Key Insights

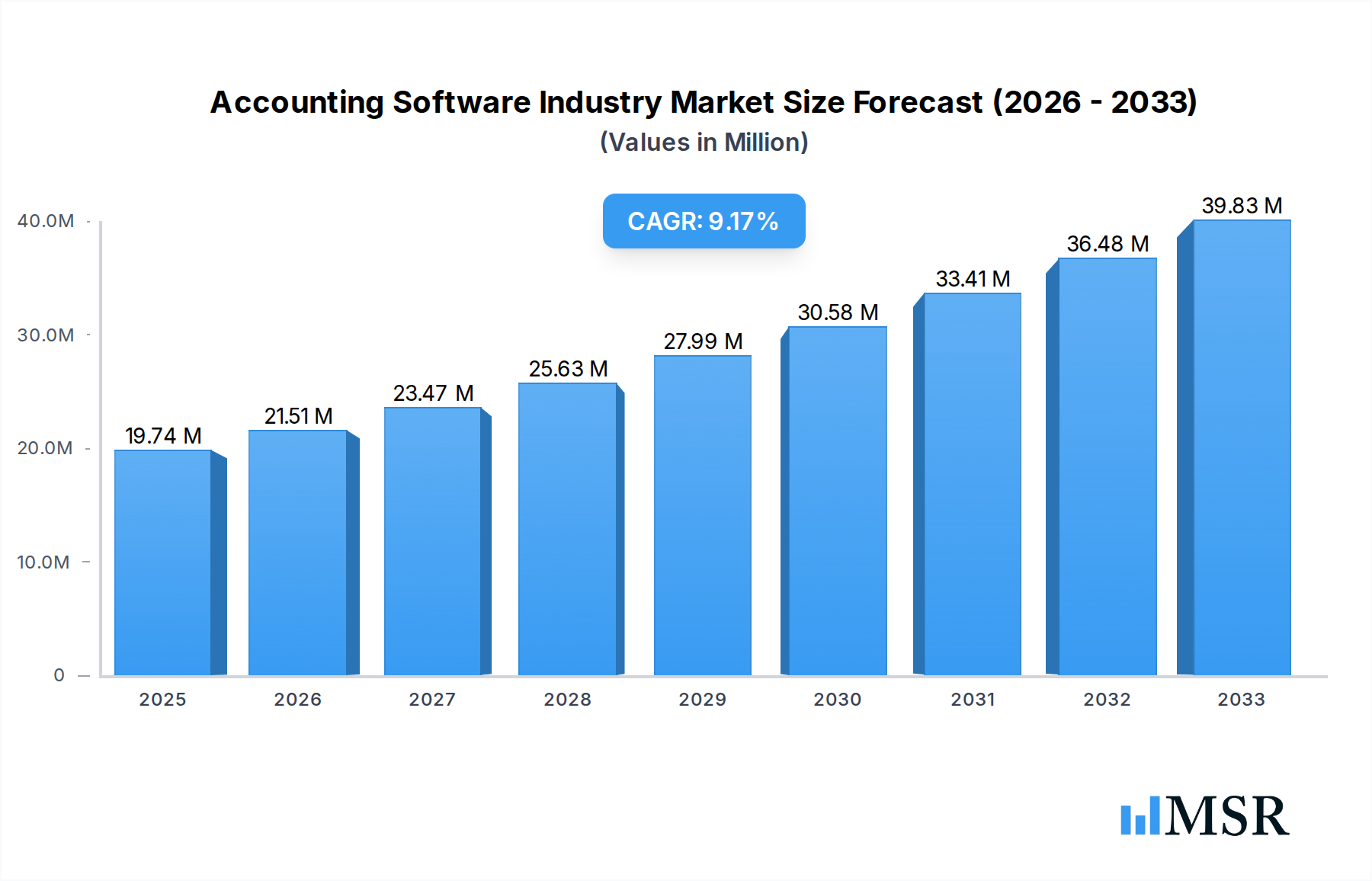

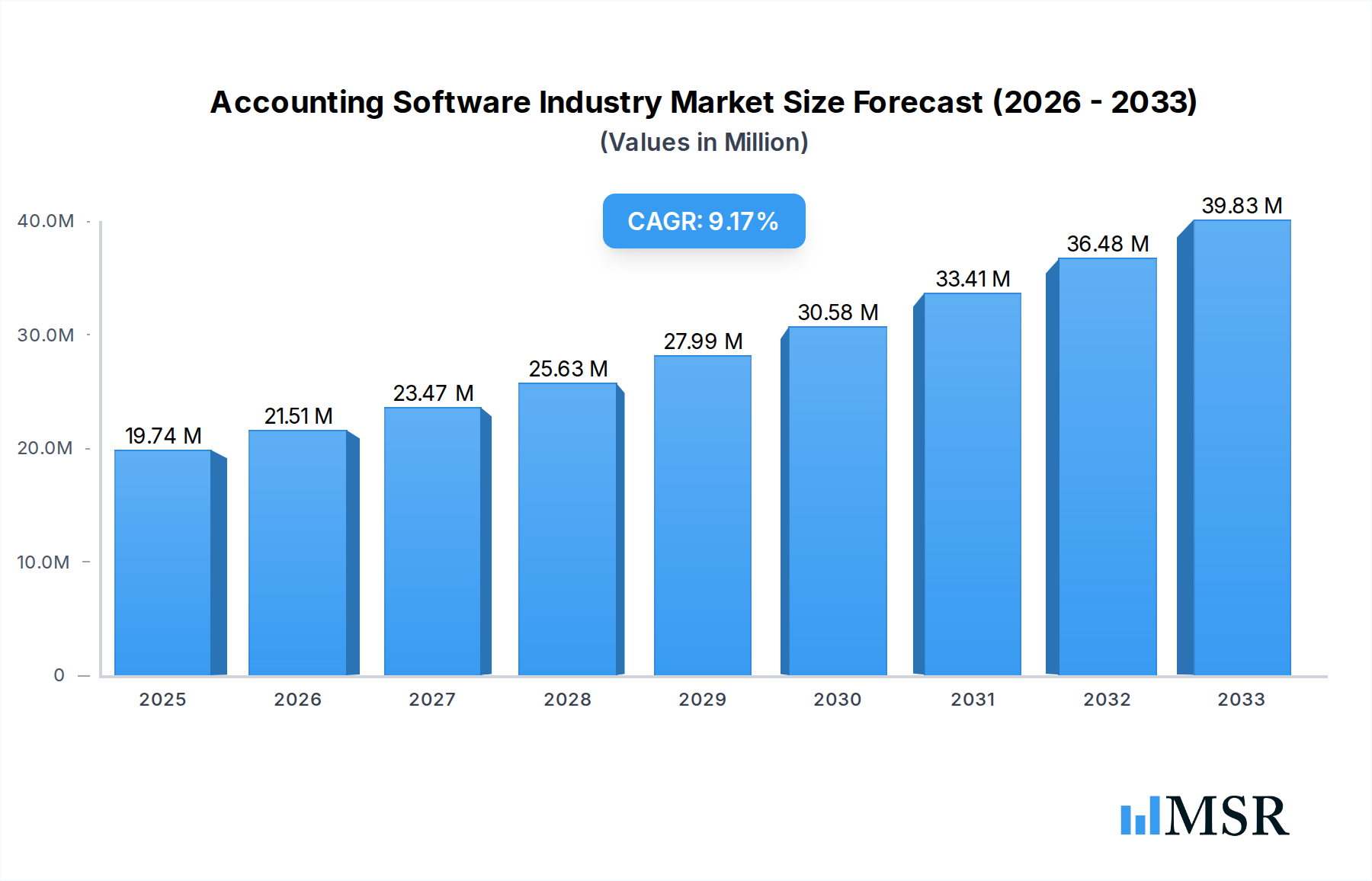

The global Accounting Software industry is poised for significant expansion, with a current market size estimated at 19.74 Million and a projected Compound Annual Growth Rate (CAGR) of 9.20%. This robust growth is fueled by a confluence of factors, including the increasing digitalization of businesses across all sectors, the growing need for efficient financial management and compliance, and the rising adoption of cloud-based solutions for enhanced accessibility and scalability. Small and Medium Enterprises (SMEs) are increasingly recognizing the value of accounting software in streamlining their operations, improving cash flow management, and gaining deeper financial insights. Simultaneously, large enterprises are leveraging these advanced tools for complex financial reporting, risk management, and strategic decision-making. The shift towards cloud deployment models is a dominant trend, offering businesses greater flexibility, reduced IT overhead, and seamless integration with other business applications. This transition is further propelling market growth as organizations seek agile and cost-effective accounting solutions.

Accounting Software Industry Market Size (In Million)

The competitive landscape is characterized by a dynamic interplay among established global players and innovative niche providers. Companies like Microsoft, Oracle, SAP, and Sage are continuously enhancing their offerings to cater to diverse business needs, while specialized vendors like Xero and Zoho Corp are capturing market share with user-friendly and feature-rich platforms. Emerging economies, particularly in Asia, are expected to be significant growth drivers due to rapid business expansion and increasing digital literacy. However, the industry also faces restraints such as the initial cost of implementation for some advanced solutions, concerns around data security and privacy, and the resistance to change from businesses accustomed to traditional manual accounting methods. Overcoming these challenges through affordable pricing models, robust security measures, and comprehensive training and support will be crucial for sustained market dominance. The forecast period, from 2025 to 2033, is expected to witness substantial innovation, with a focus on AI-powered analytics, predictive accounting, and automated financial processes.

Accounting Software Industry Company Market Share

Accounting Software Industry: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global accounting software industry, projecting market growth and identifying key trends from 2019 to 2033. With a base year of 2025 and a forecast period extending from 2025 to 2033, this study provides actionable insights for stakeholders seeking to navigate the evolving landscape of accounting technology. Discover market dynamics, product innovations, challenges, and growth drivers shaping the future of accounting software.

Accounting Software Industry Market Concentration & Dynamics

The accounting software industry, characterized by a moderate to high level of market concentration, is a dynamic ecosystem driven by continuous innovation and strategic mergers and acquisitions. Key players like Microsoft Corporation, Oracle Corporation, SAP SE, and Intuit Inc. hold significant market share, particularly in enterprise-level solutions. However, the rise of specialized cloud-based accounting software has fostered growth for agile competitors such as Xero Ltd. and Reckon Ltd. The innovation ecosystem thrives on the integration of advanced technologies like AI, machine learning, and blockchain to automate complex accounting tasks and enhance data analytics. Regulatory frameworks, including GDPR and evolving tax compliance mandates, heavily influence product development and market entry strategies. Substitute products, such as spreadsheets and manual bookkeeping, are increasingly being phased out by more robust software solutions, especially among Small and Medium Enterprises (SMEs). End-user trends highlight a strong preference for user-friendly interfaces, seamless integration with other business applications, and robust security features. Merger and acquisition activities, with an estimated XX deal count in the historical period, are crucial for market consolidation and expansion of product portfolios, enabling companies to capture new market segments and technological capabilities.

Accounting Software Industry Industry Insights & Trends

The global accounting software industry is poised for substantial growth, with an estimated market size of $XX Million in 2025, and projected to reach $XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This robust expansion is primarily fueled by increasing digitalization across businesses of all sizes, the growing need for efficient financial management, and the demand for real-time financial data. Technological disruptions are at the forefront, with advancements in cloud computing making sophisticated accounting solutions accessible and affordable for SMEs. Cloud-based accounting software, offering scalability, flexibility, and remote access, has become the dominant deployment model, significantly outpacing traditional on-premise solutions. Artificial intelligence and machine learning are revolutionizing the industry by enabling predictive analytics, automated invoice processing, anomaly detection, and fraud prevention, thereby enhancing accuracy and efficiency. Evolving consumer behaviors, driven by the demand for intuitive user interfaces and integrated functionalities, are pushing software providers to develop more user-centric products. The growing emphasis on sustainability is also influencing the market, with a rising demand for accounting software that can track and report on environmental, social, and governance (ESG) metrics, as evidenced by recent partnerships in carbon accounting. This shift necessitates continuous product innovation and adaptation to meet the diverse and evolving needs of the global business community.

Key Markets & Segments Leading Accounting Software Industry

The cloud-based deployment type and the Small and Medium Enterprises (SMEs) segment are the most dominant forces shaping the accounting software industry. Cloud-based solutions have experienced unprecedented adoption due to their inherent advantages, including lower upfront costs, automatic updates, enhanced accessibility, and scalability, making them ideal for a wide range of businesses. The ease of integration with other cloud services further solidifies their leadership.

- Drivers for Cloud-Based Dominance:

- Economic Growth: Broader economic expansion fuels the need for sophisticated financial management tools across all business sizes.

- Technological Advancements: Continuous improvements in cloud infrastructure and security protocols build user confidence and adoption.

- Flexibility and Scalability: Businesses can easily scale their accounting software usage up or down based on their evolving needs without significant capital investment.

- Remote Work Trends: The surge in remote and hybrid work models necessitates accessible, cloud-based solutions for seamless financial operations.

The Small and Medium Enterprises (SMEs) segment represents the largest and fastest-growing customer base for accounting software. SMEs often have limited IT resources and budgets, making cloud-based, subscription-model accounting software a highly attractive and cost-effective solution. These businesses are increasingly recognizing the importance of efficient financial management for growth, compliance, and informed decision-making. The availability of feature-rich yet affordable accounting software tailored to SME needs has been a significant driver of adoption.

- Drivers for SME Segment Dominance:

- Affordability and Accessibility: Cloud-based subscription models make advanced accounting features accessible to smaller budgets.

- Ease of Use: Many accounting software solutions are designed with user-friendliness in mind, catering to users who may not have extensive accounting expertise.

- Regulatory Compliance: SMEs are increasingly seeking robust software to ensure compliance with complex tax laws and financial regulations.

- Focus on Core Business: By automating accounting tasks, SMEs can free up valuable time and resources to concentrate on their core business operations and strategic growth.

While Large Enterprises continue to be a significant market, especially for highly customized and integrated ERP-centric accounting solutions from vendors like SAP SE and Oracle Corporation, the sheer volume and growth rate of SMEs adopting cloud-based solutions give this segment a leading edge in terms of market expansion and innovation focus. The On-premise deployment type, while still present, is experiencing a gradual decline in market share as businesses transition to more agile and cost-effective cloud alternatives.

Accounting Software Industry Product Developments

Product development in the accounting software industry is heavily focused on enhancing automation, improving data analytics, and ensuring seamless integration. Recent innovations include the integration of AI and machine learning for intelligent data entry, automated reconciliation, and predictive financial forecasting. Enhancements in user interfaces are prioritizing intuitive navigation and customizable dashboards for better user experience. The incorporation of advanced security features, such as multi-factor authentication and robust data encryption, is paramount. Furthermore, the development of specialized modules for areas like payroll, expense management, and inventory control, alongside deep integrations with banking platforms and other business applications, are creating comprehensive financial management ecosystems. The increasing demand for sustainability reporting is also driving the development of features for carbon accounting and ESG metric tracking. These advancements are crucial for maintaining a competitive edge and meeting the evolving demands of businesses worldwide.

Challenges in the Accounting Software Industry Market

The accounting software industry faces several significant challenges that can impact market growth and profitability. High initial implementation costs and ongoing subscription fees can be a barrier for some smaller businesses, despite the long-term benefits. Cybersecurity threats and data privacy concerns remain a constant challenge, requiring continuous investment in robust security measures and compliance with data protection regulations like GDPR. Resistance to change and the steep learning curve associated with adopting new software can hinder adoption rates among certain user demographics. Integration complexities with existing legacy systems or other third-party applications can also pose a significant hurdle. Furthermore, intense competition and price wars among vendors can compress profit margins, particularly for providers of more commoditized solutions.

Forces Driving Accounting Software Industry Growth

Several key forces are propelling the growth of the accounting software industry. The accelerating digital transformation across all business sectors mandates efficient and automated financial management. Increasing regulatory compliance requirements globally are compelling businesses to adopt sophisticated software to ensure accuracy and avoid penalties. The growing trend of cloud adoption makes advanced accounting solutions more accessible and affordable, especially for SMEs. Technological advancements, such as AI and machine learning, are enabling powerful new features like predictive analytics and automated bookkeeping, enhancing efficiency and providing deeper business insights. The global economic expansion leads to an increase in the number of businesses requiring financial management tools.

Challenges in the Accounting Software Industry Market

Long-term growth catalysts in the accounting software industry are deeply intertwined with technological innovation and strategic market expansion. The continued evolution and integration of Artificial Intelligence (AI) and Machine Learning (ML) are key drivers, offering enhanced automation, predictive analytics, and fraud detection capabilities that will differentiate leading software solutions. The increasing global focus on sustainability and ESG (Environmental, Social, and Governance) reporting presents a significant opportunity for accounting software providers to develop and integrate specialized features, creating new revenue streams and meeting a critical business need. Strategic partnerships and acquisitions will continue to play a vital role in consolidating the market, expanding product portfolios, and gaining access to new customer segments or geographic regions. Furthermore, the growing demand for integrated business management solutions will push software providers to develop or partner for broader ERP-like functionalities, solidifying their position as essential business partners.

Emerging Opportunities in Accounting Software Industry

Emerging trends and opportunities in the accounting software industry are creating new avenues for growth and innovation. The growing demand for specialized accounting software for niche industries (e.g., healthcare, e-commerce, non-profits) presents a significant untapped market. The rise of the gig economy and freelance workforce necessitates more adaptable and user-friendly accounting solutions tailored for independent contractors and small service-based businesses. The increasing adoption of blockchain technology within accounting offers opportunities for enhanced transparency, security, and efficiency in transactions and auditing processes. Furthermore, the development of mobile-first accounting applications catering to on-the-go business owners and remote workers is another burgeoning opportunity. Finally, the push for data analytics and business intelligence within accounting software will continue to grow, offering insights that go beyond traditional financial reporting.

Leading Players in the Accounting Software Industry Sector

- Red Wing Software Inc

- Reckon Ltd

- Infor Inc

- Sage Software Inc

- Intuit Inc

- Epicor Software Corporation

- Unit4 Business Software Limited

- Microsoft Corporation

- Xero Ltd

- Saasu Pty Lt

- Oracle Corporation

- MYOB Group Pty Ltd

- SAP SE

- Zoho Corp

Key Milestones in Accounting Software Industry Industry

- June 2024: thinkPARALLAX has partnered with a prominent carbon accounting software, enhancing its sustainability offerings. This alliance unites two Certified B Corporations, showcasing the power of collaborative efforts in bolstering environmental initiatives. Being B Corps, both entities uphold stringent benchmarks in social and environmental responsibility, underscoring their commitment to transparency and performance.

- April 2024: FreshBooks is set to enhance its cloud-based accounting software for small businesses and accountants by integrating the latest features from Stripe Connect. This new feature, FreshBooks Payments, is slated for a summer release, empowering business owners to effortlessly process payments. Stefano Grossi, FreshBooks' Chief Technology and Product Officer, highlighted the company's commitment to providing an exceptional payment experience by being an early adopter of Stripe Connect's embedded components.

Strategic Outlook for Accounting Software Industry Market

The strategic outlook for the accounting software industry is one of continued robust growth and innovation. The market will be shaped by the increasing adoption of cloud-based solutions, driven by their scalability and cost-effectiveness, particularly for SMEs. Artificial intelligence and machine learning will become indispensable, automating complex tasks and providing deeper financial insights. Companies that can successfully integrate advanced analytics, offer seamless user experiences, and ensure top-tier cybersecurity will lead the market. Strategic partnerships and acquisitions will remain crucial for expanding market reach and technological capabilities. The growing demand for sustainability reporting and specialized industry solutions presents significant new opportunities. Ultimately, the focus will remain on empowering businesses with efficient, insightful, and secure financial management tools to foster growth and operational excellence.

Accounting Software Industry Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud-based

-

2. Organization Size

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

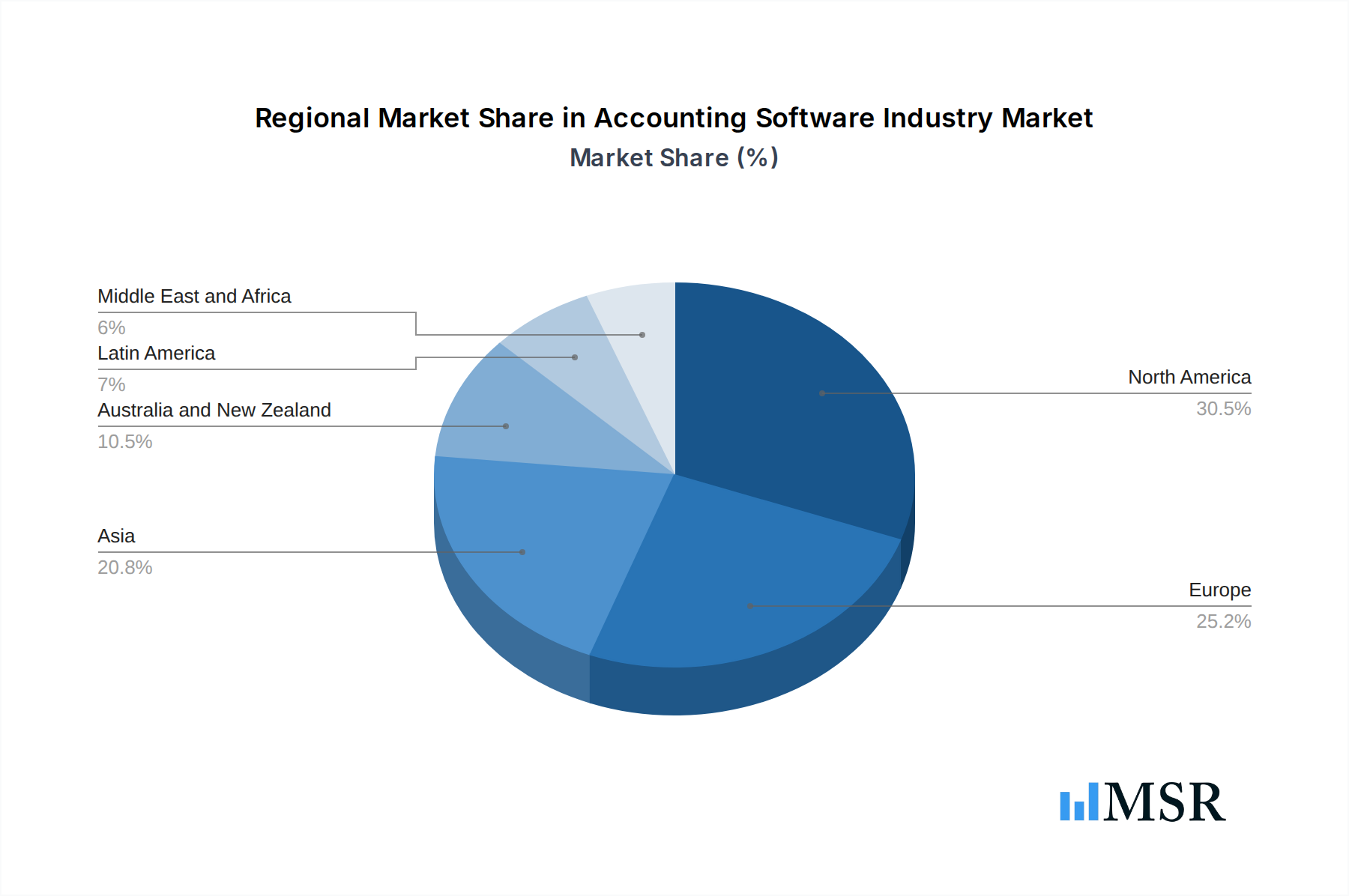

Accounting Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Accounting Software Industry Regional Market Share

Geographic Coverage of Accounting Software Industry

Accounting Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Accounting Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Increased Efficiency Offered by Accounting Software to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud-based

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-premise

- 6.1.2. Cloud-based

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-premise

- 7.1.2. Cloud-based

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-premise

- 8.1.2. Cloud-based

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Australia and New Zealand Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-premise

- 9.1.2. Cloud-based

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Latin America Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-premise

- 10.1.2. Cloud-based

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small and Medium Enterprises

- 10.2.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Middle East and Africa Accounting Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11.1.1. On-premise

- 11.1.2. Cloud-based

- 11.2. Market Analysis, Insights and Forecast - by Organization Size

- 11.2.1. Small and Medium Enterprises

- 11.2.2. Large Enterprises

- 11.1. Market Analysis, Insights and Forecast - by Deployment Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Red Wing Software Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Reckon Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Infor Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sage Software Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Intuit Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Epicor Software Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Unit4 Business Software Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Microsoft Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Xero Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Saasu Pty Lt

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Oracle Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 MYOB Group Pty Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 SAP SE

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Zoho Corp

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Red Wing Software Inc

List of Figures

- Figure 1: Global Accounting Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Accounting Software Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 3: North America Accounting Software Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 4: North America Accounting Software Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America Accounting Software Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Accounting Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Accounting Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Accounting Software Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 9: Europe Accounting Software Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 10: Europe Accounting Software Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 11: Europe Accounting Software Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 12: Europe Accounting Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Accounting Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Accounting Software Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 15: Asia Accounting Software Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 16: Asia Accounting Software Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 17: Asia Accounting Software Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 18: Asia Accounting Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Accounting Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Accounting Software Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 21: Australia and New Zealand Accounting Software Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 22: Australia and New Zealand Accounting Software Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 23: Australia and New Zealand Accounting Software Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 24: Australia and New Zealand Accounting Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Accounting Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Accounting Software Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 27: Latin America Accounting Software Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Latin America Accounting Software Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Latin America Accounting Software Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Latin America Accounting Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Accounting Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Accounting Software Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 33: Middle East and Africa Accounting Software Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 34: Middle East and Africa Accounting Software Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 35: Middle East and Africa Accounting Software Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 36: Middle East and Africa Accounting Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Accounting Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Accounting Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 5: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 6: Global Accounting Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 8: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: Global Accounting Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 11: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Global Accounting Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 15: Global Accounting Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 17: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 18: Global Accounting Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Accounting Software Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 20: Global Accounting Software Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 21: Global Accounting Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Accounting Software Industry?

The projected CAGR is approximately 9.20%.

2. Which companies are prominent players in the Accounting Software Industry?

Key companies in the market include Red Wing Software Inc, Reckon Ltd, Infor Inc, Sage Software Inc, Intuit Inc, Epicor Software Corporation, Unit4 Business Software Limited, Microsoft Corporation, Xero Ltd, Saasu Pty Lt, Oracle Corporation, MYOB Group Pty Ltd, SAP SE, Zoho Corp.

3. What are the main segments of the Accounting Software Industry?

The market segments include Deployment Type, Organization Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Accounting Automation.

6. What are the notable trends driving market growth?

Increased Efficiency Offered by Accounting Software to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

June 2024 - thinkPARALLAX has partnered with a prominent carbon accounting software, enhancing its sustainability offerings. This alliance unites two Certified B Corporations, showcasing the power of collaborative efforts in bolstering environmental initiatives. Being B Corps, both entities uphold stringent benchmarks in social and environmental responsibility, underscoring their commitment to transparency and performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Accounting Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Accounting Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Accounting Software Industry?

To stay informed about further developments, trends, and reports in the Accounting Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence