Key Insights

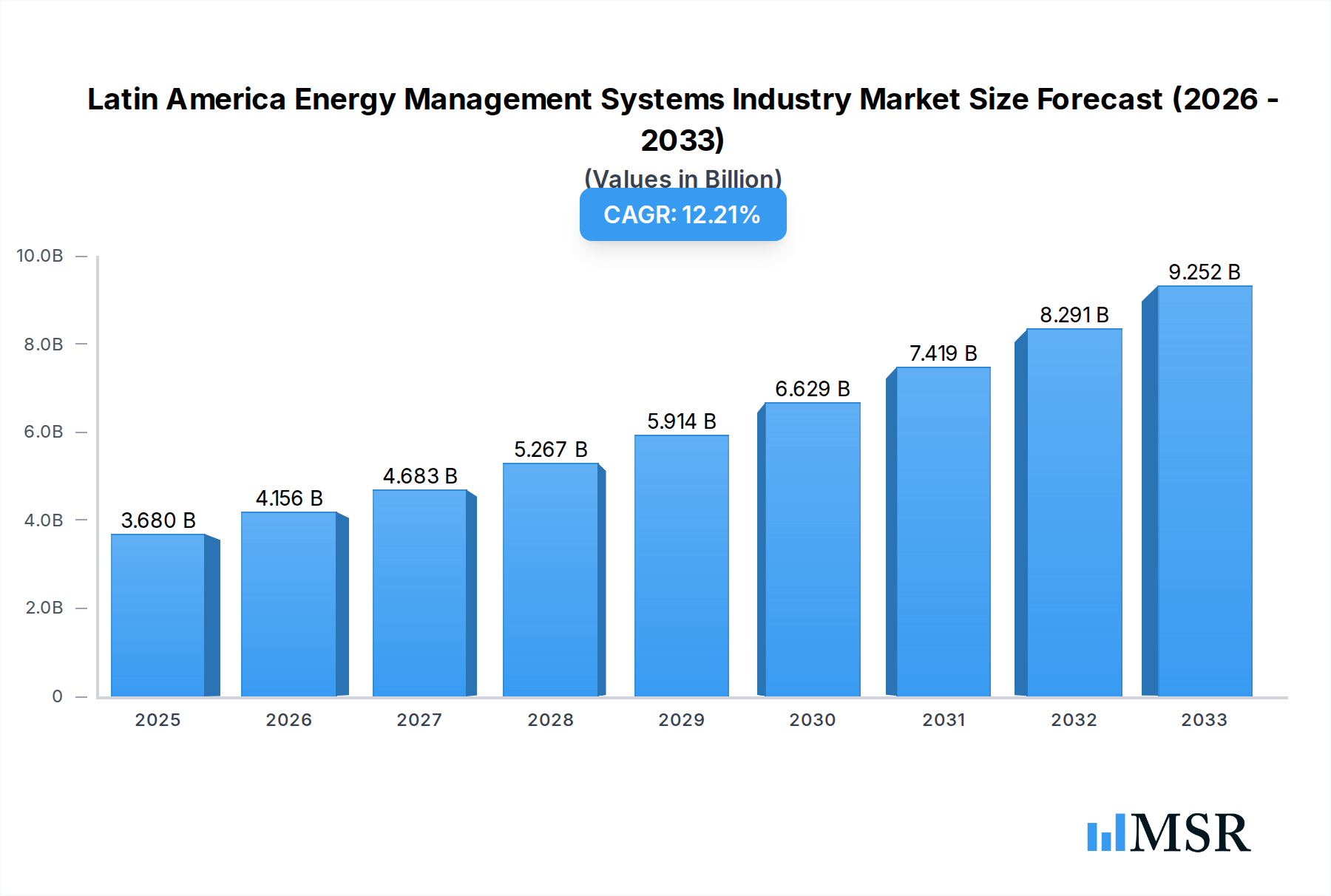

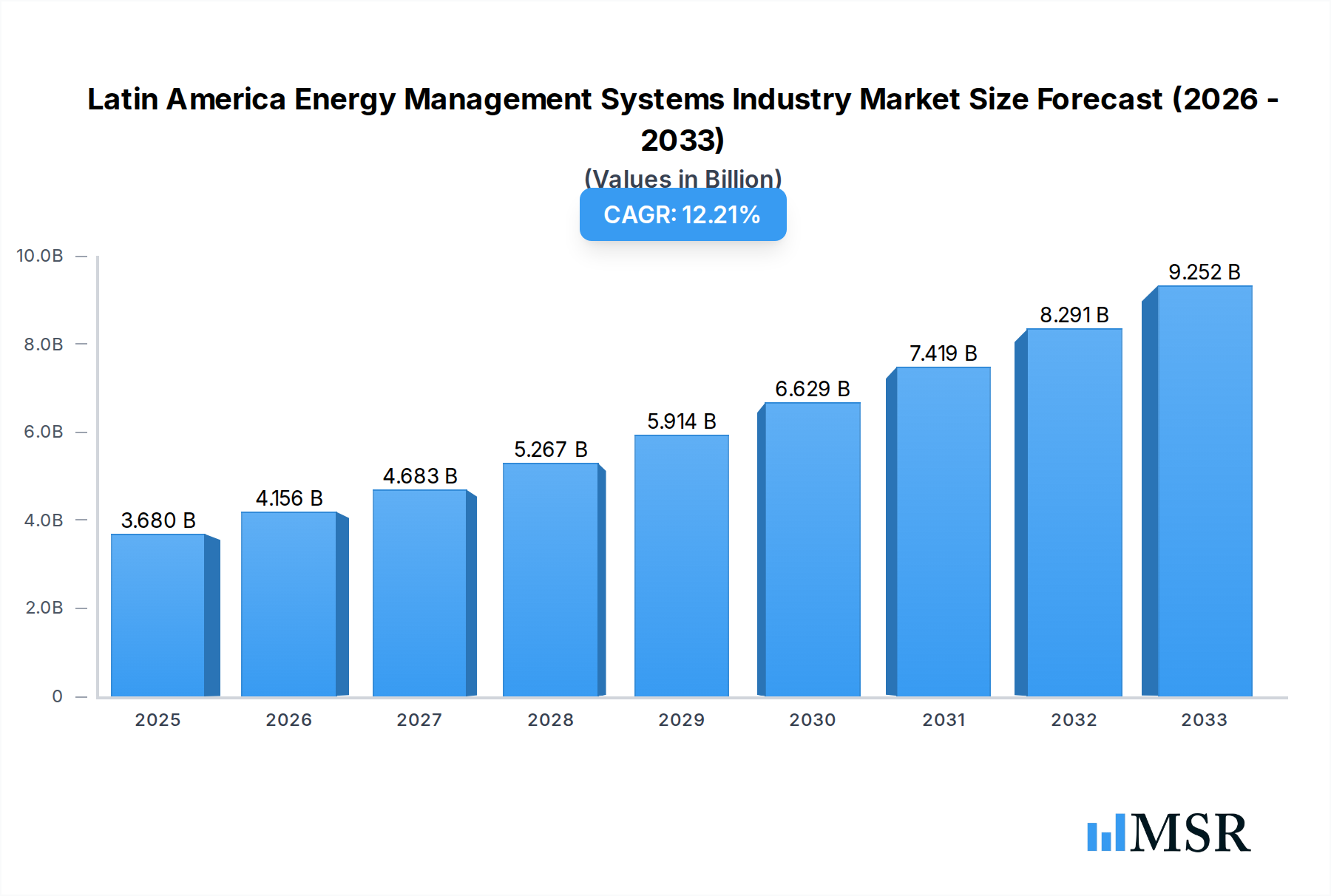

The Latin America Energy Management Systems (EMS) industry is poised for significant expansion, driven by increasing energy demands and a growing imperative for efficiency and sustainability. The market was valued at an estimated $3.68 billion in 2025 and is projected to experience a robust compound annual growth rate (CAGR) of 12.99% through 2033. This upward trajectory is largely propelled by the escalating adoption of smart grid technologies, stringent government regulations promoting energy conservation, and the rising operational costs for businesses across various sectors. Key industries like Manufacturing, Power and Energy, and IT and Telecommunication are at the forefront of this adoption, seeking to optimize their energy consumption through advanced hardware, software, and integrated services. Furthermore, the increasing demand for intelligent solutions such as Home Energy Management Systems (HEMS), Building Energy Management Systems (BEMS), and Industrial Energy Management Systems (IEMS) is fueling market growth. Geographically, Brazil and Argentina, along with the broader "Rest of Latin America" region, are presenting substantial opportunities for EMS providers.

Latin America Energy Management Systems Industry Market Size (In Billion)

The market's growth is further stimulated by the ongoing digital transformation initiatives and the increasing awareness of environmental concerns within the region. Companies are investing in EMS to reduce their carbon footprints, enhance operational resilience, and achieve substantial cost savings. The development of sophisticated software solutions and advanced hardware components, coupled with comprehensive service offerings, is enabling more effective energy monitoring, control, and optimization. While the market benefits from these strong drivers, it also faces certain restraints, such as the high initial investment costs for some advanced systems and potential challenges in infrastructure development. However, the long-term outlook remains highly positive, with innovation in cloud-based solutions and IoT integration expected to further accelerate adoption and market penetration across all end-user segments in Latin America.

Latin America Energy Management Systems Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Latin America Energy Management Systems (EMS) industry, providing critical insights into market dynamics, growth drivers, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is essential for stakeholders seeking to understand and capitalize on the burgeoning Latin America EMS market. We explore key segments including EMS hardware, EMS software, and EMS services, as well as HEMS (Home Energy Management Systems), BEMS (Building Energy Management Systems), and IEMS (Industrial Energy Management Systems). Our analysis extends to vital end-user industries such as Manufacturing, Power and Energy, IT and Telecommunication, and Healthcare, alongside a detailed geographic breakdown focusing on Brazil, Argentina, and the Rest of Latin America. Discover the projected market size, estimated at over $30 billion by 2025, and a robust CAGR of over 15% during the forecast period (2025-2033). This report leverages high-ranking keywords to enhance search visibility for terms like "energy efficiency solutions Latin America," "smart grid technology Brazil," "industrial energy automation Argentina," and "renewable energy integration systems."

Latin America Energy Management Systems Industry Market Concentration & Dynamics

The Latin America Energy Management Systems (EMS) market exhibits moderate to high concentration, driven by the increasing adoption of smart energy solutions and a growing awareness of energy conservation across various sectors. Innovation ecosystems are rapidly developing, with companies actively investing in IoT-enabled EMS platforms and AI-driven analytics to optimize energy consumption. Regulatory frameworks are evolving, with governments in countries like Brazil and Mexico implementing policies to promote energy efficiency and renewable energy integration. The threat of substitute products is minimal, as specialized EMS solutions offer superior control and efficiency compared to traditional methods. End-user trends are strongly influenced by the need for cost reduction, operational efficiency, and compliance with environmental standards. Mergers and acquisitions (M&A) activities are on the rise, with a significant number of deals observed in the historical period (2019-2024), particularly involving technology providers and established industrial players. M&A deal counts are projected to exceed 50 by the end of 2024, indicating a consolidation phase and strategic partnerships aimed at expanding market reach and technological capabilities. Key players are vying for market share, with companies like Siemens AG and Schneider Electric SE holding substantial portions of the market, estimated at over 25% combined.

Latin America Energy Management Systems Industry Industry Insights & Trends

The Latin America Energy Management Systems (EMS) industry is poised for significant expansion, driven by a confluence of technological advancements, economic imperatives, and evolving sustainability goals. The projected market size for EMS solutions in Latin America is estimated to reach over $30 billion by 2025, with a compound annual growth rate (CAGR) of over 15% anticipated during the forecast period of 2025–2033. This robust growth is underpinned by several key factors. Firstly, the increasing global focus on decarbonization and climate change mitigation is compelling businesses and governments across Latin America to invest in energy-efficient technologies. This includes a surge in demand for building energy management systems (BEMS) for commercial and residential spaces, aiming to reduce operational costs and environmental impact. Secondly, the rapid development and adoption of Internet of Things (IoT) and Artificial Intelligence (AI) technologies are transforming the EMS landscape. These technologies enable real-time data collection, advanced analytics, predictive maintenance, and automated control, leading to more sophisticated and effective energy management. Smart grid initiatives are also playing a crucial role, with investments in grid modernization creating a fertile ground for EMS integration. The power and energy sector itself is a major driver, as utilities seek to optimize power generation, distribution, and consumption, often incorporating demand-response programs managed by EMS. Furthermore, the manufacturing sector is increasingly adopting EMS to enhance productivity, reduce energy waste, and comply with stringent environmental regulations, contributing significantly to the overall market growth. The rise of distributed energy resources (DERs), including solar and wind power, necessitates advanced EMS to manage intermittency and integrate these sources seamlessly into the grid, further fueling market expansion. The IT and Telecommunication sector is also a growing adopter, driven by the energy-intensive nature of data centers and the need for efficient cooling and power management. The healthcare sector, with its critical need for uninterrupted power supply and cost control, is also emerging as a significant user of EMS solutions. The energy transition in Latin America, coupled with a growing demand for sustainable building solutions, is creating a highly dynamic and growth-oriented market for energy management systems.

Key Markets & Segments Leading Latin America Energy Management Systems Industry

The Latin America Energy Management Systems (EMS) industry is experiencing dynamic growth across its various segments and geographies, with specific markets and components showing exceptional leadership.

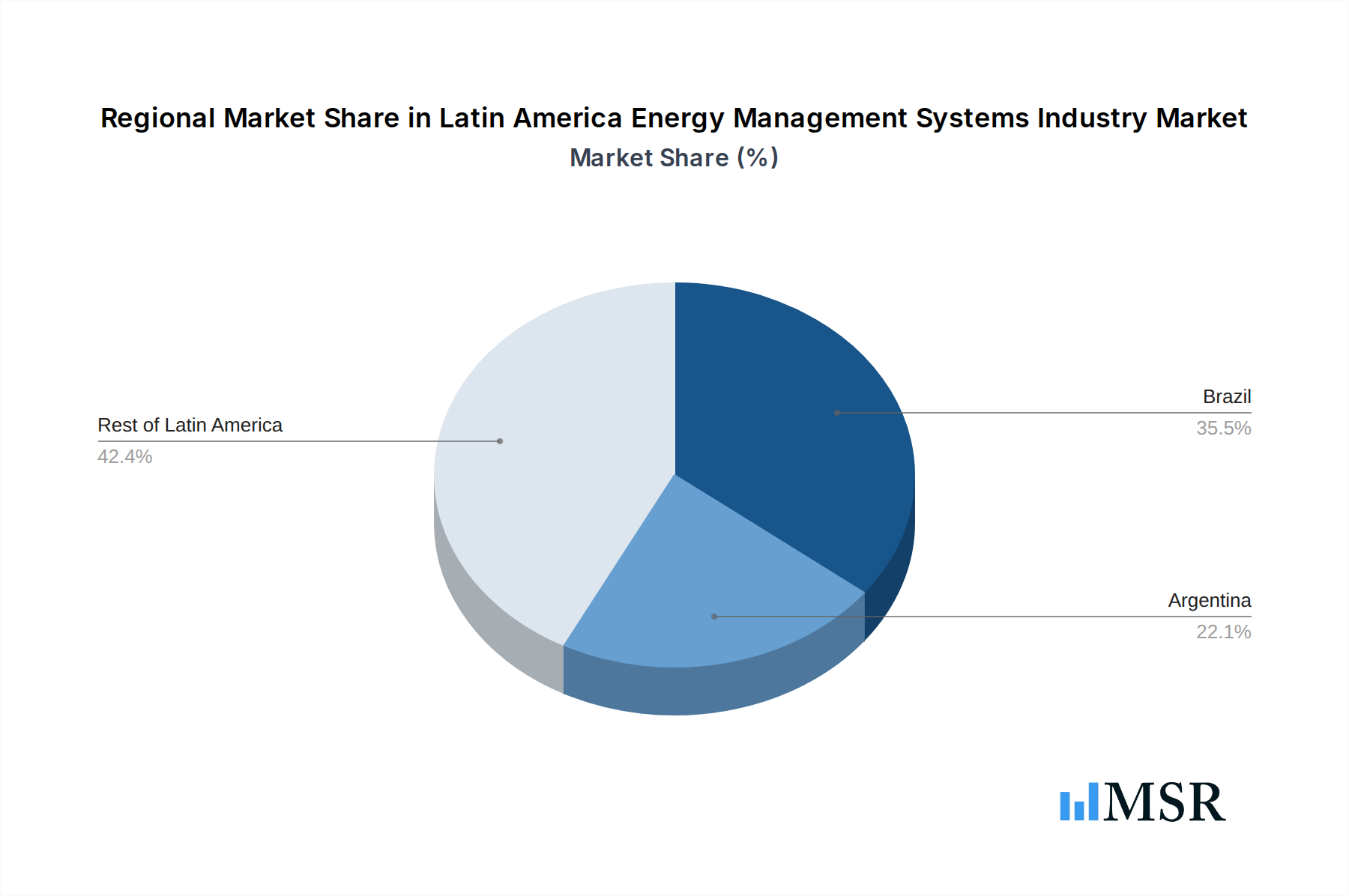

Dominant Geography:

- Brazil: Leads the Latin American EMS market due to its large industrial base, significant renewable energy investments, and government initiatives promoting energy efficiency. Its proactive stance on smart city development and the adoption of advanced technologies further solidifies its position. Economic growth and infrastructure development are key drivers in Brazil's EMS adoption.

- Argentina: Shows strong potential, driven by the need to optimize energy consumption in its growing industrial and commercial sectors, coupled with increasing awareness of sustainability. Regulatory support for energy efficiency measures is a significant factor.

- Rest of Latin America: Encompasses a diverse range of countries exhibiting varied growth trajectories. Countries with developing economies and increasing industrialization, such as Mexico, Chile, and Colombia, are witnessing a rising demand for EMS solutions.

Leading Components:

- Software: The EMS software segment is projected to exhibit the highest growth rate. This is fueled by the increasing sophistication of analytics, AI-driven optimization, and the integration of IoT platforms, enabling advanced monitoring, control, and reporting capabilities. Its dominance is driven by the demand for smart analytics and cloud-based solutions.

- Hardware: EMS hardware, including sensors, meters, and control devices, remains a foundational segment. Its growth is intrinsically linked to the expansion of smart building and industrial automation initiatives.

- Services: EMS services, encompassing consulting, installation, maintenance, and support, are crucial for the effective deployment and utilization of EMS solutions. The increasing complexity of integrated systems drives the demand for expert services.

Dominant Types:

- BEMS (Building Energy Management Systems): The commercial and residential real estate boom, coupled with stringent energy efficiency regulations for buildings, makes BEMS the most dominant type of EMS. The push for sustainable and smart buildings is a key driver.

- IEMS (Industrial Energy Management Systems): The manufacturing and heavy industry sectors are significant adopters of IEMS to reduce operational costs, enhance productivity, and meet environmental compliance.

- HEMS (Home Energy Management Systems): While currently a smaller segment, HEMS is experiencing rapid growth driven by increasing consumer awareness of energy costs and environmental impact, alongside the proliferation of smart home devices.

Key End Users:

- Manufacturing: This sector is a primary driver of IEMS adoption, seeking to optimize energy-intensive processes and reduce production costs.

- Power and Energy: Utilities are at the forefront of implementing EMS for grid optimization, demand-side management, and renewable energy integration.

- IT and Telecommunication: The increasing energy demands of data centers and communication infrastructure make this sector a significant adopter of EMS for efficient power and cooling management.

- Healthcare: Hospitals and healthcare facilities, with their critical need for reliable power and cost control, are increasingly investing in EMS solutions.

Latin America Energy Management Systems Industry Product Developments

Recent product developments in the Latin America Energy Management Systems (EMS) industry highlight a strong focus on integration, intelligence, and sustainability. Companies are launching advanced BEMS platforms that seamlessly integrate with renewable energy sources like solar and wind, offering sophisticated energy storage solutions. The "Buildings as a Grid" strategy, exemplified by Eaton's recent offerings, signifies a shift towards buildings acting as active participants in the energy ecosystem, enabling peak shaving and grid stabilization. Furthermore, the proliferation of IoT-enabled sensors and AI-driven analytics is enabling more granular control and predictive maintenance, leading to enhanced operational efficiency and significant cost savings for end-users. These advancements are crucial for maintaining a competitive edge in a market rapidly embracing digital transformation and sustainable practices.

Challenges in the Latin America Energy Management Systems Industry Market

The Latin America Energy Management Systems (EMS) industry faces several challenges that could temper its growth trajectory. High initial investment costs for sophisticated EMS hardware and software can be a significant barrier, especially for small and medium-sized enterprises (SMEs) in developing economies. A lack of skilled workforce capable of installing, operating, and maintaining complex EMS solutions is another critical constraint, hindering widespread adoption. Regulatory fragmentation and inconsistencies across different Latin American countries can create complexities for companies operating on a regional scale. Furthermore, cybersecurity concerns surrounding interconnected EMS platforms are a growing apprehension, demanding robust security measures to protect sensitive energy data.

Forces Driving Latin America Energy Management Systems Industry Growth

Several powerful forces are propelling the growth of the Latin America Energy Management Systems (EMS) industry. The escalating costs of traditional energy sources are a primary driver, compelling businesses and consumers to seek energy-efficient solutions to reduce operational expenses. Government initiatives and favorable regulatory frameworks promoting energy conservation and renewable energy integration, particularly in countries like Brazil and Mexico, are creating a conducive environment for EMS adoption. The rapid advancement and declining costs of IoT and AI technologies are enabling more sophisticated and cost-effective EMS solutions. Furthermore, a growing global and regional emphasis on sustainability and corporate social responsibility is pushing organizations to adopt EMS for environmental compliance and to enhance their brand reputation.

Challenges in the Latin America Energy Management Systems Industry Market

Looking beyond the immediate challenges, the long-term growth of the Latin America Energy Management Systems (EMS) industry hinges on overcoming persistent hurdles. The underdeveloped grid infrastructure in certain regions can limit the effective integration and deployment of advanced EMS solutions. Resistance to change and lack of awareness regarding the benefits of EMS among some traditional industries and consumers still persist. Addressing these requires sustained efforts in education and demonstration of ROI. Furthermore, economic volatility and political instability in some Latin American countries can impact investment decisions and long-term project planning for EMS implementations.

Emerging Opportunities in Latin America Energy Management Systems Industry

The Latin America Energy Management Systems (EMS) industry is ripe with emerging opportunities. The burgeoning demand for smart grid technologies and demand-response programs presents a significant avenue for growth, particularly as countries invest in modernizing their electricity infrastructure. The increasing adoption of electric vehicles (EVs) is creating new opportunities for integrated EV charging management within EMS solutions for both residential and commercial buildings. The expansion of distributed energy resources (DERs), including solar and wind power, necessitates intelligent EMS for efficient integration and management, unlocking opportunities for microgrid solutions. Furthermore, the growing focus on sustainable building certifications and green real estate development is driving demand for advanced BEMS and IEMS.

Leading Players in the Latin America Energy Management Systems Industry Sector

The Latin America Energy Management Systems industry is characterized by the presence of several influential global and regional players. These companies are at the forefront of innovation and market development, offering comprehensive solutions across hardware, software, and services. Key industry participants include:

- IBM Corporation

- Tendril Networks Inc

- EnerNOC Inc

- Cisco Systems Inc

- Siemens AG

- General Electric Co

- Schneider Electric SE

- Elster Group GmbH

- Rockwell Automation Inc

- SAP SE

- Honeywell International Inc

- Eaton Corporation

List Not Exhaustive

Key Milestones in Latin America Energy Management Systems Industry Industry

The Latin America Energy Management Systems industry has witnessed several pivotal developments that have shaped its trajectory and accelerated growth. These milestones underscore the industry's commitment to innovation and sustainability.

- February 2021: Schneider Electric, a global leader in energy management and automation digital transformation, announced the launch of its Wholesale Building Management Distributor Program. This initiative exemplifies Schneider Electric's dedication to empowering distributors with the necessary resources, incentives, and support to enhance product sales, foster business development, and improve profitability.

- March 2021: Eaton, a prominent power management business, released a comprehensive suite of hardware, software, and services designed to transform buildings into energy hubs optimized for on-site renewable energy utilization. This strategic offering, known as "Buildings as a Grid," aligns with the broader energy transition and electric car charging initiatives.

Strategic Outlook for Latin America Energy Management Systems Industry Market

The strategic outlook for the Latin America Energy Management Systems (EMS) industry is exceptionally bright, driven by a confluence of accelerating factors. Continued investments in renewable energy integration and smart grid infrastructure will be paramount growth accelerators. The increasing adoption of digital transformation initiatives across industries, coupled with a growing demand for cost optimization and operational efficiency, will further fuel the uptake of advanced EMS solutions. Strategic partnerships between technology providers and end-users, as well as potential M&A activities, are expected to consolidate the market and foster innovation. Furthermore, the global push towards ESG (Environmental, Social, and Governance) compliance will elevate the importance of EMS in achieving sustainability targets, creating sustained market potential and new strategic opportunities for market leaders.

Latin America Energy Management Systems Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Type

- 2.1. HEMS

- 2.2. BEMS

- 2.3. IEMS

-

3. End User

- 3.1. Manufacturing

- 3.2. Power and Energy

- 3.3. IT and Telecommunication

- 3.4. Healthcare

- 3.5. Other End Users

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

Latin America Energy Management Systems Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of Latin America

Latin America Energy Management Systems Industry Regional Market Share

Geographic Coverage of Latin America Energy Management Systems Industry

Latin America Energy Management Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Smart Grids and Smart Meters; Rising Investments in Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. High Initial Installation Costs Coupled with Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Brazil to Hold a Major Share in the EMS Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. HEMS

- 5.2.2. BEMS

- 5.2.3. IEMS

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Manufacturing

- 5.3.2. Power and Energy

- 5.3.3. IT and Telecommunication

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Brazil Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. HEMS

- 6.2.2. BEMS

- 6.2.3. IEMS

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Manufacturing

- 6.3.2. Power and Energy

- 6.3.3. IT and Telecommunication

- 6.3.4. Healthcare

- 6.3.5. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Argentina Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. HEMS

- 7.2.2. BEMS

- 7.2.3. IEMS

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Manufacturing

- 7.3.2. Power and Energy

- 7.3.3. IT and Telecommunication

- 7.3.4. Healthcare

- 7.3.5. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Rest of Latin America Latin America Energy Management Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. HEMS

- 8.2.2. BEMS

- 8.2.3. IEMS

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Manufacturing

- 8.3.2. Power and Energy

- 8.3.3. IT and Telecommunication

- 8.3.4. Healthcare

- 8.3.5. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 IBM Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Tendril Networks Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 EnerNOC Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cisco Systems Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Siemens AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 General Electric Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schneider Electric SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Elster Group GmbH

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Rockwell Automation Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SAP SE

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Honeywell International Inc *List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Eaton Corporation

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 IBM Corporation

List of Figures

- Figure 1: Latin America Energy Management Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Energy Management Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Energy Management Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 12: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Energy Management Systems Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 17: Latin America Energy Management Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Energy Management Systems Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Latin America Energy Management Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Energy Management Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Energy Management Systems Industry?

The projected CAGR is approximately 12.99%.

2. Which companies are prominent players in the Latin America Energy Management Systems Industry?

Key companies in the market include IBM Corporation, Tendril Networks Inc, EnerNOC Inc, Cisco Systems Inc, Siemens AG, General Electric Co, Schneider Electric SE, Elster Group GmbH, Rockwell Automation Inc, SAP SE, Honeywell International Inc *List Not Exhaustive, Eaton Corporation.

3. What are the main segments of the Latin America Energy Management Systems Industry?

The market segments include Component, Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Smart Grids and Smart Meters; Rising Investments in Energy Efficiency.

6. What are the notable trends driving market growth?

Brazil to Hold a Major Share in the EMS Market.

7. Are there any restraints impacting market growth?

High Initial Installation Costs Coupled with Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In March 2021, Eaton, a power management business, released a set of hardware, software, and services that can turn buildings into energy hubs that get the most out of on-site renewable energy. Its strategy for energy transition and electric car charging is known as "Buildings as a Grid."

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Energy Management Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Energy Management Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Energy Management Systems Industry?

To stay informed about further developments, trends, and reports in the Latin America Energy Management Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence