Key Insights

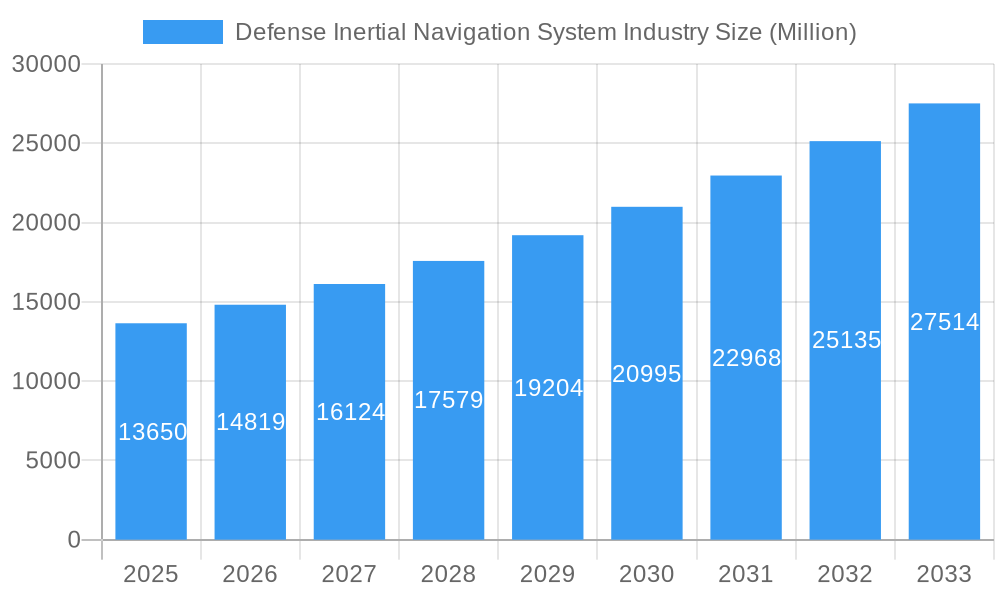

The Defense Inertial Navigation System (INS) market is poised for significant expansion, projected to reach $13.65 billion in 2025 and exhibit a robust compound annual growth rate (CAGR) of 8.6% through 2033. This growth is primarily propelled by the escalating demand for advanced navigation and guidance solutions in modern defense applications, particularly for unmanned aerial vehicles (UAVs), precision-guided munitions, and autonomous ground vehicles. The increasing geopolitical tensions and the subsequent rise in defense spending across major nations are further fueling the adoption of sophisticated INS technologies. Furthermore, the integration of INS with Global Navigation Satellite Systems (GNSS) to create hybrid systems offers enhanced accuracy and reliability, especially in environments where GNSS signals may be jammed or unavailable. This synergistic approach is a key trend driving innovation and market penetration.

Defense Inertial Navigation System Industry Market Size (In Billion)

The market's expansion is underpinned by a confluence of technological advancements and evolving defense strategies. Key drivers include the ongoing modernization of military fleets, the need for superior situational awareness, and the growing emphasis on autonomous operations to reduce human risk in combat zones. The aerospace and defense sector stands out as the dominant end-user industry, followed by automotive (particularly in defense-related autonomous driving applications), industrial (for precision guidance in complex operations), and marine (for naval vessels and submersibles). Leading companies are investing heavily in research and development to create smaller, lighter, and more power-efficient INS solutions, incorporating artificial intelligence and machine learning for improved performance and predictive maintenance. While the market benefits from strong demand, it faces challenges such as the high cost of advanced INS systems and the stringent regulatory requirements within the defense sector. Nevertheless, the continuous innovation in sensor technology and miniaturization is expected to mitigate some of these restraints, paving the way for sustained market growth.

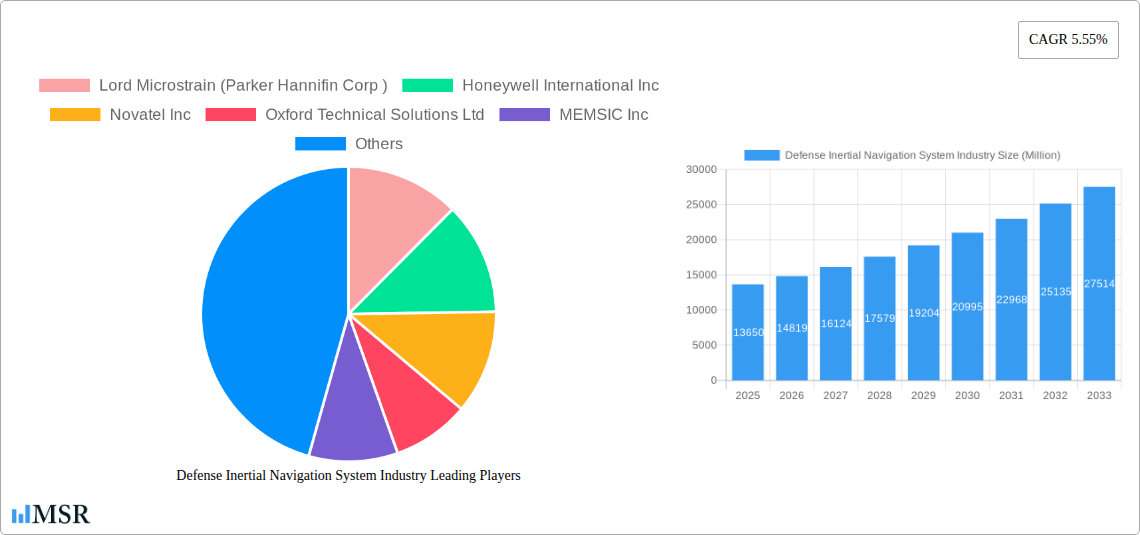

Defense Inertial Navigation System Industry Company Market Share

Defense Inertial Navigation System Industry Market Concentration & Dynamics

The Defense Inertial Navigation System (INS) market exhibits a moderate level of concentration, with a few key players dominating market share, including Northrop Grumman Corporation, Honeywell International Inc., and Lord Microstrain (Parker Hannifin Corp). These giants leverage their extensive R&D capabilities, established supply chains, and long-standing relationships with defense organizations to maintain a significant presence. The innovation ecosystem is characterized by continuous advancements in MEMS technology, fiber optic gyroscopes, and sophisticated sensor fusion algorithms, driven by the relentless pursuit of enhanced accuracy, reduced size, weight, and power (SWaP), and improved resilience against jamming and spoofing. Regulatory frameworks, particularly those from national defense agencies, heavily influence product development and procurement cycles, often requiring stringent testing and certification processes. While substitute products like GPS-denied navigation solutions are evolving, the inherent accuracy and autonomy of INS make it indispensable for critical defense applications. End-user trends are strongly skewed towards the Aerospace and Defense segment, where the demand for precise navigation in unmanned aerial vehicles (UAVs), fighter jets, and naval vessels is paramount. The Automotive and Industrial segments are also showing growing interest, driven by the need for accurate positioning in autonomous systems and harsh environments. Merger and Acquisition (M&A) activities, though not extremely frequent, are strategic, aimed at consolidating technologies, expanding market reach, or acquiring specialized expertise. For instance, recent M&A activity has seen larger defense contractors acquiring smaller, innovative INS technology providers to bolster their capabilities. The market share distribution indicates that the top 5 players collectively hold approximately 60% of the global market share. M&A deal counts have averaged 3-5 significant transactions per year over the historical period.

Defense Inertial Navigation System Industry Industry Insights & Trends

The Defense Inertial Navigation System (INS) industry is poised for substantial growth, with projections indicating a market size exceeding $25 billion by 2033. This upward trajectory is fueled by a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. The primary driver behind this expansion is the escalating geopolitical instability and the consequent surge in defense spending globally, leading to increased procurement of advanced military platforms that rely heavily on precise navigation capabilities. The continuous evolution of unmanned systems, including drones and autonomous vehicles, across military and civilian applications, is another significant catalyst. These platforms require highly accurate, reliable, and compact INS solutions to operate effectively in GPS-denied or contested environments. Technological disruptions are at the forefront of industry evolution. Advancements in Micro-Electro-Mechanical Systems (MEMS) have led to the development of smaller, lighter, and more cost-effective inertial sensors, enabling their integration into a wider array of applications and platforms. Furthermore, breakthroughs in fiber-optic gyroscope (FOG) and ring laser gyroscope (RLG) technologies are pushing the boundaries of accuracy and performance, meeting the demands of sophisticated military operations. Sensor fusion algorithms are becoming increasingly advanced, enabling the seamless integration of data from multiple sensors, including INS, GNSS, magnetometers, and barometers, to provide unparalleled navigation accuracy and robustness. Evolving consumer behaviors, particularly within the defense sector, emphasize the need for enhanced resilience, reduced lifecycle costs, and greater autonomy. This is driving innovation towards INS systems that can operate independently of external signals for extended periods, offering true situational awareness even in the most challenging operational theaters. The market is also witnessing a shift towards modular and scalable INS solutions, allowing for customization and easy integration into existing and future defense platforms. The pursuit of "always-on" navigation capabilities, ensuring continuous positional awareness, is a key trend shaping product development and strategic investments.

Key Markets & Segments Leading Defense Inertial Navigation System Industry

The Aerospace and Defense segment stands as the undisputed leader in the Defense Inertial Navigation System (INS) industry, consistently driving demand and innovation. This dominance is rooted in the critical need for highly accurate and reliable navigation systems across a vast spectrum of military applications.

- Economic Growth and Defense Budgets: Robust defense budgets in major economies like the United States, China, India, and European nations directly translate into increased procurement of advanced military hardware, including fighter jets, bombers, helicopters, and naval vessels, all of which are equipped with sophisticated INS.

- Technological Advancement and R&D Investment: Significant investments in research and development by defense contractors and government agencies foster the creation of next-generation INS technologies, ensuring the segment remains at the cutting edge.

- Rise of Unmanned Systems: The exponential growth of Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), and Unmanned Surface Vehicles (USVs) in military operations is a monumental driver. These platforms rely heavily on INS for autonomous navigation, reconnaissance, surveillance, and strike missions, especially in contested or GPS-denied environments.

- Operational Requirements: The inherent need for precise navigation during complex combat operations, missile guidance, aerial refueling, and maritime patrol underscores the indispensability of INS in Aerospace and Defense.

Within this segment, the North America region, particularly the United States, commands the largest market share due to its substantial defense expenditure and the presence of leading defense contractors. The region's proactive approach to technological integration and its extensive involvement in global defense operations further solidify its leadership.

The Marine segment is another significant contributor to the Defense INS market. Naval operations, including submarine navigation, surface fleet maneuvering, and unmanned maritime systems, require highly accurate positioning and inertial guidance. The complexity of underwater navigation, where GNSS signals are unavailable, makes INS a critical component for submarines and other submerged platforms. The increasing focus on maritime security, anti-piracy operations, and naval power projection by various nations is fueling demand for advanced INS solutions in this segment.

The Automotive sector, while emerging, is witnessing rapid adoption of INS for advanced driver-assistance systems (ADAS) and autonomous driving. While not strictly defense-focused, the underlying technology and development often benefit from defense-grade research, creating a dual-use market. The need for robust and reliable positioning in self-driving cars, even when GNSS signals are temporarily lost due to urban canyons or tunnels, makes INS a crucial enabling technology.

The Industrial segment, encompassing applications like precision agriculture, surveying, mining, and robotics, also presents growing opportunities. The demand for accurate real-time positioning and motion control in these sectors, often in remote or challenging environments, is driving the adoption of INS technologies.

Defense Inertial Navigation System Industry Product Developments

Recent product developments in the Defense Inertial Navigation System (INS) industry are characterized by a strong emphasis on miniaturization, enhanced accuracy, and increased resilience. Companies are actively innovating with advanced MEMS sensors, fiber-optic gyroscopes, and solid-state laser gyroscopes, pushing the boundaries of performance while reducing size, weight, and power (SWaP). Innovations in sensor fusion algorithms are enabling INS to seamlessly integrate with other navigation sources like GNSS, aiding in robust operation even in GPS-denied environments. The market relevance of these developments lies in their ability to support a new generation of agile and autonomous defense platforms, including small drones, advanced missiles, and unmanned ground vehicles, offering a significant competitive edge.

Challenges in the Defense Inertial Navigation System Industry Market

The Defense Inertial Navigation System (INS) market faces several significant challenges that can impact growth and adoption.

- High Development Costs and Long Qualification Cycles: The stringent requirements for defense applications necessitate extensive R&D, rigorous testing, and lengthy qualification processes, leading to substantial upfront investment and extended time-to-market.

- Technological Obsolescence and Rapid Advancement: The fast pace of technological innovation, particularly in sensor technology and digital signal processing, can lead to rapid obsolescence of existing systems, requiring continuous upgrades and replacements.

- Supply Chain Vulnerabilities and Geopolitical Risks: Reliance on specialized components and the global nature of supply chains can expose the industry to disruptions caused by geopolitical tensions, trade restrictions, and natural disasters, impacting production and availability.

- Cybersecurity Threats: As INS systems become more interconnected and reliant on digital data, they are increasingly vulnerable to cyberattacks, posing a significant risk to operational integrity and national security.

- Interoperability Standards: Ensuring seamless interoperability between different INS systems and platforms from various manufacturers and allied nations can be a complex challenge, requiring adherence to evolving international standards.

Forces Driving Defense Inertial Navigation System Industry Growth

Several key forces are propelling the growth of the Defense Inertial Navigation System (INS) industry.

- Increasing Geopolitical Instability and Defense Spending: A heightened global security landscape and rising defense budgets worldwide are directly fueling demand for advanced military hardware, which inherently relies on sophisticated INS for critical navigation functions.

- Proliferation of Unmanned Systems: The rapid expansion of Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), and Unmanned Maritime Vehicles (UMVs) across military applications necessitates highly accurate and autonomous navigation, a core capability provided by INS.

- Demand for GPS-Denied Navigation: The growing threat of GPS jamming and spoofing in modern warfare environments is driving the need for robust INS solutions that can provide reliable navigation independent of external satellite signals.

- Technological Advancements in Sensor Technology: Continuous innovation in MEMS, fiber-optic gyroscopes, and solid-state laser gyroscopes is leading to smaller, lighter, more accurate, and cost-effective INS, making them suitable for a wider range of platforms.

- Advancements in Sensor Fusion Algorithms: Sophisticated algorithms that integrate data from multiple sensors (INS, GNSS, magnetometers, etc.) are enhancing navigation accuracy, resilience, and overall system performance.

Challenges in the Defense Inertial Navigation System Industry Market

Long-term growth catalysts for the Defense Inertial Navigation System (INS) industry are deeply intertwined with ongoing technological advancements and evolving strategic imperatives. The continuous pursuit of greater accuracy, reduced size, weight, and power (SWaP), and enhanced resilience against adversarial actions will remain primary drivers. Innovations in quantum sensing, though still in nascent stages, hold the potential to revolutionize INS by offering unprecedented levels of accuracy and stability, independent of external factors. Furthermore, the increasing integration of AI and machine learning in INS will enable predictive maintenance, adaptive navigation strategies, and improved anomaly detection. Strategic partnerships and collaborations between defense contractors, technology providers, and research institutions will be crucial for accelerating the development and deployment of next-generation INS capabilities. The expansion of INS into emerging defense domains, such as hypersonic weapons and space-based defense systems, will also present significant long-term growth opportunities.

Emerging Opportunities in Defense Inertial Navigation System Industry

The Defense Inertial Navigation System (INS) industry is ripe with emerging opportunities driven by evolving technological landscapes and strategic shifts.

- AI-Powered INS: The integration of artificial intelligence (AI) and machine learning into INS will enable sophisticated self-calibration, predictive maintenance, and adaptive navigation strategies for enhanced autonomy and resilience.

- Quantum Sensing Integration: While in early development, the incorporation of quantum sensing technologies promises to unlock unparalleled levels of accuracy and stability in INS, fundamentally transforming precision navigation.

- Hypersonic and Space-Based Defense: The development of hypersonic missiles and advanced space-based defense systems will create a significant demand for highly specialized and robust INS solutions capable of operating in extreme environments.

- Cyber-Resilient INS: As cyber threats evolve, there is a growing need for INS solutions with built-in cyber resilience and advanced threat detection capabilities to ensure operational integrity.

- Commercial Off-the-Shelf (COTS) Integration: Leveraging advanced COTS inertial sensors and processing units, adapted and ruggedized for defense applications, can lead to cost efficiencies and faster deployment cycles.

Leading Players in the Defense Inertial Navigation System Industry Sector

- Lord Microstrain (Parker Hannifin Corp)

- Honeywell International Inc.

- Novatel Inc.

- Oxford Technical Solutions Ltd

- MEMSIC Inc.

- Aeron Systems Pvt Ltd

- Inertial Sense LLC

- Tersus GNSS Inc

- Northrop Grumman Corporation

Key Milestones in Defense Inertial Navigation System Industry Industry

- 2019: Introduction of advanced MEMS-based INS with enhanced drift compensation, improving accuracy for unmanned systems.

- 2020: Major defense contractor unveils a new generation of fiber-optic gyro (FOG) based INS with significantly reduced SWaP for fighter jets.

- 2021: Acquisition of a specialized INS technology startup by a leading defense conglomerate to bolster its autonomous systems capabilities.

- 2022: Development of a novel INS that integrates with quantum sensors, demonstrating record-breaking accuracy in laboratory conditions.

- 2023: Launch of a compact, ruggedized INS solution specifically designed for small tactical drones, enabling GPS-denied operations.

- 2024 (Early): Increased investment in research for INS solutions resilient to advanced cyber threats and electronic warfare.

Strategic Outlook for Defense Inertial Navigation System Industry Market

The strategic outlook for the Defense Inertial Navigation System (INS) market is overwhelmingly positive, driven by continuous technological innovation and the escalating global demand for advanced defense capabilities. Growth accelerators will include the ongoing miniaturization of INS, enabling their integration into an even wider array of platforms, and the development of highly resilient systems capable of operating effectively in the most challenging electronic warfare environments. Strategic opportunities lie in capitalizing on the burgeoning market for autonomous systems across all defense branches and in pioneering INS solutions for emerging domains like hypersonic weapons and counter-drone systems. Companies that can offer modular, cost-effective, and rapidly deployable INS solutions with built-in cybersecurity features will be well-positioned for sustained success. The ongoing evolution of INS technology promises to unlock new levels of operational effectiveness and strategic advantage for defense forces worldwide.

Defense Inertial Navigation System Industry Segmentation

-

1. End-user Industry

- 1.1. Aerospace and Defense

- 1.2. Marine

- 1.3. Automotive

- 1.4. Industrial

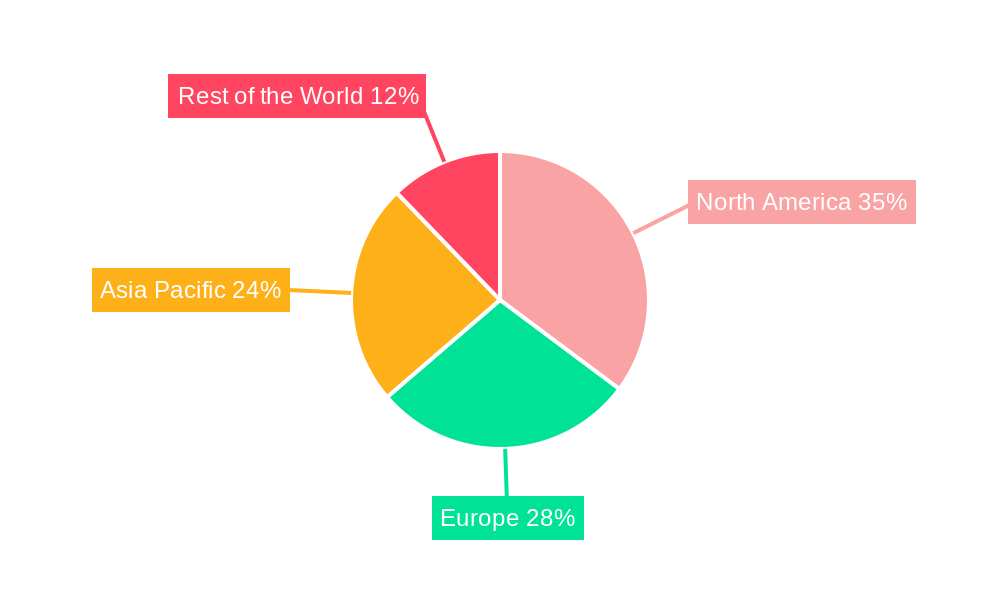

Defense Inertial Navigation System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Defense Inertial Navigation System Industry Regional Market Share

Geographic Coverage of Defense Inertial Navigation System Industry

Defense Inertial Navigation System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Military & Defense Spending

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness and Budget to Deploy INS in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Sector Dominates the Inertial Navigation System Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Aerospace and Defense

- 5.1.2. Marine

- 5.1.3. Automotive

- 5.1.4. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Aerospace and Defense

- 6.1.2. Marine

- 6.1.3. Automotive

- 6.1.4. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Aerospace and Defense

- 7.1.2. Marine

- 7.1.3. Automotive

- 7.1.4. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Aerospace and Defense

- 8.1.2. Marine

- 8.1.3. Automotive

- 8.1.4. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Defense Inertial Navigation System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Aerospace and Defense

- 9.1.2. Marine

- 9.1.3. Automotive

- 9.1.4. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lord Microstrain (Parker Hannifin Corp )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Novatel Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oxford Technical Solutions Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MEMSIC Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aeron Systems Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Inertial Sense LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tersus GNSS Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Northrop Grumman Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Lord Microstrain (Parker Hannifin Corp )

List of Figures

- Figure 1: Global Defense Inertial Navigation System Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 3: North America Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Europe Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Defense Inertial Navigation System Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Rest of the World Defense Inertial Navigation System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Rest of the World Defense Inertial Navigation System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Defense Inertial Navigation System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Defense Inertial Navigation System Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defense Inertial Navigation System Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Defense Inertial Navigation System Industry?

Key companies in the market include Lord Microstrain (Parker Hannifin Corp ), Honeywell International Inc, Novatel Inc, Oxford Technical Solutions Ltd, MEMSIC Inc, Aeron Systems Pvt Ltd, Inertial Sense LLC, Tersus GNSS Inc, Northrop Grumman Corporation.

3. What are the main segments of the Defense Inertial Navigation System Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Military & Defense Spending.

6. What are the notable trends driving market growth?

Aerospace and Defense Sector Dominates the Inertial Navigation System Market.

7. Are there any restraints impacting market growth?

; Lack of Awareness and Budget to Deploy INS in Emerging Economies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defense Inertial Navigation System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defense Inertial Navigation System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defense Inertial Navigation System Industry?

To stay informed about further developments, trends, and reports in the Defense Inertial Navigation System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence