Key Insights

The European general aviation (GA) industry, encompassing business jets, piston fixed-wing aircraft, and helicopters, presents a dynamic market landscape characterized by moderate growth. While the provided CAGR of 0.04 suggests relatively slow expansion, this figure likely underrepresents the sector's potential, given the ongoing recovery from the pandemic and increasing demand for private air travel in certain segments. Key drivers include the rising affluence of high-net-worth individuals fueling business jet demand, coupled with increasing government investments in infrastructure and initiatives promoting sustainable aviation. However, the industry faces challenges such as fluctuating fuel prices, stringent environmental regulations impacting aircraft emissions, and the ongoing global economic uncertainty that can influence investment in private aviation. The market is segmented geographically, with Germany, France, the UK, and Italy being major players, reflecting their established business and tourism sectors. Sub-segment performance varies, with business jets likely experiencing higher growth compared to smaller piston-engine aircraft due to higher purchasing power and the enhanced comfort and speed they offer. The competitive landscape is dominated by established manufacturers like Dassault Aviation, Embraer, and Textron Inc., but smaller manufacturers like Tecnam and Pilatus Aircraft also contribute significantly, particularly in the niche markets such as training and light aircraft.

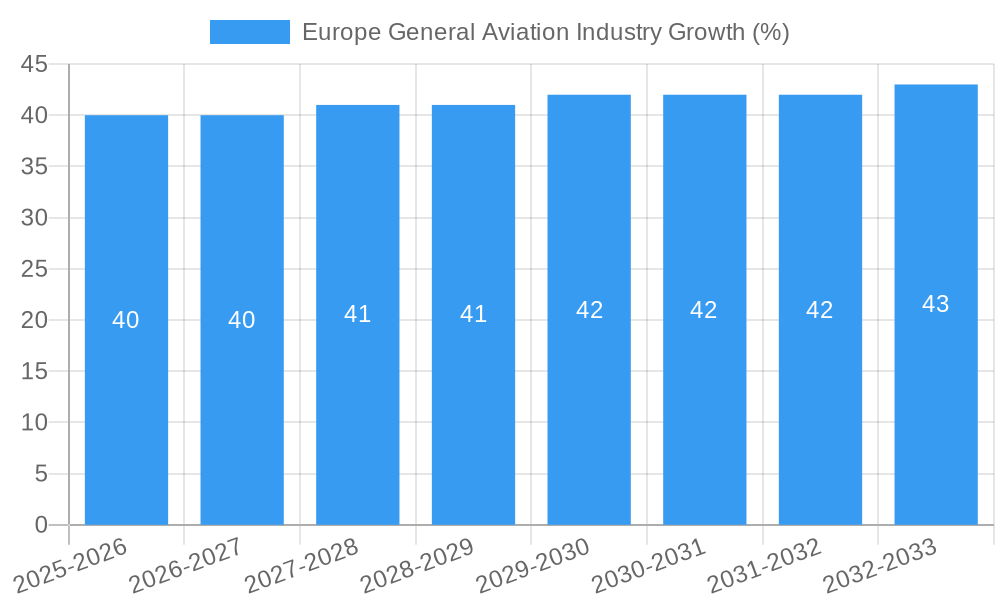

The forecast period (2025-2033) is expected to witness gradual growth, driven by the aforementioned factors. While a precise market size for 2025 is missing, assuming a current market size (let’s assume for illustrative purposes, a reasonable estimation based on other similar market reports, a value of €10 billion) and applying the given CAGR, we can project moderate year-on-year expansion. The segment representing business jets and newer aircraft types such as electric or hybrid aircraft will likely be the primary growth contributors, surpassing growth in the more mature piston fixed-wing aircraft segment. Strategic partnerships, technological advancements in aircraft design and manufacturing, and a focus on sustainable aviation fuels will shape the future of this industry. However, geopolitical instability and potential regulatory hurdles could act as significant restraints. A comprehensive understanding of these dynamics is crucial for industry stakeholders in navigation of this competitive and evolving landscape.

Europe General Aviation Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe General Aviation industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, key players, and emerging opportunities within this dynamic sector. Expect detailed breakdowns of market segments, including Mid-Size Jets, Piston Fixed-Wing Aircraft, Business Jets, and more, across key European countries like France, Germany, Italy, the UK, and others. The report also features crucial data on recent industry developments, offering a forward-looking perspective on the future of European General Aviation. Download now to gain a competitive edge!

Europe General Aviation Industry Market Concentration & Dynamics

The European General Aviation market, valued at €xx Million in 2025, exhibits a moderately concentrated landscape. Key players like Airbus SE, Textron Inc, Dassault Aviation, and Embraer hold significant market share, though a number of smaller, specialized manufacturers also contribute substantially. Innovation within the industry is driven by a complex interplay of factors. These include substantial investment in research and development focused on fuel efficiency, advanced avionics, and sustainable materials. The regulatory environment, while generally supportive of growth, presents challenges related to air traffic management and environmental regulations. The presence of substitute products, such as high-speed rail for shorter distances, poses some competitive pressure. However, the increasing demand for flexible and personalized travel, particularly for business purposes, strengthens the industry’s position. Furthermore, ongoing mergers and acquisitions (M&A) activities, with an estimated xx deals in the last five years, signal a dynamic consolidation trend within the sector.

- Market Share: Airbus SE (xx%), Textron Inc (xx%), Dassault Aviation (xx%), Embraer (xx%), Others (xx%)

- M&A Activity: xx deals (2019-2024), indicating consolidation and strategic expansion.

- Innovation Focus: Fuel efficiency, advanced avionics, sustainable materials.

- Regulatory Landscape: Supportive but with challenges in air traffic management and environmental regulations.

Europe General Aviation Industry Industry Insights & Trends

The European General Aviation market is projected to witness robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. Several factors contribute to this positive outlook. Firstly, the ongoing recovery of the European economy is boosting business travel and private aviation, thereby driving demand. Secondly, technological advancements, particularly in areas such as autonomous flight systems and electric propulsion, are poised to revolutionize the industry. These innovations offer substantial potential for improved safety, reduced operating costs, and environmental sustainability. Finally, evolving consumer behavior, marked by a growing preference for personalized and efficient travel solutions, further fuels market expansion. This trend is particularly evident in the increasing popularity of private jet charters and fractional ownership programs. This growth isn't uniform, and certain sub-segments, like business jets, are outperforming others, reflecting distinct market dynamics and demand drivers within the broader sector. Overall, the industry is navigating a period of exciting transformation, driven by economic tailwinds, technological advancements and shifts in consumer preference.

- Market Size (2025): €xx Million

- CAGR (2025-2033): xx%

Key Markets & Segments Leading Europe General Aviation Industry

The UK, France, and Germany represent the most significant national markets within the European General Aviation sector, accounting for a combined xx% of the total market value in 2025. The dominance of these countries stems from a confluence of factors. Strong economic activity, well-developed aviation infrastructure, including a dense network of airports and supporting services, and a thriving business community contribute to high demand for general aviation services. Within the segment breakdown, Business Jets constitute the largest segment, driven by the escalating needs of corporate executives and high-net-worth individuals for convenient and efficient travel.

Key Market Drivers:

- Economic Growth: Strong GDP growth in key European markets fuels demand.

- Business Travel: Increased business travel necessitates efficient and flexible travel solutions.

- Aviation Infrastructure: Well-developed airports and supporting infrastructure facilitate operations.

- High-Net-Worth Individuals: Growing affluence drives demand for private aviation services.

Dominance Analysis:

The UK benefits from a large and established business aviation sector, while France and Germany attract significant demand from multinational corporations and high-net-worth individuals. The strength of their respective economies and supportive regulatory environments cement their leadership in this segment. The emergence of other markets, however, should not be overlooked, as growth potentials in other parts of Europe exist.

Europe General Aviation Industry Product Developments

Recent product developments reflect a strong emphasis on enhanced safety features, improved fuel efficiency, and advanced technologies. Manufacturers are increasingly incorporating fly-by-wire systems, advanced avionics, and lightweight composite materials into their aircraft designs. These advancements aim to enhance operational capabilities, reduce environmental impact, and provide a superior flying experience for pilots and passengers. The incorporation of sustainable materials and alternative fuel solutions is becoming increasingly prevalent, highlighting the industry's commitment to environmental responsibility.

Challenges in the Europe General Aviation Industry Market

The European General Aviation market faces several challenges. Stringent regulatory compliance requirements can increase operational costs, especially for smaller operators. Furthermore, fluctuations in fuel prices and supply chain disruptions can impact profitability. Finally, intense competition, both from established players and new entrants, puts downward pressure on pricing and margins. These challenges necessitate strategic adaptation and innovation to maintain competitiveness and profitability within the market.

Forces Driving Europe General Aviation Industry Growth

Key growth drivers include increasing demand from the business aviation sector, government initiatives promoting regional connectivity, and technological advancements like sustainable aviation fuels and electric propulsion. Economic growth in key European markets further strengthens demand, and the increasing adoption of fractional ownership models expands market accessibility.

Challenges in the Europe General Aviation Industry Market

Long-term growth hinges on the successful development and adoption of sustainable technologies, increased investment in aviation infrastructure, and the streamlining of regulatory processes. Strategic partnerships and collaborations across the industry are crucial for fostering innovation and accelerating market expansion.

Emerging Opportunities in Europe General Aviation Industry

Emerging opportunities include the growing demand for sustainable aviation solutions, the rise of air taxi services utilizing electric vertical takeoff and landing (eVTOL) aircraft, and the expansion of general aviation into underserved regional markets.

Leading Players in the Europe General Aviation Industry Sector

- Textron Inc

- Dassault Aviation

- Diamond Aircraft

- General Dynamics Corporation

- Tecnam Aircraft

- Embraer

- Airbus SE

- Robinson Helicopter Company Inc

- Cirrus Design Corporation

- Pilatus Aircraft Ltd

- Leonardo S p A

- Daher

- Bombardier Inc

- PIAGGIO AERO INDUSTRIES S p A

Key Milestones in Europe General Aviation Industry Industry

- December 2023: Tecnam receives a significant order for two P-Mentor aircraft from ACS Aviation, expanding flight training capabilities. This signifies growing demand within the flight training segment.

- October 2023: Textron Aviation secures a major contract with Fly Alliance for up to 20 Cessna Citation business jets, bolstering the business jet market. This highlights a strong demand for luxury private jet charter services.

- June 2023: Gulfstream Aerospace Corp. invests USD 28.5 Million in expanding its completions and outfitting operations, indicating significant investment in the luxury segment of the industry.

Strategic Outlook for Europe General Aviation Industry Market

The future of the European General Aviation market appears bright, driven by a confluence of factors. Continued economic growth, technological innovation, and the increasing adoption of sustainable practices will contribute to steady expansion. Strategic partnerships and investments in infrastructure will further enhance the sector's competitiveness and attractiveness. The market presents significant opportunities for both established players and new entrants to leverage technological advancements and capitalize on the growing demand for efficient and personalized air travel.

Europe General Aviation Industry Segmentation

-

1. Sub Aircraft Type

-

1.1. Business Jets

- 1.1.1. Large Jet

- 1.1.2. Light Jet

- 1.1.3. Mid-Size Jet

- 1.2. Piston Fixed-Wing Aircraft

- 1.3. Others

-

1.1. Business Jets

Europe General Aviation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe General Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The demand for business aviation in the region is expected to aid the European general aviation sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 5.1.1. Business Jets

- 5.1.1.1. Large Jet

- 5.1.1.2. Light Jet

- 5.1.1.3. Mid-Size Jet

- 5.1.2. Piston Fixed-Wing Aircraft

- 5.1.3. Others

- 5.1.1. Business Jets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6. Germany Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe General Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Textron Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dassault Aviation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Diamond Aircraft

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 General Dynamics Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tecnam Aircraft

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Embraer

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Airbus SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Robinson Helicopter Company Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cirrus Design Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pilatus Aircraft Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Leonardo S p A

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Daher

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Bombardier Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 PIAGGIO AERO INDUSTRIES S p A

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Textron Inc

List of Figures

- Figure 1: Europe General Aviation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe General Aviation Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe General Aviation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe General Aviation Industry Revenue Million Forecast, by Sub Aircraft Type 2019 & 2032

- Table 3: Europe General Aviation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe General Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe General Aviation Industry Revenue Million Forecast, by Sub Aircraft Type 2019 & 2032

- Table 13: Europe General Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe General Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe General Aviation Industry?

The projected CAGR is approximately 0.04%.

2. Which companies are prominent players in the Europe General Aviation Industry?

Key companies in the market include Textron Inc, Dassault Aviation, Diamond Aircraft, General Dynamics Corporation, Tecnam Aircraft, Embraer, Airbus SE, Robinson Helicopter Company Inc, Cirrus Design Corporation, Pilatus Aircraft Ltd, Leonardo S p A, Daher, Bombardier Inc, PIAGGIO AERO INDUSTRIES S p A.

3. What are the main segments of the Europe General Aviation Industry?

The market segments include Sub Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The demand for business aviation in the region is expected to aid the European general aviation sector.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: Tecnam announced that the renowned Scottish flight training academy ACS Aviation ordered two P-Mentors to be added to their current fleet to expand their fleet capabilities in 2023.October 2023: Textron Aviation announced that it entered into a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, four firms with options for 16 additional aircraft. Fly Alliance is expected to use the aircraft for its luxury private jet charter operations and is expected to take delivery of the first aircraft, an XLS Gen2, in 2023.June 2023: Gulfstream Aerospace Corp. announced today the further expansion of its completions and outfitting operations at St. Louis Downtown Airport. With this latest expansion, Gulfstream is expected to increase completion operations at the site while modernizing its existing spaces by adding new, state-of-the-art equipment and tooling, representing a total capital investment of USD 28.5 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe General Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe General Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe General Aviation Industry?

To stay informed about further developments, trends, and reports in the Europe General Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence