Key Insights

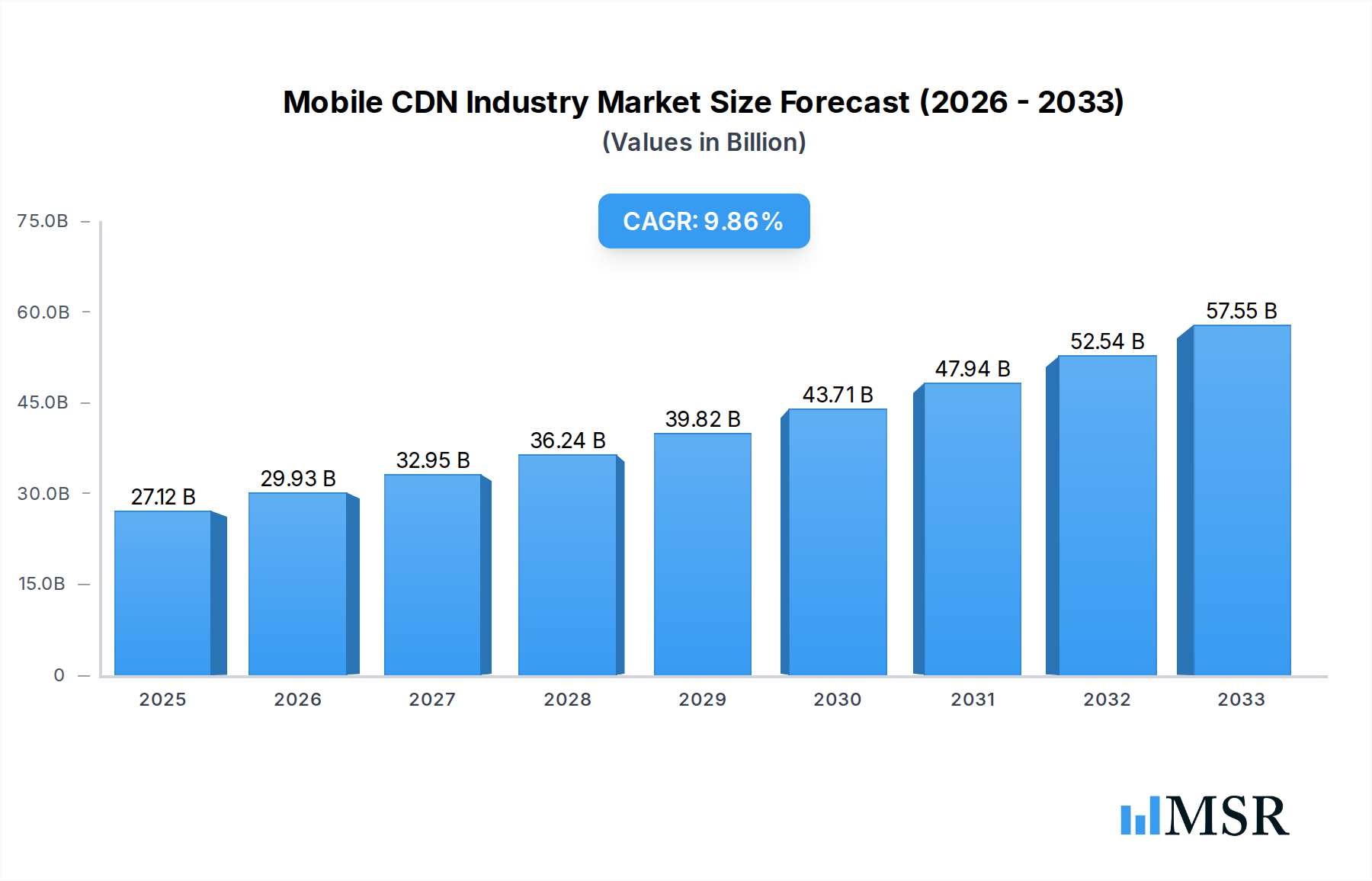

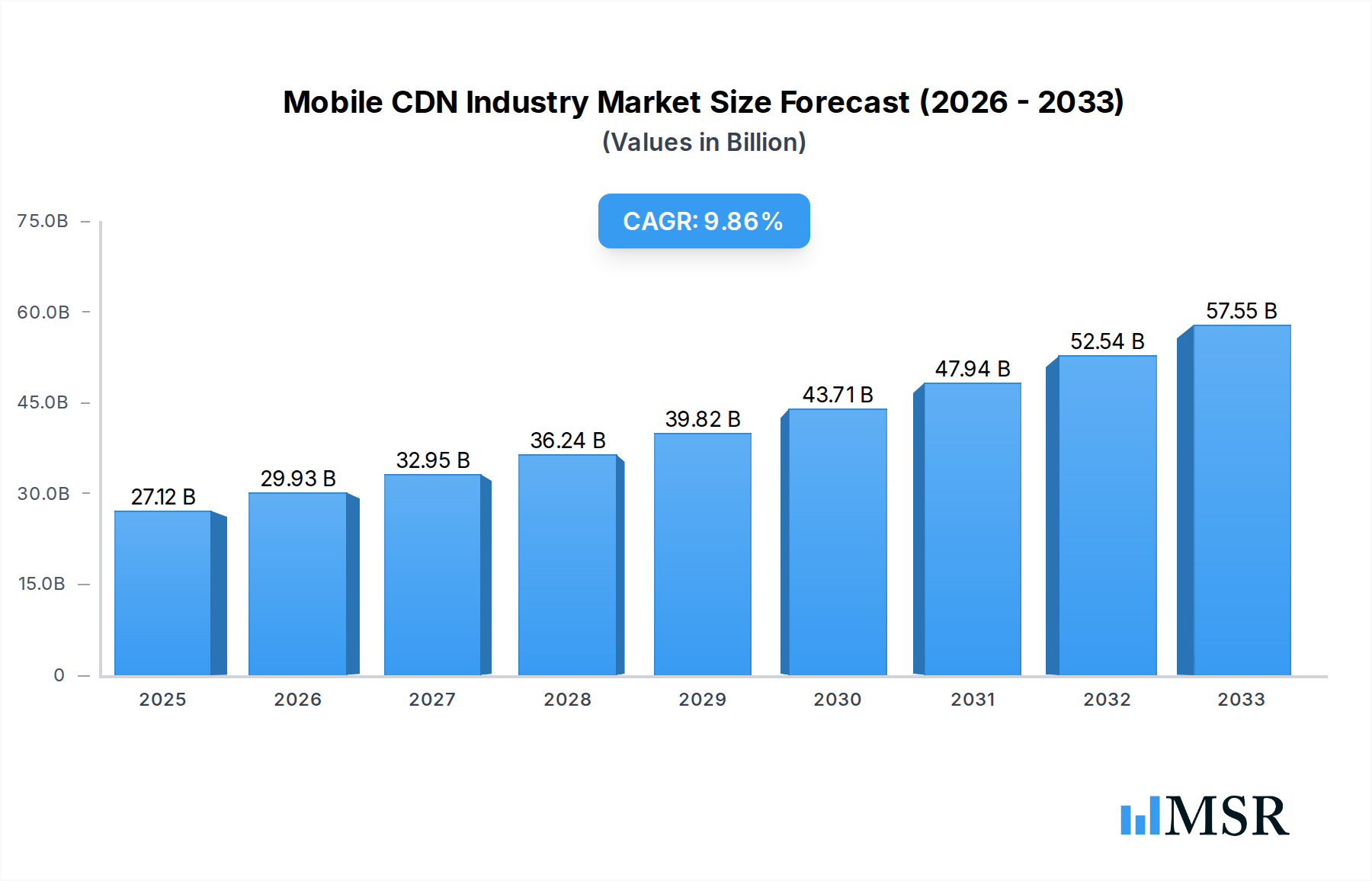

The Mobile Content Delivery Network (CDN) market is poised for significant expansion, projected to reach an estimated $27.12 billion in 2025. This robust growth is underpinned by a compelling compound annual growth rate (CAGR) of 10.72% from 2019 to 2033, indicating a sustained upward trajectory. The primary drivers fueling this surge include the ever-increasing demand for high-quality video streaming and online gaming on mobile devices, the proliferation of smartphones and mobile internet users globally, and the critical need for optimized content delivery to ensure seamless user experiences. Businesses across various sectors are increasingly recognizing the strategic importance of mobile CDNs for enhancing brand presence, improving customer engagement, and driving revenue through efficient content distribution. The ongoing digital transformation initiatives further amplify the demand for advanced CDN solutions that can handle the escalating volumes of mobile data traffic and provide low-latency access to digital content.

Mobile CDN Industry Market Size (In Billion)

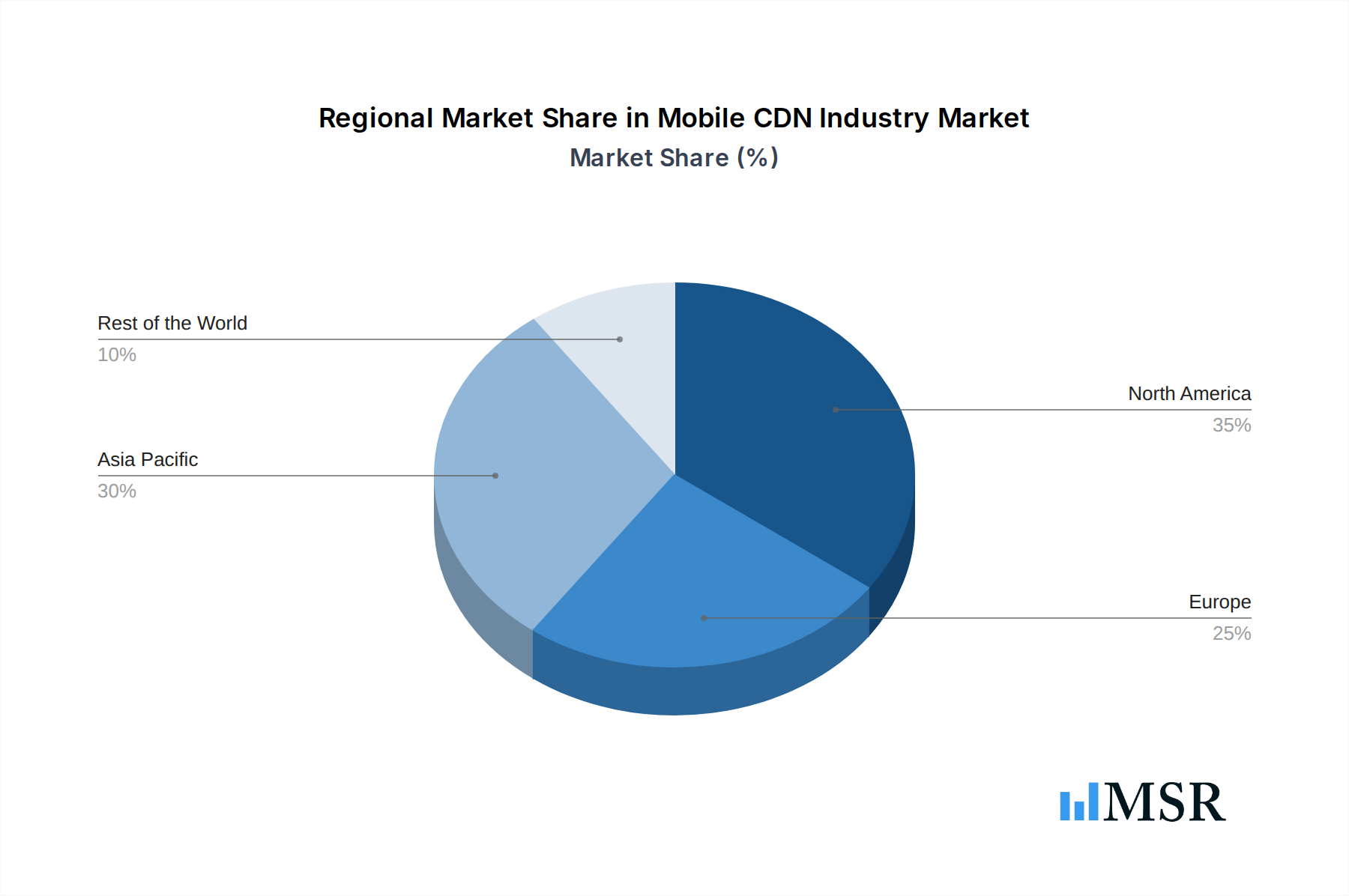

The market is segmented across diverse solutions such as Data Security, Network Acceleration, Reporting, Analysis, and Monitoring, Traffic Management, and Transcoding and Digital Rights Management, highlighting the comprehensive nature of mobile CDN offerings. These solutions are complemented by Professional Services and Support & Maintenance Services, ensuring robust implementation and ongoing operational efficiency. Both Video CDN and Non-video CDN types are experiencing growth, catering to a wide array of end-user industries including Media and Entertainment, E-commerce, Healthcare, Government, Telecom, and BFSI. Geographically, North America and Asia Pacific are expected to lead the market in terms of size and growth, driven by advanced technological adoption and a large, digitally connected population. Key players such as Akamai Technologies, Amazon Web Services Inc., and Cloudflare Inc. are at the forefront, innovating and expanding their service portfolios to meet the dynamic needs of the mobile CDN landscape.

Mobile CDN Industry Company Market Share

Unveiling the Future: Comprehensive Mobile CDN Industry Report (2019-2033)

This in-depth report offers unparalleled insights into the global Mobile Content Delivery Network (CDN) market, a critical infrastructure underpinning the digital experience. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast extending to 2033, this analysis provides a strategic roadmap for telecom, media and entertainment, and ecommerce stakeholders. With an estimated market size projected to reach $700 billion by 2025 and a Compound Annual Growth Rate (CAGR) of 18%, this report delves into the intricate dynamics shaping the mobile CDN solutions landscape, including network acceleration, data security, traffic management, and video CDN.

Mobile CDN Industry Market Concentration & Dynamics

The mobile CDN market exhibits a dynamic concentration, characterized by a blend of established giants and emerging innovators. Leading players like Akamai Technologies, Amazon Web Services Inc, and Microsoft Corporation command significant market share, driven by extensive global infrastructure and comprehensive service portfolios. The innovation ecosystem thrives on the rapid evolution of mobile technologies, including 5G deployment and edge computing, fostering continuous development in network acceleration and data security. Regulatory frameworks, while generally supportive of digital infrastructure, can introduce complexities related to data localization and privacy, impacting market entry and operations. Substitute products, such as direct peer-to-peer content delivery and localized caching solutions, present a minor competitive threat. End-user trends indicate a surging demand for seamless video streaming, online gaming, and real-time interactive applications, directly fueling mobile CDN adoption. Mergers and acquisitions (M&A) activity, with an estimated 25 deals in the historical period, highlights strategic consolidation and expansion efforts, with significant valuations ranging from $500 million to $5 billion per transaction.

Mobile CDN Industry Industry Insights & Trends

The mobile CDN industry is experiencing phenomenal growth, propelled by an insatiable global appetite for digital content and services delivered at lightning speed. The market is projected to witness a significant expansion, with the global market size estimated at $700 billion in the base year of 2025, climbing towards an impressive $2 trillion by 2033. This sustained growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of approximately 18%, reflecting the critical role mobile CDNs play in the modern digital economy. A primary growth driver is the exponential rise in mobile data consumption, fueled by the proliferation of smartphones and the increasing adoption of high-bandwidth applications such as 4K video streaming, augmented reality (AR), and virtual reality (VR). The ongoing global rollout of 5G networks is a transformative technological disruption, offering significantly higher speeds, lower latency, and greater capacity, thereby unlocking new use cases for mobile CDN services and enabling a richer, more immersive user experience. Evolving consumer behaviors are central to this expansion; users demand instant access to content, flawless performance for online gaming, and reliable connectivity for remote work and education, placing immense pressure on network infrastructure to deliver. The increasing reliance on cloud-based services and the decentralization of computing power through edge deployments further amplify the need for robust and geographically distributed mobile CDN solutions. Moreover, the burgeoning ecommerce sector, with its emphasis on seamless online shopping experiences, and the media and entertainment industry, constantly pushing the boundaries of content delivery, are major beneficiaries and key drivers of mobile CDN innovation. The integration of advanced features like intelligent caching, real-time analytics, and enhanced data security protocols within mobile CDN platforms is becoming increasingly crucial to meet the sophisticated demands of a connected world.

Key Markets & Segments Leading Mobile CDN Industry

The mobile CDN industry is experiencing dominance across several key markets and segments, driven by distinct economic and technological factors.

Dominant Regions & Countries:

- North America and Asia-Pacific are at the forefront of mobile CDN adoption. North America's mature digital infrastructure, high disposable income, and early adoption of advanced mobile technologies make it a prime market. Asia-Pacific, led by countries like China and India, presents a massive user base, rapid urbanization, and significant investments in digital infrastructure, including 5G expansion, propelling the growth of video CDN and non-video CDN services.

Leading Segments:

Solutions:

- Network Acceleration: This remains the most critical solution, directly addressing the core need for faster content delivery. Its dominance is driven by the demand for seamless streaming and real-time applications.

- Traffic Management: Essential for optimizing content delivery across fluctuating network conditions and user demands, making it indispensable for all mobile CDN deployments.

- Data Security: With increasing cyber threats, robust data security solutions are paramount, particularly for sensitive data in healthcare and BFSI sectors.

- Reporting, Analysis, and Monitoring: Provides crucial insights for optimizing performance and user experience, a non-negotiable for service providers and content owners.

- Transcoding and Digital Rights Management (DRM): Crucial for the media and entertainment sector, enabling efficient content delivery in various formats and protecting intellectual property.

Service:

- Professional Services: The increasing complexity of mobile CDN deployments necessitates expert guidance, driving demand for consulting, integration, and optimization services.

- Support and Maintenance Services: Ongoing technical support and maintenance are vital for ensuring uninterrupted service delivery and client satisfaction.

Type:

- Video CDN: Dominates due to the massive consumption of video content across all end-user industries. The demand for live streaming and on-demand video continues to fuel this segment.

- Non-video CDN: Growing in importance for delivering web assets, application updates, and other data-intensive content, supporting sectors like ecommerce and government.

End-user Industry:

- Media and Entertainment: The largest and most influential segment, driven by streaming services, online gaming, and content creation.

- Ecommerce: Relies heavily on fast, reliable content delivery to provide seamless shopping experiences and drive sales.

- Telecom: As infrastructure providers and service enablers, the telecom sector is a foundational pillar and significant consumer of mobile CDN technology.

- BFSI: Increasingly adopting mobile CDN for secure and efficient delivery of financial services and customer portals.

- Government: Utilizing mobile CDN for secure citizen services, public information dissemination, and disaster management communications.

- Healthcare: Leveraging mobile CDN for secure telehealth services, medical data exchange, and remote patient monitoring.

Drivers of Dominance:

- Economic Growth: Robust economic conditions in leading regions fuel investments in digital infrastructure and consumer spending on digital services.

- Technological Advancements: The rapid deployment of 5G, edge computing, and AI enhances the capabilities and necessity of mobile CDN.

- Infrastructure Development: Significant government and private sector investments in broadband and mobile network infrastructure are critical enablers.

- Consumer Demand: The insatiable appetite for instant, high-quality digital experiences across all demographics and industries directly translates to mobile CDN demand.

Mobile CDN Industry Product Developments

Recent product developments in the mobile CDN space are characterized by an intensified focus on performance optimization, enhanced security, and intelligent automation. Innovations include advanced caching algorithms leveraging AI for predictive content delivery, minimizing latency for real-time applications. Edge computing integration is rapidly maturing, allowing content processing and delivery closer to end-users, drastically reducing load times. Enhanced data security features, such as real-time threat detection and DDoS mitigation, are becoming standard offerings. Furthermore, the development of specialized video CDN solutions with sophisticated transcoding capabilities and adaptive bitrate streaming ensures superior viewing experiences across diverse network conditions. The market is also witnessing a surge in solutions offering comprehensive reporting, analysis, and monitoring tools, providing clients with granular insights into performance metrics and user behavior, thereby enabling proactive optimization and informed decision-making.

Challenges in the Mobile CDN Industry Market

Despite its robust growth, the mobile CDN industry faces several significant challenges. Regulatory hurdles related to data privacy laws (e.g., GDPR, CCPA) and data localization requirements in various jurisdictions can complicate global deployments and increase compliance costs. Supply chain disruptions, particularly for specialized hardware and infrastructure components, can impact deployment timelines and increase capital expenditures. Intense competitive pressures among established players and new entrants can lead to price erosion and necessitate continuous innovation to maintain market share. Quantifiable impacts include potential delays in new market entries costing millions in lost revenue and increased operational costs due to compliance burdens, potentially impacting profit margins by 5-10%.

Forces Driving Mobile CDN Industry Growth

Several potent forces are propelling the mobile CDN industry forward. The relentless growth in mobile data traffic, driven by video streaming, online gaming, and social media, forms a foundational growth driver. The widespread adoption of 5G networks is a transformative catalyst, enabling lower latency and higher bandwidth, thus unlocking new, data-intensive applications and demanding more sophisticated CDN solutions. The increasing demand for seamless and high-quality user experiences across all digital interactions, from ecommerce to remote work, mandates efficient content delivery. Furthermore, the burgeoning adoption of cloud computing and edge computing architectures necessitates robust CDN infrastructure to support distributed applications and data.

Challenges in the Mobile CDN Industry Market

While the mobile CDN industry is on an upward trajectory, long-term growth is contingent on overcoming certain persistent challenges. The increasing complexity of network infrastructures and the proliferation of edge devices present challenges in terms of unified management and seamless integration. Ensuring consistent performance and data security across a highly fragmented and dynamic network landscape requires continuous technological evolution. Furthermore, the ongoing need for significant capital investment in global infrastructure, coupled with evolving security threats, poses a sustained challenge for market players aiming for sustained profitability and expansion.

Emerging Opportunities in Mobile CDN Industry

The mobile CDN industry is ripe with emerging opportunities. The expansion of 5G networks globally is creating a massive demand for edge CDN solutions, enabling low-latency applications like autonomous driving, industrial IoT, and advanced AR/VR experiences. The increasing adoption of edge computing for real-time data processing in sectors like healthcare and manufacturing presents significant growth avenues. Furthermore, the demand for specialized CDNs tailored for emerging technologies like the metaverse and Web3, with their unique content delivery requirements, offers lucrative new markets. The growing focus on sustainability and energy efficiency within data centers also presents an opportunity for CDN providers offering greener solutions.

Leading Players in the Mobile CDN Industry Sector

- Akamai Technologies

- Amazon Web Services Inc

- Microsoft Corporation

- Cloud Flare Inc

- Ericsson AB

- ChinaCache

- Limelight Networks

- Internap Corporation

- Rackspace Inc

- AT&T Inc

- KeyCDN LLC

- Swarmify Inc

Key Milestones in Mobile CDN Industry Industry

- 2019: Widespread commercial launches of 5G networks, significantly increasing the potential for mobile CDN capabilities.

- 2020: Accelerated adoption of remote work and online services due to global events, driving demand for robust content delivery.

- 2021: Significant advancements in edge computing technologies, with CDNs playing a crucial role in enabling distributed processing.

- 2022: Increased focus on data security and compliance within CDN services due to growing cyber threats.

- 2023: Expansion of video CDN capabilities to support higher resolutions (8K) and immersive content formats.

- 2024: Greater integration of AI and machine learning for predictive caching and traffic management optimization.

Strategic Outlook for Mobile CDN Industry Market

The strategic outlook for the mobile CDN industry remains exceptionally positive, driven by continued technological innovation and evolving digital consumption patterns. Growth accelerators include the ongoing global 5G rollout, the expansion of edge computing, and the increasing demand for high-definition video streaming and interactive online experiences. Strategic opportunities lie in developing specialized CDN solutions for emerging technologies like the metaverse and Web3, enhancing data security protocols to meet stringent regulatory demands, and expanding service offerings to include comprehensive analytics and performance optimization. The market's ability to adapt to these trends will be critical for sustained leadership and profitability.

Mobile CDN Industry Segmentation

-

1. Solutions

- 1.1. Data Security

- 1.2. Network Acceleration

- 1.3. Reporting, Analysis, and Monitoring

- 1.4. Traffic Management

- 1.5. Transcoding and Digital Rights Management

-

2. Service

- 2.1. Professional Service

- 2.2. Support and Maintenance Service

-

3. Type

- 3.1. Video CDN

- 3.2. Non-video CDN

-

4. End-user Industry

- 4.1. Media and Entertainment

- 4.2. Ecommerce

- 4.3. Healthcare

- 4.4. Government

- 4.5. Telecom

- 4.6. BFSI

- 4.7. Other End-user Industry

Mobile CDN Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Mobile CDN Industry Regional Market Share

Geographic Coverage of Mobile CDN Industry

Mobile CDN Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for High-Definition Channels and Video On-Demand; Interactive Services Packaged Along with IPTV Services; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Competition from Cable TV and Satellite TV Operators; Lack of Infrastructure in Developing Regions to Offer Delay and Jitter-free Service

- 3.4. Market Trends

- 3.4.1. Media and Entertainment to Hold the Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile CDN Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Data Security

- 5.1.2. Network Acceleration

- 5.1.3. Reporting, Analysis, and Monitoring

- 5.1.4. Traffic Management

- 5.1.5. Transcoding and Digital Rights Management

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Professional Service

- 5.2.2. Support and Maintenance Service

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Video CDN

- 5.3.2. Non-video CDN

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Media and Entertainment

- 5.4.2. Ecommerce

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. Telecom

- 5.4.6. BFSI

- 5.4.7. Other End-user Industry

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. North America Mobile CDN Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 6.1.1. Data Security

- 6.1.2. Network Acceleration

- 6.1.3. Reporting, Analysis, and Monitoring

- 6.1.4. Traffic Management

- 6.1.5. Transcoding and Digital Rights Management

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Professional Service

- 6.2.2. Support and Maintenance Service

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Video CDN

- 6.3.2. Non-video CDN

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Media and Entertainment

- 6.4.2. Ecommerce

- 6.4.3. Healthcare

- 6.4.4. Government

- 6.4.5. Telecom

- 6.4.6. BFSI

- 6.4.7. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 7. Europe Mobile CDN Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 7.1.1. Data Security

- 7.1.2. Network Acceleration

- 7.1.3. Reporting, Analysis, and Monitoring

- 7.1.4. Traffic Management

- 7.1.5. Transcoding and Digital Rights Management

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Professional Service

- 7.2.2. Support and Maintenance Service

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Video CDN

- 7.3.2. Non-video CDN

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Media and Entertainment

- 7.4.2. Ecommerce

- 7.4.3. Healthcare

- 7.4.4. Government

- 7.4.5. Telecom

- 7.4.6. BFSI

- 7.4.7. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 8. Asia Pacific Mobile CDN Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 8.1.1. Data Security

- 8.1.2. Network Acceleration

- 8.1.3. Reporting, Analysis, and Monitoring

- 8.1.4. Traffic Management

- 8.1.5. Transcoding and Digital Rights Management

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Professional Service

- 8.2.2. Support and Maintenance Service

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Video CDN

- 8.3.2. Non-video CDN

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Media and Entertainment

- 8.4.2. Ecommerce

- 8.4.3. Healthcare

- 8.4.4. Government

- 8.4.5. Telecom

- 8.4.6. BFSI

- 8.4.7. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 9. Rest of the World Mobile CDN Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 9.1.1. Data Security

- 9.1.2. Network Acceleration

- 9.1.3. Reporting, Analysis, and Monitoring

- 9.1.4. Traffic Management

- 9.1.5. Transcoding and Digital Rights Management

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Professional Service

- 9.2.2. Support and Maintenance Service

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Video CDN

- 9.3.2. Non-video CDN

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Media and Entertainment

- 9.4.2. Ecommerce

- 9.4.3. Healthcare

- 9.4.4. Government

- 9.4.5. Telecom

- 9.4.6. BFSI

- 9.4.7. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ChinaCache

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ericsson AB

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Limelight Networks

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Swarmify Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Microsoft Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Akamai Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amazon Web Services Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Internap Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rackspace Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 KeyCDN LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 AT&T Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Cloud Flare Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ChinaCache

List of Figures

- Figure 1: Global Mobile CDN Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Mobile CDN Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Mobile CDN Industry Revenue (billion), by Solutions 2025 & 2033

- Figure 4: North America Mobile CDN Industry Volume (K Unit), by Solutions 2025 & 2033

- Figure 5: North America Mobile CDN Industry Revenue Share (%), by Solutions 2025 & 2033

- Figure 6: North America Mobile CDN Industry Volume Share (%), by Solutions 2025 & 2033

- Figure 7: North America Mobile CDN Industry Revenue (billion), by Service 2025 & 2033

- Figure 8: North America Mobile CDN Industry Volume (K Unit), by Service 2025 & 2033

- Figure 9: North America Mobile CDN Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: North America Mobile CDN Industry Volume Share (%), by Service 2025 & 2033

- Figure 11: North America Mobile CDN Industry Revenue (billion), by Type 2025 & 2033

- Figure 12: North America Mobile CDN Industry Volume (K Unit), by Type 2025 & 2033

- Figure 13: North America Mobile CDN Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Mobile CDN Industry Volume Share (%), by Type 2025 & 2033

- Figure 15: North America Mobile CDN Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 16: North America Mobile CDN Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 17: North America Mobile CDN Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: North America Mobile CDN Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 19: North America Mobile CDN Industry Revenue (billion), by Country 2025 & 2033

- Figure 20: North America Mobile CDN Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Mobile CDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Mobile CDN Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Mobile CDN Industry Revenue (billion), by Solutions 2025 & 2033

- Figure 24: Europe Mobile CDN Industry Volume (K Unit), by Solutions 2025 & 2033

- Figure 25: Europe Mobile CDN Industry Revenue Share (%), by Solutions 2025 & 2033

- Figure 26: Europe Mobile CDN Industry Volume Share (%), by Solutions 2025 & 2033

- Figure 27: Europe Mobile CDN Industry Revenue (billion), by Service 2025 & 2033

- Figure 28: Europe Mobile CDN Industry Volume (K Unit), by Service 2025 & 2033

- Figure 29: Europe Mobile CDN Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Europe Mobile CDN Industry Volume Share (%), by Service 2025 & 2033

- Figure 31: Europe Mobile CDN Industry Revenue (billion), by Type 2025 & 2033

- Figure 32: Europe Mobile CDN Industry Volume (K Unit), by Type 2025 & 2033

- Figure 33: Europe Mobile CDN Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Europe Mobile CDN Industry Volume Share (%), by Type 2025 & 2033

- Figure 35: Europe Mobile CDN Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 36: Europe Mobile CDN Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 37: Europe Mobile CDN Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Europe Mobile CDN Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 39: Europe Mobile CDN Industry Revenue (billion), by Country 2025 & 2033

- Figure 40: Europe Mobile CDN Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Mobile CDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Mobile CDN Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Mobile CDN Industry Revenue (billion), by Solutions 2025 & 2033

- Figure 44: Asia Pacific Mobile CDN Industry Volume (K Unit), by Solutions 2025 & 2033

- Figure 45: Asia Pacific Mobile CDN Industry Revenue Share (%), by Solutions 2025 & 2033

- Figure 46: Asia Pacific Mobile CDN Industry Volume Share (%), by Solutions 2025 & 2033

- Figure 47: Asia Pacific Mobile CDN Industry Revenue (billion), by Service 2025 & 2033

- Figure 48: Asia Pacific Mobile CDN Industry Volume (K Unit), by Service 2025 & 2033

- Figure 49: Asia Pacific Mobile CDN Industry Revenue Share (%), by Service 2025 & 2033

- Figure 50: Asia Pacific Mobile CDN Industry Volume Share (%), by Service 2025 & 2033

- Figure 51: Asia Pacific Mobile CDN Industry Revenue (billion), by Type 2025 & 2033

- Figure 52: Asia Pacific Mobile CDN Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Asia Pacific Mobile CDN Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Mobile CDN Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Mobile CDN Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 56: Asia Pacific Mobile CDN Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Asia Pacific Mobile CDN Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Asia Pacific Mobile CDN Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Asia Pacific Mobile CDN Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Mobile CDN Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Mobile CDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Mobile CDN Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of the World Mobile CDN Industry Revenue (billion), by Solutions 2025 & 2033

- Figure 64: Rest of the World Mobile CDN Industry Volume (K Unit), by Solutions 2025 & 2033

- Figure 65: Rest of the World Mobile CDN Industry Revenue Share (%), by Solutions 2025 & 2033

- Figure 66: Rest of the World Mobile CDN Industry Volume Share (%), by Solutions 2025 & 2033

- Figure 67: Rest of the World Mobile CDN Industry Revenue (billion), by Service 2025 & 2033

- Figure 68: Rest of the World Mobile CDN Industry Volume (K Unit), by Service 2025 & 2033

- Figure 69: Rest of the World Mobile CDN Industry Revenue Share (%), by Service 2025 & 2033

- Figure 70: Rest of the World Mobile CDN Industry Volume Share (%), by Service 2025 & 2033

- Figure 71: Rest of the World Mobile CDN Industry Revenue (billion), by Type 2025 & 2033

- Figure 72: Rest of the World Mobile CDN Industry Volume (K Unit), by Type 2025 & 2033

- Figure 73: Rest of the World Mobile CDN Industry Revenue Share (%), by Type 2025 & 2033

- Figure 74: Rest of the World Mobile CDN Industry Volume Share (%), by Type 2025 & 2033

- Figure 75: Rest of the World Mobile CDN Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 76: Rest of the World Mobile CDN Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Rest of the World Mobile CDN Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Rest of the World Mobile CDN Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Rest of the World Mobile CDN Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Rest of the World Mobile CDN Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Rest of the World Mobile CDN Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of the World Mobile CDN Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile CDN Industry Revenue billion Forecast, by Solutions 2020 & 2033

- Table 2: Global Mobile CDN Industry Volume K Unit Forecast, by Solutions 2020 & 2033

- Table 3: Global Mobile CDN Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 4: Global Mobile CDN Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 5: Global Mobile CDN Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Mobile CDN Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Mobile CDN Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Mobile CDN Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Mobile CDN Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Global Mobile CDN Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Mobile CDN Industry Revenue billion Forecast, by Solutions 2020 & 2033

- Table 12: Global Mobile CDN Industry Volume K Unit Forecast, by Solutions 2020 & 2033

- Table 13: Global Mobile CDN Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global Mobile CDN Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 15: Global Mobile CDN Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global Mobile CDN Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 17: Global Mobile CDN Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Mobile CDN Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Mobile CDN Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Mobile CDN Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United States Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Canada Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Mobile CDN Industry Revenue billion Forecast, by Solutions 2020 & 2033

- Table 26: Global Mobile CDN Industry Volume K Unit Forecast, by Solutions 2020 & 2033

- Table 27: Global Mobile CDN Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 28: Global Mobile CDN Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 29: Global Mobile CDN Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Mobile CDN Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 31: Global Mobile CDN Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Mobile CDN Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Mobile CDN Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Global Mobile CDN Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: United Kingdom Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Germany Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Germany Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: France Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: France Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Mobile CDN Industry Revenue billion Forecast, by Solutions 2020 & 2033

- Table 44: Global Mobile CDN Industry Volume K Unit Forecast, by Solutions 2020 & 2033

- Table 45: Global Mobile CDN Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 46: Global Mobile CDN Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 47: Global Mobile CDN Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global Mobile CDN Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global Mobile CDN Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 50: Global Mobile CDN Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 51: Global Mobile CDN Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 52: Global Mobile CDN Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 53: China Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: China Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Japan Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Japan Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: South Korea Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: South Korea Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: India Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: India Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Mobile CDN Industry Revenue billion Forecast, by Solutions 2020 & 2033

- Table 64: Global Mobile CDN Industry Volume K Unit Forecast, by Solutions 2020 & 2033

- Table 65: Global Mobile CDN Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 66: Global Mobile CDN Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 67: Global Mobile CDN Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 68: Global Mobile CDN Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 69: Global Mobile CDN Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 70: Global Mobile CDN Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 71: Global Mobile CDN Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Mobile CDN Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Latin America Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Latin America Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Middle East Mobile CDN Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Middle East Mobile CDN Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile CDN Industry?

The projected CAGR is approximately 10.72%.

2. Which companies are prominent players in the Mobile CDN Industry?

Key companies in the market include ChinaCache, Ericsson AB, Limelight Networks, Swarmify Inc, Microsoft Corporation, Akamai Technologies, Amazon Web Services Inc, Internap Corporation, Rackspace Inc, KeyCDN LLC, AT&T Inc, Cloud Flare Inc.

3. What are the main segments of the Mobile CDN Industry?

The market segments include Solutions, Service, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for High-Definition Channels and Video On-Demand; Interactive Services Packaged Along with IPTV Services; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Media and Entertainment to Hold the Highest Market Share.

7. Are there any restraints impacting market growth?

Competition from Cable TV and Satellite TV Operators; Lack of Infrastructure in Developing Regions to Offer Delay and Jitter-free Service.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile CDN Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile CDN Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile CDN Industry?

To stay informed about further developments, trends, and reports in the Mobile CDN Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence