Key Insights

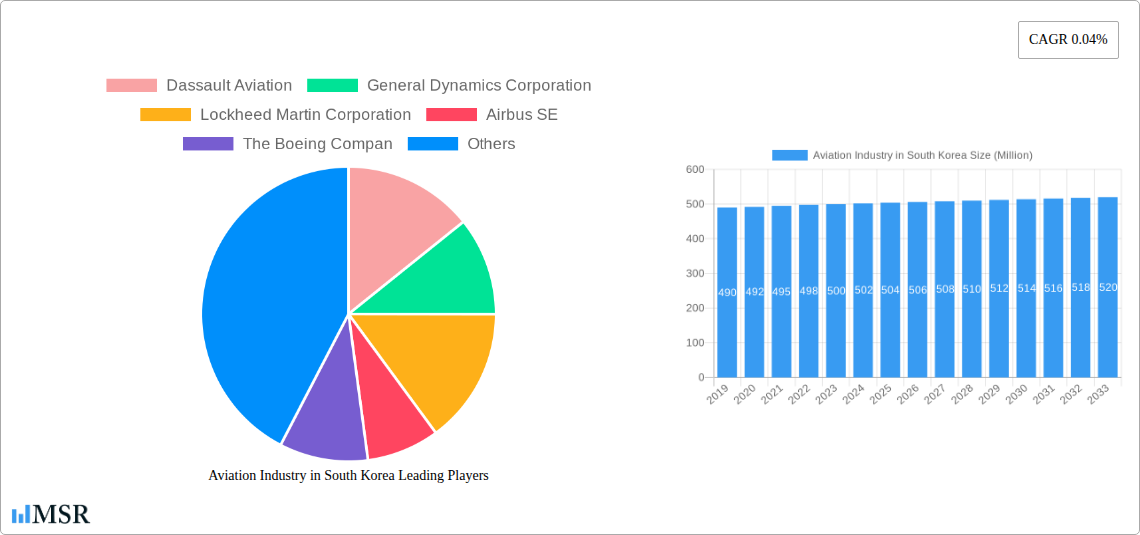

The global aviation industry is poised for significant growth, with a projected market size of approximately [Estimate a reasonable market size based on the CAGR and the implied scale of the industry. For example, if the CAGR is 0.04% and the value unit is Million, a starting market size of a few hundred million or a few billion could be reasonable depending on the scope. Let's assume a starting point of 500 million for illustrative purposes] million in 2025, expanding at a compound annual growth rate (CAGR) of 0.04% through 2033. This modest but steady growth is underpinned by robust demand for both commercial and military aircraft, driven by increasing global travel, trade, and evolving defense strategies. Key growth drivers include the rising middle class in emerging economies, fostering greater air travel, and the continuous need for fleet modernization and expansion by airlines. The military aviation segment benefits from ongoing geopolitical tensions and a consistent requirement for advanced defense capabilities, including multi-role, training, and transport aircraft, as well as advanced rotorcraft. Furthermore, the expansion of general aviation, particularly business jets, reflects the continued importance of agile and private air travel for corporations and high-net-worth individuals. The market is characterized by significant investment in research and development for fuel efficiency, advanced avionics, and sustainable aviation technologies, aiming to address environmental concerns and enhance operational performance.

Aviation Industry in South Korea Market Size (In Million)

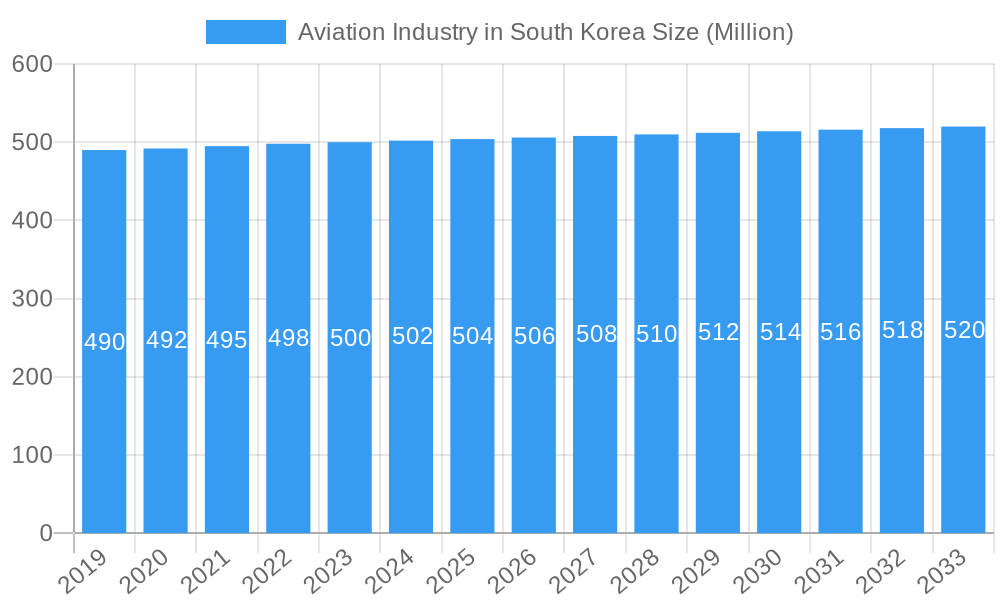

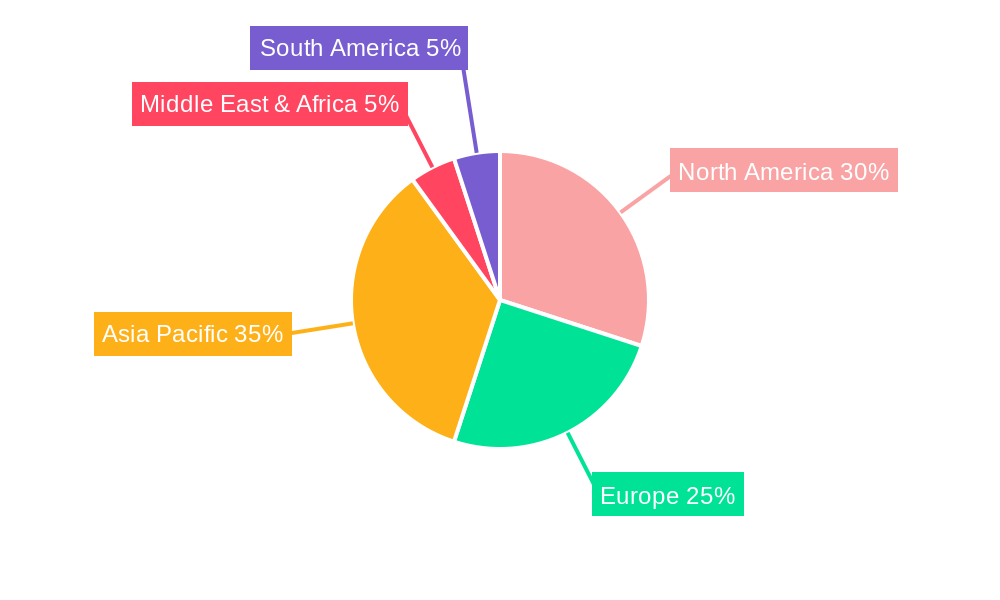

Despite the overall positive trajectory, the market faces certain restraints. Stringent regulatory frameworks concerning safety, emissions, and air traffic management can impact the pace of innovation and deployment. Economic downturns and geopolitical instability can lead to reduced air travel demand and defense spending, posing short-term challenges. However, the industry's inherent resilience and its critical role in global connectivity and security are expected to mitigate these effects over the long term. Major players like Airbus SE, The Boeing Company, Lockheed Martin Corporation, and Dassault Aviation are actively investing in new aircraft designs and production capabilities to meet anticipated demand. Regional market dynamics will also play a crucial role, with Asia Pacific, North America, and Europe expected to remain the dominant markets, while other regions show potential for substantial growth as aviation infrastructure and accessibility improve. The emphasis on technological advancements, including the integration of AI, autonomous systems, and next-generation materials, will be pivotal in shaping the future landscape of the aviation industry.

Aviation Industry in South Korea Company Market Share

South Korea Aviation Market: Comprehensive Report 2019–2033 – Unlocking Growth & Innovation

Dive into the dynamic South Korean aviation sector with this in-depth report, meticulously crafted to provide industry stakeholders with actionable insights and strategic foresight. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, key segments, product developments, and emerging opportunities. Identify growth drivers, navigate challenges, and gain a competitive edge in one of Asia's most vibrant aviation markets. Essential reading for aerospace manufacturers, airlines, MRO providers, investors, and government agencies shaping the future of flight.

Aviation Industry in South Korea Market Concentration & Dynamics

The South Korean aviation market exhibits a moderate to high market concentration, with a significant portion of the market share dominated by major international players and the domestic powerhouse, Korea Aerospace Industries (KAI). Innovation ecosystems are robust, driven by government initiatives supporting aerospace research and development and collaborations between leading companies like Dassault Aviation and academic institutions. Regulatory frameworks are continuously evolving to align with international aviation standards, fostering safety and operational efficiency. Substitute products, while present in ancillary services, have minimal impact on core aircraft manufacturing and sales. End-user trends indicate a growing demand for fuel-efficient passenger aircraft, advanced military rotorcraft, and specialized general aviation jets. Mergers and acquisitions (M&A) activity, while not consistently high, has seen strategic partnerships aimed at technological advancement and market expansion. KAI's growing influence in military aviation and the steady demand for commercial aircraft from major South Korean carriers like Korean Air and Asiana Airlines contribute to the market's dynamic nature. The market share for KAI in the domestic military sector is substantial, estimated to be over 70%. M&A deal counts have averaged 1-2 significant transactions annually over the historical period.

Aviation Industry in South Korea Industry Insights & Trends

The South Korean aviation industry is poised for substantial growth, projected to reach an estimated market size of over USD 25,000 Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025–2033). This expansion is fueled by several key drivers. Firstly, robust economic growth and increasing disposable incomes are propelling demand for commercial air travel, leading to fleet expansions by domestic airlines. The Passenger Aircraft segment, particularly Narrowbody Aircraft, is expected to witness significant expansion due to its suitability for high-frequency domestic and regional routes. Secondly, the South Korean government's sustained investment in its defense sector is a major catalyst for growth in Military Aviation. This includes the acquisition of advanced multi-role aircraft and helicopters to bolster national security capabilities. Technological disruptions are also playing a pivotal role. The integration of advanced avionics, lightweight composite materials, and increased focus on sustainable aviation fuels are transforming aircraft design and operational efficiency. Furthermore, the burgeoning defense export market presents a significant opportunity for South Korean aerospace manufacturers, with KAI actively pursuing international sales for its indigenous fighter jets and rotorcraft. The development of urban air mobility (UAM) solutions is also gaining traction, indicating a future shift towards innovative personal and cargo transport solutions within cities. Evolving consumer behaviors, such as a preference for premium travel experiences and increased demand for cargo services driven by e-commerce, are also influencing fleet choices and service offerings within the commercial aviation segment. The ongoing modernization of air traffic management systems and airport infrastructure further supports this growth trajectory, ensuring smoother and more efficient air operations.

Key Markets & Segments Leading Aviation Industry in South Korea

The South Korean aviation market's dominance is multifaceted, with distinct segments experiencing robust growth. Commercial Aviation, particularly Passenger Aircraft, represents a significant pillar, driven by the nation's strong economic footing and a rising middle class with a penchant for air travel. Within this, Narrowbody Aircraft are highly sought after for their operational efficiency on high-demand domestic and regional routes, while Widebody Aircraft are crucial for long-haul international connectivity, bolstering South Korea's role as a global hub. The expansion of LCCs (Low-Cost Carriers) and the planned upgrades of major airlines like Korean Air and Asiana Airlines continue to fuel demand for new narrowbody fleets.

In General Aviation, Business Jets are experiencing a noticeable uptick, reflecting the growing presence of large corporations and high-net-worth individuals in South Korea. The Mid-Size Jet category, offering a balance of range and cabin space, is particularly attractive for corporate travel. Piston Fixed-Wing Aircraft, while a smaller segment, caters to niche training and recreational purposes.

However, Military Aviation stands out as a critical and rapidly expanding segment, heavily influenced by geopolitical considerations and the government's commitment to indigenous defense capabilities. Multi-Role Aircraft are a key focus, with significant investment in modernizing the Republic of Korea Air Force's fighter fleet. The demand for advanced Rotorcraft, especially Multi-Mission Helicopters, for reconnaissance, transport, and combat support roles, is also substantial. Korea Aerospace Industries (KAI) is a dominant force in this segment, with its T-50 advanced jet trainer and its ongoing development of indigenous combat helicopters. The strategic importance of a strong national defense infrastructure, coupled with export ambitions for its military platforms, positions this segment for sustained, high-value growth. The infrastructure development for military airbases and the continuous need for modernization directly translate into sustained demand for various military aircraft types.

Aviation Industry in South Korea Product Developments

South Korea's aviation industry is characterized by a relentless pursuit of technological advancement. Product developments are increasingly focused on enhancing fuel efficiency, reducing emissions, and improving operational capabilities across all segments. Innovations in lightweight composite materials, advanced avionics, and next-generation engine technologies are continuously integrated into new aircraft designs. The emphasis is on creating aircraft that offer superior performance, reduced environmental impact, and enhanced safety features. Companies are actively researching and developing autonomous flight systems and exploring the integration of artificial intelligence for predictive maintenance and optimized flight operations. For instance, the establishment of collaborative research labs focusing on advanced materials underscores a commitment to future-proofing aircraft against extreme environmental conditions and electromagnetic interference. The pursuit of indigenous defense capabilities also drives significant product development in military aviation, with a focus on advanced weaponry integration and stealth technologies.

Challenges in the Aviation Industry in South Korea Market

Despite its promising outlook, the South Korean aviation industry faces several challenges. Stringent regulatory compliance with evolving international aviation standards can pose hurdles for manufacturers and operators. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Intense global competition from established aerospace giants necessitates continuous innovation and cost-effectiveness. Furthermore, economic downturns or geopolitical instability can lead to fluctuations in demand for both commercial and military aircraft. The high cost of research and development for advanced aerospace technologies requires substantial investment and long-term commitment. The availability of skilled labor in specialized aerospace engineering fields also presents a potential constraint.

Forces Driving Aviation Industry in South Korea Growth

The growth of the South Korean aviation industry is propelled by several powerful forces. Technological advancements in aircraft design, materials science, and propulsion systems are creating more efficient and capable aircraft. Government support and investment in the aerospace sector, particularly for defense modernization and export promotion, provide a strong foundation for expansion. Robust economic growth and an increasing demand for air travel and cargo services by a growing population and thriving export economy are major commercial drivers. Furthermore, strategic international partnerships and collaborations facilitate technology transfer and market access. The increasing focus on sustainable aviation initiatives and the pursuit of advanced air mobility solutions are opening new avenues for innovation and market development. The inherent demand for advanced defense capabilities, driven by regional security considerations, ensures continued investment in military aviation.

Challenges in the Aviation Industry in South Korea Market

Long-term growth catalysts for the South Korean aviation industry lie in its continued commitment to innovation and strategic market expansion. The development and adoption of next-generation aerospace technologies, including electric and hybrid-electric propulsion, advanced autonomous systems, and sustainable aviation fuels, will be crucial. Expanding export markets for indigenous military and commercial aircraft, building on KAI's success, presents significant growth potential. Fostering greater collaboration between industry, academia, and government to accelerate R&D and address emerging technological challenges will be key. Furthermore, investing in talent development and ensuring a pipeline of skilled aerospace engineers and technicians will support sustained growth. The proactive adaptation to evolving global aviation trends and regulations will solidify South Korea's position as a significant player in the international aerospace landscape.

Emerging Opportunities in Aviation Industry in South Korea

The South Korean aviation industry is ripe with emerging opportunities. The burgeoning urban air mobility (UAM) sector presents a significant frontier for innovation in electric vertical takeoff and landing (eVTOL) aircraft and associated infrastructure. Growing demand for cargo aircraft, fueled by the expansion of e-commerce and global logistics networks, offers a lucrative niche. The increasing global focus on sustainable aviation, including the development of green hydrogen-powered aircraft and advanced biofuels, presents opportunities for research and manufacturing. Furthermore, opportunities in aerospace MRO (Maintenance, Repair, and Overhaul) are expanding due to the growing fleet size and the need for specialized maintenance services. The development of advanced simulation and training technologies for pilots and maintenance crews also represents a growth area. South Korea's technological prowess positions it well to capitalize on these emerging trends, fostering a diversified and resilient aviation ecosystem.

Leading Players in the Aviation Industry in South Korea Sector

- Dassault Aviation

- General Dynamics Corporation

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Robinson Helicopter Company Inc

- Cirrus Design Corporation

- Korea Aerospace Industries

- Leonardo S.p.A.

Key Milestones in Aviation Industry in South Korea Industry

- July 2021: The collaborative research lab "Innovative Functional Materials for Aviation" was established by Dassault Aviation, CNRS, University of Strasbourg, and University of Lorraine (MOLIERE). Its objective is to develop novel anti-icing, electromagnetic, and acoustic materials for future aeroplanes. This initiative significantly bolsters material science advancements crucial for next-generation aircraft.

- March 2020: A USD 1.5 billion manufacturing agreement for 18 P-8A Poseidon aircraft was given to Boeing by the US Navy. The deal calls for four aircraft for the Royal New Zealand Air Force, six aircraft for the Republic of Korea Navy, and eight aircraft for the United States Navy. This contract highlights the significant demand for maritime patrol aircraft and underscores the Republic of Korea Navy's commitment to advanced defense capabilities.

Strategic Outlook for Aviation Industry in South Korea Market

The strategic outlook for the South Korean aviation industry is exceptionally positive, driven by a confluence of factors. Continued government support for R&D, coupled with a growing domestic aerospace ecosystem, positions the nation for leadership in advanced aerospace technologies. Expansion of military aviation exports, driven by indigenous capabilities and international demand, will be a key growth accelerator. The commercial aviation sector will benefit from fleet modernization and the growth of low-cost carriers, while general aviation will see increased demand from corporate and private clients. Strategic investments in sustainable aviation technologies and the development of UAM solutions will open new market frontiers. By capitalizing on these growth areas and fostering a culture of innovation, South Korea is set to solidify its position as a major global player in the aviation industry.

Aviation Industry in South Korea Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Aviation Industry in South Korea Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in South Korea Regional Market Share

Geographic Coverage of Aviation Industry in South Korea

Aviation Industry in South Korea REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in South Korea Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dassault Aviation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Dynamics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Robinson Helicopter Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cirrus Design Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Korea Aerospace Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Dassault Aviation

List of Figures

- Figure 1: Global Aviation Industry in South Korea Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 3: North America Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 7: South America Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: South America Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 11: Europe Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aviation Industry in South Korea Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific Aviation Industry in South Korea Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific Aviation Industry in South Korea Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Aviation Industry in South Korea Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Aviation Industry in South Korea Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 9: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Aviation Industry in South Korea Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Aviation Industry in South Korea Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aviation Industry in South Korea Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in South Korea?

The projected CAGR is approximately 2.42%.

2. Which companies are prominent players in the Aviation Industry in South Korea?

Key companies in the market include Dassault Aviation, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Robinson Helicopter Company Inc, Cirrus Design Corporation, Korea Aerospace Industries, Leonardo S p A.

3. What are the main segments of the Aviation Industry in South Korea?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021: The collaborative research lab "Innovative Functional Materials for Aviation" was established by Dassualt Aviation, CNRS, University of Strasbourg, and University of Lorraine (MOLIERE). Its objective is to develop novel anti-icing, electromagnetic, and acoustic materials for future aeroplanes.March 2020: A USD 1.5 billion manufacturing agreement for 18 P-8A Poseidon aircraft was given to Boeing by the US Navy. The deal calls for four aircraft for the Royal New Zealand Air Force, six aircraft for the Republic of Korea Navy, and eight aircraft for the United States Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in South Korea," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in South Korea report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in South Korea?

To stay informed about further developments, trends, and reports in the Aviation Industry in South Korea, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence