Key Insights

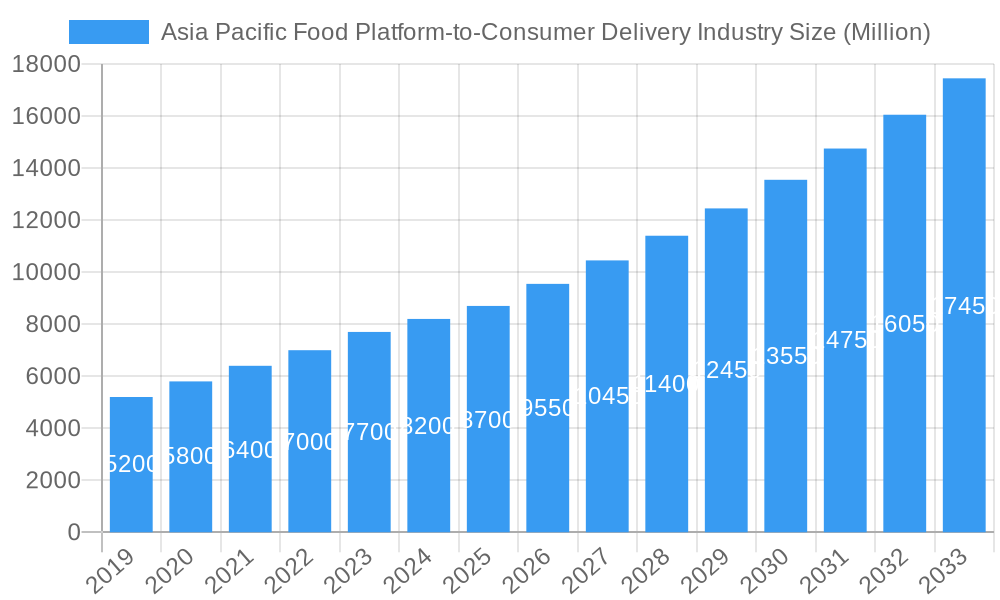

The Asia Pacific Food Platform-to-Consumer Delivery market is projected for significant expansion, fueled by a growing middle class, increasing urbanization, and a heightened demand for convenience. With an estimated market size of $8,500 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 10.52% through 2033, this sector presents a compelling investment opportunity. Key growth drivers include the rapid adoption of smartphones and widespread internet penetration across the region, facilitating effortless access to food delivery services. Evolving consumer lifestyles, marked by demanding schedules and a preference for on-demand solutions, are also critical catalysts. The inherent convenience of ordering from a broad spectrum of restaurants and grocery providers directly to residences or workplaces, coupled with increasingly sophisticated payment methods such as online transactions and cash-on-delivery, solidifies the indispensable role of these platforms in daily life.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Size (In Billion)

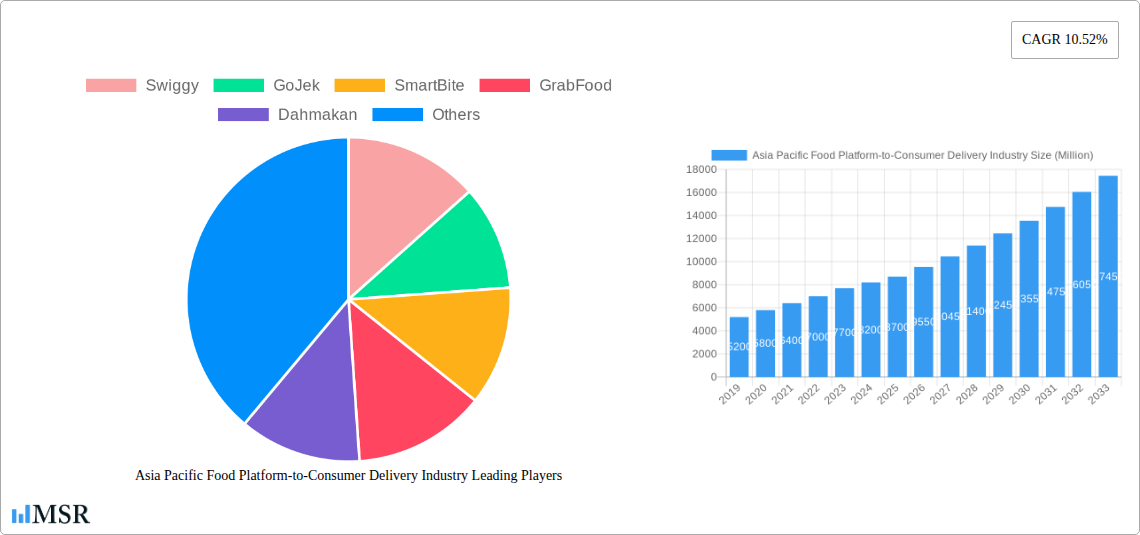

Market segmentation highlights a pronounced focus on food delivery, with grocery delivery also securing a substantial segment. Home and office deliveries are anticipated to remain the dominant delivery methods, aligning with the primary consumption habits of the target demographic. Leading industry players, including Swiggy, GoJek, GrabFood, and Deliveroo, are aggressively expanding their operations, investing significantly in technology, logistics, and customer acquisition strategies to enhance market share. Emerging economies within the region, notably China and India, are expected to spearhead this growth due to their extensive populations and rapidly developing digital infrastructures. While the growth trajectory is robust, potential challenges may arise from intense competition, specific market regulatory hurdles, and the critical need for efficient last-mile logistics to ensure service quality and cost-effectiveness. Nevertheless, continuous innovation in delivery models, such as drone and autonomous vehicle deployment, alongside strategic collaborations, are poised to address these challenges and further accelerate market growth.

Asia Pacific Food Platform-to-Consumer Delivery Industry Company Market Share

Asia Pacific Food Platform-to-Consumer Delivery Industry: Market Analysis and Forecast (2019–2033)

Gain unparalleled insights into the dynamic Asia Pacific Food Platform-to-Consumer Delivery Industry with this comprehensive report. Spanning the Study Period of 2019–2033, this in-depth analysis focuses on the Base Year of 2025 and provides projections through the Forecast Period of 2025–2033, building upon the Historical Period of 2019–2024. Discover market concentration, key trends, leading segments, product innovations, challenges, growth drivers, emerging opportunities, and the strategies of major players. This report is essential for stakeholders seeking to navigate and capitalize on the burgeoning food delivery market across the Asia Pacific region, driven by innovative platforms like Swiggy, GoJek, GrabFood, and Deliveroo.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Concentration & Dynamics

The Asia Pacific Food Platform-to-Consumer Delivery Industry exhibits a moderate to high market concentration, with a few dominant players capturing significant market share. Leading companies such as GrabFood, GoJek, and Swiggy have established extensive networks and strong brand recognition, contributing to their substantial market presence. For instance, GrabFood's expansion into Phnom Penh in August 2022, following a successful beta test, highlights its aggressive growth strategy and increasing market penetration. The innovation ecosystem is vibrant, characterized by continuous technological advancements in app development, logistics optimization, and payment solutions. Regulatory frameworks vary across countries, posing both opportunities and challenges for market expansion, with governments increasingly focusing on consumer protection and fair labor practices for delivery personnel. Substitute products, including traditional dine-in restaurants and home cooking, remain relevant but are increasingly challenged by the convenience and variety offered by food delivery platforms. End-user trends point towards a growing preference for on-demand convenience, diverse culinary options, and seamless payment experiences. Merger and Acquisition (M&A) activities are moderately prevalent as players seek to consolidate market position, expand service offerings, and gain access to new geographies. The M&A deal count is estimated to be between 10-15 deals annually in the forecast period, with an average deal value in the hundreds of Millions. Market share of the top 3 players is estimated to be around 65% in 2025.

Asia Pacific Food Platform-to-Consumer Delivery Industry Industry Insights & Trends

The Asia Pacific Food Platform-to-Consumer Delivery Industry is experiencing exponential growth, projected to reach a market size of over 200 Billion in 2025 and expanding at a robust Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period. This surge is primarily propelled by rapidly increasing internet and smartphone penetration across the region, coupled with a growing urbanized population that prioritizes convenience and time-saving solutions. Evolving consumer behaviors are a significant catalyst, with a marked shift towards digital platforms for everyday needs, including food and grocery procurement. The CAGR for Food delivery is expected to be 20%, while Grocery delivery is projected at 15%. Technological disruptions are continuously reshaping the industry landscape. Artificial intelligence (AI) and machine learning (ML) are being leveraged for sophisticated order matching, route optimization, and personalized recommendations, enhancing operational efficiency and customer experience. The integration of dark kitchens and cloud kitchens is also a prominent trend, allowing platforms to expand their reach and diversify offerings without the need for extensive physical restaurant infrastructure. Furthermore, the increasing adoption of online payment methods, moving away from traditional cash on delivery, is streamlining transactions and improving cash flow for platforms and restaurants alike. The Online payment segment is expected to grow by 25% annually. The COVID-19 pandemic acted as a significant accelerant, normalizing food delivery as a primary dining option and fostering sustained demand. The "gig economy" model, while offering flexible employment, is also a subject of ongoing discussion regarding worker rights and benefits, influencing future operational models. The market size for home delivery is projected to reach 150 Billion by 2025, driven by consumer preference for convenience.

Key Markets & Segments Leading Asia Pacific Food Platform-to-Consumer Delivery Industry

Southeast Asia stands as the dominant region in the Asia Pacific Food Platform-to-Consumer Delivery Industry, driven by a confluence of factors including a young, tech-savvy population, rapid urbanization, and a burgeoning middle class with increasing disposable income. Countries like Indonesia, Vietnam, Thailand, and the Philippines are leading the charge, exhibiting high adoption rates for food delivery services.

Within this region, Indonesia is projected to be the largest market by value, estimated at over 50 Billion in 2025, owing to its vast population and high mobile penetration. Food delivery is unequivocally the leading product type segment, accounting for an estimated 75% of the total market revenue in 2025. This dominance is fueled by the inherent demand for convenient meal solutions in busy urban environments. However, Grocery delivery is rapidly gaining traction, with an estimated market size of 35 Billion in 2025 and a higher projected CAGR of 15% compared to food delivery's 20%. This growth is attributed to evolving consumer habits and the desire for convenient grocery shopping.

The Home delivery method is the most prevalent, comprising an estimated 70% of all deliveries in 2025, reflecting the widespread appeal of having meals brought directly to one's doorstep. Office delivery, while a smaller segment, is expected to witness significant growth, particularly as businesses encourage remote or hybrid work models, driving demand for convenient meal solutions during working hours.

In terms of payment methods, Online payment is emerging as the clear leader, projected to capture over 60% of the market share in 2025. This shift is driven by increased trust in digital payment gateways, the availability of various secure online payment options, and the convenience of cashless transactions. Cash on delivery still holds a significant portion, particularly in developing economies, but its share is gradually diminishing.

- Economic Growth: Rising disposable incomes in emerging economies fuels consumer spending on convenience services.

- Urbanization: Concentration of populations in cities increases the density of potential users and restaurants, optimizing delivery logistics.

- Infrastructure Development: Improved internet connectivity and mobile network coverage are foundational for platform accessibility.

- Technological Adoption: High smartphone penetration and a willingness to adopt new digital services.

- Demographics: A young and digitally native population with a preference for on-demand services.

Asia Pacific Food Platform-to-Consumer Delivery Industry Product Developments

Product innovation in the Asia Pacific Food Platform-to-Consumer Delivery Industry is primarily focused on enhancing user experience, operational efficiency, and service diversification. This includes the development of more intuitive mobile applications with advanced search and filtering capabilities, personalized recommendation engines powered by AI, and streamlined ordering and payment processes. Platforms are also investing in sophisticated logistics management systems that leverage real-time data to optimize delivery routes, reduce delivery times, and improve driver efficiency. The integration of features like group ordering, scheduled deliveries, and subscription models are catering to diverse consumer needs. Furthermore, there's a growing trend towards expanding product offerings beyond ready-to-eat meals to include grocery items, convenience store products, and even pharmacy essentials, transforming platforms into comprehensive on-demand service providers. This diversification allows platforms to tap into new revenue streams and increase customer loyalty. The competitive edge is increasingly being gained through unique value-added services, such as loyalty programs, exclusive deals, and partnerships with a wider range of merchants.

Challenges in the Asia Pacific Food Platform-to-Consumer Delivery Industry Market

The Asia Pacific Food Platform-to-Consumer Delivery Industry faces several significant challenges. Intense competition among numerous players, including global giants and local startups, leads to price wars and high customer acquisition costs, impacting profitability. Regulatory hurdles are also a concern, with varying government policies on worker classification, food safety standards, and data privacy across different countries. Logistical complexities, such as traffic congestion, last-mile delivery inefficiencies, and the need for efficient cold chain management for groceries, present operational challenges. Maintaining profitability remains a persistent issue due to high operating expenses, including delivery fees, marketing costs, and platform development. Customer retention is another challenge, as consumers often switch between platforms based on promotions and discounts. The cost of living crisis also puts pressure on delivery driver earnings, potentially impacting driver availability and service quality.

Forces Driving Asia Pacific Food Platform-to-Consumer Delivery Industry Growth

Several forces are powerfully driving the growth of the Asia Pacific Food Platform-to-Consumer Delivery Industry. Ubiquitous smartphone penetration and affordable internet access form the bedrock of this digital transformation, making these services accessible to a vast population. Rapid urbanization and a growing middle class with increasing disposable incomes are creating a strong demand for convenient and time-saving solutions. Evolving consumer preferences for on-demand services, diverse culinary options, and seamless digital experiences are also key accelerators. Technological advancements, including AI-powered logistics optimization, predictive analytics for demand forecasting, and improved mobile app user interfaces, are enhancing operational efficiency and customer satisfaction. Government initiatives supporting digital economies and infrastructure development further facilitate market expansion. The convenience factor cannot be overstated, as busy lifestyles and a desire for immediate gratification push consumers towards these platforms.

Challenges in the Asia Pacific Food Platform-to-Consumer Delivery Industry Market

While growth is robust, the Asia Pacific Food Platform-to-Consumer Delivery Industry must navigate persistent challenges. Intensifying competition necessitates substantial marketing expenditure and promotional offers, often leading to thin profit margins or operational losses. Maintaining driver satisfaction and retention is crucial, as high driver turnover can disrupt service reliability and increase recruitment costs. Navigating diverse and evolving regulatory landscapes across multiple countries requires significant legal and compliance resources. Ensuring food safety and quality standards throughout the supply chain, especially for perishable goods, remains a paramount concern and a potential reputational risk. Managing operational costs, including fuel, vehicle maintenance, and technology investments, while offering competitive pricing, is a constant balancing act. Building and maintaining strong relationships with a wide array of restaurants and grocery partners is essential for service breadth and depth.

Emerging Opportunities in Asia Pacific Food Platform-to-Consumer Delivery Industry

Emerging opportunities within the Asia Pacific Food Platform-to-Consumer Delivery Industry are plentiful and diverse. The expansion of grocery delivery services, catering to the growing demand for convenience in household shopping, presents a significant growth avenue. The development and adoption of "dark kitchens" and cloud kitchens enable platforms to offer a wider variety of cuisines and reach new customer bases with reduced overhead. Hyper-local delivery solutions that focus on specific neighborhoods or communities can foster stronger customer loyalty and operational efficiency. Partnerships with traditional brick-and-mortar retailers to offer their products via delivery platforms unlock new market segments. The increasing adoption of sustainable delivery practices, such as the use of electric vehicles and eco-friendly packaging, aligns with growing consumer environmental consciousness and can serve as a differentiator. Furthermore, exploring B2B delivery services for corporate catering or inter-office deliveries offers a distinct revenue stream. The integration of augmented reality (AR) for virtual menu browsing or product visualization could enhance the online shopping experience.

Leading Players in the Asia Pacific Food Platform-to-Consumer Delivery Industry Sector

- Swiggy

- GoJek

- SmartBite

- GrabFood

- Dahmakan

- Delivery Guy

- Kims Kitchen

- Deliveroo

- Uber Eats

Key Milestones in Asia Pacific Food Platform-to-Consumer Delivery Industry Industry

- August 2022: GrabFood announced its official launch in Phnom Penh, Cambodia, following a successful four-month "beta" test. This move solidifies GrabFood's position as a top meal delivery service in Southeast Asia, enhancing its connectivity of customers to a wide range of food and drink options with on-demand delivery. The introduction also featured promotional savings of up to 50%, aimed at attracting new users.

- August 2022: Uber Eats launched a partnership with MotionAds, a delivery bike media owner. This collaboration aims to alleviate the financial stress on delivery drivers amidst the rising cost of living by offering them opportunities to supplement their income through top-box advertising on their delivery vehicles.

- August 2022: Deliveroo Singapore partnered with the social company TreeDots. This initiative is designed to reduce food waste and lower operating costs for restaurants in the face of escalating inflation. The collaboration allows restaurants to procure high-quality goods at reduced expenses while maintaining profitable profit margins.

Strategic Outlook for Asia Pacific Food Platform-to-Consumer Delivery Industry Market

The strategic outlook for the Asia Pacific Food Platform-to-Consumer Delivery Industry is exceptionally positive, characterized by continued innovation and market expansion. Growth accelerators will include the deep integration of AI and machine learning for hyper-personalized customer experiences and hyper-efficient logistics. Partnerships with a broader range of businesses, extending beyond food and groceries to include pharmacy and retail, will be crucial for platform diversification and revenue growth. The increasing focus on sustainability, through the adoption of electric fleets and eco-friendly packaging, will not only cater to consumer demand but also contribute to long-term brand value. Furthermore, strategic investments in emerging markets with high growth potential and untapped consumer bases will drive geographical expansion. The development of robust loyalty programs and exclusive subscriber benefits will be key to enhancing customer retention and lifetime value in an increasingly competitive landscape. The industry is poised for significant consolidation and technological advancement, promising a future of seamless, convenient, and personalized on-demand services.

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation

-

1. Product type

- 1.1. Food delivery

- 1.2. Grocery delivery

- 1.3. Other

-

2. Method

- 2.1. Mome delivery

- 2.2. Office delivery

- 2.3. Other

-

3. Payment method

- 3.1. Cash on delivery

- 3.2. Online payment

- 3.3. Other

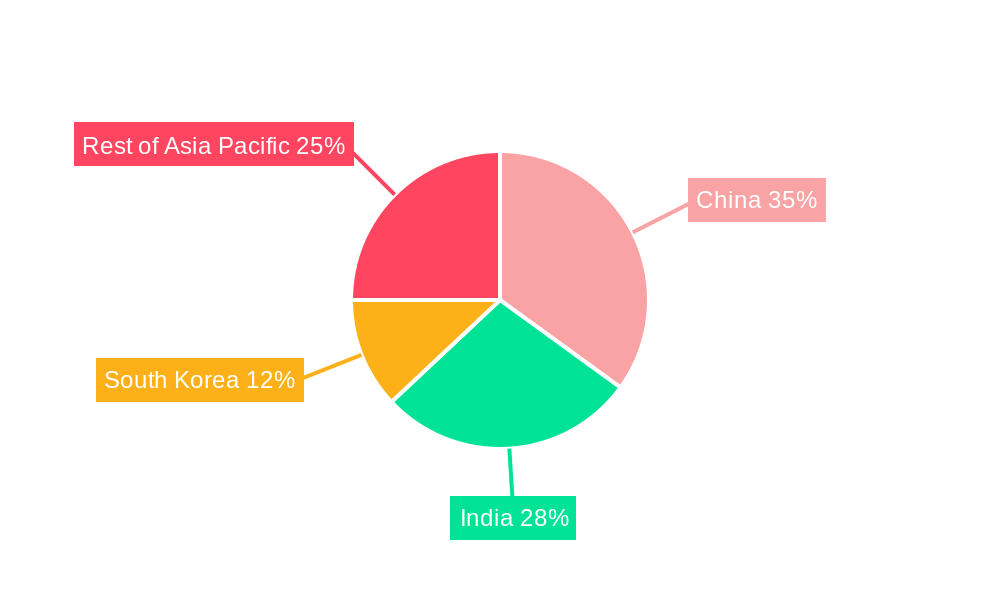

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation By Geography

- 1. China

- 2. India

- 3. South Korea

- 4. Rest of Asia Pacific

Asia Pacific Food Platform-to-Consumer Delivery Industry Regional Market Share

Geographic Coverage of Asia Pacific Food Platform-to-Consumer Delivery Industry

Asia Pacific Food Platform-to-Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders

- 3.3. Market Restrains

- 3.3.1. High Cost of Forestry Equipment; Lack of Information About Forestry Equipment

- 3.4. Market Trends

- 3.4.1. Smart Phones and Internet Penetrations in the region are driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Food delivery

- 5.1.2. Grocery delivery

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Mome delivery

- 5.2.2. Office delivery

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Payment method

- 5.3.1. Cash on delivery

- 5.3.2. Online payment

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. South Korea

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. China Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Food delivery

- 6.1.2. Grocery delivery

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Mome delivery

- 6.2.2. Office delivery

- 6.2.3. Other

- 6.3. Market Analysis, Insights and Forecast - by Payment method

- 6.3.1. Cash on delivery

- 6.3.2. Online payment

- 6.3.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. India Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Food delivery

- 7.1.2. Grocery delivery

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Mome delivery

- 7.2.2. Office delivery

- 7.2.3. Other

- 7.3. Market Analysis, Insights and Forecast - by Payment method

- 7.3.1. Cash on delivery

- 7.3.2. Online payment

- 7.3.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Food delivery

- 8.1.2. Grocery delivery

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Mome delivery

- 8.2.2. Office delivery

- 8.2.3. Other

- 8.3. Market Analysis, Insights and Forecast - by Payment method

- 8.3.1. Cash on delivery

- 8.3.2. Online payment

- 8.3.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Rest of Asia Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Food delivery

- 9.1.2. Grocery delivery

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Mome delivery

- 9.2.2. Office delivery

- 9.2.3. Other

- 9.3. Market Analysis, Insights and Forecast - by Payment method

- 9.3.1. Cash on delivery

- 9.3.2. Online payment

- 9.3.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Swiggy

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GoJek

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SmartBite

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GrabFood

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dahmakan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Delivery Guy

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kims Kitchen

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deliveroo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Swiggy

List of Figures

- Figure 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 3: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 4: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 6: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 7: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 8: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 10: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 11: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 12: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 14: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 15: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 16: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 18: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 19: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 20: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

Key companies in the market include Swiggy, GoJek, SmartBite, GrabFood, Dahmakan, Delivery Guy, Kims Kitchen, Deliveroo.

3. What are the main segments of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The market segments include Product type, Method , Payment method .

4. Can you provide details about the market size?

The market size is estimated to be USD 250 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders.

6. What are the notable trends driving market growth?

Smart Phones and Internet Penetrations in the region are driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Forestry Equipment; Lack of Information About Forestry Equipment.

8. Can you provide examples of recent developments in the market?

August 2022: The introduction of GrabFood in Phnom Penh was announced by Grab following a successful four-month "beta" test in the capital. GrabFood is the top meal delivery service in Southeast Asia, connecting customers to a wide range of food and drink options and providing on-demand delivery to customers' doors. With the new service, customers may save up to 50% when they order from GrabFood no matter how far away the restaurant or cafe is from the user's location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Food Platform-to-Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Food Platform-to-Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence