Key Insights

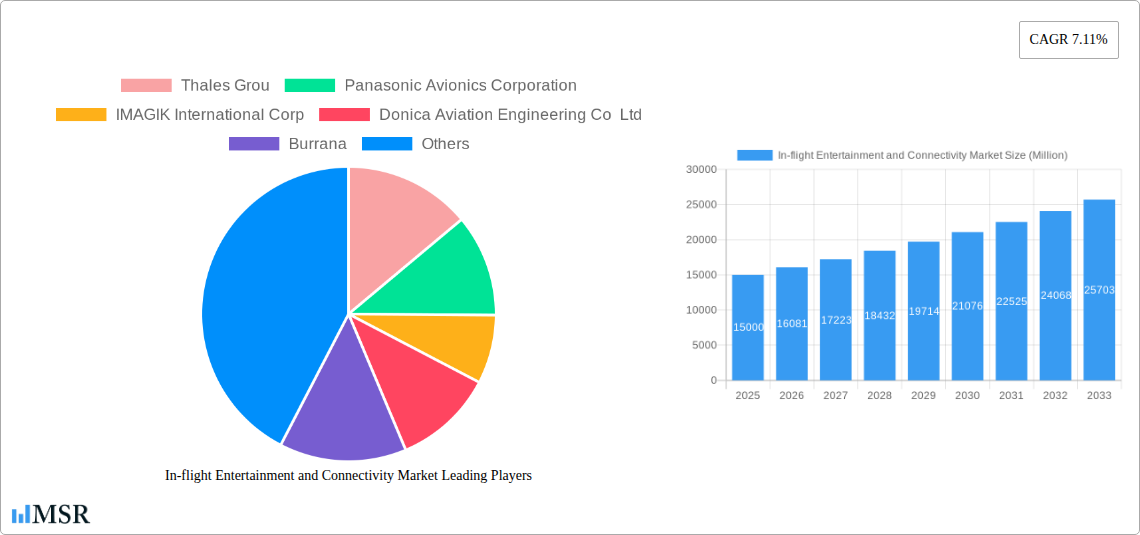

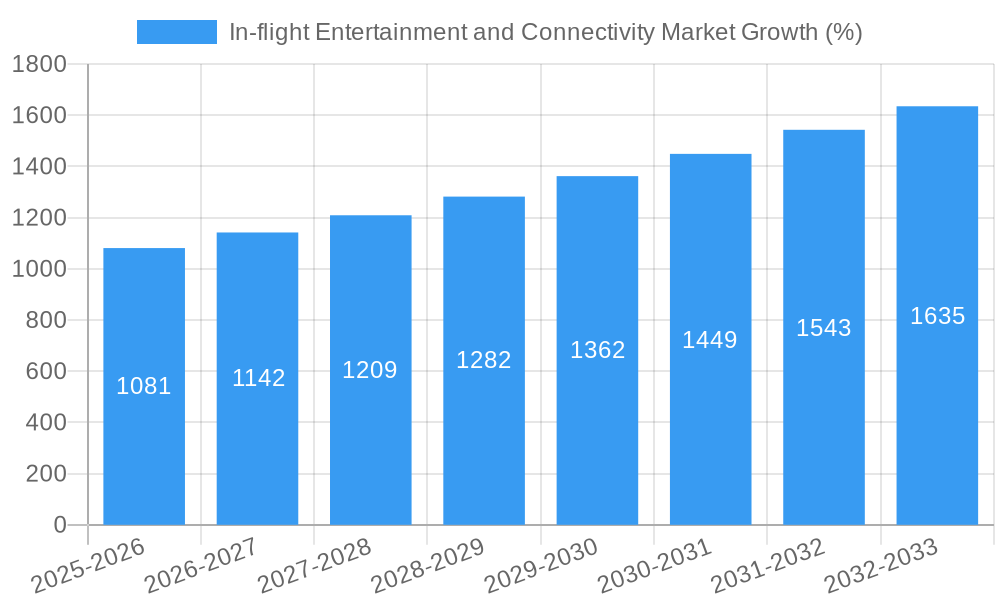

The In-flight Entertainment and Connectivity (IFEC) market is experiencing robust growth, projected to maintain a 7.11% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-speed internet access during flights, coupled with the rising popularity of streaming services and personalized entertainment options, significantly impacts market growth. Airlines are continuously investing in upgrading their IFEC systems to enhance passenger experience and gain a competitive edge. The shift towards more sophisticated and integrated systems, offering seamless connectivity and a broader range of entertainment choices, further contributes to market expansion. Narrow-body aircraft currently dominate the market share due to their higher volume, but the wide-body segment is expected to experience accelerated growth driven by long-haul flights’ increasing demand for premium entertainment and connectivity services. Competition among major players like Thales Group, Panasonic Avionics Corporation, and others is fostering innovation and driving down costs, making IFEC solutions more accessible to a wider range of airlines.

However, market growth is not without challenges. High initial investment costs associated with implementing and maintaining IFEC systems represent a significant barrier for smaller airlines. Furthermore, technological advancements require continuous upgrades, posing ongoing financial commitments for airlines. Maintaining consistent high-speed connectivity across diverse geographical locations and altitudes also remains a technical challenge requiring continuous innovation. Regulatory hurdles and varying bandwidth availability across regions can also impact the deployment and effective functioning of IFEC systems. The market is, therefore, witnessing a trend towards innovative financing models and partnerships to mitigate these challenges and accelerate adoption. This dynamic interplay of growth drivers, technological advancements, and market restraints contributes to the ongoing evolution of the IFEC landscape.

In-flight Entertainment and Connectivity Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the In-flight Entertainment and Connectivity Market, covering the period 2019-2033. It offers actionable insights into market dynamics, key players, emerging trends, and future growth opportunities, equipping stakeholders with the knowledge necessary to navigate this rapidly evolving sector. The report leverages extensive data analysis, industry expert interviews, and case studies to deliver a clear and concise overview of the market landscape. With a focus on key segments like Narrowbody and Widebody aircraft, this report is a must-have for airlines, equipment manufacturers, and investors seeking to understand and capitalize on the potential of this lucrative market. The estimated market size in 2025 is xx Million, with a projected CAGR of xx% from 2025 to 2033.

In-flight Entertainment and Connectivity Market Market Concentration & Dynamics

The In-flight Entertainment and Connectivity (IFEC) market exhibits a moderately concentrated landscape, with several major players holding significant market share. The market share of the top five players is estimated at xx%, indicating a level of consolidation. However, the presence of numerous smaller niche players ensures a dynamic competitive environment. Innovation is a key driver, with companies constantly developing advanced technologies such as high-speed internet access, personalized entertainment options, and enhanced user interfaces. Regulatory frameworks, particularly those related to data privacy and security, significantly impact market operations. Substitute products, such as personal devices and streaming services, pose a degree of competitive pressure. End-user trends, including increasing demand for high-quality connectivity and personalized entertainment experiences, shape market demand. Mergers and acquisitions (M&A) activity within the IFEC sector remains fairly active. In the historical period (2019-2024), approximately xx M&A deals were recorded, suggesting a trend toward consolidation and expansion.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation: Focus on high-speed internet, personalized entertainment, improved user interfaces.

- Regulatory Landscape: Data privacy and security regulations are key considerations.

- Substitute Products: Competition from personal devices and streaming services.

- End-User Trends: Increasing demand for high-quality connectivity and personalized experiences.

- M&A Activity: Approximately xx M&A deals in 2019-2024.

In-flight Entertainment and Connectivity Market Industry Insights & Trends

The In-flight Entertainment and Connectivity market is experiencing robust growth, driven by several key factors. The increasing adoption of high-speed broadband internet on aircraft is a primary driver, facilitating seamless connectivity for passengers. Technological disruptions, including the introduction of 5G and satellite-based internet solutions, are transforming the IFEC landscape. Evolving consumer behaviors, such as the expectation of ubiquitous connectivity and personalized entertainment, are further fueling market expansion. The global IFEC market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth trajectory is underpinned by rising passenger numbers, particularly in the Asia-Pacific region, coupled with continuous technological advancements within the IFEC sector. Furthermore, airlines are increasingly recognizing the value proposition of superior IFEC offerings in enhancing passenger satisfaction and loyalty, contributing to the market’s overall expansion.

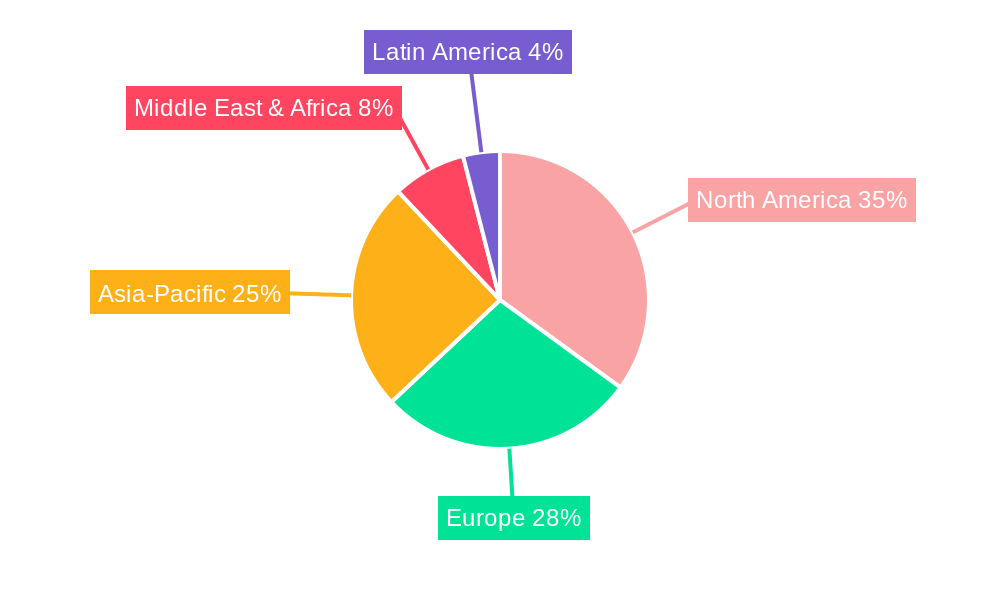

Key Markets & Segments Leading In-flight Entertainment and Connectivity Market

The In-flight Entertainment and Connectivity market displays significant regional variations in growth and adoption rates. While precise market share figures for individual regions and segments are subject to proprietary data, the North American and European markets consistently represent sizable portions of the global IFEC sector due to robust air travel and a high concentration of leading IFEC providers. Within aircraft types, the widebody segment commands a larger market share compared to narrowbody aircraft, predominantly due to the higher passenger capacity and longer flight durations of widebody aircraft. This translates into a greater need for robust and sophisticated IFEC systems.

Drivers for Widebody Segment Dominance:

- Higher Passenger Capacity: Necessitates more extensive IFEC systems.

- Longer Flight Durations: Increased demand for entertainment and connectivity.

- Premium Passenger Experience: Widebodies often cater to premium travelers demanding superior connectivity.

Drivers for Narrowbody Segment Growth:

- Cost-Effective Solutions: Development of affordable IFEC solutions for narrowbody aircraft.

- Increased Demand for Connectivity: Passengers increasingly expect connectivity even on shorter flights.

- Growing Low-Cost Carrier (LCC) Market: LCCs are investing in basic IFEC systems.

In-flight Entertainment and Connectivity Market Product Developments

Recent years have witnessed significant advancements in IFEC technology. The introduction of high-bandwidth satellite communication systems enables streaming of high-definition video and other data-intensive content. The development of user-friendly interfaces enhances the passenger experience, while innovative features such as personalized content recommendations and interactive games create engaging experiences. The integration of IFEC with other aircraft systems, such as cabin management systems, provides airlines with operational efficiency gains. These developments are enhancing the competitive landscape, leading to a continuous improvement in the quality and diversity of in-flight entertainment and connectivity offerings.

Challenges in the In-flight Entertainment and Connectivity Market Market

The IFEC market faces several challenges. High initial investment costs for installing and maintaining advanced IFEC systems can be a barrier for some airlines, especially smaller carriers. Supply chain disruptions, particularly those impacting semiconductor availability, can significantly affect the production and delivery of IFEC equipment. Intense competition amongst IFEC providers can lead to price pressures and reduced profit margins. Regulatory hurdles related to spectrum allocation and data security also pose significant challenges to market expansion. The cumulative impact of these challenges creates uncertainty and potentially limits market growth to some degree.

Forces Driving In-flight Entertainment and Connectivity Market Growth

The In-flight Entertainment and Connectivity market is propelled by several factors. Technological advancements, including the adoption of high-bandwidth satellite communication and 5G, are enabling improved connectivity and enhanced entertainment options. Economic growth globally fuels increased air travel, creating higher demand for IFEC services. Favorable regulatory policies that promote broadband availability in the skies further contribute to market growth. The rising demand for personalized and interactive in-flight experiences among passengers is a key driver of market expansion.

Challenges in the In-flight Entertainment and Connectivity Market Market

Long-term growth hinges on sustained innovation in IFEC technology, strategic partnerships between airlines and IFEC providers, and expansion into new market segments. The development of lightweight and energy-efficient IFEC equipment will be crucial for reducing operational costs. Exploring new avenues like incorporating augmented reality and virtual reality experiences into IFEC systems can unlock new growth opportunities.

Emerging Opportunities in In-flight Entertainment and Connectivity Market

Emerging opportunities abound within the IFEC sector. The increasing demand for high-speed internet access on shorter-haul flights presents a significant opportunity. The adoption of advanced technologies, such as artificial intelligence (AI) for personalized content recommendations, presents further avenues for growth. The expansion into new geographic markets, particularly in rapidly growing economies, will also yield significant opportunities. Focus on enhancing the passenger experience beyond traditional entertainment and into areas such as interactive shopping and personalized travel assistance creates considerable potential.

Leading Players in the In-flight Entertainment and Connectivity Market Sector

- Thales Group

- Panasonic Avionics Corporation

- IMAGIK International Corp

- Donica Aviation Engineering Co Ltd

- Burrana

- Latecoere

- Northern Avionics srl

Key Milestones in In-flight Entertainment and Connectivity Market Industry

- September 2022: Emirates selected Thales’ AVANT Up IFEC system for its new Airbus A350 fleet, signifying a significant win for Thales and highlighting the demand for next-generation IFEC solutions.

- June 2022: Qatar Airways partnered with Panasonic Avionics for Astrova IFEC on its Boeing 777x fleet, showcasing the ongoing collaboration between airlines and IFEC providers.

- June 2022: Recaro Aircraft Seating and Panasonic Avionics collaborated on a new seat-end IFEC solution for the CL3810 economy class seat, indicating the trend towards integrated IFEC solutions.

Strategic Outlook for In-flight Entertainment and Connectivity Market Market

The future of the In-flight Entertainment and Connectivity market appears bright, driven by continuous technological advancements, rising passenger expectations, and ongoing strategic partnerships within the industry. The market's potential for growth is substantial, driven by both the expansion of air travel and the evolution of IFEC technologies. Companies that can effectively leverage these trends, particularly those focusing on innovation, personalized experiences, and seamless connectivity, are best positioned to capture significant market share and drive future growth.

In-flight Entertainment and Connectivity Market Segmentation

-

1. Aircraft Type

- 1.1. Narrowbody

- 1.2. Widebody

In-flight Entertainment and Connectivity Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

In-flight Entertainment and Connectivity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-flight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Narrowbody

- 5.1.2. Widebody

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America In-flight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Narrowbody

- 6.1.2. Widebody

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America In-flight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Narrowbody

- 7.1.2. Widebody

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe In-flight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Narrowbody

- 8.1.2. Widebody

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa In-flight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Narrowbody

- 9.1.2. Widebody

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific In-flight Entertainment and Connectivity Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Narrowbody

- 10.1.2. Widebody

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thales Grou

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Panasonic Avionics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IMAGIK International Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Donica Aviation Engineering Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Burrana

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Latecoere

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northern Avionics srl

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Thales Grou

List of Figures

- Figure 1: Global In-flight Entertainment and Connectivity Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America In-flight Entertainment and Connectivity Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 3: North America In-flight Entertainment and Connectivity Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 4: North America In-flight Entertainment and Connectivity Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America In-flight Entertainment and Connectivity Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America In-flight Entertainment and Connectivity Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 7: South America In-flight Entertainment and Connectivity Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 8: South America In-flight Entertainment and Connectivity Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America In-flight Entertainment and Connectivity Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe In-flight Entertainment and Connectivity Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 11: Europe In-flight Entertainment and Connectivity Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 12: Europe In-flight Entertainment and Connectivity Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe In-flight Entertainment and Connectivity Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa In-flight Entertainment and Connectivity Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 15: Middle East & Africa In-flight Entertainment and Connectivity Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 16: Middle East & Africa In-flight Entertainment and Connectivity Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa In-flight Entertainment and Connectivity Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific In-flight Entertainment and Connectivity Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 19: Asia Pacific In-flight Entertainment and Connectivity Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 20: Asia Pacific In-flight Entertainment and Connectivity Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific In-flight Entertainment and Connectivity Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 5: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 10: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 15: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 26: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 34: Global In-flight Entertainment and Connectivity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific In-flight Entertainment and Connectivity Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-flight Entertainment and Connectivity Market?

The projected CAGR is approximately 7.11%.

2. Which companies are prominent players in the In-flight Entertainment and Connectivity Market?

Key companies in the market include Thales Grou, Panasonic Avionics Corporation, IMAGIK International Corp, Donica Aviation Engineering Co Ltd, Burrana, Latecoere, Northern Avionics srl.

3. What are the main segments of the In-flight Entertainment and Connectivity Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: Emirates has selected Thales’ AVANT Up, the next generation inflight entertainment system for their new fleet of Airbus A350s.June 2022: Qatar Airways Signs Deal With Panasonic Avionics To Provide Astrova for Boeing 777x Fleet.June 2022: Recaro Aircraft Seating partnered with Panasonic Avionics Corporation (Panasonic Avionics) to unveil a new in-flight entertainment seat-end solution installed on the CL3810 economy class seat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-flight Entertainment and Connectivity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-flight Entertainment and Connectivity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-flight Entertainment and Connectivity Market?

To stay informed about further developments, trends, and reports in the In-flight Entertainment and Connectivity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence