Key Insights

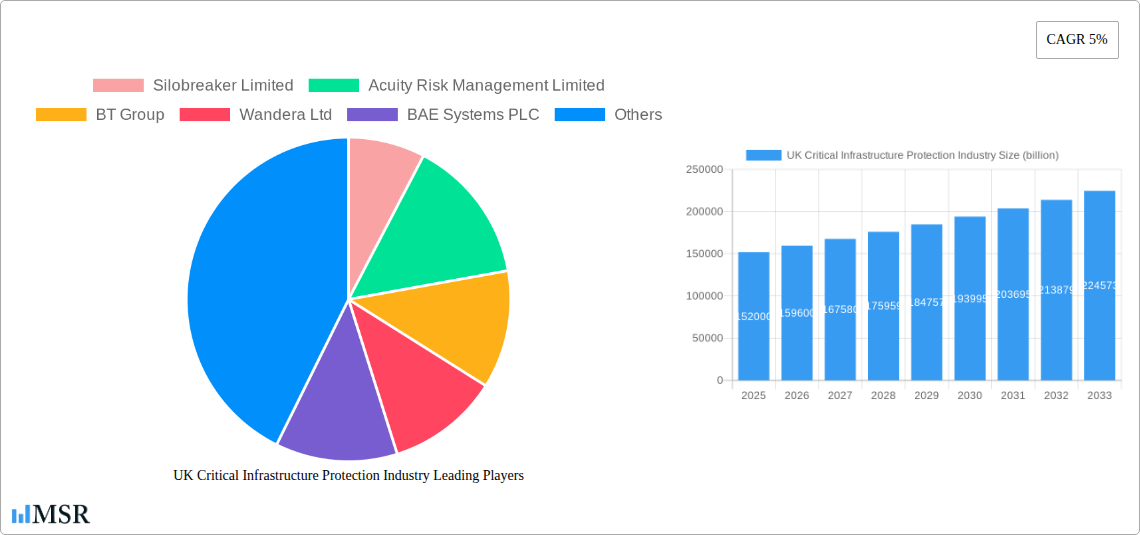

The UK Critical Infrastructure Protection (CIP) market is poised for significant expansion, demonstrating robust growth driven by escalating security threats and the increasing digitization of vital sectors. In 2025, the market is estimated at approximately $152 billion, with a projected Compound Annual Growth Rate (CAGR) of 5% anticipated to sustain this trajectory through 2033. This growth is fueled by several key drivers, including the imperative to safeguard energy grids, transportation networks, and sensitive enterprises from sophisticated cyber and physical attacks. The demand for advanced network security, intelligent building management systems, and reliable vehicle identification management solutions is paramount, reflecting a strategic shift towards proactive and integrated CIP strategies. Furthermore, the rising adoption of advanced technologies like AI and IoT in critical infrastructure necessitates enhanced protective measures.

UK Critical Infrastructure Protection Industry Market Size (In Billion)

The UK CIP landscape is characterized by a dynamic interplay of technological advancements and evolving service offerings. Key trends include the growing emphasis on managed services for remote monitoring and rapid incident response, alongside a sustained demand for comprehensive risk management services and expert consultation. Integration and support services are also critical, ensuring seamless deployment and ongoing efficacy of protection solutions. While the market benefits from substantial investment in security technologies and services, it also faces restraints such as the high cost of implementing and maintaining advanced CIP systems and the challenge of skilled personnel shortages. The services segment, encompassing everything from initial design and integration to ongoing maintenance and support, is a critical component of this ecosystem, ensuring the resilience and continuous operation of the nation's most vital assets across all verticals.

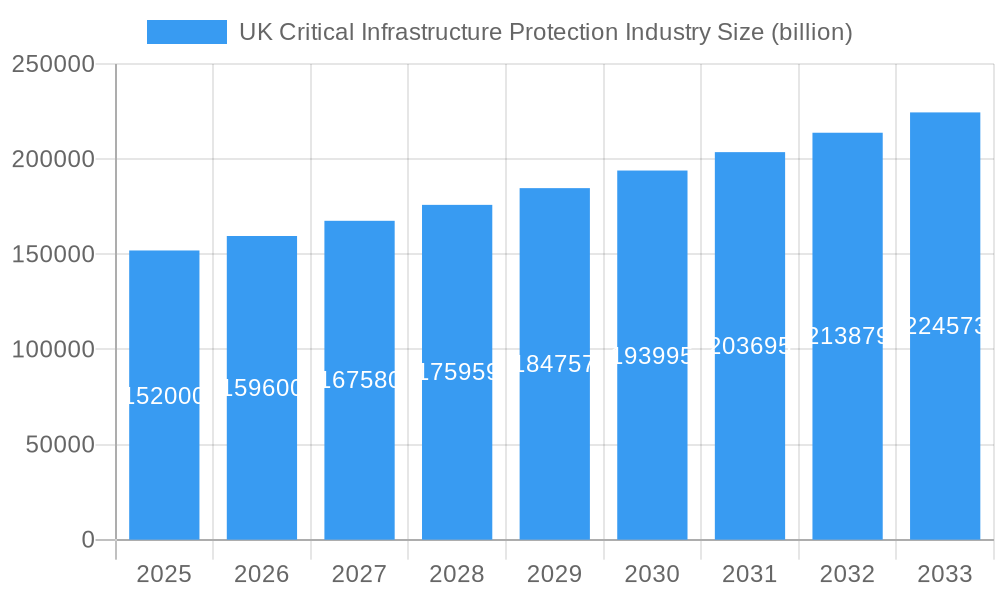

UK Critical Infrastructure Protection Industry Company Market Share

Here's the SEO-optimized, engaging report description for the UK Critical Infrastructure Protection Industry, incorporating all your specified details without placeholders.

This in-depth report offers a definitive analysis of the UK Critical Infrastructure Protection Industry, providing critical insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and mitigate risks. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report delves into the intricate landscape of security technology, service provision, and vertical sector adoption. We dissect market concentration, innovation, regulatory frameworks, and M&A activities, offering a clear picture of the competitive environment. Dive deep into industry trends, market size projections exceeding £XX billion by 2025, and compound annual growth rates (CAGR) crucial for strategic planning. Identify key market segments driving growth, from advanced Network Security and Scada Security to vital Risk Management Services and Managed Services, across pivotal sectors like Energy and Power and Transportation. Explore groundbreaking Product Developments and understand the challenges and forces shaping the future of UK critical infrastructure resilience. Discover emerging opportunities and gain strategic foresight from leading players and key industry milestones.

UK Critical Infrastructure Protection Industry Market Concentration & Dynamics

The UK Critical Infrastructure Protection Industry is characterized by a moderate level of market concentration, with a blend of large, established players and a growing number of specialized technology providers. Innovation ecosystems are thriving, fueled by significant investment in R&D for advanced security solutions. The regulatory framework remains a dominant force, with stringent compliance requirements for sectors like Energy and Power and Transportation driving demand for sophisticated protection measures. Substitute products, while present, often fall short of the comprehensive security required for critical assets, pushing end-users towards integrated, high-fidelity solutions. End-user trends are increasingly focused on proactive threat intelligence, AI-driven anomaly detection, and robust physical security integration. Merger and acquisition (M&A) activities are anticipated to remain a significant driver of market consolidation, with an estimated XX deals projected within the forecast period, aiming to expand service portfolios and geographical reach. Key players are actively acquiring niche technologies and market access to bolster their competitive standing, with an estimated market share distribution indicating the top 5 companies holding approximately XX% of the total market value.

UK Critical Infrastructure Protection Industry Industry Insights & Trends

The UK Critical Infrastructure Protection Industry is experiencing robust growth, propelled by an escalating threat landscape and the increasing digitization of essential services. The market size is projected to reach an estimated £XX billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. A primary growth driver is the continuous evolution of cyber threats targeting operational technology (OT) and industrial control systems (ICS), necessitating advanced Scada Security solutions and comprehensive Network Security protocols. The proliferation of smart grids within the Energy and Power sector, coupled with the modernization of transportation networks, demands sophisticated Building Management Systems and Secure Communications to ensure uninterrupted operations. Furthermore, the increasing adoption of Managed Services by organizations seeking to offload the complexity of security management is a significant trend. Technological disruptions, such as the integration of AI and machine learning for predictive threat analysis and the expansion of IoT devices within critical infrastructure, are creating new avenues for protection. Evolving consumer behaviors, while less direct, influence security demands through the expectation of uninterrupted service delivery and data privacy, placing greater onus on infrastructure providers to maintain robust security postures. The ongoing integration of physical and cyber security measures, driven by the need for holistic protection, also plays a crucial role in market expansion. The increasing investment in CBRNE detection and response capabilities for high-risk facilities further contributes to market vitality.

Key Markets & Segments Leading UK Critical Infrastructure Protection Industry

The Energy and Power sector stands out as a dominant market segment within the UK Critical Infrastructure Protection Industry, primarily driven by the inherent criticality of energy supply and the escalating cyber and physical threats it faces. Economic growth and the continued investment in renewable energy infrastructure necessitate advanced protection for power generation, transmission, and distribution networks. This sector's demand is particularly strong for Scada Security and robust Network Security solutions to safeguard against sophisticated cyberattacks aimed at disrupting operations.

Within the Security Technology segment, Network Security commands the largest market share, reflecting the pervasive digitalization and interconnectedness of critical infrastructure. Its dominance is fueled by the need to protect against data breaches, ransomware, and denial-of-service attacks that can have cascading effects.

- Drivers for Network Security Dominance:

- Increasing sophistication of cyber threats.

- Regulatory mandates for data protection and cybersecurity.

- Expansion of remote access and cloud integration.

Physical Security is another pivotal segment, focusing on protecting tangible assets and preventing unauthorized access. This includes the deployment of advanced surveillance systems, access control, and intrusion detection, particularly relevant for sensitive infrastructure like power plants and transportation hubs.

- Drivers for Physical Security Dominance:

- High-profile security incidents and terrorism concerns.

- Integration with cyber security for a holistic defense.

- Need for asset protection against theft and vandalism.

The Transportation vertical is rapidly growing, driven by the need to secure an increasingly complex and interconnected network of railways, airports, and road infrastructure. The integration of smart technologies and IoT devices presents both opportunities and vulnerabilities, spurring demand for specialized Vehicle Identification Management and enhanced Secure Communications.

In the Service segment, Risk Management Services are paramount. Organizations are increasingly relying on expert consultation to identify vulnerabilities, assess threats, and develop comprehensive protection strategies. This is closely followed by Designing, Integration, and Consultation, which is crucial for implementing complex security systems tailored to specific infrastructure needs.

- Drivers for Risk Management Services Dominance:

- Complex regulatory environments requiring expert navigation.

- Need for proactive threat assessment and mitigation planning.

- Increasing understanding of the financial and reputational costs of security failures.

UK Critical Infrastructure Protection Industry Product Developments

Product innovations in the UK Critical Infrastructure Protection Industry are focused on enhancing threat detection, response, and resilience. Advanced AI-powered analytics are being integrated into Network Security platforms to provide real-time threat intelligence and predictive capabilities. Developments in Physical Security include the deployment of intelligent video analytics and drone-based surveillance for comprehensive monitoring. Furthermore, advancements in Scada Security are emphasizing secure-by-design principles and robust authentication mechanisms for industrial control systems. The market is witnessing a surge in integrated solutions that bridge the gap between cyber and physical security, offering a unified approach to protection.

Challenges in the UK Critical Infrastructure Protection Industry Market

The UK Critical Infrastructure Protection Industry faces several formidable challenges that temper its growth trajectory. Regulatory hurdles can be complex and frequently updated, requiring continuous adaptation and investment from organizations. Supply chain issues, particularly concerning specialized hardware and software components, can lead to project delays and increased costs. Competitive pressures are intense, with a crowded market demanding constant innovation and cost-effectiveness. Furthermore, the scarcity of skilled cybersecurity professionals poses a significant barrier, impacting the effective deployment and management of protection solutions. The substantial initial investment required for advanced security systems also presents a restraint for some organizations.

Forces Driving UK Critical Infrastructure Protection Industry Growth

The growth of the UK Critical Infrastructure Protection Industry is primarily propelled by several key forces. The escalating sophistication and frequency of cyber threats targeting critical sectors like Energy and Power and Transportation are undeniable drivers. Increased government investment in national security and resilience initiatives, alongside stringent regulatory frameworks, mandates higher levels of protection. Technological advancements, such as the integration of AI and IoT, while introducing new risks, also create demand for innovative security solutions. Economic factors, including the continuous expansion and modernization of infrastructure, further fuel the need for robust protection measures, with projected infrastructure spending in the UK expected to exceed £XX billion annually.

Challenges in the UK Critical Infrastructure Protection Industry Market

Long-term growth catalysts for the UK Critical Infrastructure Protection Industry are deeply intertwined with continuous innovation and strategic partnerships. The ongoing evolution of threats necessitates a commitment to research and development, leading to the creation of next-generation security technologies. Collaborative efforts between government agencies, private sector enterprises, and academic institutions are vital for knowledge sharing and the development of industry-wide best practices. Market expansions into emerging areas, such as the securitization of critical underwater infrastructure and the protection of advanced manufacturing facilities, present significant growth potential. Furthermore, the increasing demand for integrated cybersecurity and physical security solutions will continue to drive market development.

Emerging Opportunities in UK Critical Infrastructure Protection Industry

Emerging opportunities within the UK Critical Infrastructure Protection Industry are diverse and capitalize on new technological frontiers and evolving societal needs. The proliferation of 5G networks presents a significant opportunity for enhanced Secure Communications and the deployment of more sophisticated IoT-enabled security solutions across various verticals. The growing emphasis on climate change and net-zero targets is creating a demand for specialized protection of renewable energy infrastructure, including offshore wind farms and advanced battery storage facilities. Furthermore, the increasing adoption of cloud-based security services by smaller enterprises and critical infrastructure operators is opening new markets for scalable and cost-effective solutions. The development of quantum-resistant cryptography is also an emerging area with long-term strategic importance.

Leading Players in the UK Critical Infrastructure Protection Industry Sector

- Silobreaker Limited

- Acuity Risk Management Limited

- BT Group

- Wandera Ltd

- BAE Systems PLC

- Vision Security Group Ltd

- Sophos Group PLC

- Wilson James Ltd

- Advance Security (United Kingdom) Limited

- G4S PLC

Key Milestones in UK Critical Infrastructure Protection Industry Industry

- 2019: Launch of the UK's National Cyber Security Centre's (NCSC) updated guidance on industrial control system security, emphasizing the criticality of Scada Security.

- 2020: Increased focus on securing the energy sector following heightened geopolitical tensions and cyber threats, leading to substantial investment in Network Security and Physical Security for power grids.

- 2021: Significant government funding announced for upgrading transportation infrastructure, with a strong emphasis on cybersecurity for rail and aviation, boosting demand for Secure Communications and Vehicle Identification Management.

- 2022: Rise in sophisticated ransomware attacks targeting critical infrastructure, prompting greater adoption of Managed Services and advanced Risk Management Services.

- 2023: Introduction of new government regulations mandating enhanced cybersecurity standards for operators of essential services, further driving the adoption of comprehensive protection solutions.

- 2024: Continued advancements in AI and machine learning applied to threat detection across Physical Security and Network Security systems, offering more proactive defense mechanisms.

Strategic Outlook for UK Critical Infrastructure Protection Industry Market

The strategic outlook for the UK Critical Infrastructure Protection Industry market remains exceptionally positive, driven by an unwavering need for robust security in an increasingly complex threat environment. Growth accelerators will include the continued integration of AI and machine learning for predictive analytics and autonomous response systems across all security technology segments. Partnerships between technology providers, service integrators, and end-users will be crucial for developing bespoke and effective protection strategies. The increasing recognition of critical infrastructure as a national asset, requiring a holistic security approach, will foster further investment and innovation. The market's future potential is further bolstered by the ongoing digital transformation of essential services and the persistent evolution of the threat landscape, demanding continuous adaptation and foresight.

UK Critical Infrastructure Protection Industry Segmentation

-

1. Security Technology

- 1.1. Network Security

- 1.2. Physical Security

- 1.3. Vehicle Identification Management

- 1.4. Building Management Systems

- 1.5. Secure Communications

- 1.6. Radars

- 1.7. Scada Security

- 1.8. CBRNE

-

2. Service

- 2.1. Risk Management Services

- 2.2. Designing, Integration, and Consultation

- 2.3. Managed Services

- 2.4. Maintenance and Support

-

3. Vertical

- 3.1. Energy and Power

- 3.2. Transportation

- 3.3. Sensitive Infrastructure and Enterprises

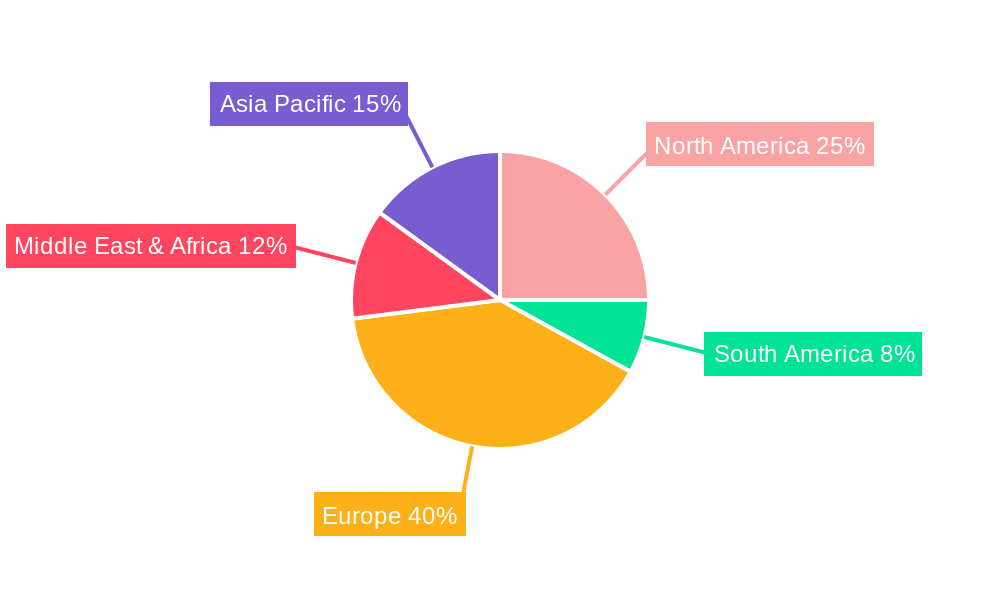

UK Critical Infrastructure Protection Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Critical Infrastructure Protection Industry Regional Market Share

Geographic Coverage of UK Critical Infrastructure Protection Industry

UK Critical Infrastructure Protection Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Joint Functioning of Cloud Computing and Critical Infrastructure Protection; Political Pressures for Better Regulations and Implementation

- 3.3. Market Restrains

- 3.3.1. Poor Understanding of Industrial Control Systems; Lack of Interoperability Between Products

- 3.4. Market Trends

- 3.4.1. Risk Management Accounts for Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Security Technology

- 5.1.1. Network Security

- 5.1.2. Physical Security

- 5.1.3. Vehicle Identification Management

- 5.1.4. Building Management Systems

- 5.1.5. Secure Communications

- 5.1.6. Radars

- 5.1.7. Scada Security

- 5.1.8. CBRNE

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Risk Management Services

- 5.2.2. Designing, Integration, and Consultation

- 5.2.3. Managed Services

- 5.2.4. Maintenance and Support

- 5.3. Market Analysis, Insights and Forecast - by Vertical

- 5.3.1. Energy and Power

- 5.3.2. Transportation

- 5.3.3. Sensitive Infrastructure and Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Security Technology

- 6. North America UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Security Technology

- 6.1.1. Network Security

- 6.1.2. Physical Security

- 6.1.3. Vehicle Identification Management

- 6.1.4. Building Management Systems

- 6.1.5. Secure Communications

- 6.1.6. Radars

- 6.1.7. Scada Security

- 6.1.8. CBRNE

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Risk Management Services

- 6.2.2. Designing, Integration, and Consultation

- 6.2.3. Managed Services

- 6.2.4. Maintenance and Support

- 6.3. Market Analysis, Insights and Forecast - by Vertical

- 6.3.1. Energy and Power

- 6.3.2. Transportation

- 6.3.3. Sensitive Infrastructure and Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Security Technology

- 7. South America UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Security Technology

- 7.1.1. Network Security

- 7.1.2. Physical Security

- 7.1.3. Vehicle Identification Management

- 7.1.4. Building Management Systems

- 7.1.5. Secure Communications

- 7.1.6. Radars

- 7.1.7. Scada Security

- 7.1.8. CBRNE

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Risk Management Services

- 7.2.2. Designing, Integration, and Consultation

- 7.2.3. Managed Services

- 7.2.4. Maintenance and Support

- 7.3. Market Analysis, Insights and Forecast - by Vertical

- 7.3.1. Energy and Power

- 7.3.2. Transportation

- 7.3.3. Sensitive Infrastructure and Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Security Technology

- 8. Europe UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Security Technology

- 8.1.1. Network Security

- 8.1.2. Physical Security

- 8.1.3. Vehicle Identification Management

- 8.1.4. Building Management Systems

- 8.1.5. Secure Communications

- 8.1.6. Radars

- 8.1.7. Scada Security

- 8.1.8. CBRNE

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Risk Management Services

- 8.2.2. Designing, Integration, and Consultation

- 8.2.3. Managed Services

- 8.2.4. Maintenance and Support

- 8.3. Market Analysis, Insights and Forecast - by Vertical

- 8.3.1. Energy and Power

- 8.3.2. Transportation

- 8.3.3. Sensitive Infrastructure and Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Security Technology

- 9. Middle East & Africa UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Security Technology

- 9.1.1. Network Security

- 9.1.2. Physical Security

- 9.1.3. Vehicle Identification Management

- 9.1.4. Building Management Systems

- 9.1.5. Secure Communications

- 9.1.6. Radars

- 9.1.7. Scada Security

- 9.1.8. CBRNE

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Risk Management Services

- 9.2.2. Designing, Integration, and Consultation

- 9.2.3. Managed Services

- 9.2.4. Maintenance and Support

- 9.3. Market Analysis, Insights and Forecast - by Vertical

- 9.3.1. Energy and Power

- 9.3.2. Transportation

- 9.3.3. Sensitive Infrastructure and Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Security Technology

- 10. Asia Pacific UK Critical Infrastructure Protection Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Security Technology

- 10.1.1. Network Security

- 10.1.2. Physical Security

- 10.1.3. Vehicle Identification Management

- 10.1.4. Building Management Systems

- 10.1.5. Secure Communications

- 10.1.6. Radars

- 10.1.7. Scada Security

- 10.1.8. CBRNE

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Risk Management Services

- 10.2.2. Designing, Integration, and Consultation

- 10.2.3. Managed Services

- 10.2.4. Maintenance and Support

- 10.3. Market Analysis, Insights and Forecast - by Vertical

- 10.3.1. Energy and Power

- 10.3.2. Transportation

- 10.3.3. Sensitive Infrastructure and Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Security Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Silobreaker Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Acuity Risk Management Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BT Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wandera Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vision Security Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sophos Group PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wilson James Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Advance Security (United Kingdom) Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 G4S PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Silobreaker Limited

List of Figures

- Figure 1: Global UK Critical Infrastructure Protection Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 3: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 4: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 5: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 7: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 8: North America UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 11: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 12: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 13: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 14: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 15: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 16: South America UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 19: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 20: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 21: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 23: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 24: Europe UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 27: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 28: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 29: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 31: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 32: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Security Technology 2025 & 2033

- Figure 35: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Security Technology 2025 & 2033

- Figure 36: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Service 2025 & 2033

- Figure 37: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Service 2025 & 2033

- Figure 38: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Vertical 2025 & 2033

- Figure 39: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Vertical 2025 & 2033

- Figure 40: Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Critical Infrastructure Protection Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 2: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 4: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 6: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 7: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 8: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 13: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 15: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 20: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 21: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 22: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 33: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 34: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 35: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Security Technology 2020 & 2033

- Table 43: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 44: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 45: Global UK Critical Infrastructure Protection Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Critical Infrastructure Protection Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Critical Infrastructure Protection Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the UK Critical Infrastructure Protection Industry?

Key companies in the market include Silobreaker Limited, Acuity Risk Management Limited, BT Group, Wandera Ltd, BAE Systems PLC, Vision Security Group Ltd, Sophos Group PLC, Wilson James Ltd, Advance Security (United Kingdom) Limited, G4S PLC.

3. What are the main segments of the UK Critical Infrastructure Protection Industry?

The market segments include Security Technology, Service, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 152 billion as of 2022.

5. What are some drivers contributing to market growth?

; Joint Functioning of Cloud Computing and Critical Infrastructure Protection; Political Pressures for Better Regulations and Implementation.

6. What are the notable trends driving market growth?

Risk Management Accounts for Significant Share.

7. Are there any restraints impacting market growth?

Poor Understanding of Industrial Control Systems; Lack of Interoperability Between Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Critical Infrastructure Protection Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Critical Infrastructure Protection Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Critical Infrastructure Protection Industry?

To stay informed about further developments, trends, and reports in the UK Critical Infrastructure Protection Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence