Key Insights

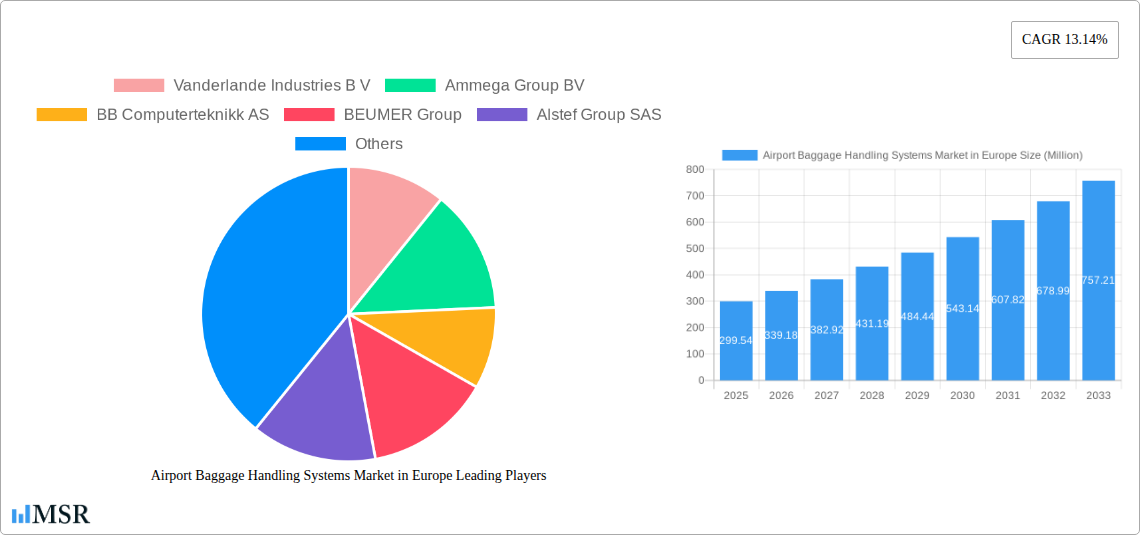

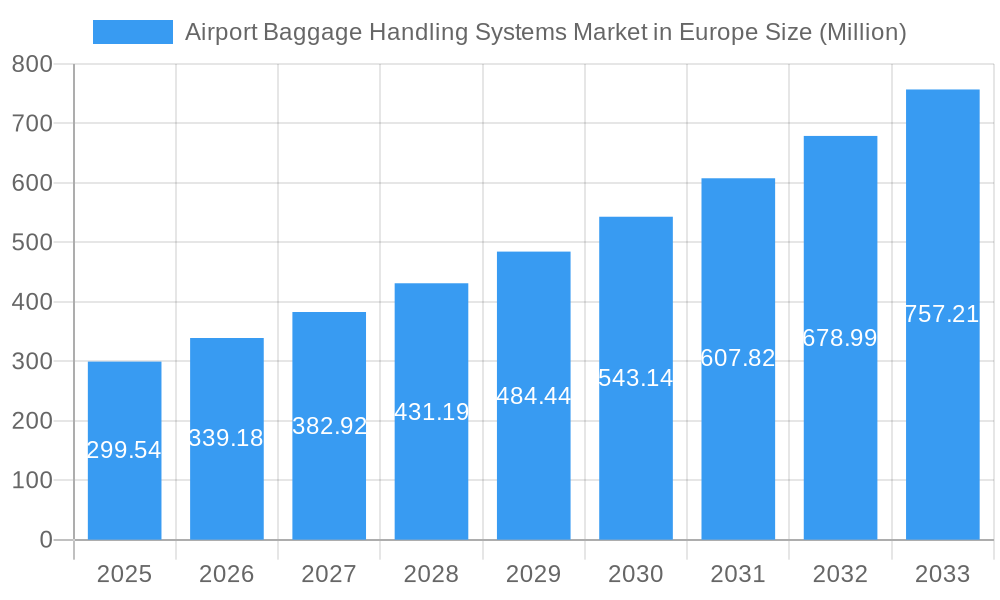

The European Airport Baggage Handling Systems Market is poised for significant expansion, projected to reach a substantial $299.54 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 13.14%, indicating a dynamic and rapidly evolving sector. The primary drivers behind this upward trajectory are the relentless need for enhanced operational efficiency at airports, coupled with the ever-increasing passenger traffic across the continent. Modernization initiatives undertaken by airports to upgrade their infrastructure and incorporate advanced technologies are also playing a crucial role. Furthermore, the growing emphasis on security and the implementation of stringent baggage screening regulations necessitate sophisticated handling systems, contributing to market expansion. Investments in automation and artificial intelligence are transforming baggage handling from a purely mechanical process to an intelligent, integrated solution, further stimulating demand.

Airport Baggage Handling Systems Market in Europe Market Size (In Million)

The market is characterized by a clear trend towards more sophisticated and integrated baggage handling solutions, driven by the need to manage increasing volumes and improve customer experience. Key trends include the adoption of self-service baggage drop, advanced sorting technologies, and real-time tracking systems. While the demand for high-capacity systems serving airports with over 40 million passengers is expected to dominate, the growth in medium-sized airports (25-40 million passengers) also presents significant opportunities. The market is highly competitive, with established players like Vanderlande Industries B.V., BEUMER Group, and Daifuku Co. Ltd. actively investing in research and development. The forecast period (2025-2033) is expected to witness continued innovation, with a focus on sustainability, energy efficiency, and seamless integration with broader airport management systems. The European landscape, particularly countries like the United Kingdom, Germany, and France, will remain a focal point for these developments.

Airport Baggage Handling Systems Market in Europe Company Market Share

This comprehensive European Airport Baggage Handling Systems Market report delves into the dynamic landscape of airport baggage solutions, analyzing critical trends, innovations, and growth drivers from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides invaluable market insights for stakeholders seeking to capitalize on the evolving demands of airport infrastructure, passenger flow management, and automated baggage systems.

Airport Baggage Handling Systems Market in Europe Market Concentration & Dynamics

The European airport baggage handling systems market exhibits a moderate to high concentration, driven by a few dominant global players with extensive project portfolios and technological expertise. Key players like BEUMER Group, Vanderlande Industries B.V., and Alstef Group SAS command significant market share, often through strategic partnerships and long-term airport contracts. The innovation ecosystem is robust, with a continuous push towards digitalization, AI-driven sorting, and enhanced security integration in baggage handling solutions. Regulatory frameworks, particularly those from the European Union Aviation Safety Agency (EASA), are increasingly stringent, mandating higher security standards and operational efficiency, thereby influencing system design and implementation. The threat of substitute products is minimal, as specialized baggage handling systems remain the only viable solution for large-scale airport operations. End-user trends highlight a growing demand for seamless passenger experiences, reduced dwell times, and integrated security screening, pushing for more intelligent and automated airport baggage systems. Mergers and acquisitions (M&A) activities, though infrequent, are strategically significant, often involving consolidation of expertise or expansion into new geographic regions within Europe. The market has witnessed approximately 15-20 significant M&A deals over the historical period, primarily focused on acquiring technological capabilities or market access.

Airport Baggage Handling Systems Market in Europe Industry Insights & Trends

The European airport baggage handling systems market is poised for substantial growth, projected to reach an estimated market size of USD xx Billion by 2033, exhibiting a compound annual growth rate (CAGR) of xx% from 2025. This expansion is fueled by a confluence of factors, including increasing air passenger traffic across the continent, the continuous need for airport capacity upgrades, and the imperative to enhance operational efficiency and security. Technological disruptions are at the forefront of this transformation. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing baggage sorting and tracking, enabling predictive maintenance and real-time monitoring. Advanced robotics and automated guided vehicles (AGVs) are streamlining the movement of baggage within terminals, reducing manual labor requirements and minimizing errors. Furthermore, the adoption of IoT sensors and data analytics provides airports with unprecedented visibility into their baggage handling operations, facilitating data-driven decision-making for optimizing throughput and resource allocation. Evolving consumer behaviors, characterized by a heightened expectation for swift and seamless travel experiences, are also playing a pivotal role. Passengers demand faster check-in processes, quicker baggage claim, and a reliable tracking system for their luggage. This necessitates investments in sophisticated airport baggage systems that can cater to these demands. The drive towards sustainability is also influencing the market, with manufacturers developing energy-efficient systems and solutions that minimize environmental impact. The ongoing modernization of existing airport infrastructure and the development of new airport hubs across Europe further bolster the demand for advanced baggage handling technology. The market is witnessing a shift from traditional conveyor systems towards more flexible and modular solutions that can be easily adapted to changing airport needs and passenger volumes.

Key Markets & Segments Leading Airport Baggage Handling Systems Market in Europe

The European airport baggage handling systems market is segmented by Airport Capacity, with a notable dominance observed in airports handling Above 40 Million passengers annually. These mega-hubs, characterized by high passenger volumes and extensive flight networks, demand the most sophisticated and high-capacity baggage handling solutions to manage the sheer volume of luggage efficiently. Factors contributing to this dominance include:

- Economic Growth & Tourism: Major European economic centers and popular tourist destinations house these large airports, directly correlating with elevated air traffic and, consequently, a greater need for robust baggage infrastructure.

- Infrastructure Investment: Airports in this capacity segment consistently receive significant investment for expansion and modernization projects, prioritizing state-of-the-art baggage handling technology to maintain their competitive edge and operational integrity.

- Technological Adoption: These airports are often at the forefront of adopting cutting-edge technologies like AI-powered sorting, advanced screening integration, and automated guided vehicles, driven by the need to optimize throughput and minimize delays.

Within the Above 40 Million capacity segment, countries such as the United Kingdom (e.g., London Heathrow), Germany (e.g., Frankfurt Airport), France (e.g., Paris Charles de Gaulle), and the Netherlands (e.g., Amsterdam Schiphol) are prime examples of markets with the highest demand for advanced airport baggage systems. The continuous need for reliability, speed, and security in these high-traffic environments makes them the primary drivers for innovation and significant revenue generation within the European baggage handling solutions sector. Airports with 25 - 40 million passenger capacity also represent a substantial segment, with growing demand for upgrades and new installations as they continue to expand. The 15 - 25 million and Up to 15 million capacity segments, while smaller individually, collectively form a significant market for modernization and smaller-scale airport projects.

Airport Baggage Handling Systems Market in Europe Product Developments

Recent product developments in the European airport baggage handling systems market are heavily focused on enhancing automation, efficiency, and security. Manufacturers are introducing intelligent conveyor systems with integrated sensors for real-time tracking and monitoring, reducing manual intervention and potential for error. The adoption of advanced sorting technologies, including AI-driven visual recognition and robotic arms, is enabling faster and more accurate redirection of baggage. Furthermore, there is a growing emphasis on modular and scalable system designs that can be easily adapted to evolving airport needs and passenger volumes. Integration of advanced screening technologies directly into the baggage handling flow is a key trend, aiming to streamline security processes and reduce passenger wait times.

Challenges in the Airport Baggage Handling Systems Market in Europe Market

The European airport baggage handling systems market faces several challenges. High upfront investment costs for advanced baggage handling solutions can be a significant barrier for smaller airports. Evolving regulatory requirements, while driving innovation, also necessitate costly upgrades and compliance measures. The integration of new systems with existing legacy infrastructure can be complex and time-consuming. Furthermore, supply chain disruptions and the availability of skilled labor for installation and maintenance pose ongoing concerns. Competitive pressures from established players and the need for continuous technological upgrades also present challenges in maintaining market share and profitability. The market is estimated to have lost approximately xx% of its potential growth due to these cumulative challenges over the historical period.

Forces Driving Airport Baggage Handling Systems Market in Europe Growth

Several key forces are driving the growth of the European airport baggage handling systems market. The sustained increase in air passenger traffic across Europe, recovering from recent global events, directly translates to higher demand for efficient baggage handling operations. Airport modernization projects and the development of new terminals are significant growth accelerators. Technological advancements, including automation, AI, and IoT, are enabling more efficient, secure, and user-friendly baggage handling solutions. Stringent security regulations and the need to comply with international aviation standards are also pushing airports to invest in advanced systems. The growing emphasis on passenger experience and the demand for reduced wait times are further incentivizing investments in cutting-edge airport baggage technology.

Challenges in the Airport Baggage Handling Systems Market in Europe Market

Long-term growth catalysts in the European airport baggage handling systems market are rooted in sustained innovation and strategic market expansion. The ongoing digital transformation of airports, with a focus on smart airport concepts, will continue to drive demand for interconnected and intelligent baggage handling systems. Partnerships between technology providers, airport authorities, and airlines will foster collaborative development and customized solutions. The increasing trend of outsourcing baggage handling operations to specialized service providers also presents a growth avenue. Furthermore, the development of sustainable and energy-efficient baggage handling solutions will gain prominence as environmental concerns continue to rise.

Emerging Opportunities in Airport Baggage Handling Systems Market in Europe

Emerging opportunities in the European airport baggage handling systems market are significant and multifaceted. The growing adoption of biometrics and facial recognition technology for passenger identification can be seamlessly integrated with advanced baggage tracking systems, enhancing security and efficiency. The development of predictive analytics for baggage handling, using AI to anticipate potential issues and proactively address them, represents a major opportunity. Furthermore, the expansion of low-cost carriers and the subsequent increase in passenger numbers at regional airports present a market for more cost-effective yet efficient baggage handling solutions. The focus on sustainability is also creating opportunities for companies offering green and energy-efficient airport baggage systems. The increasing demand for personalized passenger services, including the ability to track baggage in real-time via mobile apps, is another area ripe for innovation and market penetration.

Leading Players in the Airport Baggage Handling Systems Market in Europe Sector

- Vanderlande Industries B.V.

- BEUMER Group

- Alstef Group SAS

- Siemens AG

- Daifuku Co Ltd

- SITA

- Am

Group BV - PSI Logistics GmbH

- BB Computerteknikk AS

- Lift All A

Key Milestones in Airport Baggage Handling Systems Market in Europe Industry

- March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. This strategic win underscores Alstef's growing influence and the demand for advanced baggage handling solutions in Eastern Europe.

- December 2022: Alstef Group received a contract to upgrade the baggage handling system at Strasbourg Airport (SXB) in France. The project includes the adoption of Strasbourg Airport's baggage screening systems to meet the latest European Union Aviation Safety Agency (EASA) Standard 3.1 requirements, highlighting the continuous drive for enhanced security and regulatory compliance in airport baggage systems.

Strategic Outlook for Airport Baggage Handling Systems Market in Europe Market

The strategic outlook for the European airport baggage handling systems market is overwhelmingly positive, driven by the relentless pursuit of operational excellence and enhanced passenger experiences. Future growth accelerators will include the further integration of AI and IoT for predictive maintenance and real-time operational insights, creating more autonomous and self-optimizing baggage handling systems. Strategic partnerships and collaborations between system providers and airport operators will be crucial for developing bespoke solutions that address specific operational challenges. The increasing focus on sustainability will lead to the development and adoption of energy-efficient and environmentally friendly airport baggage solutions. Furthermore, the ongoing expansion of airport infrastructure across Europe, coupled with the continuous need to upgrade existing systems to meet evolving security and efficiency demands, presents significant long-term market potential. Companies that can offer a blend of technological innovation, reliability, and cost-effectiveness are best positioned for sustained success in this dynamic market.

Airport Baggage Handling Systems Market in Europe Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 - 25 million

- 1.3. 25 - 40 million

- 1.4. Above 40 Million

Airport Baggage Handling Systems Market in Europe Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Airport Baggage Handling Systems Market in Europe Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market in Europe

Airport Baggage Handling Systems Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Airport Baggage Handling Systems Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 - 25 million

- 5.1.3. 25 - 40 million

- 5.1.4. Above 40 Million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vanderlande Industries B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ammega Group BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BB Computerteknikk AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BEUMER Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alstef Group SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lift All A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daifuku Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SITA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PSI Logistics GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vanderlande Industries B V

List of Figures

- Figure 1: Airport Baggage Handling Systems Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Airport Baggage Handling Systems Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Europe Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market in Europe?

The projected CAGR is approximately 13.14%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market in Europe?

Key companies in the market include Vanderlande Industries B V, Ammega Group BV, BB Computerteknikk AS, BEUMER Group, Alstef Group SAS, Siemens AG, Lift All A, Daifuku Co Ltd, SITA, PSI Logistics GmbH.

3. What are the main segments of the Airport Baggage Handling Systems Market in Europe?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 299.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. Under the contract, the company will supply, install, and maintain the baggage handling solution with a capacity of up to 2,400 bags per hour.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market in Europe?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence