Key Insights

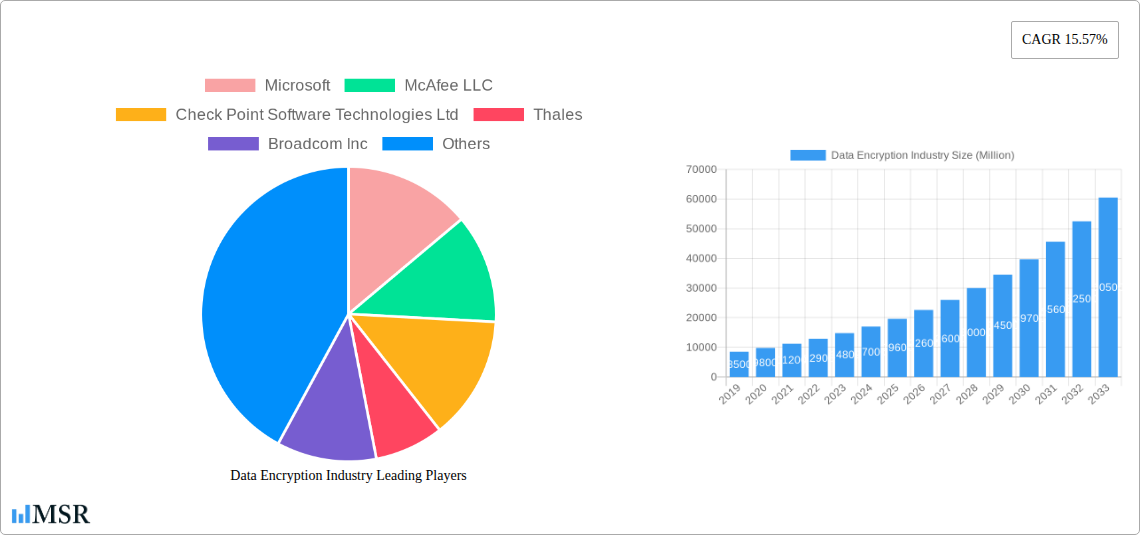

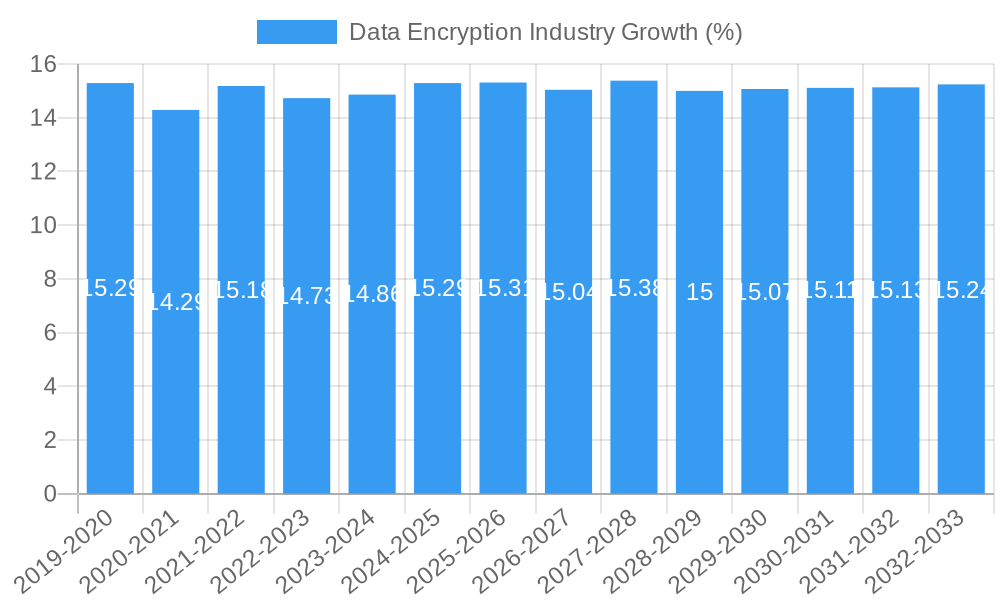

The global data encryption market is poised for substantial expansion, projected to reach an estimated market size of approximately $25,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15.57% anticipated throughout the forecast period of 2025-2033. This impressive growth is primarily fueled by escalating data volumes across enterprises and the growing imperative for stringent data protection and regulatory compliance. Key drivers include the increasing sophistication of cyber threats, the proliferation of cloud computing, and the rising adoption of encryption solutions for sensitive data across various industries. The market is also significantly influenced by stringent data privacy regulations such as GDPR and CCPA, compelling organizations to invest in robust encryption technologies to safeguard customer and proprietary information.

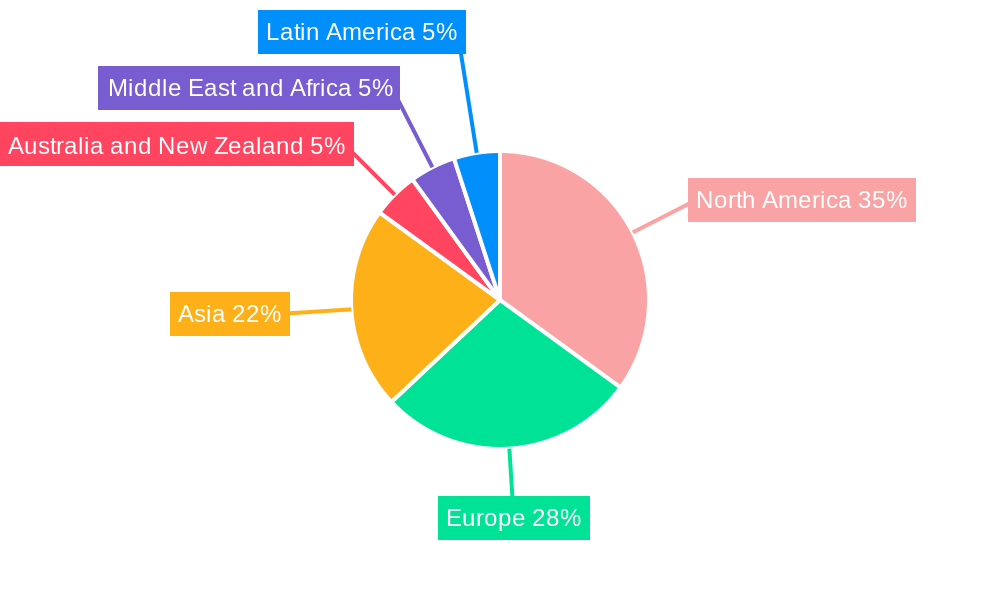

The data encryption landscape is characterized by a diversified set of solutions catering to distinct needs. Software and service segments are expected to witness strong demand, with cloud-based encryption solutions emerging as a dominant trend due to their scalability, flexibility, and cost-effectiveness. Large enterprises and small to medium-sized businesses (SMBs) alike are actively adopting encryption for disk, communication, file/folder, cloud, and database security. Geographically, North America is anticipated to lead the market, driven by early adoption of advanced technologies and a strong regulatory framework. However, the Asia-Pacific region is expected to exhibit the highest growth rate, propelled by rapid digital transformation, increasing cybersecurity awareness, and a growing number of data-intensive industries. Key players like Microsoft, McAfee, Check Point, and Thales are actively innovating and expanding their offerings to capitalize on this expanding market.

Unlock the Future of Data Security: Comprehensive Data Encryption Industry Market Report (2019–2033)

Gain unparalleled insights into the burgeoning Data Encryption Industry with this definitive market intelligence report. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a robust forecast period from 2025 to 2033, this report provides actionable intelligence for data encryption solutions, cybersecurity, data protection, and cloud security stakeholders. Dive deep into market dynamics, identify growth drivers, and understand the competitive landscape shaping the future of data security. This report is meticulously crafted for industry leaders, IT professionals, security experts, and investors seeking to navigate the complexities and opportunities within the global data encryption market.

Data Encryption Industry Market Concentration & Dynamics

The Data Encryption Industry exhibits a dynamic market concentration, characterized by a blend of established giants and agile innovators. The innovation ecosystem is flourishing, driven by increasing sophisticated cyber threats and evolving data privacy regulations worldwide. Key players are continuously investing in research and development, fostering a competitive environment where advancements in encryption algorithms, key management systems, and zero-trust security are paramount. Regulatory frameworks, such as GDPR and CCPA, are significantly influencing market dynamics, compelling organizations to adopt robust data protection measures. Substitute products, while present in the form of basic access controls, lack the comprehensive security offered by advanced encryption. End-user trends are leaning towards cloud-native encryption solutions and pervasive encryption across all data touchpoints. Mergers and acquisitions (M&A) activity is a notable driver of market consolidation, with an estimated XX M&A deals observed in the historical period, significantly impacting market share and technological integration. The market size is projected to reach $XX Billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX%.

- Market Share: Dominated by a few key players with significant market presence.

- Innovation Ecosystem: Rapid advancements in quantum-resistant encryption and homomorphic encryption.

- Regulatory Frameworks: GDPR, CCPA, HIPAA compliance mandating strong encryption.

- Substitute Products: Basic access controls vs. comprehensive data encryption.

- End-User Trends: Shift towards managed encryption services and BYOK solutions.

- M&A Activities: Strategic acquisitions to expand product portfolios and geographical reach.

Data Encryption Industry Industry Insights & Trends

The Data Encryption Industry is experiencing unprecedented growth, fueled by a confluence of technological advancements, escalating cyber threats, and stringent data privacy mandates. The global market size is projected to reach an impressive $XX Billion by 2033, with a compelling CAGR of XX% during the forecast period (2025–2033). This robust growth is underpinned by several critical factors. Firstly, the pervasive digital transformation across all industry verticals, including BFSI, Healthcare, and Government, necessitates comprehensive data protection strategies. As more sensitive data resides in cloud environments and across distributed networks, the demand for sophisticated cloud encryption, disk encryption, and communication encryption solutions is soaring. Secondly, the increasing sophistication of cyberattacks, ranging from ransomware to advanced persistent threats (APTs), has elevated the importance of robust data encryption as a primary defense mechanism. Organizations are actively seeking file/folder encryption and database encryption to safeguard their critical assets. Furthermore, evolving consumer behavior, with a growing emphasis on privacy and data security, is compelling businesses to invest more heavily in transparent and effective data protection measures. The rise of remote work and the proliferation of IoT devices further amplify the need for secure data transmission and storage. The market is also witnessing a significant trend towards the adoption of managed encryption services and BYOK (Bring Your Own Key) solutions, offering businesses greater control and flexibility in managing their encryption keys. Software-defined encryption is also gaining traction, enabling dynamic and adaptable security postures. The industry is characterized by continuous innovation, with companies like Microsoft, McAfee LLC, Check Point Software Technologies Ltd, Thales, Broadcom Inc, Trend Micro Incorporated, Dell Inc, Sophos Ltd, Micro Focus International plc, and IBM leading the charge in developing next-generation encryption technologies and solutions. The growing adoption of cloud computing, coupled with the need for data sovereignty and compliance with regional data protection laws, is creating substantial opportunities for cloud encryption services. The IT & Telecommunication sector, alongside BFSI and Healthcare, represents a significant share of the market due to the high volume of sensitive data they handle. The increasing focus on securing sensitive patient data in the Healthcare industry and financial transactions in BFSI is a major growth driver. The Government sector also presents a substantial opportunity, driven by national security concerns and the need to protect classified information. The retail sector is increasingly investing in data encryption to protect customer payment information and personal data. Education institutions are also bolstering their data security measures to safeguard student records and sensitive research data.

Key Markets & Segments Leading Data Encryption Industry

The Data Encryption Industry is currently dominated by North America, driven by early adoption of advanced technologies and stringent regulatory frameworks. The United States, in particular, is a key market, followed by Europe. However, the Asia-Pacific region is witnessing the fastest growth, propelled by increasing digitalization and a rising awareness of data security.

Component:

- Software: This segment holds the largest market share, driven by the demand for advanced encryption algorithms, key management software, and encryption tools for various applications. Software-based encryption offers flexibility and scalability.

- Service: The service segment is rapidly growing, encompassing managed encryption services, key management as a service (KMaaS), and consulting. This growth is fueled by the increasing complexity of encryption implementation and the need for specialized expertise.

Deployment Model:

- Cloud: The cloud deployment model is experiencing exponential growth, as organizations migrate their data to cloud platforms and require robust cloud encryption solutions to protect their assets. This includes public, private, and hybrid cloud environments.

- On-premise: While still significant, the on-premise segment is seeing a slower growth rate compared to cloud, as organizations increasingly leverage the scalability and cost-effectiveness of cloud solutions. However, it remains critical for organizations with highly sensitive data and strict regulatory requirements.

Enterprise Size:

- Large Enterprises: This segment is the largest contributor to the market, owing to their vast data volumes, complex IT infrastructures, and higher susceptibility to cyber threats. They are early adopters of advanced encryption solutions.

- Small & Medium Enterprises (SMEs): SMEs are increasingly recognizing the importance of data encryption, driven by regulatory compliance and the growing threat landscape. Their adoption is accelerating, supported by more affordable and user-friendly encryption solutions.

Function:

- Disk Encryption: This function is widely adopted to protect data at rest on hard drives and storage devices, offering a fundamental layer of security.

- Communication Encryption: Essential for securing data in transit, this function is crucial for protecting sensitive information exchanged over networks, including email, messaging, and web traffic.

- File/Folder Encryption: Offers granular control over data protection, allowing users to encrypt specific files and folders for enhanced privacy.

- Cloud Encryption: As cloud adoption rises, cloud encryption solutions are gaining immense traction, protecting data stored and processed in cloud environments.

- Database Encryption: Critical for securing sensitive information stored in databases, protecting against unauthorized access and data breaches.

Industry Vertical:

- IT & Telecommunication: This sector leads the market due to the sheer volume of data handled and the critical nature of their services.

- BFSI: The financial sector invests heavily in encryption to protect financial transactions, customer data, and comply with stringent regulations like PCI DSS.

- Healthcare: Protecting patient health information (PHI) and complying with HIPAA makes Healthcare a high-priority sector for data encryption.

- Government: National security, citizen data, and classified information necessitate robust encryption solutions for government entities.

- Retail: Protecting customer payment data and personal information is a key driver for encryption adoption in the retail sector.

- Education: Safeguarding student records, research data, and intellectual property are driving encryption adoption in educational institutions.

Data Encryption Industry Product Developments

The Data Encryption Industry is witnessing a surge in product innovation focused on enhanced security, simplified management, and broader compatibility. Recent advancements include the development of quantum-resistant encryption algorithms to future-proof data against emerging quantum computing threats. Unified key management solutions, like IBM's Unified Key Orchestrator, are gaining prominence, enabling seamless management of encryption keys across multi-cloud environments and on-premise systems. Companies are also focusing on integrating AI and machine learning into encryption solutions for anomaly detection and proactive threat mitigation. The evolution of database encryption and cloud encryption services aims to provide end-to-end data protection, ensuring data confidentiality throughout its lifecycle. These developments are crucial for maintaining competitive advantage and meeting the ever-increasing security demands of businesses worldwide.

Challenges in the Data Encryption Industry Market

Despite its robust growth, the Data Encryption Industry faces several challenges that can hinder its expansion. The complexity of implementing and managing encryption solutions, particularly for SMEs, remains a significant barrier. The high cost associated with advanced encryption software and hardware can also be prohibitive for smaller organizations. Furthermore, a shortage of skilled cybersecurity professionals to manage and oversee encryption processes poses a challenge. The risk of key management failure, where lost or compromised encryption keys render data inaccessible or vulnerable, is a constant concern. Additionally, evolving regulatory compliance landscapes require continuous adaptation of encryption strategies. The threat of sophisticated cyberattacks, designed to circumvent encryption mechanisms, necessitates ongoing investment in research and development.

- Complexity of implementation and management.

- High cost of advanced encryption solutions.

- Shortage of skilled cybersecurity professionals.

- Risk of key management failures.

- Evolving regulatory compliance requirements.

- Sophisticated cyberattacks targeting encryption.

Forces Driving Data Encryption Industry Growth

Several powerful forces are propelling the growth of the Data Encryption Industry. The escalating frequency and sophistication of cyber threats, including data breaches and ransomware attacks, are compelling organizations to adopt stronger data protection measures. The increasing volume of sensitive data being generated and stored, particularly in cloud environments, necessitates robust encryption for data at rest and data in transit. Stringent data privacy regulations worldwide, such as GDPR, CCPA, and HIPAA, mandate the encryption of personal and sensitive information, driving compliance-driven adoption. The widespread adoption of cloud computing and the rise of remote work environments amplify the need for secure data access and transmission. Furthermore, growing consumer awareness and demand for data privacy are pushing businesses to prioritize encryption as a trust-building measure.

- Rising cyber threats and data breaches.

- Explosive growth in data generation and storage.

- Strict data privacy regulations and compliance mandates.

- Widespread adoption of cloud computing and remote work.

- Increased consumer awareness and demand for data privacy.

Challenges in the Data Encryption Industry Market

The Data Encryption Industry is poised for continued long-term growth, driven by persistent technological advancements and evolving market needs. Key catalysts for this sustained expansion include the ongoing development of more efficient and powerful encryption algorithms, such as post-quantum cryptography, to counter future threats. Strategic partnerships and collaborations between cybersecurity firms and cloud service providers will further enhance the accessibility and integration of encryption solutions. Market expansions into emerging economies, where digitalization is rapidly accelerating, will open new avenues for growth. Furthermore, the increasing demand for specialized encryption services tailored to specific industry verticals, like healthcare data encryption and financial data encryption, will fuel innovation and market segmentation. The continuous need to secure data in an increasingly complex and interconnected digital landscape ensures the sustained relevance and growth of the data encryption market.

Emerging Opportunities in Data Encryption Industry

The Data Encryption Industry is ripe with emerging opportunities driven by new technological frontiers and evolving consumer preferences. The rise of the Internet of Things (IoT) presents a significant opportunity for developing specialized encryption solutions to secure a vast array of connected devices and the data they generate. Advancements in Homomorphic Encryption are opening doors for secure data processing in the cloud without compromising data confidentiality, creating new possibilities for sensitive data analytics. The growing adoption of blockchain technology is also creating opportunities for integrating encryption with distributed ledger systems for enhanced data integrity and security. Furthermore, the increasing demand for privacy-enhancing technologies (PETs) and the focus on confidential computing are creating niche markets for advanced encryption solutions. The development of user-friendly, AI-powered encryption management platforms will further democratize access to robust data security for businesses of all sizes.

Leading Players in the Data Encryption Industry Sector

- Microsoft

- McAfee LLC

- Check Point Software Technologies Ltd

- Thales

- Broadcom Inc

- Trend Micro Incorporated

- Dell Inc

- Sophos Ltd

- Micro Focus International plc

- IBM

Key Milestones in Data Encryption Industry Industry

- March 2022: IBM Cloud Hyper Protect Crypto Services officially launched the Unified Key Orchestrator, a multi-cloud key management solution. This offering, based on the "Keep Your Own Key" concept, empowers businesses to manage their data encryption keys across various key stores and cloud environments, including IBM Cloud, AWS, and Microsoft Azure.

- February 2022: Sophos, a prominent cybersecurity player, announced its strategic expansion with new data centers planned for Mumbai, India, and Sao Paulo, Brazil. These new facilities are designed to assist businesses in these regions in complying with increasingly stringent data sovereignty rules and regulations, particularly crucial for firms in the banking, government, and other highly regulated sectors. Sophos Encryption services will leverage these new data centers, with a plan for broader portfolio product availability over time.

Strategic Outlook for Data Encryption Industry Market

The strategic outlook for the Data Encryption Industry is overwhelmingly positive, with significant growth accelerators expected to shape its trajectory. The increasing prevalence of cloud-native applications and the ongoing migration of sensitive data to hybrid and multi-cloud environments will continue to drive demand for sophisticated cloud encryption and key management solutions. The growing focus on data sovereignty and the implementation of stricter data protection laws globally will further solidify the need for compliant encryption strategies. Companies that invest in developing quantum-resistant encryption will be well-positioned to address future security challenges. Furthermore, the integration of AI and machine learning into encryption platforms for automated threat detection and response will be a key differentiator. Strategic partnerships, particularly between cybersecurity providers and cloud infrastructure vendors, will streamline adoption and enhance the overall security posture for businesses. The market is set for sustained innovation, with a clear emphasis on usability, scalability, and comprehensive data protection across all digital touchpoints.

Data Encryption Industry Segmentation

-

1. Component

- 1.1. Software

- 1.2. Service

-

2. Deployment Model

- 2.1. On-premise

- 2.2. Cloud

-

3. Enterprise Size

- 3.1. Large Enterprises

- 3.2. Small & Medium Enterprises

-

4. Function

- 4.1. Disk Encryption

- 4.2. Communication Encryption

- 4.3. File/Folder Encryption

- 4.4. Cloud Encryption

- 4.5. Database Encryption

-

5. Industry Vertical

- 5.1. IT & Telecommunication

- 5.2. BFSI

- 5.3. Healthcare

- 5.4. Government

- 5.5. Retail

- 5.6. Education

- 5.7. Others

Data Encryption Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Data Encryption Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Standards Related to Data Transfer and its Security; Growing Volume of Strength of Cyber Attacks and Mobile Theft

- 3.3. Market Restrains

- 3.3.1. Expensive Encryption Software Deployment and Maintenance costs; Utilization of Open-Source and Pirated Encryption Products

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large Enterprises

- 5.3.2. Small & Medium Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Disk Encryption

- 5.4.2. Communication Encryption

- 5.4.3. File/Folder Encryption

- 5.4.4. Cloud Encryption

- 5.4.5. Database Encryption

- 5.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.5.1. IT & Telecommunication

- 5.5.2. BFSI

- 5.5.3. Healthcare

- 5.5.4. Government

- 5.5.5. Retail

- 5.5.6. Education

- 5.5.7. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia

- 5.6.4. Australia and New Zealand

- 5.6.5. Middle East and Africa

- 5.6.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.3.1. Large Enterprises

- 6.3.2. Small & Medium Enterprises

- 6.4. Market Analysis, Insights and Forecast - by Function

- 6.4.1. Disk Encryption

- 6.4.2. Communication Encryption

- 6.4.3. File/Folder Encryption

- 6.4.4. Cloud Encryption

- 6.4.5. Database Encryption

- 6.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.5.1. IT & Telecommunication

- 6.5.2. BFSI

- 6.5.3. Healthcare

- 6.5.4. Government

- 6.5.5. Retail

- 6.5.6. Education

- 6.5.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.3.1. Large Enterprises

- 7.3.2. Small & Medium Enterprises

- 7.4. Market Analysis, Insights and Forecast - by Function

- 7.4.1. Disk Encryption

- 7.4.2. Communication Encryption

- 7.4.3. File/Folder Encryption

- 7.4.4. Cloud Encryption

- 7.4.5. Database Encryption

- 7.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.5.1. IT & Telecommunication

- 7.5.2. BFSI

- 7.5.3. Healthcare

- 7.5.4. Government

- 7.5.5. Retail

- 7.5.6. Education

- 7.5.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.3.1. Large Enterprises

- 8.3.2. Small & Medium Enterprises

- 8.4. Market Analysis, Insights and Forecast - by Function

- 8.4.1. Disk Encryption

- 8.4.2. Communication Encryption

- 8.4.3. File/Folder Encryption

- 8.4.4. Cloud Encryption

- 8.4.5. Database Encryption

- 8.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.5.1. IT & Telecommunication

- 8.5.2. BFSI

- 8.5.3. Healthcare

- 8.5.4. Government

- 8.5.5. Retail

- 8.5.6. Education

- 8.5.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.3.1. Large Enterprises

- 9.3.2. Small & Medium Enterprises

- 9.4. Market Analysis, Insights and Forecast - by Function

- 9.4.1. Disk Encryption

- 9.4.2. Communication Encryption

- 9.4.3. File/Folder Encryption

- 9.4.4. Cloud Encryption

- 9.4.5. Database Encryption

- 9.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.5.1. IT & Telecommunication

- 9.5.2. BFSI

- 9.5.3. Healthcare

- 9.5.4. Government

- 9.5.5. Retail

- 9.5.6. Education

- 9.5.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.3.1. Large Enterprises

- 10.3.2. Small & Medium Enterprises

- 10.4. Market Analysis, Insights and Forecast - by Function

- 10.4.1. Disk Encryption

- 10.4.2. Communication Encryption

- 10.4.3. File/Folder Encryption

- 10.4.4. Cloud Encryption

- 10.4.5. Database Encryption

- 10.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.5.1. IT & Telecommunication

- 10.5.2. BFSI

- 10.5.3. Healthcare

- 10.5.4. Government

- 10.5.5. Retail

- 10.5.6. Education

- 10.5.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Latin America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Software

- 11.1.2. Service

- 11.2. Market Analysis, Insights and Forecast - by Deployment Model

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 11.3.1. Large Enterprises

- 11.3.2. Small & Medium Enterprises

- 11.4. Market Analysis, Insights and Forecast - by Function

- 11.4.1. Disk Encryption

- 11.4.2. Communication Encryption

- 11.4.3. File/Folder Encryption

- 11.4.4. Cloud Encryption

- 11.4.5. Database Encryption

- 11.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 11.5.1. IT & Telecommunication

- 11.5.2. BFSI

- 11.5.3. Healthcare

- 11.5.4. Government

- 11.5.5. Retail

- 11.5.6. Education

- 11.5.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Microsoft

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 McAfee LLC

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Check Point Software Technologies Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Thales

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Broadcom Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Trend Micro Incorporated

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Dell Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Sophos Ltd

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Micro Focus International plc*List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 IBM

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Microsoft

List of Figures

- Figure 1: Global Data Encryption Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 17: North America Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 18: North America Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 19: North America Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 20: North America Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 21: North America Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 22: North America Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 23: North America Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 24: North America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: North America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Europe Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Europe Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 29: Europe Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 30: Europe Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 31: Europe Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 32: Europe Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 33: Europe Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 34: Europe Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 35: Europe Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 36: Europe Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 39: Asia Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 40: Asia Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 41: Asia Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 42: Asia Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 43: Asia Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 44: Asia Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 45: Asia Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 46: Asia Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 47: Asia Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 48: Asia Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 51: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 52: Australia and New Zealand Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 53: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 54: Australia and New Zealand Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 55: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 56: Australia and New Zealand Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 57: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 58: Australia and New Zealand Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 59: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 60: Australia and New Zealand Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: Middle East and Africa Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 63: Middle East and Africa Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 64: Middle East and Africa Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 65: Middle East and Africa Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 66: Middle East and Africa Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 67: Middle East and Africa Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 68: Middle East and Africa Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 69: Middle East and Africa Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 70: Middle East and Africa Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 71: Middle East and Africa Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 72: Middle East and Africa Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 73: Middle East and Africa Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Latin America Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 75: Latin America Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 76: Latin America Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 77: Latin America Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 78: Latin America Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 79: Latin America Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 80: Latin America Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 81: Latin America Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 82: Latin America Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 83: Latin America Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 84: Latin America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 85: Latin America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Encryption Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 4: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 5: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 6: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 7: Global Data Encryption Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Belgium Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherland Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Nordics Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: China Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Japan Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Korea Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Southeast Asia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Australia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Indonesia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Phillipes Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Thailandc Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Brazil Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Argentina Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Peru Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Chile Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Ecuador Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Venezuela Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of South America Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United States Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Canada Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Mexico Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: United Arab Emirates Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Saudi Arabia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East and Africa Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 54: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 55: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 56: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 57: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 58: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 60: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 61: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 62: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 63: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 64: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 66: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 67: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 68: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 69: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 70: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 71: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 72: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 73: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 74: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 75: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 76: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 77: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 78: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 79: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 80: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 81: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 82: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 83: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 84: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 85: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 86: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 87: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 88: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Encryption Industry?

The projected CAGR is approximately 15.57%.

2. Which companies are prominent players in the Data Encryption Industry?

Key companies in the market include Microsoft, McAfee LLC, Check Point Software Technologies Ltd, Thales, Broadcom Inc, Trend Micro Incorporated, Dell Inc, Sophos Ltd, Micro Focus International plc*List Not Exhaustive, IBM.

3. What are the main segments of the Data Encryption Industry?

The market segments include Component, Deployment Model, Enterprise Size, Function, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Standards Related to Data Transfer and its Security; Growing Volume of Strength of Cyber Attacks and Mobile Theft.

6. What are the notable trends driving market growth?

IT & Telecommunication to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Expensive Encryption Software Deployment and Maintenance costs; Utilization of Open-Source and Pirated Encryption Products.

8. Can you provide examples of recent developments in the market?

March 2022 - Unified Key Orchestrator, a multi-cloud key management solution made available as a managed service by IBM Cloud Hyper Protect Crypto Services, was officially launched. Unified Key Orchestrator, based on the "Keep Your Own Key" concept, assists businesses in managing their data encryption keys across numerous key stores and cloud environments, including keys handled locally on IBM Cloud, AWS, and Microsoft Azure.\

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Encryption Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Encryption Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Encryption Industry?

To stay informed about further developments, trends, and reports in the Data Encryption Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence