Key Insights

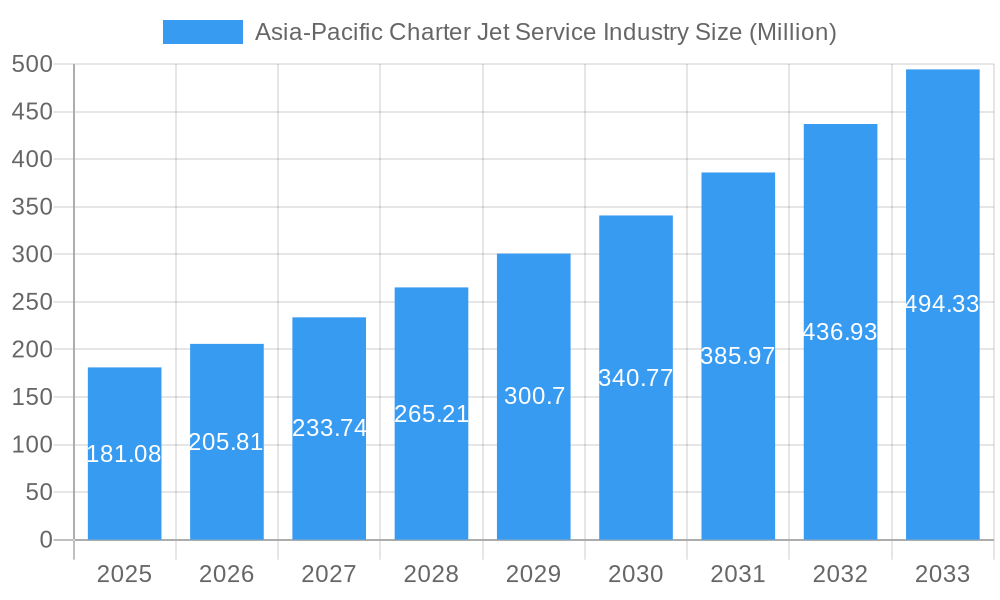

The Asia-Pacific Charter Jet Service Industry is poised for substantial growth, with a projected market size of USD 181.08 Million and an impressive Compound Annual Growth Rate (CAGR) of 13.77% during the forecast period of 2025-2033. This robust expansion is fueled by several key drivers. The increasing demand for time-efficient and flexible travel solutions among high-net-worth individuals and corporations is a primary catalyst. Furthermore, the burgeoning economies across the region, particularly in China and India, are leading to a rise in disposable income and a greater need for premium transportation services for business and leisure. The expansion of private aviation infrastructure, including new FBOs (Fixed-Base Operators) and improved air traffic management, also plays a crucial role in facilitating charter operations and enhancing the overall customer experience. These advancements are making charter services more accessible and appealing to a wider segment of the market.

Asia-Pacific Charter Jet Service Industry Market Size (In Million)

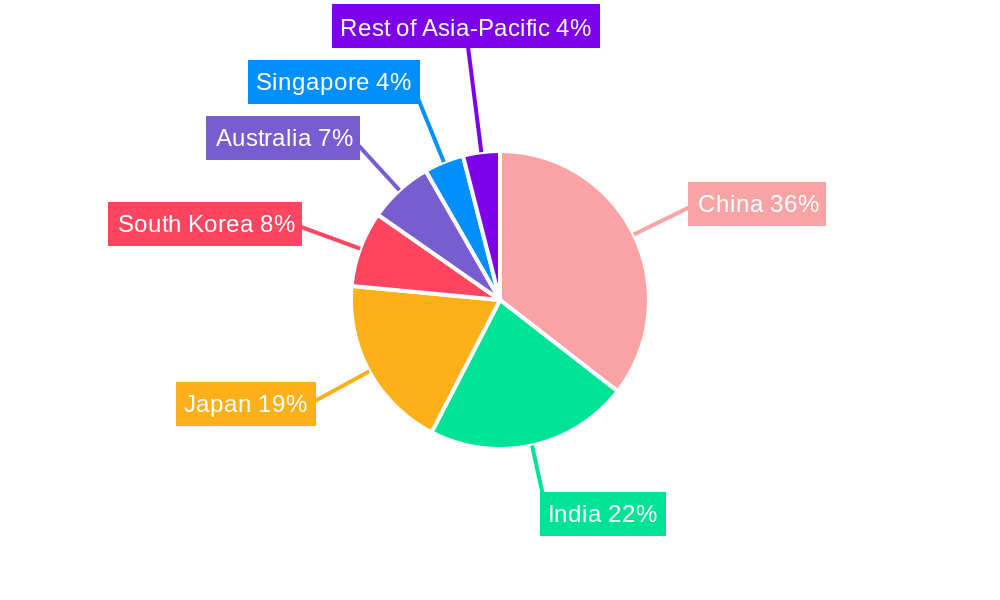

Emerging trends within the Asia-Pacific charter jet market indicate a growing preference for larger aircraft segments, such as mid-size and large jets, catering to both group travel and longer-haul destinations. This trend is supported by increasing intercontinental business ventures and a rise in luxury tourism. Conversely, certain restraints, such as stringent regulatory frameworks in some countries and the high operational costs associated with aircraft ownership and maintenance, could pose challenges. However, the dynamic nature of the market, coupled with ongoing technological advancements and a strong focus on customer-centric services, is expected to mitigate these restraints. The market is segmented geographically, with China, India, and Japan expected to dominate, while Australia and South Korea will also contribute significantly. The competitive landscape features established players like China Minsheng Investment Group and Deer Jet, alongside specialized providers such as Phenix Jet International LLC and Global Jet International, all vying for a share of this rapidly expanding sector.

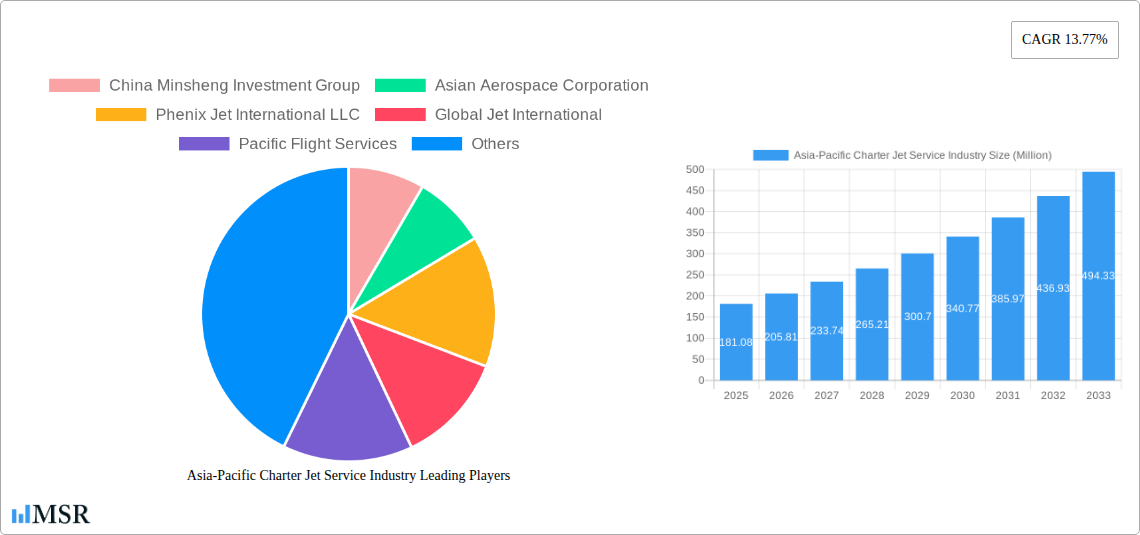

Asia-Pacific Charter Jet Service Industry Company Market Share

Here's the SEO-optimized, engaging report description for the Asia-Pacific Charter Jet Service Industry, incorporating all your specifications:

Asia-Pacific Charter Jet Service Industry Market Concentration & Dynamics

The Asia-Pacific charter jet service industry exhibits a dynamic market concentration, characterized by a blend of established players and emerging service providers. China Minsheng Investment Group and Deer Jet (Beijing) Co Ltd represent significant market share holders, leveraging extensive networks and fleet sizes. The innovation ecosystem is evolving, driven by technological advancements in aircraft efficiency and passenger experience, with companies like Phenix Jet International LLC and Executive Jets Asia Pte Ltd at the forefront. Regulatory frameworks across the region present a complex landscape, with variations in operational standards and import/export laws influencing market access. Substitute products, such as commercial first-class travel and high-speed rail, offer alternative solutions but often lack the flexibility and exclusivity of private aviation. End-user trends reveal a growing demand for personalized travel solutions from high-net-worth individuals and corporate clients, particularly in emerging economies. Merger and acquisition (M&A) activities are anticipated to increase as larger entities seek to consolidate market presence and expand service offerings. For instance, strategic partnerships between fleet operators and MRO (Maintenance, Repair, and Overhaul) providers are becoming common. The market share of leading players is estimated to be around 75% collectively. Expected M&A deal counts in the forecast period are projected to be between 10-15.

Asia-Pacific Charter Jet Service Industry Industry Insights & Trends

The Asia-Pacific charter jet service industry is poised for substantial growth, projected to reach an estimated market size of USD 45 Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including the region's burgeoning economic prosperity, increasing disposable incomes among affluent individuals, and the growing need for efficient and flexible business travel solutions. Technological disruptions are playing a pivotal role, with advancements in aircraft design leading to more fuel-efficient and quieter private jets, enhancing the overall passenger experience and reducing operational costs. The integration of advanced avionics and digital cabin technologies further elevates the appeal of charter services. Evolving consumer behaviors are a significant market growth driver. The post-pandemic era has witnessed a heightened demand for contactless travel and personalized itineraries, making charter jets an attractive option for those seeking to avoid crowded commercial terminals and adhere to strict health protocols. The convenience of on-demand scheduling, direct routes, and bespoke in-flight services caters to the sophisticated needs of the modern traveler. Furthermore, the expansion of business operations and investment across the Asia-Pacific landscape necessitates rapid and reliable transportation, positioning charter jet services as a critical enabler of economic activity. The competitive landscape is intensifying, with established operators like Asian Aerospace Corporation and Global Jet International investing in fleet modernization and service differentiation to capture market share. The increasing popularity of ultra-long-range aircraft is also facilitating seamless travel between key economic hubs within the Asia-Pacific and to international destinations. The report details how these trends will shape the market dynamics, from fleet acquisition strategies to service customization.

Key Markets & Segments Leading Asia-Pacific Charter Jet Service Industry

China stands out as the dominant market within the Asia-Pacific charter jet service industry, driven by its colossal economic engine, a rapidly expanding base of high-net-worth individuals, and significant corporate investment across various sectors. This dominance is further amplified by the increasing demand for seamless business travel connecting major economic hubs like Beijing, Shanghai, and Shenzhen. The Large aircraft size segment is experiencing significant traction in China, reflecting the need for greater capacity to accommodate corporate delegations and executive teams traveling together.

India is emerging as a critical growth market, propelled by its robust economic expansion, a growing entrepreneurial class, and the increasing need for efficient transportation solutions to support its vast geographical spread and burgeoning industries. The Mid-size aircraft segment is particularly popular in India, offering a balance of capacity and operational flexibility for a wide range of business needs.

Singapore continues to be a vital hub for the Asia-Pacific charter jet service industry, serving as a strategic gateway for both regional and international travel. Its well-developed infrastructure, stable regulatory environment, and concentration of multinational corporations make it a prime location for charter operations. The Light aircraft segment plays a crucial role in facilitating executive travel and short-haul regional trips within Singapore and to neighboring countries.

- Economic Growth: Sustained GDP growth across key Asia-Pacific nations directly translates to increased disposable income and corporate spending power, fueling demand for luxury and efficient travel.

- Infrastructure Development: Investments in modern airports and air traffic control systems across the region enhance operational capabilities and reduce transit times for charter flights.

- High-Net-Worth Individual (HNWI) Population Growth: The Asia-Pacific region boasts the fastest-growing HNWI population globally, creating a substantial client base for private aviation services.

- Corporate Expansion: The increasing footprint of multinational corporations and the expansion of domestic businesses necessitate swift and flexible travel options for executives and teams.

- Tourism and Leisure: The burgeoning tourism sector, with an increasing demand for exclusive and personalized travel experiences, is another significant driver.

The Rest of Asia-Pacific, encompassing countries like South Korea, Japan, and Australia, also contributes significantly to the market. South Korea's advanced technological sector and Japan's robust manufacturing base create consistent demand for business travel. Australia, with its vast distances and resource-based economy, benefits greatly from the efficiency of charter jet services. The interplay of these geographical markets and aircraft size segments creates a multifaceted and dynamic demand landscape for charter jet services.

Asia-Pacific Charter Jet Service Industry Product Developments

The Asia-Pacific charter jet service industry is witnessing significant product developments focused on enhancing passenger experience, operational efficiency, and sustainability. Innovations in cabin interiors are leading to more luxurious and customizable spaces, including integrated connectivity solutions, advanced entertainment systems, and ergonomic seating designed for long-haul comfort. Aircraft manufacturers are investing in next-generation engines and aerodynamic designs to improve fuel efficiency and reduce emissions, addressing growing environmental concerns. Furthermore, advancements in avionics and flight management systems are enabling greater operational precision, reduced flight times, and enhanced safety. The development of super-midsize and large cabin jets with extended range capabilities is catering to the growing demand for non-stop intercontinental travel. Digitalization is also a key area of development, with the introduction of user-friendly booking platforms and mobile applications for seamless flight management and communication. These product developments are crucial for maintaining a competitive edge and meeting the evolving demands of sophisticated clientele.

Challenges in the Asia-Pacific Charter Jet Service Industry Market

The Asia-Pacific charter jet service industry faces several key challenges that impact its growth trajectory. Regulatory complexities and varying aviation laws across different countries within the region can create administrative hurdles and increase operational costs. The significant capital investment required for acquiring and maintaining a modern fleet presents a substantial barrier to entry and expansion. Fluctuations in fuel prices and geopolitical instability can directly affect operational expenses and demand. Intense competition from established players and new entrants, coupled with potential pricing wars, can put pressure on profit margins. Ensuring a consistent supply of highly skilled pilots and maintenance personnel is also a growing concern. The estimated impact of these challenges on market growth could be a reduction of 3-5% in projected CAGR if not effectively managed.

Forces Driving Asia-Pacific Charter Jet Service Industry Growth

Several key forces are propelling the growth of the Asia-Pacific charter jet service industry. The accelerating economic development and wealth creation across the region have led to a substantial increase in the number of high-net-worth individuals and corporations with the financial capacity to afford private aviation. The growing demand for time-saving and efficient travel solutions, particularly for business purposes, makes charter jets an indispensable tool for executives. Technological advancements in aircraft design, such as lighter materials and more efficient engines, are improving operational economics and environmental performance. Furthermore, supportive government initiatives aimed at boosting aviation infrastructure and promoting business travel in certain countries are indirectly benefiting the charter sector. The increasing global connectivity and the rise of intra-Asia business travel are also significant drivers.

Challenges in the Asia-Pacific Charter Jet Service Industry Market

Long-term growth catalysts for the Asia-Pacific charter jet service industry lie in continued innovation and strategic market expansion. The ongoing development of sustainable aviation fuels (SAFs) and electric or hybrid-electric aircraft technologies will be crucial for addressing environmental concerns and attracting a more eco-conscious clientele. Expanding service offerings to include specialized charter solutions, such as air ambulance services or high-priority cargo transport, can diversify revenue streams. Strategic partnerships with luxury hospitality providers and corporations can create integrated travel packages. Furthermore, continued investment in training and development for aviation professionals will ensure a skilled workforce. As new economic corridors emerge and existing ones expand, establishing a strong presence in these developing markets will be key to sustained growth.

Emerging Opportunities in Asia-Pacific Charter Jet Service Industry

Emerging opportunities within the Asia-Pacific charter jet service industry are multifaceted. The increasing adoption of advanced connectivity solutions and in-flight digital services presents an opportunity to enhance the passenger experience and cater to the demands of a hyper-connected clientele. The development of fractional ownership and jet card programs can make private aviation more accessible to a broader segment of affluent individuals. The growing focus on sustainable aviation practices opens doors for companies that invest in eco-friendly technologies and operations. Furthermore, the untapped potential in secondary cities and less-served regions across the Asia-Pacific offers avenues for market expansion and niche service provision. The rise of bespoke travel experiences, including curated itineraries and exclusive event access, is also a significant emerging trend.

Leading Players in the Asia-Pacific Charter Jet Service Industry Sector

- China Minsheng Investment Group

- Asian Aerospace Corporation

- Phenix Jet International LLC

- Global Jet International

- Pacific Flight Services

- Revesco Aviation Pty Ltd

- Deer Jet (Beijing) Co Ltd

- Club One Air

- AUSTRALIAN CORPORATE JET CENTRES

- Executive Jets Asia Pte Ltd

Key Milestones in Asia-Pacific Charter Jet Service Industry Industry

- 2019: Launch of new ultra-long-range aircraft models by leading manufacturers, enabling non-stop flights across greater distances within and from the Asia-Pacific region.

- 2020: Increased demand for charter flights due to the COVID-19 pandemic, as travelers sought private and contactless travel options, leading to a temporary surge in utilization for some operators.

- 2021: Significant investment in fleet modernization and expansion by major players like Deer Jet, aiming to cater to the recovering and growing demand for private aviation.

- 2022: Emergence of new charter service providers focusing on specific niches, such as eco-friendly private jet options, reflecting growing environmental consciousness.

- 2023: Strategic partnerships between charter jet operators and luxury travel agencies to offer bundled, high-end travel experiences.

- 2024 (Estimated): Further advancements in digital booking platforms and in-flight connectivity solutions, enhancing customer convenience and operational efficiency.

Strategic Outlook for Asia-Pacific Charter Jet Service Industry Market

The strategic outlook for the Asia-Pacific charter jet service industry is exceptionally promising, driven by sustained economic growth and evolving travel preferences. The market is expected to witness increased adoption of sustainable aviation technologies, creating opportunities for early adopters. Strategic expansion into developing Asian economies and enhancing service offerings for ultra-high-net-worth individuals will be critical. The integration of advanced digital tools for seamless booking and client management will be a key differentiator. Anticipated M&A activities will likely lead to further market consolidation, creating stronger, more comprehensive service providers. The focus will remain on delivering unparalleled personalized service, operational excellence, and a commitment to safety and innovation, ensuring continued leadership in the global private aviation landscape.

Asia-Pacific Charter Jet Service Industry Segmentation

-

1. Aircraft Size

- 1.1. Light

- 1.2. Mid-size

- 1.3. Large

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Australia

- 2.6. Singapore

- 2.7. Rest of Asia-Pacific

Asia-Pacific Charter Jet Service Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. Singapore

- 7. Rest of Asia Pacific

Asia-Pacific Charter Jet Service Industry Regional Market Share

Geographic Coverage of Asia-Pacific Charter Jet Service Industry

Asia-Pacific Charter Jet Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Light Aircraft is Anticipated to Grow with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 5.1.1. Light

- 5.1.2. Mid-size

- 5.1.3. Large

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Australia

- 5.2.6. Singapore

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Australia

- 5.3.6. Singapore

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6. China Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6.1.1. Light

- 6.1.2. Mid-size

- 6.1.3. Large

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Australia

- 6.2.6. Singapore

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7. India Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7.1.1. Light

- 7.1.2. Mid-size

- 7.1.3. Large

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Australia

- 7.2.6. Singapore

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 8. Japan Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 8.1.1. Light

- 8.1.2. Mid-size

- 8.1.3. Large

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.2.6. Singapore

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 9. South Korea Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 9.1.1. Light

- 9.1.2. Mid-size

- 9.1.3. Large

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Australia

- 9.2.6. Singapore

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 10. Australia Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 10.1.1. Light

- 10.1.2. Mid-size

- 10.1.3. Large

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Australia

- 10.2.6. Singapore

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 11. Singapore Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 11.1.1. Light

- 11.1.2. Mid-size

- 11.1.3. Large

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Australia

- 11.2.6. Singapore

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 12. Rest of Asia Pacific Asia-Pacific Charter Jet Service Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 12.1.1. Light

- 12.1.2. Mid-size

- 12.1.3. Large

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. South Korea

- 12.2.5. Australia

- 12.2.6. Singapore

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 China Minsheng Investment Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Asian Aerospace Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Phenix Jet International LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Global Jet International

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Pacific Flight Services

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Revesco Aviation Pty Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Deer Jet (Beijing) Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Club One Air

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AUSTRALIAN CORPORATE JET CENTRES

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Executive Jets Asia Pte Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 China Minsheng Investment Group

List of Figures

- Figure 1: Asia-Pacific Charter Jet Service Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Charter Jet Service Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 2: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 5: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 8: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 11: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 14: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 17: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 20: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 23: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Charter Jet Service Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Charter Jet Service Industry?

The projected CAGR is approximately 13.77%.

2. Which companies are prominent players in the Asia-Pacific Charter Jet Service Industry?

Key companies in the market include China Minsheng Investment Group, Asian Aerospace Corporation, Phenix Jet International LLC, Global Jet International, Pacific Flight Services, Revesco Aviation Pty Ltd, Deer Jet (Beijing) Co Ltd, Club One Air, AUSTRALIAN CORPORATE JET CENTRES, Executive Jets Asia Pte Ltd.

3. What are the main segments of the Asia-Pacific Charter Jet Service Industry?

The market segments include Aircraft Size, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 181.08 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Light Aircraft is Anticipated to Grow with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Charter Jet Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Charter Jet Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Charter Jet Service Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Charter Jet Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence