Key Insights

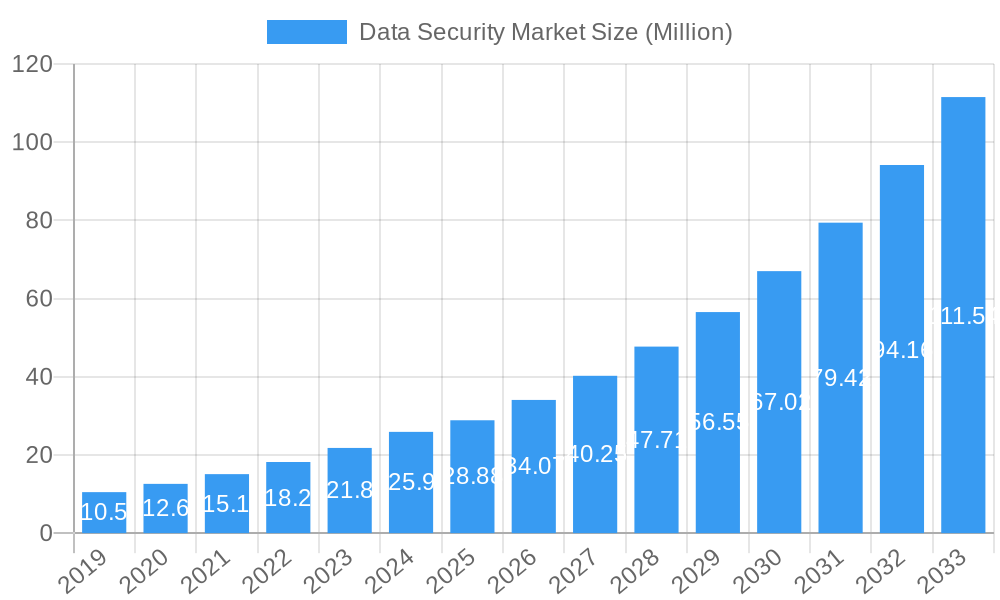

The global Data Security Market is experiencing robust expansion, projected to reach an estimated USD 28.88 billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 18.78% through 2033. This significant growth is propelled by escalating concerns over data breaches, stringent regulatory compliance mandates like GDPR and CCPA, and the pervasive digital transformation across industries. The increasing volume and complexity of data, coupled with the rise of sophisticated cyber threats, necessitate advanced data security solutions. Key market drivers include the burgeoning adoption of cloud services, which, while offering scalability, also presents new security challenges, and the growing demand for comprehensive data protection across sensitive sectors such as banking, healthcare, and government. The market's trajectory is further shaped by the evolving threat landscape, pushing organizations to invest in proactive security measures rather than reactive responses.

Data Security Market Market Size (In Million)

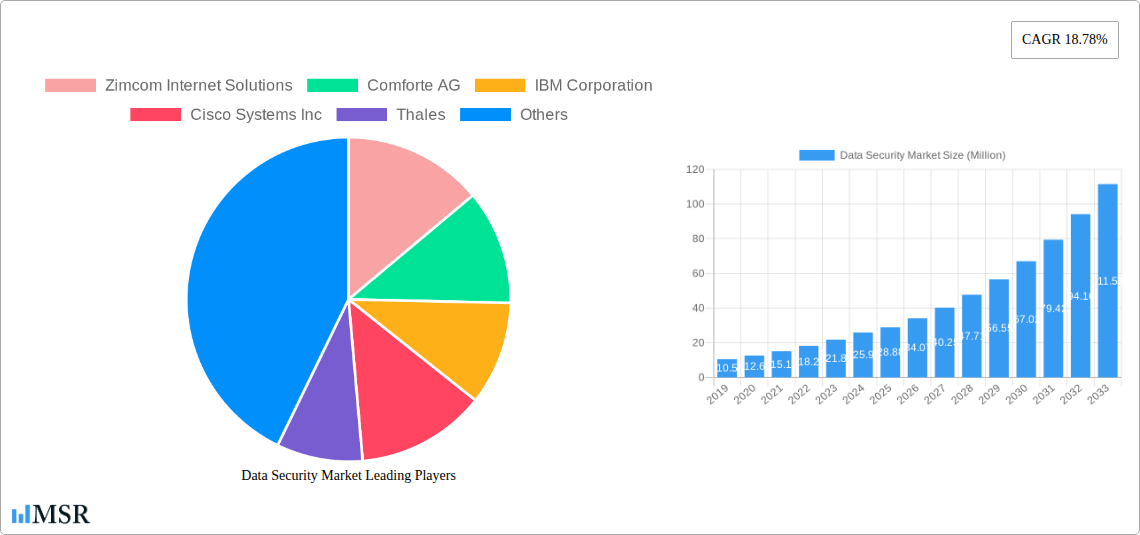

The Data Security Market is segmented across various crucial areas. By component, solutions like encryption, data loss prevention (DLP), and access management are leading the charge, supported by a growing demand for expert security services. Deployment models are increasingly favoring cloud-based solutions due to their flexibility and cost-effectiveness, although on-premises solutions remain vital for organizations with strict data sovereignty requirements. Small and medium-sized enterprises (SMEs) represent a significant growth segment, as they are increasingly targeted by cybercriminals and seek affordable yet effective data protection. Major end-user industries like Retail, Healthcare, Manufacturing, BFSI, and Government are heavily investing in data security to safeguard sensitive customer information, intellectual property, and critical infrastructure. Prominent players like IBM Corporation, Microsoft Corporation, Cisco Systems Inc., and Thales are actively innovating and expanding their offerings to cater to these dynamic market needs, contributing to the overall market's advanced and competitive nature.

Data Security Market Company Market Share

Unlocking Secure Digital Futures: Comprehensive Data Security Market Report (2019-2033)

Gain unparalleled insights into the burgeoning global Data Security Market with our definitive report, meticulously crafted to illuminate growth trajectories, competitive landscapes, and transformative trends. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate the complexities of data protection in an increasingly interconnected world. Explore critical segments like Solutions, Services, Cloud, and On-premises deployments, catering to Small and Medium Enterprises (SMEs) and Large Enterprises across vital industries including Retail, Healthcare, Manufacturing, Banking, Financial Services and Insurance (BFSI), Government, and IT & Telecommunications. This report leverages high-ranking keywords such as "data security solutions," "cybersecurity market," "cloud data protection," "enterprise data security," "data privacy regulations," "data breach prevention," and "threat intelligence" to ensure maximum search visibility and engagement from industry leaders, investors, and technology providers.

Data Security Market Market Concentration & Dynamics

The Data Security Market is characterized by a dynamic interplay of established giants and agile innovators, fostering a moderately concentrated landscape. Key players like IBM Corporation, Microsoft Corporation, and Cisco Systems Inc. command significant market share through comprehensive solution portfolios and extensive global reach. However, specialized firms such as Comforte AG, Lepide USA Inc., and Varonis Systems Inc. are carving out niches with advanced data-centric security offerings. The innovation ecosystem thrives on continuous research and development in areas like encryption, access control, and threat detection, driven by a growing awareness of data breach impacts. Regulatory frameworks, including GDPR and CCPA, are major catalysts, compelling organizations to invest heavily in robust data security measures. The threat of substitute products is relatively low, as specialized data security solutions often offer unique functionalities that are difficult to replicate. End-user trends clearly indicate a shift towards proactive data protection strategies, with a significant demand for cloud-based security solutions. Merger and acquisition (M&A) activities are on the rise as larger entities seek to acquire cutting-edge technologies and expand their market presence. For instance, the market has witnessed over xx M&A deals in the historical period, indicating a consolidation trend aimed at enhancing competitive advantages.

Data Security Market Industry Insights & Trends

The global Data Security Market is experiencing explosive growth, projected to reach an estimated USD xxx Million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. This surge is primarily fueled by the escalating volume of sensitive data generated across all industries and the ever-increasing sophistication of cyber threats. The digital transformation initiatives undertaken by organizations worldwide, coupled with the widespread adoption of cloud computing and the Internet of Things (IoT), have significantly expanded the attack surface, making robust data security solutions not just a compliance requirement but a strategic imperative.

Technological disruptions are constantly reshaping the market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in security solutions is revolutionizing threat detection and response, enabling proactive identification and mitigation of novel threats. Advanced encryption techniques, tokenization, and data masking are becoming standard practices for safeguarding sensitive information. Furthermore, the increasing demand for real-time threat intelligence and continuous monitoring solutions is driving innovation in the services segment.

Evolving consumer behaviors are also playing a crucial role. Heightened public awareness regarding data privacy and the consequences of data breaches are putting immense pressure on organizations to prioritize data security. Customers are increasingly demanding transparency and assurance that their personal information is being handled responsibly and securely. This sentiment is translating into a preference for companies with strong data protection policies and verifiable security certifications. The rise of remote workforces has further amplified the need for secure access management and endpoint security solutions, creating new avenues for market expansion. The implementation of strict data privacy regulations globally, such as GDPR and CCPA, has acted as a powerful catalyst, mandating substantial investments in data security infrastructure and services, thus propelling market growth.

Key Markets & Segments Leading Data Security Market

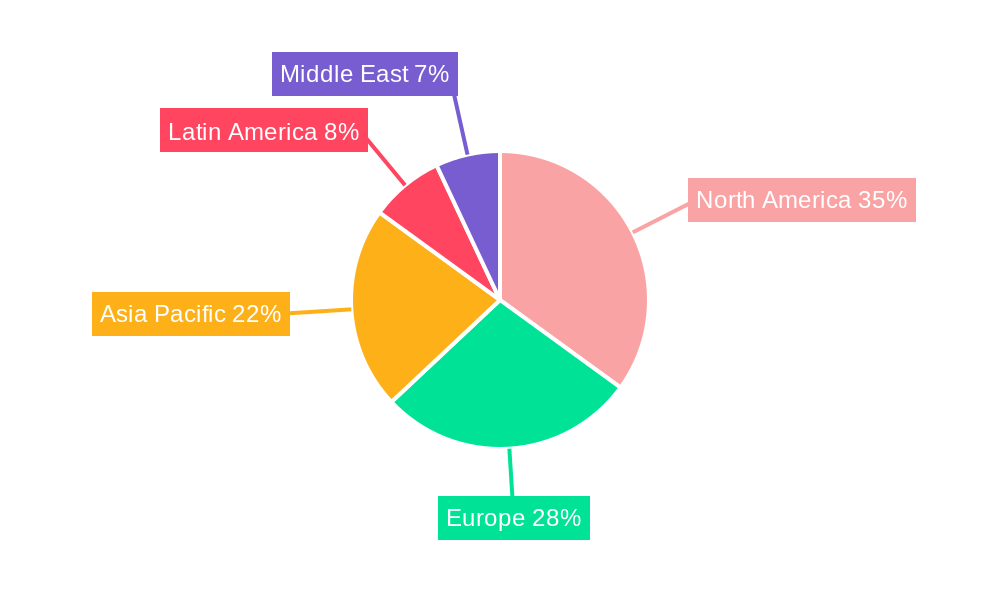

The Data Security Market is witnessing robust growth across multiple segments, with specific regions and industries demonstrating remarkable dominance.

- Dominant Region & Country: North America, particularly the United States, continues to lead the market due to its early adoption of advanced technologies, stringent regulatory environment, and the presence of major technology hubs and enterprises. Europe, with its comprehensive data protection laws like GDPR, and Asia-Pacific, with its rapidly expanding digital infrastructure and growing economies, are emerging as significant growth regions.

- Component Dominance:

- Solutions: The Solutions segment is expected to dominate the market. This includes a wide array of offerings such as encryption, data loss prevention (DLP), identity and access management (IAM), threat intelligence platforms, and security analytics. The increasing complexity of data threats necessitates sophisticated technological solutions to ensure comprehensive protection.

- Services: The Services segment, encompassing consulting, managed security services, threat monitoring, and incident response, is also experiencing substantial growth. Organizations are increasingly outsourcing their security needs to specialized providers to leverage expertise and ensure continuous protection.

- Deployment Dominance:

- Cloud: The Cloud deployment model is projected to be the fastest-growing segment. The scalability, flexibility, and cost-effectiveness of cloud-based security solutions are driving their adoption, especially among SMEs. Public, private, and hybrid cloud environments all contribute to this trend.

- On-premises: While cloud adoption is surging, On-premises deployments remain critical for organizations with strict compliance requirements or existing robust on-premises infrastructure, particularly in sectors like government and finance.

- Organization Size Dominance:

- Large Enterprises: Large Enterprises are significant contributors to the market due to their extensive data volumes, complex IT infrastructures, and higher susceptibility to large-scale breaches. Their substantial budgets allow for comprehensive security investments.

- Small and Medium Enterprises (SMEs): The SME segment is emerging as a key growth driver, with an increasing awareness of security threats and the availability of more affordable, cloud-based solutions.

- End-user Industry Dominance:

- Banking, Financial Services, and Insurance (BFSI): This sector consistently leads the data security market due to the highly sensitive nature of financial data and the stringent regulatory oversight. The constant threat of financial fraud and data theft makes robust security paramount.

- IT & Telecommunications: As the backbone of digital infrastructure, this industry faces constant cyber threats and is a significant investor in data security solutions to protect its own operations and customer data.

- Healthcare: With the digitization of patient records and the growing use of telehealth, the healthcare industry is a major focus for data security to protect patient privacy and comply with regulations like HIPAA.

- Government: Governments worldwide are investing heavily in data security to protect national security interests, critical infrastructure, and citizen data from sophisticated cyber-attacks.

- Retail: Driven by the need to protect customer payment information and loyalty program data, the retail sector is a significant spender on data security solutions.

- Manufacturing: The increasing adoption of Industry 4.0 technologies and the Internet of Things (IoT) in manufacturing introduces new vulnerabilities, driving investment in data security.

Data Security Market Product Developments

Product innovation is a cornerstone of the Data Security Market, with companies continuously developing advanced solutions to combat evolving threats. Recent developments include AI-powered threat detection platforms that can identify anomalous behavior in real-time, sophisticated encryption techniques for end-to-end data protection, and integrated data loss prevention (DLP) systems designed to monitor and control data flow across various channels. Zero-trust security models are gaining traction, emphasizing continuous verification of every user and device attempting to access resources. Furthermore, advancements in cloud security posture management (CSPM) tools are enabling organizations to maintain compliance and identify misconfigurations in their cloud environments. These innovations are crucial for maintaining a competitive edge and offering robust protection against sophisticated cyber-attacks.

Challenges in the Data Security Market Market

Despite its robust growth, the Data Security Market faces several significant challenges. The increasing complexity of cyber threats, coupled with a global shortage of skilled cybersecurity professionals, poses a substantial hurdle. The ever-evolving regulatory landscape, with new data privacy laws emerging frequently, requires continuous adaptation and investment in compliance. High implementation costs for advanced security solutions can be a barrier, especially for SMEs. Furthermore, the distributed nature of modern IT environments, including cloud services and remote workforces, makes comprehensive security monitoring and management increasingly difficult. Supply chain vulnerabilities also present a risk, as compromises in third-party software or hardware can lead to widespread data breaches.

Forces Driving Data Security Market Growth

Several powerful forces are propelling the growth of the Data Security Market. The exponential rise in the volume and value of data, coupled with increasing regulatory mandates like GDPR and CCPA, are forcing organizations to invest heavily in data protection. The growing sophistication of cyber threats, including ransomware, phishing, and state-sponsored attacks, necessitates the adoption of advanced security measures. The widespread digital transformation, leading to increased cloud adoption, remote work, and IoT deployments, expands the attack surface and amplifies the need for robust security. Furthermore, heightened consumer awareness of data privacy concerns and the potential reputational damage associated with data breaches are compelling businesses to prioritize data security.

Challenges in the Data Security Market Market

Long-term growth catalysts in the Data Security Market are intrinsically linked to continuous innovation and strategic market expansion. The ongoing evolution of threat landscapes demands persistent development of cutting-edge security technologies, including AI-driven anomaly detection, advanced encryption, and proactive threat hunting capabilities. Partnerships and collaborations between technology providers, security firms, and industry bodies are crucial for sharing threat intelligence and developing comprehensive security frameworks. Market expansion into emerging economies, where digital adoption is rapidly accelerating, presents significant growth opportunities. Furthermore, the increasing demand for specialized security solutions tailored to specific industries and use cases, such as IoT security and blockchain-based security, will continue to drive innovation and market growth.

Emerging Opportunities in Data Security Market

Emerging opportunities within the Data Security Market are abundant, driven by new technological advancements and shifting consumer preferences. The burgeoning field of Quantum-resistant cryptography presents a significant long-term opportunity as quantum computing capabilities advance. The growing demand for privacy-enhancing technologies (PETs) like federated learning and differential privacy opens new avenues for secure data analysis. The expansion of the IoT ecosystem, particularly in smart cities and industrial IoT, creates a critical need for specialized security solutions to protect a vast network of connected devices. Furthermore, the increasing adoption of blockchain technology for secure data sharing and identity management offers innovative possibilities for data integrity and security.

Leading Players in the Data Security Market Sector

- Zimcom Internet Solutions

- Comforte AG

- IBM Corporation

- Cisco Systems Inc

- Thales

- Microsoft Corporation

- Checkpoint Software Technologies Ltd

- Lepide USA Inc

- 101 Data Solutions

- Oracle Corporation

- Varonis Systems Inc

Key Milestones in Data Security Market Industry

- July 2022: Trellix achieved Amazon Web Services (AWS) Security Competency status in the Data security and protection category, highlighting its solution's capability to identify and respond to millions of malicious objects and URLs daily. This designation emphasizes Trellix's technical expertise and success in enhancing cloud security for customers.

- June 2022: Comforte AG, an enterprise data security provider, partnered with M² Business Consulting GmbH to assist large enterprises in the DACH region in adapting to new IT trends more rapidly and securely. This collaboration aims to enable secure data analytics and adoption of data privacy standards, fostering growth in the data security market.

Strategic Outlook for Data Security Market Market

The strategic outlook for the Data Security Market is overwhelmingly positive, characterized by sustained growth and innovation. Key growth accelerators include the increasing adoption of cloud-native security solutions, the integration of AI and ML for predictive threat analysis, and the rising demand for comprehensive data governance frameworks. Organizations will continue to prioritize zero-trust architectures and end-to-end data encryption to safeguard sensitive information. Strategic opportunities lie in addressing the security challenges posed by the expanding IoT landscape and the development of quantum-resistant encryption technologies. Furthermore, the growing emphasis on data privacy regulations worldwide will continue to drive investment in robust data security solutions and services, ensuring a robust and dynamic market future.

Data Security Market Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premises

-

3. Organization Size

- 3.1. Small and Medium Enterprises

- 3.2. Large Enterprises

-

4. End-user Industry

- 4.1. Retail

- 4.2. Healthcare

- 4.3. Manufacturing

- 4.4. Banking, Financial Services and Insurance

- 4.5. Government

- 4.6. IT & Telecommunications

- 4.7. Other End-user Industries

Data Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Data Security Market Regional Market Share

Geographic Coverage of Data Security Market

Data Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digitization Trends and Digital Data Production; Increase in Data Security Technologies

- 3.3. Market Restrains

- 3.3.1. Identifying and Analyzing Sensitive Information and Costly Installation

- 3.4. Market Trends

- 3.4.1. Data Security Technologies As the Greatest Asset

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Retail

- 5.4.2. Healthcare

- 5.4.3. Manufacturing

- 5.4.4. Banking, Financial Services and Insurance

- 5.4.5. Government

- 5.4.6. IT & Telecommunications

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Data Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premises

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium Enterprises

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Retail

- 6.4.2. Healthcare

- 6.4.3. Manufacturing

- 6.4.4. Banking, Financial Services and Insurance

- 6.4.5. Government

- 6.4.6. IT & Telecommunications

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Data Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premises

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium Enterprises

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Retail

- 7.4.2. Healthcare

- 7.4.3. Manufacturing

- 7.4.4. Banking, Financial Services and Insurance

- 7.4.5. Government

- 7.4.6. IT & Telecommunications

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Data Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premises

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium Enterprises

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Retail

- 8.4.2. Healthcare

- 8.4.3. Manufacturing

- 8.4.4. Banking, Financial Services and Insurance

- 8.4.5. Government

- 8.4.6. IT & Telecommunications

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Data Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premises

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium Enterprises

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Retail

- 9.4.2. Healthcare

- 9.4.3. Manufacturing

- 9.4.4. Banking, Financial Services and Insurance

- 9.4.5. Government

- 9.4.6. IT & Telecommunications

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Data Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premises

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium Enterprises

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Retail

- 10.4.2. Healthcare

- 10.4.3. Manufacturing

- 10.4.4. Banking, Financial Services and Insurance

- 10.4.5. Government

- 10.4.6. IT & Telecommunications

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zimcom Internet Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Comforte AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Checkpoint Software Technologies Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lepide USA Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 101 Data Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Varonis Systems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Zimcom Internet Solutions

List of Figures

- Figure 1: Global Data Security Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 7: North America Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 8: North America Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 17: Europe Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 18: Europe Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Pacific Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Asia Pacific Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Pacific Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 27: Asia Pacific Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Asia Pacific Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 33: Latin America Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Latin America Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Latin America Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Latin America Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 37: Latin America Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Latin America Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Data Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Data Security Market Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East Data Security Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East Data Security Market Revenue (Million), by Deployment 2025 & 2033

- Figure 45: Middle East Data Security Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 46: Middle East Data Security Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 47: Middle East Data Security Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 48: Middle East Data Security Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 49: Middle East Data Security Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East Data Security Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East Data Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Data Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 14: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 19: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 24: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Data Security Market Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Data Security Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Data Security Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 29: Global Data Security Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Data Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Security Market?

The projected CAGR is approximately 18.78%.

2. Which companies are prominent players in the Data Security Market?

Key companies in the market include Zimcom Internet Solutions, Comforte AG, IBM Corporation, Cisco Systems Inc, Thales, Microsoft Corporation, Checkpoint Software Technologies Ltd, Lepide USA Inc, 101 Data Solutions, Oracle Corporation*List Not Exhaustive, Varonis Systems Inc.

3. What are the main segments of the Data Security Market?

The market segments include Component, Deployment, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digitization Trends and Digital Data Production; Increase in Data Security Technologies.

6. What are the notable trends driving market growth?

Data Security Technologies As the Greatest Asset.

7. Are there any restraints impacting market growth?

Identifying and Analyzing Sensitive Information and Costly Installation.

8. Can you provide examples of recent developments in the market?

July 2022 - Trellix has achieved Amazon Web Services (AWS) Security Competency status in the Data security and protection category by developing a solution that identifies and responds to millions of malicious objects and URLs daily. This designation honors Trellix's extensive technical expertise and proven success in assisting customers in enhancing their security, especially in the cloud sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Security Market?

To stay informed about further developments, trends, and reports in the Data Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence