Key Insights

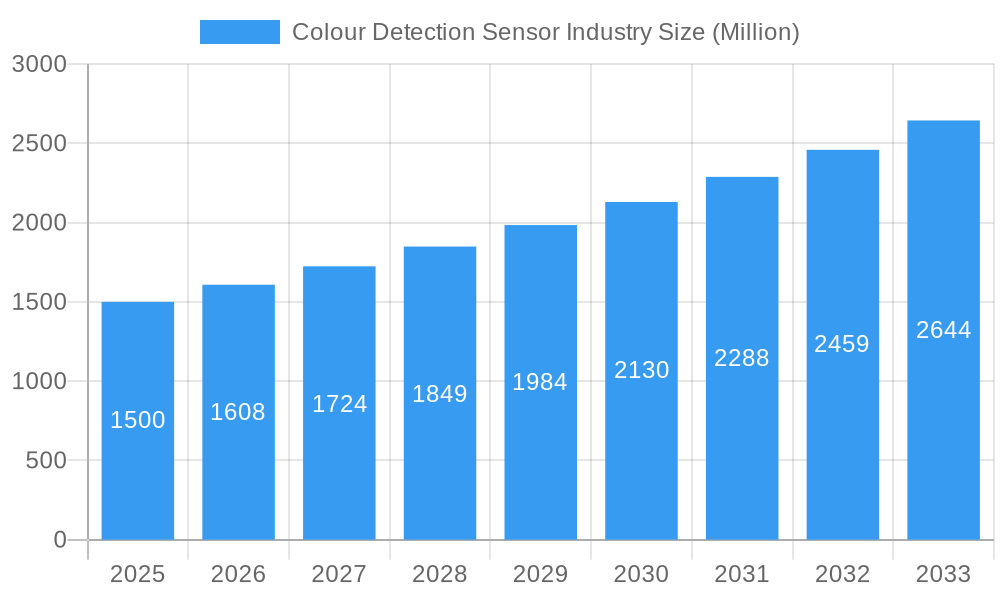

The global Colour Detection Sensor Industry is poised for significant expansion, driven by increasing automation across diverse industrial sectors. The market is projected to grow from an estimated $1.5 billion in 2025 at a Compound Annual Growth Rate (CAGR) of 7.18%, reaching substantial figures by 2033. This growth is fueled by the inherent need for precise quality control, enhanced operational efficiency, and sophisticated product differentiation in manufacturing processes. Industries such as Food and Beverage, Healthcare, and Automotive are actively adopting colour detection sensors to ensure product consistency, compliance with regulatory standards, and to detect defects that might otherwise go unnoticed. The demand for advanced sensors capable of differentiating subtle colour variations and operating in challenging environments is a key factor propelling market expansion.

Colour Detection Sensor Industry Market Size (In Billion)

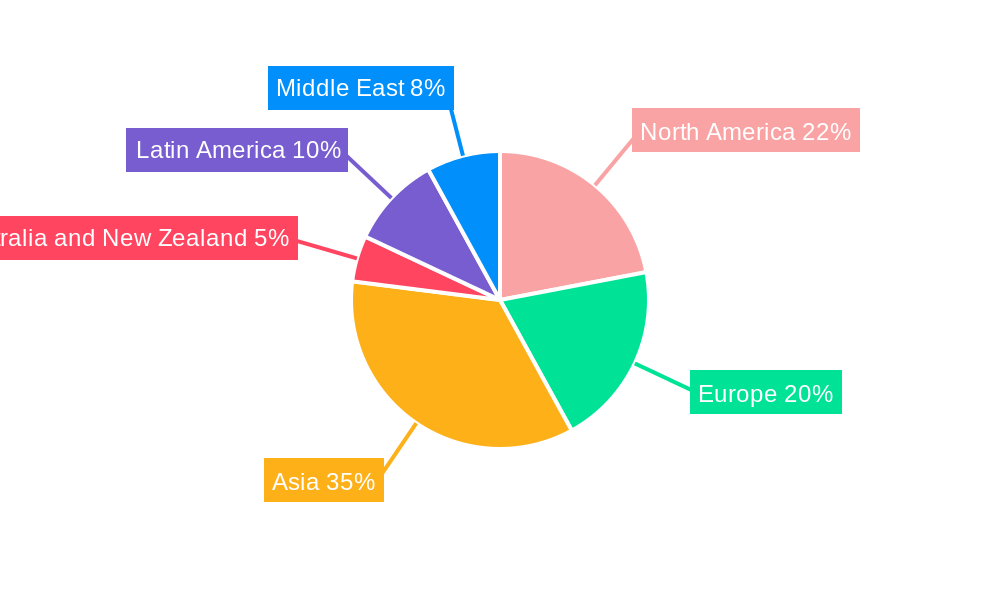

The Colour Detection Sensor market is characterized by a dynamic landscape with a broad range of sensor types catering to specific application needs, including Brightness Sensors, Molecular Luminescence Sensors, RGB Sensors, and Printed Mark Sensors. Emerging trends such as the integration of AI and machine learning for advanced colour analysis, the miniaturization of sensors for compact applications, and the development of smart sensors with enhanced connectivity are shaping the market's trajectory. While the adoption of these sophisticated sensors is a primary growth driver, the initial investment costs and the need for skilled personnel to operate and maintain them present some challenges. However, the long-term benefits in terms of reduced waste, improved product quality, and increased throughput are encouraging widespread adoption across the consumer electronics, chemical, and textile industries, among others. Geographically, Asia is anticipated to emerge as a dominant region, owing to rapid industrialization and increasing manufacturing capabilities.

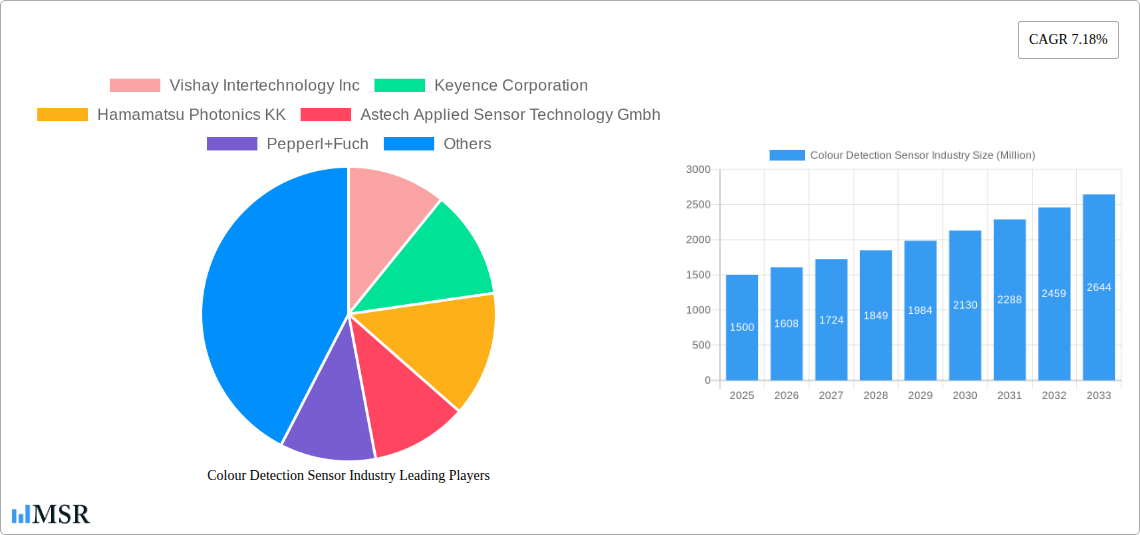

Colour Detection Sensor Industry Company Market Share

Unlocking Insights: Comprehensive Report on the Global Colour Detection Sensor Market (2019-2033)

This in-depth market research report offers a granular analysis of the Colour Detection Sensor industry, providing critical intelligence for stakeholders seeking to navigate this dynamic sector. Covering the historical period 2019-2024, the base year 2025, and extending to the forecast period 2025-2033, this report delivers actionable insights into market size, segmentation, growth drivers, and competitive landscapes. Dive deep into the transformative potential of brightness sensors, molecular luminescence sensors, RGB sensors, and printed mark sensors across diverse end-user industries, including food and beverage, healthcare, chemical, textile, automotive, and consumer electronics. This report is essential for sensor manufacturers, technology providers, system integrators, and investors keen to capitalize on the evolving demand for precision colour detection solutions.

Colour Detection Sensor Industry Market Concentration & Dynamics

The Colour Detection Sensor market exhibits a moderate to high level of concentration, with key players continuously innovating to secure market share. The innovation ecosystem is robust, driven by advancements in machine vision, AI integration, and miniaturization of sensor technologies. Regulatory frameworks are evolving, particularly concerning data accuracy and safety in sensitive applications like healthcare and food processing, influencing product development and adoption. Substitute products, while present, often lack the precision and specificity offered by dedicated colour sensors, limiting their widespread impact. End-user trends are pushing towards greater automation, quality control, and traceability, directly benefiting the demand for advanced colour detection. Merger and acquisition (M&A) activities, estimated at approximately 15-20 significant deals annually, indicate a strategic consolidation within the industry, with companies like Vishay Intertechnology Inc. and Keyence Corporation actively pursuing growth through strategic partnerships and acquisitions. The market share distribution is led by major players, with an estimated collective share of over 70% held by the top 10 companies.

- Market Concentration: Moderate to High

- Innovation Ecosystem: Robust, driven by AI & Machine Vision

- Regulatory Frameworks: Evolving, with focus on accuracy & safety

- Substitute Products: Limited in high-precision applications

- End-User Trends: Automation, Quality Control, Traceability

- M&A Activities: 15-20 significant deals annually

- Top 10 Company Market Share: > 70%

Colour Detection Sensor Industry Industry Insights & Trends

The global Colour Detection Sensor market is poised for substantial growth, projected to reach an estimated market size of $5 Billion by 2025 and expand to $8.5 Billion by 2030, exhibiting a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period. This growth is fueled by an increasing demand for automated quality control across manufacturing sectors. Technological disruptions, such as the advent of advanced spectral analysis and AI-powered colour recognition algorithms, are enhancing sensor capabilities, enabling more precise defect detection and material identification. Evolving consumer behaviors, particularly a growing preference for consistent product quality and enhanced user experience in consumer electronics, are further accelerating adoption. The integration of colour sensors into IoT devices and smart manufacturing systems is creating new avenues for data collection and analysis, driving efficiency and reducing waste. The increasing sophistication of vision systems, exemplified by innovations like the Leopard Imaging Inc. stereo camera, directly contributes to the market's upward trajectory by enabling more complex and accurate colour analysis in diverse environments, including challenging day-and-night conditions. Furthermore, the development of novel sensor technologies, such as those for detecting 'forever chemicals' using luminescence, signifies the expanding application scope beyond traditional industrial uses.

- Market Size (2025): $5 Billion

- Market Size (2030): $8.5 Billion

- CAGR (2025-2033): 7.5%

- Key Growth Drivers: Automation, AI Integration, IoT Adoption

- Technological Disruptions: Spectral Analysis, AI Colour Recognition

- Consumer Behavior Influences: Quality Consistency, User Experience

Key Markets & Segments Leading Colour Detection Sensor Industry

The Colour Detection Sensor market is experiencing robust growth across multiple regions and segments, driven by distinct industry-specific demands and technological advancements. Asia Pacific, particularly China and India, is emerging as a dominant region due to its burgeoning manufacturing sector, significant investments in automation, and rapid adoption of Industry 4.0 technologies. The Automotive and Consumer Electronics end-user industries are leading the charge in adopting advanced colour sensors for applications ranging from paint defect detection and assembly line quality control to LED colour consistency verification and product authentication.

Within the Type segment, RGB Sensors are witnessing the highest demand owing to their versatility in capturing a wide spectrum of colours, making them indispensable for applications requiring precise colour matching and inspection. This is followed closely by Brightness Sensors, crucial for maintaining consistent lighting conditions and detecting subtle variations in luminance across production lines. The Food and Beverage industry is a significant growth area, utilizing colour sensors for quality control, ripeness assessment, and contamination detection, with an estimated market penetration of over 30% in specialized applications. The Healthcare sector is increasingly adopting molecular luminescence sensors for diagnostic applications and drug discovery, driven by the need for highly sensitive and specific detection methods. The Textile industry relies heavily on colour sensors for dye consistency and pattern verification, while the Chemical industry utilizes them for product identification and purity analysis. The growth in these segments is underpinned by factors such as increasing disposable incomes, stringent quality standards, and the drive for operational efficiency.

- Dominant Region: Asia Pacific

- Leading End-User Industries: Automotive, Consumer Electronics

- Leading Sensor Type: RGB Sensor

- Key End-User Segment Drivers:

- Automotive: Autonomous driving, advanced driver-assistance systems (ADAS), quality control in manufacturing.

- Consumer Electronics: Miniaturization, demand for aesthetically pleasing products, component quality assurance.

- Food and Beverage: Food safety regulations, brand consistency, reduced spoilage.

- Healthcare: Precision diagnostics, drug development, sterile packaging verification.

- Textile: Fashion trends, demand for consistent colour palettes, automated pattern matching.

- Chemical: Product purity verification, process control, safety compliance.

Colour Detection Sensor Industry Product Developments

The Colour Detection Sensor industry is characterized by continuous product innovation, enhancing accuracy, speed, and integration capabilities. Recent developments include the introduction of high-resolution RGB-IR stereo cameras, like the Leopard Imaging Inc. EAGLE 2, offering advanced day and night vision for sophisticated machine vision applications. Furthermore, the exploration of luminescence sensors for environmental monitoring, such as detecting 'forever chemicals' in water by researchers at the University of Birmingham, highlights the expanding role of colour detection beyond traditional manufacturing, impacting sectors like environmental science and public health. These innovations empower industries with more nuanced and efficient colour analysis.

- Key Innovations: High-resolution RGB-IR stereo cameras, advanced luminescence sensors for environmental detection.

- Market Relevance: Enhanced day/night vision, precision environmental monitoring, broader application scope.

Challenges in the Colour Detection Sensor Industry Market

Despite robust growth, the Colour Detection Sensor market faces several challenges. High initial investment costs for advanced sensor systems can be a barrier for small and medium-sized enterprises (SMEs). Stringent regulatory compliance in industries like healthcare and food can lead to longer product development cycles and certification processes, estimated to add 10-15% to development timelines. Supply chain disruptions, particularly concerning specialized components, can impact production volumes and lead times, with potential delays of up to 20% in critical periods. Intense competitive pressures from established players and new entrants also necessitate continuous innovation and competitive pricing strategies.

- High Initial Investment Costs: Affecting SME adoption.

- Stringent Regulatory Compliance: Leading to longer development cycles.

- Supply Chain Disruptions: Causing production delays.

- Intense Competitive Pressure: Demanding continuous innovation.

Forces Driving Colour Detection Sensor Industry Growth

Several key forces are propelling the growth of the Colour Detection Sensor industry. The relentless pursuit of automation and Industry 4.0 across manufacturing sectors is a primary driver, enhancing efficiency and reducing human error. Advancements in artificial intelligence (AI) and machine learning (ML) are enabling sensors to perform more complex tasks, such as anomaly detection and predictive maintenance, by analyzing colour data with greater sophistication. The increasing global emphasis on product quality and safety standards, particularly in food, healthcare, and automotive industries, mandates precise colour verification. Furthermore, the growing demand for customizable and aesthetically pleasing products in consumer electronics and textiles fuels the need for accurate colour matching and control.

- Automation & Industry 4.0: Driving efficiency and error reduction.

- AI & ML Integration: Enabling advanced data analysis and predictive capabilities.

- Product Quality & Safety Standards: Requiring precise colour verification.

- Consumer Demand for Aesthetics: Fueling colour matching and control needs.

Challenges in the Colour Detection Sensor Industry Market

The long-term growth catalysts for the Colour Detection Sensor industry lie in ongoing technological advancements and market expansion. The continuous development of miniaturized and highly sensitive sensors will unlock new applications in portable devices and micro-assembly. The integration of colour sensors with advanced analytics platforms will provide deeper insights into production processes and product performance. Expanding into emerging markets and developing economies will create significant new revenue streams. Furthermore, fostering collaborations between sensor manufacturers and end-users will ensure that product development aligns with evolving industry needs and challenges. The ongoing research into novel sensing principles, like hyperspectral imaging, will further broaden the capabilities and impact of colour detection.

- Miniaturization & Sensitivity: Enabling new application domains.

- Advanced Analytics Integration: Providing deeper process insights.

- Emerging Market Expansion: Creating new revenue opportunities.

- Industry-User Collaborations: Ensuring product relevance.

Emerging Opportunities in Colour Detection Sensor Industry

Emerging opportunities within the Colour Detection Sensor industry are diverse and promising. The rapid growth of the Internet of Things (IoT) is creating a demand for smart sensors that can provide real-time colour data for environmental monitoring, smart agriculture, and smart city applications. The burgeoning field of personalized medicine and diagnostics presents opportunities for highly sensitive molecular luminescence sensors. The evolution of sustainable manufacturing practices will drive demand for colour sensors that can detect subtle variations in recycled materials or monitor the effectiveness of eco-friendly processes. Furthermore, the increasing use of augmented reality (AR) and virtual reality (VR) in training and simulation could integrate colour detection for realistic environmental rendering. The advancement in AI for edge computing will enable more intelligent and autonomous decision-making directly at the sensor level, reducing latency and processing costs.

- IoT Integration: Smart sensors for real-time data in diverse environments.

- Personalized Medicine & Diagnostics: Highly sensitive luminescence sensors.

- Sustainable Manufacturing: Monitoring eco-friendly processes and recycled materials.

- AR/VR Integration: Realistic environmental rendering and interactive applications.

- Edge AI: Intelligent, autonomous decision-making at the sensor level.

Leading Players in the Colour Detection Sensor Industry Sector

- Vishay Intertechnology Inc.

- Keyence Corporation

- Hamamatsu Photonics KK

- Astech Applied Sensor Technology Gmbh

- Pepperl+Fuchs

- Baumer NV

- Jenoptik AG

- SensoPart Industriesensorik GmbH

- SICK AG

- Wenglor Sensoric GmbH

- Omron Corporation

- Ams-Osram AG

- EMX Industries Inc.

- Balluff GmbH

- Banner Engineering Corp

- Rockwell Automation Inc.

- Datalogic SpA

- Panasonic Corporation

Key Milestones in Colour Detection Sensor Industry Industry

- May 2024: Leopard Imaging Inc. launched the stereo camera EAGLE 2 LI-VB1940-GM2A-119H at Embedded Vision Summit 2024. This marked a significant milestone with the world's first RGB-IR high-resolution stereo camera, boasting patent-pending features designed to redefine day and night vision capabilities, incorporating two automotive-grade 5.1-megapixel shutter RGB-IR image sensors.

- January 2024: Researchers at the University of Birmingham, in partnership with the German Federal Institute for Materials Research and Testing (BAM), pioneered an innovative method to detect 'forever chemicals' in water using luminescence sensors, opening new avenues for environmental safety monitoring.

Strategic Outlook for Colour Detection Sensor Industry Market

The strategic outlook for the Colour Detection Sensor industry is overwhelmingly positive, driven by a confluence of technological advancements and expanding application horizons. Future growth will be accelerated by the deeper integration of AI and machine learning, enabling predictive maintenance and enhanced quality control. The increasing demand for smart manufacturing and Industry 4.0 solutions will continue to be a significant growth accelerator. Furthermore, the expanding adoption of colour sensors in emerging sectors like wearable technology, advanced robotics, and precision agriculture presents substantial untapped market potential. Strategic collaborations, focus on niche applications, and continuous innovation in sensor accuracy and connectivity will be key to capitalizing on these opportunities and maintaining a competitive edge in the global market.

- Growth Accelerators: AI/ML integration, smart manufacturing, emerging sector adoption.

- Future Potential: Wearable tech, robotics, precision agriculture.

- Strategic Focus: Niche applications, sensor accuracy, connectivity.

Colour Detection Sensor Industry Segmentation

-

1. Type

- 1.1. Brightness Sensor

- 1.2. Molecular Luminescence Sensor

- 1.3. RGB Sensor

- 1.4. Printed Mark Sensor

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Healthcare

- 2.3. Chemical

- 2.4. Textile

- 2.5. Automotive

- 2.6. Consumer Electronics

- 2.7. Other End-user Industries

Colour Detection Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East

Colour Detection Sensor Industry Regional Market Share

Geographic Coverage of Colour Detection Sensor Industry

Colour Detection Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Process Automation across Various Industries; Increased Use of Color Sensors in Smartphones

- 3.3. Market Restrains

- 3.3.1. Higher Initial Costs

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry to be the Fastest Growing End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Brightness Sensor

- 5.1.2. Molecular Luminescence Sensor

- 5.1.3. RGB Sensor

- 5.1.4. Printed Mark Sensor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare

- 5.2.3. Chemical

- 5.2.4. Textile

- 5.2.5. Automotive

- 5.2.6. Consumer Electronics

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Brightness Sensor

- 6.1.2. Molecular Luminescence Sensor

- 6.1.3. RGB Sensor

- 6.1.4. Printed Mark Sensor

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverage

- 6.2.2. Healthcare

- 6.2.3. Chemical

- 6.2.4. Textile

- 6.2.5. Automotive

- 6.2.6. Consumer Electronics

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Brightness Sensor

- 7.1.2. Molecular Luminescence Sensor

- 7.1.3. RGB Sensor

- 7.1.4. Printed Mark Sensor

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverage

- 7.2.2. Healthcare

- 7.2.3. Chemical

- 7.2.4. Textile

- 7.2.5. Automotive

- 7.2.6. Consumer Electronics

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Brightness Sensor

- 8.1.2. Molecular Luminescence Sensor

- 8.1.3. RGB Sensor

- 8.1.4. Printed Mark Sensor

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverage

- 8.2.2. Healthcare

- 8.2.3. Chemical

- 8.2.4. Textile

- 8.2.5. Automotive

- 8.2.6. Consumer Electronics

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Brightness Sensor

- 9.1.2. Molecular Luminescence Sensor

- 9.1.3. RGB Sensor

- 9.1.4. Printed Mark Sensor

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverage

- 9.2.2. Healthcare

- 9.2.3. Chemical

- 9.2.4. Textile

- 9.2.5. Automotive

- 9.2.6. Consumer Electronics

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Brightness Sensor

- 10.1.2. Molecular Luminescence Sensor

- 10.1.3. RGB Sensor

- 10.1.4. Printed Mark Sensor

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverage

- 10.2.2. Healthcare

- 10.2.3. Chemical

- 10.2.4. Textile

- 10.2.5. Automotive

- 10.2.6. Consumer Electronics

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East Colour Detection Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Brightness Sensor

- 11.1.2. Molecular Luminescence Sensor

- 11.1.3. RGB Sensor

- 11.1.4. Printed Mark Sensor

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Food and Beverage

- 11.2.2. Healthcare

- 11.2.3. Chemical

- 11.2.4. Textile

- 11.2.5. Automotive

- 11.2.6. Consumer Electronics

- 11.2.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vishay Intertechnology Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Keyence Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Hamamatsu Photonics KK

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Astech Applied Sensor Technology Gmbh

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Pepperl+Fuch

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Baumer NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Jenoptik AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SensoPart Industriesensorik GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SICK AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Wenglor Sensoric GmbH

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Omron Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Ams-Osram AG

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 EMX Industries Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Balluff GmbH

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Banner Engineering Corp

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Rockwell Automation Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Datalogic SpA

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Panasonic Corporation

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Colour Detection Sensor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Colour Detection Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Colour Detection Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Colour Detection Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Colour Detection Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Colour Detection Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Colour Detection Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Colour Detection Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Colour Detection Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Colour Detection Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Colour Detection Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Colour Detection Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Colour Detection Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Colour Detection Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Colour Detection Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Colour Detection Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Colour Detection Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Colour Detection Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Colour Detection Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Colour Detection Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Colour Detection Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Colour Detection Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Colour Detection Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Colour Detection Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Colour Detection Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Colour Detection Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Colour Detection Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Colour Detection Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Latin America Colour Detection Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Colour Detection Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Colour Detection Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East Colour Detection Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East Colour Detection Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East Colour Detection Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Middle East Colour Detection Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East Colour Detection Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East Colour Detection Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Colour Detection Sensor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Colour Detection Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Colour Detection Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Colour Detection Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Colour Detection Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Colour Detection Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Colour Detection Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Colour Detection Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Colour Detection Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colour Detection Sensor Industry?

The projected CAGR is approximately 7.18%.

2. Which companies are prominent players in the Colour Detection Sensor Industry?

Key companies in the market include Vishay Intertechnology Inc, Keyence Corporation, Hamamatsu Photonics KK, Astech Applied Sensor Technology Gmbh, Pepperl+Fuch, Baumer NV, Jenoptik AG, SensoPart Industriesensorik GmbH, SICK AG, Wenglor Sensoric GmbH, Omron Corporation, Ams-Osram AG, EMX Industries Inc, Balluff GmbH, Banner Engineering Corp, Rockwell Automation Inc, Datalogic SpA, Panasonic Corporation.

3. What are the main segments of the Colour Detection Sensor Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Process Automation across Various Industries; Increased Use of Color Sensors in Smartphones.

6. What are the notable trends driving market growth?

Food and Beverage Industry to be the Fastest Growing End User.

7. Are there any restraints impacting market growth?

Higher Initial Costs.

8. Can you provide examples of recent developments in the market?

May 2024: Leopard Imaging Inc. announced the stereo camera EAGLE 2 LI-VB1940-GM2A-119H launch at Embedded Vision Summit 2024. The camera marked a significant milestone in vision technology. It introduces the world's first RGB-IR high-resolution stereo camera with patent-pending features, poised to redefine day and night vision capabilities. The Eagle 2 camera boasts an advanced design, incorporating two automotive-grade 5.1-megapixel shutter RGB-IR image sensors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colour Detection Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colour Detection Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colour Detection Sensor Industry?

To stay informed about further developments, trends, and reports in the Colour Detection Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence