Key Insights

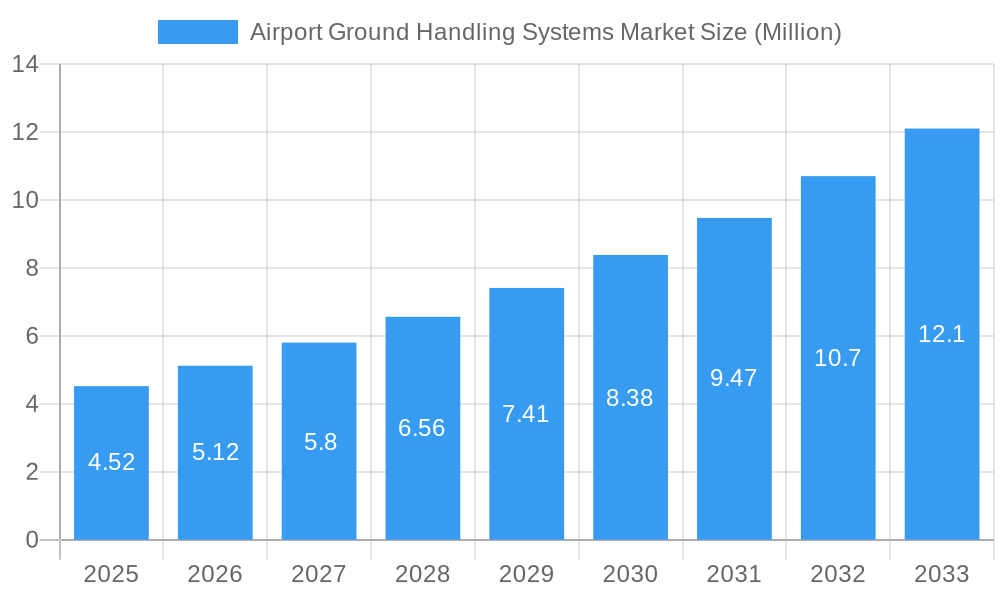

The Airport Ground Handling Systems Market is forecast for significant expansion, propelled by the robust growth of the global aviation sector and the increasing need for streamlined airport operations. The market is projected to reach approximately $24.3 billion by 2025, demonstrating a strong Compound Annual Growth Rate (CAGR) of 8.1% through 2033. This growth is underpinned by escalating global passenger traffic, necessitating advanced handling systems for seamless management of passengers and baggage. Furthermore, the continuous development of airport infrastructure in emerging economies presents substantial opportunities for market participants. The emphasis on enhanced operational efficiency, safety, and sustainability in ground handling services is a key driver, encouraging investment in cutting-edge equipment and technologies. The market comprises critical segments including Aircraft Handling, Passenger Handling, and Cargo and Baggage Handling, with both electric and non-electric power sources serving diverse operational requirements.

Airport Ground Handling Systems Market Market Size (In Billion)

Market dynamics are further influenced by the adoption of automation and AI-powered solutions aimed at optimizing ground operations, reducing turnaround times, and improving resource allocation. The heightened focus on environmental sustainability is also stimulating demand for electric ground support equipment (eGSE), aligning with global initiatives to curb aviation-related carbon emissions. While considerable growth prospects exist, certain restraints, such as stringent regulatory frameworks and high initial investment costs for advanced systems, may present challenges. However, anticipated increases in air travel, particularly in the Asia Pacific and Middle East & Africa regions, coupled with the demand for modernized airport facilities, are expected to counterbalance these impediments. Leading companies such as Textron Inc., Kalmar Motor AB, and Daifuku Co Ltd. are actively pursuing innovation and portfolio expansion to address the evolving needs of the global airport ground handling sector.

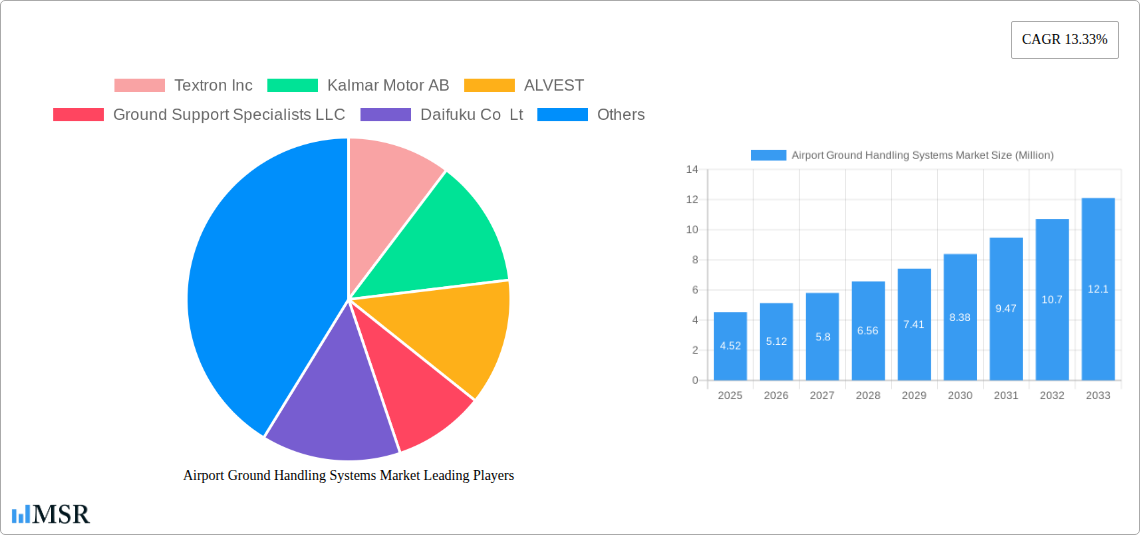

Airport Ground Handling Systems Market Company Market Share

This comprehensive report offers a critical analysis of the global Airport Ground Handling Systems Market, providing actionable intelligence for industry stakeholders. Covering the historical period from 2019-2024, with 2025 as the base and estimated year, and a detailed forecast extending from 2025-2033, this study examines market dynamics, key segments, emerging opportunities, and strategic outlooks. With an estimated market size of $24.3 billion in 2025, projected to reach further by 2033, the Airport Ground Handling Systems Market is set for substantial growth driven by increased air travel, technological advancements, and an elevated focus on operational efficiency and sustainability.

Airport Ground Handling Systems Market Market Concentration & Dynamics

The Airport Ground Handling Systems Market exhibits a moderate level of concentration, characterized by a mix of large, established players and a growing number of specialized providers. Innovation ecosystems are flourishing, particularly in the development of electric and autonomous ground handling equipment, pushing the boundaries of operational efficiency and environmental responsibility. Regulatory frameworks, while essential for safety and security, can also present adoption challenges for new technologies. Substitute products are emerging, primarily in the form of advanced automation and AI-driven solutions that augment traditional systems. End-user trends are increasingly favoring sustainable and cost-effective solutions, prompting investments in electric-powered ground support equipment (GSE) and optimized baggage handling systems. Merger and acquisition (M&A) activities are anticipated to continue as companies seek to expand their product portfolios, geographical reach, and technological capabilities. The market has witnessed XX significant M&A deals in the historical period, indicating a trend towards consolidation and strategic partnerships. Market share distribution sees key players like Textron Inc and Kalmar Motor AB holding substantial portions, with a growing influence from innovative firms like Vestergaard Company and MOTOTOK INTERNATIONAL GMBH.

Airport Ground Handling Systems Market Industry Insights & Trends

The Airport Ground Handling Systems Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is fueled by several key factors, including the resurgence of global air travel post-pandemic, leading to increased demand for efficient and reliable ground handling operations. Technological disruptions are at the forefront of market evolution, with a significant shift towards electrification of ground support equipment (GSE). This trend is driven by stringent environmental regulations and airlines' commitment to reducing their carbon footprint. The development of autonomous and semi-autonomous GSE is also gaining traction, promising enhanced safety, reduced labor costs, and improved operational efficiency. Evolving consumer behaviors, particularly the growing passenger volume and the demand for seamless travel experiences, necessitate advanced passenger handling systems. Similarly, the surge in e-commerce and the global logistics network are driving demand for sophisticated cargo and baggage handling solutions. The market size, estimated at $XX Billion in 2025, is expected to witness substantial growth in the coming years. Innovations in areas such as AI-powered baggage tracking, predictive maintenance for GSE, and integrated airport management systems are shaping the competitive landscape and creating new avenues for revenue generation.

Key Markets & Segments Leading Airport Ground Handling Systems Market

The Aircraft Handling segment is currently the largest contributor to the Airport Ground Handling Systems Market, driven by the critical need for safe and efficient aircraft turnaround services. This segment is further propelled by the increasing number of aircraft movements globally.

- Drivers for Aircraft Handling Dominance:

- Economic Growth and Air Travel Demand: A recovering global economy and increasing disposable incomes lead to higher air travel demand, directly impacting the need for aircraft handling services.

- Airport Infrastructure Expansion: Development and expansion of airports worldwide necessitate advanced aircraft handling equipment and systems.

- Airline Fleet Modernization: The introduction of larger and more technologically advanced aircraft requires specialized handling equipment.

- Safety and Security Regulations: Stringent aviation safety regulations mandate the use of reliable and certified ground handling equipment.

The Electric power source segment is experiencing the most significant growth within the Airport Ground Handling Systems Market. This is a direct response to global sustainability initiatives and increasingly stringent environmental regulations.

- Drivers for Electric Power Source Growth:

- Environmental Regulations: Government mandates and international agreements to reduce carbon emissions are pushing airports and airlines towards electric GSE.

- Lower Operating Costs: Electric GSE typically have lower fuel and maintenance costs compared to their internal combustion engine counterparts.

- Noise Reduction: Electric vehicles contribute to a quieter airport environment, improving the working conditions for ground staff and reducing noise pollution for surrounding communities.

- Technological Advancements: Improvements in battery technology, charging infrastructure, and electric motor efficiency are making electric GSE more viable and efficient.

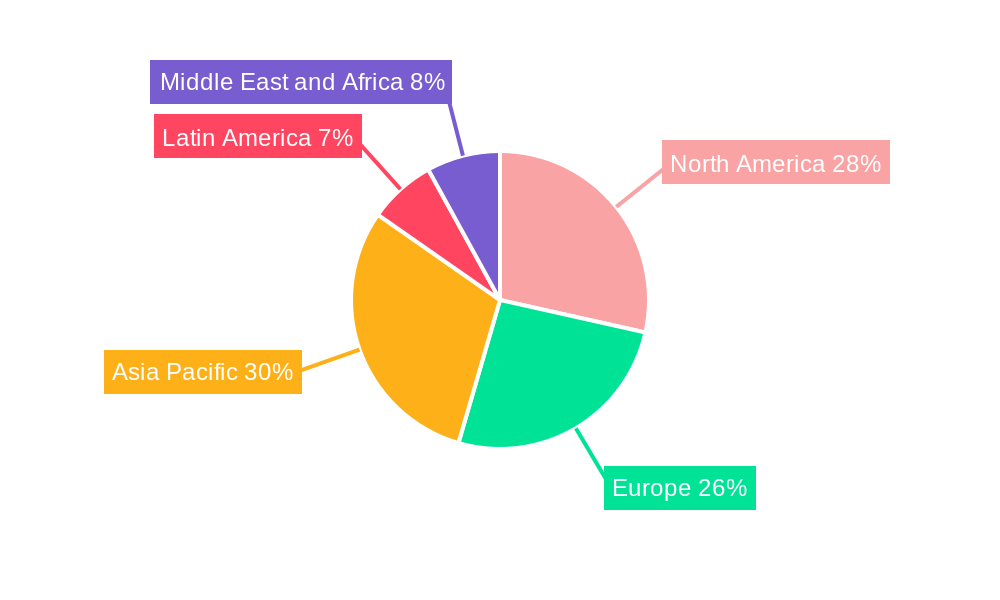

Geographically, the Asia-Pacific region is emerging as a dominant market for airport ground handling systems. This growth is attributed to rapid economic expansion, increasing urbanization, a burgeoning middle class, and substantial investments in airport infrastructure development across countries like China, India, and Southeast Asian nations. The region's commitment to modernizing its aviation sector and accommodating a projected surge in passenger and cargo traffic makes it a prime area for adoption of advanced ground handling technologies.

Airport Ground Handling Systems Market Product Developments

Product innovations within the Airport Ground Handling Systems Market are primarily focused on enhancing efficiency, safety, and sustainability. Key advancements include the development of advanced electric-powered ground support equipment (GSE) such as towbarless aircraft tractors and de-icing units, reducing emissions and operational costs. The integration of AI and IoT in baggage handling systems is improving tracking accuracy and operational flow. Furthermore, there's a growing trend towards modular and scalable solutions that can adapt to varying operational demands. These technological advancements are crucial for maintaining a competitive edge and meeting the evolving needs of airports and airlines worldwide.

Challenges in the Airport Ground Handling Systems Market Market

The Airport Ground Handling Systems Market faces several significant challenges. High upfront investment costs for advanced and electric GSE can be a barrier, particularly for smaller airports and ground handling operators. The need for specialized infrastructure, such as charging stations for electric equipment, adds to the complexity and cost of adoption. Furthermore, the integration of new technologies with existing legacy systems can be challenging. Regulatory hurdles and varying compliance standards across different regions can slow down the deployment of innovative solutions. Supply chain disruptions, as experienced globally in recent years, can impact the availability and timely delivery of critical components and equipment, leading to project delays and increased costs. Competitive pressures from established players and the emergence of new entrants also require continuous innovation and cost-efficiency.

Forces Driving Airport Ground Handling Systems Market Growth

Several forces are driving the growth of the Airport Ground Handling Systems Market. The exponential increase in global air passenger traffic, projected to recover and surpass pre-pandemic levels, is a primary driver, necessitating efficient and rapid ground handling services. The ongoing commitment to environmental sustainability by aviation stakeholders is a significant catalyst for the adoption of electric and eco-friendly ground support equipment (GSE). Technological advancements, including automation, AI, and IoT integration, are enhancing operational efficiency, safety, and reducing turnaround times. Government initiatives promoting airport modernization and infrastructure development, coupled with favorable aviation policies, further stimulate market expansion. The growing demand for efficient cargo and baggage handling systems, driven by the expansion of global e-commerce, also contributes significantly to market growth.

Challenges in the Airport Ground Handling Systems Market Market

Long-term growth catalysts for the Airport Ground Handling Systems Market lie in continuous innovation and strategic market expansion. The development and widespread adoption of fully autonomous ground handling systems represent a significant future growth area, promising enhanced productivity and safety. Partnerships between GSE manufacturers, airlines, and airports will be crucial for co-developing tailored solutions and addressing specific operational needs. Expansion into emerging markets with rapidly developing aviation sectors will provide substantial growth opportunities. Furthermore, the increasing focus on data analytics and predictive maintenance for GSE will lead to optimized asset utilization and reduced downtime, contributing to long-term efficiency and profitability. The drive towards sustainable aviation also presents an ongoing opportunity for the development and deployment of next-generation green ground handling solutions.

Emerging Opportunities in Airport Ground Handling Systems Market

Emerging opportunities within the Airport Ground Handling Systems Market are abundant. The increasing demand for smart airport solutions, integrating IoT and AI for seamless passenger and cargo flow, presents a significant avenue for growth. The development of specialized ground handling equipment for a new generation of aircraft, including eVTOLs (electric Vertical Take-Off and Landing) and drones, will open up entirely new market segments. The growing emphasis on cybersecurity within airport operations creates opportunities for providers of secure ground handling systems. Furthermore, the potential for retrofitting existing GSE fleets with electric powertrains offers a cost-effective pathway for sustainability, creating a substantial secondary market. Exploring modular and flexible GSE designs that can be rapidly deployed and reconfigured to meet dynamic operational needs is another promising opportunity.

Leading Players in the Airport Ground Handling Systems Market Sector

- Textron Inc

- Kalmar Motor AB

- ALVEST

- Ground Support Specialists LLC

- Daifuku Co Lt

- MULAG Fahrzeugwerk

- MOTOTOK INTERNATIONAL GMBH

- Tronair Inc

- Weihai Guangtai Airport Equipment Co Ltd

- 6 3 Other Companies

- ADELTE Group SL

- Cavotec SA

- Vestergaard Company

- John Bean Technologies Corp

- Air T Inc

- Mallaghan Engineering Limited

Key Milestones in Airport Ground Handling Systems Market Industry

- April 2022: Airpro announced an investment of EUR 4 million to procure four Elephant e-BETA de-icers from Vestergaard Company, with delivery expected by winter 2022 for operation at Helsinki Airport. This move positions Airpro as the first ground handling company in Finland to deploy electric de-icing services.

- March 2022: Lufthansa LEOS, the ground handling subsidiary of the Lufthansa Group, became the launch customer of the all-electric towbarless aircraft tractor Phoenix E manufactured by Goldhofer. This battery-powered vehicle boasts a towing capacity of up to 352 metric tons, marking a significant step towards electric aviation ground operations.

Strategic Outlook for Airport Ground Handling Systems Market Market

The strategic outlook for the Airport Ground Handling Systems Market is characterized by significant growth and transformative innovation. Key growth accelerators include the ongoing global recovery of air travel, the relentless pursuit of sustainability goals by the aviation industry, and the rapid advancement of automation and digitalization. Stakeholders are advised to focus on developing and integrating electric and autonomous ground support equipment (GSE), as well as smart, data-driven solutions that enhance operational efficiency and safety. Strategic partnerships and collaborations will be crucial for navigating the complex regulatory landscape and co-creating solutions that meet the evolving demands of airports and airlines. The market presents a strong opportunity for companies that can offer innovative, cost-effective, and environmentally conscious ground handling solutions, ensuring a competitive edge in the dynamic aviation ecosystem.

Airport Ground Handling Systems Market Segmentation

-

1. Type

- 1.1. Aircraft Handling

- 1.2. Passenger Handling

- 1.3. Cargo and Baggage Handling

-

2. Power Source

- 2.1. Non-electric

- 2.2. Electric

Airport Ground Handling Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Airport Ground Handling Systems Market Regional Market Share

Geographic Coverage of Airport Ground Handling Systems Market

Airport Ground Handling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Aircraft Handling Segment Held Highest Shares in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Ground Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Aircraft Handling

- 5.1.2. Passenger Handling

- 5.1.3. Cargo and Baggage Handling

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. Non-electric

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Airport Ground Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Aircraft Handling

- 6.1.2. Passenger Handling

- 6.1.3. Cargo and Baggage Handling

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. Non-electric

- 6.2.2. Electric

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Airport Ground Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Aircraft Handling

- 7.1.2. Passenger Handling

- 7.1.3. Cargo and Baggage Handling

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. Non-electric

- 7.2.2. Electric

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Airport Ground Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Aircraft Handling

- 8.1.2. Passenger Handling

- 8.1.3. Cargo and Baggage Handling

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. Non-electric

- 8.2.2. Electric

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Airport Ground Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Aircraft Handling

- 9.1.2. Passenger Handling

- 9.1.3. Cargo and Baggage Handling

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. Non-electric

- 9.2.2. Electric

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Airport Ground Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Aircraft Handling

- 10.1.2. Passenger Handling

- 10.1.3. Cargo and Baggage Handling

- 10.2. Market Analysis, Insights and Forecast - by Power Source

- 10.2.1. Non-electric

- 10.2.2. Electric

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kalmar Motor AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ALVEST

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ground Support Specialists LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daifuku Co Lt

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MULAG Fahrzeugwerk

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MOTOTOK INTERNATIONAL GMBH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tronair Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Weihai Guangtai Airport Equipment Co Ltd*List Not Exhaustive 6 3 Other Companies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ADELTE Group SL

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cavotec SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vestergaard Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 John Bean Technologies Corp

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Air T Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mallaghan Engineering Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Airport Ground Handling Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Airport Ground Handling Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Airport Ground Handling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Airport Ground Handling Systems Market Revenue (billion), by Power Source 2025 & 2033

- Figure 5: North America Airport Ground Handling Systems Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 6: North America Airport Ground Handling Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Airport Ground Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Airport Ground Handling Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Airport Ground Handling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Airport Ground Handling Systems Market Revenue (billion), by Power Source 2025 & 2033

- Figure 11: Europe Airport Ground Handling Systems Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 12: Europe Airport Ground Handling Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Airport Ground Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Airport Ground Handling Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Airport Ground Handling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Airport Ground Handling Systems Market Revenue (billion), by Power Source 2025 & 2033

- Figure 17: Asia Pacific Airport Ground Handling Systems Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 18: Asia Pacific Airport Ground Handling Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Airport Ground Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Airport Ground Handling Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Airport Ground Handling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Airport Ground Handling Systems Market Revenue (billion), by Power Source 2025 & 2033

- Figure 23: Latin America Airport Ground Handling Systems Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 24: Latin America Airport Ground Handling Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Airport Ground Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Airport Ground Handling Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Airport Ground Handling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Airport Ground Handling Systems Market Revenue (billion), by Power Source 2025 & 2033

- Figure 29: Middle East and Africa Airport Ground Handling Systems Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 30: Middle East and Africa Airport Ground Handling Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Airport Ground Handling Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Power Source 2020 & 2033

- Table 3: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Power Source 2020 & 2033

- Table 6: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Power Source 2020 & 2033

- Table 11: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Power Source 2020 & 2033

- Table 19: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Power Source 2020 & 2033

- Table 27: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Power Source 2020 & 2033

- Table 32: Global Airport Ground Handling Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Airport Ground Handling Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Ground Handling Systems Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Airport Ground Handling Systems Market?

Key companies in the market include Textron Inc, Kalmar Motor AB, ALVEST, Ground Support Specialists LLC, Daifuku Co Lt, MULAG Fahrzeugwerk, MOTOTOK INTERNATIONAL GMBH, Tronair Inc, Weihai Guangtai Airport Equipment Co Ltd*List Not Exhaustive 6 3 Other Companies, ADELTE Group SL, Cavotec SA, Vestergaard Company, John Bean Technologies Corp, Air T Inc, Mallaghan Engineering Limited.

3. What are the main segments of the Airport Ground Handling Systems Market?

The market segments include Type, Power Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Aircraft Handling Segment Held Highest Shares in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, Airpro announced an investment of EUR 4 million to procure four Elephant e-BETA de-icers from Vestergaard Company. The equipment is expected to be delivered by winter 2022 and will be operated at Helsinki Airport. The company is expected to become the first ground handling company in Finland to deploy electric de-icing services following the delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Ground Handling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Ground Handling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Ground Handling Systems Market?

To stay informed about further developments, trends, and reports in the Airport Ground Handling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence