Key Insights

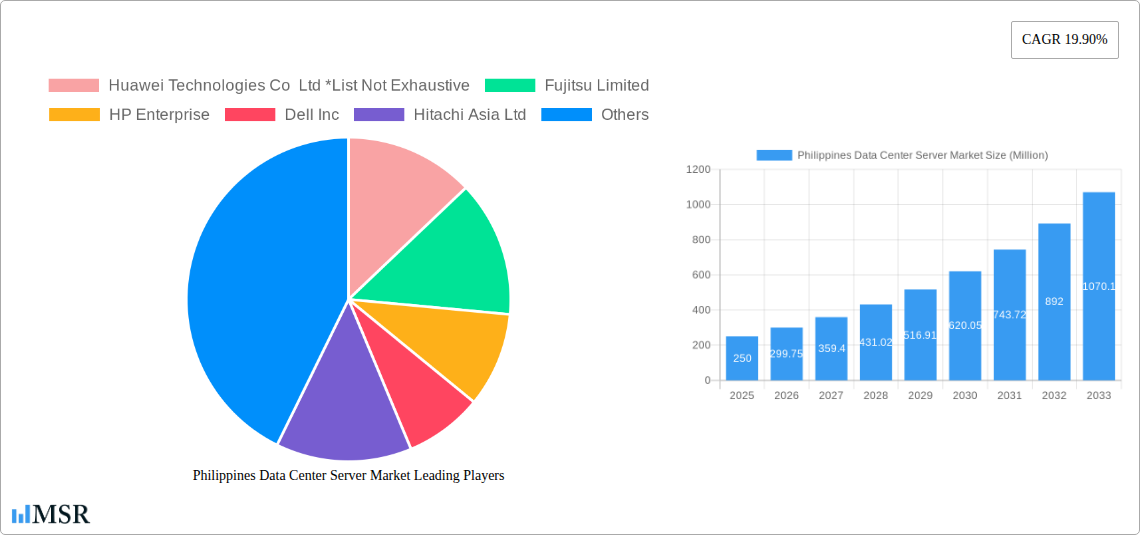

The Philippines data center server market is poised for substantial expansion, driven by an accelerating digital transformation across key sectors. With a projected market size of approximately $250 million and an impressive Compound Annual Growth Rate (CAGR) of 19.90% anticipated over the forecast period of 2025-2033, the demand for robust server infrastructure is set to surge. This growth is primarily fueled by the escalating adoption of cloud computing, the burgeoning demand for data analytics, and the increasing deployment of artificial intelligence and machine learning technologies by businesses. The IT & Telecommunication sector, alongside BFSI and Government, are leading this charge, investing heavily in upgrading their data center capabilities to support enhanced services and operational efficiencies. Emerging trends such as edge computing and the increasing reliance on high-performance computing for advanced simulations and research are further contributing to the market's upward trajectory.

Philippines Data Center Server Market Market Size (In Million)

The market's growth, however, faces certain constraints, including the significant capital investment required for deploying advanced server solutions and the persistent challenge of ensuring a stable and high-speed internet infrastructure across the archipelago. Despite these hurdles, the Philippine government's ongoing initiatives to promote digitalization and attract foreign investment in technology infrastructure are creating a favorable ecosystem for market players. The server market is segmented across various form factors, with Blade Servers and Rack Servers expected to dominate due to their scalability and efficiency in enterprise data center environments. Companies like Huawei Technologies, Fujitsu Limited, HP Enterprise, Dell Inc., and IBM Corporation are key players vying for market share, offering a diverse range of solutions to meet the evolving needs of Philippine enterprises. Continued investment in network infrastructure and supportive government policies will be critical for the sustained, high-paced growth of the Philippines data center server market.

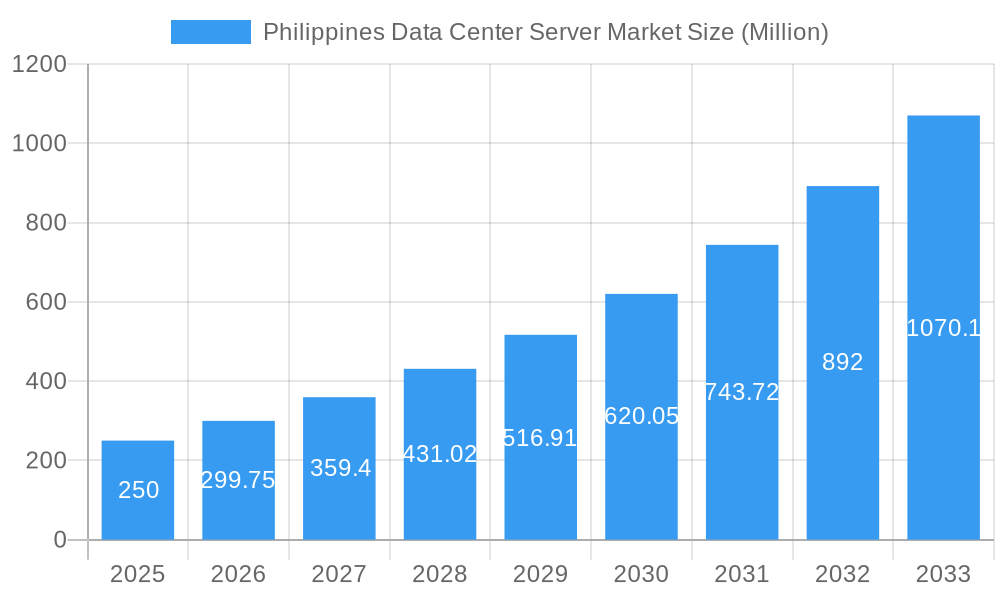

Philippines Data Center Server Market Company Market Share

Unlock critical insights into the booming Philippines Data Center Server Market. This in-depth report provides a definitive forecast, segmentation analysis, and strategic outlook for the Philippines data center server market. Discover market size projections, growth drivers, technological trends, and competitive landscapes essential for strategic decision-making. Featuring analysis of key players like Huawei Technologies Co Ltd, Fujitsu Limited, HP Enterprise, Dell Inc, and Oracle Corporation, this report is your indispensable guide to the evolving Philippine server market and its impact on the Southeast Asian data center infrastructure.

Philippines Data Center Server Market Market Concentration & Dynamics

The Philippines data center server market is characterized by a moderate to high concentration, with a few leading global players dominating significant market share. Innovation ecosystems are flourishing, fueled by increasing demand for robust cloud infrastructure Philippines and advanced enterprise server solutions. Regulatory frameworks are evolving to support digital transformation initiatives, creating a more favorable environment for market expansion. While substitute products exist in the form of cloud-based services that abstract hardware, the core demand for physical servers in private and hybrid cloud deployments remains strong. End-user trends reveal a consistent shift towards higher-density, more energy-efficient server form factors, particularly rack servers and increasingly blade servers for specialized workloads. Mergers and acquisitions (M&A) activities are present, though less frequent than in more mature markets, reflecting consolidation potential and strategic partnerships aimed at expanding service offerings and market reach. For instance, the ongoing digital transformation across various sectors contributes to a consistent M&A deal count. The market share of leading players is estimated to be concentrated within the top 5-7 vendors, holding approximately 65-75% of the total market revenue.

Philippines Data Center Server Market Industry Insights & Trends

The Philippines data center server market is poised for significant growth, driven by the nation's accelerating digital transformation agenda and burgeoning demand for robust IT infrastructure. The market size is projected to reach an estimated US$xxx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is underpinned by several key factors. The increasing adoption of cloud computing services, both public and private, necessitates a scalable and reliable server backbone. Businesses across various sectors, including IT & Telecommunication, BFSI, and Government, are heavily investing in upgrading their existing data center capabilities and establishing new facilities to accommodate growing data volumes and the need for faster processing power. The proliferation of digital services, e-commerce, and the rise of AI and big data analytics are further amplifying the demand for high-performance servers. Technological disruptions, such as the integration of AI and machine learning capabilities within server hardware and the ongoing evolution towards more energy-efficient architectures, are also shaping the market. Evolving consumer behaviors, marked by an increasing reliance on digital platforms for entertainment, communication, and commerce, indirectly fuel the demand for underlying server infrastructure. The Philippines data center server market is also influenced by government initiatives aimed at fostering a digital economy, which often include incentives for IT infrastructure development and data localization policies. The shift towards hybrid cloud environments further bolsters the market for on-premises servers that can seamlessly integrate with public cloud offerings. The market is also witnessing a trend towards specialized server solutions tailored to specific industry needs, moving beyond generic offerings. The continuous innovation in processor technology and memory modules plays a crucial role in driving performance enhancements and enabling more complex workloads. The increasing focus on data sovereignty and security is also a significant trend, leading organizations to invest in robust on-premises or private cloud server solutions.

Key Markets & Segments Leading Philippines Data Center Server Market

The IT & Telecommunication sector is the most dominant end-user segment within the Philippines data center server market, driving substantial demand due to the nation's rapidly expanding digital landscape and the continuous need for network infrastructure upgrades. This segment is fueled by investments in 5G deployment, cloud service providers, and the exponential growth of internet users. The BFSI sector also represents a significant market, driven by the need for secure and high-performance servers to support critical financial transactions, data analytics, and digital banking services. The Government segment, with its increasing focus on e-governance initiatives, smart city projects, and national security, is another key contributor to server market growth. Media & Entertainment is also a growing segment, propelled by the surge in digital content consumption, streaming services, and the increasing adoption of high-definition content delivery.

Dominant End-User: IT & Telecommunication

- Drivers: Rapid expansion of broadband internet, 5G network rollouts, increasing demand for cloud services, growth of over-the-top (OTT) platforms.

- Analysis: Telecommunication companies are consistently upgrading their core network infrastructure and data center capabilities to handle massive data traffic. Cloud service providers are expanding their offerings and require scalable server deployments to meet enterprise and individual user demands. This segment's investment in advanced Philippines enterprise servers is paramount.

Dominant Form Factor: Rack Server

- Drivers: Versatility, scalability, cost-effectiveness, wide range of configurations available.

- Analysis: Rack servers offer a balanced approach to performance, density, and cost, making them the workhorse for most data center deployments. They are highly adaptable to various workloads, from general computing to specific application hosting, and are preferred for their ease of management and integration into standard rack enclosures.

BFSI Sector:

- Drivers: Strict regulatory compliance, need for high availability and reliability, increasing adoption of digital banking, big data analytics for risk management and customer insights.

- Analysis: Financial institutions demand robust server solutions that ensure data integrity, security, and uninterrupted service. The growing adoption of fintech and digital payment platforms necessitates powerful and reliable server infrastructure.

Government Sector:

- Drivers: E-governance initiatives, digital transformation of public services, national security requirements, smart city development projects.

- Analysis: Governments are investing heavily in modernizing their IT infrastructure to improve public service delivery, enhance national security, and foster economic growth through digitalization.

Media & Entertainment Sector:

- Drivers: Growth of online streaming, demand for high-definition content, increasing use of digital platforms for content creation and distribution.

- Analysis: The shift towards digital content consumption requires significant server capacity for storage, processing, and delivery of media.

Philippines Data Center Server Market Product Developments

The Philippines data center server market is witnessing continuous innovation focused on enhancing performance, efficiency, and specialized capabilities. Product developments are largely driven by advancements in processing power, memory technologies, and the integration of AI and machine learning functionalities. For instance, the recent release of Kingston Technology Corporation's Server Premier DDR5 ECC Unbuffered DIMMs and ECC SODIMMs signifies a leap in memory speed and capacity, crucial for demanding server workloads. Furthermore, the adoption of energy-efficient processors, as seen in Hewlett Packard Enterprise's HPE ProLiant RL300 Gen11 servers, highlights a growing trend towards sustainable data center operations, supporting AI inferencing and cloud gaming with improved performance. These innovations cater to the evolving needs of businesses seeking to optimize their Philippines IT infrastructure and gain a competitive edge.

Challenges in the Philippines Data Center Server Market Market

The Philippines data center server market faces several challenges that could impede its growth trajectory. Regulatory hurdles, while improving, can still present complexities in terms of data localization laws and compliance requirements. Supply chain disruptions, exacerbated by global events, can lead to extended lead times and increased costs for server hardware. Intense competitive pressures from global vendors and the increasing adoption of cloud services pose a constant challenge for on-premises server providers. Furthermore, skills gap in specialized IT talent for managing and maintaining advanced server infrastructure can limit adoption. Electricity costs and reliability are also significant concerns impacting the operational expenditure of data centers.

Forces Driving Philippines Data Center Server Market Growth

Several key forces are propelling the Philippines data center server market forward. The nation's accelerating digital transformation initiatives across government and private sectors are a primary driver. Increased adoption of cloud computing and the growing demand for robust IT & Telecommunication infrastructure are creating a substantial need for server hardware. Furthermore, the burgeoning e-commerce sector and the proliferation of digital services are generating vast amounts of data that require efficient processing and storage. Government support for IT infrastructure development and the increasing focus on data analytics and AI are also significant growth catalysts. The ongoing expansion of data center capacity, both by local and international players, directly fuels demand for servers.

Challenges in the Philippines Data Center Server Market Market

Long-term growth catalysts for the Philippines data center server market lie in continuous technological innovation and strategic market expansion. The increasing demand for edge computing solutions presents a significant opportunity for decentralized server deployments. Furthermore, the development of specialized servers optimized for AI and machine learning workloads will be crucial. Strategic partnerships between hardware vendors, cloud providers, and system integrators can unlock new market segments and enhance service offerings. The focus on sustainability and energy efficiency in server design will also be a critical long-term growth factor, aligning with global environmental concerns.

Emerging Opportunities in Philippines Data Center Server Market

Emerging opportunities within the Philippines data center server market are diverse and promising. The growing adoption of Internet of Things (IoT) devices will necessitate substantial server capacity for data ingestion and processing. The increasing demand for high-performance computing (HPC) solutions in research and development, as well as in advanced analytics, presents a significant niche. The expansion of gaming and entertainment platforms will drive demand for powerful servers capable of delivering seamless user experiences. Furthermore, the development of next-generation data centers that leverage advanced cooling technologies and renewable energy sources will open new avenues for specialized server hardware. The digitalization of small and medium-sized enterprises (SMEs) also represents an untapped market.

Leading Players in the Philippines Data Center Server Market Sector

- Huawei Technologies Co Ltd

- Fujitsu Limited

- HP Enterprise

- Dell Inc

- Hitachi Asia Ltd

- Oracle Corporation

- IBM Corporation

- Lenovo Group Limited

- Kingston Technology Corporation

- Super Micro Computer Inc

Key Milestones in Philippines Data Center Server Market Industry

- August 2023: Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from Ampere Computing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with improved performance and energy efficiency.

- June 2023: Kingston Technology announced the release of its 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs. Server Premier is Kingston's industry-standard server class memory solution sold by the specification for use in white-box systems and is the Intel platform validated and qualified by leading motherboard/system manufacturers.

Strategic Outlook for Philippines Data Center Server Market Market

The strategic outlook for the Philippines data center server market is exceptionally positive, characterized by sustained growth and technological advancement. Key growth accelerators include the continued government push for digitalization, the increasing penetration of cloud services, and the demand for robust IT infrastructure to support emerging technologies like AI and IoT. Strategic opportunities lie in catering to the specific needs of high-growth sectors such as BFSI and IT & Telecommunication with tailored server solutions. Vendors focusing on energy efficiency, high-density computing, and robust security features will be well-positioned for success. Furthermore, strategic partnerships and a focus on providing comprehensive support and maintenance services will be crucial for capturing and retaining market share in this dynamic landscape. The Philippines presents a significant opportunity for players looking to expand their footprint in the rapidly evolving Southeast Asian data center server market.

Philippines Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Philippines Data Center Server Market Segmentation By Geography

- 1. Philippines

Philippines Data Center Server Market Regional Market Share

Geographic Coverage of Philippines Data Center Server Market

Philippines Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Rollout Towards Fiber Connectivity and 5G Deployment; Demand for Cloud Computing Among Enterprises

- 3.3. Market Restrains

- 3.3.1. High CapEx for Building Data Center Along With Security Challenges

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fujitsu Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Asia Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IBM Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lenovo Group Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kingston Technology Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Super Micro Computer Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: Philippines Data Center Server Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Data Center Server Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Data Center Server Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Philippines Data Center Server Market Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 3: Philippines Data Center Server Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Philippines Data Center Server Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Philippines Data Center Server Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Philippines Data Center Server Market Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 7: Philippines Data Center Server Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Philippines Data Center Server Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Data Center Server Market?

The projected CAGR is approximately 19.90%.

2. Which companies are prominent players in the Philippines Data Center Server Market?

Key companies in the market include Huawei Technologies Co Ltd *List Not Exhaustive, Fujitsu Limited, HP Enterprise, Dell Inc, Hitachi Asia Ltd, Oracle Corporation, IBM Corporation, Lenovo Group Limited, Kingston Technology Corporation, Super Micro Computer Inc.

3. What are the main segments of the Philippines Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Rollout Towards Fiber Connectivity and 5G Deployment; Demand for Cloud Computing Among Enterprises.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Growth.

7. Are there any restraints impacting market growth?

High CapEx for Building Data Center Along With Security Challenges.

8. Can you provide examples of recent developments in the market?

August 2023 - Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from AmpereComputing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with improved performance and energy efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Data Center Server Market?

To stay informed about further developments, trends, and reports in the Philippines Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence