Key Insights

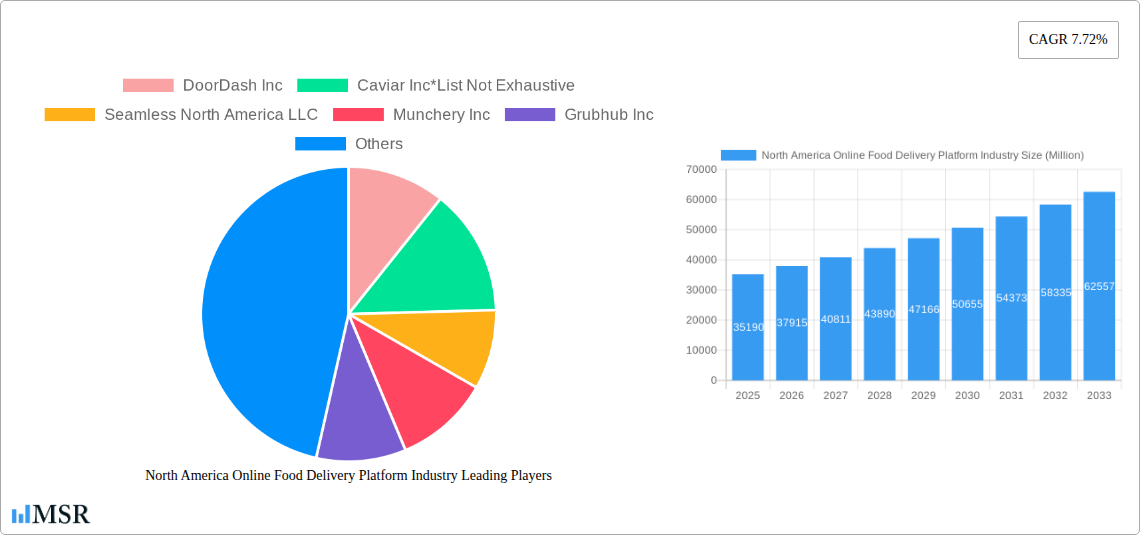

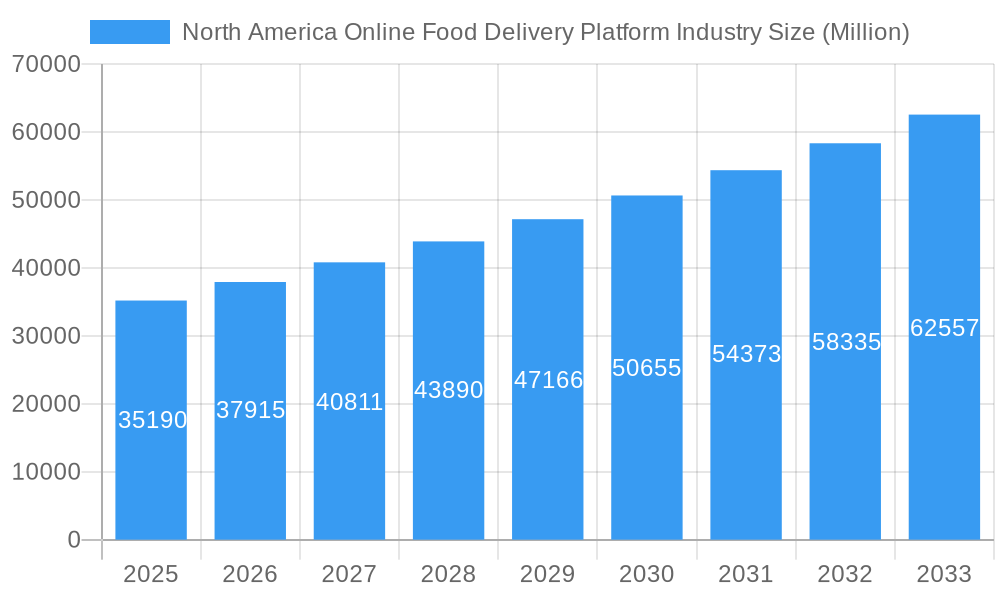

The North America Online Food Delivery Platform Industry is poised for robust expansion, projected to reach a substantial market size of $35190 million by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 7.72% through 2033. This dynamic growth is primarily fueled by several key drivers. The increasing adoption of smartphones and widespread internet penetration have created a fertile ground for digital platforms, making online food ordering more accessible than ever. Furthermore, evolving consumer lifestyles, characterized by a preference for convenience and time-saving solutions, are a significant catalyst. The surge in dual-income households and the desire for diverse culinary experiences further bolster demand for the variety and ease offered by online food delivery services. The proliferation of third-party delivery platforms, coupled with restaurant partnerships, has expanded the reach and availability of food options, directly contributing to market growth.

North America Online Food Delivery Platform Industry Market Size (In Billion)

Several emerging trends are shaping the competitive landscape of the North America Online Food Delivery Platform Industry. The integration of artificial intelligence and machine learning for personalized recommendations and optimized delivery routes is becoming increasingly prevalent. Moreover, the focus on sustainability, with platforms exploring eco-friendly packaging and delivery methods, is gaining traction among environmentally conscious consumers. The expansion of quick-commerce models, offering faster delivery of groceries and convenience items alongside prepared meals, represents another significant trend. While the market demonstrates strong growth potential, it also faces certain restraints. Intense competition among established players and new entrants can lead to price wars and reduced profit margins. Additionally, logistical challenges, including driver shortages, traffic congestion, and weather disruptions, can impact delivery efficiency and customer satisfaction. Regulatory scrutiny concerning labor practices and commission fees also presents an ongoing concern for platform providers.

North America Online Food Delivery Platform Industry Company Market Share

Unlocking the Future of Dining: Comprehensive Report on the North America Online Food Delivery Platform Industry (2019–2033)

This in-depth report provides an indispensable analysis of the North America online food delivery platform industry, exploring its dynamic landscape from 2019 to 2033, with a base and estimated year of 2025. Delve into critical insights covering market concentration, growth drivers, key segments, product innovations, challenges, and strategic outlook. Essential for investors, strategists, and industry players seeking to capitalize on the booming food delivery market, online restaurant ordering, and meal delivery services.

North America Online Food Delivery Platform Industry Market Concentration & Dynamics

The North America online food delivery platform industry exhibits a moderately concentrated market, with a few dominant players holding significant market share. Key companies like DoorDash Inc., Uber Technologies Inc. (UberEats), and Grubhub Inc. are at the forefront, driving innovation and shaping consumer expectations for convenient food delivery. The innovation ecosystem is characterized by continuous platform enhancements, expansion into new verticals such as grocery and convenience store delivery, and a focus on improving logistics and driver efficiency. Regulatory frameworks are evolving, with ongoing discussions around driver classification and commission caps, impacting operational models. Substitute products, including direct restaurant ordering and in-home cooking, remain relevant but are increasingly challenged by the unparalleled convenience offered by online platforms. End-user trends lean heavily towards instant gratification, personalized offers, and a wider selection of culinary options. Merger and acquisition (M&A) activities are a significant feature, with major players actively consolidating to expand their geographical reach and service offerings. For instance, the DoorDash Inc. acquisition of Wolt Enterprises Oy for approximately USD 8 billion highlights this consolidation trend, aiming to bolster its global presence and competitive edge in the food delivery market. The industry sees an average of 5-8 significant M&A deals annually within the study period.

North America Online Food Delivery Platform Industry Industry Insights & Trends

The North America online food delivery platform industry is poised for substantial growth, driven by a confluence of factors that have fundamentally altered consumer dining habits. The market size, estimated at over USD 50 Million in the historical period and projected to reach over USD 100 Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033), underscores its rapid expansion. The Covid-19 pandemic acted as a significant catalyst, accelerating the adoption of online food ordering apps and food delivery services as consumers sought safe and convenient ways to access their favorite meals. This shift has ingrained the habit of ordering food online, creating a sustained demand for these platforms. Technological disruptions are at the core of this evolution. Advancements in AI-powered recommendation engines, sophisticated route optimization algorithms for faster food delivery, and the integration of virtual kitchens (dark kitchens) are enhancing operational efficiency and customer experience. Furthermore, the rise of ghost kitchens is reducing overheads for restaurants and enabling platform expansion into underserved areas. Evolving consumer behaviors are characterized by an increasing demand for contactless delivery, personalized dining experiences, and a broader spectrum of culinary choices, from gourmet restaurants to niche ethnic cuisines. The convenience of ordering from a smartphone, coupled with competitive pricing and promotional offers, continues to fuel user acquisition and retention. The market is also witnessing a growing interest in subscription models for meal delivery services, offering regular discounts and exclusive benefits to loyal customers. The integration of third-party logistics and the development of proprietary delivery fleets are strategies employed by key players to ensure reliable and swift food delivery North America. The overall trend indicates a maturing but still rapidly growing market, with innovation and consumer convenience as the primary growth engines.

Key Markets & Segments Leading North America Online Food Delivery Platform Industry

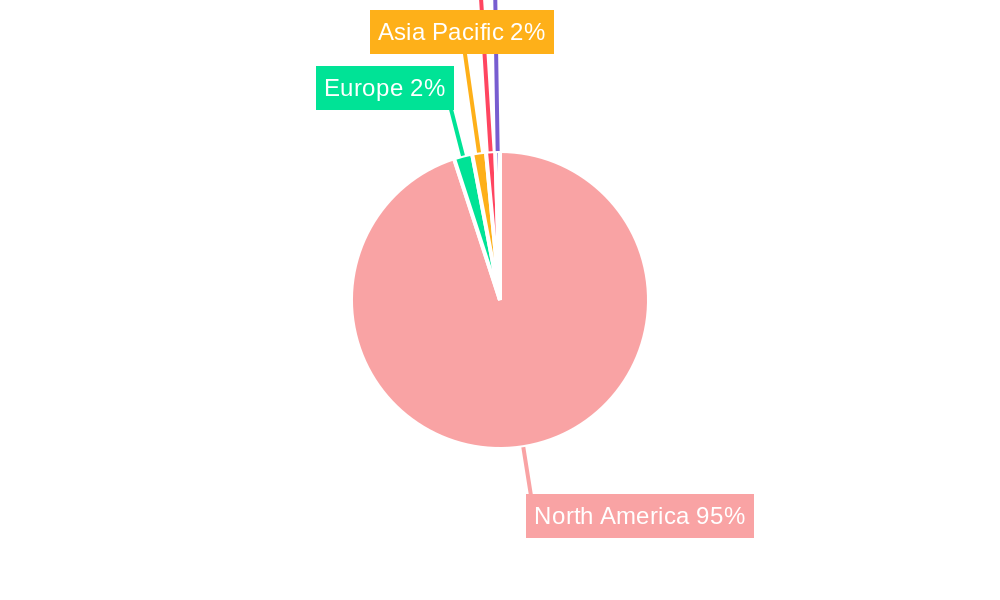

The dominance within the North America online food delivery platform industry is multifaceted, with the United States serving as the primary engine for both production and consumption, driven by a large, tech-savvy population and a well-developed restaurant infrastructure.

Consumption Analysis: The U.S. market accounts for over 80% of the total consumption in North America. This is fueled by high disposable incomes, widespread smartphone penetration, and a cultural embrace of convenience. Major metropolitan areas like New York City, Los Angeles, and Chicago represent the highest consumption hubs, with a strong preference for diverse cuisines and quick delivery times.

- Drivers of Consumption Dominance:

- High population density in urban centers.

- Significant disposable income.

- Widespread adoption of smartphones and internet access.

- A robust restaurant ecosystem offering a wide variety of cuisines.

- Growing preference for on-demand services.

- Drivers of Consumption Dominance:

Production Analysis: The production side, which involves the operational infrastructure of platforms, restaurant partnerships, and driver networks, is also heavily concentrated in the U.S. Companies are investing heavily in technology and logistics to optimize delivery routes, ensure food quality, and manage a vast network of restaurants and delivery personnel. The development of proprietary technology for order management, dispatch, and customer service is crucial for production efficiency.

Import Market Analysis (Value & Volume): While North America is largely self-sufficient in terms of online food delivery platform services, there are indirect imports related to the technology infrastructure and software solutions that power these platforms. The "import" here is less about finished food products and more about the technological backbone. The value of these technological imports is estimated at over USD 50 Million annually, with a volume of xx units of software licenses and hardware.

Export Market Analysis (Value & Volume): Some North American companies are actively exporting their platform technology and business models to other regions. However, the primary focus remains on the domestic market. The export value is nascent, estimated at less than USD 5 Million annually, primarily consisting of licensing agreements for the platform technology.

Price Trend Analysis: Pricing in the North American market is competitive, influenced by commission rates charged to restaurants, delivery fees paid by consumers, and promotional offers. Delivery fees typically range from USD 2 to USD 8, with surge pricing during peak hours. Restaurant commission rates can range from 15% to 30% of the order value. The trend is towards dynamic pricing and value-based strategies, with subscription models offering a more predictable cost for consumers.

North America Online Food Delivery Platform Industry Product Developments

Product development in the North America online food delivery platform industry is hyper-focused on enhancing user experience and operational efficiency. Innovations include AI-driven personalized recommendations, sophisticated order tracking with real-time updates, and seamless integration with smart home devices. Platforms are expanding their offerings beyond traditional restaurant meals to include groceries, convenience items, and alcohol delivery, catering to a broader range of consumer needs. The development of advanced logistics software, including predictive analytics for demand forecasting and optimized routing, is crucial for maintaining fast and reliable delivery times. Furthermore, advancements in contactless delivery technologies and improved packaging solutions are enhancing safety and food quality.

Challenges in the North America Online Food Delivery Platform Industry Market

The North America online food delivery platform industry faces several significant challenges. Regulatory hurdles, including evolving labor laws concerning gig workers and potential price controls on commission fees, pose a substantial risk to business models. Intense competition leads to price wars and high marketing costs, impacting profitability. Supply chain disruptions, particularly in the availability of delivery personnel during peak demand or unforeseen events, can affect service reliability. Furthermore, maintaining consistent food quality and customer satisfaction across a diverse range of restaurant partners remains an ongoing challenge. The cost of customer acquisition and retention is also a significant factor in this competitive landscape.

Forces Driving North America Online Food Delivery Platform Industry Growth

Several powerful forces are propelling the growth of the North America online food delivery platform industry. The unwavering consumer demand for convenience and instant gratification is a primary driver, exacerbated by increasingly busy lifestyles. Technological advancements, including widespread smartphone adoption, sophisticated mobile applications, and efficient logistics software, are making food delivery more accessible and efficient than ever before. Economic factors, such as rising disposable incomes and a growing middle class, contribute to increased spending on discretionary services like online meal delivery. The expansion of partnerships with a wider array of restaurants, including local eateries and national chains, diversifies offerings and attracts a broader customer base.

Challenges in the North America Online Food Delivery Platform Industry Market

The North America online food delivery platform industry faces persistent challenges that require strategic mitigation. Profitability remains a key concern for many players due to high operational costs, intense competition, and the need for continuous investment in technology and marketing. Maintaining consistent service quality and ensuring the safety and freshness of delivered food are critical for customer retention. The reliance on gig economy workers presents ongoing labor and regulatory complexities, with potential impacts on operational costs and service availability. Additionally, building and maintaining strong relationships with a diverse range of restaurant partners, while managing their expectations and ensuring their success on the platform, is a delicate balancing act.

Emerging Opportunities in North America Online Food Delivery Platform Industry

Emerging opportunities within the North America online food delivery platform industry are abundant. The expansion into non-food verticals like grocery delivery, convenience store delivery, and pharmacy delivery represents a significant growth avenue, leveraging existing logistics infrastructure and customer bases. The development and adoption of ghost kitchens and virtual restaurant models offer new avenues for market penetration and service diversification. Furthermore, the increasing consumer interest in healthy and specialized dietary options (e.g., vegan, gluten-free) presents an opportunity for platforms to curate and promote niche food offerings. The integration of advanced technologies such as drone delivery and autonomous vehicles, while still in nascent stages, holds long-term potential for revolutionizing delivery efficiency and cost-effectiveness.

Leading Players in the North America Online Food Delivery Platform Industry Sector

- DoorDash Inc.

- Uber Technologies Inc.

- Grubhub Inc.

- Seamless North America LLC

- ChowNow

- goBrands Inc (goPuff Delivery)

- Caviar Inc

- Munchery Inc

Key Milestones in North America Online Food Delivery Platform Industry Industry

- November 2021 - DoorDash Inc. announced its acquisition of Finnish food-delivery startup Wolt Enterprises Oy for approximately USD 8 billion, significantly expanding its global footprint and competitive advantage.

- June 2021 - Uber Technologies Inc. highlighted the strong performance of its Uber Eats business, driven by the sustained demand for food delivery services attributed to the COVID-19 pandemic, demonstrating its strategic shift beyond ride-hailing.

Strategic Outlook for North America Online Food Delivery Platform Industry Market

The strategic outlook for the North America online food delivery platform industry is one of continued innovation and expansion. Key growth accelerators will include the diversification of service offerings beyond traditional restaurant meals, such as groceries and convenience items, and the continued development and adoption of ghost kitchens. Companies will focus on enhancing technological capabilities, including AI for personalized customer experiences and advanced logistics for greater efficiency. Strategic partnerships and potential further consolidation will shape the competitive landscape. The industry is expected to capitalize on evolving consumer preferences for convenience, variety, and speed, ensuring sustained growth throughout the forecast period.

North America Online Food Delivery Platform Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Online Food Delivery Platform Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Online Food Delivery Platform Industry Regional Market Share

Geographic Coverage of North America Online Food Delivery Platform Industry

North America Online Food Delivery Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. Rise of Mobile Penetration in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DoorDash Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caviar Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Seamless North America LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Munchery Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grubhub Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ChowNow

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 goBrands Inc (goPuff Delivery)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uber Technologies Inc (UberEats)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 DoorDash Inc

List of Figures

- Figure 1: North America Online Food Delivery Platform Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Food Delivery Platform Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Food Delivery Platform Industry?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the North America Online Food Delivery Platform Industry?

Key companies in the market include DoorDash Inc, Caviar Inc*List Not Exhaustive, Seamless North America LLC, Munchery Inc, Grubhub Inc, ChowNow, goBrands Inc (goPuff Delivery), Uber Technologies Inc (UberEats).

3. What are the main segments of the North America Online Food Delivery Platform Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps.

6. What are the notable trends driving market growth?

Rise of Mobile Penetration in North America.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

November 2021 - DoorDash Inc., DoorDash Inc said it's buying Finnish food-delivery startup Wolt Enterprises Oy for about USD 8 billion. The biggest meal-delivery service in the U.S. said it's buying Finnish food-delivery startup Wolt Enterprises Oy for about $8 billion as it seeks to stay ahead of rivals in the race to satisfy soaring demand for the fast delivery of everything from food to prescriptions and pet supplies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Food Delivery Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Food Delivery Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Food Delivery Platform Industry?

To stay informed about further developments, trends, and reports in the North America Online Food Delivery Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence