Key Insights

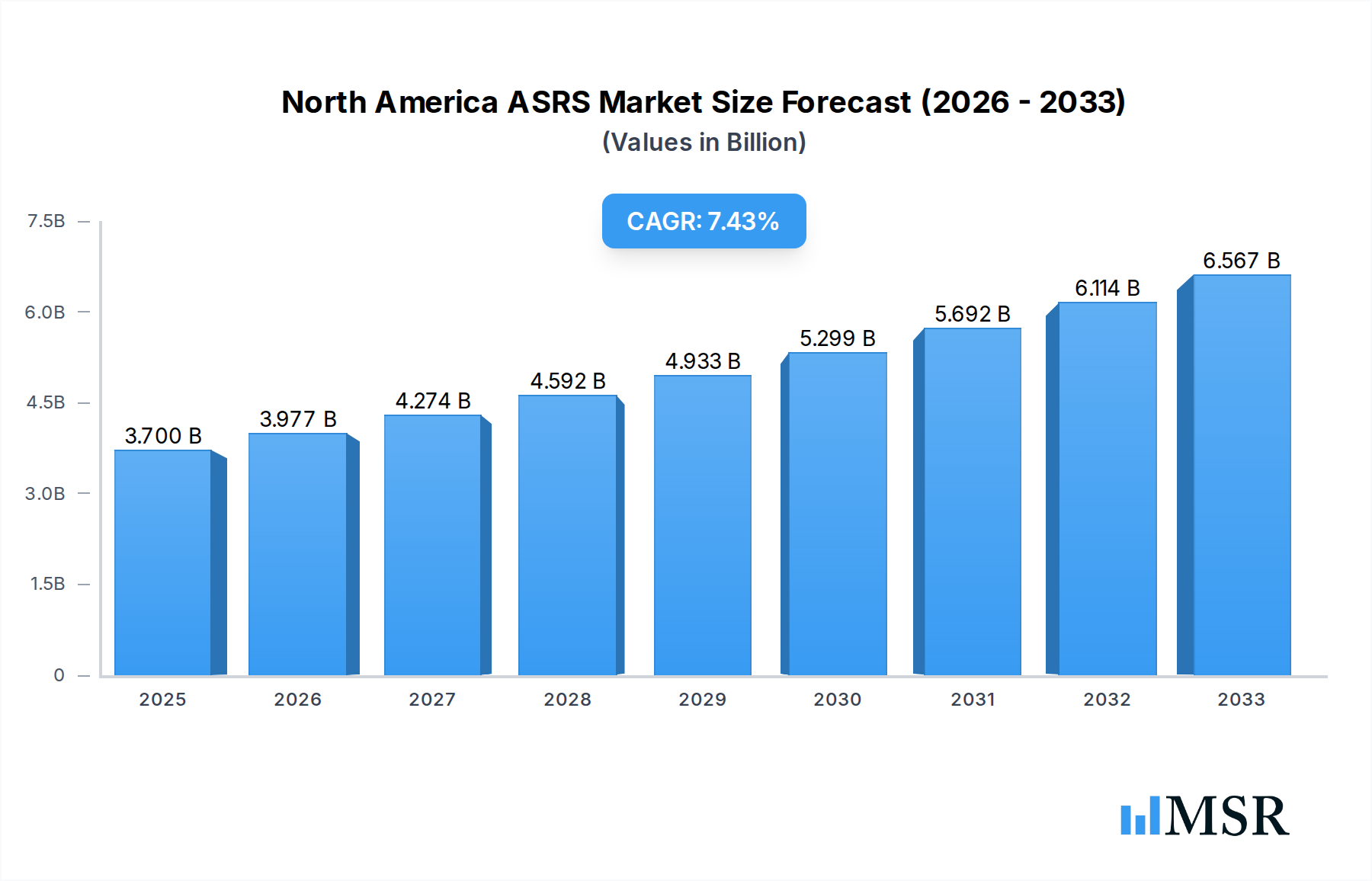

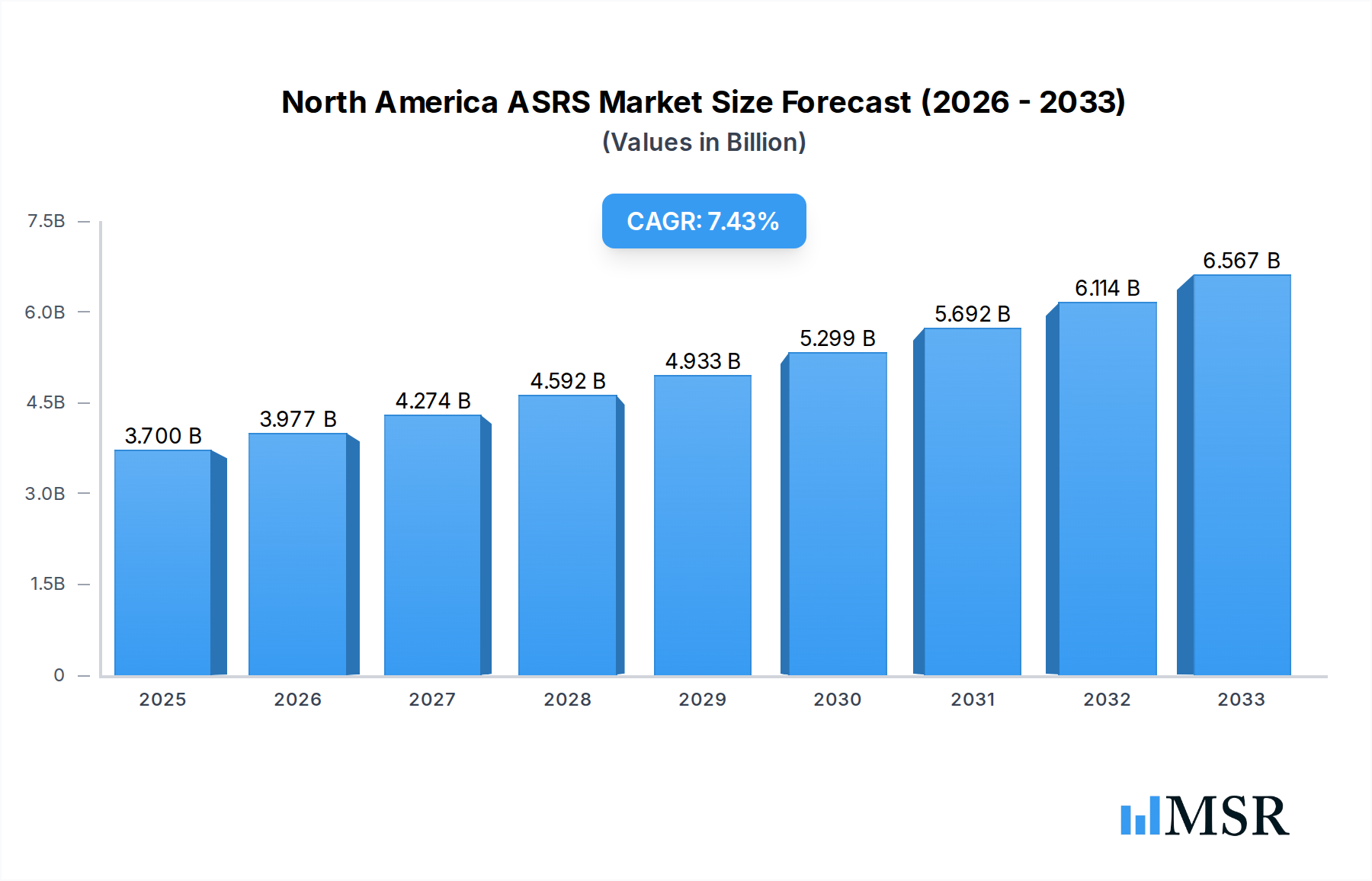

The North America Automated Storage and Retrieval Systems (ASRS) market is poised for significant expansion, projected to reach USD 3.7 billion in 2025. Driven by the relentless pursuit of operational efficiency, reduced labor costs, and enhanced inventory accuracy across a multitude of industries, the market is expected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025-2033. Key industries like Automotive, Food and Beverages, Retail, and General Manufacturing are at the forefront of ASRS adoption, seeking to optimize their warehouse operations and supply chain performance. The increasing demand for faster order fulfillment, coupled with the growing complexity of modern supply chains, further fuels the need for advanced ASRS solutions.

North America ASRS Market Market Size (In Billion)

Technological advancements in robotics, artificial intelligence, and software integration are continually enhancing the capabilities of ASRS, making them more adaptable and intelligent. Products like Vertical Lift Modules (VLMs) and Horizontal Carousels are gaining traction due to their space-saving designs and efficient retrieval times. While the market benefits from strong growth drivers, potential restraints such as the high initial investment cost and the need for skilled personnel for implementation and maintenance could pose challenges. However, the long-term benefits in terms of productivity gains, reduced errors, and optimized space utilization are compelling businesses to invest in these sophisticated systems, solidifying ASRS's role as a critical component of modern logistics and warehousing.

North America ASRS Market Company Market Share

North America Automated Storage and Retrieval Systems (ASRS) Market Report: Unlocking Efficiency and Innovation

This comprehensive report delves into the dynamic North America Automated Storage and Retrieval Systems (ASRS) Market, offering in-depth analysis and actionable insights for stakeholders. With a study period spanning 2019–2033, base year of 2025, and a forecast period from 2025–2033, this report provides a detailed examination of market concentration, industry dynamics, key segments, product developments, challenges, growth drivers, and emerging opportunities. The North America ASRS market is projected to witness substantial growth, reaching an estimated value of over $15 billion by 2025 and expanding significantly through 2033.

North America ASRS Market Market Concentration & Dynamics

The North America ASRS market exhibits a moderate to high degree of market concentration, with a few key players dominating the landscape. Innovation ecosystems are robust, fueled by ongoing advancements in robotics, AI, and IoT technologies, fostering a competitive environment for enhanced system efficiency and data integration. Regulatory frameworks, while generally supportive of automation for increased productivity and safety, can present varying compliance requirements across different jurisdictions. Substitute products, such as traditional shelving and manual warehousing solutions, still hold a presence but are increasingly being outpaced by the superior efficiency and accuracy offered by ASRS. End-user trends are heavily influenced by the drive for operational excellence, labor cost reduction, and the need for agile supply chains. Mergers and acquisitions (M&A) activities are notable, with companies consolidating their market positions and expanding their technological capabilities. The market has seen approximately 3-5 significant M&A deals annually over the historical period, indicating strategic consolidation. Market share is currently distributed with the top 5 players holding an estimated 60-70% of the market.

North America ASRS Market Industry Insights & Trends

The North America ASRS market is poised for exceptional growth, driven by an insatiable demand for optimized logistics and warehousing solutions. The market size for ASRS in North America was approximately $9.5 billion in the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. Key growth drivers include the relentless pursuit of operational efficiency, the critical need to mitigate labor shortages and rising labor costs, and the imperative to enhance inventory accuracy and throughput in an increasingly competitive global marketplace. Technological disruptions are at the forefront of this evolution, with the integration of artificial intelligence (AI) for predictive maintenance and route optimization, the adoption of the Internet of Things (IoT) for real-time monitoring and data analytics, and the increasing use of collaborative robots (cobots) to work alongside human operators. Evolving consumer behaviors, characterized by the rise of e-commerce and the demand for faster delivery times, are placing unprecedented pressure on fulfillment centers, making ASRS solutions indispensable for meeting these expectations. Furthermore, the shift towards smart manufacturing and Industry 4.0 principles is accelerating the adoption of automated systems across various industries, recognizing ASRS as a cornerstone of modern, agile, and resilient supply chains. The increasing complexity of inventory management and the desire for greater control over warehouse operations are also significant catalysts. The market is also witnessing a trend towards modular and scalable ASRS solutions, allowing businesses to adapt their systems to changing demands and expand their capacity incrementally. The continuous innovation in software for warehouse management systems (WMS) further enhances the capabilities and ROI of ASRS investments.

Key Markets & Segments Leading North America ASRS Market

The Automotive sector stands as a dominant end-user industry in the North America ASRS market, largely due to its complex supply chains, high-volume production, and stringent inventory management requirements. The implementation of ASRS in automotive manufacturing significantly improves the flow of parts, reduces lead times, and enhances overall production line efficiency. Economic growth and significant investments in new manufacturing facilities in countries like the United States and Canada are key drivers for this dominance.

- Drivers for Automotive Dominance:

- Lean Manufacturing Principles: ASRS directly supports lean manufacturing by minimizing waste and optimizing inventory levels.

- Just-In-Time (JIT) Delivery: Facilitates the precise delivery of components to assembly lines, reducing downtime.

- Labor Cost Reduction: Automating repetitive material handling tasks mitigates the impact of labor shortages and rising wages.

- Safety Enhancements: Reduces the risk of workplace accidents associated with manual material handling in large-scale operations.

- Increased Throughput: Enables faster movement of goods, crucial for high-volume automotive production.

Another significant segment is the Food and Beverages industry, driven by the need for strict temperature control, traceability, and rapid order fulfillment. The increasing demand for processed and packaged foods, coupled with stringent food safety regulations, necessitates highly automated and efficient storage solutions.

- Drivers for Food and Beverage Dominance:

- Perishability Management: ASRS offers precise temperature and humidity control, crucial for preserving the quality of perishable goods.

- Traceability & Compliance: Automated systems enhance lot tracking and recall management, vital for regulatory compliance.

- Hygiene & Sanitation: Minimizes human contact with products, reducing contamination risks.

- Inventory Accuracy: Essential for managing expiry dates and preventing stockouts or overstocking.

- E-commerce Growth: The surge in online grocery shopping necessitates faster and more accurate order picking.

Within product types, the Fixed Aisle System is a leading segment due to its versatility, high storage density, and suitability for a wide range of applications, especially in large-scale distribution centers.

- Drivers for Fixed Aisle System Dominance:

- High Storage Capacity: Maximizes warehouse space utilization.

- Scalability: Can be expanded to meet growing storage needs.

- Versatility: Accommodates various product sizes and types.

- Cost-Effectiveness: Offers a strong return on investment for high-volume operations.

- Integration with Other Technologies: Easily integrates with WMS and other automation solutions.

The Post and Parcel and Retail sectors are also experiencing substantial growth, propelled by the explosive expansion of e-commerce and the subsequent demand for efficient order processing and last-mile delivery.

North America ASRS Market Product Developments

Product developments in the North America ASRS market are characterized by a focus on enhanced intelligence, speed, and flexibility. Innovations include the integration of advanced robotics for picking and sorting, the development of high-density storage solutions, and the increasing adoption of AI-powered analytics for optimizing system performance and predictive maintenance. Companies are also developing modular and scalable ASRS solutions to cater to businesses of varying sizes and operational needs. The emphasis is on creating integrated systems that seamlessly connect with existing warehouse management software, providing end-to-end visibility and control over operations. These advancements aim to reduce operational costs, improve order accuracy, and accelerate throughput, ultimately providing a significant competitive edge to adopting businesses.

Challenges in the North America ASRS Market Market

Despite the robust growth, the North America ASRS market faces several challenges. High initial investment costs for implementing ASRS solutions remain a significant barrier for small and medium-sized enterprises (SMEs). The complexity of integration with existing legacy systems can also be a hurdle, requiring substantial time and resources. Additionally, the availability of skilled labor for the maintenance and operation of sophisticated ASRS equipment can be a constraint. Supply chain disruptions, as witnessed in recent years, can impact the availability of components and lead to project delays. The market also grapples with evolving cybersecurity threats, necessitating robust security measures to protect sensitive operational data. The competitive pressure from established players and the emergence of new technologies can also present challenges in maintaining market share.

Forces Driving North America ASRS Market Growth

The North America ASRS market growth is propelled by several powerful forces. The relentless surge in e-commerce, demanding faster order fulfillment and same-day delivery, is a primary driver. The ongoing labor shortage and rising wage pressures across the region are compelling businesses to automate repetitive tasks. Furthermore, the imperative to enhance operational efficiency, reduce costs, and improve inventory accuracy in a competitive global landscape is a significant catalyst. Technological advancements in AI, robotics, and IoT are making ASRS solutions more sophisticated, affordable, and adaptable, further fueling adoption. Government initiatives promoting automation and Industry 4.0 adoption also contribute to market expansion.

Challenges in the North America ASRS Market Market

Long-term growth catalysts for the North America ASRS market are deeply rooted in continuous innovation and strategic market expansion. The development of more intelligent and autonomous ASRS solutions, capable of adapting to dynamic operational environments, will be crucial. Strategic partnerships between ASRS providers and software developers will foster the creation of more integrated and value-added solutions. Furthermore, the expansion of ASRS applications into emerging industries and the development of customized solutions for niche markets will unlock new growth avenues. The increasing focus on sustainability and energy efficiency in ASRS design will also resonate with environmentally conscious businesses, creating a competitive advantage.

Emerging Opportunities in North America ASRS Market

Emerging opportunities in the North America ASRS market are abundant and diverse. The growing demand for micro-fulfillment centers in urban areas presents a significant opportunity for compact and flexible ASRS solutions. The increasing adoption of ASRS in cold chain logistics for the food and pharmaceutical industries, driven by the need for stringent temperature control, is another key area. The rise of the circular economy and the increasing need for efficient reverse logistics also present a fertile ground for ASRS innovation. Furthermore, the application of AI-powered predictive analytics for optimizing warehouse operations and inventory management offers substantial growth potential. The development of cloud-based ASRS solutions, providing greater accessibility and scalability, is also a promising trend.

Leading Players in the North America ASRS Market Sector

- Murata Machinery Ltd

- Schaefer Systems International Pvt Ltd

- Viastore Systems Inc

- Dematic Group (KION Group AG)

- Kardex Remster

- Mecalux S A

- Bastian Solutions Inc

- Toyota Industries Corporation

- Honeywell Intelligrated

- Daifuku Co Ltd

- Knapp AG

- Swisslog Holding AG

Key Milestones in North America ASRS Market Industry

- September 2020: The Wichita State University announced the launch of The Smart Factory@Wichita in collaboration with Deloitte, including a full-scale production line, automated storage, and hosting sponsors and experimental labs to expand the technological expertise. This initiative underscored the growing importance of integrated automation and experimental learning in shaping the future of manufacturing and logistics.

Strategic Outlook for North America ASRS Market Market

The strategic outlook for the North America ASRS market is overwhelmingly positive, characterized by sustained growth and innovation. Key growth accelerators will include the continued expansion of e-commerce, the increasing adoption of automation in manufacturing to combat labor shortages, and the ongoing push for supply chain resilience and efficiency. Strategic opportunities lie in the development of more intelligent, interconnected, and sustainable ASRS solutions. Companies that can offer comprehensive, end-to-end automation strategies, including advanced software integration and data analytics, will be well-positioned for future success. The market's trajectory points towards a future where ASRS is not merely a storage solution but a critical component of an integrated, intelligent, and highly efficient operational ecosystem.

North America ASRS Market Segmentation

-

1. Product Type

- 1.1. Fixed Aisle System

- 1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 1.3. Vertical Lift Module

-

2. End-User Industries

- 2.1. Airports

- 2.2. Automotive

- 2.3. Food and beverages

- 2.4. General Manufacturing

- 2.5. Post and Parcel

- 2.6. Retail

- 2.7. Other End-user Industries

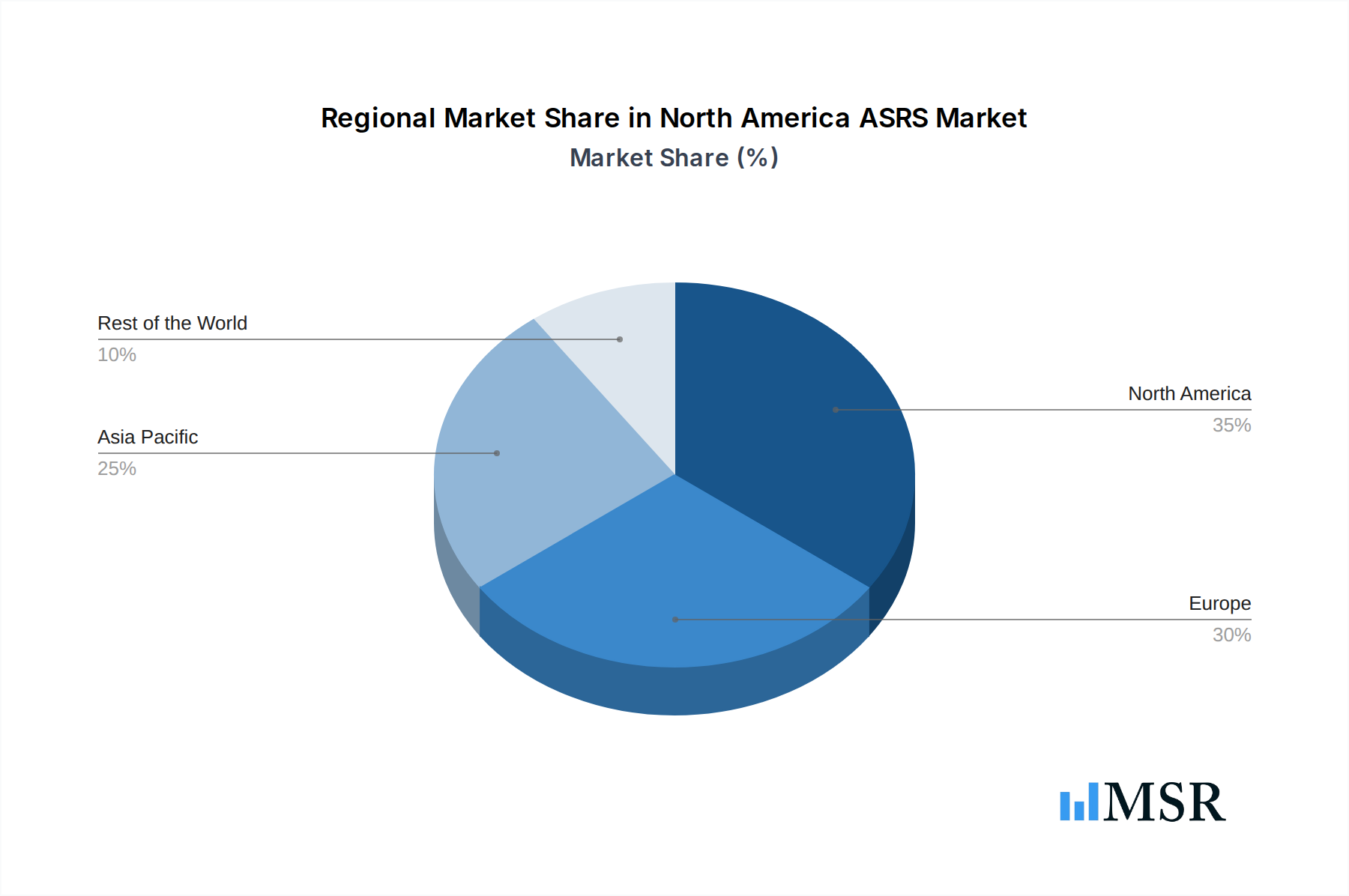

North America ASRS Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America ASRS Market Regional Market Share

Geographic Coverage of North America ASRS Market

North America ASRS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs

- 3.3. Market Restrains

- 3.3.1. Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ASRS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fixed Aisle System

- 5.1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.1.3. Vertical Lift Module

- 5.2. Market Analysis, Insights and Forecast - by End-User Industries

- 5.2.1. Airports

- 5.2.2. Automotive

- 5.2.3. Food and beverages

- 5.2.4. General Manufacturing

- 5.2.5. Post and Parcel

- 5.2.6. Retail

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Murata Machinery Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schaefer Systems International Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Viastore Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dematic Group (KION Group AG)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kardex Remster

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mecalux S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bastian Solutions Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Industries Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell Intelligrated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daifuku Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Knapp AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Swisslog Holding AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Murata Machinery Ltd

List of Figures

- Figure 1: North America ASRS Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America ASRS Market Share (%) by Company 2025

List of Tables

- Table 1: North America ASRS Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America ASRS Market Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 3: North America ASRS Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America ASRS Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: North America ASRS Market Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 6: North America ASRS Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America ASRS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America ASRS Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America ASRS Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ASRS Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the North America ASRS Market?

Key companies in the market include Murata Machinery Ltd, Schaefer Systems International Pvt Ltd, Viastore Systems Inc , Dematic Group (KION Group AG), Kardex Remster, Mecalux S A, Bastian Solutions Inc, Toyota Industries Corporation, Honeywell Intelligrated, Daifuku Co Ltd, Knapp AG, Swisslog Holding AG.

3. What are the main segments of the North America ASRS Market?

The market segments include Product Type, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Need for Skilled Workforce and Concerns over Replacement of Manual Labor.

8. Can you provide examples of recent developments in the market?

September 2020 - The Wichita State University announced the launch of The Smart Factory@Wichita in collaboration with Deloitte, including a full-scale production line, automated storage, and hosting sponsors and experimental labs to expand the technological expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ASRS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ASRS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ASRS Market?

To stay informed about further developments, trends, and reports in the North America ASRS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence