Key Insights

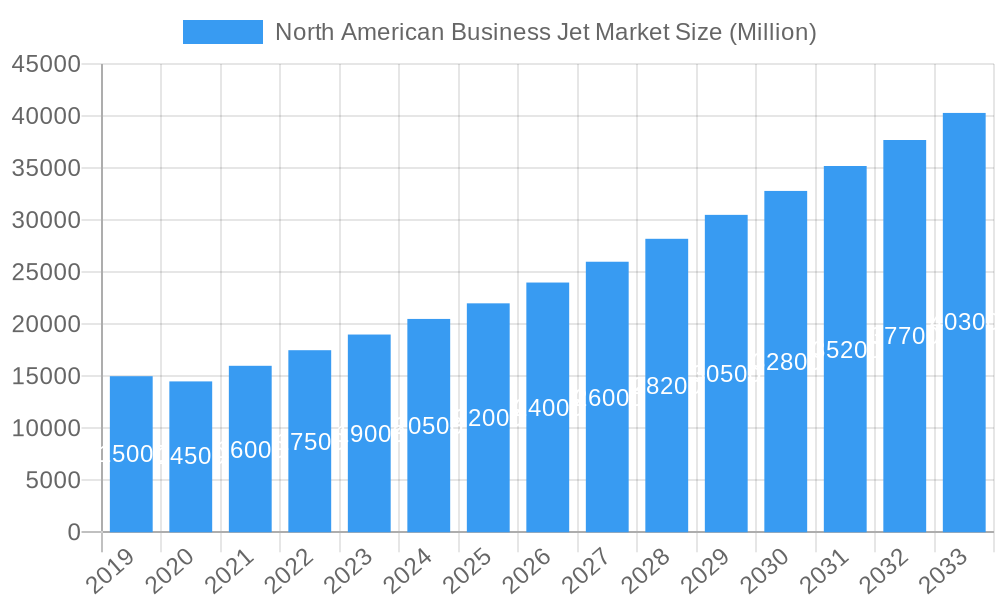

The North American Business Jet Market is projected to experience significant expansion, reaching a market size of $48.13 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.99%. This growth is propelled by escalating demand for personalized air travel among high-net-worth individuals and corporations, continuous technological advancements fostering fuel-efficient aircraft, and the growing adoption of fractional ownership and charter services. The market is further bolstered by a strong post-pandemic recovery in business travel and a sustained need for global connectivity. Key trends include a preference for light and mid-size jets for operational flexibility, the integration of advanced avionics and cabin technologies, and a growing emphasis on sustainable aviation solutions.

North American Business Jet Market Market Size (In Billion)

While the outlook is optimistic, market growth may be tempered by high acquisition and operational costs, stringent regulations, and fluctuating economic conditions impacting corporate discretionary spending. However, the inherent advantages of business aviation—time savings, enhanced productivity, and unparalleled flexibility—continue to drive demand. The North American region is expected to remain dominant due to its mature business aviation ecosystem, high concentration of wealth, and the continuous need for swift business connectivity. Leading players like Textron Inc., Bombardier Inc., and Embraer are actively innovating to meet evolving market demands.

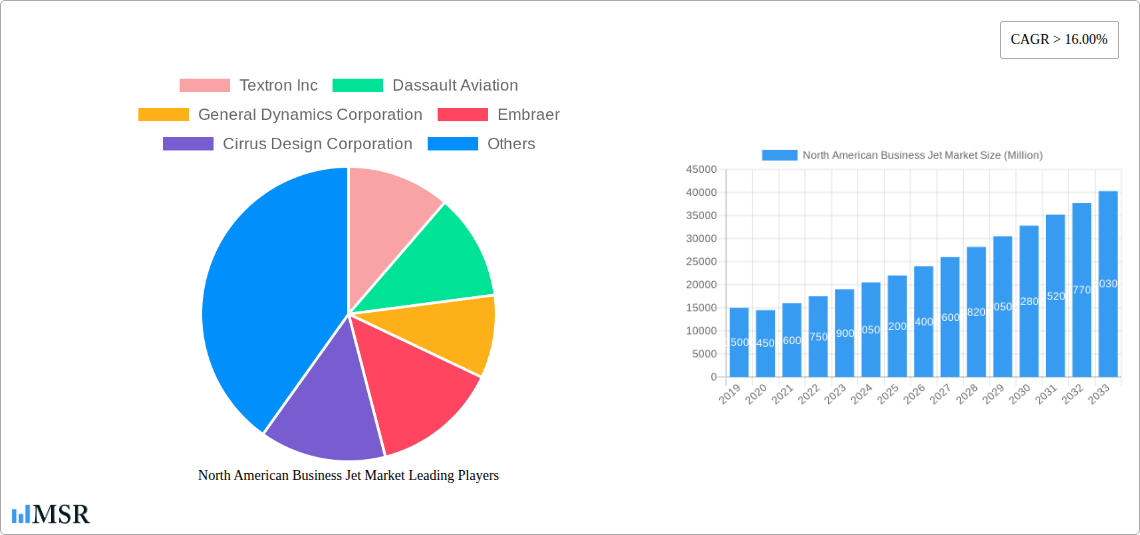

North American Business Jet Market Company Market Share

North American Business Jet Market Insights: 2025-2033 Forecast

This comprehensive report provides in-depth analysis of the North American Business Jet Market, covering the period from 2019 to 2033, with a base year of 2025. Explore market concentration, industry trends, key segments (including ultra-long-range, super-midsize, and light jets), product developments, challenges, growth drivers, emerging opportunities, and the strategies of leading players such as Textron Inc., Bombardier Inc., and Embraer. Essential for business aviation stakeholders, private jet manufacturers, charter operators, and investors, this report offers actionable intelligence to navigate the competitive landscape and capitalize on future growth.

North American Business Jet Market Market Concentration & Dynamics

The North American Business Jet Market exhibits a moderately concentrated landscape, dominated by a few key players while offering opportunities for specialized manufacturers. Innovation ecosystems are thriving, fueled by significant R&D investments in performance, efficiency, and passenger experience. Regulatory frameworks, while stringent, are generally supportive of aviation growth in North America, with ongoing efforts to streamline certification processes. Substitute products, such as commercial airline first-class and fractional ownership programs, present competition, but the unique value proposition of business jets – time savings, flexibility, and privacy – continues to drive demand. End-user trends show a growing preference for large jets with extended range capabilities and advanced cabin amenities, alongside a steady demand for versatile light jets for shorter routes. Mergers and acquisitions (M&A) activities, while not always large-scale, are strategic, focusing on acquiring specialized technologies or expanding service networks. For instance, recent strategic agreements indicate a focus on fleet expansion and operational enhancement.

- Market Share: Leading players like Textron Aviation and Bombardier Inc hold substantial market shares, with other manufacturers like Dassault Aviation and Embraer carving out significant niches.

- M&A Deal Counts: While specific recent deal counts are not publicly available, the trend indicates strategic partnerships and acquisitions aimed at enhancing product portfolios and service offerings.

- Innovation Ecosystem: Driven by key manufacturers and suppliers, the ecosystem is characterized by advancements in aerodynamics, engine technology, and cabin interiors.

North American Business Jet Market Industry Insights & Trends

The North American Business Jet Market is poised for robust growth, driven by a confluence of factors including post-pandemic recovery, increasing wealth concentration, and the inherent need for efficient business travel solutions. The market size is projected to reach over $30 Billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5-7% during the forecast period of 2025-2033. Technological disruptions are continuously reshaping the industry, with a strong emphasis on sustainable aviation fuels (SAF), advanced avionics, and enhanced cabin connectivity. Evolving consumer behaviors reflect a growing appreciation for the flexibility and time-saving benefits of private aviation, particularly among high-net-worth individuals and corporations seeking to optimize travel efficiency. The demand for new aircraft, coupled with a robust pre-owned market and increasing interest in charter services, fuels this expansion. The integration of digital technologies in aircraft management and operational systems further streamlines operations and enhances the user experience.

- Market Size (Estimated 2025): Over $30 Billion

- CAGR (2025-2033): 5-7%

- Key Growth Drivers: Economic recovery, wealth creation, corporate travel needs, technological advancements, and demand for efficiency and privacy.

- Technological Disruptions: Focus on SAF, electric and hybrid propulsion (long-term), advanced avionics, AI in flight planning, and enhanced cabin connectivity.

- Consumer Behavior Shifts: Increased preference for point-to-point travel, flexibility, time optimization, and personalized travel experiences.

Key Markets & Segments Leading North American Business Jet Market

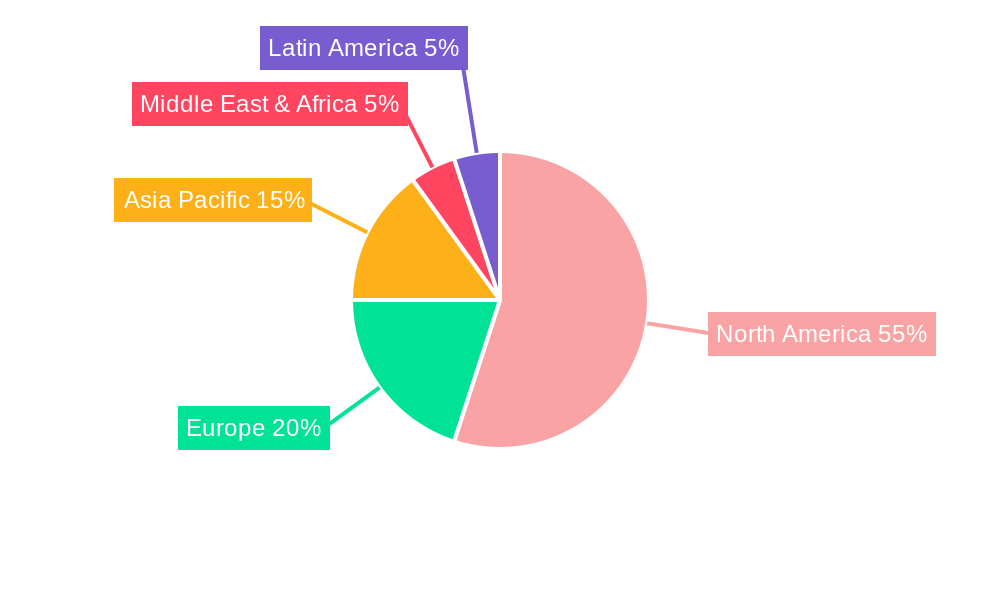

North America, particularly the United States, remains the undisputed leader in the North American Business Jet Market. This dominance is underpinned by a robust economy, a high concentration of wealth, a vast corporate landscape, and a well-developed aviation infrastructure. Within this leading market, the Large Jet segment is expected to continue its strong performance, driven by demand for intercontinental travel, enhanced cabin space, and advanced amenities catering to executive and VIP travel. Mid-Size Jets are also anticipated to see significant growth, offering a compelling balance of range, speed, and operating costs, making them ideal for a wide array of business missions. The Light Jet segment, while mature, maintains consistent demand due to its accessibility and suitability for regional travel, corporate shuttles, and personal use.

- Dominant Region: North America (primarily the United States)

- Dominant Segments: Large Jet, Mid-Size Jet, Light Jet

Drivers for Large Jet Dominance:

- Global Connectivity: Essential for international business operations and executive travel.

- Cabin Comfort & Productivity: Ample space for meetings, rest, and in-flight work.

- Range Capabilities: Non-stop flights across continents, minimizing downtime.

- VIP and Government Use: Preferred for official delegations and high-profile individuals.

Drivers for Mid-Size Jet Growth:

- Versatility: Suitable for a broad spectrum of business needs, from transcontinental to transoceanic flights.

- Cost-Effectiveness: Lower operating costs compared to large jets, appealing to a wider corporate base.

- Performance: Strong speed and range capabilities for efficient travel.

- Technological Advancements: New models offer improved fuel efficiency and cabin features.

Drivers for Light Jet Sustained Demand:

- Accessibility & Affordability: Lower acquisition and operating costs make them accessible to more users.

- Regional Travel Efficiency: Ideal for shorter trips and accessing smaller airports.

- On-Demand Charter: Popular choice for charter operators serving frequent travelers.

- Personal Use: Attractive option for individuals seeking private travel solutions.

North American Business Jet Market Product Developments

Product development in the North American Business Jet Market is intensely focused on enhancing range, fuel efficiency, speed, and passenger comfort. Manufacturers are investing in advanced aerodynamics, lighter composite materials, and more powerful, efficient engine technologies. Innovations in avionics, including integrated flight management systems and enhanced situational awareness tools, are a key differentiator. Cabin interiors are seeing a surge in customization, with a focus on connectivity, productivity, and well-being features. These advancements aim to reduce operational costs, minimize environmental impact, and elevate the overall travel experience, providing a competitive edge for companies like Textron Aviation, Dassault Aviation, and Embraer.

Challenges in the North American Business Jet Market Market

The North American Business Jet Market faces several challenges. Economic volatility can impact discretionary spending on high-value assets. Increasing regulatory scrutiny on emissions and noise pollution may lead to stricter operational requirements and higher compliance costs. Supply chain disruptions, particularly for specialized components and raw materials, can affect production timelines and increase costs. The escalating cost of new aircraft development and manufacturing presents a significant barrier, requiring substantial capital investment. Furthermore, competition from emerging markets and alternative transportation solutions necessitates continuous innovation and value proposition refinement.

- Economic Headwinds: Fluctuations in global and regional economies can impact demand.

- Regulatory Pressures: Environmental regulations and air traffic control complexities.

- Supply Chain Vulnerabilities: Dependence on global suppliers for critical components.

- High Development Costs: Significant R&D and manufacturing expenses.

Forces Driving North American Business Jet Market Growth

Several forces are propelling the North American Business Jet Market. The relentless pursuit of operational efficiency and time optimization by corporations remains a primary driver. Globalization and the need for rapid business travel to diverse locations fuel demand for long-range aircraft. Advancements in sustainable aviation technologies are not only addressing environmental concerns but also driving innovation and market appeal. Increasing wealth and disposable income among high-net-worth individuals create a robust customer base for new and pre-owned aircraft. Furthermore, evolving corporate travel policies that prioritize flexibility, privacy, and productivity are increasingly favoring business jet solutions.

Challenges in the North American Business Jet Market Market

Long-term growth catalysts in the North American Business Jet Market are intrinsically linked to continuous innovation and strategic market expansion. The development of more fuel-efficient and environmentally sustainable business jets, potentially including hybrid or electric propulsion systems in the distant future, will be crucial for long-term viability and broader market acceptance. Strategic partnerships between manufacturers, technology providers, and service operators can create new service models and enhance customer value. Market expansions into underserved niches or the development of aircraft catering to specific operational needs (e.g., enhanced short-field performance) will also foster sustained growth. The evolution of the pre-owned aircraft market and flexible ownership models will continue to make business aviation accessible to a broader audience.

Emerging Opportunities in North American Business Jet Market

Emerging opportunities in the North American Business Jet Market are abundant. The increasing demand for on-demand charter services and jet card programs presents significant growth potential for operators. Advancements in sustainable aviation fuels (SAF) and potential for new energy sources offer a pathway to greener aviation, attracting environmentally conscious customers. The development of advanced cabin technologies focusing on connectivity, productivity, and personalized comfort will enhance the appeal of business jets. Furthermore, the exploration of new market segments such as air ambulance services or specialized cargo transport using business jet platforms could unlock untapped revenue streams.

Leading Players in the North American Business Jet Market Sector

- Textron Inc

- Dassault Aviation

- General Dynamics Corporation

- Embraer

- Cirrus Design Corporation

- Pilatus Aircraft Ltd

- Bombardier Inc

- Honda Motor Co Ltd

Key Milestones in North American Business Jet Market Industry

- October 2023: Textron Aviation announced a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, with options for 16 additional aircraft, targeting luxury private jet charter operations. The first delivery, a Citation XLS Gen2, was expected in 2023.

- June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at St. Louis Downtown Airport, representing a capital investment of USD 28.5 million to modernize facilities and increase operational capacity.

- June 2023: Gulfstream Aerospace Corp. announced the super-midsize Gulfstream G280 has been cleared for operations at France’s Airport of the Gulf of Saint-Tropez (La Môle), following successful short-field takeoff and landing demonstrations.

Strategic Outlook for North American Business Jet Market Market

The strategic outlook for the North American Business Jet Market is exceptionally positive, characterized by sustained demand and continuous innovation. Growth accelerators include the ongoing development of more fuel-efficient and environmentally responsible aircraft, such as those incorporating sustainable aviation fuels. The increasing adoption of digital technologies for operational management and passenger experience will further enhance the market's appeal. Strategic opportunities lie in expanding service networks, developing flexible ownership and usage models, and catering to the evolving preferences of ultra-high-net-worth individuals and corporations. The market is well-positioned for robust expansion, driven by its inherent ability to provide unparalleled efficiency, flexibility, and privacy in business travel.

North American Business Jet Market Segmentation

-

1. Body Type

- 1.1. Large Jet

- 1.2. Light Jet

- 1.3. Mid-Size Jet

North American Business Jet Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Business Jet Market Regional Market Share

Geographic Coverage of North American Business Jet Market

North American Business Jet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing preferences for private travel and the rising HNWI population are driving the demand for business jets in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Large Jet

- 5.1.2. Light Jet

- 5.1.3. Mid-Size Jet

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Dynamics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Embraer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cirrus Design Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pilatus Aircraft Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bombardier Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honda Motor Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: North American Business Jet Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North American Business Jet Market Share (%) by Company 2025

List of Tables

- Table 1: North American Business Jet Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: North American Business Jet Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North American Business Jet Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 4: North American Business Jet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North American Business Jet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North American Business Jet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North American Business Jet Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Business Jet Market?

The projected CAGR is approximately 4.99%.

2. Which companies are prominent players in the North American Business Jet Market?

Key companies in the market include Textron Inc, Dassault Aviation, General Dynamics Corporation, Embraer, Cirrus Design Corporation, Pilatus Aircraft Ltd, Bombardier Inc, Honda Motor Co Ltd.

3. What are the main segments of the North American Business Jet Market?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing preferences for private travel and the rising HNWI population are driving the demand for business jets in the region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Textron Aviation announced that it entered a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, with options for 16 additional aircraft. Fly Alliance is expected to use the aircraft for its luxury private jet charter operations. It expected the delivery of the first aircraft, an XLS Gen2, in 2023.June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at St. Louis Downtown Airport. With this latest expansion, Gulfstream expects to increase operations at the site while modernizing its existing spaces by adding new, state-of-the-art equipment and tooling, representing a total capital investment of USD 28.5 million.June 2023: Gulfstream Aerospace Corp. announced the super-midsize Gulfstream G280 has been cleared for operations at France’s Airport of the Gulf of Saint-Tropez located in La Môle. The aircraft recently flew several takeoff and landing demonstrations at the short-field airport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Business Jet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Business Jet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Business Jet Market?

To stay informed about further developments, trends, and reports in the North American Business Jet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence