Key Insights

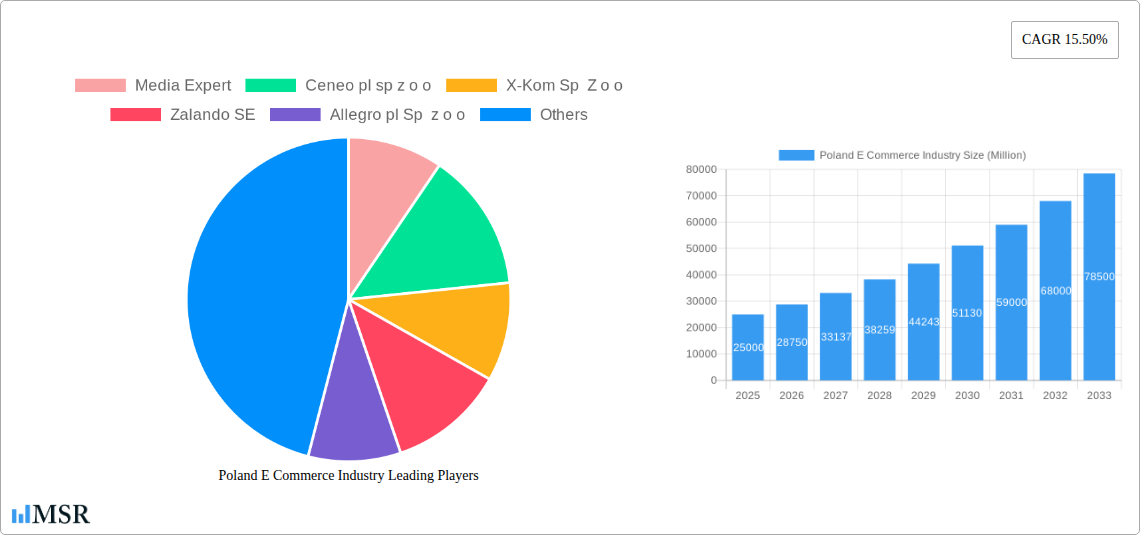

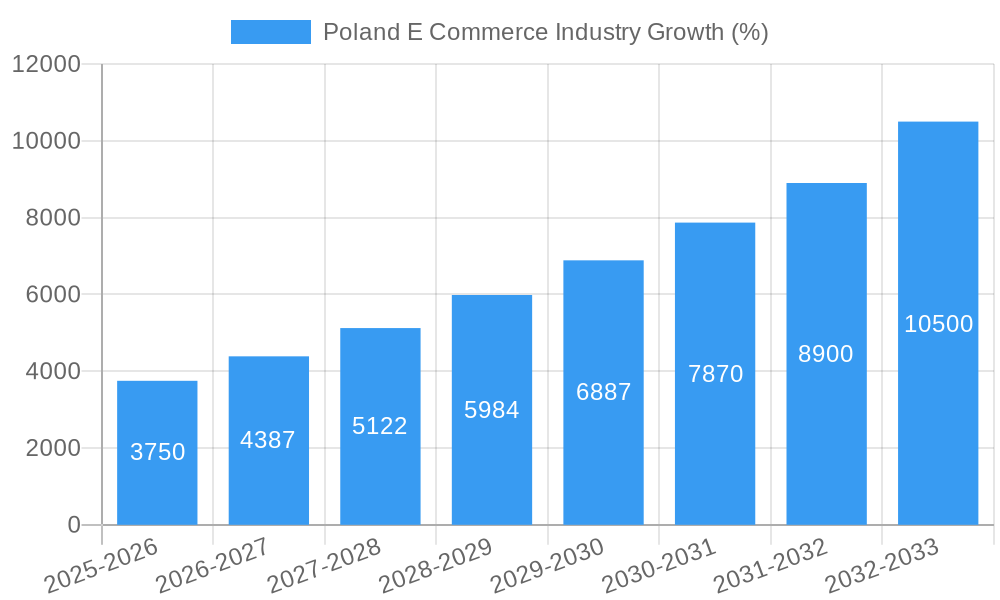

The Polish e-commerce market exhibits robust growth, fueled by increasing internet and smartphone penetration, rising disposable incomes, and a shift in consumer preferences towards online shopping convenience. The market's Compound Annual Growth Rate (CAGR) of 15.50% from 2019 to 2024 suggests a significant expansion, indicating a thriving digital economy. Key drivers include the expansion of logistics infrastructure, a growing number of online marketplaces and retailers offering competitive pricing and diverse product selections, and the increasing adoption of digital payment methods. Popular categories driving growth likely include electronics, apparel, and groceries, mirroring global e-commerce trends. While challenges such as cybersecurity concerns and the need for improved digital literacy among some demographics exist, the overall market trajectory remains positive. The competitive landscape is dynamic, with established players like Allegro, Media Expert, and Ceneo competing alongside international giants like Zalando. The dominance of these players indicates a mature but still rapidly evolving market, primed for further innovation and growth in areas like mobile commerce and personalized shopping experiences.

Looking ahead, the forecast period of 2025-2033 anticipates continued expansion, albeit potentially at a slightly moderated pace as the market matures. Factors such as inflation and global economic uncertainties could influence growth rates. However, the strong underlying fundamentals—a young and tech-savvy population, increasing urbanization, and government initiatives promoting digitalization—suggest continued positive growth. Continued investment in logistics and payment infrastructure will be vital to further expansion. Market segmentation by application (e.g., fashion, electronics, groceries) will likely show varied growth rates, with some sectors experiencing faster expansion than others. The competitive landscape will remain intense, necessitating strategic investments in technology, customer service, and marketing to maintain market share.

Poland E-Commerce Industry Report: 2019-2033

This comprehensive report provides a deep dive into the dynamic Polish e-commerce market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this analysis unveils market concentration, growth drivers, emerging trends, and key players shaping the future of Polish online retail. The report projects a market size of xx Million in 2025 and a CAGR of xx% during the forecast period (2025-2033).

Poland E-Commerce Industry Market Concentration & Dynamics

The Polish e-commerce landscape is characterized by a blend of established giants and emerging players. Allegro.pl Sp z o.o holds a significant market share, estimated at xx%, followed by other key players like Media Expert, Ceneo.pl sp z o.o, and X-Kom Sp Z o.o. The market exhibits moderate concentration, with the top 5 players accounting for approximately xx% of the total revenue. Innovation is driven by a burgeoning fintech sector and government initiatives promoting digitalization. The regulatory framework, while generally supportive, faces ongoing evolution to address data privacy and consumer protection concerns. Substitute products, particularly from traditional brick-and-mortar retailers with enhanced online presence, exert competitive pressure. End-user trends show a strong preference for mobile commerce and a growing demand for personalized experiences. M&A activity has been relatively consistent, with an average of xx deals per year during the historical period (2019-2024).

- Market Share: Allegro.pl Sp z o.o (xx%), Media Expert (xx%), Ceneo.pl sp z o.o (xx%), X-Kom Sp Z o.o (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

Poland E-Commerce Industry Insights & Trends

The Polish e-commerce market has witnessed robust growth, driven by factors such as rising internet and smartphone penetration, increasing disposable incomes, and a shift towards online shopping habits. Technological disruptions, particularly in areas like mobile payments, AI-powered personalization, and advanced logistics, are reshaping the industry. Consumers increasingly value convenience, speed, and seamless omnichannel experiences. The market size is projected to reach xx Million by 2025, indicating a strong growth trajectory. Emerging trends include the rise of social commerce, the growing popularity of subscription boxes, and the increasing adoption of e-commerce solutions by small and medium-sized enterprises (SMEs). The increasing use of Big Data analytics for improved customer segmentation and targeted marketing initiatives plays a critical role in the success of leading Polish eCommerce players.

Key Markets & Segments Leading Poland E-Commerce Industry

While nationwide penetration is high, urban areas exhibit higher e-commerce adoption rates due to improved infrastructure and digital literacy. Key growth drivers across segments include:

- Economic Growth: Rising disposable incomes fuel increased online spending.

- Improved Infrastructure: Enhanced logistics and internet connectivity facilitate faster delivery and smoother online experiences.

- Government Initiatives: Policies supporting digitalization and e-commerce further stimulate market growth.

The dominance of specific segments within the "Market Segmentation - by Application" category requires further data to be accurately described. Currently, a balanced distribution across various application areas is observed, with no single segment dominating completely. This presents opportunities for diverse players to establish niche expertise and gain a competitive advantage.

Poland E-Commerce Industry Product Developments

Significant product innovations include the adoption of advanced analytics for personalized recommendations, the integration of AR/VR technologies for enhanced product visualization, and the utilization of AI-powered chatbots for improved customer service. These developments offer competitive advantages by enhancing customer experience and driving sales conversions. The emphasis remains on improving delivery speed and efficiency, reducing shopping cart abandonment, and offering convenient payment options.

Challenges in the Poland E-Commerce Industry Market

The Polish e-commerce market faces several challenges, including evolving regulatory landscapes, particularly concerning data privacy and cross-border e-commerce regulations. Supply chain disruptions, impacting delivery times and costs, pose significant hurdles. Intense competition from established players and the entry of new international entrants creates a highly contested market environment. Logistics costs and cyber security threats also need consideration.

Forces Driving Poland E-Commerce Industry Growth

Key growth drivers include:

- Technological Advancements: Continued improvements in mobile technology, payment systems, and logistics infrastructure.

- Economic Growth: Rising disposable incomes and increased consumer confidence.

- Government Support: Policies fostering digitalization and e-commerce.

Examples include the expansion of high-speed internet access and the government's initiatives to support digital entrepreneurship.

Long-Term Growth Catalysts in the Poland E-Commerce Industry

Long-term growth will be fueled by the continued adoption of innovative technologies such as AI and blockchain, strategic partnerships between e-commerce platforms and logistics providers, and expansion into underserved rural markets.

Emerging Opportunities in Poland E-Commerce Industry

Emerging opportunities include:

- Niche Market Penetration: Targeting specific demographic segments with tailored products and services.

- Cross-border E-commerce: Expanding into neighboring markets.

- Sustainable E-commerce: Offering eco-friendly products and packaging.

Leading Players in the Poland E-Commerce Industry Sector

- Allegro pl Sp z o o

- Media Expert

- Ceneo pl sp z o o

- X-Kom Sp Z o o

- Zalando SE

- Empik S A

- Olx Poland

- Otomoto Poland

- Zoo Plus AG

Key Milestones in Poland E-Commerce Industry

- April 2022: MAXIMA GRUPĖ's Barbora launched operations in Poland, expanding the online grocery market. The subsequent invasion of Ukraine significantly impacted its operations.

- April 2022: eBay announced its return to the Polish market, aiming to become a top-three e-commerce platform.

Strategic Outlook for Poland E-Commerce Industry Market

The Polish e-commerce market holds significant future potential, driven by ongoing technological advancements, supportive government policies, and a growing consumer base. Strategic opportunities lie in leveraging innovative technologies to enhance customer experience, expanding into new market segments, and fostering strategic alliances to strengthen market positioning. Companies with agile strategies and a focus on customer-centric solutions are well-positioned for success in this dynamic market.

Poland E Commerce Industry Segmentation

-

1. B2C E-Commerce

- 1.1. Fashion & Apparel

- 1.2. Consumer Electronics

- 1.3. Beauty & Personal Care

- 1.4. Food & Beverage

-

2. B2B E-Commerce

- 2.1. Enterprise software

- 2.2. hardware

- 2.3. supplies

Poland E Commerce Industry Segmentation By Geography

- 1. Poland

Poland E Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Different pandemic strategies for large and small retailers; Digital literacy drives digital commerce; New regulations boost consumer trust across all channels

- 3.3. Market Restrains

- 3.3.1. Falling Average Selling Prices of Sensor Components Affecting New Market Entrants

- 3.4. Market Trends

- 3.4.1. Fashion Industry Plays an Important Role in Poland E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Fashion & Apparel

- 5.1.2. Consumer Electronics

- 5.1.3. Beauty & Personal Care

- 5.1.4. Food & Beverage

- 5.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 5.2.1. Enterprise software

- 5.2.2. hardware

- 5.2.3. supplies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Media Expert

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ceneo pl sp z o o

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 X-Kom Sp Z o o

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalando SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Allegro pl Sp z o o

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Empik S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Olx Poland

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Otomoto Poland

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zoo Plus AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Media Expert

List of Figures

- Figure 1: Poland E Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland E Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Poland E Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 3: Poland E Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2019 & 2032

- Table 4: Poland E Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Poland E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Poland E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 7: Poland E Commerce Industry Revenue Million Forecast, by B2B E-Commerce 2019 & 2032

- Table 8: Poland E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland E Commerce Industry?

The projected CAGR is approximately 15.50%.

2. Which companies are prominent players in the Poland E Commerce Industry?

Key companies in the market include Media Expert, Ceneo pl sp z o o, X-Kom Sp Z o o, Zalando SE, Allegro pl Sp z o o, Empik S A, Olx Poland, Otomoto Poland, Zoo Plus AG.

3. What are the main segments of the Poland E Commerce Industry?

The market segments include B2C E-Commerce, B2B E-Commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Different pandemic strategies for large and small retailers; Digital literacy drives digital commerce; New regulations boost consumer trust across all channels.

6. What are the notable trends driving market growth?

Fashion Industry Plays an Important Role in Poland E-commerce Sector.

7. Are there any restraints impacting market growth?

Falling Average Selling Prices of Sensor Components Affecting New Market Entrants.

8. Can you provide examples of recent developments in the market?

April 2022 - MAXIMA GRUPĖ's e-commerce operator Barbora launched operations in Poland in 2021 and successfully met a further increase in demand for online grocery shopping in the Baltics. The invasion of Ukraine by the military forces of the Russian Federation brought a new focus on MAXIMA GRUPĖ's efforts and challenges for the year 2022. Also, MAXIMA GRUPĖ announced to continue its expansion in Poland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland E Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland E Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland E Commerce Industry?

To stay informed about further developments, trends, and reports in the Poland E Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence