Key Insights

The Indian Aviation Industry is projected for substantial growth, fueled by India's robust economic expansion, a growing middle class, and rising disposable incomes. The market, valued at $14.47 billion in the base year 2024, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 12.21% through the forecast period concluding in 2033. Key growth drivers include the government's focus on enhancing regional connectivity via initiatives like UDAN, increased airline capacity, and surging demand for both leisure and business air travel. The Commercial Aviation segment, especially Passenger Aircraft, is expected to lead, supported by rising passenger traffic. General Aviation, including business jets, is also set for growth as corporate travel increases. Military Aviation will also see expansion driven by modernization efforts and defense procurements.

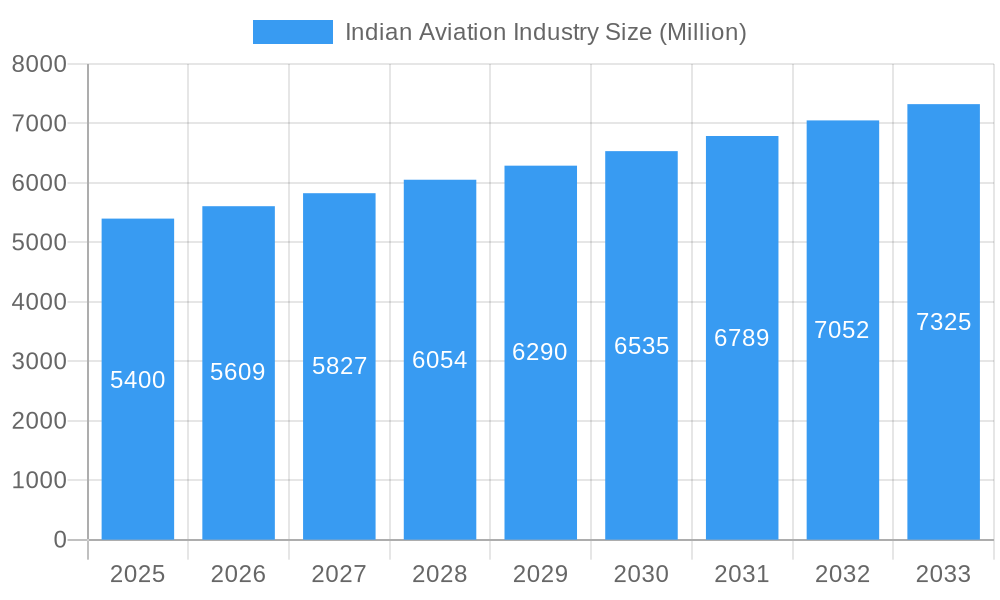

Indian Aviation Industry Market Size (In Billion)

The Indian aviation market is evolving with trends like technology adoption, sustainability initiatives, and airport infrastructure development. Airlines are investing in fleet modernization for improved fuel efficiency and passenger experience. The proliferation of low-cost carriers (LCCs) is making air travel more accessible, stimulating demand. Potential challenges include volatile fuel prices, intense competition, and the need for skilled aviation professionals. Nevertheless, strong underlying demand, supportive government policies, and ongoing infrastructure investments indicate a promising future for the Indian Aviation Industry, positioning it for sustained growth within the Asia-Pacific region due to India's demographic advantages.

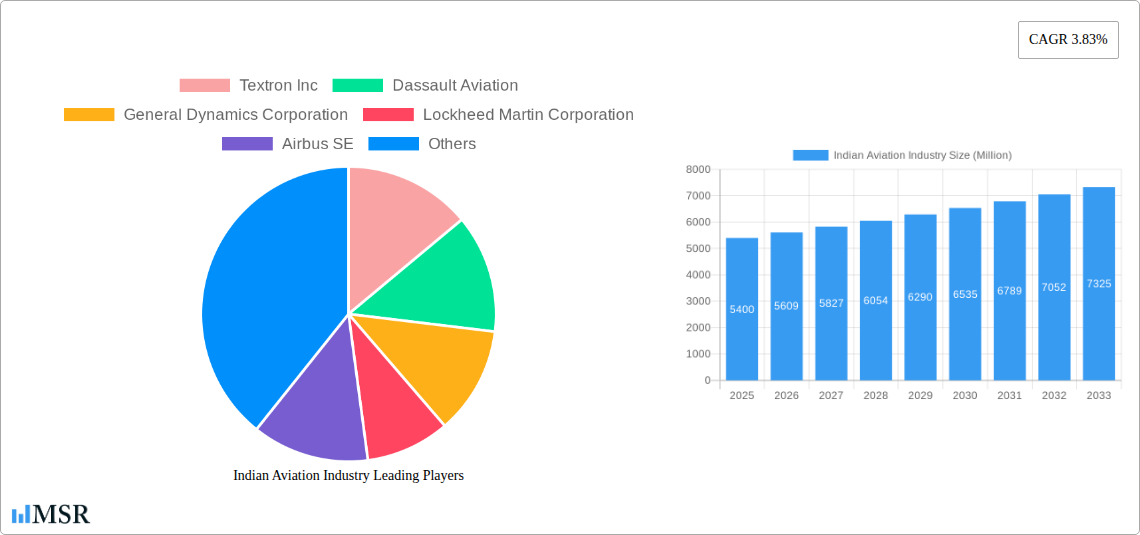

Indian Aviation Industry Company Market Share

This report provides a comprehensive analysis of the Indian Aviation Industry, examining market concentration, key insights, segment dominance, product developments, challenges, growth drivers, and emerging opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2024, this report offers actionable intelligence for industry stakeholders, investors, and decision-makers. Analysis includes the impact of major players like Airbus SE, The Boeing Company, and Hindustan Aeronautics Limited, alongside critical industry developments shaping the future of Indian aviation.

Indian Aviation Industry Market Concentration & Dynamics

The Indian Aviation Industry exhibits a moderate level of market concentration, with a significant presence of both established global aerospace giants and a growing domestic player. Key global manufacturers such as Airbus SE and The Boeing Company dominate the supply of commercial and military aircraft, while companies like Lockheed Martin Corporation and General Dynamics Corporation are pivotal in the defense sector. Hindustan Aeronautics Limited (HAL) is a crucial domestic entity, particularly in military aviation and helicopter manufacturing. The innovation ecosystem is fueled by significant R&D investments from these major players, alongside growing collaboration with Indian research institutions. Regulatory frameworks, governed by bodies like the Directorate General of Civil Aviation (DGCA) and the Ministry of Civil Aviation, are evolving to support industry growth, focusing on safety, air traffic management, and indigenization initiatives like 'Make in India.' Substitute products are limited in the aviation sector due to its highly specialized nature, with the primary alternatives being other modes of transport for shorter distances. End-user trends are strongly influenced by the burgeoning middle class, increasing disposable incomes, and a growing demand for both passenger and cargo air transport. Merger and acquisition (M&A) activities, while not as frequent as in some other sectors, have been significant, with past deals aimed at consolidating market share or acquiring critical technologies. For instance, the strategic importance of domestic manufacturing is underscored by potential partnerships and acquisitions involving HAL. The market share distribution is largely influenced by the order book of major airlines and defense procurements.

Indian Aviation Industry Industry Insights & Trends

The Indian Aviation Industry is poised for substantial growth, projected to reach an estimated market size of 250 Million by 2025, with a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period (2025-2033). This robust expansion is driven by a confluence of factors. Increasing disposable incomes and a rapidly growing middle class are fueling an unprecedented demand for air travel, making passenger aircraft, particularly narrow-body aircraft, a dominant segment. The Indian government's focus on improving regional connectivity through schemes like UDAN (Ude Desh Ka Aam Nagrik) further stimulates growth in this area. The e-commerce boom and the need for efficient logistics are also driving the demand for freighter aircraft. Technological disruptions are playing a crucial role, with advancements in fuel efficiency, sustainable aviation fuels, and digital technologies transforming aircraft design and operations. The increasing adoption of smart manufacturing processes and AI in aviation MRO (Maintenance, Repair, and Overhaul) is also a significant trend. Evolving consumer behaviors are characterized by a preference for convenience, speed, and value for money, prompting airlines to optimize their offerings and expand their route networks. The rise of low-cost carriers (LCCs) continues to democratize air travel, making it accessible to a wider population. Furthermore, the defense modernization drive is creating significant opportunities for military aviation, with substantial orders for multi-role aircraft and advanced rotorcraft. The market is also witnessing a surge in demand for business jets, reflecting the growth of India's corporate sector. The overall market trajectory is positive, supported by supportive government policies and a strong underlying economic growth.

Key Markets & Segments Leading Indian Aviation Industry

The Indian Aviation Industry's growth is predominantly led by Commercial Aviation, particularly the Passenger Aircraft segment. Within this, Narrowbody Aircraft are experiencing the most significant demand due to their operational efficiency and suitability for high-frequency domestic routes. This surge is driven by economic growth, leading to increased disposable incomes and a burgeoning middle class with a higher propensity for air travel. Government initiatives like the National Civil Aviation Policy and the Regional Connectivity Scheme (RCS) are instrumental in expanding air connectivity to Tier II and Tier III cities, further boosting the demand for narrow-body aircraft.

- Drivers for Commercial Aviation Dominance:

- Economic Growth & Rising Disposable Incomes: A larger middle class translates directly into increased air travel.

- Government Policies & Infrastructure Development: Initiatives like UDAN and airport modernization projects enhance accessibility and capacity.

- Growing Tourism & Business Travel: India's expanding economy and tourism sector necessitate efficient air transport.

- Fleet Expansion by Indian Carriers: Major airlines are actively placing large orders for new aircraft.

While Commercial Aviation takes the lead, Military Aviation is another crucial segment, driven by national security imperatives and ongoing modernization programs. India's strategic location and geopolitical landscape necessitate a robust defense air fleet. The demand for Multi-Role Aircraft and Rotorcraft, including multi-mission helicopters, is substantial, supported by domestic manufacturing capabilities and foreign collaborations. Companies like Hindustan Aeronautics Limited are at the forefront of this segment.

General Aviation, encompassing Business Jets (Large Jet, Light Jet, Mid-Size Jet) and Piston Fixed-Wing Aircraft, is also showing promising growth, albeit from a smaller base. The expansion of India's corporate sector and the increasing need for efficient executive travel are key drivers. The market for larger jets is driven by major corporations, while smaller jets cater to burgeoning enterprises and high-net-worth individuals.

The dominance of these segments is characterized by:

- Passenger Aircraft (Narrowbody): This segment accounts for approximately 70% of the total commercial aviation market in India, driven by consistent demand from LCCs and full-service carriers.

- Military Aviation: Constituting roughly 25% of the overall market, this segment sees substantial investment in aircraft and helicopter procurements.

- General Aviation: Represents about 5% of the market, with a steady upward trend in business jet acquisitions.

Indian Aviation Industry Product Developments

Product developments in the Indian Aviation Industry are increasingly focused on enhancing efficiency, sustainability, and advanced capabilities. Airbus SE and The Boeing Company are continuously innovating their narrow-body and wide-body aircraft, such as the A350 and A330neo, with improved aerodynamics and fuel-efficient engines. In the military sector, Hindustan Aeronautics Limited is at the forefront of developing advanced rotorcraft and multi-role aircraft, while Textron Inc.'s Bell unit is involved in next-generation helicopter programs. The integration of advanced avionics, composite materials, and digital cockpits is a common theme across all segments, aiming to reduce operational costs, improve safety, and enhance pilot situational awareness.

Challenges in the Indian Aviation Industry Market

The Indian Aviation Industry faces several challenges, including regulatory hurdles related to land acquisition for airport expansion and complex approval processes for new technologies. Supply chain issues, particularly for specialized components and raw materials, can lead to production delays and increased costs. Intense competition among airlines, both domestic and international, puts pressure on margins, while the high cost of aviation fuel remains a persistent concern. Attracting and retaining skilled aviation professionals, including pilots and engineers, is also a critical challenge. The infrastructure deficit in certain regions can also limit growth opportunities.

Forces Driving Indian Aviation Industry Growth

Several forces are propelling the Indian Aviation Industry forward. Economic Growth is a primary driver, leading to increased disposable incomes and a higher propensity for air travel. Government Initiatives, such as the National Civil Aviation Policy and 'Make in India,' are fostering a conducive environment for expansion and indigenization. Technological Advancements in aircraft design, fuel efficiency, and sustainable aviation practices are enhancing operational capabilities and reducing environmental impact. The Growing Middle Class and a burgeoning tourism sector are creating sustained demand for passenger air transport. Furthermore, the Defense Modernization Program is a significant catalyst for growth in the military aviation segment.

Challenges in the Indian Aviation Industry Market

Long-term growth catalysts in the Indian Aviation Industry are rooted in continued innovation and strategic market expansions. The increasing focus on Sustainable Aviation Fuels (SAFs) and electric/hybrid aircraft technologies presents a significant opportunity to address environmental concerns and attract a new wave of environmentally conscious travelers. Partnerships between Indian manufacturers and global aerospace leaders will be crucial for technology transfer and indigenous capability development. Expansion of air cargo infrastructure and services to support the growing e-commerce sector will unlock further growth potential. Investments in advanced pilot training and MRO facilities will ensure a skilled workforce to support the expanding fleet.

Emerging Opportunities in Indian Aviation Industry

Emerging opportunities in the Indian Aviation Industry are vast and varied. The burgeoning demand for Regional Connectivity presents a significant avenue for growth, particularly for smaller aircraft and helicopter services. The rapid expansion of the Air Cargo Sector, driven by e-commerce and logistics advancements, offers substantial potential. Drone technology and its applications in logistics, surveillance, and passenger transport represent a nascent but rapidly evolving opportunity. The increasing interest in Sustainable Aviation is creating demand for new technologies and fuel solutions. Furthermore, the ongoing Defense Modernization program continues to offer significant opportunities for both domestic and international players in the military aviation segment.

Leading Players in the Indian Aviation Industry Sector

- Airbus SE

- The Boeing Company

- Dassault Aviation

- Lockheed Martin Corporation

- General Dynamics Corporation

- Textron Inc.

- Leonardo S.p.A.

- Bombardier Inc.

- ATR

- Hindustan Aeronautics Limited

Key Milestones in Indian Aviation Industry Industry

- June 2023: Delta Air Lines Inc. is in talks with Airbus SE to order wide-body aircraft, specifically the A350 and A330neo twin-aisle aircraft.

- March 2023: Boeing was awarded a significant contract by Air India for 220 aircraft, comprising 190 Boeing 737 Max, 20 Boeing 787, and 10 Boeing 777X.

- December 2022: Textron Inc.'s Bell unit was awarded a contract by the US Army to supply next-generation helicopters, as part of the Army's "Future Vertical Lift" initiative to replace aging UH-60 Black Hawk utility helicopters.

Strategic Outlook for Indian Aviation Industry Market

The strategic outlook for the Indian Aviation Industry market is exceptionally positive, driven by a confluence of strong demographic trends, supportive government policies, and technological advancements. The ongoing expansion of commercial aviation, fueled by increasing passenger traffic and fleet modernization, will continue to be a primary growth accelerator. Significant investments in defense modernization will ensure sustained demand for military aircraft and rotorcraft. Furthermore, the burgeoning air cargo sector and the emerging drone ecosystem present new frontiers for growth and innovation. Strategic partnerships and a continued focus on indigenous manufacturing capabilities will be crucial for long-term success and for capitalizing on the immense future market potential of this dynamic industry.

Indian Aviation Industry Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Indian Aviation Industry Segmentation By Geography

- 1. India

Indian Aviation Industry Regional Market Share

Geographic Coverage of Indian Aviation Industry

Indian Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Dynamics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lockheed Martin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbus SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Boeing Compan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leonardo S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bombardier Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ATR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hindustan Aeronautics Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Indian Aviation Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indian Aviation Industry Share (%) by Company 2025

List of Tables

- Table 1: Indian Aviation Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Indian Aviation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Indian Aviation Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Indian Aviation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Aviation Industry?

The projected CAGR is approximately 12.21%.

2. Which companies are prominent players in the Indian Aviation Industry?

Key companies in the market include Textron Inc, Dassault Aviation, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Leonardo S p A, Bombardier Inc, ATR, Hindustan Aeronautics Limited.

3. What are the main segments of the Indian Aviation Industry?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.47 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Delta Air Lines Inc. is in talks with Airbus SE to order wide-body aircraft, Bloomberg News reported Monday, citing people familiar with the matter. The discussion focuses on A350 and A330neo hai twin-aisle aircraft.March 2023: Boeing was awarded a contract by Air India for 220 Boeing aircraft, including 190 737 Max, 20 787, and 10 777X.December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Aviation Industry?

To stay informed about further developments, trends, and reports in the Indian Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence