Key Insights

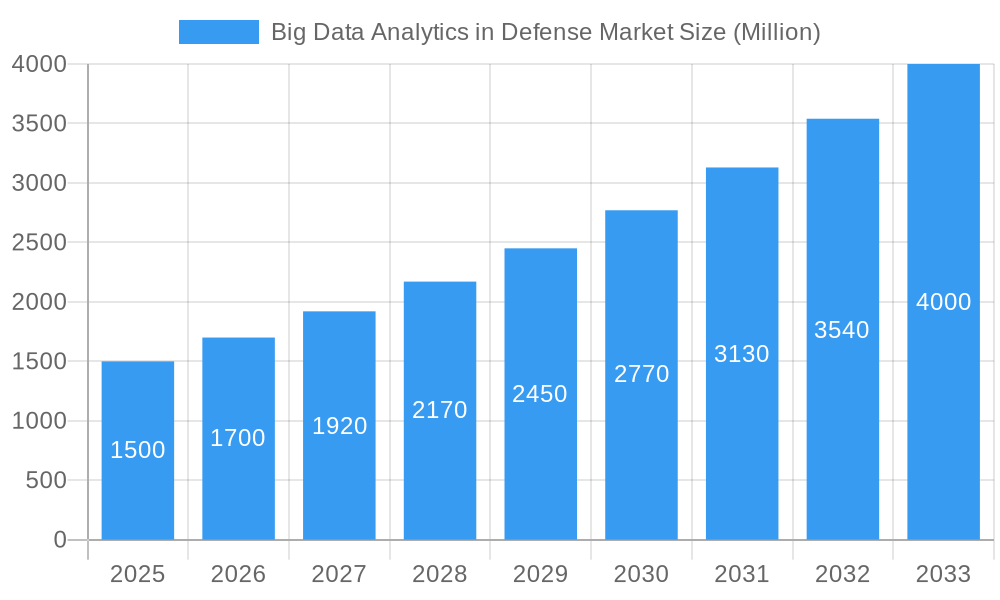

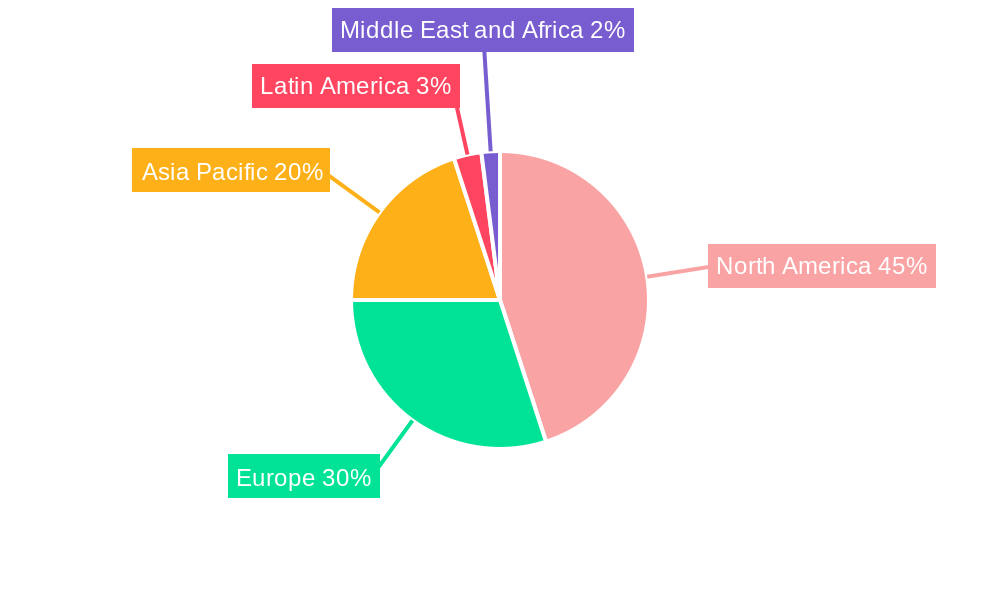

The global Big Data Analytics in Defense market is experiencing robust growth, driven by the increasing need for advanced intelligence gathering, predictive maintenance, and improved operational efficiency within military operations. A Compound Annual Growth Rate (CAGR) exceeding 13% from 2019 to 2033 signifies a substantial expansion, with the market size projected to reach significant figures by 2033 (precise figures require more detailed initial market size data, but a logical estimate based on a 13% CAGR would place it in the billions). Key drivers include the escalating volume of data generated from various military sources (sensors, drones, satellites), the demand for real-time insights for strategic decision-making, and the growing adoption of artificial intelligence (AI) and machine learning (ML) for enhanced data analysis. Market segmentation reveals a strong emphasis on software solutions, reflecting the crucial role of sophisticated algorithms in data processing and interpretation. The North American region, particularly the United States, is expected to maintain a dominant market share due to high defense budgets and technological advancements. However, the Asia-Pacific region is poised for rapid growth, fueled by increasing defense spending and modernization initiatives in countries like China and India. While data security and privacy concerns pose some restraints, the strategic advantages offered by Big Data Analytics are overcoming these challenges, solidifying its position as a crucial element of modern defense strategies.

Big Data Analytics in Defense Market Market Size (In Billion)

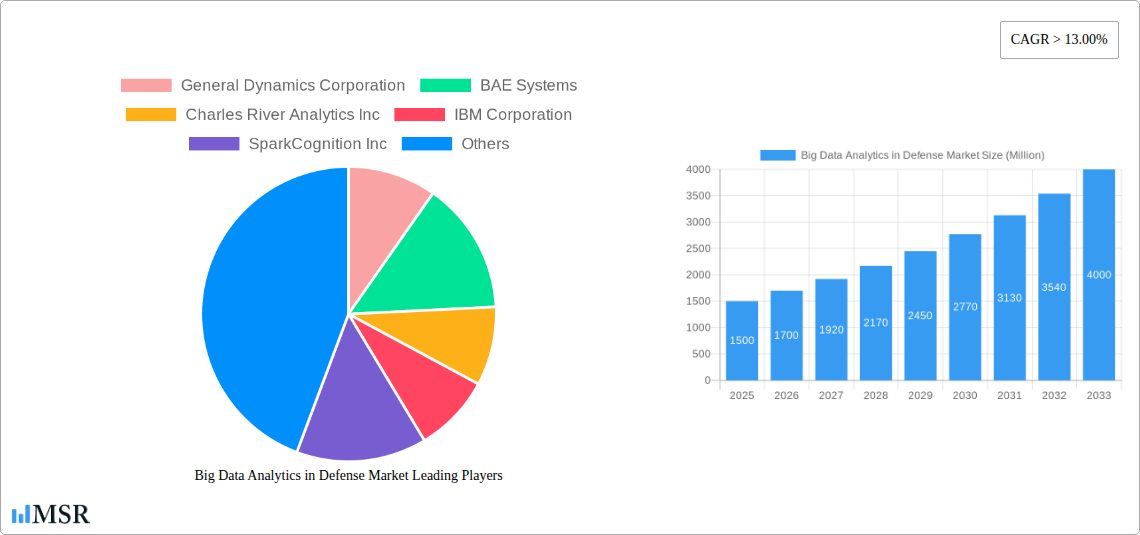

The competitive landscape is characterized by a mix of established defense contractors and innovative technology companies. Major players like General Dynamics, BAE Systems, and Lockheed Martin are leveraging their expertise in integrating Big Data Analytics into their existing product offerings. Meanwhile, companies specializing in AI and data analytics, such as IBM and SparkCognition, are aggressively targeting the defense sector with tailored solutions. The market's evolution will likely see increased collaborations between these entities, fostering the development of sophisticated, integrated systems for advanced defense applications. The future of Big Data Analytics in Defense hinges on continuous technological advancements in areas such as cloud computing, edge computing, and the development of more robust and explainable AI algorithms to enhance decision support and operational effectiveness. This creates a significant opportunity for both established and emerging players in this rapidly growing market.

Big Data Analytics in Defense Market Company Market Share

Big Data Analytics in Defense Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Big Data Analytics in Defense Market, covering market dynamics, industry trends, key segments, leading players, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is crucial for defense contractors, technology providers, investors, and government agencies seeking to understand and capitalize on this rapidly evolving market expected to reach xx Million by 2033.

Big Data Analytics in Defense Market Market Concentration & Dynamics

The Big Data Analytics in Defense market is characterized by a moderately concentrated landscape, dominated by established defense contractors and emerging technology companies. Key players like General Dynamics Corporation, BAE Systems, Charles River Analytics Inc, IBM Corporation, SparkCognition Inc, Shield AI, Leidos, Thales Group, Northrop Grumman, Lockheed Martin Corporation, and Raytheon Technologies Inc hold significant market share. However, the emergence of specialized AI and big data analytics firms is increasing competition.

Market share distribution is dynamic, with larger players focusing on integrating big data solutions into existing defense systems, while smaller, more agile companies specialize in niche areas like AI-powered threat detection. The market is influenced by stringent regulatory frameworks concerning data security and privacy, particularly for sensitive defense information. Substitute products, such as traditional intelligence gathering methods, are gradually being replaced as big data analytics offer superior efficiency and actionable insights. End-user trends reveal a growing demand for real-time intelligence, predictive analytics, and improved situational awareness on the battlefield. Mergers and acquisitions (M&A) activity has been significant, with xx M&A deals recorded between 2019 and 2024, primarily driven by companies aiming to expand their technological capabilities and market reach. The average deal size was approximately xx Million.

Big Data Analytics in Defense Market Industry Insights & Trends

The Big Data Analytics in Defense market is experiencing robust growth, driven by several factors. The global market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Increased government spending on defense modernization and technological advancements are key drivers. The growing adoption of AI and machine learning (ML) in defense applications, including autonomous weapons systems and predictive maintenance, is significantly boosting market expansion. Technological disruptions, such as the proliferation of IoT devices and edge computing, are creating new opportunities for data collection and analysis in diverse operational environments. Evolving consumer behaviors—meaning, the demands of defense organizations—indicate a preference for cloud-based solutions, enhanced cybersecurity features, and interoperable systems that can seamlessly integrate with existing infrastructure. Furthermore, the increasing need for real-time intelligence gathering and analysis in counterterrorism and cybersecurity operations is fueling market growth. The integration of big data analytics with other technologies, such as blockchain for secure data management, is also creating new possibilities.

Key Markets & Segments Leading Big Data Analytics in Defense Market

Dominant Region/Country: North America currently holds the largest market share, driven by substantial defense budgets and the presence of major technology companies. However, the Asia-Pacific region is exhibiting significant growth due to increased defense spending and modernization efforts in countries like India and China.

By Technology: Artificial Intelligence (AI) dominates the technology segment, accounting for xx% of the market due to its potential for automating tasks, enhancing decision-making, and improving situational awareness. Big data analytics is the second-largest segment, providing the foundation for AI applications and supporting other advanced analytics capabilities.

By Platform: The Army segment holds the largest share, followed by the Navy and Air Force, owing to the varying needs and deployment scenarios across different branches. The Army requires extensive data analytics for ground troop operations, logistics, and intelligence gathering. The Navy utilizes the technology for maritime surveillance, submarine tracking, and fleet management. The Air Force employs big data analytics for drone operations, air traffic management, and situational awareness in flight.

By Offering: The software segment currently leads the market, reflecting the increasing demand for advanced analytics platforms and applications. However, hardware and services components play critical supporting roles, especially as they are central to the implementation and upkeep of data-driven defense systems.

Drivers for Growth:

- Increased defense budgets.

- Modernization of defense infrastructure.

- Growing adoption of AI and machine learning.

- Demand for real-time intelligence gathering.

- Need for improved cybersecurity and threat detection.

Big Data Analytics in Defense Market Product Developments

Recent product innovations focus on improving the accuracy and speed of data analysis, incorporating advanced algorithms and cloud-based platforms for enhanced scalability and accessibility. The development of AI-powered systems for autonomous decision-making and predictive maintenance is revolutionizing operations. These advancements provide competitive advantages by enabling rapid responses to threats, optimized resource allocation, and improved operational efficiency. For example, the integration of big data analytics with sensor networks and drones enhances situational awareness and allows for more precise targeting.

Challenges in the Big Data Analytics in Defense Market Market

Significant challenges include stringent data security regulations requiring sophisticated encryption and access controls, impacting costs. Supply chain disruptions can also hinder the timely procurement of hardware and software components. Intense competition from both established defense contractors and emerging technology companies poses a challenge to smaller players. The total impact of these challenges on market growth is estimated at a reduction of xx Million annually.

Forces Driving Big Data Analytics in Defense Market Growth

Technological advancements, particularly in AI and machine learning, are propelling market growth. Increased defense spending by major global powers is also a key driver. Furthermore, evolving geopolitical landscapes and the need for improved national security are creating significant demand for big data analytics solutions. Specific examples include the adoption of AI-powered surveillance systems, predictive maintenance for military equipment, and the use of big data analytics for enhanced cybersecurity.

Challenges in the Big Data Analytics in Defense Market Market (Long-Term Growth Catalysts)

Long-term growth hinges on continuous innovation in AI algorithms, advanced data visualization techniques, and enhanced cybersecurity measures. Strategic partnerships between defense contractors and technology providers will also play a crucial role in market expansion. The exploration of new applications for big data analytics in defense, such as improving logistics and supply chain management, will drive future growth.

Emerging Opportunities in Big Data Analytics in Defense Market

Emerging opportunities include the development of AI-powered autonomous weapons systems, the use of big data analytics for predictive maintenance of military equipment, and the application of these technologies for cybersecurity and threat detection. The integration of big data analytics with other emerging technologies like blockchain and quantum computing holds significant potential for future growth. Exploring new markets, particularly in developing economies with increasing defense budgets, presents attractive opportunities for expansion.

Leading Players in the Big Data Analytics in Defense Market Sector

- General Dynamics Corporation

- BAE Systems

- Charles River Analytics Inc

- IBM Corporation

- SparkCognition Inc

- Shield AI

- Leidos

- Thales Group

- Northrop Grumman

- Lockheed Martin Corporation

- Raytheon Technologies Inc

Key Milestones in Big Data Analytics in Defense Market Industry

July 2022: The Indian Ministry of Defense launched 75 newly developed AI products and technologies, showcasing a significant push towards AI adoption in the defense sector. This has implications for the growth of the Indian big data analytics market and broader adoption of AI in defense globally.

September 2022: The United States Air Force awarded a USD 1.25 million contract to ZeroEyes for AI-powered gun detection technology. This highlights the growing interest in AI-driven security solutions within the defense sector and the significant potential of such technologies.

Strategic Outlook for Big Data Analytics in Defense Market Market

The future of the Big Data Analytics in Defense Market looks promising, driven by the increasing demand for advanced intelligence gathering, improved situational awareness, and autonomous systems. Strategic partnerships, technological innovations, and expanding global defense budgets will continue to fuel growth. Companies focusing on developing secure, scalable, and user-friendly solutions will be well-positioned to capitalize on the numerous opportunities in this dynamic market.

Big Data Analytics in Defense Market Segmentation

-

1. Offering

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Technology

- 2.1. Artificial Intelligence

- 2.2. Big Data Analytics

- 2.3. Other Te

-

3. Platform

- 3.1. Army

- 3.2. Navy

- 3.3. Airforce

Big Data Analytics in Defense Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Big Data Analytics in Defense Market Regional Market Share

Geographic Coverage of Big Data Analytics in Defense Market

Big Data Analytics in Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Software Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Artificial Intelligence

- 5.2.2. Big Data Analytics

- 5.2.3. Other Te

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Army

- 5.3.2. Navy

- 5.3.3. Airforce

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Artificial Intelligence

- 6.2.2. Big Data Analytics

- 6.2.3. Other Te

- 6.3. Market Analysis, Insights and Forecast - by Platform

- 6.3.1. Army

- 6.3.2. Navy

- 6.3.3. Airforce

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Artificial Intelligence

- 7.2.2. Big Data Analytics

- 7.2.3. Other Te

- 7.3. Market Analysis, Insights and Forecast - by Platform

- 7.3.1. Army

- 7.3.2. Navy

- 7.3.3. Airforce

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Artificial Intelligence

- 8.2.2. Big Data Analytics

- 8.2.3. Other Te

- 8.3. Market Analysis, Insights and Forecast - by Platform

- 8.3.1. Army

- 8.3.2. Navy

- 8.3.3. Airforce

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Artificial Intelligence

- 9.2.2. Big Data Analytics

- 9.2.3. Other Te

- 9.3. Market Analysis, Insights and Forecast - by Platform

- 9.3.1. Army

- 9.3.2. Navy

- 9.3.3. Airforce

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East and Africa Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Artificial Intelligence

- 10.2.2. Big Data Analytics

- 10.2.3. Other Te

- 10.3. Market Analysis, Insights and Forecast - by Platform

- 10.3.1. Army

- 10.3.2. Navy

- 10.3.3. Airforce

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BAE Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Charles River Analytics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SparkCognition Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shield AI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leidos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lockheed Martin Corportaion

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Raytheon Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Big Data Analytics in Defense Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 3: North America Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 7: North America Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 8: North America Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 11: Europe Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 12: Europe Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 13: Europe Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 15: Europe Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Europe Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 19: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 20: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 23: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 27: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 28: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 31: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 32: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 35: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 36: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 37: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 39: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 40: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 2: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 4: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 6: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 8: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 12: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 13: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 14: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Germany Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Russia Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 21: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 22: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 23: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: India Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: China Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Japan Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Korea Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 30: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 31: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 32: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Brazil Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 36: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 37: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 38: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: United Arab Emirates Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Egypt Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Big Data Analytics in Defense Market?

The projected CAGR is approximately 13.5%.

2. Which companies are prominent players in the Big Data Analytics in Defense Market?

Key companies in the market include General Dynamics Corporation, BAE Systems, Charles River Analytics Inc, IBM Corporation, SparkCognition Inc, Shield AI, Leidos, Thales Group, Northrop Grumman, Lockheed Martin Corportaion, Raytheon Technologies Inc.

3. What are the main segments of the Big Data Analytics in Defense Market?

The market segments include Offering, Technology, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Software Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: The United States Air Force signed a contract worth USD 1.25 million with ZeroEyto procure an AI gun detection solution for the service's unmanned aerial vehicles (UAVs) at the Dover Air Force Base, Delaware. ZeroEyes' technology will enable drones to detect handheld weapons for base protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Big Data Analytics in Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Big Data Analytics in Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Big Data Analytics in Defense Market?

To stay informed about further developments, trends, and reports in the Big Data Analytics in Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence