Key Insights

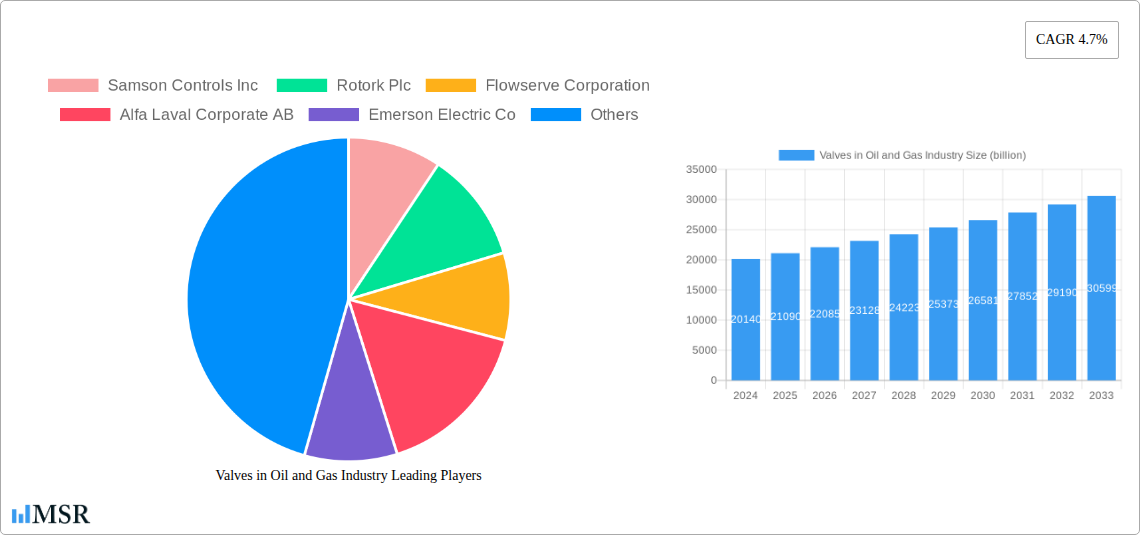

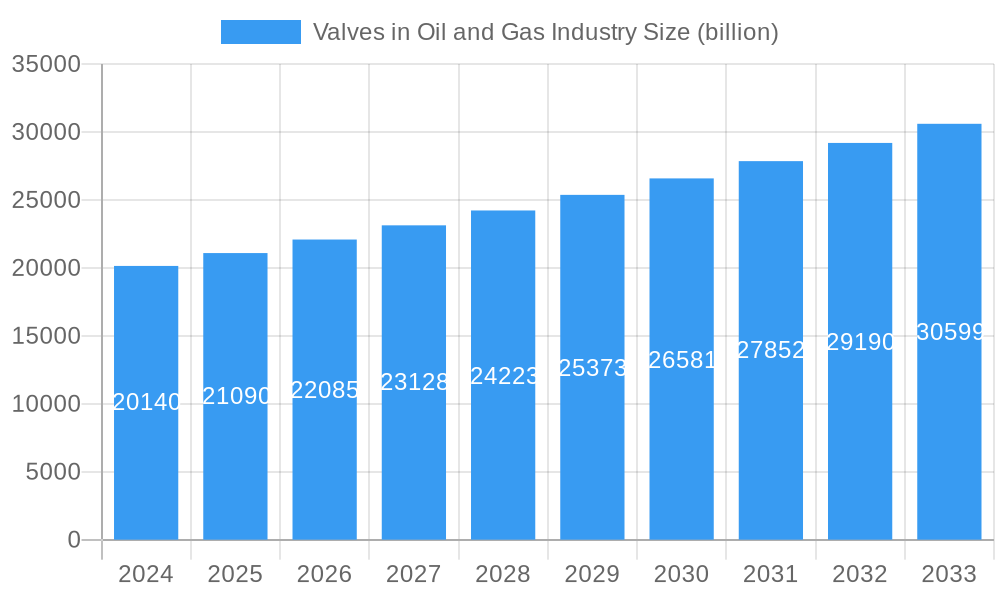

The global Valves in Oil and Gas Industry market is projected to reach USD 20.14 billion in 2024, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.7% from 2019 to 2033. This sustained growth is primarily fueled by increasing global energy demand, necessitating significant investments in oil and gas exploration, production, and refining activities. Key drivers include the expansion of upstream operations, particularly in unconventional resources, and the continuous need for reliable and efficient valve solutions to manage complex fluid control in high-pressure and corrosive environments. Technological advancements, such as the integration of smart valve technologies with IoT capabilities for enhanced monitoring, predictive maintenance, and remote operation, are also playing a pivotal role in market expansion. The market is also benefiting from the ongoing upgrades and maintenance of aging oil and gas infrastructure worldwide, which require sophisticated valve systems to ensure operational safety and efficiency.

Valves in Oil and Gas Industry Market Size (In Billion)

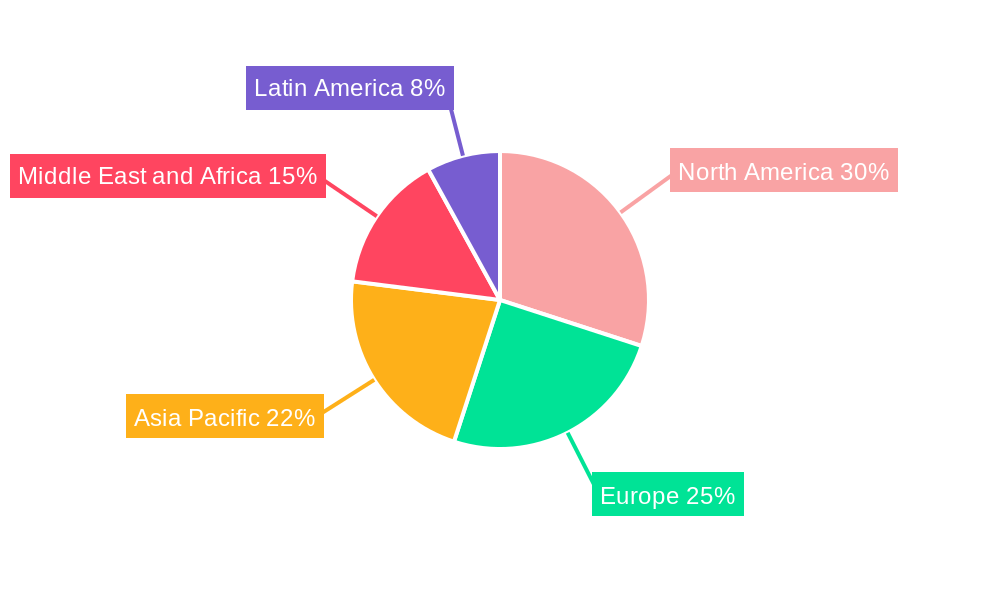

The market for valves in the oil and gas sector is segmented across various types, including Ball Valves, Butterfly Valves, Gate/Globe/Check Valves, and Control Valves, each catering to specific operational needs. The increasing complexity of oil and gas operations and the stringent regulatory requirements for safety and environmental compliance are driving the demand for advanced control valves. Major industry players like Flowserve Corporation, Emerson Electric Co., and Rotork Plc are actively involved in research and development, introducing innovative valve solutions. Geographically, North America and Europe are significant markets due to the presence of established oil and gas infrastructure and technological adoption, while Asia Pacific is expected to witness the fastest growth driven by increasing exploration and production activities. Restraints such as fluctuating crude oil prices and environmental concerns are present, but the indispensable nature of valves in ensuring operational integrity within the oil and gas industry underpins the market's positive trajectory.

Valves in Oil and Gas Industry Company Market Share

Unlocking Value: The Comprehensive Valves in Oil and Gas Industry Market Report (2019-2033)

Gain unparalleled insights into the global Valves in Oil and Gas Industry market with this in-depth report. Spanning the historical period of 2019-2024, base year 2025, and a robust forecast period from 2025-2033, this analysis provides critical intelligence for stakeholders seeking to navigate this dynamic sector. With an estimated market size of over three billion dollars and a projected Compound Annual Growth Rate (CAGR) of xx%, this report delves into market concentration, key trends, technological advancements, and strategic opportunities. Understand the intricate interplay of major players like Samson Controls Inc, Rotork Plc, Flowserve Corporation, Alfa Laval Corporate AB, Emerson Electric Co, IMI Critical Engineering, Metso Oyj, Crane Co, Schlumberger Limited, and KITZ Corporation, and explore the critical segments of Ball Valve, Butterfly Valve, Gate/Globe/Check Valve, and Control Valve.

Valves in Oil and Gas Industry Market Concentration & Dynamics

The Valves in Oil and Gas Industry market exhibits a moderately concentrated landscape, with a few dominant players accounting for a significant portion of the market share, estimated to be over 60% by the base year 2025. The innovation ecosystem is thriving, driven by a continuous need for enhanced safety, efficiency, and environmental compliance in upstream, midstream, and downstream operations. Regulatory frameworks worldwide are increasingly stringent, pushing manufacturers to develop advanced valve solutions compliant with evolving standards. Substitute products, such as advanced sealing technologies and increasingly integrated flow control systems, are emerging, prompting valve manufacturers to focus on product differentiation and value-added services. End-user trends underscore a demand for smart, connected valves with remote monitoring and diagnostic capabilities, driven by the digital transformation of the oil and gas sector. Mergers and acquisitions (M&A) activities are a strategic imperative for market consolidation and expansion, with an estimated xx number of significant deals in the historical period 2019-2024, shaping the competitive terrain.

- Market Share Dominance: Top players collectively hold over 60% of the market share.

- Innovation Focus: Emphasis on safety, efficiency, and environmental compliance drives product development.

- Regulatory Influence: Stringent regulations are key drivers for advanced valve technologies.

- Substitute Threat: Emerging integrated flow control systems necessitate product innovation.

- End-User Demand: Growing preference for smart, connected valves with digital capabilities.

- M&A Activity: An estimated xx significant M&A deals in the historical period, shaping market structure.

Valves in Oil and Gas Industry Industry Insights & Trends

The global Valves in Oil and Gas Industry market is poised for substantial growth, fueled by a confluence of robust market growth drivers, transformative technological disruptions, and evolving consumer behaviors. The estimated market size in the base year 2025 is over three billion dollars, with projections indicating a significant expansion throughout the forecast period 2025-2033. A key growth driver is the sustained global demand for energy, necessitating ongoing exploration, extraction, and processing activities across the oil and gas value chain. Furthermore, the increasing focus on maintaining and upgrading aging infrastructure in existing fields requires reliable and high-performance valve solutions. Technological disruptions, including the advent of the Industrial Internet of Things (IIoT) and advanced materials science, are revolutionizing valve design and functionality. Smart valves with integrated sensors for real-time monitoring of pressure, temperature, and flow rates are becoming indispensable, enabling predictive maintenance and minimizing downtime. The development of advanced alloys and coatings enhances valve durability and resistance to corrosive environments, particularly in upstream exploration and production. Evolving consumer behaviors within the industry are characterized by a heightened emphasis on operational efficiency, safety protocols, and environmental stewardship. Oil and gas companies are actively seeking valve solutions that contribute to reduced emissions, leak prevention, and optimized energy consumption. This translates into a demand for intelligent valve actuation systems, advanced sealing technologies, and valves designed for extreme operating conditions, such as high-pressure and high-temperature applications. The adoption of digital twins and advanced analytics further influences purchasing decisions, as clients look for valve data integration to improve overall asset management and operational performance. The market CAGR is projected to be xx% during the forecast period, underscoring a healthy and sustained growth trajectory driven by these intertwined factors.

Key Markets & Segments Leading Valves in Oil and Gas Industry

The Valves in Oil and Gas Industry market is characterized by the dominance of specific regions, countries, and valve segments, each driven by unique economic, infrastructural, and technological factors.

North America: A Dominant Force

North America, particularly the United States and Canada, stands as a leading market due to its extensive oil and gas reserves and significant investment in exploration and production activities.

- Drivers of Dominance:

- Abundant Hydrocarbon Resources: Vast reserves of oil and natural gas necessitate robust flow control infrastructure.

- Advanced Technological Adoption: High adoption rates of cutting-edge technologies in upstream and midstream operations.

- Infrastructure Development & Maintenance: Continuous investment in new pipelines, refineries, and the upkeep of existing assets.

- Stringent Safety and Environmental Regulations: Drives demand for high-performance, compliant valve solutions.

Ball Valves: Leading the Pack

Ball valves consistently represent a significant share of the market due to their versatility, reliability, and suitability for a wide range of applications in the oil and gas industry. Their robust design makes them ideal for on-off services and throttling applications across various pressure and temperature ranges. The increasing demand for automated and remotely operated systems further bolsters the growth of this segment.

- Segment Dominance Factors:

- Versatility and Reliability: Suitable for diverse applications from crude oil transport to refined product distribution.

- Ease of Operation: Quick quarter-turn action for efficient flow control.

- Leak Prevention: Tight shut-off capabilities are critical for safety and environmental compliance.

- Automation Compatibility: Easily integrated with electric, pneumatic, and hydraulic actuators.

Gate/Globe/Check Valves: Essential for Upstream and Midstream

Gate, globe, and check valves are foundational components in the oil and gas infrastructure, playing crucial roles in fluid control, isolation, and preventing backflow in upstream extraction and midstream transportation. Their established track record and proven performance in demanding environments ensure their continued significance.

- Segment Dominance Factors:

- Critical Isolation Functions: Gate valves are essential for system isolation during maintenance.

- Precise Flow Regulation: Globe valves offer excellent control for throttling applications.

- Preventing Backflow: Check valves are vital for protecting equipment and ensuring unidirectional flow.

- Durability in Harsh Conditions: Designed to withstand high pressures and corrosive fluids.

Control Valves: Enabling Process Optimization

Control valves are indispensable for precise process automation and optimization in refineries, petrochemical plants, and LNG facilities. Their ability to modulate flow rates based on real-time process demands drives efficiency and product quality. The increasing complexity of refining processes and the drive for energy efficiency further elevate their importance.

- Segment Dominance Factors:

- Process Automation and Control: Essential for maintaining optimal operating parameters in complex industrial processes.

- Energy Efficiency: Precise flow control contributes to reduced energy consumption.

- Product Quality Enhancement: Enables consistent and high-quality output in refining and petrochemical operations.

- Integration with DCS/SCADA: Seamless integration with distributed control systems for centralized management.

Butterfly Valves: Cost-Effective Solutions

Butterfly valves offer a cost-effective and lightweight alternative for many applications, particularly in larger diameter pipelines and where high-pressure sealing is not the paramount concern. Their ease of installation and maintenance makes them attractive for specific segments of the oil and gas industry.

- Segment Dominance Factors:

- Cost-Effectiveness: A more economical choice for many fluid handling applications.

- Lightweight Design: Simplifies installation and reduces structural support requirements.

- Good for Large Diameter Lines: Efficient for controlling flow in extensive pipeline networks.

- Versatile Sealing Options: Available with various liner and disc materials for different service conditions.

Valves in Oil and Gas Industry Product Developments

Recent product developments in the Valves in Oil and Gas Industry are centered on enhancing performance, safety, and smart capabilities. In May 2022, Webstone, a brand of NIBCO, launched innovative ball valves featuring reversible handles, elbows, and couplings. This includes press ball valves with bleeder and reversible handles, as well as large Pro-Pal Union Balls in sizes 1 1/4' and 1 1/2', available in FIP, sweat, and press configurations. These advancements aim to simplify installation, improve user experience, and offer greater flexibility in plumbing and fluid control systems within the oil and gas sector, providing a competitive edge through practical engineering solutions.

Challenges in the Valves in Oil and Gas Industry Market

The Valves in Oil and Gas Industry market, while robust, faces several significant challenges. Stringent and evolving environmental regulations worldwide present a constant challenge, requiring continuous investment in compliance and the development of specialized valves to minimize emissions and prevent leaks. Supply chain disruptions, exacerbated by geopolitical instability and global economic fluctuations, can impact material availability and lead times, affecting production schedules and costs. Intense competitive pressures from both established players and emerging manufacturers necessitate constant innovation and cost optimization to maintain market share. The cyclical nature of oil and gas prices also introduces volatility, influencing capital expenditure decisions and, consequently, demand for new valve installations and replacements.

- Regulatory Hurdles: Compliance with increasingly strict environmental and safety standards.

- Supply Chain Volatility: Potential disruptions in raw material sourcing and product delivery.

- Intense Competition: Pressure to innovate and maintain competitive pricing.

- Price Cyclicality: Fluctuations in oil and gas prices impacting investment decisions.

Forces Driving Valves in Oil and Gas Industry Growth

Several key forces are propelling the growth of the Valves in Oil and Gas Industry. Technological advancements in materials science and manufacturing are enabling the creation of more durable, efficient, and specialized valves capable of withstanding extreme operating conditions. The global demand for energy, driven by population growth and industrialization, ensures sustained activity in exploration, extraction, and processing, requiring a constant supply of reliable valve solutions. Government initiatives and investments in infrastructure development, particularly in emerging economies, are opening new markets and driving demand for critical flow control components. Furthermore, the growing emphasis on operational safety and environmental protection mandates the adoption of advanced valve technologies that minimize risks and reduce emissions.

Challenges in the Valves in Oil and Gas Industry Market

Long-term growth catalysts for the Valves in Oil and Gas Industry are deeply rooted in innovation and market expansion. The ongoing digital transformation of the oil and gas sector, with its focus on Industry 4.0, is a significant driver. This includes the integration of smart valves with IoT capabilities for real-time data analytics, predictive maintenance, and remote monitoring, leading to enhanced operational efficiency and reduced downtime. Strategic partnerships and collaborations between valve manufacturers and oilfield service companies are crucial for developing bespoke solutions and expanding market reach. Furthermore, market expansion into emerging geographical regions with developing oil and gas infrastructure presents substantial opportunities for growth. The continued investment in renewable energy infrastructure, which often involves similar fluid handling requirements, also offers a diversification avenue for valve manufacturers.

Emerging Opportunities in Valves in Oil and Gas Industry

Emerging opportunities in the Valves in Oil and Gas Industry are diverse and promising. The increasing focus on decarbonization and the energy transition presents opportunities for valves used in carbon capture, utilization, and storage (CCUS) projects, as well as in the handling of hydrogen and other alternative fuels. The development of smart, automated valve systems with advanced diagnostic capabilities represents a significant technological frontier, catering to the growing demand for data-driven operational management. New markets in regions with untapped hydrocarbon reserves or significant infrastructure development plans offer substantial growth potential. Furthermore, the demand for specialized valves designed for extreme environments, such as ultra-high pressure, cryogenic temperatures, or highly corrosive media, is on the rise, creating niche market opportunities.

Leading Players in the Valves in Oil and Gas Industry Sector

- Samson Controls Inc

- Rotork Plc

- Flowserve Corporation

- Alfa Laval Corporate AB

- Emerson Electric Co

- IMI Critical Engineering

- Metso Oyj

- Crane Co

- Schlumberger Limited

- KITZ Corporation

Key Milestones in Valves in Oil and Gas Industry Industry

- May 2022: Webstone, a brand of NIBCO, announced the launch of innovative ball valves with reversible handles, elbows, and couplings, including press ball valves with bleeder and reversible handles, and large Pro-Pal Union Balls (1 1/4' and 1 1/2') in FIP, sweat, and press configurations, enhancing ease of installation and operational flexibility.

Strategic Outlook for Valves in Oil and Gas Industry Market

The strategic outlook for the Valves in Oil and Gas Industry market is characterized by sustained growth driven by technological innovation, a focus on sustainability, and the ongoing demand for energy. Manufacturers will increasingly invest in smart valve technologies, emphasizing IoT integration, predictive maintenance capabilities, and remote monitoring solutions. The drive for decarbonization will spur the development of valves for emerging energy sectors, such as CCUS and hydrogen infrastructure. Strategic partnerships and the exploration of new geographical markets will be crucial for expanding market share. Companies that can offer reliable, efficient, and environmentally compliant valve solutions, coupled with exceptional customer service and aftermarket support, are best positioned for success in this evolving landscape. The market will witness a continued emphasis on high-performance materials and customized solutions for specialized applications, ensuring long-term value creation.

Valves in Oil and Gas Industry Segmentation

-

1. Valve

- 1.1. Ball Valve

- 1.2. Butterfly Valve

- 1.3. Gate/Globe/Check Valve

- 1.4. Control Valve

Valves in Oil and Gas Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Valves in Oil and Gas Industry Regional Market Share

Geographic Coverage of Valves in Oil and Gas Industry

Valves in Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing projects in Oil and Gas Projects across the World

- 3.3. Market Restrains

- 3.3.1. ; Stagnant Industrial Growth in Developed Countries

- 3.4. Market Trends

- 3.4.1. Ball Valves is Expected to gain significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Valves in Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Valve

- 5.1.1. Ball Valve

- 5.1.2. Butterfly Valve

- 5.1.3. Gate/Globe/Check Valve

- 5.1.4. Control Valve

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Valve

- 6. North America Valves in Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Valve

- 6.1.1. Ball Valve

- 6.1.2. Butterfly Valve

- 6.1.3. Gate/Globe/Check Valve

- 6.1.4. Control Valve

- 6.1. Market Analysis, Insights and Forecast - by Valve

- 7. Europe Valves in Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Valve

- 7.1.1. Ball Valve

- 7.1.2. Butterfly Valve

- 7.1.3. Gate/Globe/Check Valve

- 7.1.4. Control Valve

- 7.1. Market Analysis, Insights and Forecast - by Valve

- 8. Asia Valves in Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Valve

- 8.1.1. Ball Valve

- 8.1.2. Butterfly Valve

- 8.1.3. Gate/Globe/Check Valve

- 8.1.4. Control Valve

- 8.1. Market Analysis, Insights and Forecast - by Valve

- 9. Latin America Valves in Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Valve

- 9.1.1. Ball Valve

- 9.1.2. Butterfly Valve

- 9.1.3. Gate/Globe/Check Valve

- 9.1.4. Control Valve

- 9.1. Market Analysis, Insights and Forecast - by Valve

- 10. Middle East and Africa Valves in Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Valve

- 10.1.1. Ball Valve

- 10.1.2. Butterfly Valve

- 10.1.3. Gate/Globe/Check Valve

- 10.1.4. Control Valve

- 10.1. Market Analysis, Insights and Forecast - by Valve

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Samson Controls Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rotork Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flowserve Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alfa Laval Corporate AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IMI Critical Engineering

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Metso Oyj

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crane Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KITZ Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Samson Controls Inc

List of Figures

- Figure 1: Global Valves in Oil and Gas Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Valves in Oil and Gas Industry Revenue (billion), by Valve 2025 & 2033

- Figure 3: North America Valves in Oil and Gas Industry Revenue Share (%), by Valve 2025 & 2033

- Figure 4: North America Valves in Oil and Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Valves in Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Valves in Oil and Gas Industry Revenue (billion), by Valve 2025 & 2033

- Figure 7: Europe Valves in Oil and Gas Industry Revenue Share (%), by Valve 2025 & 2033

- Figure 8: Europe Valves in Oil and Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Valves in Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Valves in Oil and Gas Industry Revenue (billion), by Valve 2025 & 2033

- Figure 11: Asia Valves in Oil and Gas Industry Revenue Share (%), by Valve 2025 & 2033

- Figure 12: Asia Valves in Oil and Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Valves in Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Valves in Oil and Gas Industry Revenue (billion), by Valve 2025 & 2033

- Figure 15: Latin America Valves in Oil and Gas Industry Revenue Share (%), by Valve 2025 & 2033

- Figure 16: Latin America Valves in Oil and Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Valves in Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Valves in Oil and Gas Industry Revenue (billion), by Valve 2025 & 2033

- Figure 19: Middle East and Africa Valves in Oil and Gas Industry Revenue Share (%), by Valve 2025 & 2033

- Figure 20: Middle East and Africa Valves in Oil and Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Valves in Oil and Gas Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Valve 2020 & 2033

- Table 2: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Valve 2020 & 2033

- Table 4: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Valve 2020 & 2033

- Table 6: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Valve 2020 & 2033

- Table 8: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Valve 2020 & 2033

- Table 10: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Valve 2020 & 2033

- Table 12: Global Valves in Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Valves in Oil and Gas Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Valves in Oil and Gas Industry?

Key companies in the market include Samson Controls Inc , Rotork Plc, Flowserve Corporation, Alfa Laval Corporate AB, Emerson Electric Co, IMI Critical Engineering, Metso Oyj, Crane Co, Schlumberger Limited, KITZ Corporation.

3. What are the main segments of the Valves in Oil and Gas Industry?

The market segments include Valve.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing projects in Oil and Gas Projects across the World.

6. What are the notable trends driving market growth?

Ball Valves is Expected to gain significant market share.

7. Are there any restraints impacting market growth?

; Stagnant Industrial Growth in Developed Countries.

8. Can you provide examples of recent developments in the market?

In May 2022, Webstone, a brand of NIBCO, announced the launch of ball valves with reversible handles, elbows, and couplings. The product that is available in the press ball valve with bleeder and reversible handle and large Pro-Pal Union Ball that are of sizes 1 1/4' and 1 1/2') in FIP, sweat, and press.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Valves in Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Valves in Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Valves in Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Valves in Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence