Key Insights

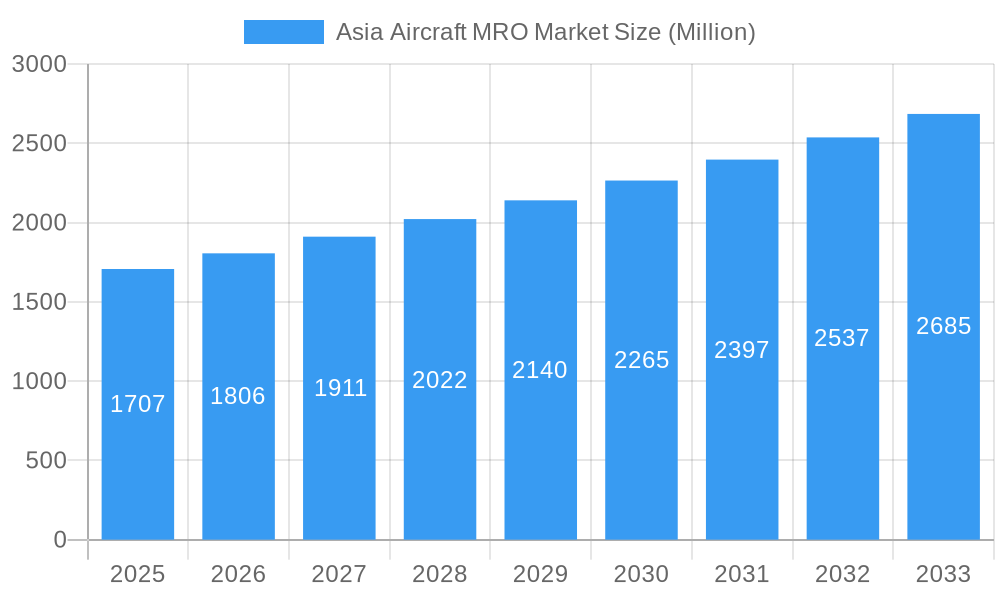

The Asia Aircraft MRO (Maintenance, Repair, and Overhaul) market is poised for significant expansion, driven by a confluence of robust commercial aviation growth, increasing fleet sizes, and a growing emphasis on fleet modernization and safety. With a projected market size of USD 17.07 Million and a compelling Compound Annual Growth Rate (CAGR) of 5.74%, the sector is expected to witness sustained dynamism throughout the forecast period of 2025-2033. This growth is underpinned by the burgeoning air travel demand across the Asia-Pacific region, fueled by a growing middle class, expanding tourism, and increasing cargo operations. Airlines are investing heavily in extending the lifespan and operational efficiency of their aircraft fleets, leading to a higher demand for comprehensive MRO services. Furthermore, the increasing complexity of modern aircraft, equipped with advanced avionics and engines, necessitates specialized MRO expertise, further stimulating market growth. The region’s strategic importance as a global manufacturing and trade hub also contributes to the sustained demand for efficient air cargo and passenger services, directly impacting the MRO sector.

Asia Aircraft MRO Market Market Size (In Billion)

The market segmentation reveals key areas of opportunity, with Engine MRO and Airframe MRO expected to command substantial market shares due to the critical nature of these components for flight safety and performance. Commercial Aviation remains the dominant application segment, reflecting the massive scale of airline operations in Asia. Geographically, the Asia-Pacific region itself is the primary focus, with China, India, Japan, and South Korea emerging as major consumption hubs for aircraft MRO services. This is supported by substantial investments in aviation infrastructure and the presence of leading global and regional MRO providers like Lufthansa Technik, SIA Engineering Company, and ST Engineering, alongside major aircraft manufacturers such as Boeing and General Electric. The increasing prevalence of new generation aircraft with advanced technological features presents both opportunities and challenges, requiring MRO providers to continuously upgrade their capabilities and invest in specialized training. The market is characterized by strategic partnerships, mergers, and acquisitions as companies seek to consolidate their positions and offer integrated MRO solutions to meet the evolving needs of the aviation industry in Asia.

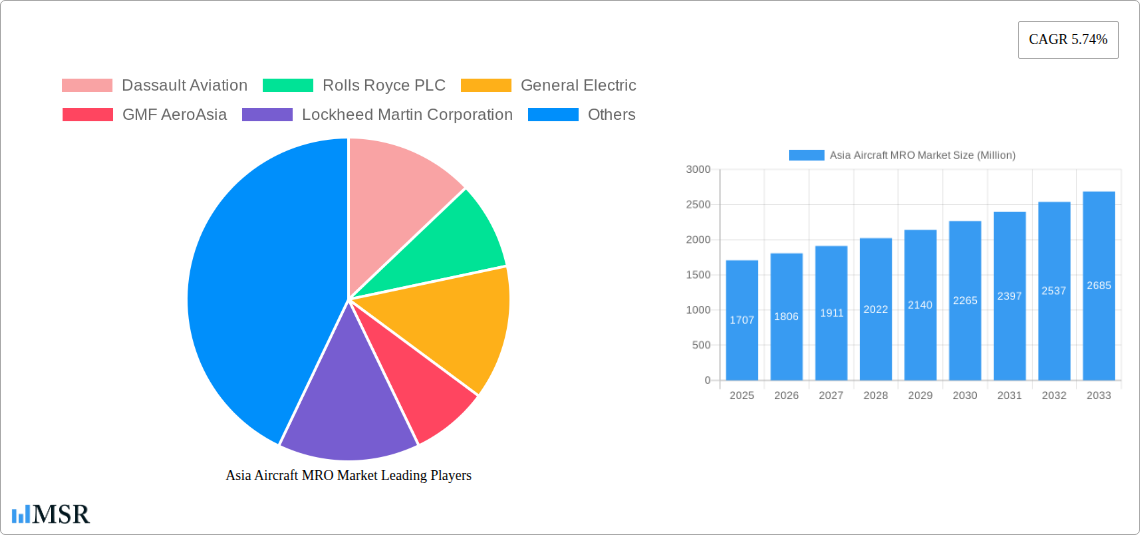

Asia Aircraft MRO Market Company Market Share

This comprehensive Asia Aircraft MRO Market report provides an in-depth analysis of the Maintenance, Repair, and Overhaul sector across the Asia-Pacific region. With a focus on the study period of 2019–2033, including a base year of 2025, estimated year of 2025, and a robust forecast period from 2025–2033, this report offers unparalleled insights into market dynamics, key players, and future trends. Leveraging high-ranking keywords such as aircraft maintenance, aerospace MRO, engine overhaul, airframe repair, and component maintenance, this report is designed to attract industry stakeholders, investors, and decision-makers seeking to capitalize on the burgeoning Asia-Pacific aerospace landscape.

Asia Aircraft MRO Market Market Concentration & Dynamics

The Asia Aircraft MRO Market exhibits a moderately concentrated landscape, characterized by the presence of established global players and rapidly expanding regional service providers. The innovation ecosystem is thriving, fueled by investments in advanced technologies like predictive maintenance, AI-driven diagnostics, and digital twin solutions for engine MRO and airframe MRO. Regulatory frameworks across Asia-Pacific countries are evolving to support MRO growth, with a growing emphasis on safety standards, environmental compliance, and the adoption of international best practices for commercial aviation and military aviation. Substitute products, primarily in the form of new aircraft acquisitions, are less of a direct threat to MRO services, as fleet expansion inherently drives MRO demand. End-user trends highlight a growing preference for cost-effective and efficient MRO solutions, with airlines increasingly outsourcing non-core maintenance activities to specialized providers. Mergers and Acquisitions (M&A) activities are a significant driver of market concentration, with companies seeking to expand their service portfolios, geographical reach, and technological capabilities. For instance, the historical period (2019-2024) has witnessed several strategic partnerships and acquisitions aimed at consolidating market share and enhancing service offerings within Component MRO and Line Maintenance. The market share distribution is dynamic, with key players continuously vying for dominance in lucrative segments.

- Market Share Dynamics: Key players like Lufthansa Technik, SIA Engineering Company, and HAECO hold significant market shares, particularly in the airframe MRO and engine MRO segments for commercial aviation.

- M&A Deal Counts: The historical period saw an estimated xx M&A deals, indicating a trend towards consolidation and strategic alliances to enhance capabilities and market penetration.

- Innovation Ecosystem Focus: Investments in digital MRO solutions, drone-based inspections, and advanced composite repair technologies are shaping the competitive landscape.

- Regulatory Framework Evolution: Increased focus on EASA and FAA certifications, alongside localized regulatory approvals, is crucial for market access.

Asia Aircraft MRO Market Industry Insights & Trends

The Asia Aircraft MRO Market is poised for substantial growth, projected to reach an estimated market size of USD XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This robust expansion is propelled by several critical industry insights and evolving trends. The burgeoning middle class across Asia-Pacific is driving unprecedented growth in air travel demand, directly translating into a larger active aircraft fleet requiring extensive aircraft maintenance. This surge in passenger traffic, particularly in commercial aviation, necessitates more frequent and comprehensive engine MRO, airframe MRO, and component MRO services. Technological disruptions are at the forefront of this transformation. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance is revolutionizing line maintenance by minimizing unscheduled downtime and optimizing maintenance schedules. Digital twin technology is enabling more accurate diagnostics and simulation-based repairs, leading to enhanced efficiency and reduced costs. Furthermore, the increasing adoption of advanced materials and lighter composites in modern aircraft necessitates specialized repair capabilities, creating new opportunities for MRO providers. Evolving consumer behaviors, specifically the airline industry's focus on operational efficiency and cost reduction, are pushing for more integrated and value-added MRO solutions. Airlines are increasingly seeking long-term service agreements and performance-based contracts, fostering deeper partnerships with MRO providers. The growing demand for general aviation and the expansion of military aviation fleets in key Asian countries further contribute to the market's diversification and growth trajectory. The increasing sophistication of aircraft, coupled with longer operational lifespans, ensures a consistent demand for high-quality MRO services. The push towards sustainability in the aerospace sector is also influencing MRO practices, with a growing emphasis on eco-friendly repair processes and component lifecycle management.

- Market Size Projection: The market is estimated to reach USD XXX Million by 2033.

- CAGR: A projected CAGR of XX% from 2025 to 2033.

- Key Growth Drivers: Increasing air passenger traffic, fleet expansion, and demand for cost-effective MRO solutions.

- Technological Advancements: Adoption of AI, ML, IoT, and digital twin technology for predictive maintenance and enhanced diagnostics.

- Evolving Airline Strategies: Shift towards integrated MRO solutions and long-term service agreements.

Key Markets & Segments Leading Asia Aircraft MRO Market

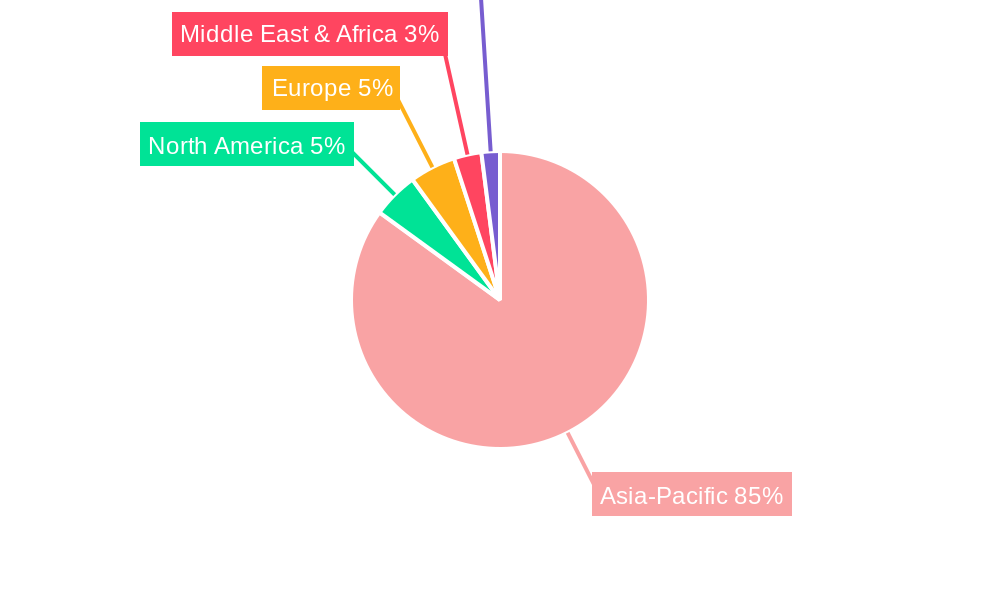

The Asia-Pacific region stands as the undisputed leader in the Asia Aircraft MRO Market, driven by the economic powerhouse of China and the rapidly expanding aviation sectors of India and Southeast Asia. Within this dominant geography, Commercial Aviation is the primary application segment, accounting for the largest share of MRO spending due to the sheer volume of aircraft operations. The airframe MRO and engine MRO segments are the most significant contributors to market revenue, reflecting the critical nature of these services for maintaining flight safety and operational efficiency.

Dominance Drivers in Asia-Pacific:

- Economic Growth & Air Travel Demand: Sustained economic growth across Asia-Pacific has fueled a dramatic increase in air passenger traffic, necessitating a larger and more active aircraft fleet. This directly translates into a higher volume of required MRO services.

- Fleet Expansion & Modernization: Airlines in the region are undertaking significant fleet expansion and modernization programs, acquiring new, technologically advanced aircraft that, while requiring less frequent heavy maintenance initially, still demand sophisticated MRO expertise throughout their lifecycle.

- Strategic Aviation Hubs: Countries like Singapore, Hong Kong, and Dubai (though not strictly Asia-Pacific, often considered in regional market analysis) have established themselves as major aviation hubs, attracting MRO service providers and fostering a competitive ecosystem.

- Government Support & Initiatives: Several governments in the region are actively promoting the aerospace industry, including MRO capabilities, through favorable policies, incentives, and infrastructure development.

Segment Dominance Analysis:

The China Aircraft MRO Market is a significant driver, owing to its vast domestic air travel market, substantial fleet size, and the presence of major state-owned airlines with extensive maintenance requirements. The country is also investing heavily in developing its indigenous MRO capabilities. India follows closely, with its rapidly growing low-cost carrier segment and increasing defense spending bolstering demand for both commercial aviation and military aviation MRO. Japan and South Korea maintain strong MRO markets driven by their advanced aerospace industries and well-established airlines, focusing on high-value engine MRO and specialized component MRO.

- Dominant Geography: Asia-Pacific, with China and India as key growth engines.

- Leading Application: Commercial Aviation, followed by Military Aviation and General Aviation.

- Key MRO Types: Airframe MRO and Engine MRO dominate market share due to their critical role and high expenditure.

- Emerging Trends: Growth in specialized component MRO for advanced aircraft systems and increasing demand for line maintenance to support high flight frequencies.

Asia Aircraft MRO Market Product Developments

Product developments in the Asia Aircraft MRO Market are heavily focused on enhancing efficiency, reducing turnaround times, and improving diagnostic accuracy. Innovations in engine MRO include advanced engine washing techniques and digital tools for performance monitoring. For airframe MRO, advancements in composite repair technologies and non-destructive testing (NDT) methods are crucial. The development of predictive maintenance software, leveraging AI and machine learning, is a significant trend across all MRO types, enabling proactive identification of potential issues before they escalate. The market is also witnessing the introduction of specialized component MRO solutions for increasingly complex avionics and auxiliary power units (APUs). These product developments are directly enhancing the market relevance by offering airlines more cost-effective and reliable maintenance solutions.

Challenges in the Asia Aircraft MRO Market Market

The Asia Aircraft MRO Market faces several challenges that could impede its growth trajectory. Regulatory fragmentation across different countries in the Asia-Pacific region can create complexities for MRO providers operating across borders, requiring diverse certifications and compliance measures. Supply chain disruptions, exacerbated by geopolitical events and global logistics challenges, can lead to extended lead times for spare parts and specialized components, impacting engine MRO and airframe MRO turnaround times. Intense competition from both established global players and emerging local MRO providers can put pressure on pricing and profitability. Furthermore, the shortage of skilled and experienced MRO technicians, particularly those proficient in newer aircraft technologies, poses a significant constraint on the industry's capacity.

- Regulatory Hurdles: Navigating diverse and evolving national aviation regulations.

- Supply Chain Vulnerabilities: Dependence on global supply chains for critical parts.

- Skilled Workforce Shortage: Difficulty in attracting and retaining qualified MRO personnel.

- Competitive Pressures: Intense competition impacting profit margins.

Forces Driving Asia Aircraft MRO Market Growth

Several powerful forces are propelling the Asia Aircraft MRO Market forward. The sustained and robust growth in air passenger traffic across the Asia-Pacific region, driven by economic development and a burgeoning middle class, is the primary catalyst. This surge in travel directly translates into an expanding aircraft fleet requiring comprehensive aircraft maintenance, engine MRO, and airframe MRO services. Furthermore, the increasing average age of aircraft fleets in many Asian countries necessitates more intensive maintenance, repair, and overhaul activities. Technological advancements, particularly in digital MRO solutions such as AI-powered predictive maintenance and IoT-enabled monitoring, are enhancing efficiency and reducing operational costs for airlines, making MRO services more attractive. Government initiatives to develop domestic aerospace manufacturing and MRO capabilities, along with favorable policies for foreign investment, are also significant growth accelerators. The expanding military aviation sector across several Asian nations also contributes substantially to the MRO market.

Challenges in the Asia Aircraft MRO Market Market

Long-term growth catalysts for the Asia Aircraft MRO Market are rooted in strategic industry evolution. The continuous advancement and adoption of cutting-edge technologies, including additive manufacturing for spare parts, advanced robotics for inspections, and sophisticated data analytics for predictive maintenance, will be crucial. Partnerships and collaborations between MRO providers, Original Equipment Manufacturers (OEMs), and airlines will foster innovation and create integrated service offerings. Market expansions into underserved or emerging economies within the Asia-Pacific region present significant opportunities. Furthermore, the increasing focus on sustainability in aviation will drive demand for MRO solutions that prioritize environmental responsibility, such as component repair and lifecycle management over replacement. The development of specialized MRO capabilities for next-generation aircraft, including eVTOLs and sustainable aviation fuel-powered planes, will also shape long-term growth.

Emerging Opportunities in Asia Aircraft MRO Market

Emerging opportunities within the Asia Aircraft MRO Market are diverse and promising. The rapid growth of low-cost carriers (LCCs) in emerging economies presents a substantial market for efficient and cost-effective line maintenance and component MRO. The increasing demand for specialized MRO services for general aviation aircraft, including business jets and helicopters, offers a niche yet lucrative avenue. The development of dedicated MRO hubs and specialized training centers in strategic locations within Asia-Pacific is creating an environment conducive to innovation and growth. Furthermore, the growing adoption of digital MRO solutions, such as remote diagnostics and augmented reality-assisted repairs, is opening up new service delivery models. The increasing focus on sustainable aviation is also creating opportunities for MRO providers offering environmentally friendly repair processes and component refurbishment services.

Leading Players in the Asia Aircraft MRO Market Sector

- Dassault Aviation

- Rolls Royce PLC

- General Electric

- GMF AeroAsia

- Lockheed Martin Corporation

- Guangzhou Aircraft Maintenance Engineering Company Limited

- Sepang Aircraft Engineering Sdn Bh

- Avia Solutions Group PLC

- AAR Corporation

- Safran SA

- Lufthansa Technik

- Hong Kong Aircraft Engineering Company Limited (HAECO)

- SIA Engineering Company

- Air Works India (Engineering) Private Limited

- ST Engineering

- ExecuJet MRO Services

- The Boeing Company

Key Milestones in Asia Aircraft MRO Market Industry

- 2019: Lufthansa Technik establishes a new engine overhaul facility in Singapore, expanding its Asian footprint.

- 2020: GMF AeroAsia announces significant investments in digital transformation initiatives for its MRO operations.

- 2021: SIA Engineering Company partners with a technology firm to develop AI-powered predictive maintenance solutions.

- 2022: HAECO inaugurates a new hangar facility in Xiamen, China, enhancing its airframe MRO capabilities.

- 2023: Rolls Royce PLC inaugurates its first Trent XWB engine service center in Asia, catering to the growing A350 fleet.

- 2024: The Boeing Company expands its MRO support network in India, focusing on component services.

- 2025 (Estimated): Several MRO providers are expected to announce strategic partnerships for composite repair technologies.

Strategic Outlook for Asia Aircraft MRO Market Market

The strategic outlook for the Asia Aircraft MRO Market is exceptionally positive, driven by a confluence of factors that are set to accelerate its growth. The increasing demand for air travel, coupled with fleet expansion and aging aircraft requiring comprehensive maintenance, forms the bedrock of this optimism. Key growth accelerators include the aggressive adoption of advanced digital technologies, such as AI, IoT, and big data analytics, to optimize MRO processes, enhance predictive capabilities, and reduce operational costs for airlines. Strategic collaborations between MRO providers, OEMs, and airlines will be crucial for developing integrated service solutions and expanding service portfolios. Furthermore, the ongoing development of MRO infrastructure and the nurturing of skilled talent pools across the Asia-Pacific region will further solidify its position as a global MRO powerhouse. Opportunities in emerging markets and specialized MRO segments like general aviation and military aviation will also contribute to the market's sustained expansion.

Asia Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Airframe MRO

- 1.2. Engine MRO

- 1.3. Component MRO

- 1.4. Line Maintenance

-

2. Application

- 2.1. Commercial Aviation

- 2.2. Military Aviation

- 2.3. General Aviation

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Australia

- 3.1.6. Thailand

- 3.1.7. Singapore

- 3.1.8. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia Aircraft MRO Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Thailand

- 1.7. Singapore

- 1.8. Rest of Asia Pacific

Asia Aircraft MRO Market Regional Market Share

Geographic Coverage of Asia Aircraft MRO Market

Asia Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe MRO

- 5.1.2. Engine MRO

- 5.1.3. Component MRO

- 5.1.4. Line Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Aviation

- 5.2.2. Military Aviation

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Australia

- 5.3.1.6. Thailand

- 5.3.1.7. Singapore

- 5.3.1.8. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dassault Aviation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rolls Royce PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electric

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GMF AeroAsia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Guangzhou Aircraft Maintenance Engineering Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sepang Aircraft Engineering Sdn Bh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Avia Solutions Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AAR Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Safran SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lufthansa Technik

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hong Kong Aircraft Engineering Company Limited (HAECO)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SIA Engineering Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Air Works India (Engineering) Private Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ST Engineering

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ExecuJet MRO Services

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 The Boeing Company

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Dassault Aviation

List of Figures

- Figure 1: Asia Aircraft MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 2: Asia Aircraft MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Aircraft MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia Aircraft MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 6: Asia Aircraft MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia Aircraft MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Aircraft MRO Market?

The projected CAGR is approximately 5.74%.

2. Which companies are prominent players in the Asia Aircraft MRO Market?

Key companies in the market include Dassault Aviation, Rolls Royce PLC, General Electric, GMF AeroAsia, Lockheed Martin Corporation, Guangzhou Aircraft Maintenance Engineering Company Limited, Sepang Aircraft Engineering Sdn Bh, Avia Solutions Group PLC, AAR Corporation, Safran SA, Lufthansa Technik, Hong Kong Aircraft Engineering Company Limited (HAECO), SIA Engineering Company, Air Works India (Engineering) Private Limited, ST Engineering, ExecuJet MRO Services, The Boeing Company.

3. What are the main segments of the Asia Aircraft MRO Market?

The market segments include MRO Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Asia Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence