Key Insights

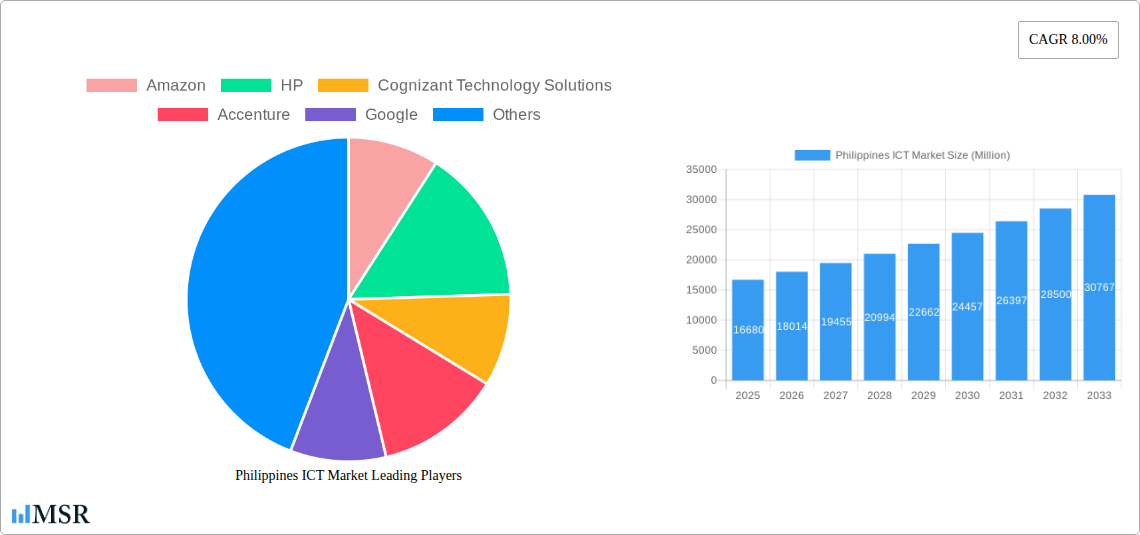

The Philippine Information and Communications Technology (ICT) market is poised for significant expansion, projected to reach an estimated USD 16.68 billion in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 8% during the forecast period. Key drivers for this upward trajectory include the increasing adoption of digital transformation initiatives across various industries, a surge in demand for cloud services, and the continuous expansion of telecommunication infrastructure, particularly in 5G deployment. The burgeoning internet penetration and the growing digital literacy among the population further contribute to a fertile ground for ICT services and solutions. The market is witnessing a strong push towards innovation, with a particular focus on advanced technologies like artificial intelligence, data analytics, and the Internet of Things (IoT), all of which are expected to revolutionize business operations and consumer experiences.

Philippines ICT Market Market Size (In Billion)

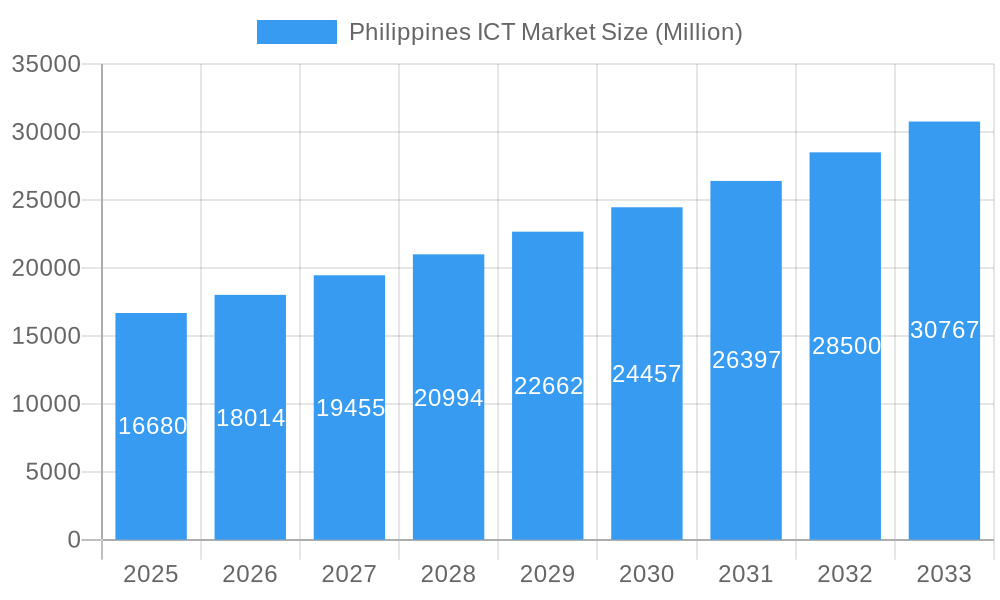

The market segmentation reveals a dynamic landscape. The "Hardware" segment is expected to maintain a strong presence, driven by the demand for advanced computing devices and network infrastructure. Simultaneously, "Software" and "IT Services" are experiencing rapid growth as businesses increasingly invest in digital solutions for enhanced efficiency, security, and customer engagement. "Telecommunication Services" will continue to be a cornerstone, underpinning the digital ecosystem with reliable connectivity. Small and Medium Enterprises (SMEs) are emerging as significant contributors to market growth, actively embracing digital tools to enhance their competitiveness. Furthermore, the increasing digitalization within sectors like BFSI, IT & Telecom, Government, and Retail & E-commerce underscores the pervasive influence of ICT across the Philippine economy. Leading global and local technology giants are actively participating in this market, offering a diverse range of solutions and services.

Philippines ICT Market Company Market Share

Unlock the potential of the Philippines' rapidly evolving Information and Communication Technology (ICT) sector with this in-depth market report. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market dynamics, growth drivers, emerging opportunities, and the competitive landscape. Essential for industry stakeholders, investors, and policymakers, this analysis leverages high-ranking keywords to ensure maximum search visibility and deliver actionable intelligence. The report delves into the intricacies of hardware, software, IT services, and telecommunication services, analyzing their impact on Small and Medium Enterprises (SMEs) and Large Enterprises across key verticals like BFSI, IT & Telecom, Government, Retail & E-commerce, Manufacturing, and Energy & Utilities.

Philippines ICT Market Market Concentration & Dynamics

The Philippines ICT market exhibits a dynamic and evolving concentration, characterized by significant innovation ecosystems and a rapidly developing regulatory framework. The market is driven by increasing digital adoption across all enterprise sizes, from Small and Medium Enterprises (SMEs) to Large Enterprises, fueling demand for advanced IT services and robust telecommunication services. End-user trends point towards a strong preference for cloud-based solutions, cybersecurity, and digital transformation initiatives within sectors such as BFSI, IT & Telecom, and Retail & E-commerce. Hardware and software segments are experiencing steady growth, bolstered by investments in digital infrastructure. Mergers and acquisitions (M&A) activities, while not at extreme levels, are strategic, focusing on consolidating market share and expanding service portfolios. For instance, significant tower deals involving Globe Telecom, such as the USD 340 million agreement with a Macquarie Group unit and the USD 472.2 million acquisition by Stonepeak, highlight the intense activity within the telecommunications infrastructure segment, indicating a move towards greater efficiency and investment in network expansion. The overall market share is distributed among key players, with a healthy competitive environment fostering innovation. The regulatory landscape, though evolving, is becoming more conducive to foreign investment and technological advancements, further shaping market concentration.

- Key Market Drivers: Digital transformation initiatives, increasing internet penetration, government digitalization programs, growing startup ecosystem.

- M&A Activities: Focus on telecommunications infrastructure, cloud service providers, and cybersecurity firms.

- Innovation Ecosystem: Thriving startup scene in Metro Manila, growing R&D investments by established players like Microsoft Corporation and Google.

- Regulatory Framework: Evolving policies to support digital economy growth, cybersecurity mandates, data privacy laws.

- Substitute Products: Cloud-based solutions offer alternatives to on-premise infrastructure, impacting traditional hardware sales.

Philippines ICT Market Industry Insights & Trends

The Philippines ICT market is poised for substantial expansion, projected to reach an estimated market size of over $XX billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust growth is underpinned by a confluence of factors, including the accelerated adoption of digital technologies driven by the COVID-19 pandemic, significant investments in telecommunication services, and a burgeoning demand for IT services across various industry verticals. The hardware segment is experiencing a resurgence with the demand for upgraded computing devices and network infrastructure, while the software market is witnessing a boom in cloud-based solutions, artificial intelligence (AI), and data analytics.

Key growth drivers include the Philippine government's aggressive push towards digitalization, aiming to transform public services and foster a more competitive business environment. Initiatives like the National Broadband Program and the e-government master plan are creating substantial opportunities for ICT providers. The BFSI sector is leading the charge in digital transformation, with banks and financial institutions investing heavily in fintech solutions, mobile banking, and enhanced cybersecurity measures to meet evolving customer expectations. The IT & Telecom sector itself remains a primary consumer of ICT solutions, driving innovation and deployment of next-generation networks. The Retail and E-commerce segment is also a significant contributor to market growth, fueled by the increasing adoption of online shopping and the need for robust e-commerce platforms and supply chain management software.

Technological disruptions, such as the widespread deployment of 5G technology by operators like Globe Telecom and the increasing integration of AI and machine learning across business processes, are reshaping the competitive landscape. The growing emphasis on data analytics is enabling businesses to gain deeper insights into consumer behavior, leading to personalized marketing strategies and optimized operational efficiency. End-user behaviors are shifting towards greater reliance on digital channels for communication, transactions, and information access, creating a fertile ground for innovative ICT solutions. The increasing prevalence of remote work models has further amplified the demand for collaboration tools, cloud infrastructure, and robust cybersecurity solutions. Companies like Amazon, HP, Cognizant Technology Solutions, Accenture, Cisco Systems, Huawei Technologies, Oracle, IBM, and Dell Technologies are key players actively contributing to and benefiting from these industry trends through their comprehensive product and service offerings. The historical period from 2019–2024 has laid a strong foundation, with continuous innovation and investment setting the stage for sustained growth in the coming decade.

Key Markets & Segments Leading Philippines ICT Market

The Philippines ICT market is characterized by strong performance across several key segments, with IT Services and Telecommunication Services emerging as the dominant forces driving overall market growth. These segments are crucial for enabling the digital transformation journey of businesses across all scales, from Small and Medium Enterprises (SMEs) to Large Enterprises. The increasing demand for cloud computing, cybersecurity, data analytics, and digital transformation consulting fuels the IT Services segment, with global giants like Accenture, Cognizant Technology Solutions, and IBM playing a significant role. Concurrently, the continuous expansion and upgrade of telecommunications infrastructure, particularly the rollout of 5G technology by major players like Globe Telecom and the ongoing investments in broadband connectivity, are propelling the Telecommunication Services segment.

Within the Type segmentation, Hardware and Software also contribute significantly, with companies like HP, Dell Technologies, Microsoft Corporation, and Oracle providing essential digital building blocks. The demand for advanced computing devices, networking equipment, and enterprise software solutions remains high as businesses seek to enhance their operational efficiency and competitive edge.

Regarding Size of Enterprise, both SMEs and Large Enterprises are pivotal. While Large Enterprises are undertaking large-scale digital transformation projects, the rapid growth of the SME sector, coupled with government initiatives to support them, presents a substantial and expanding market for scalable and affordable ICT solutions. SMEs are increasingly leveraging cloud-based services and outsourced IT support to compete effectively.

The Industry Vertical analysis reveals that IT & Telecom itself is a major consumer of ICT solutions, driving innovation and adoption. Following closely is the BFSI sector, which is heavily investing in digital banking, fintech solutions, and robust cybersecurity to enhance customer experience and operational resilience. The Government sector is also a significant driver, with ongoing digitalization efforts for public services and smart city initiatives. The Retail and E-commerce sector is witnessing rapid growth, driven by the surge in online transactions and the need for efficient supply chain management and customer engagement platforms. Manufacturing and Energy and Utilities are also increasingly adopting ICT solutions for automation, IoT integration, and data-driven decision-making, aiming to improve productivity and sustainability.

- Dominance of IT Services: Driven by cloud adoption, cybersecurity needs, and digital transformation initiatives across all industry verticals.

- Growth in Telecommunication Services: Fueled by 5G network expansion, increased broadband penetration, and demand for reliable connectivity.

- SME Adoption: Growing reliance on cloud-based solutions and cost-effective IT services for competitive advantage.

- BFSI Transformation: Leading adoption of fintech, AI, and robust security measures to enhance customer experience.

- E-commerce Boom: Driving demand for integrated platforms, logistics software, and digital payment solutions.

Philippines ICT Market Product Developments

The Philippines ICT market is a hotbed of product innovation, with companies continuously launching advanced solutions to meet evolving market demands. Key developments include the rollout of next-generation hardware components, such as high-performance servers and networking equipment from Dell Technologies and Cisco Systems, enabling more robust data processing and connectivity. In the software domain, advancements in cloud computing platforms by Amazon Web Services (AWS) and Microsoft Corporation are offering scalable and flexible solutions for businesses. The proliferation of AI-powered analytics tools and automation software by companies like Oracle and IBM is enhancing business intelligence and operational efficiency. Furthermore, Huawei Technologies is at the forefront of developing advanced telecommunications infrastructure, including 5G base stations, which are critical for the expansion of high-speed mobile internet. The market is also witnessing a surge in specialized IT services, focusing on cybersecurity, data management, and IoT integration, with Accenture and Cognizant Technology Solutions offering cutting-edge solutions tailored to local industry needs. These product developments are not only enhancing existing capabilities but also paving the way for new digital paradigms within the Philippine economy.

Challenges in the Philippines ICT Market Market

Despite robust growth, the Philippines ICT market faces several challenges that can impede its full potential. Regulatory hurdles, including inconsistent policies and lengthy approval processes for new technologies and investments, can slow down innovation and market entry. The digital divide, with disparities in internet access and digital literacy across different regions and demographics, remains a significant barrier to widespread adoption of ICT services. Supply chain disruptions, particularly for hardware components, can lead to increased costs and delivery delays, impacting project timelines. Moreover, intense competitive pressures among global and local players can lead to price wars and reduced profit margins, especially in commoditized segments. The shortage of skilled ICT professionals, particularly in specialized areas like cybersecurity and AI, also poses a constraint on the industry's ability to meet the growing demand for advanced services.

Forces Driving Philippines ICT Market Growth

The growth of the Philippines ICT market is propelled by several interconnected forces. The strong government commitment to digitalization, evidenced by initiatives like the National Broadband Program and the push for e-governance, creates a conducive environment for ICT investment and adoption. Increasing foreign direct investment in the technology sector, attracted by the country's growing digital economy and skilled workforce, further fuels expansion. The rapidly growing young, tech-savvy population is a key driver of demand for digital services, from e-commerce and online entertainment to mobile applications and fintech solutions. Furthermore, the continuous advancements in global ICT trends, such as cloud computing, AI, 5G technology, and the Internet of Things (IoT), are being rapidly adopted and localized, pushing the boundaries of what is possible in the Philippine market. The strategic importance of the IT and Business Process Management (BPM) sector to the Philippine economy also ensures sustained focus and investment in ICT infrastructure and services.

Challenges in the Philippines ICT Market Market

Long-term growth catalysts in the Philippines ICT market are deeply rooted in its inherent potential for innovation and strategic market expansion. The ongoing digital transformation across various sectors, particularly BFSI and Retail, continues to drive demand for advanced IT services and software solutions. Investments in 5G infrastructure by leading telecommunication companies are not only enhancing connectivity but also creating a foundation for emerging technologies like the Internet of Things (IoT) and edge computing. The government's commitment to digital infrastructure development and cybersecurity frameworks will foster a more secure and efficient digital ecosystem. Furthermore, the Philippines' strategic location and its large, English-speaking, and skilled workforce present significant opportunities for global tech companies to establish R&D centers and offshore operations. Partnerships between local and international ICT firms will continue to accelerate technology transfer and market penetration, ensuring sustained growth.

Emerging Opportunities in Philippines ICT Market

Emerging opportunities in the Philippines ICT market are diverse and promising, driven by evolving consumer preferences and technological advancements. The burgeoning FinTech landscape presents a significant avenue for growth, with increasing adoption of digital payments, mobile banking, and insurtech solutions, catering to both banked and unbanked populations. The rapid expansion of e-commerce continues to create demand for sophisticated supply chain management software, logistics technology, and personalized customer engagement platforms. The growing focus on sustainability and smart cities presents opportunities for ICT solutions in areas like smart grids, efficient resource management, and intelligent transportation systems. The increasing adoption of remote and hybrid work models is also driving demand for advanced collaboration tools, cloud-based infrastructure, and enhanced cybersecurity services. Furthermore, the government's push for digital transformation in education and healthcare offers substantial potential for edtech and healthtech innovations.

Leading Players in the Philippines ICT Market Sector

- Amazon

- HP

- Cognizant Technology Solutions

- Accenture

- Microsoft Corporation

- Globe Telecom

- Cisco Systems

- Huawei Technologies

- Oracle

- IBM

- Dell Technologies

Key Milestones in Philippines ICT Market Industry

- September 2022: Globe Telecom and Singapore Telecommunication agreed to sell 1,350 cellular towers to a consortium backed by a unit of Australia's Macquarie Group for USD 340 million, significantly impacting telecommunications infrastructure consolidation.

- October 2022: Globe Telecom deployed 252 5G-ready base stations in Mindanao, signaling ongoing network expansion and creating growth opportunities for related services and devices.

- August 2022: Stonepeak signed definitive agreements to acquire 2,180 telecom towers and related passive infrastructure from Globe Telecom Inc. for approximately USD 472.2 million, underscoring strategic investments in telecommunications infrastructure and regional expansion.

Strategic Outlook for Philippines ICT Market Market

The strategic outlook for the Philippines ICT market is exceptionally positive, with continued robust growth anticipated. Key accelerators include the sustained drive towards digital transformation across all enterprise verticals, spurred by global competitive pressures and evolving consumer demands. Investments in advanced telecommunication services, particularly the nationwide expansion of 5G networks, will unlock new possibilities for IoT, AI, and edge computing applications. The government's commitment to digital infrastructure development, including broadband expansion and cybersecurity enhancements, will further solidify the market's foundation. Strategic partnerships between local and international ICT players will foster innovation, facilitate technology transfer, and expand market reach. The increasing adoption of cloud computing, data analytics, and automation technologies by businesses of all sizes presents significant revenue opportunities for IT services and software providers. The Philippines' inherent advantages, such as a young, skilled, and English-speaking workforce, continue to attract foreign investment, positioning the country as a key hub for ICT innovation and service delivery in the Asia-Pacific region.

Philippines ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT & Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Philippines ICT Market Segmentation By Geography

- 1. Philippines

Philippines ICT Market Regional Market Share

Geographic Coverage of Philippines ICT Market

Philippines ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Rising Need to Explore and Adopt Digital technologies and Initiatives

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness and Security Concerns

- 3.4. Market Trends

- 3.4.1. Growing demand for Cloud Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines ICT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT & Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cognizant Technology Solutions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Accenture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Microsoft Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Globe Telecom

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IBM

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dell Technologies

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Philippines ICT Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Philippines ICT Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines ICT Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Philippines ICT Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Philippines ICT Market Revenue undefined Forecast, by Size of Enterprise 2020 & 2033

- Table 4: Philippines ICT Market Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 5: Philippines ICT Market Revenue undefined Forecast, by Industry Vertical 2020 & 2033

- Table 6: Philippines ICT Market Volume K Unit Forecast, by Industry Vertical 2020 & 2033

- Table 7: Philippines ICT Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Philippines ICT Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Philippines ICT Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Philippines ICT Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Philippines ICT Market Revenue undefined Forecast, by Size of Enterprise 2020 & 2033

- Table 12: Philippines ICT Market Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 13: Philippines ICT Market Revenue undefined Forecast, by Industry Vertical 2020 & 2033

- Table 14: Philippines ICT Market Volume K Unit Forecast, by Industry Vertical 2020 & 2033

- Table 15: Philippines ICT Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Philippines ICT Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines ICT Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Philippines ICT Market?

Key companies in the market include Amazon, HP, Cognizant Technology Solutions, Accenture, Google, Microsoft Corporation, Globe Telecom, Cisco Systems, Huawei Technologies, Oracle, IBM, Dell Technologies.

3. What are the main segments of the Philippines ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Rising Need to Explore and Adopt Digital technologies and Initiatives.

6. What are the notable trends driving market growth?

Growing demand for Cloud Technology.

7. Are there any restraints impacting market growth?

Lack of Awareness and Security Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: Globe Telecom and Singapore Telecommunication agreed to sell 1,350 cellular towers to a consortium backed by a unit of Australia's Macquarie Group for USD 340 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines ICT Market?

To stay informed about further developments, trends, and reports in the Philippines ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence