Key Insights

The global Armored Vehicle Upgrade and Retrofit market is projected to reach $51.6 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.3%. This growth, expected through 2033, is driven by rising geopolitical tensions and the critical need to modernize existing military fleets. Nations are prioritizing enhanced armored capabilities to address evolving threats, including asymmetric warfare and advanced weaponry. Demand for upgraded Armored Personnel Carriers (APCs), Infantry Fighting Vehicles (IFVs), Mine-resistant Ambush Protected (MRAP) vehicles, and Main Battle Tanks (MBTs) is increasing as defense forces aim to extend asset lifespans and improve survivability, lethality, and situational awareness. Key upgrade areas include enhanced ballistic protection, advanced fire control systems, comprehensive communication suites, and modern sensor integration.

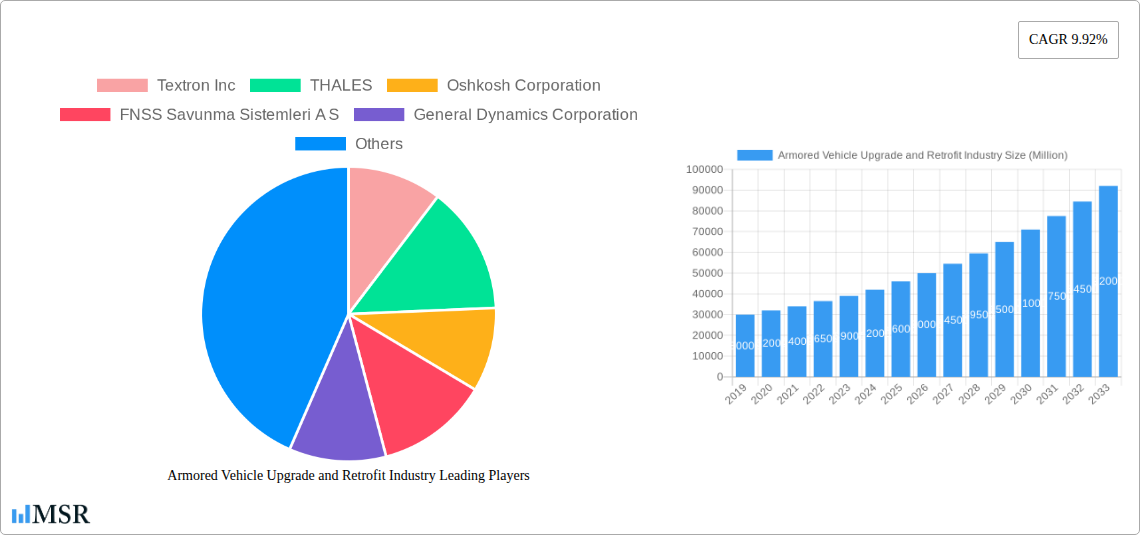

Armored Vehicle Upgrade and Retrofit Industry Market Size (In Billion)

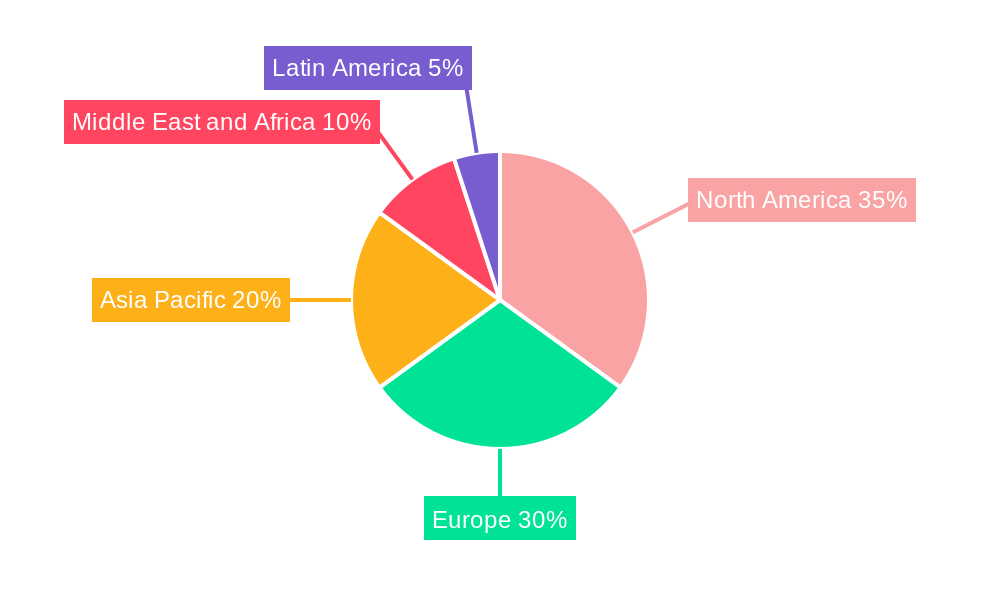

Market dynamics emphasize cost-effectiveness and strategic necessity, with retrofitting existing vehicles offering a more economical alternative to new platform procurement. This cost-benefit advantage, coupled with the urgency to adapt to new battlefield doctrines, significantly fuels market expansion. However, restraints include the complexities of integrating new technologies with legacy systems and the substantial budgetary requirements for large-scale upgrade programs. Leading companies are investing in R&D for comprehensive upgrade solutions. The Asia Pacific and Middle East & Africa regions are anticipated to experience the fastest growth due to increasing defense expenditures and regional conflicts, while North America and Europe will remain dominant markets, supported by established defense industries and ongoing military modernization.

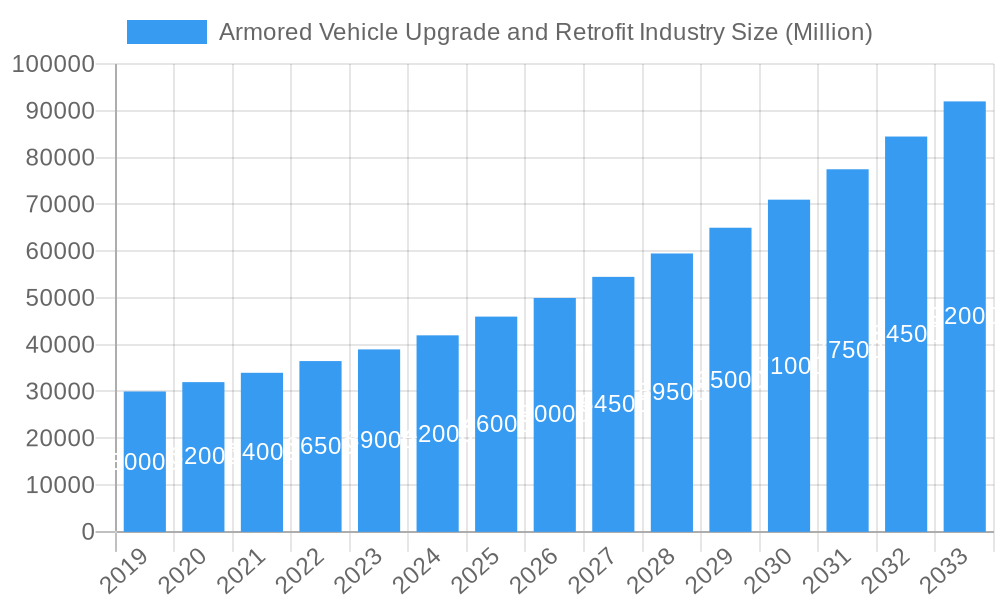

Armored Vehicle Upgrade and Retrofit Industry Company Market Share

Gain strategic insights into the Armored Vehicle Upgrade and Retrofit Industry. This comprehensive report offers critical intelligence for defense manufacturers, government agencies, and investors focused on capitalizing on the demand for enhanced operational capabilities and extended lifecycles of armored fleets. Explore market dynamics, technological innovations, key players, and future projections from 2019–2033, with a base year of 2025.

Armored Vehicle Upgrade and Retrofit Industry Market Concentration & Dynamics

The global armored vehicle upgrade and retrofit market exhibits a moderate level of concentration, with a significant portion of market share held by established defense conglomerates. Key players such as General Dynamics Corporation, BAE Systems PLC, and Rheinmetall AG dominate the landscape, driving innovation and investment. The innovation ecosystem is robust, fueled by continuous research and development into advanced protection systems, C4ISR integration, and enhanced mobility solutions. Regulatory frameworks, primarily driven by national defense procurement policies and international arms control agreements, significantly influence market access and product development. The threat of substitute products, while less pronounced in the realm of heavy armor, exists in the form of new vehicle acquisitions; however, the cost-effectiveness of upgrades makes retrofitting a compelling alternative. End-user trends are overwhelmingly focused on maximizing the combat effectiveness and operational longevity of existing platforms, driven by budget constraints and the need for rapid deployment capabilities. Mergers and acquisitions (M&A) activity, while not at peak levels, remains a strategic tool for companies to expand their technological portfolios and market reach. The total M&A deal count over the historical period (2019-2024) is approximately 25 deals, with an average deal value in the range of 100 Million to 500 Million. The market share of the top 5 players is estimated to be around 65% in 2025.

Armored Vehicle Upgrade and Retrofit Industry Industry Insights & Trends

The Armored Vehicle Upgrade and Retrofit Industry is poised for significant expansion, driven by geopolitical tensions and the imperative for armed forces worldwide to modernize their aging fleets. The market size was approximately 30,000 Million in 2024 and is projected to reach 55,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2025–2033). This robust growth is underpinned by several key factors, including the increasing demand for enhanced survivability against evolving threats such as improvised explosive devices (IEDs) and advanced anti-tank weaponry. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) for improved situational awareness, autonomous capabilities, and predictive maintenance. The development of active protection systems (APS), advanced composite materials for lighter yet stronger armor, and modernized weapon systems are transforming existing platforms into formidable fighting machines. Evolving consumer behaviors within the defense sector are characterized by a shift towards modular and scalable upgrade solutions that can be tailored to specific mission requirements and budget constraints. This allows for a phased approach to modernization, minimizing operational downtime and maximizing return on investment. The increasing emphasis on network-centric warfare and interoperability further fuels the demand for sophisticated electronic warfare suites and communication systems integrated into retrofitted vehicles. The continuous need to counter emerging threats from near-peer adversaries necessitates a perpetual cycle of upgrades, ensuring that armored fleets remain relevant and dominant on the battlefield. The global security environment, marked by regional conflicts and the rise of asymmetric warfare, amplifies the demand for robust and adaptable armored vehicle solutions.

Key Markets & Segments Leading Armored Vehicle Upgrade and Retrofit Industry

The North America region is a dominant force in the Armored Vehicle Upgrade and Retrofit Industry, with the United States spearheading this leadership through substantial defense spending and a proactive approach to military modernization. The primary drivers for this dominance include substantial government investment in defense, a highly advanced industrial base, and a continuous need to maintain technological superiority. The Infantry Fighting Vehicle (IFV) segment, alongside Armored Personnel Carriers (APC), represents a significant area of focus for upgrades, driven by the requirements of modern infantry operations and urban warfare.

- Economic Growth & Infrastructure: Sustained economic growth in the US allows for significant defense budget allocations, directly impacting upgrade programs.

- Technological Advancement: The presence of leading defense contractors fosters rapid innovation in armor, lethality, and digital systems.

- Operational Demands: Frequent deployment in diverse theaters of operation highlights the need for versatile and survivable IFVs and APCs.

The dominance of the US market influences global trends, setting benchmarks for technological adoption and procurement strategies. Countries like Canada also contribute to the North American market, with ongoing modernization efforts for their armored fleets. The Main Battle Tank (MBT) segment also sees substantial upgrade activity, particularly in Europe and Asia, as nations seek to enhance the longevity and combat effectiveness of their heavy armor against modern threats. While APCs and IFVs are more frequently upgraded due to higher operational tempo and diverse deployment scenarios, MBTs receive significant life-extension programs focusing on firepower, protection, and mobility upgrades. Mine-resistant Ambush Protected (MRAP) vehicles continue to be a critical component, with ongoing upgrades to enhance their protection against a wider spectrum of threats and to improve their operational efficiency in counter-insurgency and peacekeeping missions.

Armored Vehicle Upgrade and Retrofit Industry Product Developments

Product developments in the Armored Vehicle Upgrade and Retrofit Industry are characterized by a relentless pursuit of enhanced survivability and operational effectiveness. Innovations focus on integrating advanced active protection systems (APS) capable of defeating incoming threats, modular armor solutions utilizing composite materials for reduced weight and increased protection, and sophisticated C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) suites for superior battlefield awareness. The integration of networked communication systems and advanced sensor technologies allows for real-time data sharing and improved target acquisition, significantly boosting the combat capabilities of retrofitted vehicles. Furthermore, engine upgrades for improved power-to-weight ratios and enhanced mobility, alongside modernized weapon stations and fire control systems, are crucial for maintaining a competitive edge. These advancements ensure that existing armored platforms can meet the demands of modern warfare for the foreseeable future.

Challenges in the Armored Vehicle Upgrade and Retrofit Industry Market

The Armored Vehicle Upgrade and Retrofit Industry faces several significant challenges that impact market growth and operational efficiency. Regulatory hurdles and stringent export controls on advanced defense technologies can slow down the procurement and integration of critical upgrade components, particularly for international markets. Supply chain disruptions, exacerbated by global events and geopolitical instability, can lead to extended lead times for specialized parts and components, impacting program timelines and costs. The estimated impact of these disruptions can lead to project delays of up to 15%. Competitive pressures from both established players and emerging market participants drive down margins, requiring companies to optimize their offerings and operational costs. The substantial upfront investment required for comprehensive upgrade programs can also be a barrier for some defense ministries with constrained budgets.

Forces Driving Armored Vehicle Upgrade and Retrofit Industry Growth

The growth of the Armored Vehicle Upgrade and Retrofit Industry is propelled by a confluence of powerful forces. Geopolitical instability and the resurgence of near-peer competition globally necessitate the continuous enhancement of military capabilities, making upgrades a cost-effective alternative to new acquisitions. Technological advancements, particularly in areas like AI, active protection systems, and advanced materials, offer compelling solutions for improving vehicle survivability and combat effectiveness. Economic factors, such as the need to maximize return on investment for expensive armored platforms and budget constraints in defense spending, strongly favor upgrade and retrofit programs. Furthermore, evolving operational doctrines that emphasize modularity, network-centric warfare, and increased situational awareness drive the demand for advanced integrated systems.

Challenges in the Armored Vehicle Upgrade and Retrofit Industry Market

Long-term growth catalysts for the Armored Vehicle Upgrade and Retrofit Industry are rooted in strategic foresight and continuous innovation. The persistent threat landscape ensures a sustained demand for modernized defense equipment, making ongoing upgrades essential for national security. Advancements in areas like directed energy weapons, cyber warfare defense integration, and autonomous system integration for manned-unmanned teaming will open new avenues for retrofit programs. Strategic partnerships and collaborations between defense contractors, technology providers, and end-users will be crucial for developing and implementing cutting-edge solutions. Market expansions into emerging economies with growing defense budgets and increasing regional security concerns also represent significant long-term growth opportunities.

Emerging Opportunities in Armored Vehicle Upgrade and Retrofit Industry

Emerging opportunities within the Armored Vehicle Upgrade and Retrofit Industry are diverse and promising. The growing demand for modernized light armored vehicles for rapid deployment and special operations presents a significant niche. The integration of enhanced electronic warfare (EW) capabilities and counter-drone systems into existing platforms is another rapidly expanding area. The adoption of digital engineering and simulation technologies for faster and more cost-effective design and testing of upgrade packages offers considerable efficiency gains. Furthermore, the development of sustainable and environmentally friendly upgrade solutions, including hybrid powertrains and advanced energy management systems, is an emerging trend. Opportunities also lie in providing through-life support and sustainment services for upgraded fleets, fostering long-term customer relationships.

Leading Players in the Armored Vehicle Upgrade and Retrofit Industry Sector

- Textron Inc

- THALES

- Oshkosh Corporation

- FNSS Savunma Sistemleri A S

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- Patria Group

- Nexter Group

- BAE Systems PLC

- Bharat Electronics Limited (BEL)

- Ruag International Holding AG

Key Milestones in Armored Vehicle Upgrade and Retrofit Industry Industry

- 2019: Rheinmetall AG secures a major contract for upgrading Leopard 2 MBTs in Germany, focusing on enhanced protection and firepower.

- 2020: BAE Systems PLC announces the successful completion of advanced testing for its new APS for various armored platforms.

- 2021: Oshkosh Corporation receives a significant order for M-ATV vehicles with upgraded survivability features for international customers.

- 2022: THALES develops and showcases an innovative modular protection system for APCs and IFVs at a leading defense exhibition.

- 2023: General Dynamics Corporation initiates a modernization program for the Abrams tank, incorporating new digital architectures and weapon systems.

- 2024: Elbit Systems Ltd announces a breakthrough in AI-driven battlefield management systems for retrofitted armored vehicles.

Strategic Outlook for Armored Vehicle Upgrade and Retrofit Industry Market

The strategic outlook for the Armored Vehicle Upgrade and Retrofit Industry is overwhelmingly positive, driven by a persistent global demand for enhanced defense capabilities. Growth accelerators include the ongoing need to counter evolving threats with advanced protection and lethality upgrades, the cost-effectiveness of retrofitting versus new platform acquisition, and the increasing integration of digital technologies for superior situational awareness and network-centric operations. Strategic opportunities lie in developing modular, scalable, and future-proof upgrade solutions that can adapt to evolving mission requirements. Companies that can offer integrated packages encompassing advanced armor, C4ISR, and self-protection systems will be well-positioned to capture significant market share. The focus on life-extension programs for existing platforms, coupled with the development of next-generation retrofit technologies, will ensure sustained growth and innovation in this critical defense sector.

Armored Vehicle Upgrade and Retrofit Industry Segmentation

-

1. Vehicle Type

- 1.1. Armored Personnel Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Mine-resistant Ambush Protected (MRAP)

- 1.4. Main Battle Tank (MBT)

- 1.5. Other Vehicle Types

Armored Vehicle Upgrade and Retrofit Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Turkey

- 5.5. Rest of Middle East and Africa

Armored Vehicle Upgrade and Retrofit Industry Regional Market Share

Geographic Coverage of Armored Vehicle Upgrade and Retrofit Industry

Armored Vehicle Upgrade and Retrofit Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Infantry Fighting Vehicle (IFV) Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Armored Vehicle Upgrade and Retrofit Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Armored Personnel Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Mine-resistant Ambush Protected (MRAP)

- 5.1.4. Main Battle Tank (MBT)

- 5.1.5. Other Vehicle Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Armored Vehicle Upgrade and Retrofit Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Armored Personnel Carrier (APC)

- 6.1.2. Infantry Fighting Vehicle (IFV)

- 6.1.3. Mine-resistant Ambush Protected (MRAP)

- 6.1.4. Main Battle Tank (MBT)

- 6.1.5. Other Vehicle Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Armored Vehicle Upgrade and Retrofit Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Armored Personnel Carrier (APC)

- 7.1.2. Infantry Fighting Vehicle (IFV)

- 7.1.3. Mine-resistant Ambush Protected (MRAP)

- 7.1.4. Main Battle Tank (MBT)

- 7.1.5. Other Vehicle Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Armored Vehicle Upgrade and Retrofit Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Armored Personnel Carrier (APC)

- 8.1.2. Infantry Fighting Vehicle (IFV)

- 8.1.3. Mine-resistant Ambush Protected (MRAP)

- 8.1.4. Main Battle Tank (MBT)

- 8.1.5. Other Vehicle Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Latin America Armored Vehicle Upgrade and Retrofit Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Armored Personnel Carrier (APC)

- 9.1.2. Infantry Fighting Vehicle (IFV)

- 9.1.3. Mine-resistant Ambush Protected (MRAP)

- 9.1.4. Main Battle Tank (MBT)

- 9.1.5. Other Vehicle Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa Armored Vehicle Upgrade and Retrofit Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Armored Personnel Carrier (APC)

- 10.1.2. Infantry Fighting Vehicle (IFV)

- 10.1.3. Mine-resistant Ambush Protected (MRAP)

- 10.1.4. Main Battle Tank (MBT)

- 10.1.5. Other Vehicle Types

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 THALES

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oshkosh Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FNSS Savunma Sistemleri A S

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Dynamics Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rheinmetall AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elbit Systems Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Patria Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nexter Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAE Systems PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bharat Electronics Limited (BEL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ruag International Holding AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Armored Vehicle Upgrade and Retrofit Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: Europe Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: Europe Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Asia Pacific Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Asia Pacific Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Latin America Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Latin America Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 19: Middle East and Africa Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Middle East and Africa Armored Vehicle Upgrade and Retrofit Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Armored Vehicle Upgrade and Retrofit Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: France Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: China Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: India Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: South Korea Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Brazil Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Latin America Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Armored Vehicle Upgrade and Retrofit Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Arab Emirates Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Saudi Arabia Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Egypt Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Turkey Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Armored Vehicle Upgrade and Retrofit Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Armored Vehicle Upgrade and Retrofit Industry?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Armored Vehicle Upgrade and Retrofit Industry?

Key companies in the market include Textron Inc, THALES, Oshkosh Corporation, FNSS Savunma Sistemleri A S, General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, Patria Group, Nexter Group, BAE Systems PLC, Bharat Electronics Limited (BEL, Ruag International Holding AG.

3. What are the main segments of the Armored Vehicle Upgrade and Retrofit Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.6 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Infantry Fighting Vehicle (IFV) Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Armored Vehicle Upgrade and Retrofit Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Armored Vehicle Upgrade and Retrofit Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Armored Vehicle Upgrade and Retrofit Industry?

To stay informed about further developments, trends, and reports in the Armored Vehicle Upgrade and Retrofit Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence