Key Insights

The United States AC Motor Market is poised for steady growth, reaching an estimated $3.60 million by the base year 2025. This expansion is driven by the critical role of AC motors across a diverse range of end-user industries, including power generation, oil & gas, chemical & petrochemical, and water & wastewater treatment. As these sectors continue to invest in infrastructure upgrades and operational efficiency, the demand for reliable and advanced AC motor solutions is set to rise. Furthermore, the increasing adoption of automation and sophisticated machinery in discrete manufacturing industries, such as automotive and electronics, will act as a significant catalyst for market growth. The ongoing trend towards energy-efficient motor technologies, fueled by environmental regulations and a focus on reducing operational costs, will further propel the market forward. Innovations in motor design, including the integration of smart technologies for predictive maintenance and enhanced control, are also contributing to the market's positive trajectory.

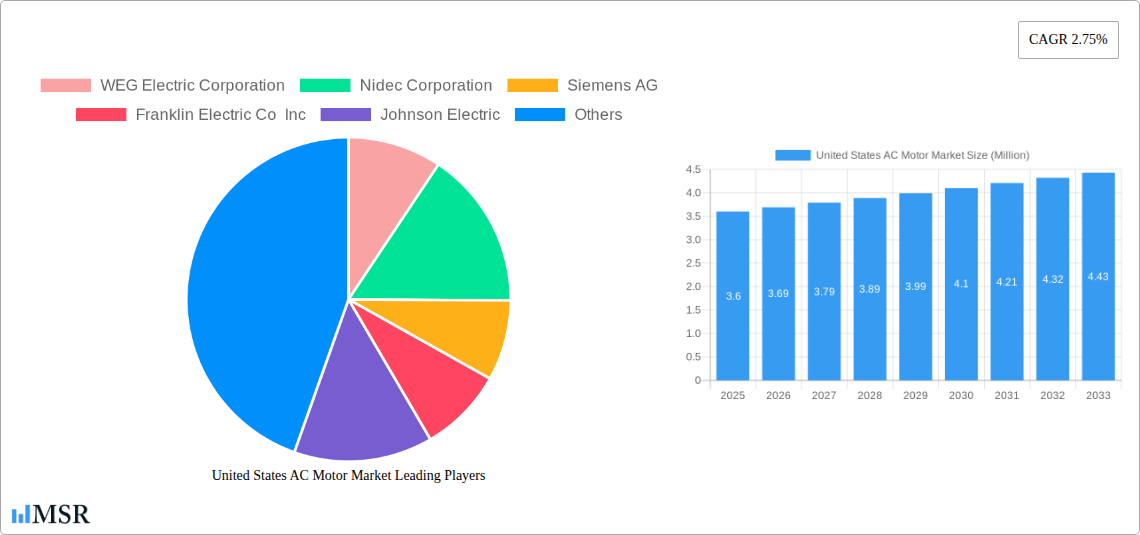

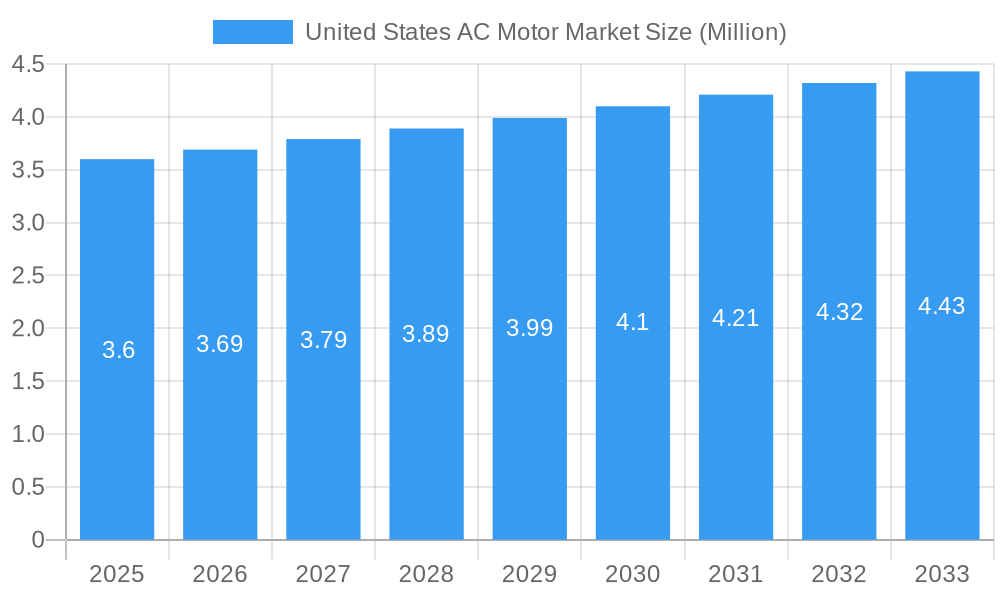

United States AC Motor Market Market Size (In Million)

Projected to expand at a Compound Annual Growth Rate (CAGR) of 2.75% from 2025 to 2033, the United States AC Motor Market will witness sustained demand. While the market is influenced by drivers such as technological advancements and industrial expansion, it also faces certain restraints. These could include the initial high cost of certain high-efficiency AC motor models and the availability of alternative motor technologies in specific niche applications. However, the inherent advantages of AC motors, such as their durability, low maintenance requirements, and versatility, are expected to outweigh these challenges. Key segments within the market, particularly polyphase induction AC motors and permanent magnet synchronous AC motors, are anticipated to see robust demand due to their superior performance and energy savings. The continuous innovation from leading players like Siemens AG, Nidec Corporation, and WEG Electric Corporation is expected to shape the competitive landscape and introduce new solutions to meet evolving industry needs.

United States AC Motor Market Company Market Share

Here's the SEO-optimized, engaging report description for the United States AC Motor Market:

United States AC Motor Market: In-depth Analysis, Trends, and Forecasts (2019-2033)

Gain unparalleled insights into the dynamic United States AC Motor Market with this comprehensive report. Covering the historical period from 2019-2024, a robust base year of 2025, and an extensive forecast period from 2025-2033, this study provides critical data and actionable strategies for industry stakeholders. Delve into market size estimations, CAGR analysis, and key growth drivers for Induction AC Motors (Single Phase, Poly Phase) and Synchronous AC Motors (DC Excited Rotor, Permanent Magnet, Hysteresis Motor, Reluctance Motor). Understand the impact of end-user industries such as Oil & Gas, Chemical & Petrochemical, Power Generation, Water & Wastewater, Metal & Mining, Food & Beverage, and Discrete Industries. This report is essential for manufacturers, suppliers, investors, and policymakers seeking to navigate the evolving landscape of US AC motor market, electric motor industry United States, and AC motor manufacturers USA.

United States AC Motor Market Market Concentration & Dynamics

The United States AC Motor Market exhibits a moderate to high level of concentration, with a few key players dominating significant market share. Leading companies are actively engaged in strategic mergers, acquisitions, and partnerships to expand their product portfolios and geographical reach. Innovation ecosystems are thriving, driven by increasing demand for energy-efficient motors, smart motor technologies, and automation solutions across various industries. Regulatory frameworks, particularly those focused on energy efficiency standards and environmental compliance, play a crucial role in shaping market trends and product development. While substitute products like DC motors exist, AC motors continue to be the preferred choice for a vast array of industrial applications due to their reliability, cost-effectiveness, and performance. End-user trends are heavily influenced by the resurgence of manufacturing, reshoring initiatives, and the accelerating adoption of advanced technologies in sectors like oil & gas, power generation, and discrete manufacturing. The M&A activity, exemplified by recent strategic moves, indicates a consolidation phase aimed at capturing greater market share and technological leadership.

- Market Share Dominance: Top players hold a substantial collective market share, driving competitive dynamics.

- M&A Deal Counts: XX M&A deals have been observed in the historical period, highlighting strategic consolidation.

- Innovation Focus: Emphasis on energy efficiency, IoT integration, and predictive maintenance for AC motors.

- Regulatory Impact: Compliance with EPA and NEMA standards influences product design and market entry.

United States AC Motor Market Industry Insights & Trends

The United States AC Motor Market is poised for significant growth, propelled by a confluence of technological advancements, robust industrial demand, and supportive government policies. The market size for AC motors in the United States is estimated to reach approximately USD XXXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This expansion is fundamentally driven by the increasing adoption of energy-efficient AC motors, which are crucial for reducing operational costs and complying with stringent environmental regulations. The surge in industrial automation, particularly in sectors like food & beverage, pharmaceuticals, and discrete manufacturing, is creating substantial demand for high-performance AC motors. Furthermore, the ongoing investments in infrastructure development, including power generation and water & wastewater treatment facilities, are significant growth catalysts. The trend towards Industry 4.0, characterized by the integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) into industrial processes, is fostering the development and adoption of smart AC motors with enhanced control, monitoring, and diagnostic capabilities. This technological evolution not only improves operational efficiency but also enables predictive maintenance, thereby minimizing downtime and optimizing asset utilization. The reshoring of manufacturing operations in the US is further bolstering demand for domestic AC motor production and supply. The chemical and petrochemical industry continues to be a major consumer, with ongoing expansion projects requiring reliable and high-capacity AC motor solutions. The oil and gas sector, despite its cyclical nature, contributes steadily to the AC motor market, especially in exploration, extraction, and refining processes. The power generation sector, with its continuous need for efficient and robust motor systems, remains a cornerstone of market demand. The metal and mining industry's demand is linked to infrastructure development and commodity prices. Overall, the US AC motor market is characterized by a strong interplay between economic growth, technological innovation, and the imperative for sustainable industrial operations.

Key Markets & Segments Leading United States AC Motor Market

The United States AC Motor Market is primarily led by the Induction AC Motors segment, which constitutes a substantial portion of the overall market share. Within this segment, Poly Phase Induction Motors are particularly dominant due to their superior performance, efficiency, and robustness, making them the workhorse for a vast array of industrial applications requiring high power output. The Single Phase Induction Motors also hold a significant market presence, catering to smaller applications in residential, commercial, and light industrial settings. The Synchronous AC Motors segment, while smaller in volume compared to induction motors, is experiencing robust growth, especially the Permanent Magnet Synchronous Motors (PMSM), driven by their exceptional energy efficiency and high power density, crucial for applications demanding precise speed control and maximum energy savings.

The Discrete Industries end-user segment is a leading consumer of AC motors, encompassing sectors like automotive manufacturing, electronics production, and machinery fabrication. The ongoing trend of automation and the reshoring of manufacturing activities in the US are significantly boosting demand in this segment. The Oil & Gas industry remains a critical market, with AC motors essential for pumps, compressors, and drilling equipment across upstream, midstream, and downstream operations. Despite price volatility, continuous investments in energy infrastructure and exploration ensure sustained demand. The Power Generation sector is another major driver, requiring reliable and high-efficiency AC motors for turbines, generators, and auxiliary equipment. The push for renewable energy sources also creates demand for specialized AC motor solutions. The Water & Wastewater industry's need for robust pumping and aeration systems, coupled with increasing infrastructure upgrades, further fuels the demand for AC motors. The Chemical & Petrochemical industry's extensive use of pumps, mixers, and conveyors for processing and material handling solidifies its position as a significant end-user. The Metal & Mining sector's demand is tied to the extraction and processing of raw materials, requiring powerful AC motors for heavy-duty machinery. The Food & Beverage industry utilizes AC motors in processing, packaging, and conveyor systems, with a growing emphasis on hygienic and energy-efficient solutions.

- Dominant Motor Type: Poly Phase Induction Motors, followed by Single Phase Induction Motors, and rapidly growing Permanent Magnet Synchronous Motors.

- Key End-User Industries: Discrete Industries, Oil & Gas, Power Generation, and Water & Wastewater are major contributors to market demand.

- Drivers in Discrete Industries: Automation, Industry 4.0 adoption, and reshoring initiatives.

- Drivers in Oil & Gas: Infrastructure development, exploration activities, and demand for energy efficiency.

- Drivers in Power Generation: Grid modernization, renewable energy integration, and energy efficiency mandates.

United States AC Motor Market Product Developments

Recent product developments in the United States AC Motor Market are heavily focused on enhancing energy efficiency, integrating smart technologies, and improving reliability. Manufacturers are increasingly offering variable frequency drives (VFDs) integrated with AC motors to provide precise speed control and significant energy savings, aligning with the growing demand for sustainable industrial operations. The advent of IoT-enabled smart motors with built-in sensors for real-time monitoring of performance, temperature, and vibration is a key innovation, enabling predictive maintenance and reducing costly downtime. Advancements in materials science and motor design are leading to smaller, lighter, and more powerful AC motor solutions tailored for specific applications in industries like robotics and electric vehicles. The development of motors with enhanced ingress protection (IP) ratings and explosion-proof features caters to the stringent requirements of the oil & gas and chemical industries.

Challenges in the United States AC Motor Market Market

The United States AC Motor Market faces several challenges that could impede its growth trajectory. Intense price competition among manufacturers, particularly for standard motor offerings, can put pressure on profit margins. Supply chain disruptions, including the availability and cost of raw materials like copper and rare earth magnets, can impact production timelines and costs. Evolving regulatory landscapes, while often driving innovation, can also pose compliance challenges and necessitate significant R&D investments for manufacturers to meet new efficiency standards and environmental mandates. The adoption rate of cutting-edge smart motor technologies can be hindered by the initial capital investment required by end-users, especially in cost-sensitive sectors. Furthermore, the shortage of skilled labor capable of installing, maintaining, and troubleshooting advanced AC motor systems presents a growing concern for the industry.

Forces Driving United States AC Motor Market Growth

Several powerful forces are propelling the growth of the United States AC Motor Market. The escalating demand for energy efficiency, driven by both regulatory mandates and cost-saving imperatives, is a primary growth accelerator. Industrial automation and the adoption of Industry 4.0 principles are creating a substantial need for advanced AC motors with precise control and connectivity. Government initiatives supporting manufacturing and infrastructure development, such as the reshoring trend, are directly boosting demand for industrial equipment, including AC motors. Technological advancements in motor design, materials, and control systems are leading to the development of more powerful, reliable, and application-specific AC motor solutions. The continuous expansion and modernization of key end-user industries, including power generation, water & wastewater, and chemical processing, further underpin the market's upward trajectory.

Challenges in the United States AC Motor Market Market

Addressing long-term growth catalysts is crucial for sustained success in the United States AC Motor Market. Continuous innovation in energy-efficient motor technologies, such as advanced permanent magnet designs and integrated power electronics, will be key. Strategic partnerships and collaborations between motor manufacturers, VFD suppliers, and automation solution providers will foster comprehensive system offerings. Expanding market penetration into emerging applications, like electric mobility infrastructure and advanced robotics, presents significant growth potential. The development of robust after-sales service and support networks will enhance customer loyalty and drive repeat business. Furthermore, actively participating in shaping future energy efficiency standards will ensure market leadership and competitive advantage.

Emerging Opportunities in United States AC Motor Market

Emerging trends and opportunities in the United States AC Motor Market are shaping its future landscape. The growing emphasis on sustainability and the circular economy is creating opportunities for AC motors designed for longevity, ease of repair, and recyclability. The expansion of electric vehicle charging infrastructure will require specialized AC motors for pumps and cooling systems. The increasing adoption of AI and machine learning for predictive maintenance in industrial settings will drive demand for smart AC motors equipped with advanced sensor capabilities. The development of AC motors for specialized applications in renewable energy sectors, such as tidal and geothermal power, presents untapped market potential. Furthermore, the increasing demand for customized AC motor solutions tailored to unique industrial process requirements offers significant niche market opportunities.

Leading Players in the United States AC Motor Market Sector

- WEG Electric Corporation

- Nidec Corporation

- Siemens AG

- Franklin Electric Co Inc

- Johnson Electric

- Kirloskar Electric Co Ltd

- Rockwell Automation Inc

- Abb Ltd

- Baldor Electric

- Regal Rexnord Corporation

- Yaskawa Electric Corporation

Key Milestones in United States AC Motor Market Industry

- May 2023: ABB Ltd announced the completion of the acquisition of Siemens's low-voltage NEMA motor business to expand into new markets and strengthen its growth strategy. This acquisition is a part of the Motion business area's profitable growth strategy.

- April 2023: ABB Ltd announced that it would invest USD 170 million in the United States as a part of its growth strategy. The company aims to grow its business in the United States by investing in its automation and electrification businesses to meet the increased demand from industry-leading clients while supporting the clean energy transition and the trend toward reshoring production.

Strategic Outlook for United States AC Motor Market Market

The strategic outlook for the United States AC Motor Market is highly positive, driven by innovation and a strong demand for energy-efficient and intelligent solutions. Key growth accelerators include the continued adoption of Industry 4.0 technologies, the ongoing infrastructure development boom, and increasing regulatory pressures favoring sustainable energy consumption. Manufacturers are expected to focus on developing highly integrated motor and drive systems, leveraging AI for predictive maintenance, and expanding their product offerings to cater to emerging applications in renewable energy and advanced manufacturing. Strategic alliances and potential further consolidation within the market will likely shape competitive dynamics, leading to greater specialization and enhanced value propositions for end-users. The focus on reshoring production will continue to bolster domestic manufacturing capabilities and create opportunities for localized supply chains.

United States AC Motor Market Segmentation

-

1. Type

-

1.1. Induction AC Motors

- 1.1.1. Single Phase

- 1.1.2. Poly Phase

-

1.2. Synchronous AC Motors

- 1.2.1. DC Excited Rotor

- 1.2.2. Permanent Magnet

- 1.2.3. Hysteresis Motor

- 1.2.4. Reluctance Motor

-

1.1. Induction AC Motors

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemical & Petrochemical

- 2.3. Power Generation

- 2.4. Water & Wastewater

- 2.5. Metal & Mining

- 2.6. Food & Beverage

- 2.7. Discrete Industries

- 2.8. Other End-user Industries

United States AC Motor Market Segmentation By Geography

- 1. United States

United States AC Motor Market Regional Market Share

Geographic Coverage of United States AC Motor Market

United States AC Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Industrialization and Increasing Infrastructure Development Will Drive the Market Growth; Demand for Energy Efficiency Owning to Government Regulations

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation

- 3.4. Market Trends

- 3.4.1. Rapid Industrialization and Increasing Infrastructure Development Will Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States AC Motor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Induction AC Motors

- 5.1.1.1. Single Phase

- 5.1.1.2. Poly Phase

- 5.1.2. Synchronous AC Motors

- 5.1.2.1. DC Excited Rotor

- 5.1.2.2. Permanent Magnet

- 5.1.2.3. Hysteresis Motor

- 5.1.2.4. Reluctance Motor

- 5.1.1. Induction AC Motors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemical & Petrochemical

- 5.2.3. Power Generation

- 5.2.4. Water & Wastewater

- 5.2.5. Metal & Mining

- 5.2.6. Food & Beverage

- 5.2.7. Discrete Industries

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States AC Motor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United States AC Motor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 Italy

- 7.1.4 France

- 7.1.5 Rest of Europe

- 8. Asia Pacific United States AC Motor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 India

- 8.1.2 Japan

- 8.1.3 South Korea

- 8.1.4 Rest of the Asia Pacific

- 9. Latin America United States AC Motor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States AC Motor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WEG Electric Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nidec Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Franklin Electric Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Electric

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kirloskar Electric Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockwell Automation Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abb Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baldor Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Regal Rexnord Corporation*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yaskawa Electric Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 WEG Electric Corporation

List of Figures

- Figure 1: United States AC Motor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States AC Motor Market Share (%) by Company 2025

List of Tables

- Table 1: United States AC Motor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: United States AC Motor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States AC Motor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: United States AC Motor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States AC Motor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United States AC Motor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Italy United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States AC Motor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: India United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: South Korea United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of the Asia Pacific United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United States AC Motor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: United States AC Motor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United States AC Motor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United States AC Motor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: United States AC Motor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: United States AC Motor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States AC Motor Market?

The projected CAGR is approximately 2.75%.

2. Which companies are prominent players in the United States AC Motor Market?

Key companies in the market include WEG Electric Corporation, Nidec Corporation, Siemens AG, Franklin Electric Co Inc, Johnson Electric, Kirloskar Electric Co Ltd, Rockwell Automation Inc, Abb Ltd, Baldor Electric, Regal Rexnord Corporation*List Not Exhaustive, Yaskawa Electric Corporation.

3. What are the main segments of the United States AC Motor Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Industrialization and Increasing Infrastructure Development Will Drive the Market Growth; Demand for Energy Efficiency Owning to Government Regulations.

6. What are the notable trends driving market growth?

Rapid Industrialization and Increasing Infrastructure Development Will Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation.

8. Can you provide examples of recent developments in the market?

May 2023: ABB Ltd announced the completion of the acquisition of Siemens's low-voltage NEMA motor business to expand into new markets and strengthen its growth strategy. This acquisition is a part of the Motion business area's profitable growth strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States AC Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States AC Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States AC Motor Market?

To stay informed about further developments, trends, and reports in the United States AC Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence