Key Insights

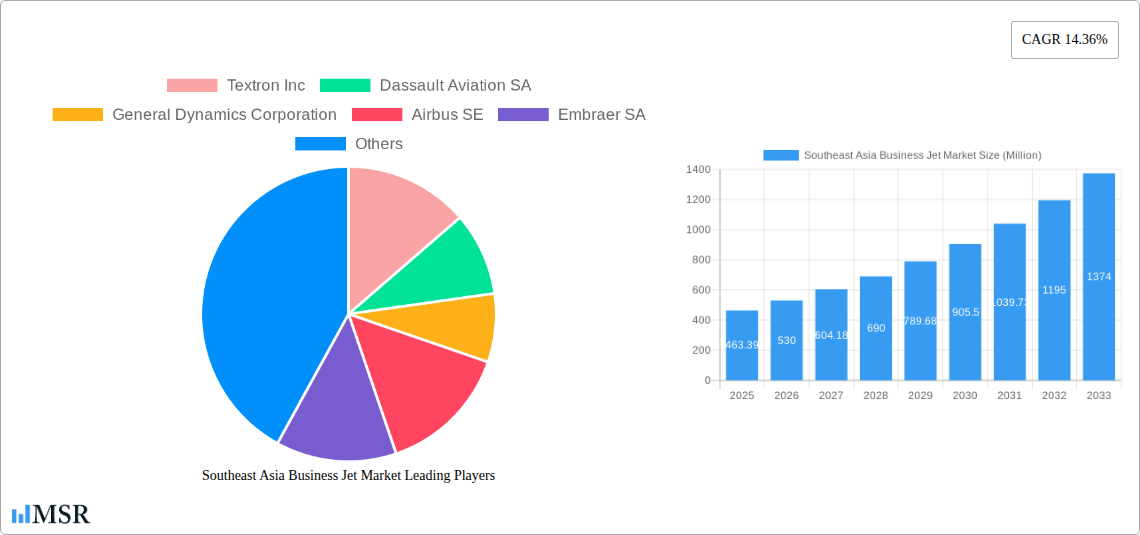

The Southeast Asia business jet market, valued at $463.39 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 14.36% from 2025 to 2033. This expansion is fueled by several key factors. The rising high-net-worth individual (HNWI) population in the region, coupled with increased business travel and a growing preference for private aviation's convenience and efficiency, significantly contribute to market demand. Furthermore, government initiatives promoting infrastructure development, particularly in aviation, are creating a more favorable environment for business jet operations. While challenges remain, such as potential economic fluctuations and regulatory hurdles, the overall market outlook is positive. Strong demand from countries like China, Japan, India, and Singapore, which represent major economic hubs in the region, will be vital to sustained market growth. The market segmentation, focusing on light, mid-size, and large jets, offers diverse options catering to various needs and budgets, thus broadening market appeal. Leading manufacturers like Textron, Dassault, and Bombardier will play a key role in shaping the market's trajectory through product innovation and strategic partnerships.

Southeast Asia Business Jet Market Market Size (In Million)

The substantial growth forecast underscores the increasing importance of private aviation in Southeast Asia. This growth trajectory is likely to see further acceleration if economic conditions remain stable and infrastructure investments continue. The market segmentation provides opportunities for specialized services and targeted marketing approaches, allowing businesses to tailor their offerings to specific customer requirements. Moreover, the presence of major global aircraft manufacturers indicates the significant potential of the Southeast Asia business jet market, drawing considerable attention from industry players eager to capitalize on this expansion. This creates a competitive landscape driving innovation and customer-centric service improvements.

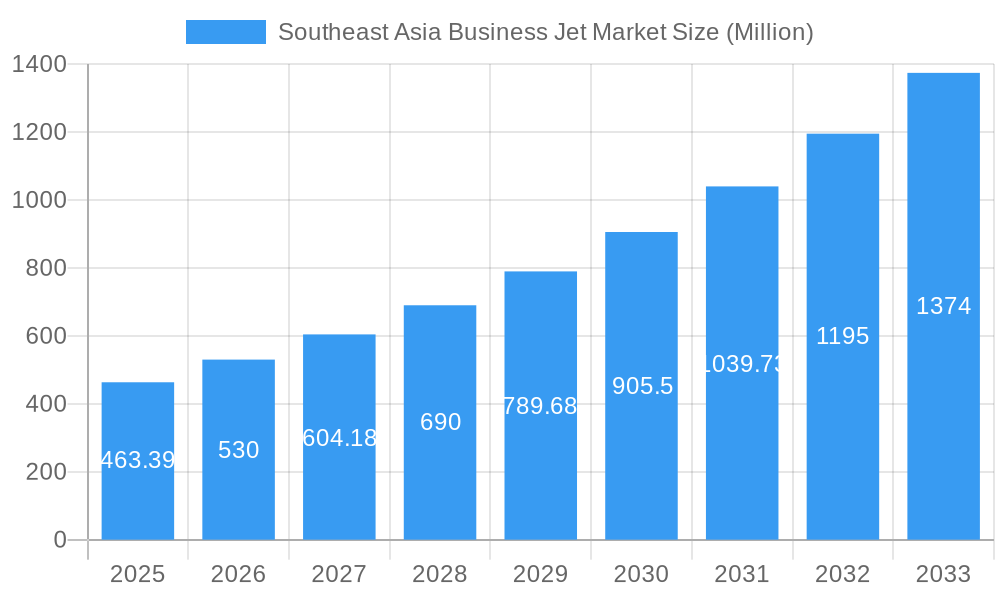

Southeast Asia Business Jet Market Company Market Share

Southeast Asia Business Jet Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Southeast Asia business jet market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report meticulously examines market dynamics, key segments (Light Jets, Mid-size Jets, Large Jets), leading players (including Textron Inc, Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc, Honda Aircraft Company, and The Boeing Company), and emerging opportunities, providing actionable intelligence for navigating this dynamic market. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Southeast Asia Business Jet Market Market Concentration & Dynamics

The Southeast Asia business jet market exhibits a moderately concentrated landscape, with a few key players holding significant market share. However, the emergence of new entrants and technological disruptions is fostering increased competition. The market is influenced by a complex interplay of factors, including stringent regulatory frameworks, evolving end-user preferences (towards larger, more technologically advanced aircraft), and a growing number of M&A activities.

- Market Share: The top five players collectively hold approximately xx% of the market share in 2025.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, indicating a consolidated yet dynamic market.

- Innovation Ecosystem: The region is witnessing growing investments in research and development, particularly in areas like sustainable aviation fuels and advanced avionics.

- Regulatory Frameworks: Varying regulatory landscapes across Southeast Asian nations influence operational costs and market accessibility.

- Substitute Products: While helicopters and commercial flights offer alternative transportation, the unique advantages of business jets—speed, convenience, and privacy—maintain a strong demand.

Southeast Asia Business Jet Market Industry Insights & Trends

The Southeast Asia business jet market is experiencing robust growth, driven by several key factors. The burgeoning economies of several Southeast Asian nations, coupled with rising high-net-worth individuals (HNWIs) and a growing business class, are fueling demand. Technological advancements, such as enhanced safety features and improved fuel efficiency, further enhance the appeal of business jets. The evolving consumer behavior includes a preference for larger, more luxurious cabins and advanced in-flight connectivity. These trends collectively contribute to the market's impressive growth trajectory.

The market size in 2025 is estimated to be xx Million, projected to reach xx Million by 2033, representing a CAGR of xx%. Furthermore, the increasing adoption of fractional ownership and jet card programs is democratizing access to business aviation, expanding the market further. The rising focus on sustainability is driving innovations in fuel-efficient engines and sustainable aviation fuels, adding another dimension to market growth.

Key Markets & Segments Leading Southeast Asia Business Jet Market

While the entire Southeast Asian region shows significant promise, [Country X] currently dominates the business jet market, driven by its robust economic growth, substantial HNWIs population and well-developed aviation infrastructure. The Mid-size Jets segment holds the largest market share in 2025, largely due to its balance of capacity and cost-effectiveness.

Drivers for [Country X] Dominance:

- Strong Economic Growth

- High Concentration of HNWIs

- Well-Developed Airport Infrastructure

- Supportive Government Policies

Segment Analysis:

- Mid-size Jets: Largest segment due to optimal balance of capacity and cost.

- Light Jets: Significant market share, catering to individual business travelers and shorter trips.

- Large Jets: Growing segment, driven by increasing demand for long-haul travel and larger group accommodations.

Southeast Asia Business Jet Market Product Developments

Recent product innovations focus heavily on enhancing cabin comfort, incorporating advanced in-flight entertainment systems, and optimizing fuel efficiency. Manufacturers are incorporating cutting-edge technologies, such as advanced avionics and improved safety features, to enhance the overall flight experience. This focus on technological advancements is creating a competitive edge in the market.

Challenges in the Southeast Asia Business Jet Market Market

The Southeast Asia business jet market faces several challenges, including complex regulatory landscapes across different countries, potential supply chain disruptions, and intense competition from established players. These factors could limit market growth if not addressed proactively.

Forces Driving Southeast Asia Business Jet Market Growth

The market growth is fuelled by several factors: rapid economic expansion in several nations, increasing HNWIs population, improving airport infrastructure, and favorable government policies supporting aviation development.

Challenges in the Southeast Asia Business Jet Market Market

Long-term growth depends on addressing regulatory inconsistencies across the region, further developing supporting infrastructure, and fostering innovation in areas like sustainable aviation fuels and advanced aircraft technologies.

Emerging Opportunities in Southeast Asia Business Jet Market

The market presents opportunities in expanding into less-penetrated markets within the region, leveraging the growing popularity of fractional ownership, and capitalizing on the demand for enhanced sustainability and technological features.

Leading Players in the Southeast Asia Business Jet Market Sector

Key Milestones in Southeast Asia Business Jet Market Industry

- 2021-Q4: Introduction of a new mid-size business jet model by [Manufacturer Name].

- 2022-Q2: Merger between two regional business jet operators.

- 2023-Q3: Announcement of a significant investment in airport infrastructure in [Country X].

Strategic Outlook for Southeast Asia Business Jet Market Market

The Southeast Asia business jet market is poised for continued growth, driven by strong economic fundamentals and evolving consumer preferences. Strategic partnerships, investments in technology, and a focus on sustainable practices will be crucial for companies to succeed in this competitive yet highly lucrative market.

Southeast Asia Business Jet Market Segmentation

-

1. Aircraft Type

- 1.1. Light Jets

- 1.2. Mid-size Jets

- 1.3. Large Jets

-

2. Geography

- 2.1. Singapore

- 2.2. Indonesia

- 2.3. Thailand

- 2.4. Philippines

- 2.5. Vietnam

- 2.6. Rest of Southeast Asia

Southeast Asia Business Jet Market Segmentation By Geography

- 1. Singapore

- 2. Indonesia

- 3. Thailand

- 4. Philippines

- 5. Vietnam

- 6. Rest of Southeast Asia

Southeast Asia Business Jet Market Regional Market Share

Geographic Coverage of Southeast Asia Business Jet Market

Southeast Asia Business Jet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Large Jets Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Light Jets

- 5.1.2. Mid-size Jets

- 5.1.3. Large Jets

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Singapore

- 5.2.2. Indonesia

- 5.2.3. Thailand

- 5.2.4. Philippines

- 5.2.5. Vietnam

- 5.2.6. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.3.2. Indonesia

- 5.3.3. Thailand

- 5.3.4. Philippines

- 5.3.5. Vietnam

- 5.3.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Singapore Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Light Jets

- 6.1.2. Mid-size Jets

- 6.1.3. Large Jets

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Singapore

- 6.2.2. Indonesia

- 6.2.3. Thailand

- 6.2.4. Philippines

- 6.2.5. Vietnam

- 6.2.6. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Indonesia Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Light Jets

- 7.1.2. Mid-size Jets

- 7.1.3. Large Jets

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Singapore

- 7.2.2. Indonesia

- 7.2.3. Thailand

- 7.2.4. Philippines

- 7.2.5. Vietnam

- 7.2.6. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Thailand Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Light Jets

- 8.1.2. Mid-size Jets

- 8.1.3. Large Jets

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Singapore

- 8.2.2. Indonesia

- 8.2.3. Thailand

- 8.2.4. Philippines

- 8.2.5. Vietnam

- 8.2.6. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Philippines Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Light Jets

- 9.1.2. Mid-size Jets

- 9.1.3. Large Jets

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Singapore

- 9.2.2. Indonesia

- 9.2.3. Thailand

- 9.2.4. Philippines

- 9.2.5. Vietnam

- 9.2.6. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Vietnam Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Light Jets

- 10.1.2. Mid-size Jets

- 10.1.3. Large Jets

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Singapore

- 10.2.2. Indonesia

- 10.2.3. Thailand

- 10.2.4. Philippines

- 10.2.5. Vietnam

- 10.2.6. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Rest of Southeast Asia Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11.1.1. Light Jets

- 11.1.2. Mid-size Jets

- 11.1.3. Large Jets

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Singapore

- 11.2.2. Indonesia

- 11.2.3. Thailand

- 11.2.4. Philippines

- 11.2.5. Vietnam

- 11.2.6. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dassault Aviation SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 General Dynamics Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Airbus SE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Embraer SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bombardier Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Honda Aircraft Compan

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Boeing Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: Southeast Asia Business Jet Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Business Jet Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 2: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Southeast Asia Business Jet Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 5: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 8: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 11: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 14: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 17: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 20: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Business Jet Market?

The projected CAGR is approximately 14.36%.

2. Which companies are prominent players in the Southeast Asia Business Jet Market?

Key companies in the market include Textron Inc, Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc, Honda Aircraft Compan, The Boeing Company.

3. What are the main segments of the Southeast Asia Business Jet Market?

The market segments include Aircraft Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 463.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Large Jets Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Business Jet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Business Jet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Business Jet Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Business Jet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence