Key Insights

The Middle East Commercial Aircraft Cabin Lighting Market is poised for robust growth, projected to reach an estimated $1.98 billion in 2024. This expansion is driven by a confluence of factors, including the region's burgeoning aviation sector, characterized by significant investments in fleet modernization and expansion by national carriers. The increasing demand for passenger comfort and enhanced cabin experiences is a primary catalyst, compelling airlines to adopt advanced lighting solutions that offer improved ambiance, reduced eye strain, and personalized lighting options. Furthermore, the growing emphasis on energy efficiency and the integration of smart cabin technologies, such as LED and dynamic lighting systems, are expected to fuel market penetration. Emerging trends include the adoption of biophilic lighting to mimic natural daylight cycles, contributing to passenger well-being on long-haul flights, and the incorporation of customizable lighting schemes for branding and advertising purposes within the cabin. The market is also experiencing a surge in demand for retrofitting older aircraft with newer, more efficient lighting technologies to comply with evolving environmental regulations and enhance operational efficiency.

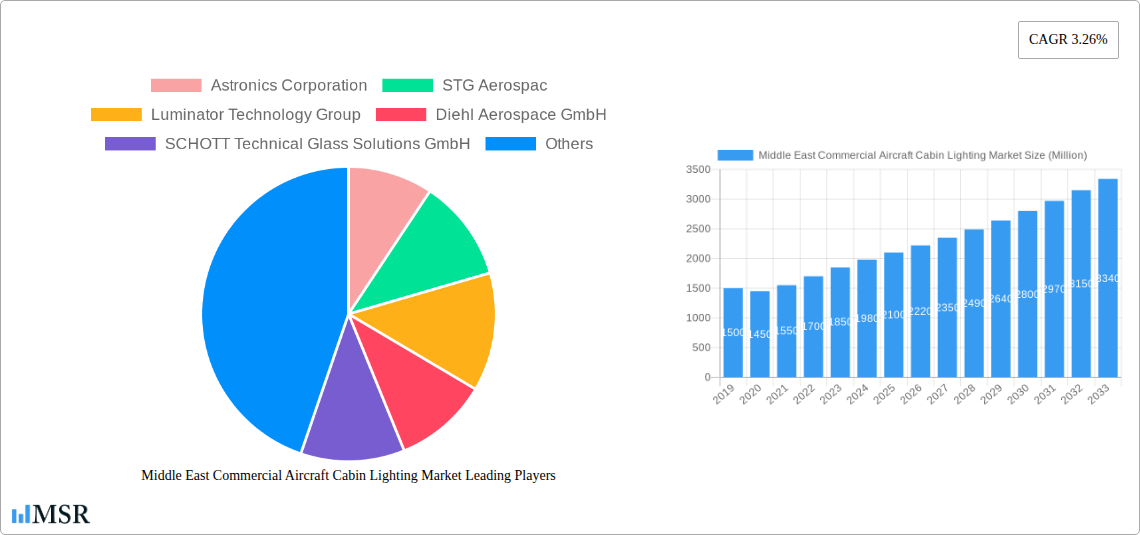

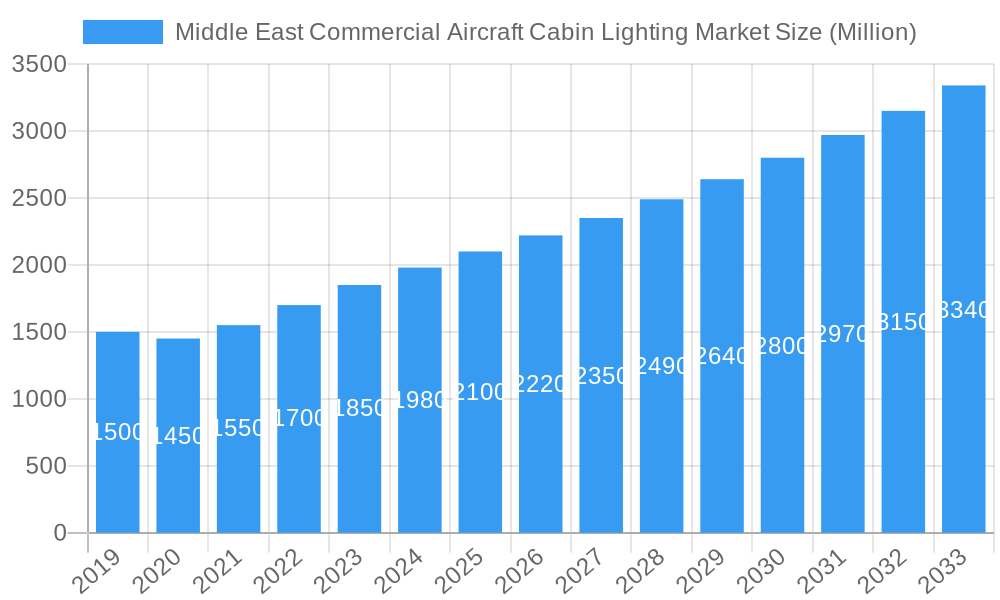

Middle East Commercial Aircraft Cabin Lighting Market Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 6.2% for the Middle East Commercial Aircraft Cabin Lighting Market between 2025 and 2033 underscores its significant upward trajectory. This growth is expected to be particularly strong in the Narrowbody and Widebody aircraft segments, reflecting the dominant fleet types in the region. While the market is buoyed by strong demand for innovative and efficient cabin lighting, certain restraints may influence its pace. These could include the high initial investment costs associated with advanced lighting systems, potential supply chain disruptions impacting component availability, and the complex certification processes required for new aviation technologies. However, the strategic importance of the Middle East as a global aviation hub, coupled with ongoing government initiatives to boost tourism and air travel, are expected to mitigate these challenges. Key companies such as Astronics Corporation, STG Aerospace, Luminator Technology Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, and Collins Aerospace are actively innovating and expanding their offerings to cater to the sophisticated demands of airlines in Saudi Arabia, the United Arab Emirates, Israel, Qatar, Kuwait, Oman, Bahrain, Jordan, and Lebanon.

Middle East Commercial Aircraft Cabin Lighting Market Company Market Share

Middle East Commercial Aircraft Cabin Lighting Market: Unveiling Growth & Innovation in Aviation Interiors

Embark on a comprehensive exploration of the burgeoning Middle East commercial aircraft cabin lighting market. This in-depth report meticulously analyzes the landscape from 2019–2033, with a base year of 2025, providing critical insights into market size, growth drivers, technological advancements, and competitive dynamics. Discover untapped opportunities and strategic imperatives for stakeholders navigating this dynamic sector. The global Middle East commercial aircraft cabin lighting market was valued at approximately $1.5 billion in 2025 and is projected to reach $3.2 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 9.5% during the forecast period of 2025–2033.

Middle East Commercial Aircraft Cabin Lighting Market Market Concentration & Dynamics

The Middle East commercial aircraft cabin lighting market exhibits a moderate to high level of concentration, characterized by the significant influence of established global players alongside emerging regional contenders. Innovation ecosystems are rapidly evolving, driven by airlines' increasing demand for sophisticated, passenger-centric cabin experiences. Regulatory frameworks, primarily dictated by aviation safety and certification bodies, are crucial in shaping product development and market entry. The market is characterized by a low threat of substitute products due to the specialized nature of aircraft cabin lighting solutions. End-user trends are heavily influenced by passenger expectations for enhanced comfort, mood lighting, and energy efficiency. Merger and acquisition (M&A) activities, though not extensively documented in the regional context, are observed globally among key players, signaling consolidation and strategic expansion. Key market players hold substantial market share, with the top five companies estimated to control over 65% of the Middle East market. The number of significant M&A deals in the broader aerospace lighting sector has seen a steady increase over the past five years, indicating a strategic push for market dominance and technological integration.

Middle East Commercial Aircraft Cabin Lighting Market Industry Insights & Trends

The Middle East commercial aircraft cabin lighting market is poised for substantial growth, propelled by a confluence of factors including escalating air travel demand, fleet expansion by major Middle Eastern carriers, and a growing emphasis on passenger experience. The market is projected to witness a significant expansion, moving from an estimated $1.5 billion in 2025 to an impressive $3.2 billion by 2033. This robust growth trajectory translates to a compelling CAGR of 9.5% throughout the forecast period. Technological disruptions are playing a pivotal role, with the advent of advanced LED lighting solutions, dynamic mood lighting systems, and smart cabin features revolutionizing in-cabin ambiance. Airlines are increasingly investing in cutting-edge lighting technologies to differentiate their offerings and enhance passenger comfort and well-being during long-haul flights. Evolving consumer behaviors, particularly the heightened expectation for personalized and immersive travel experiences, are compelling aircraft manufacturers and cabin interior suppliers to prioritize innovative lighting designs that can adapt to various flight phases and passenger preferences. Furthermore, the drive towards fuel efficiency and reduced operational costs is incentivizing the adoption of lighter and more energy-efficient lighting systems, further bolstering market expansion. The integration of biophilic design principles, utilizing lighting to mimic natural daylight cycles, is also emerging as a key trend. The market's expansion is further supported by ongoing investments in airport infrastructure and the continuous modernization of airline fleets across the region, catering to a growing cosmopolitan population and a burgeoning tourism sector.

Key Markets & Segments Leading Middle East Commercial Aircraft Cabin Lighting Market

The Middle East commercial aircraft cabin lighting market is significantly influenced by the Widebody aircraft segment, which currently holds a dominant position. This is primarily driven by the region's status as a global aviation hub, with major carriers operating extensive long-haul routes necessitating a substantial fleet of widebody aircraft. The economic growth and robust infrastructure development across key Middle Eastern countries like the UAE, Saudi Arabia, and Qatar have fostered a strong demand for premium air travel, further underpinning the dominance of the widebody segment.

Drivers for Widebody Dominance:

- High Passenger Volume & Long-Haul Flights: Widebody aircraft are integral to connecting the Middle East to major global destinations, carrying a high volume of passengers on extended journeys. This necessitates advanced cabin lighting solutions to enhance passenger comfort and mitigate the effects of jet lag.

- Premium Cabin Configurations: Airlines in the region are renowned for their luxurious cabin offerings, including first and business class suites, which often feature sophisticated and customizable mood lighting systems to create an exclusive ambiance.

- Fleet Modernization & Expansion: Major Middle Eastern airlines are consistently investing in new-generation widebody aircraft such as the Boeing 777, 787 Dreamliner, and Airbus A350, all of which are equipped with advanced cabin lighting capabilities as standard or optional features.

- Technological Integration: The demand for advanced features like dynamic lighting, circadian rhythm lighting, and entertainment system integration is more pronounced in widebody cabins, where longer flight times allow for greater passenger engagement with cabin environment.

While the Narrowbody aircraft segment is also experiencing steady growth, driven by a rising demand for short-to-medium haul travel and the expansion of low-cost carriers, it currently lags behind the widebody segment in terms of overall market value and technological sophistication in the Middle East. However, the increasing deployment of narrowbody aircraft for premium regional routes and the integration of advanced lighting features in these aircraft are expected to narrow this gap over the forecast period.

Middle East Commercial Aircraft Cabin Lighting Market Product Developments

Product innovation is a key differentiator in the Middle East commercial aircraft cabin lighting market. Companies are focusing on developing advanced LED solutions offering unparalleled color rendering, dimming capabilities, and energy efficiency. The integration of smart technologies, enabling dynamic mood lighting, circadian rhythm lighting, and personalized passenger experiences, is a significant trend. Innovations such as Collins Aerospace's Hypergamut™ Lighting System, scheduled for early 2024 entry into service, exemplify the push towards richer color palettes and enhanced cabin aesthetics. These developments not only elevate passenger comfort but also contribute to aircraft weight reduction and reduced power consumption, offering airlines a competitive edge.

Challenges in the Middle East Commercial Aircraft Cabin Lighting Market Market

The Middle East commercial aircraft cabin lighting market faces several challenges that could temper growth. Stringent regulatory approvals and certification processes for aerospace components add significant lead times and development costs. Supply chain disruptions, exacerbated by global geopolitical events and the specialized nature of aerospace manufacturing, can impact production schedules and material availability. Furthermore, intense competition among established global players and emerging suppliers can lead to price pressures and necessitate continuous innovation to maintain market share. The high upfront investment required for R&D and manufacturing also poses a barrier for smaller regional players.

Forces Driving Middle East Commercial Aircraft Cabin Lighting Market Growth

Several powerful forces are propelling the Middle East commercial aircraft cabin lighting market forward. Exponential growth in air passenger traffic within and through the region, fueled by robust economic development and tourism initiatives, is a primary driver. The continuous fleet modernization and expansion programs undertaken by major Middle Eastern airlines, seeking to offer cutting-edge passenger experiences, are creating significant demand for advanced lighting systems. Technological advancements in LED lighting and smart cabin control systems enable airlines to enhance cabin ambiance, improve passenger well-being, and reduce operational costs. Furthermore, the increasing passenger demand for personalized and comfortable travel environments is pushing for more sophisticated and adaptable cabin lighting solutions.

Challenges in the Middle East Commercial Aircraft Cabin Lighting Market Market

Long-term growth catalysts for the Middle East commercial aircraft cabin lighting market are deeply rooted in continuous technological innovation and strategic market expansion. The ongoing development of even more energy-efficient, lighter, and intelligent lighting systems will be crucial. Strategic partnerships between lighting manufacturers, aircraft OEMs, and airlines will foster co-development of tailored solutions. Furthermore, the expansion of air travel into secondary cities and the growing demand for premium cabin experiences in the business aviation sector present significant new market opportunities that will drive sustained growth.

Emerging Opportunities in Middle East Commercial Aircraft Cabin Lighting Market

Emerging opportunities in the Middle East commercial aircraft cabin lighting market are abundant, driven by evolving passenger preferences and technological advancements. The growing demand for biophilic lighting solutions, designed to mimic natural light cycles and promote passenger well-being on long-haul flights, presents a significant niche. The expansion of private and business jet aviation in the region also opens up opportunities for highly customized and luxurious cabin lighting. Furthermore, the increasing focus on sustainability and reduced environmental impact creates a market for highly energy-efficient and lightweight lighting systems. The integration of advanced cabin management systems with intelligent lighting controls for personalized passenger experiences is another key emerging trend.

Leading Players in the Middle East Commercial Aircraft Cabin Lighting Market Sector

- Astronics Corporation

- STG Aerospace

- Luminator Technology Group

- Diehl Aviation

- SCHOTT Technical Glass Solutions GmbH

- Collins Aerospace

Key Milestones in Middle East Commercial Aircraft Cabin Lighting Market Industry

- June 2022: Collins Aerospace launched its Hypergamut™ Lighting System, scheduled for entry into service in early 2024, offering enhanced color spectrum and passenger ambiance.

- February 2021: Diehl Aviation secured a contract extension from Boeing for the delivery of the interior lighting system for the Boeing 787 Dreamliner, reinforcing its position in the widebody market.

Strategic Outlook for Middle East Commercial Aircraft Cabin Lighting Market Market

The strategic outlook for the Middle East commercial aircraft cabin lighting market is exceptionally positive, driven by a powerful combination of factors that will continue to accelerate growth. Airlines in the region are deeply committed to differentiating themselves through superior passenger experience, making cabin interiors, and thus lighting, a key focus area. The ongoing investment in fleet modernization, coupled with the introduction of new aircraft types that often feature integrated advanced lighting solutions, provides a consistent demand stream. Furthermore, the ongoing advancements in LED technology, including greater energy efficiency, enhanced color control, and miniaturization, will continue to enable innovative and more cost-effective cabin designs. Strategic partnerships between lighting solution providers and aircraft manufacturers are crucial for fostering co-development and ensuring that lighting systems meet the evolving needs of the aviation industry and its discerning passengers.

Middle East Commercial Aircraft Cabin Lighting Market Segmentation

-

1. Aircraft Type

- 1.1. Narrowbody

- 1.2. Widebody

Middle East Commercial Aircraft Cabin Lighting Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Commercial Aircraft Cabin Lighting Market Regional Market Share

Geographic Coverage of Middle East Commercial Aircraft Cabin Lighting Market

Middle East Commercial Aircraft Cabin Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Narrowbody

- 5.1.2. Widebody

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Astronics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 STG Aerospac

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luminator Technology Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Diehl Aerospace GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SCHOTT Technical Glass Solutions GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Collins Aerospace

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Astronics Corporation

List of Figures

- Figure 1: Middle East Commercial Aircraft Cabin Lighting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Commercial Aircraft Cabin Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 2: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 4: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Commercial Aircraft Cabin Lighting Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Middle East Commercial Aircraft Cabin Lighting Market?

Key companies in the market include Astronics Corporation, STG Aerospac, Luminator Technology Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, Collins Aerospace.

3. What are the main segments of the Middle East Commercial Aircraft Cabin Lighting Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Collins Aerospace launched its Hypergamut™ Lighting System which is scheduled for entry into service in early 2024.February 2021: Diehl Aviation has secured a contract extension from Boeing for the delivery of the interior lighting system for the Boeing 787 Dreamliner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Commercial Aircraft Cabin Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Commercial Aircraft Cabin Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Commercial Aircraft Cabin Lighting Market?

To stay informed about further developments, trends, and reports in the Middle East Commercial Aircraft Cabin Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence