Key Insights

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is projected for substantial expansion, propelled by increased space exploration investments, the rapid growth of satellite constellations for communication and Earth observation, and the rising deployment of satellites in various orbits, including LEO and GEO. The market is anticipated to reach approximately $0.96 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 10.94% through 2033, indicating a strong upward trend. Key applications such as communication and Earth observation are driving demand, fueled by the necessity for advanced data transmission and global monitoring capabilities. The growth of commercial satellite services, alongside significant government and military initiatives within the region, further supports market expansion. Manufacturers are prioritizing the development of advanced AOCS solutions that are lighter, more efficient, and cost-effective, particularly for the expanding segment of satellites weighing between 10-100kg and 100-500kg. Innovations in miniaturization and integrated AOCS technologies are vital for addressing the evolving demands of the NewSpace era.

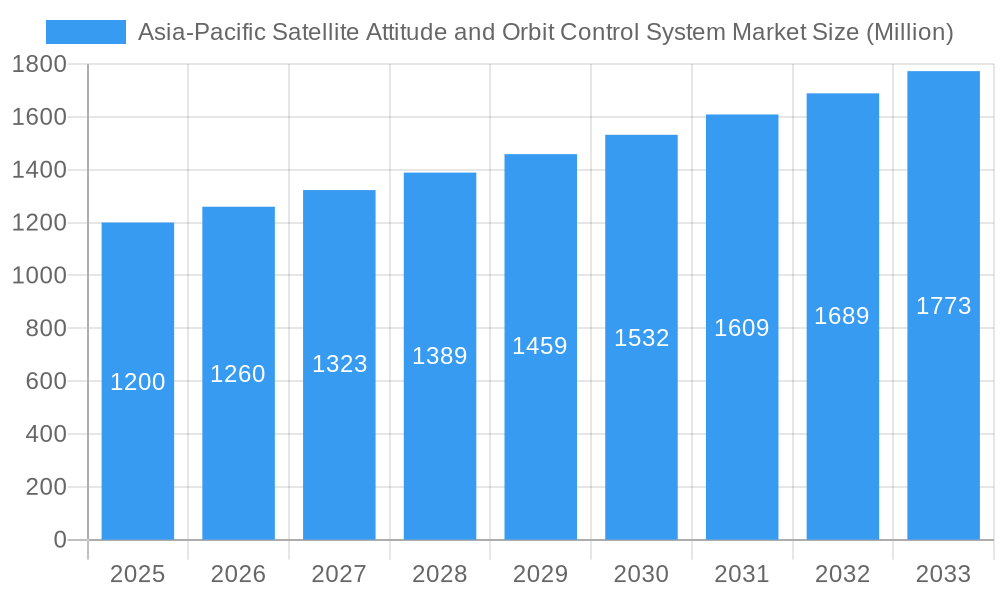

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Size (In Million)

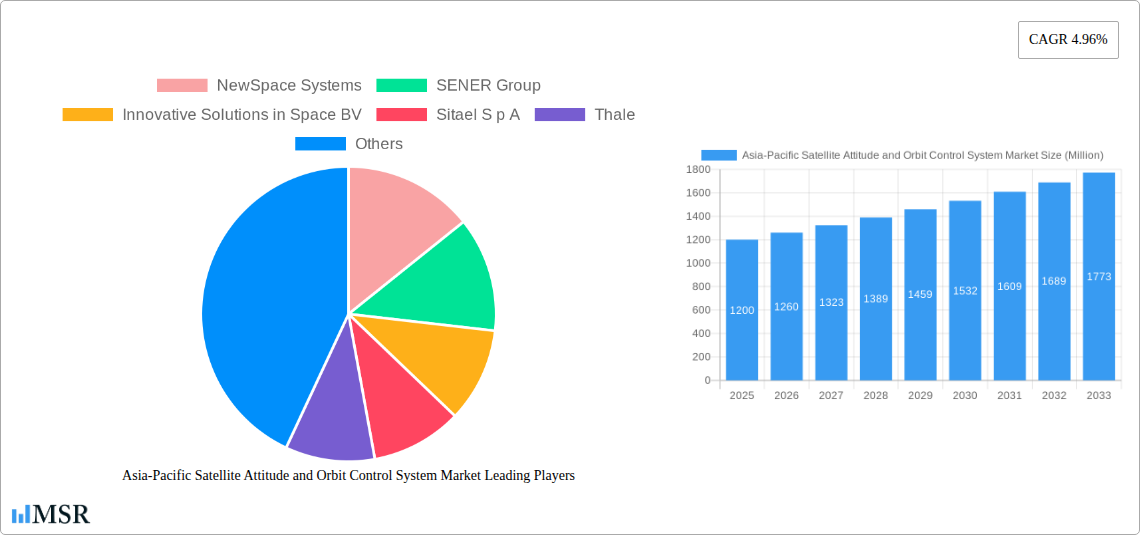

The competitive landscape of the Asia-Pacific AOCS market features established enterprises and emerging innovators. While specific market share data is not provided, the region's robust R&D capabilities and governmental backing for domestic space industries point to a dynamic environment. Key players are expected to concentrate on technological advancements, strategic alliances, and expanding product portfolios to serve diverse satellite applications and end-users. Market growth is further bolstered by improved space accessibility through reduced launch costs and the proliferation of small satellites. Potential restraints, such as high initial development costs and stringent regulatory frameworks, are anticipated to be offset by technological progress and economies of scale. The market is poised for considerable growth in the coming years, establishing Asia-Pacific as a critical hub for satellite technology development and deployment.

Asia-Pacific Satellite Attitude and Orbit Control System Market Company Market Share

Asia-Pacific Satellite Attitude and Orbit Control System Market: Comprehensive Growth Analysis and Forecast (2025-2033)

This comprehensive report delivers a definitive analysis of the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) Market, providing critical insights for industry stakeholders. Explore market dynamics, key trends, competitive landscapes, and future opportunities shaping satellite control technologies across the region. With a detailed study period from 2019 to 2033, a base year of 2025, and a forecast period extending to 2033, this report offers actionable intelligence for strategic decision-making in the dynamic space sector.

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Concentration & Dynamics

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market exhibits a moderate to high concentration, characterized by the presence of established global players and a growing number of regional innovators. The innovation ecosystem is thriving, driven by increasing R&D investments in advanced AOCS technologies, particularly for small satellite constellations and next-generation Earth observation missions. Regulatory frameworks are gradually evolving to support space activities, though variations exist across countries, impacting market entry and operational standards. Substitute products, such as advanced software-based control algorithms and more integrated subsystem solutions, are emerging but have yet to fully displace dedicated AOCS hardware for critical missions. End-user trends reveal a strong demand for miniaturized, cost-effective, and highly reliable AOCS solutions, particularly from the commercial sector for communication and Earth observation applications. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate market share, acquire new technologies, and expand their geographical reach. While specific M&A deal counts are fluid, strategic partnerships and joint ventures are becoming more prevalent. The market share distribution is influenced by the ability of companies to offer comprehensive AOCS solutions tailored to the diverse needs of the Asia-Pacific region's burgeoning space economy.

Asia-Pacific Satellite Attitude and Orbit Control System Market Industry Insights & Trends

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is poised for substantial growth, projected to reach approximately $1,500 Million by 2033. This expansion is fueled by a confluence of technological advancements, increasing satellite deployments, and growing government and commercial investments in space-based applications. The market size in the base year of 2025 is estimated at $850 Million, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. Key growth drivers include the escalating demand for high-resolution Earth observation data for environmental monitoring, disaster management, and precision agriculture, directly necessitating sophisticated AOCS for accurate pointing and stabilization. The rapid proliferation of LEO satellite constellations for global internet connectivity and telecommunications is another significant catalyst, requiring cost-effective and mass-producible AOCS solutions. Furthermore, the growing interest in space tourism, scientific research missions, and national security applications further boosts the demand for advanced AOCS. Technological disruptions are primarily centered around the miniaturization of AOCS components, enhanced algorithmic capabilities for autonomous control, and the integration of AI and machine learning for predictive maintenance and improved mission performance. The miniaturization trend is particularly evident in the growing adoption of AOCS for small satellites (Below 10 Kg and 10-100kg), driving innovation in compact and power-efficient systems. Evolving consumer behaviors, while indirect, manifest in the demand for more responsive and resilient satellite services, pushing manufacturers to develop AOCS that can handle complex maneuvers and adapt to dynamic mission requirements. The increasing focus on debris mitigation and sustainable space operations also influences AOCS design towards systems that can facilitate controlled de-orbiting. The historical period of 2019–2024 laid the groundwork for this growth, marked by early adoption of new technologies and increased satellite launches.

Key Markets & Segments Leading Asia-Pacific Satellite Attitude and Orbit Control System Market

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is experiencing leadership driven by specific segments and applications, with Low Earth Orbit (LEO) Class satellites dominating the landscape. This dominance is primarily attributed to the burgeoning demand for satellite constellations in LEO for communication and Earth observation services.

Orbit Class Dominance: LEO satellites require frequent orbital adjustments and precise attitude control due to their lower altitudes and faster orbital periods. This necessitates robust and responsive AOCS, making LEO the most significant orbit class in terms of AOCS market share. GEO and MEO applications, while important, generally involve fewer satellite deployments and distinct AOCS requirements.

Application Segment Leadership:

- Communication: The expansion of global internet connectivity through satellite constellations in LEO is a primary driver. This segment demands AOCS capable of maintaining precise pointing for continuous data transmission and supporting large constellation deployments.

- Earth Observation: The increasing need for high-resolution imagery for environmental monitoring, climate change studies, resource management, and urban planning fuels the demand for AOCS that enable accurate target tracking and imaging.

Satellite Mass Segmentation:

- Below 10 Kg and 10-100kg: The rise of small satellites (smallsats) and CubeSats has created a significant market for lightweight, cost-effective, and standardized AOCS solutions. This segment is experiencing the fastest growth due to the accessibility and versatility of smaller satellite platforms for various applications.

- 100-500kg: This segment also represents a substantial portion of the market, encompassing many commercial and scientific satellites that require more sophisticated AOCS for extended missions and complex payloads.

End User Segment Dynamics:

- Commercial: This is the largest end-user segment, driven by telecommunications companies, Earth observation service providers, and emerging space-tech startups. Their focus on cost-efficiency and rapid deployment influences AOCS development towards mass-producible and integrated solutions.

- Military & Government: National security and defense initiatives, along with governmental scientific and infrastructure monitoring programs, contribute significantly to the demand for high-reliability, secure, and advanced AOCS.

The economic growth in key Asia-Pacific nations, coupled with substantial government investments in space infrastructure and the development of domestic satellite industries, are key drivers behind the leadership of these segments. The increasing affordability of launching small satellites and the development of advanced AOCS components are further accelerating the adoption of these technologies, making LEO, communication, and Earth observation applications for smaller satellite masses the primary engines of market growth.

Asia-Pacific Satellite Attitude and Orbit Control System Market Product Developments

Recent product developments in the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market are focused on enhancing miniaturization, improving precision, and increasing autonomy. Innovations like Jena-Optronik's ASTRO CL star tracker exemplify this trend, offering compact and highly accurate guidance, navigation, and control solutions specifically designed for proliferated LEO satellite platforms and small satellites. These advancements are crucial for enabling the cost-effective deployment and efficient operation of large satellite constellations. Furthermore, the integration of advanced sensor technologies and sophisticated algorithms is leading to AOCS that can perform complex maneuvers with greater reliability and reduced ground intervention, offering a competitive edge to manufacturers and improved mission outcomes for satellite operators.

Challenges in the Asia-Pacific Satellite Attitude and Orbit Control System Market Market

Despite robust growth, the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market faces several challenges. Stringent export control regulations and varying national security policies across the region can impede the seamless transfer of advanced AOCS technologies and components. Supply chain disruptions, particularly for specialized electronic components and rare earth materials, pose a continuous risk, impacting production timelines and costs. The high cost of research and development for cutting-edge AOCS technologies can be a barrier for smaller companies, leading to market consolidation. Additionally, the increasing complexity of satellite missions requires AOCS solutions that are not only reliable but also highly adaptable, presenting a significant engineering challenge.

Forces Driving Asia-Pacific Satellite Attitude and Orbit Control System Market Growth

The growth of the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is propelled by several key forces. Escalating demand for satellite-based services, including broadband internet, high-resolution Earth observation, and advanced navigation systems, directly fuels the need for reliable AOCS. Significant government investments in space programs, driven by economic, scientific, and national security objectives across countries like China, Japan, India, and South Korea, are creating a conducive environment for market expansion. The advancement in miniaturization and cost reduction of satellite components, particularly for small satellites, is democratizing space access and increasing the number of satellite deployments, thereby boosting AOCS demand. Furthermore, technological innovations in AOCS, such as enhanced sensor accuracy, improved algorithms for autonomous control, and greater power efficiency, are making these systems more attractive and capable.

Challenges in the Asia-Pacific Satellite Attitude and Orbit Control System Market Market

Long-term growth catalysts in the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market are intrinsically linked to continuous innovation and strategic market penetration. The increasing adoption of AI and machine learning in AOCS for predictive maintenance, enhanced autonomy, and adaptive mission planning represents a significant long-term growth driver. Expansion into new application areas, such as in-orbit servicing, space debris removal, and lunar/interplanetary exploration, will require the development of more sophisticated and resilient AOCS capabilities. Strategic partnerships and collaborations between established players and emerging startups, focusing on co-development of next-generation AOCS technologies, will also foster sustained growth. Furthermore, the growing emphasis on space situational awareness and debris mitigation will necessitate AOCS with enhanced maneuverability and precise control, creating new market opportunities.

Emerging Opportunities in Asia-Pacific Satellite Attitude and Orbit Control System Market

Emerging opportunities in the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market lie in the development of highly integrated and software-defined AOCS solutions that can be adapted to a wide range of satellite platforms and missions. The burgeoning small satellite constellation market, particularly for IoT connectivity and remote sensing, presents a substantial opportunity for mass-produced, cost-effective AOCS. The increasing interest in in-orbit servicing, assembly, and manufacturing (ISAM) will create demand for advanced AOCS capable of intricate rendezvous, docking, and manipulation operations. Furthermore, the growing space infrastructure development and national space programs in emerging economies within the Asia-Pacific region offer new avenues for market penetration and growth.

Leading Players in the Asia-Pacific Satellite Attitude and Orbit Control System Market Sector

- NewSpace Systems

- SENER Group

- Innovative Solutions in Space BV

- Sitael S p A

- Thales

- Jena-Optronik

- AAC Clyde Space

Key Milestones in Asia-Pacific Satellite Attitude and Orbit Control System Market Industry

- February 2023: Jena-Optronik announced its selection by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites. This partnership signifies a significant win for Jena-Optronik and highlights the growing demand for its advanced AOCS sensors in the burgeoning LEO satellite constellation market.

- December 2022: The ASTRO CL, recognized as the smallest member of Jena-Optronik's ASTRO star tracker family, was chosen to support Maxar's new proliferated LEO satellite platform. Each satellite will be equipped with two ASTRO CL star trackers, crucial for enabling its precise guidance, navigation, and control capabilities. This deployment underscores the reliability and suitability of Jena-Optronik's technology for large-scale LEO constellations.

- November 2022: NASA's Artemis I mission was successfully equipped with two star sensors from Jena-Optronik GmbH. These sensors played a vital role in ensuring the precise alignment of the spaceship during its journey to the Moon, demonstrating the high accuracy and reliability of Jena-Optronik's products for critical space missions.

Strategic Outlook for Asia-Pacific Satellite Attitude and Orbit Control System Market Market

The strategic outlook for the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is highly positive, driven by several key growth accelerators. The continued expansion of LEO satellite constellations for global connectivity and Earth observation will remain a primary growth engine, demanding scalable and cost-effective AOCS solutions. Strategic opportunities lie in leveraging advancements in AI and machine learning to develop smarter, more autonomous AOCS, reducing reliance on ground control and enhancing mission efficiency. Furthermore, partnerships with emerging space nations and the development of localized manufacturing capabilities will be crucial for capturing market share. The growing interest in in-orbit servicing and sustainable space operations presents a significant avenue for developing specialized AOCS with enhanced maneuverability and precision.

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

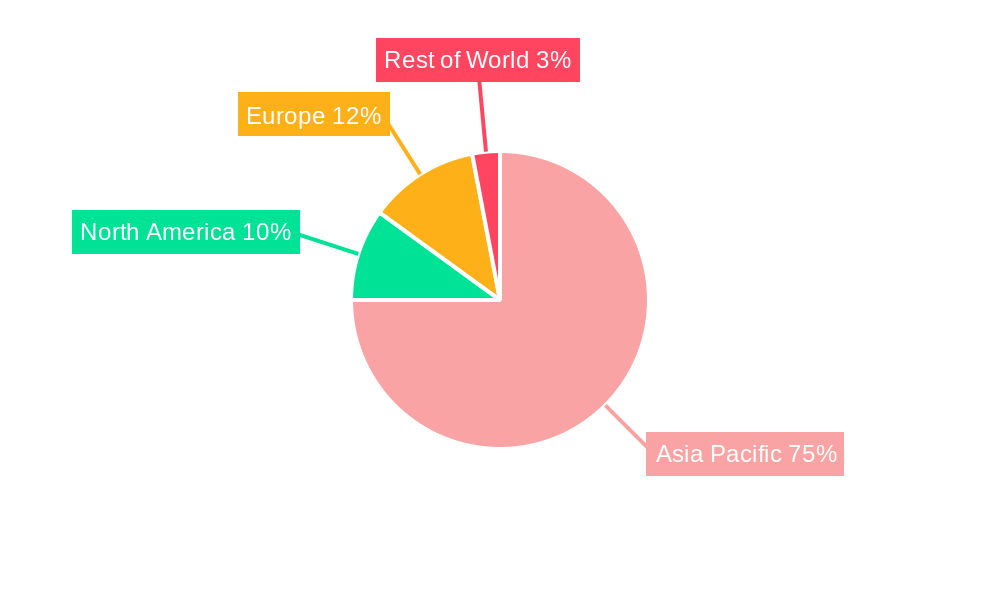

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of Asia-Pacific Satellite Attitude and Orbit Control System Market

Asia-Pacific Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innovative Solutions in Space BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sitael S p A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jena-Optronik

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AAC Clyde Space

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, Innovative Solutions in Space BV, Sitael S p A, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence