Key Insights

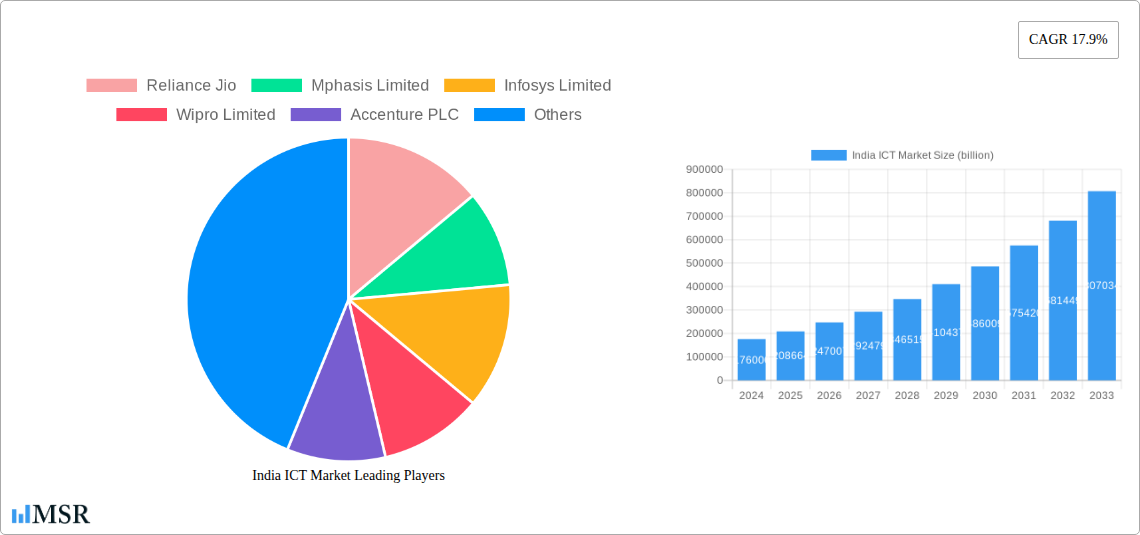

The Indian Information and Communication Technology (ICT) market is poised for substantial growth, demonstrating remarkable dynamism and a significant upward trajectory. With a current market size of $176 billion in 2024, the sector is projected to expand at an impressive compound annual growth rate (CAGR) of 17.9% from 2025 to 2033. This robust expansion is fueled by a confluence of potent drivers, including the increasing adoption of digital technologies across all business sectors, the government's push for digital transformation through initiatives like Digital India, and the escalating demand for cloud computing, artificial intelligence, and data analytics solutions. The burgeoning startup ecosystem, coupled with a growing pool of skilled IT professionals, further acts as a catalyst for innovation and market penetration. Emerging trends such as the rise of 5G technology, the Internet of Things (IoT) integration, and the growing importance of cybersecurity are shaping the market landscape, creating new avenues for growth and value creation.

India ICT Market Market Size (In Billion)

Despite this optimistic outlook, certain restraints could temper the pace of growth. These include the persistent challenge of digital infrastructure disparities in certain regions, the evolving regulatory landscape, and the need for continuous upskilling and reskilling of the workforce to keep pace with rapid technological advancements. The market is segmented across various components, with hardware, software, IT services, and telecommunication services all playing crucial roles. Enterprises of all sizes, from micro, small, and medium businesses (MSMEs) to large corporations, are increasingly investing in ICT solutions to enhance operational efficiency and gain a competitive edge. Key industry verticals such as BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, and Energy and Utilities are actively driving demand. Geographically, all regions are contributing to market expansion, reflecting the widespread digital adoption across India. Prominent companies like Reliance Jio, Infosys, Wipro, Accenture, and Tata Consultancy Services are at the forefront, shaping the competitive dynamics of this vibrant market.

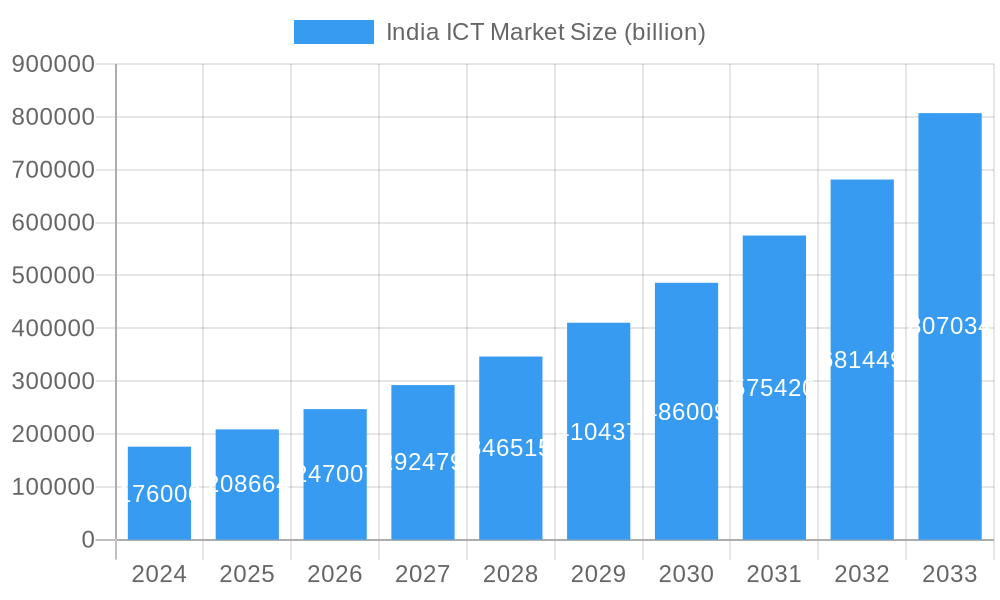

India ICT Market Company Market Share

Unlock the immense potential of the rapidly expanding Indian Information and Communications Technology (ICT) market with this in-depth report. Analyzing the period from 2019 to 2033, with a base and estimated year of 2025, this study provides critical insights into market size, growth drivers, competitive landscape, and emerging opportunities. Discover the strategic imperatives for stakeholders navigating the dynamic Indian digital economy. This report is essential for businesses, investors, and policymakers seeking to capitalize on India's digital transformation journey, driven by robust IT services, telecommunication advancements, and a burgeoning software sector.

India ICT Market Market Concentration & Dynamics

The Indian ICT market exhibits a dynamic blend of concentration and fragmentation. While a few large players dominate segments like IT services and telecommunications, the software and hardware sectors feature a more diverse ecosystem of domestic and international companies. Innovation is heavily concentrated within major technology hubs, fueled by a skilled workforce and government initiatives promoting R&D. Regulatory frameworks, while evolving, can present challenges, particularly concerning data privacy and digital taxation. Substitute products are constantly emerging, driven by rapid technological advancements and the increasing affordability of digital solutions. End-user trends are heavily influenced by digital adoption across all demographics, a growing preference for cloud-based solutions, and the pervasive impact of mobile technology. Mergers and acquisitions (M&A) are a significant feature, driven by the pursuit of market consolidation, access to new technologies, and expansion into high-growth segments. For instance, the last few years have seen numerous M&A deals aimed at strengthening capabilities in areas like cloud computing, artificial intelligence, and cybersecurity.

- Market Share Dynamics: Dominant players hold substantial market share in specific segments, while smaller innovative companies carve out niches.

- M&A Activities: A consistent stream of M&A deals signifies strategic consolidation and capability enhancement.

- Innovation Ecosystems: Bengaluru, Hyderabad, and Pune lead as hubs for technological innovation and talent.

- Regulatory Landscape: Evolving policies impact data management, digital infrastructure, and market access.

India ICT Market Industry Insights & Trends

The Indian ICT market is experiencing unprecedented growth, projected to reach an estimated USD 250 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 15% projected for the forecast period of 2025–2033. This surge is propelled by a confluence of factors including increasing digital penetration, government initiatives like 'Digital India,' and a burgeoning startup ecosystem. The IT services sector continues to be a major revenue generator, driven by the global demand for digital transformation, cloud migration, and data analytics. Telecommunication services are expanding rapidly, fueled by the rollout of 5G networks, increasing smartphone adoption, and the demand for high-speed internet connectivity across both urban and rural areas. The software segment is witnessing innovation in areas such as AI, machine learning, and blockchain, catering to diverse industry needs. Hardware, while facing global supply chain challenges, is seeing increased domestic manufacturing push. E-commerce growth is a significant contributor, demanding robust digital infrastructure and seamless online experiences. The demand for advanced IT solutions from large enterprises is matched by a growing need for cost-effective, scalable solutions for Micro, Small, and Medium Enterprises (MSMEs). Evolving consumer behaviors, characterized by a preference for on-demand services and personalized digital experiences, are further shaping market trends and driving innovation across all ICT segments. The historical period of 2019–2024 laid the foundation for this accelerated growth, with consistent investment in digital infrastructure and a growing awareness of technology's transformative power.

Key Markets & Segments Leading India ICT Market

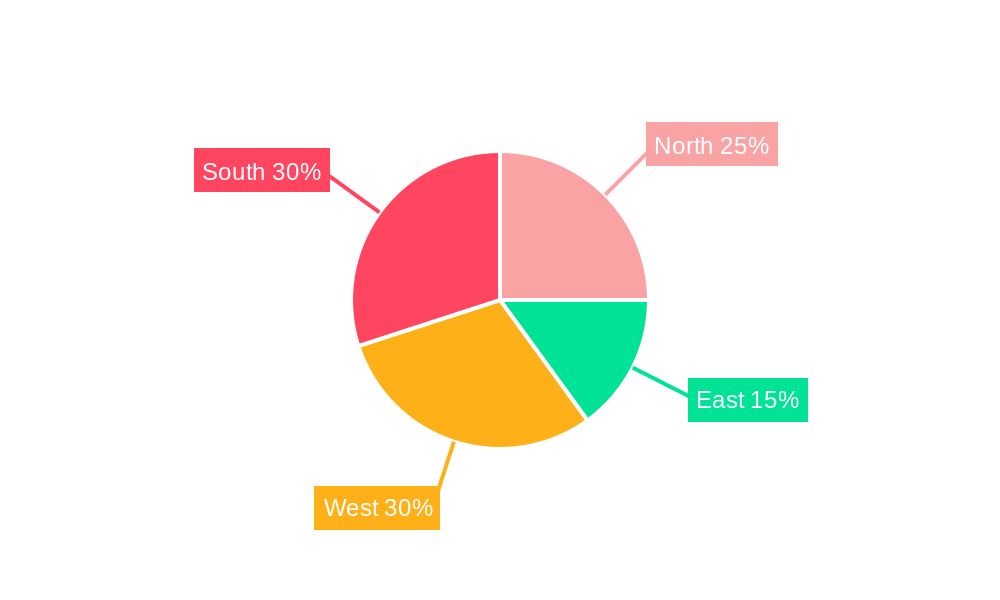

The Indian ICT market's dominance is multifaceted, with specific segments and geographies exhibiting particularly strong growth trajectories. IT Services remains a cornerstone, consistently contributing a significant portion to the market's overall value, driven by global outsourcing trends and the increasing need for digital transformation services from large enterprises. The BFSI (Banking, Financial Services, and Insurance) and IT and Telecom industry verticals are leading adopters of advanced ICT solutions, demanding robust cybersecurity, cloud migration, and data analytics capabilities. The Retail and E-commerce sector is also a major driver, propelled by the rapid shift towards online shopping, requiring sophisticated digital platforms and logistics management. Geographically, the South and West regions of India are leading the charge, housing major technology hubs like Bengaluru and Mumbai, and attracting substantial investment in ICT infrastructure and talent. The Large Enterprises segment commands a substantial market share due to their higher spending capacity and complex technological requirements, but the Micro, Small, and Medium Enterprises (MSMEs) segment represents a significant and rapidly growing opportunity, with increasing digital adoption and demand for scalable, affordable solutions.

Dominant Segments:

- Type: IT Services, Telecommunication Services

- Size of Enterprise: Large Enterprises, with rapidly growing MSME adoption.

- Industry Vertical: BFSI, IT and Telecom, Retail and E-commerce.

- Geography: South, West India.

Drivers of Dominance:

- Economic Growth: A strong and growing economy fuels digital spending across all sectors.

- Infrastructure Development: Significant investments in broadband, 5G, and data centers enable widespread digital access.

- Skilled Workforce: Availability of a large pool of technically skilled professionals supports innovation and service delivery.

- Government Initiatives: Programs like 'Digital India' and 'Make in India' foster digital adoption and local manufacturing.

- Startup Ecosystem: A vibrant startup scene drives innovation and creates demand for advanced ICT solutions.

India ICT Market Product Developments

The Indian ICT market is characterized by a continuous stream of product innovations aimed at enhancing efficiency, security, and user experience. Key advancements include the rapid development and adoption of AI-powered analytics platforms that offer deeper insights into customer behavior and operational efficiency for businesses across verticals like BFSI and Retail. The proliferation of cloud-native software solutions continues, enabling greater scalability and flexibility for enterprises. In telecommunications, the focus remains on optimizing 5G network deployments, leading to the development of advanced network management tools and edge computing solutions that reduce latency and enhance real-time data processing. Cybersecurity solutions are also evolving with the integration of machine learning to detect and respond to sophisticated threats in real-time.

Challenges in the India ICT Market Market

Despite robust growth, the Indian ICT market faces several challenges that can impede its full potential. Regulatory hurdles, including evolving data localization norms and tax structures, can create uncertainty for businesses. Supply chain disruptions, particularly for hardware components, continue to be a concern, impacting manufacturing and delivery timelines. Intense competitive pressures, both from established global players and agile domestic startups, necessitate continuous innovation and cost-efficiency. Furthermore, skill gaps in specialized areas like AI and cybersecurity can slow down the adoption of advanced technologies. The cost of implementing cutting-edge solutions can also be a barrier for MSMEs.

Forces Driving India ICT Market Growth

The Indian ICT market's growth is propelled by a powerful combination of technological, economic, and regulatory factors. The widespread digitalization wave across industries, from traditional manufacturing to emerging sectors, is a primary driver. The government's sustained push through initiatives like 'Digital India' and the ongoing 5G rollout are creating fertile ground for advanced technologies and services. A rapidly growing young demographic, comfortable with technology, fuels demand for digital products and services. The expansion of the startup ecosystem fosters innovation and drives demand for cutting-edge ICT solutions. Furthermore, the increasing adoption of cloud computing and AI/ML by businesses of all sizes is transforming operational efficiencies and creating new service opportunities.

Challenges in the India ICT Market Market

Long-term growth catalysts for the Indian ICT market lie in sustained innovation, strategic partnerships, and market expansion. Continued investment in research and development is crucial for staying ahead of global technological curves. The formation of strategic alliances between Indian IT service providers and global technology giants will accelerate the adoption of advanced solutions and expand market reach. Furthermore, focusing on emerging technologies such as IoT, blockchain, and edge computing, and developing tailored solutions for these areas, will unlock new revenue streams. The increasing focus on sustainability and green IT presents another avenue for growth.

Emerging Opportunities in India ICT Market

Emerging opportunities within the India ICT market are vast and dynamic. The burgeoning Internet of Things (IoT) market, driven by smart city initiatives and industrial automation, presents significant growth potential. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) across various sectors, from healthcare to agriculture, is creating demand for specialized software and services. The push for data analytics and big data solutions to derive actionable insights is another key trend. Furthermore, the expanding fintech sector, with its innovative digital payment and lending solutions, continues to drive demand for robust ICT infrastructure. The government's focus on developing domestic manufacturing capabilities for electronics and IT hardware also opens up new avenues.

Leading Players in the India ICT Market Sector

- Reliance Jio

- Mphasis Limited

- Infosys Limited

- Wipro Limited

- Accenture PLC

- Atria Convergence Technologies Ltd

- HCL Technologies

- Allied Digital Services Ltd

- Vodafone India

- Tata Consultancy Services Limited

- Tech Mahindra Ltd

- Bharti Airtel Limited

- IBM Global Services

- Mindtree Ltd

- BSNL

- Capgemini Technology Services India Ltd

Key Milestones in India ICT Market Industry

- May 2023: SolarWinds and Infosys announced a collaboration to advance the shift of SolarWinds solutions to a new SaaS model. Through this engagement, Infosys will leverage its engineering capabilities to accelerate the SaaSification of SolarWinds products and platforms built to increase customer visibility in highly complex hybrid and multi-cloud environments. This collaboration is a key component of the SolarWinds strategy to offer accessible, highly effective, and value-based solutions built to empower its customers to accelerate their digital transformation efforts regardless of where they are on their journey to the cloud.

- October 2022: HCL Technologies announced the expansion of its strategic partnership with Google Cloud, adding new capabilities and service options to speed up HCL Tech's cloud migration. Together, the two companies will fortify their partnership, significantly enhancing HCL Tech's capacity to support digital transformation and offer enterprise clients professional services, critical migration, and system modernization.

Strategic Outlook for India ICT Market Market

The strategic outlook for the India ICT market remains exceptionally positive, driven by sustained digital transformation initiatives, favorable government policies, and a large, tech-savvy population. Growth accelerators include the continued expansion of cloud infrastructure, the widespread adoption of AI and automation across industries, and the ongoing development of 5G networks, which will unlock new use cases and demand for high-speed connectivity. The increasing focus on cybersecurity and data privacy will also drive investment in specialized solutions. The potential for further M&A activities to consolidate market share and acquire new capabilities remains high. Strategic opportunities lie in leveraging India's cost advantages and skilled workforce to cater to global demand while strengthening domestic capabilities in niche technologies.

India ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Micro, Small, and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

-

4. Geography

- 4.1. North

- 4.2. East

- 4.3. West

- 4.4. South

India ICT Market Segmentation By Geography

- 1. North

- 2. East

- 3. West

- 4. South

India ICT Market Regional Market Share

Geographic Coverage of India ICT Market

India ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Explore and Adopt Digital technologies and Initiatives

- 3.3. Market Restrains

- 3.3.1. Managing Regulatory and Compliance Needs Across the World

- 3.4. Market Trends

- 3.4.1 Micro

- 3.4.2 Small

- 3.4.3 and Medium Enterprises to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India ICT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Micro, Small, and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North

- 5.4.2. East

- 5.4.3. West

- 5.4.4. South

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North

- 5.5.2. East

- 5.5.3. West

- 5.5.4. South

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India ICT Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. IT Services

- 6.1.4. Telecommunication Services

- 6.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6.2.1. Micro, Small, and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. BFSI

- 6.3.2. IT and Telecom

- 6.3.3. Government

- 6.3.4. Retail and E-commerce

- 6.3.5. Manufacturing

- 6.3.6. Energy and Utilities

- 6.3.7. Other Industry Verticals

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. North

- 6.4.2. East

- 6.4.3. West

- 6.4.4. South

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. East India ICT Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. IT Services

- 7.1.4. Telecommunication Services

- 7.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7.2.1. Micro, Small, and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. BFSI

- 7.3.2. IT and Telecom

- 7.3.3. Government

- 7.3.4. Retail and E-commerce

- 7.3.5. Manufacturing

- 7.3.6. Energy and Utilities

- 7.3.7. Other Industry Verticals

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. North

- 7.4.2. East

- 7.4.3. West

- 7.4.4. South

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. West India ICT Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. IT Services

- 8.1.4. Telecommunication Services

- 8.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8.2.1. Micro, Small, and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. BFSI

- 8.3.2. IT and Telecom

- 8.3.3. Government

- 8.3.4. Retail and E-commerce

- 8.3.5. Manufacturing

- 8.3.6. Energy and Utilities

- 8.3.7. Other Industry Verticals

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. North

- 8.4.2. East

- 8.4.3. West

- 8.4.4. South

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South India ICT Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. IT Services

- 9.1.4. Telecommunication Services

- 9.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9.2.1. Micro, Small, and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. BFSI

- 9.3.2. IT and Telecom

- 9.3.3. Government

- 9.3.4. Retail and E-commerce

- 9.3.5. Manufacturing

- 9.3.6. Energy and Utilities

- 9.3.7. Other Industry Verticals

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. North

- 9.4.2. East

- 9.4.3. West

- 9.4.4. South

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Reliance Jio

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mphasis Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Infosys Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Wipro Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Accenture PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Atria Convergence Technologies Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 HCL Technologies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Allied Digital Services Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vodafone India*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Tata Consultancy Services Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Tech Mahindra Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Bharti Airtel Limited

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 IBM Global Services

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Mindtree Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 BSNL

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Capgemini Technology Services India Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Reliance Jio

List of Figures

- Figure 1: India ICT Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India ICT Market Share (%) by Company 2025

List of Tables

- Table 1: India ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 3: India ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: India ICT Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: India ICT Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: India ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 8: India ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 9: India ICT Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: India ICT Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: India ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: India ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 13: India ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 14: India ICT Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: India ICT Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: India ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: India ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 18: India ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 19: India ICT Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: India ICT Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: India ICT Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: India ICT Market Revenue billion Forecast, by Size of Enterprise 2020 & 2033

- Table 23: India ICT Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 24: India ICT Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: India ICT Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India ICT Market?

The projected CAGR is approximately 17.9%.

2. Which companies are prominent players in the India ICT Market?

Key companies in the market include Reliance Jio, Mphasis Limited, Infosys Limited, Wipro Limited, Accenture PLC, Atria Convergence Technologies Ltd, HCL Technologies, Allied Digital Services Ltd, Vodafone India*List Not Exhaustive, Tata Consultancy Services Limited, Tech Mahindra Ltd, Bharti Airtel Limited, IBM Global Services, Mindtree Ltd, BSNL, Capgemini Technology Services India Ltd.

3. What are the main segments of the India ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 176 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Explore and Adopt Digital technologies and Initiatives.

6. What are the notable trends driving market growth?

Micro. Small. and Medium Enterprises to Register Significant Growth.

7. Are there any restraints impacting market growth?

Managing Regulatory and Compliance Needs Across the World.

8. Can you provide examples of recent developments in the market?

May 2023: Solarwinds and Infoysis have announced a collaboration to advance the shift of SolarWinds solutions to a new SaaS model. Through this engagement, Infosys will leverage its engineering capabilities to accelerate the SaaSification of SolarWinds products and platforms built to increase customer visibility in highly complex hybrid and multi-cloud environments. This collaboration is a key component of the SolarWinds strategy to offer accessible, highly effective, and value-based solutions built to empower its customers to accelerate their digital transformation efforts regardless of where they are on their journey to the cloud.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India ICT Market?

To stay informed about further developments, trends, and reports in the India ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence