Key Insights

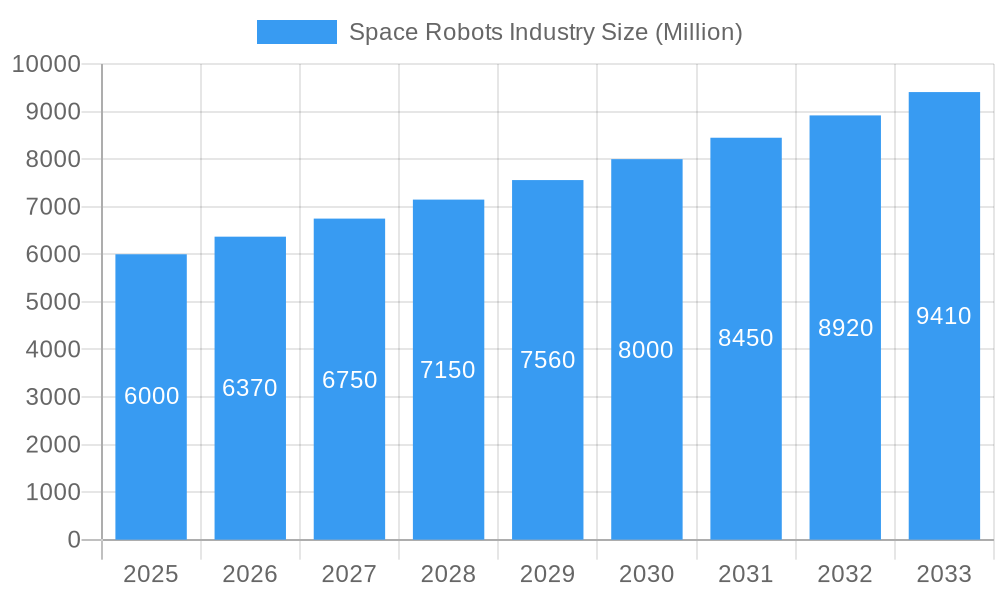

The global Space Robots Industry is poised for significant expansion, projected to reach a market size exceeding $6,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of over 6.00% throughout the forecast period of 2025-2033. This remarkable growth is primarily fueled by escalating investments in space exploration initiatives, the burgeoning demand for satellite servicing and debris removal, and the increasing deployment of robotic systems for scientific research and resource utilization beyond Earth's atmosphere. Key drivers include advancements in AI and machine learning, enhancing robot autonomy and operational capabilities, alongside the miniaturization of components enabling more versatile and cost-effective robotic solutions. The industry is witnessing a surge in the development of specialized robots for in-orbit assembly, manufacturing, and the servicing of critical space infrastructure.

Space Robots Industry Market Size (In Billion)

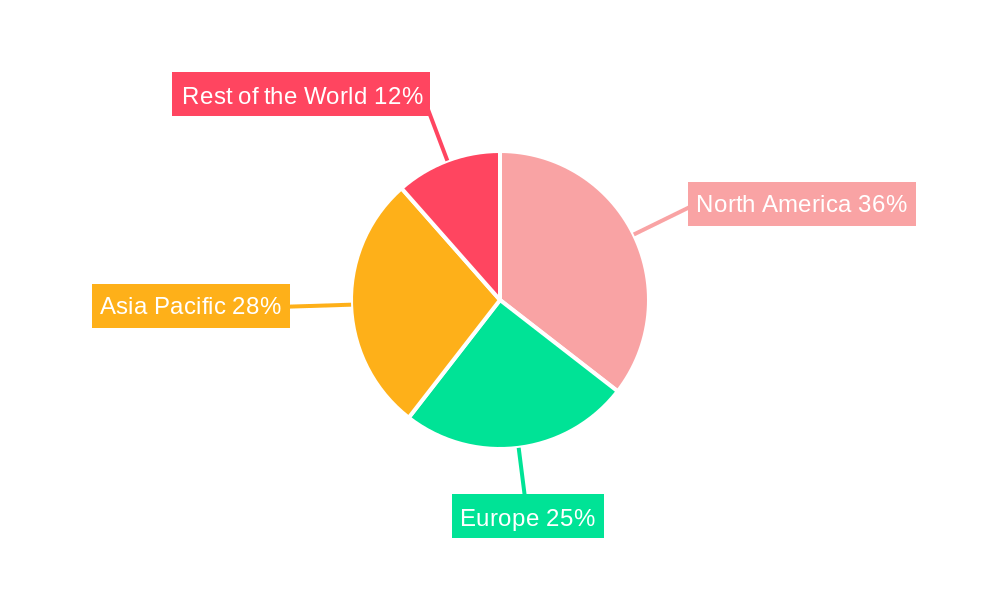

Several pivotal trends are shaping the trajectory of the space robotics market. The growing emphasis on sustainability in space, including the critical need for space debris mitigation, is driving innovation in robotic capture and disposal systems. Furthermore, the commercialization of space, marked by an increase in private sector involvement in launch services, satellite constellations, and lunar missions, is creating new avenues for robotic applications. While the market experiences strong growth, potential restraints include the high cost of development and deployment of space-grade robotics, stringent regulatory frameworks, and the inherent risks associated with operating in the harsh space environment. However, ongoing technological advancements and strategic collaborations among key players like Lockheed Martin, Northrop Grumman, and MDA Corporation are expected to mitigate these challenges, ensuring sustained market expansion and innovation. The Asia Pacific region, particularly China and India, is emerging as a significant growth hub due to substantial government backing for space programs and an expanding indigenous space industry.

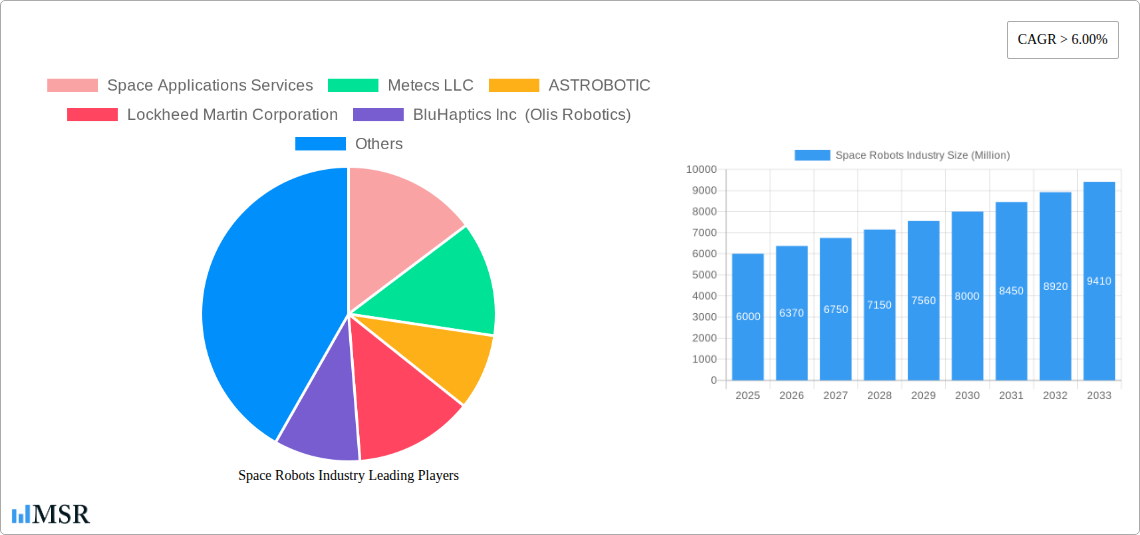

Space Robots Industry Company Market Share

Here's an SEO-optimized and engaging report description for the Space Robots Industry, designed for high search visibility and stakeholder attraction, with no placeholder text and all values in millions.

Unlock unparalleled insights into the rapidly evolving Space Robots Industry with this definitive market research report. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report provides granular analysis of the global space robotics market, forecast period 2025–2033, and historical period 2019–2024. We delve deep into market dynamics, technological advancements, and strategic opportunities within the commercial space robotics sector, defense space robotics, in-orbit servicing, satellite servicing, and lunar exploration robotics. This report is an essential resource for aerospace manufacturers, defense contractors, satellite operators, investment firms, and government agencies seeking to understand and capitalize on the burgeoning space automation market.

Space Robots Industry Market Concentration & Dynamics

The space robots industry exhibits a moderate to high market concentration, with a dynamic interplay between established aerospace giants and innovative startups. Key players like Northrop Grumman Corporation, Lockheed Martin Corporation, and MDA Corporation (Maxar Technologies Ltd) hold significant market share, driven by large-scale government contracts for defense and exploration. However, the ecosystem is increasingly energized by agile companies such as ASTROBOTIC, Effective Space Solutions Limited, and GITAI Inc, focusing on specialized solutions for in-orbit servicing, debris removal, and lunar surface operations. Innovation hubs are concentrated in North America and Europe, fostering collaborative R&D and the development of advanced robotic technologies. Regulatory frameworks, primarily guided by international space law and national space policies, are evolving to accommodate the increasing commercialization and privatization of space activities. Substitute products, while limited in the context of advanced space-grade robotics, can include human-led missions or simpler automated systems for less complex tasks. End-user trends are shifting towards increased demand for autonomy, maneuverability, and adaptability in robotic systems for a variety of missions, from satellite servicing to deep space exploration. Mergers and acquisitions (M&A) activity, while not at its peak, is strategically significant, with recent deals (estimated 5-10 deals annually) aimed at consolidating technological capabilities and market access. For instance, the acquisition of companies specializing in AI and advanced manipulation by larger players signifies a trend towards integrated robotic solutions.

Space Robots Industry Industry Insights & Trends

The space robots industry is experiencing robust growth, propelled by a confluence of factors including increasing government investment in space exploration and national security, the burgeoning commercial space sector, and significant technological advancements. The global market size is projected to reach approximately $25,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 15% during the forecast period. Market growth drivers are primarily attributed to the growing demand for satellite servicing for life extension and refueling, the urgent need for space debris mitigation solutions, and ambitious lunar and Martian exploration missions. Technological disruptions are at the forefront, with advancements in artificial intelligence (AI) enabling greater autonomy and decision-making capabilities for robots. Enhanced sensor technologies, improved power efficiency, and miniaturization of components are also crucial. The development of dexterous manipulators and advanced mobility systems, such as wheeled and legged robots for surface exploration, are transforming mission capabilities. Evolving consumer behaviors, or rather, end-user demands, are emphasizing reliability, cost-effectiveness, and mission versatility. Operators are increasingly looking for robotic solutions that can perform a range of tasks, from complex repairs to sample collection and in-situ resource utilization (ISRU). The rise of new space companies and commercial space initiatives further fuels demand for adaptable and scalable robotic systems. Furthermore, the trend towards constellations of satellites necessitates sophisticated robotic capabilities for deployment, maintenance, and deorbiting. The increasing focus on sustainable space operations also drives innovation in robots capable of assisting with environmental monitoring and management in orbit. The development of sophisticated simulation and testing environments is also playing a vital role in accelerating development cycles and reducing mission risks, thereby fostering greater adoption of space robotics.

Key Markets & Segments Leading Space Robots Industry

North America currently dominates the space robots industry, driven by substantial investments from NASA and the U.S. Department of Defense, alongside a vibrant private sector. This dominance is evident across all key segments:

Production Analysis:

- Drivers: Robust R&D infrastructure, strong government funding for space programs, and the presence of leading aerospace manufacturers.

- Dominance: The United States leads in the development and production of high-fidelity space robots, including advanced manipulators, autonomous navigation systems, and specialized lunar rovers. Companies like Lockheed Martin Corporation and Northrop Grumman Corporation are central to this production capability.

Consumption Analysis:

- Drivers: Extensive space exploration initiatives, a large existing satellite infrastructure requiring servicing, and growing defense applications.

- Dominance: The U.S. government and its affiliated space agencies are the largest consumers of space robotics, particularly for scientific missions and national security purposes. The growing private space sector also contributes significantly to consumption through satellite servicing and exploration ventures.

Import Market Analysis (Value & Volume):

- Drivers: Demand for specialized robotic components, software, and niche robotic systems not readily available domestically.

- Dominance: While the U.S. is a net exporter of complex robotic systems, it imports specialized components and software solutions to complement its domestic production. The volume of imports is significant for specialized sensors and advanced materials. (Estimated Import Value: $1,500 Million, Estimated Import Volume: 500,000 Units).

Export Market Analysis (Value & Volume):

- Drivers: Technological superiority, competitive pricing for advanced systems, and strong international partnerships.

- Dominance: The U.S. is a significant exporter of advanced space robotics and related technologies to countries with developing space programs and allied nations. Europe also represents a substantial export market. (Estimated Export Value: $2,800 Million, Estimated Export Volume: 800,000 Units).

Price Trend Analysis:

- Drivers: High development costs, stringent reliability requirements, and the specialized nature of space-grade components.

- Dominance: The price of space robots remains high due to complex engineering, rigorous testing, and limited production volumes. However, increasing commercialization and advancements in manufacturing are expected to drive a gradual reduction in per-unit costs for certain categories of robots over the forecast period.

Space Robots Industry Product Developments

Recent product developments in the space robots industry are focused on enhancing autonomy, dexterity, and operational efficiency. Innovations include advanced AI-driven navigation systems for complex terrains, dexterous robotic arms capable of intricate manipulation for in-orbit servicing and assembly, and miniaturized robotic platforms for lunar and asteroid exploration. Companies are also investing in self-healing robotic materials and adaptable locomotion systems for diverse space environments. These advancements aim to reduce mission risks, expand operational capabilities, and enable more ambitious scientific and commercial endeavors in space.

Challenges in the Space Robots Industry Market

The space robots industry faces several significant challenges that can hinder growth and adoption. These include:

- High development and operational costs: The extreme conditions of space demand robust, specialized, and rigorously tested components, leading to substantial price tags.

- Regulatory hurdles and evolving international law: Navigating complex licensing, spectrum allocation, and international space treaties can be time-consuming and costly.

- Supply chain complexities and long lead times: Sourcing specialized components and ensuring their reliability can be challenging, leading to extended development cycles.

- Intense competition and technological obsolescence: The rapid pace of technological advancement requires continuous innovation to stay competitive, risking obsolescence of existing systems.

- Risk of mission failure and the need for extreme reliability: The inability to easily repair or retrieve malfunctioning robots in space necessitates an exceptionally high degree of reliability, adding to development costs and complexity.

Forces Driving Space Robots Industry Growth

Several key forces are propelling the growth of the space robots industry:

- Growing demand for in-orbit servicing and satellite life extension: As the number of satellites in orbit increases, the need for robotic maintenance, refueling, and repair becomes critical.

- Escalating interest in space exploration and resource utilization: Ambitious plans for lunar bases, Martian colonization, and asteroid mining necessitate advanced robotic capabilities for construction, exploration, and resource extraction.

- The imperative of space debris mitigation and removal: The growing threat of space debris is driving the development of robotic solutions for tracking, capturing, and deorbiting defunct satellites and space junk.

- Advancements in artificial intelligence and machine learning: These technologies are enabling greater autonomy, adaptability, and efficiency in space robots, reducing reliance on constant human intervention.

- Increasing commercialization of space activities: The rise of private space companies and new business models is creating new markets and driving demand for cost-effective robotic solutions.

Challenges in the Space Robots Industry Market

Long-term growth catalysts for the space robots industry are deeply rooted in technological innovation and market expansion. Continued investment in AI and advanced automation will enable robots to perform increasingly complex tasks autonomously, such as in-situ resource utilization on celestial bodies and sophisticated orbital assembly of large structures. The development of modular and reconfigurable robotic systems will further enhance versatility and reduce costs. Furthermore, the establishment of sustainable space economies, including space-based manufacturing and in-space servicing depots, will create a persistent demand for advanced robotic services. International collaborations and public-private partnerships will also play a crucial role in sharing risks and accelerating the development and deployment of next-generation space robotics.

Emerging Opportunities in Space Robots Industry

Emerging opportunities within the space robots industry are vast and transformative. The rapidly growing commercial space station market presents significant demand for robotic arms for assembly, maintenance, and crew support. The burgeoning trend of lunar resource prospecting and extraction, particularly water ice, will require specialized robotic excavators and haulers. Furthermore, the development of orbital manufacturing capabilities, such as in-space 3D printing of components and structures, will heavily rely on robotic assembly and manipulation systems. The increasing focus on planetary defense is also creating a market for robotic systems capable of monitoring and potentially intercepting near-Earth objects. The expansion of deep space communication networks could also benefit from robotic maintenance and upgrade capabilities.

Leading Players in the Space Robots Industry Sector

- Space Applications Services

- Metecs LLC

- ASTROBOTIC

- Lockheed Martin Corporation

- BluHaptics Inc (Olis Robotics)

- Motiv Space Systems Inc

- Honeybee Robotics

- Oceaneering International

- Effective Space Solutions Limited

- MDA Corporation (Maxar Technologies Ltd)

- GITAI Inc

- Made in Space

- Northrop Grumman Corporation

Key Milestones in Space Robots Industry Industry

- 2020: Launch of Astrobotic's Peregrine lunar lander, showcasing advanced robotic capabilities for surface operations.

- 2021: Maxar Technologies (MDA Corporation) successfully demonstrates robotic arm capabilities for satellite servicing missions.

- 2022: GITAI Inc unveils highly dexterous robots designed for lunar construction and maintenance.

- 2023: NASA's OSIRIS-REx mission utilizes robotic sampling arm to collect asteroid material.

- 2024: Honeybee Robotics develops advanced drilling technologies for lunar resource extraction.

- 2025 (Estimated): Continued advancements in AI for autonomous orbital maneuvering and servicing operations.

- 2025 (Estimated): Increased deployment of robotic systems for active debris removal missions.

- 2026-2030: Significant progress in developing reusable and refuelable robotic spacecraft for extended lunar and Martian missions.

- 2030-2033: Maturation of in-orbit assembly technologies, enabling the construction of larger space infrastructure.

Strategic Outlook for Space Robots Industry Market

The strategic outlook for the space robots industry is exceptionally positive, driven by sustained investment in space exploration, defense, and commercial ventures. Future growth accelerators will focus on enhancing the autonomy, adaptability, and cost-effectiveness of robotic systems. Strategic opportunities lie in developing integrated solutions for in-orbit servicing, assembly, and manufacturing (ISAM), as well as pioneering robotics for resource utilization on the Moon and Mars. Furthermore, strategic collaborations between established aerospace giants and agile startups will continue to drive innovation. The industry is poised for significant expansion as it moves towards more complex missions, greater sustainability, and the commercialization of space-based services, promising a dynamic and lucrative future for all stakeholders.

Space Robots Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Space Robots Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Space Robots Industry Regional Market Share

Geographic Coverage of Space Robots Industry

Space Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Deep Space Segment is Projected to Register with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Applications Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metecs LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASTROBOTIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BluHaptics Inc (Olis Robotics)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Motiv Space Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeybee Robotics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oceaneering International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Effective Space Solutions Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MDA Corporation (Maxar Technologies Ltd)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GITAI Inc **List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Made in Space

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Northrop Grumman Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Space Applications Services

List of Figures

- Figure 1: Global Space Robots Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Space Robots Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Space Robots Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Robots Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Space Robots Industry?

Key companies in the market include Space Applications Services, Metecs LLC, ASTROBOTIC, Lockheed Martin Corporation, BluHaptics Inc (Olis Robotics), Motiv Space Systems Inc, Honeybee Robotics, Oceaneering International, Effective Space Solutions Limited, MDA Corporation (Maxar Technologies Ltd), GITAI Inc **List Not Exhaustive, Made in Space, Northrop Grumman Corporation.

3. What are the main segments of the Space Robots Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Deep Space Segment is Projected to Register with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Robots Industry?

To stay informed about further developments, trends, and reports in the Space Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence