Key Insights

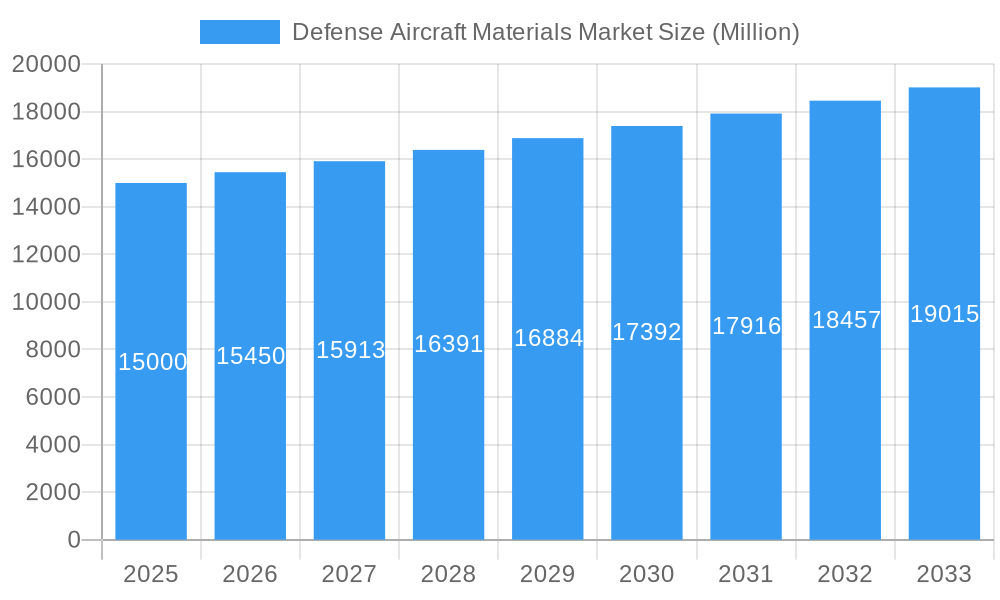

The global Defense Aircraft Materials Market is projected for significant growth, with an estimated market size of $22.69 billion by 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.78% through 2033. This expansion is driven by increasing global geopolitical instability, heightened defense expenditures, and continuous air force modernization efforts. Demand is fueled by the need for advanced materials offering superior strength-to-weight ratios, enhanced durability, and improved resistance to extreme operational conditions. Key applications span fighter jets, bombers, transport, and reconnaissance aircraft, all benefiting from the integration of next-generation materials. The market is segmented by aircraft type into combat and non-combat categories, with combat aircraft necessitating more specialized, high-performance materials. Critical material types include advanced Aluminum Alloys, high-strength Steel, lightweight Titanium Alloys, and sophisticated Composites.

Defense Aircraft Materials Market Market Size (In Billion)

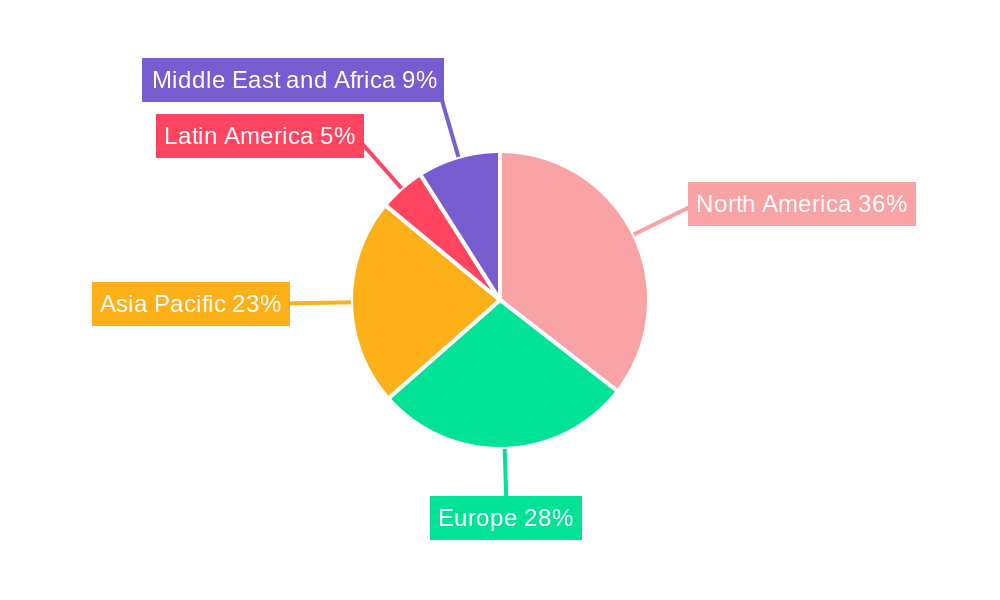

The competitive landscape is defined by innovation and strategic alliances among key industry players such as Toray Industries Inc., DuPont de Nemours Inc., Henkel Singapore Pte Ltd, Arconic Corp, and Solvay SA. These companies are focused on research and development to produce lighter, stronger, and more cost-effective materials that meet stringent military specifications. Regionally, North America, led by the United States, dominates due to substantial defense investment and advanced aerospace manufacturing. Europe, with its robust defense industrial base, is also a significant market. The Asia Pacific region is a key growth area, propelled by China's expanding defense sector and increased investment in domestic aircraft development. Market restraints, including high material costs and lengthy qualification processes, are being addressed through technological advancements and strategic sourcing. The overarching trend favors advanced composites and novel metal alloys for improved aircraft performance and reduced operational expenses.

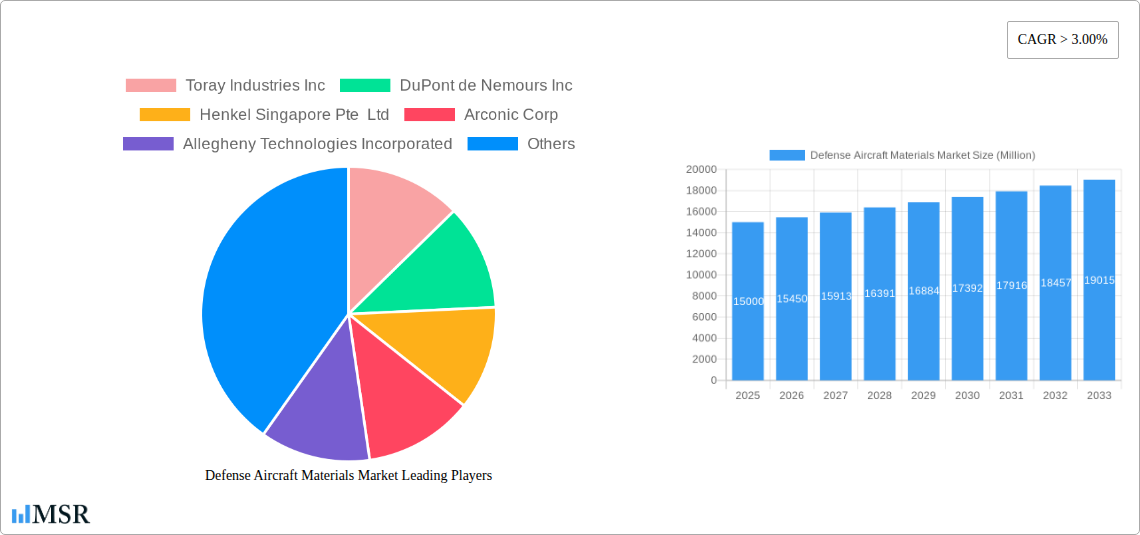

Defense Aircraft Materials Market Company Market Share

This report delivers a comprehensive analysis of the global Defense Aircraft Materials Market, emphasizing the pivotal role of advanced materials in shaping military aviation's future. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast extending to 2033, this study provides critical insights for stakeholders. Explore market dynamics, key growth drivers, emerging trends, and strategic opportunities within the Defense Aircraft Materials Market, essential for understanding combat aircraft materials, non-combat aircraft materials, aluminum alloys for defense, steel in aerospace, titanium alloys for military aircraft, and composites for defense aviation. The market size is valued at $22.69 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.78% during the forecast period.

Defense Aircraft Materials Market Market Concentration & Dynamics

The Defense Aircraft Materials Market exhibits a moderate to high level of concentration, with a blend of established global giants and specialized material manufacturers. Key players like Toray Industries Inc., DuPont de Nemours Inc., Henkel Singapore Pte Ltd, Arconic Corp, Allegheny Technologies Incorporated, Solvay SA, Constellium SE, AMG Advanced Metallurgical Group N V, and Hexcel Corporation hold significant market share, driven by their extensive R&D capabilities and long-standing relationships with defense contractors. Innovation ecosystems are thriving, fueled by the continuous demand for materials that enhance aircraft performance, reduce weight, and improve survivability. Regulatory frameworks, including strict quality control and certification processes, play a pivotal role in market entry and product development. The threat of substitute products is relatively low, given the stringent performance requirements for defense applications, but advancements in material science constantly push the boundaries. End-user trends are dominated by the need for lightweight yet incredibly strong materials, increased fuel efficiency, and enhanced stealth capabilities. Merger and acquisition activities, though not at an extremely high frequency, are strategically aimed at consolidating capabilities, acquiring new technologies, or expanding market reach. For instance, the market has seen strategic integrations to bolster composites for defense aviation and titanium alloys for military aircraft production. The market share of leading players is estimated to be over 60% in key material segments.

- Market Concentration: Moderate to High

- Innovation Ecosystems: Strong focus on R&D for next-generation materials.

- Regulatory Frameworks: Stringent certifications and quality control are critical.

- Substitute Products: Limited threat, but material science advancements are key.

- End-User Trends: Demand for lightweight, strong, fuel-efficient, and stealthy materials.

- M&A Activities: Strategic acquisitions to enhance technology and market access.

- Market Share (Leading Players): > 60% in critical material segments.

- M&A Deal Counts (Historical Period): Approximately 5-7 significant deals.

Defense Aircraft Materials Market Industry Insights & Trends

The Defense Aircraft Materials Market is poised for significant expansion driven by a confluence of factors, including escalating geopolitical tensions, the modernization of existing air forces, and the development of next-generation combat and non-combat aircraft. The projected market size for 2025 is estimated at $XX Billion, with a projected CAGR of XX% through 2033. This robust growth is underpinned by the relentless pursuit of enhanced aircraft performance, where lightweight and high-strength materials are paramount. The demand for advanced composites for defense aviation is surging, as these materials offer superior strength-to-weight ratios, improved fatigue resistance, and reduced radar detectability, making them indispensable for stealth applications and advanced fighter jets. Similarly, titanium alloys for military aircraft continue to be a cornerstone due to their exceptional strength, corrosion resistance, and ability to withstand extreme temperatures, crucial for engine components and airframes in high-performance platforms. Aluminum alloys for defense remain vital for structural components where cost-effectiveness and proven reliability are key, while specialized steel in aerospace applications continues to be critical for high-stress areas.

Technological disruptions are continuously reshaping the Defense Aircraft Materials Market. The development of additive manufacturing (3D printing) for aerospace components is gaining traction, enabling the creation of complex geometries and optimized designs with reduced material waste. This is particularly relevant for the production of intricate titanium alloys for military aircraft parts and advanced composites for defense aviation. Furthermore, research into smart materials, self-healing composites, and nano-engineered materials promises to revolutionize aircraft durability, maintenance, and operational capabilities. The evolving consumer behavior, in this context, refers to the demands of defense ministries and prime contractors who are increasingly prioritizing lifecycle costs, reduced maintenance requirements, and sustainable material sourcing. The integration of advanced materials directly contributes to enhanced operational readiness, improved payload capacity, and extended service life of defense aircraft. The market's trajectory is also influenced by government initiatives and defense spending across major economies, focusing on maintaining technological superiority and addressing evolving security threats. The increasing complexity and sophistication of modern defense platforms necessitate a commensurate advancement in the materials used to construct them.

Key Markets & Segments Leading Defense Aircraft Materials Market

The Defense Aircraft Materials Market is experiencing robust growth driven by several key markets and segments that are instrumental in shaping its trajectory. Among the aircraft types, Combat aircraft materials are a primary driver, reflecting ongoing investments in modern fighter jets, bombers, and reconnaissance aircraft designed for superior maneuverability, stealth, and combat effectiveness. The demand for advanced composites for defense aviation, titanium alloys for military aircraft, and specialized aluminum alloys for defense is particularly high in this segment. The modernization programs of global air forces, coupled with the development of next-generation fighter platforms, are creating substantial demand for high-performance materials that can withstand extreme stresses, reduce radar signatures, and optimize fuel efficiency.

- Aircraft Type Dominance: Combat aircraft represent the largest segment due to continuous modernization and development of advanced platforms.

- Drivers:

- Geopolitical Stability Concerns: Nations are investing in advanced air power for national security.

- Technological Superiority: Demand for stealth, speed, and enhanced combat capabilities.

- Platform Modernization: Upgrading existing fleets with advanced materials for extended service life and improved performance.

- Development of Next-Gen Fighters: Significant R&D investment in new aircraft designs.

- Drivers:

Within the material types, Composites are leading the charge, experiencing rapid adoption due to their exceptional strength-to-weight ratio, corrosion resistance, and tailorability. These materials are critical for reducing aircraft weight, thereby improving fuel efficiency, increasing payload capacity, and enhancing maneuverability, especially in advanced combat aircraft materials.

- Material Type Dominance: Composites are the fastest-growing segment, followed by Titanium Alloys.

- Drivers for Composites:

- Weight Reduction: Critical for fuel efficiency and performance enhancements.

- High Strength-to-Weight Ratio: Enables stronger and more agile airframes.

- Corrosion Resistance: Reduces maintenance needs and extends lifespan.

- Stealth Capabilities: Reduced radar cross-section is vital for modern warfare.

- Design Flexibility: Ability to form complex shapes and integrate functionalities.

- Drivers for Composites:

Titanium Alloys are also a significant contributor to market growth, favored for their high strength, excellent temperature resistance, and corrosion resistance. They are extensively used in engine components, airframes, and structural parts of both combat and non-combat aircraft, particularly in areas requiring extreme durability and performance.

- Drivers for Titanium Alloys: * High Temperature Resistance: Essential for engine components and high-speed aircraft. * Superior Strength: Critical for load-bearing structures. * Corrosion Resistance: Ensures long-term durability in harsh environments. * Biocompatibility (in some non-defense applications, but reflects material resilience): Demonstrates material robustness.

While Aluminum Alloys continue to be a foundational material in non-combat aircraft materials and certain structural components of combat aircraft due to their cost-effectiveness and established manufacturing processes, the trend is leaning towards advanced composites and titanium for performance-critical applications. Steel finds its niche in high-stress applications and landing gear components where immense strength and toughness are paramount. The Asia-Pacific region, particularly countries like China and India, are emerging as key growth markets due to increasing defense spending and indigenous manufacturing capabilities for both combat and non-combat aircraft.

Defense Aircraft Materials Market Product Developments

Product developments in the Defense Aircraft Materials Market are focused on enhancing performance and reducing lifecycle costs. Innovations in composites for defense aviation include the development of lighter, stronger, and more damage-tolerant materials, as well as advanced manufacturing techniques like automated fiber placement and additive manufacturing for composite structures. The integration of sensing capabilities within composite materials for real-time structural health monitoring is a significant advancement. For titanium alloys for military aircraft, research is concentrating on developing new alloy compositions with improved tensile strength and fracture toughness, along with more efficient and cost-effective processing methods. The application of these materials extends from advanced fighter jet airframes and engine components to critical structural elements in reconnaissance and transport aircraft, contributing to enhanced mission capabilities and operational efficiency.

Challenges in the Defense Aircraft Materials Market Market

The Defense Aircraft Materials Market faces several significant challenges that can impede its growth trajectory. Stringent regulatory requirements and lengthy qualification processes for new materials in defense applications can slow down the adoption of innovative solutions. High development and production costs associated with advanced materials, particularly specialized alloys and high-performance composites, pose a considerable barrier. Supply chain volatility and geopolitical risks can disrupt the availability of critical raw materials, impacting production schedules and cost predictability. Furthermore, the specialized nature of defense applications means that market volumes for specific materials can be limited, making economies of scale challenging to achieve. The continuous need for R&D investment to stay ahead of technological advancements also represents a substantial financial commitment.

- Regulatory Hurdles: Lengthy qualification processes and strict certification standards.

- High Development & Production Costs: Specialized materials are inherently expensive.

- Supply Chain Vulnerabilities: Reliance on specific raw materials and geopolitical risks.

- Limited Market Volumes: Niche applications can restrict economies of scale.

- Intense R&D Investment: Continuous need for innovation to maintain competitive edge.

Forces Driving Defense Aircraft Materials Market Growth

The Defense Aircraft Materials Market is propelled by several potent forces that underscore its growth potential. A primary driver is the continuous modernization of global air forces and the development of next-generation military aircraft. This necessitates advanced materials that offer superior performance, reduced weight, and enhanced survivability. The escalating geopolitical landscape and the pursuit of technological superiority by nations worldwide further fuel demand for cutting-edge combat aircraft materials. Advancements in material science, such as the development of lighter, stronger, and more resilient composites and alloys, are opening new possibilities for aircraft design and functionality. Government investments in defense research and development, aimed at maintaining a strategic advantage, also play a crucial role. Furthermore, the increasing emphasis on fuel efficiency and reduced operational costs in military aviation is driving the adoption of lightweight materials like advanced composites and titanium alloys.

Challenges in the Defense Aircraft Materials Market Market

Looking beyond immediate hurdles, the Defense Aircraft Materials Market is also shaped by long-term growth catalysts that promise sustained expansion. Continuous innovation in material science, leading to the discovery and application of novel materials with unprecedented properties, will be a significant catalyst. This includes research into self-healing materials, advanced ceramic composites for thermal protection, and lighter, more durable metallic alloys. Strategic partnerships and collaborations between material manufacturers, aerospace OEMs, and research institutions are crucial for accelerating the development and adoption of new technologies. Furthermore, the growing trend of outsourcing manufacturing and the establishment of global supply chains for defense components can open up new market opportunities and drive efficiency. The increasing focus on sustainability and the development of recyclable or eco-friendlier advanced materials will also become a key growth driver as environmental regulations become more stringent.

Emerging Opportunities in Defense Aircraft Materials Market

The Defense Aircraft Materials Market is rife with emerging opportunities driven by technological advancements and evolving defense strategies. The increasing demand for unmanned aerial vehicles (UAVs) and drones, both for surveillance and combat roles, presents a significant opportunity for specialized, lightweight, and cost-effective materials. The ongoing development of hypersonic aircraft and advanced missile defense systems will require materials capable of withstanding extreme temperatures and stresses, opening avenues for novel ceramic composites and high-temperature alloys. The adoption of additive manufacturing (3D printing) for aerospace components, particularly for complex parts made from titanium alloys for military aircraft and specialized polymers, offers opportunities for rapid prototyping, on-demand production, and reduced waste. Furthermore, the growing emphasis on space-based defense and the development of space-launch vehicles will create demand for materials that can perform reliably in the harsh environment of space.

Leading Players in the Defense Aircraft Materials Market Sector

- Toray Industries Inc.

- DuPont de Nemours Inc.

- Henkel Singapore Pte Ltd

- Arconic Corp

- Allegheny Technologies Incorporated

- Solvay SA

- Constellium SE

- AMG Advanced Metallurgical Group N V

- Hexcel Corporation

Key Milestones in Defense Aircraft Materials Market Industry

- May 2022: French company Daher announced an investment of EUR 7.5 million to build a tech center researching new composite materials suitable for various aviation applications, including military aviation, to cater to the increased demand for lighter and stronger composite aircraft materials.

- February 2021: Hindustan Aeronautics Limited (HAL) signed an agreement with MIDHANI to develop and manufacture composite raw materials. These composite materials are planned to be used in platforms like Light Combat Aircraft (LCA), Advanced Light Helicopter (ALH), Light Combat Helicopter (LCH), and Light Utility Helicopter (LUH).

Strategic Outlook for Defense Aircraft Materials Market Market

The strategic outlook for the Defense Aircraft Materials Market is characterized by a sustained upward trajectory, driven by the persistent need for advanced capabilities in military aviation. Growth accelerators include the ongoing development of fifth and sixth-generation fighter aircraft, the expansion of drone technology, and the increasing global focus on aerial defense superiority. Strategic opportunities lie in the continued innovation of lightweight, high-strength composites for defense aviation and titanium alloys for military aircraft, coupled with advancements in additive manufacturing for complex component production. Furthermore, the growing demand for materials that enhance stealth capabilities and reduce radar signatures presents a significant avenue for growth. Collaborations between material suppliers and defense manufacturers will be crucial for developing tailored solutions that meet the exacting requirements of modern defense platforms, ensuring long-term market relevance and profitability.

Defense Aircraft Materials Market Segmentation

-

1. Aircraft Type

- 1.1. Combat

- 1.2. Non-combat

-

2. Material Type

- 2.1. Aluminum Alloys

- 2.2. Steel

- 2.3. Titanium Alloys

- 2.4. Composites

Defense Aircraft Materials Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Turkey

- 5.4. Rest of Middle East and Africa

Defense Aircraft Materials Market Regional Market Share

Geographic Coverage of Defense Aircraft Materials Market

Defense Aircraft Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Combat Aircraft Segment to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Aircraft Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Combat

- 5.1.2. Non-combat

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Aluminum Alloys

- 5.2.2. Steel

- 5.2.3. Titanium Alloys

- 5.2.4. Composites

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Defense Aircraft Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Combat

- 6.1.2. Non-combat

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Aluminum Alloys

- 6.2.2. Steel

- 6.2.3. Titanium Alloys

- 6.2.4. Composites

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Europe Defense Aircraft Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Combat

- 7.1.2. Non-combat

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Aluminum Alloys

- 7.2.2. Steel

- 7.2.3. Titanium Alloys

- 7.2.4. Composites

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Asia Pacific Defense Aircraft Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Combat

- 8.1.2. Non-combat

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Aluminum Alloys

- 8.2.2. Steel

- 8.2.3. Titanium Alloys

- 8.2.4. Composites

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Latin America Defense Aircraft Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Combat

- 9.1.2. Non-combat

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Aluminum Alloys

- 9.2.2. Steel

- 9.2.3. Titanium Alloys

- 9.2.4. Composites

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Middle East and Africa Defense Aircraft Materials Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Combat

- 10.1.2. Non-combat

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Aluminum Alloys

- 10.2.2. Steel

- 10.2.3. Titanium Alloys

- 10.2.4. Composites

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toray Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DuPont de Nemours Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henkel Singapore Pte Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Arconic Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allegheny Technologies Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Solvay SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Constellium SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AMG Advanced Metallurgical Group N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hexcel Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Toray Industries Inc

List of Figures

- Figure 1: Global Defense Aircraft Materials Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Defense Aircraft Materials Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 3: North America Defense Aircraft Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Defense Aircraft Materials Market Revenue (billion), by Material Type 2025 & 2033

- Figure 5: North America Defense Aircraft Materials Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Defense Aircraft Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Defense Aircraft Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Defense Aircraft Materials Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 9: Europe Defense Aircraft Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 10: Europe Defense Aircraft Materials Market Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Defense Aircraft Materials Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Defense Aircraft Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Defense Aircraft Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Defense Aircraft Materials Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 15: Asia Pacific Defense Aircraft Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Asia Pacific Defense Aircraft Materials Market Revenue (billion), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Defense Aircraft Materials Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Defense Aircraft Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Defense Aircraft Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Defense Aircraft Materials Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 21: Latin America Defense Aircraft Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 22: Latin America Defense Aircraft Materials Market Revenue (billion), by Material Type 2025 & 2033

- Figure 23: Latin America Defense Aircraft Materials Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Latin America Defense Aircraft Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Defense Aircraft Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Defense Aircraft Materials Market Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 27: Middle East and Africa Defense Aircraft Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 28: Middle East and Africa Defense Aircraft Materials Market Revenue (billion), by Material Type 2025 & 2033

- Figure 29: Middle East and Africa Defense Aircraft Materials Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Middle East and Africa Defense Aircraft Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Defense Aircraft Materials Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Defense Aircraft Materials Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Defense Aircraft Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: Global Defense Aircraft Materials Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Defense Aircraft Materials Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 5: Global Defense Aircraft Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Defense Aircraft Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Defense Aircraft Materials Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 10: Global Defense Aircraft Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 11: Global Defense Aircraft Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Defense Aircraft Materials Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 17: Global Defense Aircraft Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global Defense Aircraft Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Defense Aircraft Materials Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Defense Aircraft Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 26: Global Defense Aircraft Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Defense Aircraft Materials Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 30: Global Defense Aircraft Materials Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 31: Global Defense Aircraft Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Turkey Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Defense Aircraft Materials Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Aircraft Materials Market?

The projected CAGR is approximately 5.78%.

2. Which companies are prominent players in the Defense Aircraft Materials Market?

Key companies in the market include Toray Industries Inc, DuPont de Nemours Inc, Henkel Singapore Pte Ltd, Arconic Corp, Allegheny Technologies Incorporated, Solvay SA, Constellium SE, AMG Advanced Metallurgical Group N V, Hexcel Corporation.

3. What are the main segments of the Defense Aircraft Materials Market?

The market segments include Aircraft Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.69 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Combat Aircraft Segment to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, the French company Daher announced an investment of EUR 7.5 million to build a tech center that researches new composite materials that could be suitable for various aviation applications including military aviation, to cater to the increased demand for lighter and stronger composite aircraft materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Aircraft Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Aircraft Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Aircraft Materials Market?

To stay informed about further developments, trends, and reports in the Defense Aircraft Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence