Key Insights

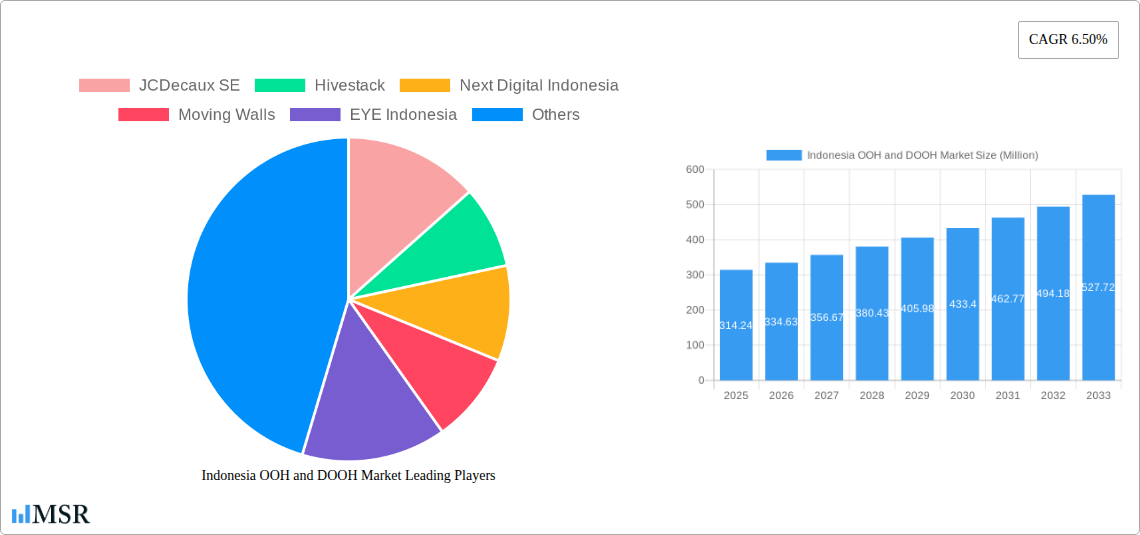

The Indonesian Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market exhibits robust growth potential, projected to reach a market size of $314.24 million in 2025, fueled by a Compound Annual Growth Rate (CAGR) of 6.50%. This expansion is driven by several key factors. Firstly, Indonesia's burgeoning digital economy and increasing smartphone penetration are creating fertile ground for DOOH's expansion. Secondly, the rising urban population and increasing consumer spending are boosting overall advertising expenditure, with OOH and DOOH benefiting from their high visibility and impact. Thirdly, advancements in technology, such as programmatic buying and data-driven targeting, are enhancing the effectiveness and measurability of DOOH campaigns, attracting more advertisers. Finally, innovative OOH formats, such as interactive billboards and mobile-integrated campaigns, are capturing consumer attention and driving engagement. Despite these positive trends, challenges remain, including the need for improved infrastructure in certain regions and addressing concerns about environmental impact. Companies like JCDecaux SE, Hivestack, and others are actively shaping the market landscape through strategic partnerships, technological investments, and expansion efforts.

Indonesia OOH and DOOH Market Market Size (In Million)

The forecast period of 2025-2033 promises continued growth, albeit potentially at a slightly moderated pace due to macroeconomic factors and competitive pressures. The segmentation within the market, though not explicitly detailed, likely includes various formats like billboards, transit advertising, street furniture, and digital screens located in malls, airports, and other high-traffic areas. Regional variations in market penetration are expected, with more developed urban centers driving a larger proportion of the overall market value. Successful players will need to adapt to evolving consumer preferences, invest in data analytics for precise targeting, and embrace sustainable practices to navigate the challenges and fully capitalize on the significant opportunities presented by this dynamic market. Continuous innovation and strategic partnerships are crucial for long-term success in the competitive Indonesian OOH and DOOH advertising landscape.

Indonesia OOH and DOOH Market Company Market Share

Indonesia OOH and DOOH Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, covering the period from 2019 to 2033. With a focus on market dynamics, key players, and emerging trends, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand the growth potential of this dynamic sector. The report leverages extensive data analysis to provide actionable insights and forecasts, including market size estimations and Compound Annual Growth Rates (CAGR).

Indonesia OOH and DOOH Market Market Concentration & Dynamics

This section assesses the competitive landscape, innovation drivers, and regulatory factors influencing the Indonesian OOH and DOOH market from 2019-2024. We analyze market concentration, identifying key players and their respective market shares (estimated at xx Million for the top 5 players in 2025). The report examines the innovation ecosystem, including technological advancements and their impact on market dynamics. Furthermore, we delve into the regulatory frameworks governing OOH and DOOH advertising in Indonesia, assessing their influence on market growth. The impact of substitute advertising methods and evolving end-user trends are also scrutinized. Finally, the report explores M&A activity within the sector, quantifying deal counts and their implications for market consolidation.

- Market Share: A detailed breakdown of market share among key players (JCDecaux SE, Hivestack, Next Digital Indonesia, Moving Walls, EYE Indonesia, Plan B Media Public Company Limited, VIOOH, Vistar Media, Jaris & K, Pixel Group, and others) for the period 2019-2024, with projections for 2025 and beyond.

- M&A Activity: Analysis of merger and acquisition activity, including the number of deals and their aggregate value (estimated at xx Million) in the historical and forecast periods.

- Regulatory Landscape: An in-depth assessment of the regulatory environment and its effect on market growth.

- Innovation Ecosystem: Evaluation of technological advancements and their integration into the OOH and DOOH industry.

Indonesia OOH and DOOH Market Industry Insights & Trends

This section provides a detailed overview of the Indonesian OOH and DOOH market's growth trajectory. We analyze market size, estimating it to reach xx Million in 2025 and projecting a CAGR of xx% from 2025 to 2033. The report will explore key growth drivers, including urbanization, rising disposable incomes, increasing digital adoption, and the expansion of programmatic advertising. Moreover, the impact of technological disruptions, such as the integration of data analytics and AI, will be assessed. The report further explores shifting consumer behaviors and their influence on OOH and DOOH advertising strategies.

Key Markets & Segments Leading Indonesia OOH and DOOH Market

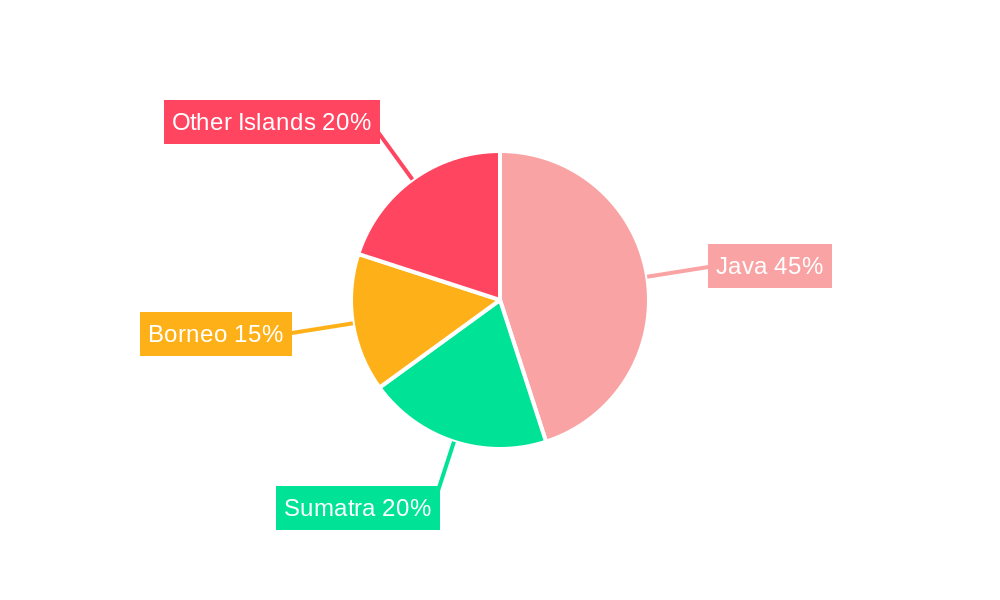

This section identifies the dominant regions, cities, and segments within the Indonesian OOH and DOOH market. We will analyze the factors contributing to the dominance of specific areas, providing a comprehensive understanding of regional variations in market size and growth rates.

- Dominant Regions/Cities: Jakarta, Surabaya, Bandung, and other major metropolitan areas are analyzed, assessing their respective contributions to market size.

- Growth Drivers:

- Economic Growth: Analysis of the correlation between economic growth and OOH/DOOH advertising expenditure.

- Infrastructure Development: Examination of the role of improved infrastructure (e.g., transportation networks, digital infrastructure) in driving market growth.

- Population Density: Correlation between population density and the effectiveness of OOH/DOOH campaigns.

- Tourism: Impact of tourism on OOH and DOOH advertising demand.

Indonesia OOH and DOOH Market Product Developments

This section will cover the latest innovations in OOH and DOOH advertising products and technologies in Indonesia. It highlights advancements in digital display technology, programmatic advertising platforms, and data analytics solutions, illustrating their impact on enhancing campaign effectiveness and targeting precision. The competitive landscape shaped by these technological advancements is also analyzed.

Challenges in the Indonesia OOH and DOOH Market Market

This section identifies key challenges facing the Indonesian OOH and DOOH market. These include regulatory hurdles potentially impacting permit acquisition and campaign execution, supply chain disruptions affecting the availability of advertising inventory, and intense competition among advertising agencies and technology providers. The quantifiable impacts of these challenges on market growth are also discussed.

Forces Driving Indonesia OOH and DOOH Market Growth

This section identifies key factors driving the long-term growth of the Indonesian OOH and DOOH market. These include technological advancements (e.g., improved screen resolution, interactive displays), economic factors (e.g., rising consumer spending, increased disposable income), and supportive regulatory environments that foster innovation and investment. Specific examples of these factors are provided.

Challenges in the Indonesia OOH and DOOH Market Market

This section will analyze long-term catalysts contributing to sustainable growth within the Indonesian OOH/DOOH market. This includes strategic partnerships that foster innovation and market expansion, as well as technological advancements that create new advertising opportunities.

Emerging Opportunities in Indonesia OOH and DOOH Market

This section explores emerging trends and opportunities within the Indonesian OOH and DOOH market. These include the expansion into new markets (e.g., smaller cities, rural areas), the adoption of innovative technologies (e.g., augmented reality, virtual reality), and catering to evolving consumer preferences for personalized and interactive advertising experiences.

Leading Players in the Indonesia OOH and DOOH Market Sector

- JCDecaux SE

- Hivestack

- Next Digital Indonesia

- Moving Walls

- EYE Indonesia

- Plan B Media Public Company Limited

- VIOOH

- Vistar Media

- Jaris & K

- Pixel Group

- List Not Exhaustive

Key Milestones in Indonesia OOH and DOOH Market Industry

- July 2024: Magnite, in collaboration with Dentsu Indonesia, achieved a 100% share of voice (SOV) with a programmatic roadblock campaign on Viu, Vidio, and WeTV, highlighting the growing importance of programmatic advertising in the Indonesian DOOH market. Concurrently, Nestlé Indonesia leveraged streaming platforms to promote its new NESCAFÉ Biscuit Coffee.

- April 2024: inDrive partnered with The Perfect Media for outdoor advertising campaigns in Jakarta and other key cities and implemented mall branding at Central Mall Bandar Lampung, showcasing the effectiveness of targeted OOH campaigns.

Strategic Outlook for Indonesia OOH and DOOH Market Market

The Indonesian OOH and DOOH market presents significant growth potential driven by increasing digitalization, rising consumer spending, and the expansion of programmatic advertising. Strategic opportunities lie in leveraging data analytics for targeted campaigns, investing in innovative technologies, and forming strategic partnerships to expand market reach and enhance campaign effectiveness. The long-term outlook remains positive, with the market poised for sustained growth in the coming years.

Indonesia OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Digital OOH

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Other Transportation (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Indonesia OOH and DOOH Market Segmentation By Geography

- 1. Indonesia

Indonesia OOH and DOOH Market Regional Market Share

Geographic Coverage of Indonesia OOH and DOOH Market

Indonesia OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Digital OOH

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Other Transportation (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hivestack

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Next Digital Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moving Walls

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EYE Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Plan B Media Public Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VIOOH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vistar Media

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jaris & K

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pixel Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: Indonesia OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Indonesia OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Indonesia OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Indonesia OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Indonesia OOH and DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Indonesia OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Indonesia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Indonesia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Indonesia OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Indonesia OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 13: Indonesia OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Indonesia OOH and DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Indonesia OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia OOH and DOOH Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Indonesia OOH and DOOH Market?

Key companies in the market include JCDecaux SE, Hivestack, Next Digital Indonesia, Moving Walls, EYE Indonesia, Plan B Media Public Company Limited, VIOOH, Vistar Media, Jaris & K, Pixel Group*List Not Exhaustive.

3. What are the main segments of the Indonesia OOH and DOOH Market?

The market segments include Type, Application, End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 314.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

8. Can you provide examples of recent developments in the market?

July 2024: Magnite, in collaboration with Dentsu Indonesia, rolled out a programmatic roadblock campaign on Indonesia's top streaming platforms – Viu, Vidio, and WeTV. This strategic move secured Magnite a 100% share of voice (SOV), ensuring unparalleled brand exposure. Concurrently, Nestlé Indonesia unveiled its latest offering, the limited-edition NESCAFÉ Biscuit Coffee featuring Marie Regal Biscuit. Recognizing the surging popularity of streaming platforms, Nestlé Indonesia partnered with Magnite and Dentsu Indonesia to amplify its audience reach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Indonesia OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence