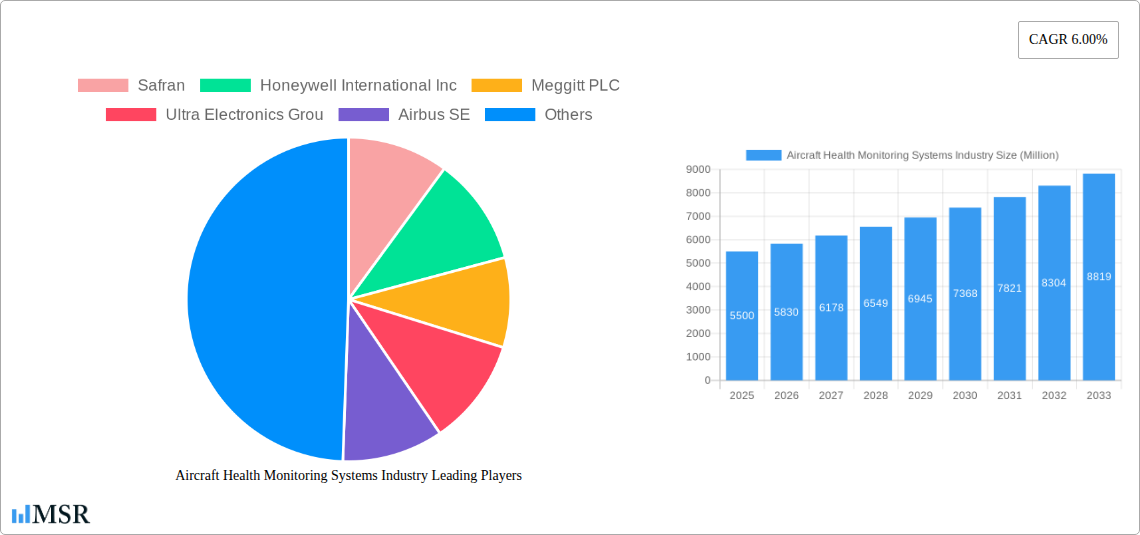

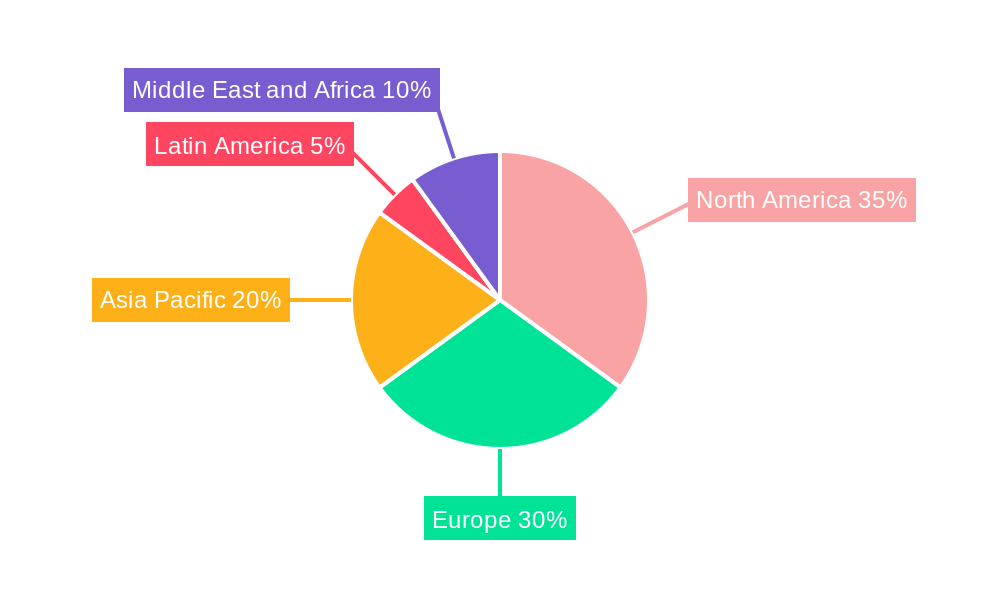

Market segmentation highlights diverse applications and subsystem specializations. Key end-users comprise Commercial and Military aviation. Core subsystems include Aero-propulsion, Avionics, Aircraft Structures, and Ancillary Systems. Innovations focus on Diagnostics, Prognostics, Condition-Based Maintenance (CBM), and Adaptive Control. Leading companies such as Safran, Honeywell International Inc., Meggitt PLC, Airbus SE, Collins Aerospace, and GE Aviation are investing heavily in R&D. North America and Europe currently lead the market due to mature aerospace sectors and robust regulatory environments. However, the Asia Pacific region is emerging as a significant growth driver, fueled by expanding air travel and increased defense expenditure.

Aircraft Health Monitoring Systems Industry Company Market Share

Unlocking Predictive Power: Aircraft Health Monitoring Systems Industry Report 2024-2033

This comprehensive Aircraft Health Monitoring Systems (AHMS) Industry Report delves into the dynamic landscape of predictive maintenance, prognostics, and condition-based maintenance solutions for aviation. Spanning a study period from 2019–2033, with a base year of 2025, this report provides critical market intelligence for stakeholders seeking to navigate the burgeoning aerospace maintenance, repair, and overhaul (MRO) sector. With a projected market size expected to reach an impressive $15 Billion by 2033, driven by a compound annual growth rate (CAGR) of 8.5%, this analysis offers unparalleled insights into market concentration, key growth drivers, emerging opportunities, and the competitive strategies of leading players like Safran, Honeywell International Inc, Meggitt PLC, Ultra Electronics Group, Airbus SE, Collins Aerospace, GE Aviation, Rolls-Royce, and The Boeing Company. Explore the transformative impact of AI in aviation maintenance, IoT for aircraft monitoring, and digital twin technology in enhancing aircraft safety, operational efficiency, and reduced lifecycle costs.

Aircraft Health Monitoring Systems Industry Market Concentration & Dynamics

The Aircraft Health Monitoring Systems (AHMS) Industry is characterized by a moderate to high degree of market concentration, driven by the substantial R&D investments and stringent regulatory approvals required for entry. Leading players such as Honeywell International Inc, Collins Aerospace, and GE Aviation hold significant market shares, fueled by their established relationships with major aircraft manufacturers like Airbus SE and The Boeing Company, and their extensive portfolios of integrated avionics and aero-propulsion monitoring solutions. Innovation ecosystems are thriving, with collaborations between system integrators, sensor manufacturers, and software developers fostering advancements in diagnostics and prognostics. Regulatory frameworks, spearheaded by aviation authorities like the FAA and EASA, prioritize safety and reliability, influencing product development and adoption cycles. Substitute products, while present in traditional maintenance approaches, are increasingly being overshadowed by the demonstrable benefits of AHMS in preventing costly unscheduled downtime. End-user trends highlight a growing preference for condition-based maintenance over scheduled overhauls, especially within the commercial aviation segment, driven by cost-saving imperatives. Mergers and acquisitions (M&A) activity is anticipated to remain robust, as companies seek to expand their technological capabilities, gain market access, and consolidate their positions. M&A deal counts are projected to increase by approximately 15% over the forecast period, as larger entities acquire innovative smaller firms specializing in niche AHMS technologies.

Aircraft Health Monitoring Systems Industry Industry Insights & Trends

The Aircraft Health Monitoring Systems (AHMS) Industry is on an upward trajectory, propelled by a confluence of technological advancements and evolving operational demands. The global AHMS market size is estimated at $7 Billion in 2025 and is forecast to reach $15 Billion by 2033, exhibiting a robust CAGR of 8.5% during the forecast period. This significant growth is underpinned by several key market drivers. The escalating complexity of modern aircraft, with their intricate systems and advanced materials, necessitates sophisticated monitoring to ensure continued airworthiness and operational integrity. The relentless pursuit of enhanced flight safety and the reduction of aviation accidents are paramount, and AHMS plays a crucial role in identifying potential failures before they manifest, thereby minimizing risks. Furthermore, the economic imperative to reduce operational costs and minimize unscheduled downtime is a powerful catalyst. Predictive maintenance enabled by AHMS allows airlines to optimize maintenance schedules, reduce spare parts inventory, and extend the service life of components, leading to substantial cost savings. Technological disruptions are at the forefront of this evolution. The integration of the Internet of Things (IoT) is enabling real-time data acquisition from a multitude of sensors across the aircraft, feeding into sophisticated algorithms for analysis. Artificial intelligence (AI) and machine learning (ML) are revolutionizing data interpretation, allowing for more accurate prognostics and early fault detection. Digital twin technology is emerging as a transformative tool, creating virtual replicas of aircraft systems for simulation and predictive analysis. Evolving consumer behaviors, particularly within the commercial aviation sector, are characterized by an increased demand for reliability and on-time performance, which AHMS directly supports. Passengers and cargo operators alike benefit from reduced flight delays and cancellations. The growing trend towards fleet modernization, with airlines investing in new, more technologically advanced aircraft equipped with integrated AHMS, further fuels market expansion. The increasing adoption of advanced diagnostics, prognostics, and condition-based maintenance strategies by airlines globally signifies a paradigm shift towards proactive rather than reactive maintenance practices. The expansion of global air travel, despite recent cyclical downturns, continues to underpin the long-term demand for robust and efficient aircraft operations, making AHMS an indispensable component of modern aviation.

Key Markets & Segments Leading Aircraft Health Monitoring Systems Industry

The Aircraft Health Monitoring Systems (AHMS) Industry is experiencing significant growth across multiple dimensions, with distinct markets and segments driving its expansion. North America currently dominates the market, accounting for approximately 40% of the global share in 2025. This leadership is attributed to the presence of major aviation hubs, a high concentration of commercial and military fleets, and significant investments in R&D by leading companies like Honeywell International Inc and Collins Aerospace. The United States, in particular, benefits from a robust aerospace manufacturing sector and a strong regulatory environment that encourages the adoption of advanced monitoring technologies.

Within the End User segments, Commercial Aviation is the largest and fastest-growing market, projected to contribute over 60% of the total AHMS revenue by 2033. The economic pressure on airlines to optimize operational efficiency, reduce maintenance costs, and ensure passenger safety is a primary driver. The sheer volume of commercial aircraft operations globally necessitates sophisticated systems to manage fleet health effectively. Military aviation also represents a significant segment, driven by the need for enhanced readiness, reduced lifecycle costs for aging fleets, and the development of advanced combat capabilities.

Analyzing the Subsystem breakdown, Avionics commands the largest market share, estimated at over 35% in 2025. This is due to the extensive reliance on electronic systems for flight control, navigation, and communication, all of which are critical for monitoring and diagnostics. Aero-propulsion systems represent another substantial segment, given the critical nature of engines and their performance. As engine technology becomes more sophisticated, the demand for advanced monitoring to ensure optimal performance and longevity increases. Ancillary Systems and Aircraft Structures are also growing segments, with increasing emphasis on structural health monitoring for fatigue and damage detection.

The Integration aspect reveals that Condition-based Maintenance (CBM) is the dominant integration strategy, followed closely by Prognostics. This reflects the industry's shift from scheduled maintenance to data-driven, predictive approaches. Diagnostics serves as the foundational element for both CBM and prognostics. The market is increasingly leveraging these integrated solutions to achieve proactive fleet management and enhance overall operational safety and efficiency. The trend towards more integrated AHMS solutions, encompassing diagnostics, prognostics, and CBM, will continue to accelerate throughout the forecast period.

Aircraft Health Monitoring Systems Industry Product Developments

Product developments in the Aircraft Health Monitoring Systems (AHMS) Industry are largely focused on enhancing the accuracy, real-time capabilities, and integration of monitoring solutions. Key innovations include the development of advanced sensor technologies that can detect minute changes in component performance and stress, alongside sophisticated data analytics platforms powered by AI and machine learning. Companies are investing in the creation of more comprehensive digital twin models for aircraft systems, enabling highly precise prognostics and predictive maintenance. The market is also seeing the emergence of integrated AHMS solutions that seamlessly combine diagnostics, prognostics, and condition-based maintenance functionalities, offering a holistic approach to asset management. These advancements are crucial for improving aircraft safety, reducing operational costs, and extending the lifespan of critical components.

Challenges in the Aircraft Health Monitoring Systems Industry Market

The Aircraft Health Monitoring Systems (AHMS) Industry faces several challenges that can impact its growth trajectory. High initial investment costs for implementing advanced AHMS solutions can be a barrier for smaller airlines and operators. Integration complexity with existing legacy aircraft systems and MRO infrastructure requires significant technical expertise and standardization efforts. Furthermore, data security and privacy concerns surrounding the vast amounts of sensitive flight data collected by AHMS necessitate robust cybersecurity measures. Regulatory hurdles and certification processes for new AHMS technologies, while essential for safety, can be lengthy and complex, potentially slowing down market adoption. Supply chain disruptions for specialized sensors and components, exacerbated by geopolitical factors, can also pose a significant challenge.

Forces Driving Aircraft Health Monitoring Systems Industry Growth

The Aircraft Health Monitoring Systems (AHMS) Industry is propelled by several potent growth drivers. The paramount importance of flight safety remains the primary impetus, with AHMS playing a crucial role in preventing incidents through early fault detection and predictive maintenance. The escalating operational costs for airlines worldwide create a strong economic incentive to adopt AHMS, which optimizes maintenance schedules, reduces unscheduled downtime, and minimizes part failures. Technological advancements, particularly in areas like IoT, AI, and big data analytics, are making AHMS more sophisticated, accurate, and cost-effective. The increasing adoption of digitalization across the aerospace sector further supports the integration of AHMS into broader fleet management strategies. Moreover, the growing demand for predictive maintenance over traditional scheduled maintenance is a significant trend, allowing for more efficient resource allocation and reduced lifecycle costs.

Challenges in the Aircraft Health Monitoring Systems Industry Market

Long-term growth catalysts for the Aircraft Health Monitoring Systems (AHMS) Industry are intrinsically linked to continuous innovation and strategic market expansion. The development of next-generation AI algorithms capable of even more precise prognostics will be critical. Increased collaboration between AHMS providers, airlines, and MRO organizations will foster greater standardization and interoperability, accelerating adoption. Market expansion into emerging aviation markets, particularly in Asia and the Middle East, presents significant growth potential as these regions witness substantial increases in air traffic. Furthermore, the integration of AHMS with unmanned aerial vehicle (UAV) operations and the development of specialized monitoring solutions for new aircraft designs, such as electric and hybrid-electric aircraft, will open up new avenues for growth and innovation.

Emerging Opportunities in Aircraft Health Monitoring Systems Industry

Emerging opportunities within the Aircraft Health Monitoring Systems (AHMS) Industry are diverse and promising. The growing demand for predictive maintenance solutions tailored for regional and business aircraft presents a significant untapped market. The advancement of edge computing technologies will enable more real-time data processing directly on the aircraft, reducing latency and enhancing immediate response capabilities. There is also a burgeoning opportunity in providing AHMS-as-a-service (AHMSaaS) models, which can lower the upfront cost barrier for smaller operators. Furthermore, the integration of AHMS data with sustainability initiatives, such as optimizing fuel efficiency through better engine health monitoring, is an evolving area. The development of cyber-resilient AHMS architectures to combat evolving cyber threats is also a critical emerging area of focus.

Leading Players in the Aircraft Health Monitoring Systems Industry Sector

- Safran

- Honeywell International Inc

- Meggitt PLC

- Ultra Electronics Group

- Airbus SE

- Collins Aerospace (United Technologies Corporation)

- Esterline Technologies Corporation

- Rolls-Royce

- GE Aviation

- Curtiss-Wright Corporation

- FLYHT Aerospace Solutions Ltd

- The Boeing Company

Key Milestones in Aircraft Health Monitoring Systems Industry Industry

- 2019: Launch of advanced AI-powered prognostics platforms by leading AHMS providers, significantly improving fault prediction accuracy.

- 2020: Increased adoption of IoT sensors across aircraft fleets, enabling more granular real-time data acquisition for health monitoring.

- 2021: Significant advancements in digital twin technology, allowing for more precise virtual representation and simulation of aircraft system behavior.

- 2022: Greater emphasis on cybersecurity measures integrated into AHMS solutions to protect sensitive flight data.

- 2023: Strategic partnerships formed between AHMS providers and airlines to develop bespoke predictive maintenance strategies.

- 2024: Growing interest and initial deployments of integrated AHMS solutions encompassing diagnostics, prognostics, and condition-based maintenance by major operators.

Strategic Outlook for Aircraft Health Monitoring Systems Industry Market

The strategic outlook for the Aircraft Health Monitoring Systems (AHMS) Industry is exceptionally positive, driven by an unwavering focus on enhancing aviation safety and operational efficiency. Future growth will be accelerated by the continued integration of cutting-edge technologies like advanced AI, machine learning, and edge computing, enabling more proactive and precise predictive maintenance. Strategic opportunities lie in the expansion of AHMS into new aircraft segments and geographical markets, as well as the development of more comprehensive, cloud-based data analytics platforms. Collaboration and partnerships between technology providers, aircraft manufacturers, and airlines will be crucial for driving standardization and widespread adoption of advanced AHMS solutions, ultimately leading to reduced operational costs and improved aircraft availability across the global aviation ecosystem.

Aircraft Health Monitoring Systems Industry Segmentation

-

1. End User

- 1.1. Commercial

- 1.2. Military

-

2. Subsystem

- 2.1. Aero-propulsion

- 2.2. Avionics

- 2.3. Ancillary Systems

- 2.4. Aircraft Structures

-

3. Integrat

- 3.1. Diagnostics

- 3.2. Prognostics

- 3.3. Condition-based Maintenance and Adaptive Control

Aircraft Health Monitoring Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Aircraft Health Monitoring Systems Industry Regional Market Share

Geographic Coverage of Aircraft Health Monitoring Systems Industry

Aircraft Health Monitoring Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 By End User

- 3.4.2 The Commercial Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Health Monitoring Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial

- 5.1.2. Military

- 5.2. Market Analysis, Insights and Forecast - by Subsystem

- 5.2.1. Aero-propulsion

- 5.2.2. Avionics

- 5.2.3. Ancillary Systems

- 5.2.4. Aircraft Structures

- 5.3. Market Analysis, Insights and Forecast - by Integrat

- 5.3.1. Diagnostics

- 5.3.2. Prognostics

- 5.3.3. Condition-based Maintenance and Adaptive Control

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Aircraft Health Monitoring Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial

- 6.1.2. Military

- 6.2. Market Analysis, Insights and Forecast - by Subsystem

- 6.2.1. Aero-propulsion

- 6.2.2. Avionics

- 6.2.3. Ancillary Systems

- 6.2.4. Aircraft Structures

- 6.3. Market Analysis, Insights and Forecast - by Integrat

- 6.3.1. Diagnostics

- 6.3.2. Prognostics

- 6.3.3. Condition-based Maintenance and Adaptive Control

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Aircraft Health Monitoring Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial

- 7.1.2. Military

- 7.2. Market Analysis, Insights and Forecast - by Subsystem

- 7.2.1. Aero-propulsion

- 7.2.2. Avionics

- 7.2.3. Ancillary Systems

- 7.2.4. Aircraft Structures

- 7.3. Market Analysis, Insights and Forecast - by Integrat

- 7.3.1. Diagnostics

- 7.3.2. Prognostics

- 7.3.3. Condition-based Maintenance and Adaptive Control

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Aircraft Health Monitoring Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial

- 8.1.2. Military

- 8.2. Market Analysis, Insights and Forecast - by Subsystem

- 8.2.1. Aero-propulsion

- 8.2.2. Avionics

- 8.2.3. Ancillary Systems

- 8.2.4. Aircraft Structures

- 8.3. Market Analysis, Insights and Forecast - by Integrat

- 8.3.1. Diagnostics

- 8.3.2. Prognostics

- 8.3.3. Condition-based Maintenance and Adaptive Control

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Aircraft Health Monitoring Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial

- 9.1.2. Military

- 9.2. Market Analysis, Insights and Forecast - by Subsystem

- 9.2.1. Aero-propulsion

- 9.2.2. Avionics

- 9.2.3. Ancillary Systems

- 9.2.4. Aircraft Structures

- 9.3. Market Analysis, Insights and Forecast - by Integrat

- 9.3.1. Diagnostics

- 9.3.2. Prognostics

- 9.3.3. Condition-based Maintenance and Adaptive Control

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Aircraft Health Monitoring Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Commercial

- 10.1.2. Military

- 10.2. Market Analysis, Insights and Forecast - by Subsystem

- 10.2.1. Aero-propulsion

- 10.2.2. Avionics

- 10.2.3. Ancillary Systems

- 10.2.4. Aircraft Structures

- 10.3. Market Analysis, Insights and Forecast - by Integrat

- 10.3.1. Diagnostics

- 10.3.2. Prognostics

- 10.3.3. Condition-based Maintenance and Adaptive Control

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Safran

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meggitt PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ultra Electronics Grou

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Collins Aerospace (United Technologies Corporation)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Esterline Technologies Corpoartion

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolls-Royce

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GE Aviation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Curtiss-Wright Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FLYHT Aerospace Solutions Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Safran

List of Figures

- Figure 1: Global Aircraft Health Monitoring Systems Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Health Monitoring Systems Industry Revenue (billion), by End User 2025 & 2033

- Figure 3: North America Aircraft Health Monitoring Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Aircraft Health Monitoring Systems Industry Revenue (billion), by Subsystem 2025 & 2033

- Figure 5: North America Aircraft Health Monitoring Systems Industry Revenue Share (%), by Subsystem 2025 & 2033

- Figure 6: North America Aircraft Health Monitoring Systems Industry Revenue (billion), by Integrat 2025 & 2033

- Figure 7: North America Aircraft Health Monitoring Systems Industry Revenue Share (%), by Integrat 2025 & 2033

- Figure 8: North America Aircraft Health Monitoring Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Aircraft Health Monitoring Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aircraft Health Monitoring Systems Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Aircraft Health Monitoring Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Aircraft Health Monitoring Systems Industry Revenue (billion), by Subsystem 2025 & 2033

- Figure 13: Europe Aircraft Health Monitoring Systems Industry Revenue Share (%), by Subsystem 2025 & 2033

- Figure 14: Europe Aircraft Health Monitoring Systems Industry Revenue (billion), by Integrat 2025 & 2033

- Figure 15: Europe Aircraft Health Monitoring Systems Industry Revenue Share (%), by Integrat 2025 & 2033

- Figure 16: Europe Aircraft Health Monitoring Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Aircraft Health Monitoring Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue (billion), by End User 2025 & 2033

- Figure 19: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue (billion), by Subsystem 2025 & 2033

- Figure 21: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue Share (%), by Subsystem 2025 & 2033

- Figure 22: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue (billion), by Integrat 2025 & 2033

- Figure 23: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue Share (%), by Integrat 2025 & 2033

- Figure 24: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Aircraft Health Monitoring Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Aircraft Health Monitoring Systems Industry Revenue (billion), by End User 2025 & 2033

- Figure 27: Latin America Aircraft Health Monitoring Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 28: Latin America Aircraft Health Monitoring Systems Industry Revenue (billion), by Subsystem 2025 & 2033

- Figure 29: Latin America Aircraft Health Monitoring Systems Industry Revenue Share (%), by Subsystem 2025 & 2033

- Figure 30: Latin America Aircraft Health Monitoring Systems Industry Revenue (billion), by Integrat 2025 & 2033

- Figure 31: Latin America Aircraft Health Monitoring Systems Industry Revenue Share (%), by Integrat 2025 & 2033

- Figure 32: Latin America Aircraft Health Monitoring Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Aircraft Health Monitoring Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue (billion), by End User 2025 & 2033

- Figure 35: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue (billion), by Subsystem 2025 & 2033

- Figure 37: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue Share (%), by Subsystem 2025 & 2033

- Figure 38: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue (billion), by Integrat 2025 & 2033

- Figure 39: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue Share (%), by Integrat 2025 & 2033

- Figure 40: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Subsystem 2020 & 2033

- Table 3: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Integrat 2020 & 2033

- Table 4: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Subsystem 2020 & 2033

- Table 7: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Integrat 2020 & 2033

- Table 8: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Subsystem 2020 & 2033

- Table 13: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Integrat 2020 & 2033

- Table 14: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Subsystem 2020 & 2033

- Table 21: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Integrat 2020 & 2033

- Table 22: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: South Korea Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Subsystem 2020 & 2033

- Table 31: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Integrat 2020 & 2033

- Table 32: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Mexico Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Brazil Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Latin America Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 37: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Subsystem 2020 & 2033

- Table 38: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Integrat 2020 & 2033

- Table 39: Global Aircraft Health Monitoring Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: United Arab Emirates Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Saudi Arabia Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: South Africa Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Aircraft Health Monitoring Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Health Monitoring Systems Industry?

The projected CAGR is approximately 7.96%.

2. Which companies are prominent players in the Aircraft Health Monitoring Systems Industry?

Key companies in the market include Safran, Honeywell International Inc, Meggitt PLC, Ultra Electronics Grou, Airbus SE, Collins Aerospace (United Technologies Corporation), Esterline Technologies Corpoartion, Rolls-Royce, GE Aviation, Curtiss-Wright Corporation, FLYHT Aerospace Solutions Ltd, The Boeing Company.

3. What are the main segments of the Aircraft Health Monitoring Systems Industry?

The market segments include End User, Subsystem, Integrat.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

By End User. The Commercial Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Health Monitoring Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Health Monitoring Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Health Monitoring Systems Industry?

To stay informed about further developments, trends, and reports in the Aircraft Health Monitoring Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence