Key Insights

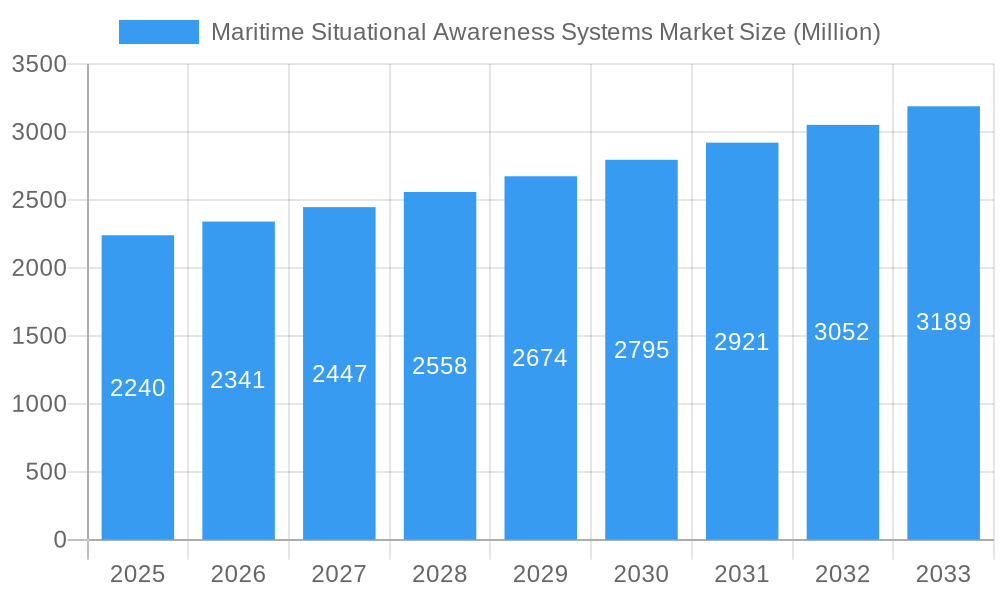

The global Maritime Situational Awareness Systems Market is poised for robust growth, projected to reach \$2.24 billion in 2025 with a Compound Annual Growth Rate (CAGR) of 4.51% through 2033. This expansion is primarily fueled by the escalating demand for enhanced maritime security, the increasing complexity of naval operations, and the continuous technological advancements in sensor fusion, artificial intelligence, and data analytics. The imperative to monitor vast ocean expanses, detect potential threats like piracy and illegal fishing, and ensure safe navigation drives significant investment in sophisticated SA systems. Furthermore, the growing emphasis on homeland security, coupled with the need for effective border surveillance and the protection of critical maritime infrastructure, are key accelerators for market development. The integration of advanced RADARs, SONARs, and optronics, alongside sophisticated command and control platforms, is central to achieving comprehensive maritime awareness.

Maritime Situational Awareness Systems Market Market Size (In Billion)

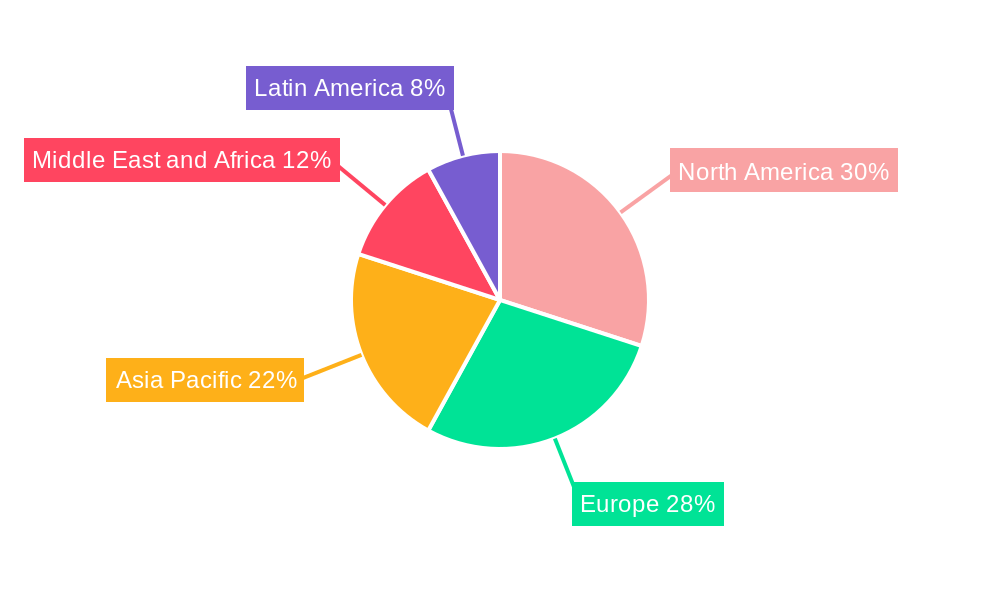

The market segmentation reveals a dynamic landscape where components like advanced sensors and high-resolution displays are critical enablers of effective situational awareness. Command and Control systems, along with RADARs and SONARs, represent substantial segments, reflecting their foundational role in threat detection and operational decision-making. Geographically, North America and Europe are expected to dominate the market, driven by substantial defense budgets and a proactive approach to maritime security. The Asia Pacific region is emerging as a significant growth area, propelled by increasing naval modernization efforts in countries like India and China. Emerging trends include the adoption of AI and machine learning for predictive analysis, the development of integrated C5ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) solutions, and the increasing use of unmanned systems to extend surveillance capabilities. However, high implementation costs and the need for skilled personnel to operate and maintain these complex systems present potential restraints to market expansion.

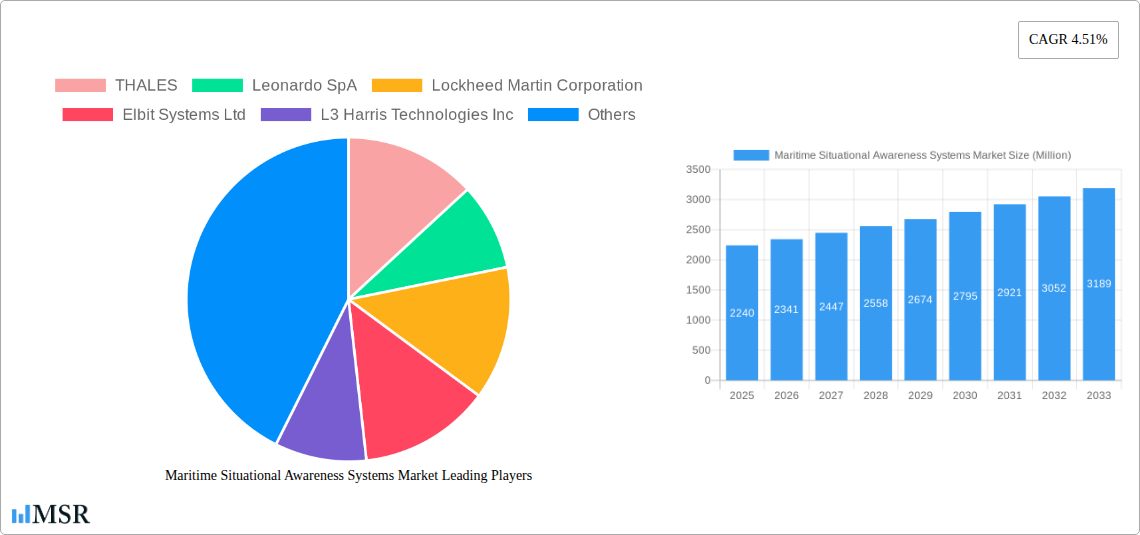

Maritime Situational Awareness Systems Market Company Market Share

Maritime Situational Awareness Systems Market: Comprehensive Analysis and Forecast 2019–2033

This comprehensive report provides an in-depth analysis of the global Maritime Situational Awareness Systems Market, offering critical insights into market dynamics, growth drivers, key segments, and future opportunities. With an estimated market size of $xx Billion in 2025 and a projected CAGR of xx% during the forecast period (2025–2033), this study is an indispensable resource for industry stakeholders seeking to navigate the evolving landscape of maritime defense, security, and commercial operations.

Maritime Situational Awareness Systems Market Market Concentration & Dynamics

The Maritime Situational Awareness Systems Market exhibits a moderate to high concentration, characterized by the presence of established global defense contractors and specialized technology providers. Key players like THALES, Leonardo SpA, Lockheed Martin Corporation, Elbit Systems Ltd, L3 Harris Technologies Inc, Rafael Advanced Defense Systems Ltd, BAE Systems PLC, Northrop Grumman Corporation, Saab AB, HENSOLDT A, and Teledyne FLIR LLC dominate a significant portion of the market share. The innovation ecosystem is robust, driven by continuous R&D investments in sensor fusion, AI-powered analytics, and advanced networking capabilities. Regulatory frameworks, primarily driven by national security concerns and international maritime law, shape product development and deployment strategies. The threat of piracy, illegal fishing, and asymmetric warfare continues to be a major end-user driver. Substitute products are limited due to the specialized nature of maritime surveillance, but advancements in drone technology and satellite imaging are increasingly integrated into broader situational awareness solutions. Merger and acquisition activities are notable, with an estimated xx M&A deals observed in the historical period (2019–2024), primarily aimed at consolidating capabilities, expanding product portfolios, and gaining market access. The market anticipates further consolidation to leverage synergies and address the growing demand for integrated, multi-domain awareness.

Maritime Situational Awareness Systems Market Industry Insights & Trends

The Maritime Situational Awareness Systems Market is experiencing robust growth, propelled by escalating geopolitical tensions, rising maritime trade volumes, and an increasing focus on border security and resource protection. The market size was estimated at $xx Billion in 2025, with projections indicating a significant expansion in the coming years. A key driver is the continuous need for enhanced maritime security, driven by threats such as piracy, smuggling, terrorism, and illegal activities at sea. Governments worldwide are investing heavily in upgrading their naval fleets and coastal surveillance capabilities, which directly fuels demand for advanced situational awareness solutions. Technological disruptions are at the forefront of market evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into maritime surveillance systems is revolutionizing data analysis, enabling faster threat detection and more accurate decision-making. The proliferation of advanced sensors, including high-resolution RADARs, SONARs, electro-optical/infrared (EO/IR) systems, and electronic warfare (EW) suites, is enhancing the ability to monitor vast oceanic territories. Furthermore, the increasing adoption of Command and Control (C2) systems that integrate data from various sources provides a unified operational picture for naval commanders. Evolving consumer behaviors, particularly within the defense and homeland security sectors, are shifting towards integrated, network-centric, and scalable solutions. End-users are seeking systems that offer not just detection but also identification, tracking, and prediction capabilities. The demand for interoperability between different platforms and systems is also a significant trend, pushing manufacturers towards developing open architecture solutions. The expansion of the global shipping industry and the exploitation of offshore resources, such as oil and gas, also contribute to the growing need for comprehensive maritime domain awareness.

Key Markets & Segments Leading Maritime Situational Awareness Systems Market

The Maritime Situational Awareness Systems Market is witnessing significant leadership from several key regions and segments. North America, particularly the United States, stands out as a dominant market, driven by substantial defense spending and a proactive approach to national security. This dominance is fueled by the need to monitor extensive coastlines, protect critical maritime infrastructure, and maintain naval superiority.

Component:

- Sensors: This segment is a primary growth engine, encompassing advanced RADARs, SONARs, EO/IR, SIGINT, and other detection technologies. The constant need for improved range, resolution, and multi-spectral capabilities makes this a vital component for effective situational awareness.

- Displays and Notification Systems: Crucial for translating raw sensor data into actionable intelligence, this segment sees significant investment in user-friendly interfaces and advanced visualization tools.

- Other Components: This includes data processing units, communication systems, and networking hardware, which are essential for integrating and disseminating information across the maritime domain.

Type:

- Command and Control (C2): This is a critical area, as C2 systems provide the central nervous system for integrating all situational awareness data. The demand for sophisticated C2 platforms that enable effective decision-making is paramount.

- RADARs: With their ability to detect objects at long ranges under various weather conditions, RADARs remain indispensable. Advancements in AESA and multi-function RADARs are further solidifying their position.

- SONARs: Essential for underwater detection and tracking of submarines, mines, and other submerged objects, SONAR technology continues to evolve with improved algorithms and transducer designs.

- Optronics: This includes EO/IR cameras, thermal imagers, and laser rangefinders, providing visual identification and tracking capabilities, especially for shorter-range threats.

Economic growth in emerging economies is also contributing to the expansion of the maritime surveillance systems market, with countries in the Asia-Pacific and Middle East regions increasingly investing in their maritime capabilities. Infrastructure development, such as the expansion of ports and offshore energy platforms, necessitates enhanced security and monitoring, thereby boosting demand for integrated maritime safety solutions. The rising incidence of illegal maritime activities, including smuggling and piracy, in various global choke points also compels nations to bolster their coastal surveillance systems and vessel tracking systems.

Maritime Situational Awareness Systems Market Product Developments

Product innovation in the Maritime Situational Awareness Systems Market is characterized by the integration of advanced technologies to provide a comprehensive and real-time understanding of the maritime environment. Companies are focusing on developing sensor fusion capabilities that seamlessly combine data from diverse sources like RADAR, SONAR, electro-optical, and electronic intelligence systems. The incorporation of AI and machine learning algorithms is a significant trend, enabling automated threat detection, target classification, and predictive analysis, thereby enhancing operational efficiency and reducing operator workload. Furthermore, the development of modular and scalable systems ensures adaptability to evolving mission requirements and platform constraints. The focus is on creating solutions that offer enhanced range, accuracy, and resilience in challenging maritime conditions.

Challenges in the Maritime Situational Awareness Systems Market Market

The Maritime Situational Awareness Systems Market faces several challenges that can impede its growth. High development and procurement costs for advanced maritime security solutions can be a significant barrier, especially for nations with limited defense budgets. The complexity of integrating disparate sensor systems and legacy platforms into a unified network presents substantial interoperability challenges. Stringent regulatory requirements and certification processes for defense-grade equipment can lead to extended development timelines and increased costs. Furthermore, the rapidly evolving nature of threats necessitates continuous upgrades and adaptation of existing systems, which can strain resources. The global supply chain for specialized electronic components can also be subject to disruptions, impacting production timelines and availability.

Forces Driving Maritime Situational Awareness Systems Market Growth

Several key forces are driving the growth of the Maritime Situational Awareness Systems Market. Increasing geopolitical tensions and the rise of asymmetric threats at sea, including terrorism, piracy, and illegal resource exploitation, necessitate robust maritime surveillance. Growing global trade volumes and the expansion of maritime infrastructure, such as ports and offshore energy facilities, require enhanced security and monitoring capabilities, boosting the demand for maritime domain awareness. Technological advancements, particularly in sensor technology, AI, and data analytics, are enabling more sophisticated and effective situational awareness solutions. Government initiatives and defense modernization programs worldwide are also significant growth catalysts. The growing emphasis on maritime safety and environmental protection, including oil spill detection and search and rescue operations, further expands the market.

Challenges in the Maritime Situational Awareness Systems Market Market

Long-term growth catalysts for the Maritime Situational Awareness Systems Market include the continued integration of AI and machine learning for predictive threat analysis and autonomous operations. Partnerships and collaborations between defense contractors, technology providers, and cybersecurity firms are crucial for developing comprehensive, end-to-end solutions. The expansion into new markets and the development of solutions tailored for emerging naval powers and coast guard agencies represent significant growth avenues. Furthermore, the increasing demand for integrated ISR (Intelligence, Surveillance, and Reconnaissance) capabilities across multiple domains, including air, land, and sea, will drive innovation in networked maritime systems. The adoption of cloud-based solutions and edge computing will also play a role in enhancing data processing and dissemination capabilities.

Emerging Opportunities in Maritime Situational Awareness Systems Market

Emerging opportunities in the Maritime Situational Awareness Systems Market are abundant. The development of AI-powered drone surveillance systems for maritime patrol and reconnaissance presents a significant growth area. The demand for advanced underwater surveillance capabilities, including passive and active SONAR systems for detecting stealthy threats, is increasing. The market also sees opportunities in providing cybersecurity solutions specifically tailored for maritime command and control networks. Furthermore, the growing need for ship tracking systems and Automatic Identification System (AIS) data analytics for commercial and regulatory purposes offers a substantial market niche. The increasing focus on environmental monitoring and disaster response at sea creates demand for specialized maritime situational awareness tools.

Leading Players in the Maritime Situational Awareness Systems Market Sector

- THALES

- Leonardo SpA

- Lockheed Martin Corporation

- Elbit Systems Ltd

- L3 Harris Technologies Inc

- Rafael Advanced Defense Systems Ltd

- BAE Systems PLC

- Northrop Grumman Corporation

- Saab AB

- HENSOLDT A

- Teledyne FLIR LLC

Key Milestones in Maritime Situational Awareness Systems Market Industry

- 2019: Launch of advanced integrated sensor suites offering enhanced multi-domain awareness.

- 2020: Significant investments in AI and ML for threat detection in naval systems.

- 2021: Increased focus on cybersecurity for maritime C2 platforms due to rising cyber threats.

- 2022: Expansion of drone integration into maritime surveillance operations.

- 2023: Development of next-generation RADAR and SONAR systems with improved performance.

- 2024: Key acquisitions and partnerships aimed at consolidating capabilities in maritime security technology.

Strategic Outlook for Maritime Situational Awareness Systems Market Market

The Maritime Situational Awareness Systems Market is poised for sustained growth, driven by an unceasing demand for enhanced maritime security and operational efficiency. Future growth will be accelerated by the continued integration of advanced technologies such as AI, IoT, and quantum computing into maritime intelligence systems. Strategic opportunities lie in developing highly interoperable and scalable solutions that cater to the diverse needs of navies, coast guards, and commercial maritime entities. Collaboration between industry leaders and government agencies will be crucial in shaping the future landscape, focusing on cybersecurity, data fusion, and predictive analytics. The market's trajectory suggests a strong emphasis on networked, multi-domain awareness solutions that provide a holistic understanding of the maritime environment, ensuring safety, security, and optimal resource utilization.

Maritime Situational Awareness Systems Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Displays and Notification Systems

- 1.3. Other Components

-

2. Type

- 2.1. Command and Control

- 2.2. RADARs

- 2.3. SONARs

- 2.4. Optronics

Maritime Situational Awareness Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Maritime Situational Awareness Systems Market Regional Market Share

Geographic Coverage of Maritime Situational Awareness Systems Market

Maritime Situational Awareness Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Command and Control Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Displays and Notification Systems

- 5.1.3. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Command and Control

- 5.2.2. RADARs

- 5.2.3. SONARs

- 5.2.4. Optronics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Maritime Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Sensors

- 6.1.2. Displays and Notification Systems

- 6.1.3. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Command and Control

- 6.2.2. RADARs

- 6.2.3. SONARs

- 6.2.4. Optronics

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Maritime Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Sensors

- 7.1.2. Displays and Notification Systems

- 7.1.3. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Command and Control

- 7.2.2. RADARs

- 7.2.3. SONARs

- 7.2.4. Optronics

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Maritime Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Sensors

- 8.1.2. Displays and Notification Systems

- 8.1.3. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Command and Control

- 8.2.2. RADARs

- 8.2.3. SONARs

- 8.2.4. Optronics

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Maritime Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Sensors

- 9.1.2. Displays and Notification Systems

- 9.1.3. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Command and Control

- 9.2.2. RADARs

- 9.2.3. SONARs

- 9.2.4. Optronics

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Maritime Situational Awareness Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Sensors

- 10.1.2. Displays and Notification Systems

- 10.1.3. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Command and Control

- 10.2.2. RADARs

- 10.2.3. SONARs

- 10.2.4. Optronics

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leonardo SpA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Elbit Systems Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 L3 Harris Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rafael Advanced Defense Systems Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BAE Systems PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Northrop Grumman Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saab AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HENSOLDT A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne FLIR LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Global Maritime Situational Awareness Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Maritime Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Maritime Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Maritime Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Maritime Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Maritime Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Maritime Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Maritime Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Maritime Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Maritime Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Maritime Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Maritime Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Maritime Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Maritime Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Maritime Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Maritime Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Maritime Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Maritime Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Maritime Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Maritime Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Maritime Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Maritime Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Maritime Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Maritime Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Maritime Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Maritime Situational Awareness Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Maritime Situational Awareness Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Maritime Situational Awareness Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East and Africa Maritime Situational Awareness Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Maritime Situational Awareness Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Maritime Situational Awareness Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: India Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 25: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Mexico Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Brazil Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 31: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Maritime Situational Awareness Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Israel Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Maritime Situational Awareness Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Situational Awareness Systems Market?

The projected CAGR is approximately 4.51%.

2. Which companies are prominent players in the Maritime Situational Awareness Systems Market?

Key companies in the market include THALES, Leonardo SpA, Lockheed Martin Corporation, Elbit Systems Ltd, L3 Harris Technologies Inc, Rafael Advanced Defense Systems Ltd, BAE Systems PLC, Northrop Grumman Corporation, Saab AB, HENSOLDT A, Teledyne FLIR LLC.

3. What are the main segments of the Maritime Situational Awareness Systems Market?

The market segments include Component, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.24 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Command and Control Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Situational Awareness Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Situational Awareness Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Situational Awareness Systems Market?

To stay informed about further developments, trends, and reports in the Maritime Situational Awareness Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence