Key Insights

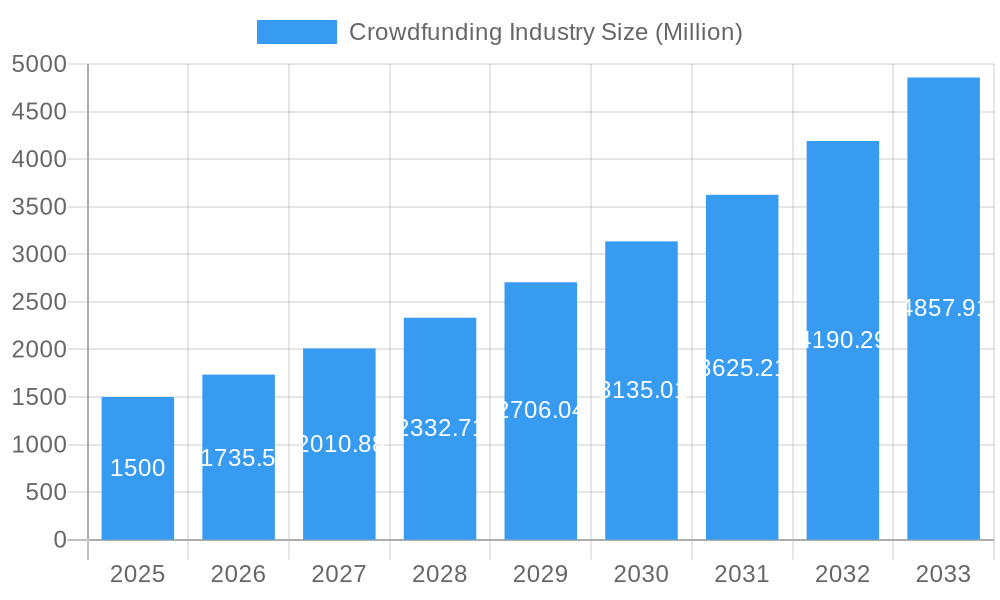

The global crowdfunding market is poised for significant expansion, projected to reach an impressive $1.5 Billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.70% throughout the forecast period of 2025-2033. This dynamic growth is primarily fueled by increasing adoption across diverse sectors, notably the cultural sector, technology, and healthcare, which are leveraging crowdfunding as an accessible and innovative funding alternative. The rise of reward-based and equity crowdfunding models has democratized investment opportunities, empowering individuals and businesses to raise capital for a wide array of projects. Furthermore, the growing accessibility of online platforms and a heightened awareness of crowdfunding's potential are instrumental in driving market penetration. The increasing number of startups and small businesses seeking seed funding, alongside established organizations exploring new avenues for project financing, further underscores the strong upward trajectory of this market.

Crowdfunding Industry Market Size (In Billion)

Despite this optimistic outlook, certain factors present potential headwinds for the crowdfunding industry. Regulatory complexities and evolving compliance requirements in different regions can pose challenges to market expansion. Concerns regarding investor protection and the risk of project failure also warrant careful consideration. However, the inherent advantages of crowdfunding, including rapid capital generation, community building, and market validation, continue to outweigh these restraints. Emerging trends such as the integration of blockchain technology for enhanced transparency and security, and the proliferation of specialized crowdfunding platforms catering to niche markets, are expected to further stimulate growth and innovation. As digital literacy and online transaction confidence continue to rise globally, the crowdfunding market is well-positioned to witness sustained and accelerated development.

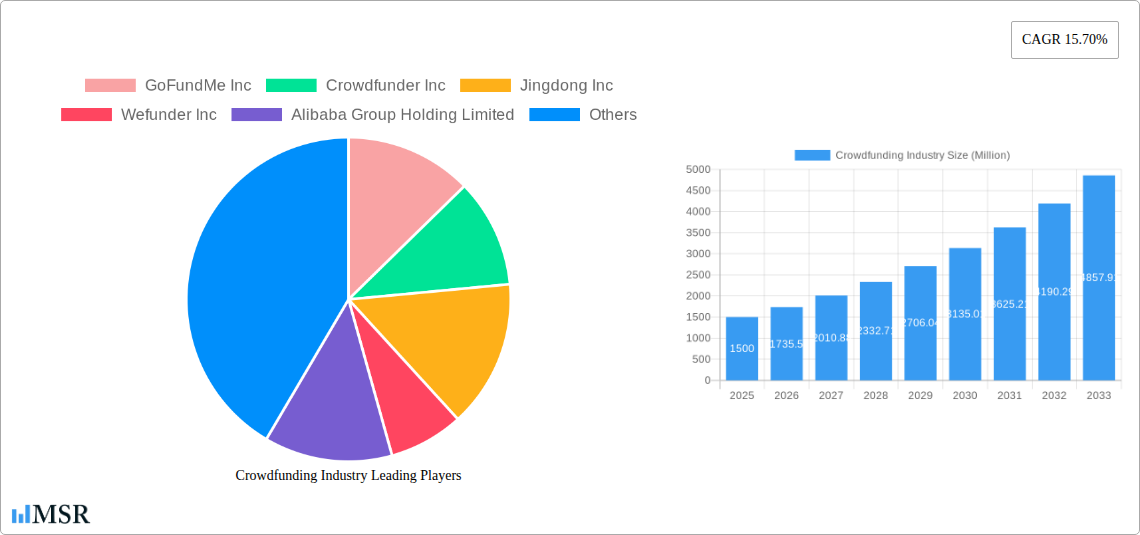

Crowdfunding Industry Company Market Share

Crowdfunding Industry Market Report: Unlocking Global Funding Opportunities

Unlock unprecedented insights into the dynamic Crowdfunding Industry with our comprehensive market analysis. This report provides an in-depth examination of reward-based crowdfunding, equity crowdfunding, and donation-based crowdfunding, covering key segments like cultural sector, technology, product, and healthcare. Discover current crowdfunding market size, projected crowdfunding industry growth, and emerging investment trends. Analyze the strategies of industry giants including GoFundMe Inc, Crowdfunder Inc, Jingdong Inc, Wefunder Inc, Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc, Realcrowd Inc, GoGetFunding, Fundly, Suning com Co Ltd, Kickstarter PBC, and more. Leveraging data from the historical period (2019–2024) and projecting through 2033, this report is your definitive guide to navigating the global crowdfunding landscape and identifying lucrative crowdfunding opportunities.

Crowdfunding Industry Market Concentration & Dynamics

The crowdfunding industry exhibits a moderate to high market concentration, driven by a select group of influential platforms and a growing number of specialized players. Innovation ecosystems are flourishing, particularly in the equity crowdfunding and technology sectors, fostering rapid product development and investment diversification. Regulatory frameworks, while evolving, continue to shape market entry and operational strategies, with varying degrees of stringency across major economies. Substitute products, such as traditional venture capital and angel investing, remain significant, yet crowdfunding's accessibility and broader investor base present a compelling alternative. End-user trends reveal an increasing demand for accessible funding solutions, particularly from startups and small to medium-sized enterprises (SMEs) seeking capital for product development and cultural sector initiatives. Mergers and acquisition (M&A) activities are on the rise, indicating a consolidation phase as larger platforms seek to expand their offerings and market reach. For instance, the M&A deal count is projected to increase by xx% in the forecast period. Key players like GoFundMe Inc and Alibaba Group Holding Limited often dominate through strategic acquisitions. Market share within reward-based crowdfunding is significant for platforms like Kickstarter PBC and Indiegogo Inc, while Wefunder Inc and Crowdcube Limited are prominent in equity crowdfunding. The overall crowdfunding market share is estimated to reach xx Million by the base year.

Crowdfunding Industry Industry Insights & Trends

The crowdfunding industry is experiencing robust growth, with the global crowdfunding market size projected to reach an impressive One Trillion Million by the forecast period. This expansion is underpinned by a compound annual growth rate (CAGR) of approximately 15% from the historical period (2019–2024) through to 2033. Key growth drivers include the increasing digitalization of finance, a greater acceptance of alternative funding models among both investors and entrepreneurs, and the continuous innovation in platform technology. Technological disruptions, such as the integration of blockchain for enhanced transparency and security in equity crowdfunding, are further accelerating adoption. Evolving consumer behaviors, characterized by a desire to support emerging brands and socially conscious projects, are significantly boosting reward-based crowdfunding and donation and other product types. The accessibility of crowdfunding platforms democratizes investment, allowing individuals to participate in early-stage ventures previously out of reach. Furthermore, regulatory bodies are increasingly providing clearer guidelines, fostering greater investor confidence and market stability. The estimated crowdfunding market value for 2025 stands at Five Hundred Billion Million, a testament to its growing influence. The seamless user experience offered by platforms like Jingdong Inc and Suning com Co Ltd in specific markets also contributes to this upward trajectory. The ability to reach a global audience without geographical limitations is a paramount trend shaping the future of fundraising.

Key Markets & Segments Leading Crowdfunding Industry

Equity crowdfunding is emerging as a dominant segment within the crowdfunding industry, driven by its potential for substantial financial returns and its appeal to both accredited and, in some jurisdictions, retail investors. This segment is particularly strong in developed economies with established venture capital ecosystems and supportive regulatory environments, such as the United States, the United Kingdom, and increasingly, parts of Asia. The technology sector represents the leading end-user application, consistently attracting the largest share of crowdfunding capital due to its high growth potential and inherent innovativeness. Countries like the United States, with its concentration of tech startups and venture capital firms, are spearheading this trend.

- Dominant Region/Country: North America, particularly the United States, continues to lead in equity crowdfunding volume and innovation, fostering a dynamic environment for tech startups.

- Dominant Product Type: Equity Crowdfunding is witnessing significant expansion, fueled by increasing investor appetite for early-stage company stakes.

- Dominant End-User Application: The Technology sector consistently dominates, benefiting from its perceived high growth potential and the widespread appeal of technological innovations.

Drivers for this dominance include robust economic growth, well-developed financial infrastructure, and supportive government policies encouraging investment in startups. The ease of accessing capital through platforms like Wefunder Inc and Crowdcube Limited for tech companies, and the growing investor base interested in early-stage ventures, are significant accelerators. The cultural sector also shows notable growth in reward-based crowdfunding, particularly for creative projects and independent artists, demonstrating the diverse applications of crowdfunding models. The Product segment, encompassing innovative consumer goods, also benefits greatly from reward-based platforms.

Crowdfunding Industry Product Developments

The crowdfunding industry is characterized by continuous product innovation, enhancing user experience and expanding funding capabilities. Platforms are increasingly integrating advanced features such as AI-driven analytics for campaign optimization, sophisticated investor matching tools for equity crowdfunding, and streamlined payment gateways for reward-based crowdfunding. The development of niche crowdfunding platforms catering to specific industries like renewable energy, social impact initiatives, and real estate investment (e.g., Realcrowd Inc) is a significant trend. Blockchain technology is being explored for its potential to revolutionize fractional ownership and enhance transparency in investment rounds. These advancements are critical in providing entrepreneurs with more effective fundraising tools and investors with more secure and diverse investment opportunities, strengthening the overall competitive edge of the market.

Challenges in the Crowdfunding Industry Market

Despite its rapid growth, the crowdfunding industry faces several significant challenges. Regulatory hurdles remain a primary concern, with varying and often complex compliance requirements across different jurisdictions creating barriers to entry and cross-border campaigns. Supply chain issues can indirectly impact reward-based crowdfunding, delaying product delivery and potentially affecting backer satisfaction and platform reputation. Intense competitive pressures from both established and emerging platforms necessitate continuous innovation and differentiation, driving down margins. Furthermore, the risk of fraud and the need for robust due diligence processes for investors and projects represent ongoing operational complexities.

Forces Driving Crowdfunding Industry Growth

Several powerful forces are propelling the crowdfunding industry forward. Technological advancements, including the widespread adoption of mobile devices and the internet, have made crowdfunding more accessible than ever. Economic factors, such as the need for alternative funding sources for startups and SMEs, especially when traditional lending is difficult to secure, play a crucial role. Regulatory support in various regions, aimed at fostering innovation and democratizing investment, is also a significant driver. The increasing global awareness and acceptance of crowdfunding as a legitimate funding mechanism, coupled with the desire for community engagement and direct support of innovative projects, further fuels its expansion.

Challenges in the Crowdfunding Industry Market

Long-term growth catalysts for the crowdfunding industry are deeply rooted in continued innovation and market expansion. The development of more sophisticated financial instruments and investor protection mechanisms will build further trust and attract larger institutional investors. Strategic partnerships between crowdfunding platforms and financial institutions, accelerators, and government agencies can unlock new capital pools and provide enhanced support services for entrepreneurs. Market expansion into emerging economies, where the need for accessible capital is high, presents a significant avenue for growth. Furthermore, the increasing focus on environmental, social, and governance (ESG) investing provides a fertile ground for specialized crowdfunding initiatives.

Emerging Opportunities in Crowdfunding Industry

The crowdfunding industry is brimming with emerging opportunities. The growing popularity of impact investing presents a significant avenue for donation and other product types, allowing individuals to support projects with social and environmental benefits. The integration of crowdfunding with decentralized finance (DeFi) protocols could unlock new models for liquidity and investment, particularly in equity crowdfunding. The expansion of crowdfunding into new asset classes, such as intellectual property and renewable energy projects, is an untapped frontier. Consumer preferences for supporting authentic brands and direct engagement with creators are also creating fertile ground for reward-based crowdfunding in niche markets.

Leading Players in the Crowdfunding Industry Sector

- GoFundMe Inc

- Crowdfunder Inc

- Jingdong Inc

- Wefunder Inc

- Alibaba Group Holding Limited

- Owners Circle

- Crowdcube Limited

- Fundable LLC

- Indiegogo Inc

- Realcrowd Inc

- GoGetFunding

- Fundly

- Suning com Co Ltd

- Kickstarter PBC

Key Milestones in Crowdfunding Industry Industry

- 2019: Significant increase in regulatory clarity for equity crowdfunding in several key markets, boosting investor confidence.

- 2020: Rapid adoption of online fundraising for disaster relief and social causes amidst global events, highlighting the power of donation-based crowdfunding.

- 2021: Emergence of specialized real estate crowdfunding platforms like Realcrowd Inc gaining traction.

- 2022: Growing integration of AI and machine learning on platforms to optimize campaign success rates.

- 2023: Increased M&A activity as larger players acquire smaller, innovative platforms to expand market reach and service offerings.

- 2024: Heightened focus on investor protection and anti-fraud measures by regulatory bodies globally.

Strategic Outlook for Crowdfunding Industry Market

The strategic outlook for the crowdfunding industry is exceptionally positive, driven by its proven ability to democratize access to capital and foster innovation. Growth accelerators include the continued evolution of regulatory frameworks towards greater harmonization and investor protection, the deepening integration of advanced technologies like AI and blockchain, and the expanding global reach into untapped markets. Strategic opportunities lie in the development of more sophisticated financial products, the cultivation of stronger partnerships with traditional financial institutions, and the leveraging of ESG trends to attract purpose-driven capital. The industry is poised for sustained expansion, becoming an indispensable component of the global financial ecosystem.

Crowdfunding Industry Segmentation

-

1. Product Type

- 1.1. Reward-based Crowdfunding

- 1.2. Equity Crowdfunding

- 1.3. Donation and Other Product Types

-

2. End-User Application

- 2.1. Cultural Sector

- 2.2. Technology

- 2.3. Product

- 2.4. Healthcare

- 2.5. Other End-User Applications

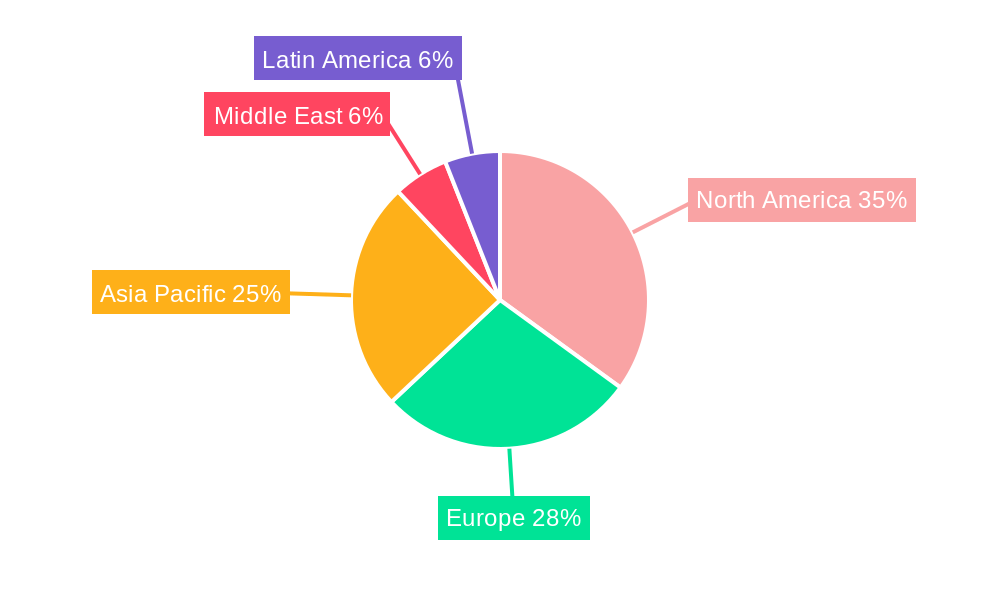

Crowdfunding Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia pacific

- 4. Middle East

- 5. Latin America

Crowdfunding Industry Regional Market Share

Geographic Coverage of Crowdfunding Industry

Crowdfunding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors

- 3.3. Market Restrains

- 3.3.1. Time Consuming Process and Stringent Regulatory Compliance

- 3.4. Market Trends

- 3.4.1. Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Reward-based Crowdfunding

- 5.1.2. Equity Crowdfunding

- 5.1.3. Donation and Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Application

- 5.2.1. Cultural Sector

- 5.2.2. Technology

- 5.2.3. Product

- 5.2.4. Healthcare

- 5.2.5. Other End-User Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia pacific

- 5.3.4. Middle East

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Reward-based Crowdfunding

- 6.1.2. Equity Crowdfunding

- 6.1.3. Donation and Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User Application

- 6.2.1. Cultural Sector

- 6.2.2. Technology

- 6.2.3. Product

- 6.2.4. Healthcare

- 6.2.5. Other End-User Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Reward-based Crowdfunding

- 7.1.2. Equity Crowdfunding

- 7.1.3. Donation and Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User Application

- 7.2.1. Cultural Sector

- 7.2.2. Technology

- 7.2.3. Product

- 7.2.4. Healthcare

- 7.2.5. Other End-User Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia pacific Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Reward-based Crowdfunding

- 8.1.2. Equity Crowdfunding

- 8.1.3. Donation and Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User Application

- 8.2.1. Cultural Sector

- 8.2.2. Technology

- 8.2.3. Product

- 8.2.4. Healthcare

- 8.2.5. Other End-User Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Reward-based Crowdfunding

- 9.1.2. Equity Crowdfunding

- 9.1.3. Donation and Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User Application

- 9.2.1. Cultural Sector

- 9.2.2. Technology

- 9.2.3. Product

- 9.2.4. Healthcare

- 9.2.5. Other End-User Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Reward-based Crowdfunding

- 10.1.2. Equity Crowdfunding

- 10.1.3. Donation and Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User Application

- 10.2.1. Cultural Sector

- 10.2.2. Technology

- 10.2.3. Product

- 10.2.4. Healthcare

- 10.2.5. Other End-User Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GoFundMe Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crowdfunder Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jingdong Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wefunder Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alibaba Group Holding Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Owners Circle

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crowdcube Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fundable LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indiegogo Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Realcrowd Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GoGetFunding

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fundly

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Suning com Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kickstarter PBC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 GoFundMe Inc

List of Figures

- Figure 1: Global Crowdfunding Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 5: North America Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 6: North America Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 11: Europe Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 12: Europe Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia pacific Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia pacific Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia pacific Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 17: Asia pacific Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 18: Asia pacific Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia pacific Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 23: Middle East Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 24: Middle East Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Latin America Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Latin America Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 29: Latin America Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 30: Latin America Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 3: Global Crowdfunding Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 6: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 9: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 12: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 15: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 18: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crowdfunding Industry?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the Crowdfunding Industry?

Key companies in the market include GoFundMe Inc, Crowdfunder Inc, Jingdong Inc, Wefunder Inc, Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc, Realcrowd Inc *List Not Exhaustive, GoGetFunding, Fundly, Suning com Co Ltd, Kickstarter PBC.

3. What are the main segments of the Crowdfunding Industry?

The market segments include Product Type, End-User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors.

6. What are the notable trends driving market growth?

Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market.

7. Are there any restraints impacting market growth?

Time Consuming Process and Stringent Regulatory Compliance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crowdfunding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crowdfunding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crowdfunding Industry?

To stay informed about further developments, trends, and reports in the Crowdfunding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence