Key Insights

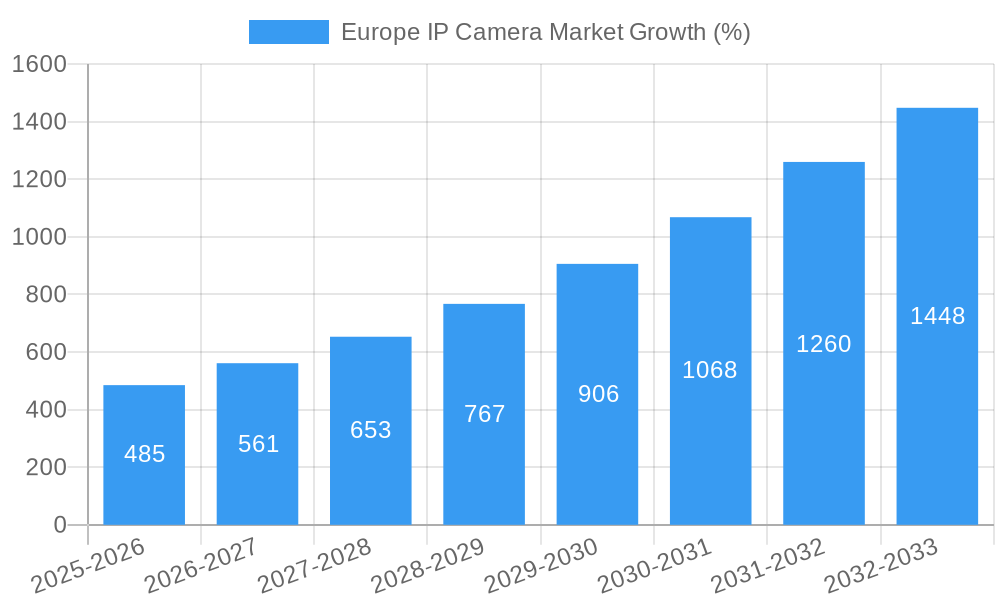

The European IP camera market, valued at €3.52 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14% from 2025 to 2033. This surge is driven by several key factors. Increasing adoption of smart home and building technologies fuels demand for advanced surveillance solutions. The rise of cloud-based video management systems (VMS) simplifies data storage and access, encouraging wider IP camera deployment across residential, commercial, and industrial sectors. Furthermore, stringent security regulations and the need for improved crime prevention measures in major European cities like London, Paris, and Berlin are pushing governments and businesses towards investing in high-quality IP camera systems. The market is segmented by camera type (fixed, PTZ, varifocal), end-user industry (residential, commercial encompassing BFSI, education, healthcare, real estate, and retail), and geography (UK, Germany, France, Italy, and other European countries). Leading players like Motorola Solutions, Dahua Technology, and Hikvision are strategically focusing on innovation in features like 4K resolution, AI-powered analytics, and enhanced cybersecurity to maintain their market dominance.

The competitive landscape is characterized by both established players and emerging technology companies vying for market share. While established players benefit from brand recognition and extensive distribution networks, agile startups are driving innovation with cost-effective and feature-rich solutions. The market's growth, however, is not without its challenges. Concerns surrounding data privacy and cybersecurity remain significant hurdles, necessitating robust security protocols and user education. Furthermore, the high initial investment cost associated with implementing IP camera systems can be a barrier to entry for smaller businesses, particularly in the residential sector. Nevertheless, the ongoing advancements in technology, coupled with increasing demand for enhanced security, are expected to outweigh these challenges, ensuring consistent market growth throughout the forecast period.

Europe IP Camera Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe IP Camera market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The €XX Million market is poised for significant expansion, driven by technological advancements and increasing demand across diverse sectors. Download now to gain a competitive edge!

Europe IP Camera Market Market Concentration & Dynamics

The Europe IP Camera market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. However, the presence of numerous smaller, specialized vendors contributes to a dynamic competitive environment. Market share data for 2024 estimates that Hangzhou Hikvision Digital Technology Co Ltd holds approximately xx%, followed by Dahua Technology with xx%, and Bosch Security and Systems with xx%. The remaining share is distributed amongst other prominent players like Motorola Solutions Inc, Sony Corporation, and Samsung.

Innovation is a key driver, with continuous advancements in image quality, analytics capabilities, and connectivity. Regulatory frameworks, particularly concerning data privacy (GDPR) and cybersecurity, significantly influence market dynamics. Substitute products, such as traditional analog cameras, are gradually being replaced by IP cameras due to their superior functionality and cost-effectiveness in the long term.

End-user trends favor integrated security solutions that incorporate IP cameras with advanced analytics, access control, and video management systems. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, primarily focused on consolidating market share and expanding technological capabilities.

Europe IP Camera Market Industry Insights & Trends

The Europe IP Camera market is experiencing robust growth, with an estimated market size of €XX Million in 2025 and a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing adoption of smart home technologies and the rising demand for enhanced security solutions in residential and commercial settings are major contributors. Furthermore, the growing need for effective surveillance in critical infrastructure sectors, such as transportation and utilities, is driving market expansion.

Technological advancements, such as the integration of Artificial Intelligence (AI) and machine learning (ML) in IP cameras, are revolutionizing security applications. AI-powered features like facial recognition, object detection, and behavioral analysis are enhancing the effectiveness and efficiency of surveillance systems. Evolving consumer behaviors, including a preference for remote monitoring capabilities and user-friendly interfaces, further fuel market growth. The demand for high-resolution cameras and advanced analytics is steadily increasing, driving innovation and product diversification.

Key Markets & Segments Leading Europe IP Camera Market

By Type: The PTZ (Pan-Tilt-Zoom) segment currently dominates the market, owing to its versatility and ability to cover wide areas effectively. Fixed cameras maintain a substantial share due to their cost-effectiveness and simplicity, while varifocal cameras are gaining traction for their adjustable field-of-view capabilities.

By End-User Industry: The commercial sector, particularly BFSI (Banking, Financial Services, and Insurance), retail, and healthcare, constitutes the largest segment due to the high demand for robust security systems and data protection. The residential sector is also experiencing significant growth, driven by increased awareness of home security and smart home technology adoption. The industrial and government sectors are witnessing substantial adoption as well, driven by the need for advanced security and surveillance in critical infrastructure.

By Country: The United Kingdom, Germany, and France are the leading markets within Europe, propelled by strong economic growth, advanced infrastructure, and a high level of security awareness. Italy also displays significant potential, driven by government investments in public safety initiatives.

Drivers for market growth across these segments include:

- Economic growth: Increased disposable income boosts investment in security solutions.

- Infrastructure development: Expansion of smart city projects and infrastructure modernization enhance the demand for IP cameras.

- Government initiatives: Regulatory frameworks and government investments in surveillance systems bolster market growth.

Europe IP Camera Market Product Developments

Recent product innovations are characterized by advancements in AI-powered analytics, higher resolutions (4K and beyond), improved low-light performance, and enhanced cybersecurity features. For instance, the launch of Sony's BRC-AM7 PTZ camera with its compact design and AI-powered auto-framing showcases the direction of technological advancement. These advancements are enhancing the capabilities and market appeal of IP cameras, enabling diverse applications across various sectors. Furthermore, the increasing integration of IP cameras with cloud-based platforms enables remote monitoring and data storage, providing enhanced security and management capabilities.

Challenges in the Europe IP Camera Market Market

Significant challenges include stringent data privacy regulations (GDPR compliance costs approximately €XX Million annually across the industry), supply chain disruptions impacting component availability, and intense competition from established and emerging players. These factors pose challenges to market growth and profitability. Furthermore, the complexity of integrating IP cameras with existing systems can be a barrier for smaller businesses and residences.

Forces Driving Europe IP Camera Market Growth

The market growth is driven by several factors. Technological advancements, such as AI-powered analytics and improved image quality, are key drivers. Economic growth in Europe leads to increased investment in security infrastructure. Government regulations mandating security measures in certain sectors also boost the market. Moreover, the rising demand for remote monitoring capabilities and seamless integration with other security systems fuels market expansion.

Long-Term Growth Catalysts in Europe IP Camera Market

Long-term growth will be fueled by the increasing adoption of AI and ML for enhanced security analytics, the expansion of IoT (Internet of Things) connectivity for better system integration, and strategic partnerships between technology providers and system integrators. Furthermore, expansion into new market segments, like smart agriculture and logistics, will significantly contribute to sustained growth.

Emerging Opportunities in Europe IP Camera Market

Emerging opportunities lie in the development of specialized IP cameras for niche applications, such as thermal imaging for security and industrial automation. Integration of edge computing capabilities for faster and more efficient data processing is also a growing opportunity. Moreover, the increased demand for cybersecurity features and user-friendly interfaces presents significant growth potential for innovative products and services.

Leading Players in the Europe IP Camera Market Sector

- Motorola Solutions Inc. www.motorolasolutions.com

- GeoVision Inc.

- Dahua Technology

- Honeywell HBT

- Johnson Controls

- Hangzhou Hikvision Digital Technology Co Ltd www.hikvision.com

- The Infinova Group

- Samsung www.samsung.com

- Panasonic Holdings Corporation www.panasonic.com

- Sony Corporation www.sony.com

- Bosch Security and Systems www.boschsecurity.com

Key Milestones in Europe IP Camera Market Industry

January 2024: Motorola Solutions Inc. launched the Pelco Spectra Enhanced 8 Series, featuring advanced analytics and auto-tracking capabilities. This launch significantly boosted the company's market position and highlighted the growing demand for enhanced security features.

April 2024: Sony Electronics launched the BRC-AM7, a compact and lightweight 4K 60p PTZ camera with AI-powered auto-framing. This launch demonstrated significant technological advancement and underscored the increasing adoption of AI in IP cameras.

Strategic Outlook for Europe IP Camera Market Market

The Europe IP Camera market holds immense potential for future growth. Strategic opportunities lie in developing innovative products with enhanced AI capabilities, focusing on cybersecurity features, and expanding into new market segments. Companies that effectively leverage technological advancements, build strong partnerships, and prioritize customer needs will be best positioned to capture significant market share in the years to come. The continued demand for robust and intelligent security solutions across diverse sectors ensures a promising long-term outlook for the market.

Europe IP Camera Market Segmentation

-

1. Type

- 1.1. Fixed

- 1.2. Pan-Tilt-Zoom (PTZ)

- 1.3. Varifocal

-

2. End-User Industry

- 2.1. Residential

- 2.2. Commerci

- 2.3. Industrial

- 2.4. Government and Law Enforcement

Europe IP Camera Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Security Threats; Increasing Adoption of IP Cameras Across Various End User Industries; Integration with IoT (Internet of Things) and AI (Artificial Intelligence)

- 3.3. Market Restrains

- 3.3.1. Complexity of Installation and Maintenance; Rising Security Concerns; Compatability Issues with Existing Infrastructure and Systems

- 3.4. Market Trends

- 3.4.1. Commercial Sector to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.2. Pan-Tilt-Zoom (PTZ)

- 5.1.3. Varifocal

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Residential

- 5.2.2. Commerci

- 5.2.3. Industrial

- 5.2.4. Government and Law Enforcement

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Motorola Solutions Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 GeoVision Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Dahua Technolog

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Honeywell HBT

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Johnson Controls

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Hangzhou Hikvision Digital Technology Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Infinova Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Samsung

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Panasonic Holdings Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sony Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Bosch Security and Systems

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Europe IP Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe IP Camera Market Share (%) by Company 2024

List of Tables

- Table 1: Europe IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe IP Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe IP Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Europe IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe IP Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe IP Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe IP Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 15: Europe IP Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe IP Camera Market?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the Europe IP Camera Market?

Key companies in the market include Motorola Solutions Inc, GeoVision Inc, Dahua Technolog, Honeywell HBT, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, The Infinova Group, Samsung, Panasonic Holdings Corporation, Sony Corporation, Bosch Security and Systems.

3. What are the main segments of the Europe IP Camera Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Security Threats; Increasing Adoption of IP Cameras Across Various End User Industries; Integration with IoT (Internet of Things) and AI (Artificial Intelligence).

6. What are the notable trends driving market growth?

Commercial Sector to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Complexity of Installation and Maintenance; Rising Security Concerns; Compatability Issues with Existing Infrastructure and Systems.

8. Can you provide examples of recent developments in the market?

April 2024: Sony Electronics is launching a new flagship 4K 60p pan-tilt-zoom (PTZ) camera called the BRC-AM7 with a built-in lens. The camera features PTZ Auto Framing technology that utilizes artificial intelligence (AI) for improved recognition, making it easier to track moving subjects. The BRC-AM7 holds the title of being the most compact and lightweight integrated lens PTZ camera globally. It is 225.2mm tall (approximately 8.87 inches), 192.3mm deep (about 7.57 inches), and 168.7mm wide (around 6.64 inches). The camera weighs roughly about 8.16 pounds (3.7kg).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe IP Camera Market?

To stay informed about further developments, trends, and reports in the Europe IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence