Key Insights

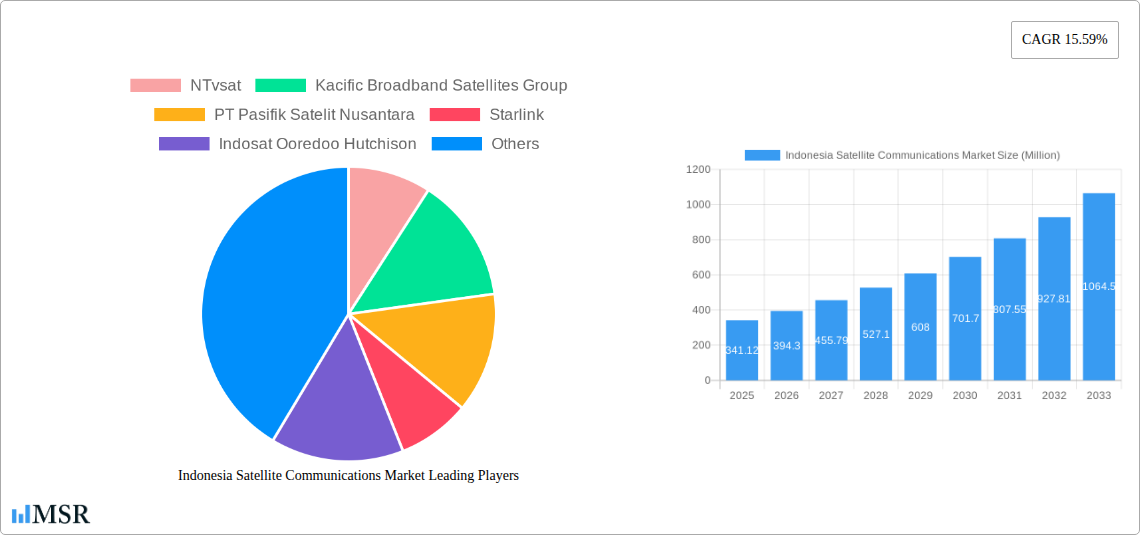

The Indonesian satellite communications market is experiencing robust growth, projected to reach $341.12 million by 2025. This expansion is driven by a significant CAGR of 15.59% between 2019 and 2033, indicating a dynamic and rapidly evolving industry. Key drivers fueling this ascent include the increasing demand for high-speed broadband internet in remote and underserved areas, particularly crucial for Indonesia's archipelagic geography. The escalating adoption of satellite-based services by enterprises, government bodies, and the defense sector for reliable connectivity and operational efficiency further bolsters market momentum. Furthermore, the growing media and entertainment industry's reliance on satellite distribution for content delivery also contributes to this upward trajectory.

Indonesia Satellite Communications Market Market Size (In Million)

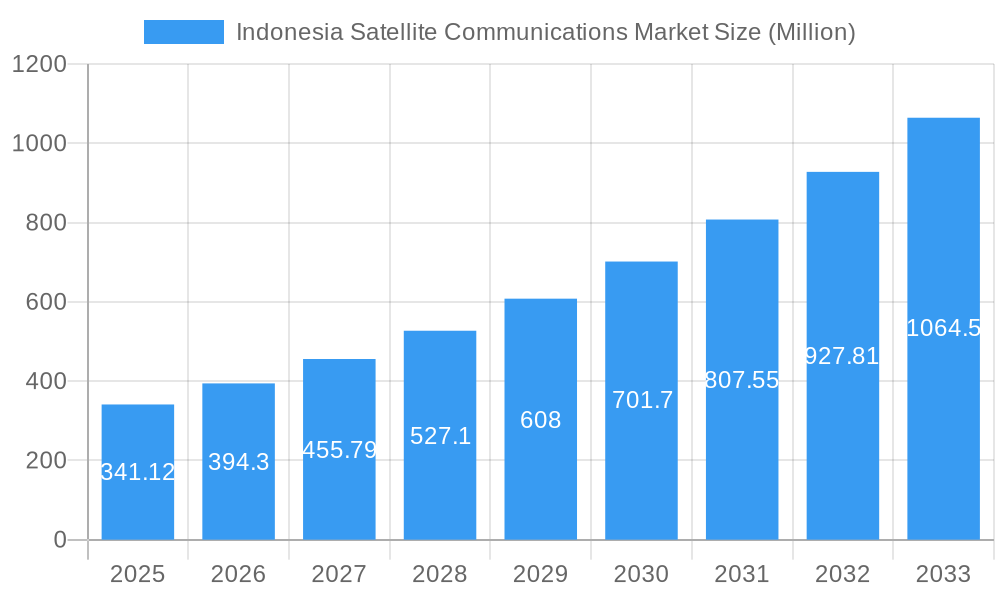

The market segments offer diverse opportunities, with Ground Equipment and Services playing pivotal roles. The Platform segment is characterized by a strong presence of Portable, Land, Maritime, and Airborne solutions, catering to a wide array of applications. End-user verticals are highly diversified, encompassing Maritime, Defense and Government, Enterprises, and Media and Entertainment, with "Other End-user Verticals" suggesting untapped potential. Major players like Starlink, Indosat Ooredoo Hutchison, and NTvSAT are actively shaping the competitive landscape. Emerging trends such as the deployment of Low Earth Orbit (LEO) satellites for enhanced latency and bandwidth, alongside the increasing integration of satellite technology with 5G networks, are poised to revolutionize connectivity solutions across Indonesia.

Indonesia Satellite Communications Market Company Market Share

Indonesia Satellite Communications Market: Unlocking Connectivity Across Archipelagos

This comprehensive report offers an in-depth analysis of the Indonesia satellite communications market, a dynamic sector poised for significant growth driven by geographical challenges and an increasing demand for robust connectivity solutions. Examining the study period of 2019–2033, with a base year of 2025, this report provides critical insights into market size, CAGR, key trends, and future projections. We delve into the intricate landscape of satellite internet Indonesia, VSAT market Indonesia, and telecommunications satellite Indonesia, identifying growth catalysts and emerging opportunities for industry stakeholders. This analysis is crucial for understanding the evolving satellite broadband Indonesia landscape and its impact on various end-user verticals.

Indonesia Satellite Communications Market Market Concentration & Dynamics

The Indonesia satellite communications market exhibits a moderately concentrated structure, with a blend of established players and new entrants driving innovation and competition. Key participants are actively engaged in expanding their network infrastructure and service offerings to cater to the archipelago's vast and dispersed population. The innovation ecosystem is thriving, fueled by advancements in satellite technology, including the proliferation of Low Earth Orbit (LEO) constellations and the increasing capabilities of Geostationary (GEO) satellites. Regulatory frameworks are evolving to facilitate greater market access and encourage investment, particularly in underserved regions. While terrestrial broadband solutions exist, the unique geographical challenges of Indonesia underscore the indispensable role of satellite communication. Mergers and acquisitions (M&A) are anticipated as companies seek to consolidate their market positions and leverage synergistic opportunities. The market share distribution is dynamic, with significant shifts expected due to recent and upcoming satellite launches and regulatory approvals. The M&A deal counts are projected to increase as the market matures and consolidation becomes a strategic imperative.

- Market Concentration: Moderately concentrated with key players.

- Innovation Ecosystem: Driven by LEO and GEO advancements.

- Regulatory Frameworks: Evolving to enhance market access.

- Substitute Products: Terrestrial broadband, but with limitations in remote areas.

- End-User Trends: Growing demand for reliable and high-speed internet across all sectors.

- M&A Activities: Expected to rise for market consolidation.

Indonesia Satellite Communications Market Industry Insights & Trends

The Indonesia satellite communications market is experiencing robust expansion, propelled by a confluence of factors including government initiatives to bridge the digital divide, the burgeoning digital economy, and the increasing reliance on satellite connectivity for critical services. The market size is projected to reach substantial figures within the forecast period, with a compelling CAGR that reflects the high growth potential. Technological disruptions are at the forefront, with the deployment of advanced satellite technologies significantly enhancing service capabilities and reach. LEO constellations, such as those being introduced by Starlink, promise lower latency and higher speeds, revolutionizing internet access in previously unconnected areas. Simultaneously, enhancements in GEO satellite technology continue to provide reliable and high-capacity solutions for enterprises and government agencies. Evolving consumer behaviors, characterized by a growing demand for seamless connectivity for remote work, online education, entertainment, and essential services, are directly fueling the market's upward trajectory. The rapid digitalization of industries across Indonesia, from SMEs to large enterprises, is creating a persistent demand for dependable communication channels, which satellite services are uniquely positioned to fulfill. The increasing adoption of cloud-based services and the growth of the Internet of Things (IoT) further amplify the need for ubiquitous and resilient connectivity, making satellite communications a cornerstone of Indonesia's digital infrastructure development. The strategic importance of secure and reliable communication for national defense and disaster management also contributes significantly to market expansion.

Key Markets & Segments Leading Indonesia Satellite Communications Market

The Indonesia satellite communications market is characterized by the dominance of specific segments and offerings that cater to the nation's unique infrastructural and demographic landscape. The Services segment is leading the market's revenue generation, driven by the pervasive need for internet access, data transmission, and specialized communication solutions across the archipelago. This is closely followed by Ground Equipment, essential for enabling these services, including VSAT terminals and modems.

In terms of platforms, Land-based applications represent the largest market share, encompassing enterprise connectivity, government networks, and widespread internet access. However, the Maritime platform is a critical and rapidly growing segment, given Indonesia's status as an archipelagic nation with extensive shipping routes and offshore industries. The Airborne platform, while currently smaller, is poised for growth with the increasing integration of satellite connectivity in aviation for enhanced passenger experience and operational efficiency.

The End-user Vertical analysis reveals that Defense and Government sectors are significant consumers of satellite communication services, leveraging them for secure communication, surveillance, and disaster response. The Maritime vertical, as mentioned, is a major driver due to its extensive offshore activities and maritime trade. Enterprises of all sizes are increasingly adopting satellite solutions for business continuity, remote site connectivity, and expansion into underserved regions. The Media and Entertainment sector also relies on satellite for broadcasting and content delivery across vast geographical areas. Other emerging end-user verticals, such as agriculture technology (AgriTech) and remote healthcare, are also beginning to harness the power of satellite communications for their operations.

- Dominant Offering: Services

- Drivers: High demand for internet access, data transmission, and specialized communication solutions across the archipelago.

- Detailed Dominance: The inherent need for reliable connectivity in remote and island locations makes comprehensive service packages, including broadband internet and managed network solutions, highly sought after.

- Dominant Platform: Land

- Drivers: Widespread enterprise connectivity, government network infrastructure, and public internet access initiatives.

- Detailed Dominance: The vast landmass and population density in certain regions necessitate robust terrestrial satellite ground infrastructure for businesses and individuals alike.

- Dominant End-user Vertical: Defense and Government

- Drivers: National security requirements, disaster management needs, and the need for reliable communication in remote government outposts.

- Detailed Dominance: Governments worldwide, and particularly in geographically complex nations like Indonesia, depend on satellite communications for secure, resilient, and wide-reaching communication networks.

Indonesia Satellite Communications Market Product Developments

Recent product developments in the Indonesia satellite communications market are focused on enhancing bandwidth, reducing latency, and increasing accessibility. Innovations in LEO satellite technology are a significant trend, promising to bring high-speed internet to previously underserved areas. The launch of advanced telecommunications satellites, such as the Merah-Putih-2, equipped with high-capacity transponders operating on C-band and Ku-band frequencies, exemplifies this progress. These developments aim to provide a more robust and ubiquitous connectivity experience, directly impacting enterprise, government, and consumer applications by enabling smoother video conferencing, faster data downloads, and improved real-time communication capabilities, thereby bolstering Indonesia's digital transformation initiatives.

Challenges in the Indonesia Satellite Communications Market Market

The Indonesia satellite communications market faces several significant challenges that can impact its growth trajectory. Regulatory hurdles and the complexities of spectrum allocation can slow down the deployment of new services and infrastructure. Supply chain disruptions, particularly for specialized satellite components and ground equipment, can lead to project delays and increased costs. Intense competitive pressures from both established satellite operators and emerging terrestrial broadband providers necessitate continuous innovation and cost optimization. Furthermore, the substantial upfront investment required for satellite infrastructure and the ongoing operational expenses pose financial barriers for some market participants.

Forces Driving Indonesia Satellite Communications Market Growth

Several key forces are driving the robust growth of the Indonesia satellite communications market. The primary driver is the vast geographical dispersion of Indonesia's islands, creating an unparalleled demand for satellite-based connectivity to bridge the digital divide and connect remote communities. Government initiatives aimed at promoting digital inclusion and economic development through enhanced internet access are significantly accelerating market expansion. Technological advancements in satellite technology, including the rise of LEO constellations and higher-throughput GEO satellites, are making satellite internet more affordable and accessible with improved performance. The burgeoning digital economy, with its increasing reliance on data-intensive applications, cloud services, and IoT deployments, further fuels the demand for reliable and widespread communication networks.

Challenges in the Indonesia Satellite Communications Market Market

While the Indonesia satellite communications market is on an upward trajectory, long-term growth catalysts will hinge on overcoming persistent challenges and capitalizing on evolving technological landscapes. Continued investment in satellite manufacturing and launch capabilities will be crucial to meet the increasing demand for capacity. Fostering strong public-private partnerships will be essential to fund large-scale infrastructure projects and ensure equitable access to services. The development of localized satellite technology and manufacturing within Indonesia could also drive cost efficiencies and create new employment opportunities, further solidifying the market's sustainable growth. Adapting to and integrating new communication standards and protocols will also be vital for maintaining a competitive edge.

Emerging Opportunities in Indonesia Satellite Communications Market

Emerging opportunities within the Indonesia satellite communications market are abundant, driven by technological innovation and unmet connectivity needs. The expansion of LEO satellite services presents a significant opportunity to provide high-speed, low-latency internet to even the most remote locations, catering to a wider consumer base and enabling new digital applications. The growing demand for specialized satellite solutions in sectors like precision agriculture, remote healthcare diagnostics, and maritime surveillance offers lucrative avenues for niche market penetration. Furthermore, the increasing adoption of IoT devices across various industries will create a substantial market for reliable, always-on connectivity solutions. The potential for satellite-enabled 5G backhaul in areas where terrestrial fiber deployment is unfeasible is another promising opportunity for market players.

Leading Players in the Indonesia Satellite Communications Market Sector

- NTvsat

- Kacific Broadband Satellites Group

- PT Pasifik Satelit Nusantara

- Starlink

- Indosat Ooredoo Hutchison

- PT PRIMACOM INTERBUANA

- PT Telkom Satelit Indonesia

- Thaicom Public Company Limited

- SES S A

- PT Wahana Telekomunikasi Dirgantara

- PT SATELIT NUSANTARA TIG

Key Milestones in Indonesia Satellite Communications Market Industry

- April 2024: The Indonesian Internet Service Providers Association (APJII) inked a memorandum of understanding (MoU) with SpaceX's Starlink. This collaboration seeks to bolster internet accessibility in Indonesia as Starlink, the LEO satellite operator, awaits the green light from regulators to kick off its operations in the country.

- February 2024: From Cape Canaveral, Florida, SpaceX successfully launched the Merah-Putih-2 telecommunications satellite tailored for Indonesia. Echoing the hues of Indonesia's flag, the Merah-Putih-2 satellite is poised to elevate the country's connectivity. Constructed by Thales Alenia Space on the Spacebus 4000B2 platform, it boasts a robust capacity of no less than 32 gigabits per second. With transponders active on both C-band and Ku-band frequencies, Merah-Putih-2 is primed to extend its coverage across every corner of Indonesia.

Strategic Outlook for Indonesia Satellite Communications Market Market

The strategic outlook for the Indonesia satellite communications market is exceptionally bright, fueled by the nation's ongoing digital transformation and the critical role satellite technology plays in achieving widespread connectivity. Future growth will be accelerated by the strategic deployment of LEO and advanced GEO satellites, aimed at serving diverse end-user verticals with high-performance solutions. Key growth accelerators include continued government support for digital infrastructure development, strategic partnerships between satellite operators and local internet service providers, and the increasing adoption of satellite-enabled IoT and machine-to-machine communication. The market is poised for expansion into new applications, such as advanced disaster management systems and enhanced maritime surveillance, further solidifying its importance to Indonesia's economic and social progress.

Indonesia Satellite Communications Market Segmentation

-

1. Offering

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Indonesia Satellite Communications Market Segmentation By Geography

- 1. Indonesia

Indonesia Satellite Communications Market Regional Market Share

Geographic Coverage of Indonesia Satellite Communications Market

Indonesia Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.3. Market Restrains

- 3.3.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.4. Market Trends

- 3.4.1. Expansion of 5G Satellite Communication is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NTvsat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kacific Broadband Satellites Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Pasifik Satelit Nusantara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Starlink

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indosat Ooredoo Hutchison

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT PRIMACOM INTERBUANA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Telkom Satelit Indonesia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thaicom Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SES S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Telkom Satelit Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Wahana Telekomunikasi Dirgantara

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pasifik Satelit Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT SATELIT NUSANTARA TIG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 NTvsat

List of Figures

- Figure 1: Indonesia Satellite Communications Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2020 & 2033

- Table 3: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2020 & 2033

- Table 5: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 7: Indonesia Satellite Communications Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia Satellite Communications Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 10: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2020 & 2033

- Table 11: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2020 & 2033

- Table 13: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 14: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Indonesia Satellite Communications Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia Satellite Communications Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Satellite Communications Market?

The projected CAGR is approximately 15.59%.

2. Which companies are prominent players in the Indonesia Satellite Communications Market?

Key companies in the market include NTvsat, Kacific Broadband Satellites Group, PT Pasifik Satelit Nusantara, Starlink, Indosat Ooredoo Hutchison, PT PRIMACOM INTERBUANA, PT Telkom Satelit Indonesia, Thaicom Public Company Limited, SES S A, PT Telkom Satelit Indonesia, PT Wahana Telekomunikasi Dirgantara, PT Pasifik Satelit Nusantara, PT SATELIT NUSANTARA TIG.

3. What are the main segments of the Indonesia Satellite Communications Market?

The market segments include Offering, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 341.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

6. What are the notable trends driving market growth?

Expansion of 5G Satellite Communication is Driving the Market.

7. Are there any restraints impacting market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

8. Can you provide examples of recent developments in the market?

April 2024 - The Indonesian Internet Service Providers Association (APJII) inked a memorandum of understanding (MoU) with SpaceX's Starlink. This collaboration seeks to bolster internet accessibility in Indonesia as Starlink, the LEO satellite operator, awaits the green light from regulators to kick off its operations in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Indonesia Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence