Key Insights

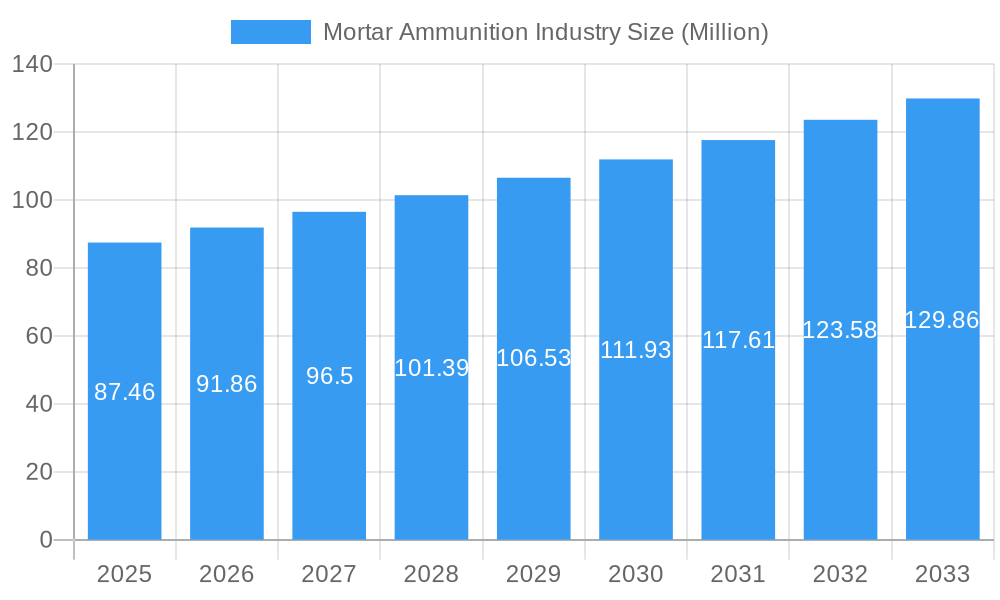

The global mortar ammunition market is projected to reach a significant valuation of USD 87.46 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.04% during the forecast period of 2025-2033. This growth is underpinned by a confluence of escalating geopolitical tensions, the persistent need for modernizing defense arsenals, and increased military spending across key regions. Demand is particularly strong for light and medium caliber mortar ammunition due to their versatility in various combat scenarios, from urban warfare to direct fire support. Emerging economies are also a key factor, with substantial investments in defense infrastructure aimed at bolstering national security and maintaining regional stability. The continuous innovation in mortar shell technology, focusing on enhanced precision, extended range, and reduced collateral damage, further fuels market expansion as armed forces seek superior battlefield capabilities.

Mortar Ammunition Industry Market Size (In Million)

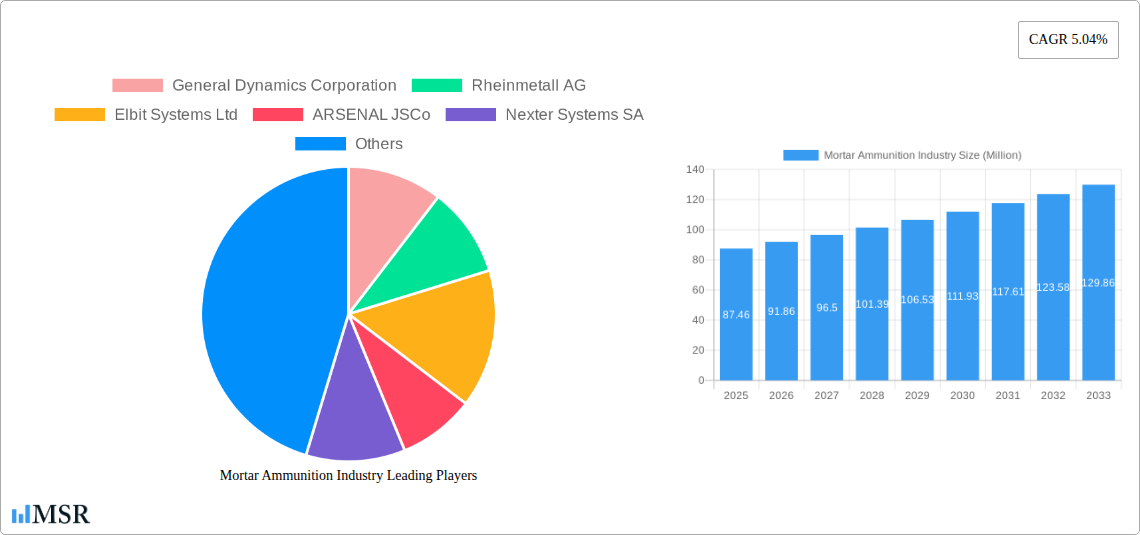

The market landscape is characterized by a dynamic interplay of established defense giants and emerging players, each vying for market share through strategic partnerships, technological advancements, and expansion into developing defense sectors. Key players like General Dynamics Corporation, Rheinmetall AG, and BAE Systems PLC are at the forefront, offering a comprehensive range of mortar ammunition solutions. The increasing adoption of smart and guided mortar munitions, coupled with the development of advanced fuzing systems, is a significant trend shaping the industry. While the market presents substantial growth opportunities, it also faces certain restraints, including stringent regulatory frameworks governing arms trade, the high cost associated with research and development of cutting-edge ammunition, and the potential for budget cuts in defense spending by some nations. Nevertheless, the persistent demand for effective indirect fire support and the ongoing global security challenges are expected to sustain the upward trajectory of the mortar ammunition market.

Mortar Ammunition Industry Company Market Share

Mortar Ammunition Industry Market Research Report: Forecast 2025–2033

This comprehensive report delivers an in-depth analysis of the global Mortar Ammunition Industry, covering the historical period from 2019 to 2024 and projecting market dynamics through 2033. With a base year of 2025, the study examines market concentration, key industry insights, leading markets and segments, product developments, challenges, growth drivers, emerging opportunities, and strategic outlook. It meticulously details the competitive landscape, featuring key players and significant industry milestones. This report is essential for defense contractors, government procurement agencies, investors, and strategic planners seeking a nuanced understanding of the mortar ammunition market, defense industry trends, and artillery systems.

Mortar Ammunition Industry Market Concentration & Dynamics

The global Mortar Ammunition Industry is characterized by a moderate to high level of market concentration, with a select group of established defense manufacturers dominating production. Innovation ecosystems are driven by advancements in precision guidance, explosive technologies, and smart munitions, fueled by ongoing geopolitical tensions and military modernization programs. Regulatory frameworks, primarily governed by national defense policies and international arms control treaties, play a crucial role in market access and product standardization. Substitute products, while limited in direct replacement for core mortar rounds, include advanced artillery systems and precision-guided missiles that can fulfill similar battlefield roles. End-user trends are increasingly focused on enhanced lethality, reduced collateral damage, and interoperability. Merger and acquisition (M&A) activities, while not as frequent as in some other industrial sectors, are strategic and often involve consolidation to achieve economies of scale or acquire specialized technological capabilities. Market share estimations indicate a dominance of leading players, with numerous smaller entities focusing on niche segments or regional supply. M&A deal counts are expected to remain consistent, driven by the need for enhanced capabilities and market expansion.

- Market Concentration: Moderate to High

- Innovation Focus: Smart munitions, precision guidance, advanced propellants.

- Regulatory Influence: National defense procurement, export controls, international agreements.

- Substitute Threats: Precision-guided missiles, advanced artillery.

- End-User Demand: Enhanced accuracy, reduced collateral damage, modularity.

- M&A Activity: Strategic, driven by capability enhancement and market consolidation.

Mortar Ammunition Industry Industry Insights & Trends

The Mortar Ammunition Industry is poised for significant growth, driven by escalating global defense spending and a heightened demand for advanced indirect fire support capabilities. The market size for mortar ammunition is projected to reach an estimated $xx Million by the end of 2025 and is expected to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This robust growth is underpinned by several key factors. Firstly, persistent geopolitical conflicts and regional instability in various parts of the world, from Eastern Europe to the Middle East and Asia-Pacific, necessitate a continuous replenishment and modernization of military arsenals. This demand is particularly strong for reliable and cost-effective indirect fire solutions like mortar systems, which offer tactical flexibility and significant firepower. Secondly, technological advancements are revolutionizing mortar ammunition. The integration of advanced fusing mechanisms, guidance systems, and improved propellants is leading to the development of smart munitions with enhanced accuracy, extended range, and reduced circular error probable (CEP). This shift from traditional to intelligent ammunition is a significant trend, allowing for greater precision targeting and minimizing unintended damage. Furthermore, the evolving nature of warfare, with an increased emphasis on urban combat and asymmetric threats, demands adaptable and precise munitions that can be effectively employed in complex environments. Military forces are investing heavily in training and equipping their personnel with systems that can deliver immediate and accurate fire support, making mortar systems and their associated ammunition indispensable assets. The development of multi-purpose warheads and programmable fuzes is also a growing trend, allowing a single mortar round to be adapted for various combat scenarios, from high-explosive to illumination and smoke. The digitalization of military operations and the concept of networked warfare further contribute to the demand for smart and interoperable ammunition solutions. This report will delve into the specific market size projections and CAGR for various sub-segments within the mortar ammunition market, providing a detailed financial outlook.

Key Markets & Segments Leading Mortar Ammunition Industry

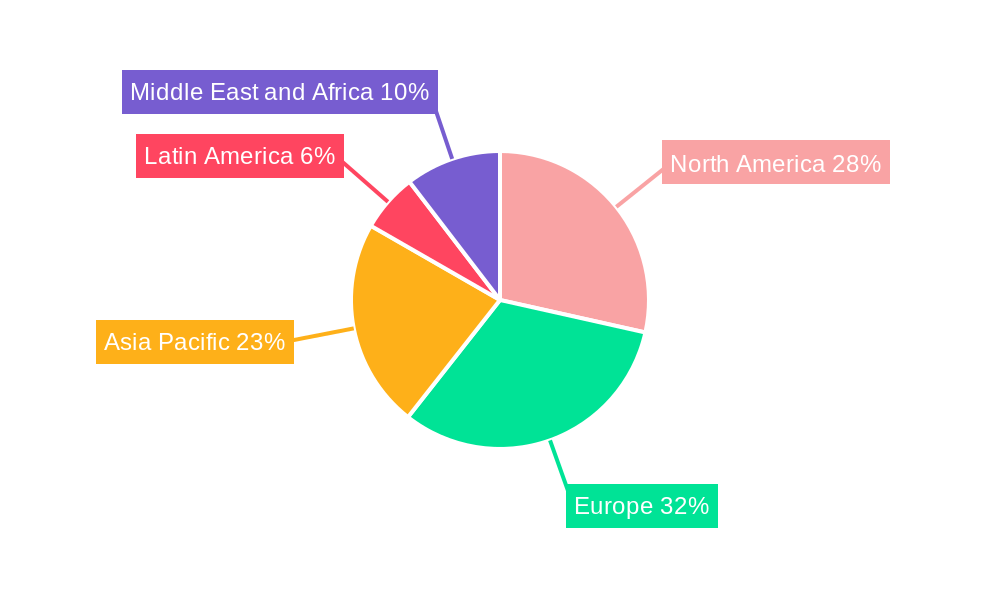

The global mortar ammunition market is experiencing robust growth, with North America and Europe currently leading in terms of market share and demand. This dominance is attributed to substantial defense budgets, ongoing military modernization programs, and active participation in international security operations. The light mortar ammunition segment (e.g., 60 mm) is crucial for infantry units, offering portability and immediate support in close-quarters combat. Its market is driven by the continuous need for dismounted troop support and the proliferation of light infantry forces globally.

- Drivers for Light Mortar Ammunition:

- Infantry deployment in asymmetric warfare.

- Requirement for portable indirect fire support.

- Cost-effectiveness for widespread adoption.

The medium mortar ammunition segment (e.g., 81 mm) represents a significant portion of the market, bridging the gap between light and heavy systems. These calibers are favored for their balance of range, payload, and portability, making them versatile for various tactical scenarios. The demand in this segment is fueled by the need for sustained fire support for advancing ground forces and counter-battery fire.

- Drivers for Medium Mortar Ammunition:

- Versatility in ground combat operations.

- Balance of range, accuracy, and logistic feasibility.

- Integration with modern fire support systems.

The heavy mortar ammunition segment (e.g., 120 mm) is critical for providing substantial indirect fire support, often from mobile platforms. This segment is driven by the requirements of mechanized infantry and armored units, as well as by the increasing adoption of vehicle-mounted mortar systems. The 120 mm mortar ammunition market, in particular, is experiencing heightened demand due to its effectiveness against fortified positions and its utility in large-scale combat operations.

- Drivers for Heavy Mortar Ammunition:

- Requirement for high-volume indirect fire.

- Effectiveness against hardened targets.

- Integration with modern artillery and support platforms.

Geographically, the United States mortar ammunition market remains a primary driver, due to its extensive military presence and continuous procurement cycles. European nations, particularly those with active roles in NATO and facing regional security challenges, also represent significant markets. The Asia-Pacific region is emerging as a key growth area, with countries like South Korea, Japan, and India enhancing their defense capabilities, thereby increasing the demand for advanced mortar systems and ammunition. Emerging markets in the Middle East are also showing increased procurement activities.

Mortar Ammunition Industry Product Developments

The Mortar Ammunition Industry is witnessing significant product innovation focused on enhancing accuracy, range, and lethality. Key developments include the introduction of guided mortar projectiles (GMPs) that utilize GPS or laser guidance systems to achieve pinpoint accuracy, significantly reducing collateral damage and increasing first-round hit probability. Advancements in propellant technology are enabling extended range capabilities, allowing mortar systems to engage targets at greater distances. Furthermore, the development of multi-purpose warheads and programmable fuzes offers greater flexibility in employment, catering to diverse combat scenarios from direct fire to area suppression and precision strikes. These technological leaps are driven by the demand for smarter, more effective, and adaptable munitions in modern warfare, providing defense forces with a critical competitive edge.

Challenges in the Mortar Ammunition Industry Market

The Mortar Ammunition Industry faces several significant challenges that impact its growth and operational landscape. Stringent regulatory compliance and export controls are primary hurdles, requiring extensive documentation and adherence to international arms treaties. Supply chain disruptions, particularly for specialized raw materials and components, can lead to production delays and cost escalations. The high cost of research and development for advanced munitions, coupled with intense competition from established players and emerging manufacturers, puts pressure on profit margins. Additionally, the long lead times for procurement cycles in government contracts can create forecasting uncertainties.

- Regulatory Hurdles: Export controls, national security classifications, international agreements.

- Supply Chain Vulnerabilities: Raw material sourcing, component availability, logistical complexities.

- R&D Investment: High costs associated with advanced technology development.

- Competitive Landscape: Market saturation in certain segments, price pressures.

- Procurement Cycles: Extended lead times, bureaucratic processes.

Forces Driving Mortar Ammunition Industry Growth

Several powerful forces are propelling the growth of the Mortar Ammunition Industry. Foremost among these is the escalation of global defense spending, driven by geopolitical instability and regional conflicts, which necessitates robust artillery and indirect fire capabilities. Technological advancements, particularly in precision guidance and smart munitions, are creating new market opportunities and driving demand for upgraded ammunition. The modernization of military forces worldwide and the emphasis on enhancing battlefield effectiveness further fuel the need for advanced mortar systems and their associated ammunition. Additionally, increasing demand for indirect fire support in urban warfare and asymmetric combat scenarios, where mortar systems offer a tactical advantage due to their flexibility and deployability, is a significant growth catalyst.

Challenges in the Mortar Ammunition Industry Market

While growth is evident, the Mortar Ammunition Industry navigates a complex landscape of long-term growth catalysts and potential hindrances. The continuous drive for enhanced battlefield effectiveness remains a primary catalyst, pushing for innovations in lethality, accuracy, and survivability. Strategic partnerships and collaborations between defense manufacturers and technology firms are crucial for accelerating the development and deployment of next-generation munitions. Furthermore, the expansion into emerging defense markets with growing military modernization needs presents significant long-term growth potential. However, challenges such as ethical considerations and public perception surrounding the use of advanced weaponry, alongside the ever-evolving threat landscape, require constant adaptation and innovation to maintain market relevance and ensure sustained growth.

Emerging Opportunities in Mortar Ammunition Industry

Emerging opportunities within the Mortar Ammunition Industry are largely centered on technological innovation and market expansion. The development and adoption of loitering munitions and smart mortar systems offer a significant growth avenue, providing enhanced battlefield intelligence and precision strike capabilities. Increased demand for non-lethal mortar rounds, such as illumination and smoke projectiles, for specialized operations presents niche market opportunities. Furthermore, the growing defense budgets in developing nations and their focus on acquiring advanced military hardware create new markets for mortar ammunition. The potential for exporting advanced mortar technologies to allied nations seeking to modernize their artillery capabilities also represents a substantial opportunity for established manufacturers.

Leading Players in the Mortar Ammunition Industry Sector

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- ARSENAL JSCo

- Nexter Systems SA

- Hanwha Corporation

- Denel SOC Ltd

- BAE Systems PLC

- Hirtenberger Defence Systems GmbH & Co KG

- Nammo AS

- Singapore Technologies Engineering Ltd

- Mechanical and Chemical Industry Company (MKEK)

- Saab AB

Key Milestones in Mortar Ammunition Industry Industry

- April 2024: Rheinmetall AG was awarded a significant contract by the Spanish authorities to supply 104,000 mortar projectiles across various caliber sizes, including 60 mm, 81 mm, and 120 mm, with delivery expected by the end of 2025. This order underscores the ongoing demand for medium and heavy caliber mortar ammunition in European defense markets.

- November 2023: Rheinmetall AG secured a crucial order from the German government to supply approximately 100,000 rounds of 120 mm mortar ammunition to Ukraine. This substantial deal, part of a EUR 400 million military aid package, highlights the critical role of mortar ammunition in ongoing conflicts and the importance of robust supply chains for international military support.

Strategic Outlook for Mortar Ammunition Industry Market

The strategic outlook for the Mortar Ammunition Industry is characterized by sustained growth and a strong emphasis on technological advancement and market diversification. Future growth will be significantly influenced by the continued demand for precision-guided munitions, the integration of artificial intelligence in fire control systems, and the development of modular and adaptable ammunition solutions. Manufacturers focusing on R&D for smart artillery and expanding their production capabilities to meet global defense needs will be well-positioned. Furthermore, strategic alliances and partnerships, particularly in emerging markets, will be crucial for market penetration and capturing new revenue streams, ensuring the industry's continued evolution and relevance in the global defense landscape.

Mortar Ammunition Industry Segmentation

-

1. Caliber Type

- 1.1. Light

- 1.2. Medium

- 1.3. Heavy

Mortar Ammunition Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Mortar Ammunition Industry Regional Market Share

Geographic Coverage of Mortar Ammunition Industry

Mortar Ammunition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Heavy Caliber Segment is Expected to Witness the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Caliber Type

- 5.1.1. Light

- 5.1.2. Medium

- 5.1.3. Heavy

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Caliber Type

- 6. North America Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Caliber Type

- 6.1.1. Light

- 6.1.2. Medium

- 6.1.3. Heavy

- 6.1. Market Analysis, Insights and Forecast - by Caliber Type

- 7. Europe Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Caliber Type

- 7.1.1. Light

- 7.1.2. Medium

- 7.1.3. Heavy

- 7.1. Market Analysis, Insights and Forecast - by Caliber Type

- 8. Asia Pacific Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Caliber Type

- 8.1.1. Light

- 8.1.2. Medium

- 8.1.3. Heavy

- 8.1. Market Analysis, Insights and Forecast - by Caliber Type

- 9. Latin America Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Caliber Type

- 9.1.1. Light

- 9.1.2. Medium

- 9.1.3. Heavy

- 9.1. Market Analysis, Insights and Forecast - by Caliber Type

- 10. Middle East and Africa Mortar Ammunition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Caliber Type

- 10.1.1. Light

- 10.1.2. Medium

- 10.1.3. Heavy

- 10.1. Market Analysis, Insights and Forecast - by Caliber Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rheinmetall AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elbit Systems Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ARSENAL JSCo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nexter Systems SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hanwha Corporatio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Denel SOC Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BAE Systems PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hirtenberger Defence Systems GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nammo AS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Singapore Technologies Engineering Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mechanical and Chemical Industry Company (MKEK)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Saab AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Mortar Ammunition Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 3: North America Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 4: North America Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 7: Europe Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 8: Europe Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 11: Asia Pacific Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 12: Asia Pacific Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 15: Latin America Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 16: Latin America Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Mortar Ammunition Industry Revenue (Million), by Caliber Type 2025 & 2033

- Figure 19: Middle East and Africa Mortar Ammunition Industry Revenue Share (%), by Caliber Type 2025 & 2033

- Figure 20: Middle East and Africa Mortar Ammunition Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Mortar Ammunition Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 2: Global Mortar Ammunition Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 4: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 8: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 14: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 21: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Mexico Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Mortar Ammunition Industry Revenue Million Forecast, by Caliber Type 2020 & 2033

- Table 25: Global Mortar Ammunition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: United Arab Emirates Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Africa Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Mortar Ammunition Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mortar Ammunition Industry?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Mortar Ammunition Industry?

Key companies in the market include General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, ARSENAL JSCo, Nexter Systems SA, Hanwha Corporatio, Denel SOC Ltd, BAE Systems PLC, Hirtenberger Defence Systems GmbH & Co KG, Nammo AS, Singapore Technologies Engineering Ltd, Mechanical and Chemical Industry Company (MKEK), Saab AB.

3. What are the main segments of the Mortar Ammunition Industry?

The market segments include Caliber Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.46 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Heavy Caliber Segment is Expected to Witness the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2024: Rheinmetall was awarded a contract by the Spanish authorities to supply 104,000 mortar projectiles in various caliber sizes, including 60 mm, 81 mm, and 120 mm, by the end of 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mortar Ammunition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mortar Ammunition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mortar Ammunition Industry?

To stay informed about further developments, trends, and reports in the Mortar Ammunition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence