Key Insights

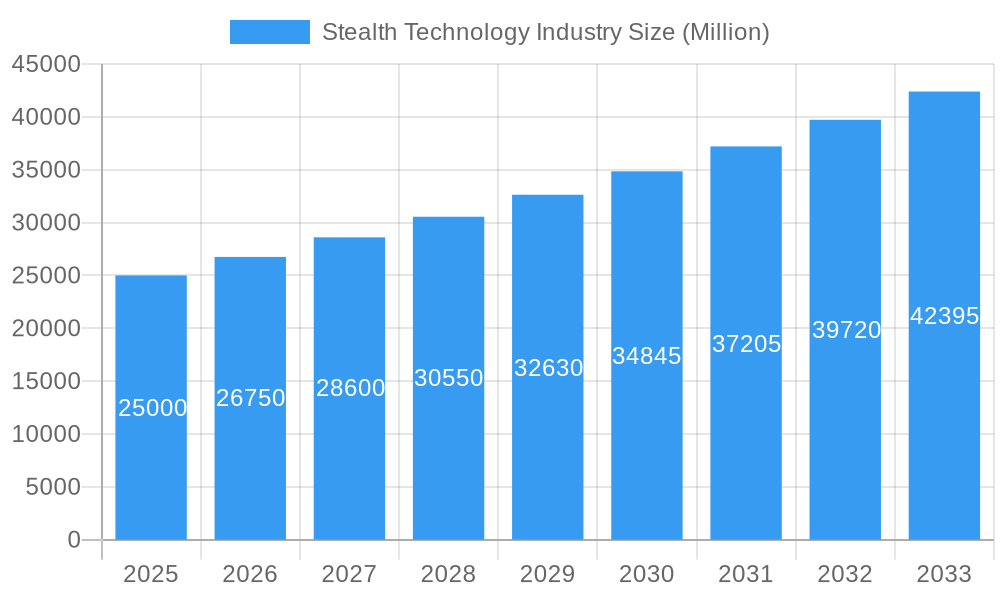

The global Stealth Technology Industry is experiencing robust growth, projected to surpass a market size of approximately $25,000 million by 2025, with a compound annual growth rate (CAGR) exceeding 6.00% throughout the forecast period of 2025-2033. This expansion is primarily fueled by escalating geopolitical tensions, increased defense spending across major economies, and the relentless pursuit of advanced military capabilities. Nations are heavily investing in stealth technologies to gain a strategic advantage through enhanced survivability and operational effectiveness in increasingly complex and contested airspace, maritime, and land environments. Key drivers include the development of next-generation fighter jets, unmanned aerial vehicles (UAVs), and naval vessels equipped with sophisticated radar-absorbent materials, low-observable shaping, and advanced electronic countermeasures. The demand for stealth solutions spans aerial platforms like fighter jets and bombers, marine applications such as submarines and warships, and terrestrial systems including reconnaissance vehicles and secure communication networks.

Stealth Technology Industry Market Size (In Billion)

The industry's growth trajectory is further supported by significant technological advancements in materials science, sensor fusion, and signal processing, enabling the creation of more effective and persistent stealth capabilities. Major players like Raytheon Technologies, Lockheed Martin, BAE Systems, and Northrop Grumman are at the forefront of innovation, investing heavily in research and development to maintain a competitive edge. However, the industry faces certain restraints, including the extremely high cost of developing and integrating stealth systems, stringent export controls and intellectual property concerns, and the ongoing development of counter-stealth technologies by potential adversaries. Despite these challenges, the persistent need for strategic deterrence and operational superiority ensures a sustained demand for stealth solutions, making this a critical and dynamic sector within the global defense landscape. Asia Pacific, particularly China and India, is emerging as a significant growth region, driven by modernization programs and increasing defense budgets.

Stealth Technology Industry Company Market Share

Stealth Technology Industry: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global stealth technology industry, a critical sector in modern defense and advanced surveillance. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides invaluable insights for defense contractors, aerospace manufacturers, government agencies, investors, and research institutions. Dive into market dynamics, technological advancements, key players, and strategic opportunities shaping the future of low observability technology.

Stealth Technology Industry Market Concentration & Dynamics

The stealth technology market exhibits moderate to high concentration, with a few major global players dominating R&D and manufacturing. Companies like Lockheed Martin Corporation, Northrop Grumman Corporation, The Boeing Company, Raytheon Technologies Corporation, and BAE Systems plc command significant market share due to their extensive experience and substantial defense contracts. Innovation ecosystems are primarily driven by government-funded research and development initiatives, fostering collaboration between public institutions and private enterprises. Regulatory frameworks, particularly export controls and intellectual property rights, significantly influence market accessibility and international trade. Substitute products are limited in their effectiveness against advanced stealth capabilities, but advancements in sensor technology, such as advanced radar and infrared detection, pose a continuous challenge. End-user trends are strongly influenced by geopolitical tensions and the increasing demand for advanced air, marine, and terrestrial defense platforms. Mergers and acquisition (M&A) activities are observed as companies seek to consolidate expertise, expand their product portfolios, and secure key technologies. Over the historical period (2019-2024), there were approximately 5 significant M&A deals within the broader defense sector with stealth technology components. The market share of the top 5 companies is estimated to be over 60%.

Stealth Technology Industry Industry Insights & Trends

The stealth technology industry is poised for substantial growth, driven by escalating global security concerns and the relentless pursuit of military and intelligence superiority. The market size for stealth technology is projected to reach an estimated USD 50 Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. Key growth drivers include the modernization of air forces worldwide, the development of next-generation naval vessels with reduced signatures, and the integration of stealth capabilities into terrestrial reconnaissance and combat systems. Technological disruptions are at the forefront, with continuous advancements in materials science for radar-absorbent coatings, electromagnetic spectrum management, and infrared suppression. The development of fifth-generation fighter jets and advanced unmanned aerial vehicles (UAVs) incorporating sophisticated stealth features is a significant trend. Evolving consumer behaviors, in this context, refer to the procurement strategies of defense ministries, which are increasingly prioritizing advanced, survivable platforms that can operate in contested environments. The demand for electronic warfare capabilities integrated with stealth platforms also represents a growing segment. The ongoing shift towards networked warfare and the need for platforms that can evade detection and evade enemy countermeasures are further accelerating market expansion.

Key Markets & Segments Leading Stealth Technology Industry

The Aerial platform segment is currently the dominant market within the stealth technology industry. This dominance is driven by several factors, including the strategic importance of air superiority in modern warfare, the high investment in fighter jet modernization programs, and the proven effectiveness of stealth aircraft in achieving mission objectives.

- Economic Growth: Significant defense budgets in major economies like the United States, China, and European nations fuel the demand for advanced aerial platforms.

- Technological Advancement: Continuous innovation in aerodynamics, materials science, and avionics for aircraft has consistently pushed the boundaries of stealth capabilities.

- Geopolitical Factors: Regional conflicts and the perceived threats from potential adversaries necessitate the acquisition of advanced air defense evasion technologies.

The Marine platform segment is experiencing robust growth, particularly in submarine technology. The development of next-generation submarines equipped with advanced stealth features is a key trend, driven by the need for silent, undetectable underwater operations for intelligence gathering, power projection, and strategic deterrence.

- Naval Modernization: Countries are investing heavily in upgrading their naval fleets to maintain a competitive edge.

- Strategic Deterrence: Submarine-launched ballistic missile systems, often incorporating stealth, remain a cornerstone of nuclear deterrence.

- Intelligence, Surveillance, and Reconnaissance (ISR): Stealth submarines offer unparalleled capabilities for covert ISR missions.

The Terrestrial platform segment is emerging as a significant growth area, with increasing applications in armored vehicles, ground-based sensors, and electronic warfare systems designed for reduced electromagnetic and thermal signatures.

- Advanced Reconnaissance: Stealthy ground vehicles and sensors are crucial for covert battlefield reconnaissance and situational awareness.

- Force Protection: Reducing the signature of terrestrial assets enhances survivability in hostile environments.

Stealth Technology Industry Product Developments

Product developments in the stealth technology industry are characterized by a relentless pursuit of enhanced low observability. This includes advancements in multi-spectral stealth materials that absorb or scatter radar, infrared, and acoustic signals across a wider range of frequencies. Innovations in active stealth technologies, which can adapt their signatures in real-time, are emerging. The integration of artificial intelligence (AI) for optimizing stealth profiles and managing electronic countermeasures is a key competitive edge. Applications are expanding beyond traditional military aircraft to include unmanned systems, naval vessels, and even advanced ground vehicles, offering superior battlefield survivability and operational effectiveness.

Challenges in the Stealth Technology Industry Market

The stealth technology industry faces several challenges that can impede market growth. Regulatory hurdles, particularly stringent export controls on advanced defense technologies, limit international market penetration. Supply chain disruptions for specialized materials and components, exacerbated by geopolitical instability, can lead to production delays and increased costs. The sheer cost of developing and integrating advanced stealth capabilities is substantial, placing a significant financial burden on procurement agencies. Furthermore, the constant evolution of sensor and detection technologies by adversaries necessitates continuous R&D investment, creating an ongoing arms race. The estimated impact of supply chain disruptions on project timelines can be up to 15%.

Forces Driving Stealth Technology Industry Growth

Several key forces are driving the stealth technology industry growth. Geopolitical tensions and regional conflicts are compelling nations to invest in advanced military capabilities that offer a decisive advantage, with stealth technology being paramount. The constant need for technological superiority in defense procurement pushes governments to fund research and development into the latest low observability solutions. Advances in materials science, particularly in the development of lighter, stronger, and more effective radar-absorbent materials, are crucial enablers. Furthermore, the increasing adoption of unmanned aerial vehicles (UAVs) and other autonomous systems requiring enhanced survivability in contested airspace is a significant growth accelerator. The strategic imperative to maintain air and naval dominance fuels continuous investment.

Challenges in the Stealth Technology Industry Market

The long-term growth catalysts for the stealth technology industry are rooted in ongoing technological innovation and market expansion. The development of hypersonic vehicles with integrated stealth capabilities presents a significant future frontier. Partnerships between established defense primes and emerging technology companies specializing in AI, advanced materials, and sensor fusion are crucial for driving innovation. Market expansion into new geographical regions with growing defense expenditures, coupled with the development of more cost-effective stealth solutions for a wider range of platforms, will be key. The continuous evolution of countermeasures by potential adversaries also drives the need for perpetual advancements, ensuring sustained demand for R&D.

Emerging Opportunities in Stealth Technology Industry

Emerging opportunities in the stealth technology industry lie in several promising areas. The increasing demand for counter-stealth technologies presents a parallel opportunity for companies developing advanced detection and tracking systems, creating a dynamic equilibrium. The integration of stealth capabilities into civilian applications such as high-end surveillance and secure communication platforms could open new market avenues. Furthermore, the development of adaptive stealth that can dynamically adjust to changing environmental conditions and threat vectors offers a significant technological leap. The growing focus on cybersecurity in defense systems also presents opportunities for integrating stealth features into network infrastructure and communication nodes for enhanced security.

Leading Players in the Stealth Technology Industry Sector

- Raytheon Technologies Corporation

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- United Aircraft Corporation

- Chengdu Aircraft Industrial Group Ltd

- Leonardo S.p.A.

- SAAB AB

- BAE Systems plc

- Hindustan Aeronautics Limited

- Northrop Grumman Corporation

- The Boeing Company

Key Milestones in Stealth Technology Industry Industry

- November 2021: The United Kingdom announced the construction of four Dreadnought Class submarines, incorporating new stealth features and armed with Trident D5 missiles, to replace the Vanguard Class fleet.

- February 2023: DRDO (India) announced the completion of development for the Advanced Medium Combat Aircraft (AMCA) fifth-generation stealth fighter jet, awaiting critical design review. Mark 1 will feature 5.5 generation technologies, with Mark 2 to include sixth-generation upgrades.

Strategic Outlook for Stealth Technology Industry Market

The strategic outlook for the stealth technology industry market is exceptionally strong, driven by persistent global security challenges and the imperative for military modernization. Future growth will be accelerated by continued investment in advanced materials science, the integration of AI and machine learning for enhanced stealth performance, and the development of multi-domain stealth capabilities across air, sea, and land. Strategic opportunities include closer collaboration between industry and government research institutions to fast-track innovation, a focus on developing modular and adaptable stealth systems, and exploring international partnerships for co-development and production to manage costs and expand market reach. The increasing emphasis on survivability in increasingly complex threat environments will ensure sustained demand for cutting-edge stealth solutions.

Stealth Technology Industry Segmentation

-

1. Platform

- 1.1. Aerial

- 1.2. Marine

- 1.3. Terrestrial

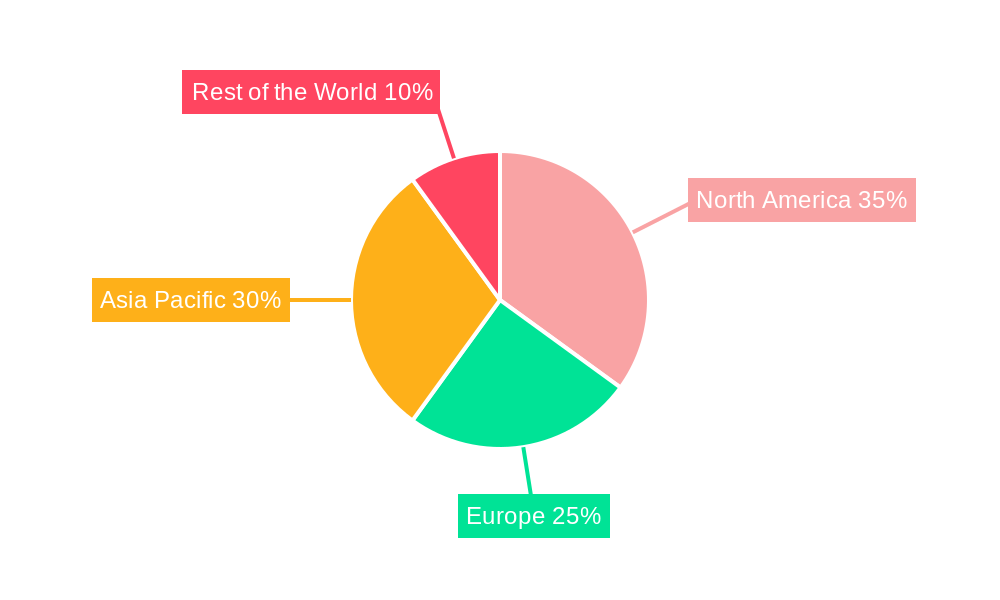

Stealth Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Russia

- 2.4. Germany

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Stealth Technology Industry Regional Market Share

Geographic Coverage of Stealth Technology Industry

Stealth Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Land Segment is Expected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Aerial

- 5.1.2. Marine

- 5.1.3. Terrestrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Aerial

- 6.1.2. Marine

- 6.1.3. Terrestrial

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Aerial

- 7.1.2. Marine

- 7.1.3. Terrestrial

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Aerial

- 8.1.2. Marine

- 8.1.3. Terrestrial

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Rest of the World Stealth Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Aerial

- 9.1.2. Marine

- 9.1.3. Terrestrial

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Raytheon Technologies Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 THALES

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Dynamics Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lockheed Martin Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 United Aircraft Corporatio

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chengdu Aircraft Industrial Group Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leonardo S p A

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAAB AB

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 BAE Systems plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hindustan Aeronautics Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Northrop Grumman Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Boeing Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Raytheon Technologies Corporation

List of Figures

- Figure 1: Global Stealth Technology Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 3: North America Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 7: Europe Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Europe Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 11: Asia Pacific Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Asia Pacific Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Stealth Technology Industry Revenue (undefined), by Platform 2025 & 2033

- Figure 15: Rest of the World Stealth Technology Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Rest of the World Stealth Technology Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Stealth Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 2: Global Stealth Technology Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 4: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 8: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: France Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Russia Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Germany Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 15: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: China Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Japan Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: India Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: South Korea Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Stealth Technology Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Stealth Technology Industry Revenue undefined Forecast, by Platform 2020 & 2033

- Table 22: Global Stealth Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stealth Technology Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Stealth Technology Industry?

Key companies in the market include Raytheon Technologies Corporation, THALES, General Dynamics Corporation, Lockheed Martin Corporation, United Aircraft Corporatio, Chengdu Aircraft Industrial Group Ltd, Leonardo S p A, SAAB AB, BAE Systems plc, Hindustan Aeronautics Limited, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Stealth Technology Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Land Segment is Expected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, the United Kingdom announced that four Dreadnought Class submarines are being built to replace the current fleet of Vanguard Class boats. The submarines will be armed with Trident D5 missiles and incorporate a number of new stealth features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stealth Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stealth Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stealth Technology Industry?

To stay informed about further developments, trends, and reports in the Stealth Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence