Key Insights

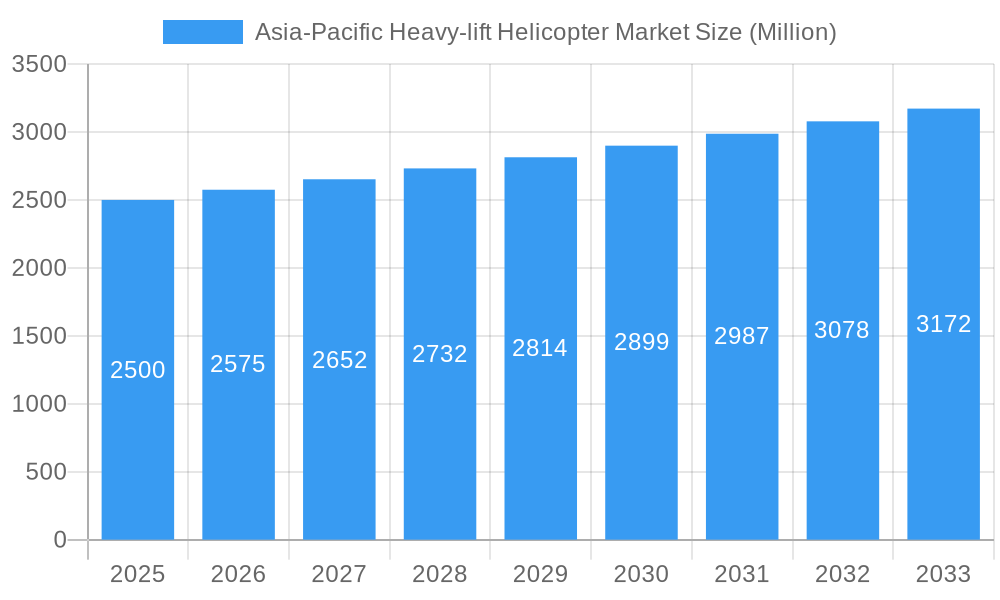

The Asia-Pacific heavy-lift helicopter market is experiencing robust growth, driven by increasing infrastructure development, particularly in rapidly expanding economies like China and India. The region's rising demand for efficient cargo transportation in challenging terrains, coupled with modernization efforts within military and civilian sectors, fuels this expansion. A Compound Annual Growth Rate (CAGR) exceeding 3.0% from 2019 to 2033 indicates a significant market expansion. Key players like Textron, Lockheed Martin, Airbus, and others are strategically investing in technological advancements and expanding their presence to capitalize on this lucrative market. While factors like high acquisition costs and stringent regulatory compliance pose challenges, the overall positive growth trajectory is expected to continue. The civilian segment, driven by infrastructure projects and disaster relief operations, is poised for significant growth, paralleling the military segment's expansion due to regional geopolitical dynamics and modernization initiatives. The market size in 2025 is estimated to be approximately $2.5 Billion (assuming a conservative estimate given the CAGR and general market trends within the Aerospace sector). This figure is projected to increase steadily throughout the forecast period (2025-2033), reflecting the sustained demand and the entrance of new players into the market and continued growth of established ones. China, Japan, India, and South Korea are projected to be the largest contributors to the market’s overall growth, given their substantial infrastructure development plans and investments in defense capabilities.

Asia-Pacific Heavy-lift Helicopter Market Market Size (In Billion)

The market's segmentation into military and civilian end-users provides distinct growth avenues. The military segment is stimulated by ongoing defense modernization, border security concerns, and the need for enhanced aerial logistical capabilities. The civilian segment benefits from surging infrastructure projects (highways, railways, power lines) across the region, requiring efficient heavy-lift solutions for transporting large equipment and materials to remote locations. This dual-pronged demand contributes to the overall market vitality. The Asia-Pacific region's unique geographical features, including mountainous terrains and vast distances, further propel the demand for heavy-lift helicopters, underlining the crucial role these aircraft play in diverse applications from search and rescue to construction and logistics.

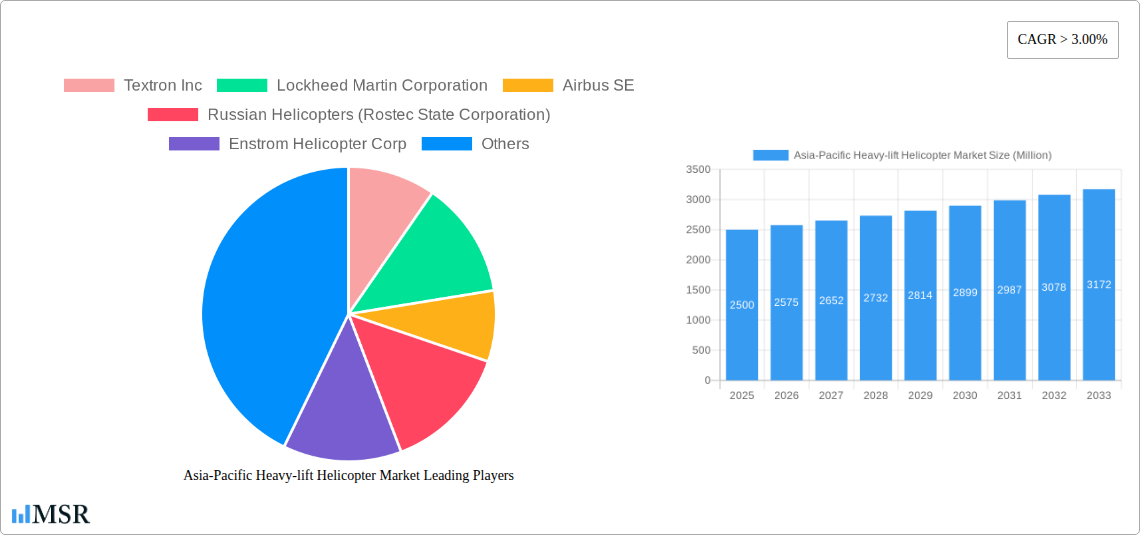

Asia-Pacific Heavy-lift Helicopter Market Company Market Share

Asia-Pacific Heavy-lift Helicopter Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Asia-Pacific heavy-lift helicopter market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, utilizing 2025 as the base and estimated year. The report meticulously examines market dynamics, growth drivers, key segments (Military and Civilian), leading players (including Textron Inc, Lockheed Martin Corporation, Airbus SE, Russian Helicopters, Enstrom Helicopter Corp, AVIC, and The Boeing Company), and emerging opportunities. Projected market values are presented in Millions (M).

Asia-Pacific Heavy-lift Helicopter Market Market Concentration & Dynamics

The Asia-Pacific heavy-lift helicopter market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. In 2025, the top five players are estimated to account for approximately xx% of the total market. However, the market is witnessing increased competition from regional players and new entrants, particularly from China and India, driving increased innovation. The regulatory framework varies across countries within the region, influencing market access and operational costs. Substitute products, such as heavy-lift cargo aircraft and specialized ground transportation solutions, exert some competitive pressure. End-user trends, particularly in the military sector, favor advanced technologies, such as unmanned aerial vehicles (UAVs) and autonomous flight systems. M&A activity in the sector has been moderate, with an estimated xx M&A deals concluded in the historical period (2019-2024), primarily focused on technology acquisition and market expansion. This trend is expected to accelerate in the forecast period driven by the increasing demand for heavy lift capabilities.

Asia-Pacific Heavy-lift Helicopter Market Industry Insights & Trends

The Asia-Pacific heavy-lift helicopter market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. The market size in 2025 is estimated at xx Million, expanding to xx Million by 2033. Several factors contribute to this growth. Increasing infrastructure development projects across the region, particularly in Southeast Asia, create a surge in demand for heavy-lift helicopters for transportation of materials and personnel. The rising need for disaster relief and emergency response capabilities also fuels market expansion. Furthermore, the modernization of military fleets in several countries within the region boosts the military segment's growth. Technological advancements, such as improved rotor designs, advanced avionics, and enhanced safety features, further enhance market attractiveness. The increasing adoption of advanced materials and the development of more fuel-efficient engines are also key trends shaping the market. Evolving consumer behaviors towards higher safety and operational efficiency are shaping product preferences and market demands.

Key Markets & Segments Leading Asia-Pacific Heavy-lift Helicopter Market

Within the Asia-Pacific region, China and India are expected to be the leading markets for heavy-lift helicopters, driven by robust economic growth, significant infrastructure development initiatives, and expanding military budgets. Other key markets include Australia, South Korea, and Japan.

Dominant Segment: Military

- High military expenditure and modernization initiatives.

- Requirement for heavy-lift helicopters in military logistics and operations.

- Strategic investments in defense capabilities.

Dominant Segment: Civilian

- Rapid infrastructure development projects (e.g., roads, bridges, and power plants).

- Growing demand for heavy-lift capabilities in oil & gas exploration and construction.

- Increased focus on disaster relief and emergency response.

The Military segment currently dominates the market owing to high government spending on defense modernization and procurement of advanced military helicopters. However, the civilian segment is expected to witness substantial growth over the forecast period due to rising infrastructure investments.

Asia-Pacific Heavy-lift Helicopter Market Product Developments

Recent advancements in heavy-lift helicopter technology have focused on increasing payload capacity, extending operational range, enhancing safety features, and improving fuel efficiency. Manufacturers are integrating advanced materials, such as composites, to reduce weight and increase payload capacity. The incorporation of advanced avionics and flight control systems enhances safety and operational capabilities. Development of hybrid-electric propulsion systems is emerging, promising higher efficiency and reduced emissions, offering a significant competitive edge. These innovations are driving market expansion and creating new applications across diverse industries.

Challenges in the Asia-Pacific Heavy-lift Helicopter Market Market

The Asia-Pacific heavy-lift helicopter market faces challenges such as stringent regulatory hurdles, particularly concerning safety and airworthiness certification. Supply chain disruptions caused by geopolitical factors and global events can impact the availability and costs of components. Intense competition from established and emerging players poses a significant challenge, requiring manufacturers to constantly innovate and improve their offerings. These factors can limit market growth and increase operational costs.

Forces Driving Asia-Pacific Heavy-lift Helicopter Market Growth

Key growth drivers include increasing government spending on defense and infrastructure, rising demand for heavy-lift capabilities in various sectors (oil & gas, construction, disaster relief), technological advancements leading to enhanced safety and efficiency, and supportive government policies promoting domestic manufacturing and technological development in certain regions like China. The growing need for heavy-lift helicopters in search and rescue operations further fuels the market’s expansion.

Long-term Growth Catalysts in Asia-Pacific Heavy-lift Helicopter Market

Long-term growth catalysts include the continuous development of innovative technologies such as unmanned and autonomous systems, strategic partnerships between manufacturers and operators, and market expansion into new regions and applications (e.g., offshore wind energy). The rising global emphasis on sustainability is expected to drive demand for more environmentally friendly heavy-lift helicopter designs.

Emerging Opportunities in Asia-Pacific Heavy-lift Helicopter Market

Emerging opportunities include the growing demand for heavy-lift helicopters in offshore wind energy projects, the development of specialized helicopters for specific applications (e.g., firefighting, medical evacuation), and the increasing adoption of digital technologies for maintenance, operations, and fleet management. Expansion into underserved markets and the development of new maintenance and repair solutions presents further opportunities.

Leading Players in the Asia-Pacific Heavy-lift Helicopter Market Sector

Key Milestones in Asia-Pacific Heavy-lift Helicopter Market Industry

- 2020: AVIC launches a new heavy-lift helicopter model.

- 2022: Airbus secures a significant contract for heavy-lift helicopters from an Asian nation.

- 2023: Lockheed Martin and a regional partner sign an agreement for joint helicopter development.

- 2024: Significant investment in research and development of electric propulsion systems by multiple players.

Strategic Outlook for Asia-Pacific Heavy-lift Helicopter Market Market

The Asia-Pacific heavy-lift helicopter market presents significant growth potential, driven by long-term trends like infrastructure development, military modernization, and technological advancements. Strategic partnerships, investments in research and development, and expansion into new markets will be crucial for success. Focus on sustainability and the adoption of digital technologies will shape future competitive dynamics, paving the way for a significant expansion of the market.

Asia-Pacific Heavy-lift Helicopter Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

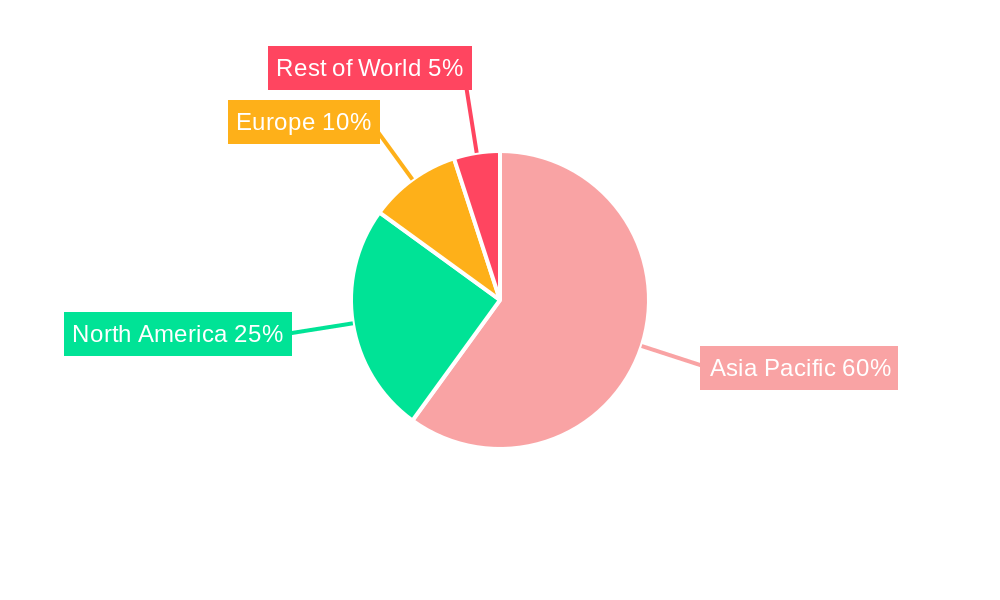

Asia-Pacific Heavy-lift Helicopter Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Heavy-lift Helicopter Market Regional Market Share

Geographic Coverage of Asia-Pacific Heavy-lift Helicopter Market

Asia-Pacific Heavy-lift Helicopter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Military Segment is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Heavy-lift Helicopter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Russian Helicopters (Rostec State Corporation)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Enstrom Helicopter Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aviation Corporation of China (AVIC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Boeing Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Asia-Pacific Heavy-lift Helicopter Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Heavy-lift Helicopter Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Heavy-lift Helicopter Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Heavy-lift Helicopter Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Heavy-lift Helicopter Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Asia-Pacific Heavy-lift Helicopter Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Russian Helicopters (Rostec State Corporation), Enstrom Helicopter Corp, Aviation Corporation of China (AVIC), The Boeing Company.

3. What are the main segments of the Asia-Pacific Heavy-lift Helicopter Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Military Segment is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Heavy-lift Helicopter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Heavy-lift Helicopter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Heavy-lift Helicopter Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Heavy-lift Helicopter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence