Key Insights

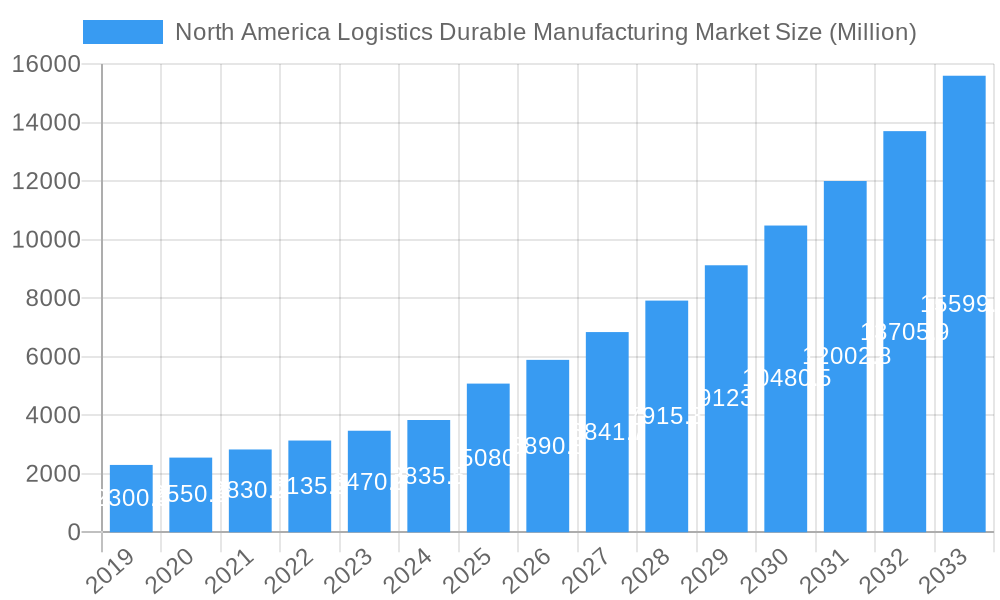

The North America Logistics Durable Manufacturing Market is poised for significant expansion, projected to reach an estimated $5.08 Billion by 2025, driven by a robust compound annual growth rate (CAGR) of 16.01% from 2019 to 2033. This impressive growth trajectory is primarily fueled by the increasing demand for automation and efficiency within durable manufacturing sectors, including automotive, aerospace, and heavy machinery. Key drivers include the relentless pursuit of operational excellence, the need to reduce lead times, and the adoption of advanced technologies like robotics, AI-powered software, and intelligent conveyor systems. The shift towards Industry 4.0 principles necessitates sophisticated logistics solutions to manage complex supply chains, optimize inventory, and ensure timely delivery of finished goods. Furthermore, government initiatives promoting reshoring and advanced manufacturing are expected to bolster domestic production and, consequently, the demand for cutting-edge logistics infrastructure. The market's expansion will be further accelerated by significant investments in smart warehousing, automated guided vehicles (AGVs), and sophisticated sortation systems, all aimed at enhancing productivity and cost-effectiveness in the durable goods supply chain.

North America Logistics Durable Manufacturing Market Market Size (In Billion)

This dynamic market is characterized by a strong emphasis on integrated solutions, encompassing both hardware and software components. Hardware segments, particularly automated conveying and palletizing systems, are witnessing substantial adoption, enabling seamless material flow within manufacturing facilities. Software solutions, including Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), are becoming indispensable for optimizing operations, providing real-time visibility, and enabling data-driven decision-making. While the market benefits from strong growth drivers, it also faces certain restraints, such as the high initial investment costs for advanced automation and the need for skilled labor to operate and maintain these sophisticated systems. However, the long-term benefits of increased efficiency, reduced operational costs, and enhanced competitiveness are compelling manufacturers to overcome these challenges. The North American region, with its advanced industrial base and strong adoption of technology, is expected to remain a dominant force in this evolving market landscape.

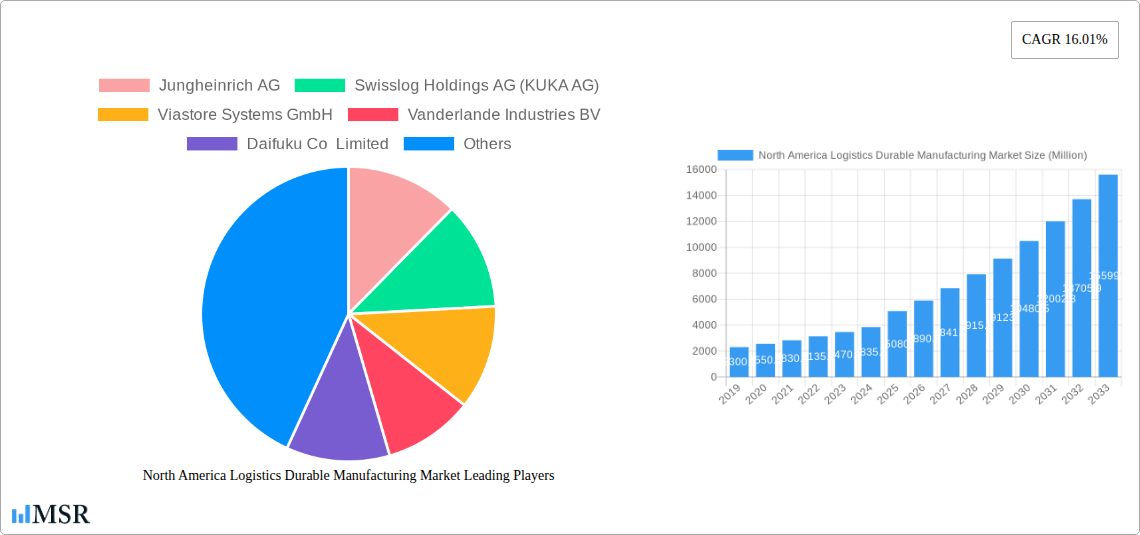

North America Logistics Durable Manufacturing Market Company Market Share

North America Logistics Durable Manufacturing Market Report 2025-2033: Unlocking Efficiency and Scalability

Unlock unparalleled insights into the North America Logistics Durable Manufacturing Market with this comprehensive report. Covering the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis is your definitive guide to navigating the evolving landscape of automated logistics solutions for durable goods manufacturing. We delve into market size, CAGR, key players, emerging trends, and strategic opportunities, empowering industry stakeholders to make informed decisions.

North America Logistics Durable Manufacturing Market Market Concentration & Dynamics

The North America Logistics Durable Manufacturing Market is characterized by a moderate to high level of concentration, with a few key players dominating the landscape. Major companies like Jungheinrich AG, Swisslog Holdings AG (KUKA AG), Viastore Systems GmbH, Vanderlande Industries BV, Daifuku Co Limited, Murata Machinery Limited, Witron Logistik, TGW Logistics Group GmbH, Kardex Group, Kion Group AG (including Dematic), Honeywell Intranalized, Beumer Group GMBH & CO KG, SSI SCHAEFER AG, and Mecalux SA are at the forefront of innovation and market penetration. These companies exhibit a strong focus on research and development, continuously introducing advanced automation hardware, intelligent software, and integrated solutions designed to enhance efficiency, reduce operational costs, and improve overall supply chain performance for durable goods manufacturers.

The innovation ecosystem is vibrant, fueled by strategic partnerships, significant R&D investments, and a keen understanding of end-user demands. Regulatory frameworks, while generally supportive of automation for safety and efficiency, can vary, necessitating careful navigation. Substitute products, such as manual labor or less sophisticated automation, are steadily being phased out as the ROI for advanced logistics solutions becomes increasingly evident. End-user trends are heavily influenced by the demand for faster order fulfillment, improved inventory management, and greater supply chain resilience. Mergers and acquisitions (M&A) activities are a significant indicator of market dynamics, with companies strategically acquiring complementary technologies or expanding their geographical reach. For instance, recent M&A activities and strategic alliances highlight the ongoing consolidation and expansion efforts within the sector. The market share distribution among top players is dynamic, with continuous efforts to capture a larger segment through product differentiation and comprehensive service offerings.

North America Logistics Durable Manufacturing Market Industry Insights & Trends

The North America Logistics Durable Manufacturing Market is experiencing robust growth, driven by an insatiable demand for enhanced operational efficiency and scalability within the durable goods manufacturing sector. The projected market size for the base year of 2025 stands at approximately XX Million USD, with a significant Compound Annual Growth Rate (CAGR) of XX% anticipated during the forecast period of 2025–2033. This expansion is underpinned by several critical growth drivers. The increasing complexity of supply chains, coupled with the need for rapid order fulfillment in industries like general merchandise, apparel, and food and beverages, necessitates sophisticated automation. Durable goods manufacturers are increasingly investing in automated solutions to optimize warehousing, material handling, and internal logistics, thereby reducing labor costs, minimizing errors, and improving throughput.

Technological disruptions are playing a pivotal role. The integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) is transforming traditional logistics operations into intelligent, self-optimizing systems. Advanced robotics, including Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs), are revolutionizing warehouse operations by providing flexible and scalable automation. Conveyor systems, including belt, roller, pallet, and overhead configurations, are becoming more intelligent and integrated, facilitating seamless material flow. Sortation systems are achieving higher speeds and accuracy, crucial for high-volume operations. Furthermore, the proliferation of data analytics is enabling manufacturers to gain deeper insights into their logistics operations, leading to predictive maintenance, optimized inventory levels, and improved decision-making.

Evolving consumer behaviors, characterized by a preference for faster delivery times and a wider selection of products, are compelling manufacturers to re-evaluate and upgrade their logistics infrastructure. The surge in e-commerce has further amplified these demands, pushing the need for highly efficient and responsive fulfillment centers. The manufacturing industry itself, encompassing both durable and non-durable goods, is a significant end-user, seeking to streamline its internal logistics to reduce lead times and enhance production efficiency. The ongoing digital transformation across all sectors is accelerating the adoption of smart logistics solutions. Industry-specific solutions, such as those tailored for food and beverages with stringent temperature control requirements, or for post & parcel with high-speed sorting needs, are also contributing to market expansion. The increasing emphasis on sustainability is also influencing the adoption of energy-efficient automation technologies.

Key Markets & Segments Leading North America Logistics Durable Manufacturing Market

The North America Logistics Durable Manufacturing Market is segmented by Solution Type, Industry, and geographical region. Within the Solution Type segment, Hardware solutions are currently leading the market, driven by substantial investments in physical automation infrastructure. This includes:

- Mobile Robotics (AMRs/AGVs): Experiencing rapid adoption due to their flexibility, scalability, and ability to navigate dynamic environments, crucial for optimizing warehouse operations and internal material movement.

- Automated Storage and Retrieval Systems (AS/RS): Essential for high-density storage and efficient order picking, particularly in industries with large SKUs and high inventory volumes.

- Conveyor Systems: Including belt, roller, pallet, and overhead conveyors, these remain fundamental for continuous material flow and inter-process transportation.

- Palletizing and Depalletizing Systems: Critical for automating the handling of bulk goods, reducing manual labor and improving efficiency in loading and unloading.

- Sortation Systems: High-speed and accurate sortation is vital for e-commerce fulfillment, postal services, and distribution centers, driving demand for advanced solutions.

Software solutions, while a smaller segment currently, are poised for significant growth as they become increasingly integrated with hardware to enable intelligent automation. This includes Warehouse Management Systems (WMS), Warehouse Execution Systems (WES), and Transportation Management Systems (TMS). Other Solutions, such as specialized Transportation Management Solutions and various custom-built logistics applications, also contribute to the market's diversity.

In terms of Industry, the Manufacturing (Durable and Non-Durable) sector itself is a primary driver, seeking to optimize its internal logistics. However, other industries are also significantly contributing to the market's leadership:

- General Merchandise: Driven by the need for efficient inventory management and rapid order fulfillment for a vast array of products.

- Apparel: Experiencing increased automation demands due to e-commerce growth and the need for efficient picking and sorting of a wide variety of SKUs.

- Food and Beverages: Requires specialized, often temperature-controlled, automated solutions for efficient storage, handling, and distribution.

- Groceries: The rise of online grocery shopping is a major catalyst for automation in this sector, demanding high-speed picking and last-mile delivery solutions.

- Post & Parcel: This industry is a massive adopter of high-speed sortation and automated material handling solutions due to the sheer volume of shipments.

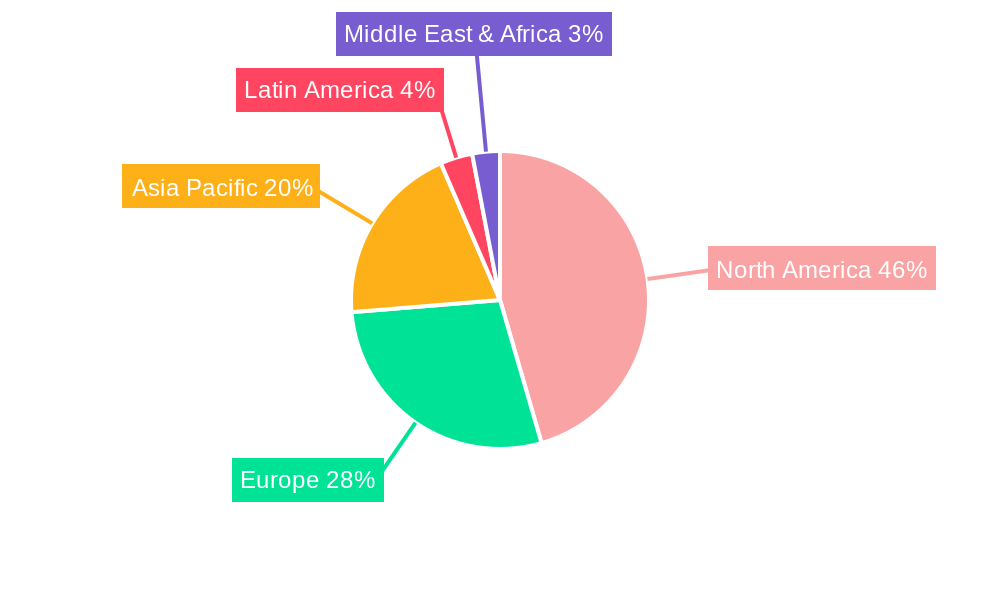

Geographically, North America as a whole represents a dominant market, with the United States being the primary growth engine. Factors driving dominance include a strong manufacturing base, advanced technological adoption, significant e-commerce penetration, and substantial investment in supply chain optimization. Economic growth, robust infrastructure, and a favorable regulatory environment for automation further bolster the market's leadership. The concentration of major retail and manufacturing hubs in the US, coupled with a proactive approach to adopting cutting-edge logistics technologies, positions it as a key market for durable manufacturing logistics solutions. The continuous evolution of e-commerce and omnichannel retail strategies further amplifies the demand for agile and efficient logistics.

North America Logistics Durable Manufacturing Market Product Developments

Product developments in the North America Logistics Durable Manufacturing Market are characterized by a strong emphasis on enhancing automation capabilities, intelligence, and integration. Companies are continuously innovating to offer more agile and efficient hardware solutions, such as advanced robotic systems capable of handling a wider range of materials and operating in more complex environments. Software advancements are focused on AI-powered optimization, real-time data analytics, and seamless integration across the entire supply chain. The development of modular and scalable automation systems allows manufacturers to adapt their logistics infrastructure to changing demands. Innovations in conveyor technology, particularly in smart and self-optimizing systems, and highly precise sortation mechanisms are also notable. These product developments aim to reduce operational costs, increase throughput, improve accuracy, and enhance overall supply chain resilience for durable goods manufacturers.

Challenges in the North America Logistics Durable Manufacturing Market Market

The North America Logistics Durable Manufacturing Market faces several challenges. High initial investment costs for advanced automation systems can be a significant barrier for smaller and medium-sized enterprises (SMEs). Integration complexities with existing legacy systems and the need for skilled labor to operate and maintain sophisticated equipment pose further hurdles. Supply chain disruptions, as evidenced in recent years, can impact the availability of automation components and the timely execution of projects. Regulatory compliance, particularly concerning safety standards for automated operations, requires careful attention and adherence. Finally, resistance to change from workforce and a lack of adequately trained personnel can slow down adoption rates. Quantifiable impacts include extended ROI periods for initial investments and potential operational inefficiencies if integration is not seamless.

Forces Driving North America Logistics Durable Manufacturing Market Growth

Several forces are propelling the North America Logistics Durable Manufacturing Market forward. The exponential growth of e-commerce and omnichannel retail is a primary driver, necessitating faster, more accurate, and scalable fulfillment operations. The increasing demand for supply chain efficiency and cost reduction compels manufacturers to adopt automation to minimize labor expenses, reduce errors, and optimize inventory management. Technological advancements in robotics, AI, and IoT are making sophisticated automation solutions more accessible and effective. A growing emphasis on improving worker safety and ergonomics in warehouses and manufacturing facilities further encourages automation. Globalization and the need for competitive advantage in a dynamic market also push companies towards advanced logistics solutions.

Challenges in the North America Logistics Durable Manufacturing Market Market

Long-term growth catalysts in the North America Logistics Durable Manufacturing Market are rooted in continuous innovation and strategic market expansion. The increasing sophistication of AI and ML algorithms will unlock new levels of predictive analytics, route optimization, and autonomous decision-making within logistics. The development of more collaborative robotics (cobots) that can work seamlessly alongside human workers will enhance flexibility and efficiency. The ongoing trend towards sustainability and the circular economy will drive demand for logistics solutions that minimize waste and energy consumption. Strategic partnerships and collaborations between technology providers and end-users will foster tailored solutions and accelerate adoption. Market expansion into emerging niches and industries that are currently underserved by advanced automation will present significant growth opportunities.

Emerging Opportunities in North America Logistics Durable Manufacturing Market

Emerging opportunities in the North America Logistics Durable Manufacturing Market are ripe for exploration. The integration of augmented reality (AR) and virtual reality (VR) for training, maintenance, and order picking presents a significant advancement. The growth of micro-fulfillment centers in urban areas, powered by compact and highly automated systems, addresses the demand for faster last-mile delivery. The increasing focus on resilient supply chains due to global uncertainties creates opportunities for flexible and adaptable automation solutions. The adoption of automation in traditionally labor-intensive sectors like agriculture and construction, for logistics and material handling, opens new avenues. Furthermore, the development of sustainable and energy-efficient automation technologies aligns with global environmental goals and presents a compelling value proposition.

Leading Players in the North America Logistics Durable Manufacturing Market Sector

- Jungheinrich AG

- Swisslog Holdings AG (KUKA AG)

- Viastore Systems GmbH

- Vanderlande Industries BV

- Daifuku Co Limited

- Murata Machinery Limited

- Witron Logistik

- TGW Logistics Group GmbH

- Kardex Group

- Kion Group AG (including Dematic)

- Honeywell Intranalized

- Beumer Group GMBH & CO KG

- SSI SCHAEFER AG

- Mecalux SA

Key Milestones in North America Logistics Durable Manufacturing Market Industry

- February 2021: Kardex Group signed a global partnership agreement with AutoStore AS, enhancing its offering with high-performance, space-saving storage and picking solutions utilizing autonomous robots for rapid small-parts order processing. This partnership allows Kardex to sell, project-manage, and install AutoStore solutions worldwide.

- February 2021: Urban Outfitters, Inc., a prominent lifestyle products and services company, partnered with TGW to design and implement an automation solution for their new fulfillment center in Kansas City, US. The TGW FlashPick system is central to this solution, enabling fully automated order picking and streamlining subsequent processes, demonstrating the ability of such partnerships to scale business operations.

Strategic Outlook for North America Logistics Durable Manufacturing Market Market

The strategic outlook for the North America Logistics Durable Manufacturing Market is overwhelmingly positive, driven by an intensified focus on operational excellence and digital transformation. Key growth accelerators include the continued advancement and adoption of AI-driven logistics platforms, enabling predictive analytics and dynamic resource allocation. The integration of IoT devices will provide real-time visibility across the entire supply chain, facilitating proactive management and enhanced decision-making. Further development and deployment of sophisticated robotic systems, including swarms of collaborative robots, will unlock new levels of efficiency and flexibility. Strategic partnerships, industry-specific automation solutions tailored for sectors like food and beverage and e-commerce, and an increasing emphasis on sustainable logistics practices will shape future market potential. Companies that invest in R&D for intelligent automation and embrace agile deployment strategies will be best positioned for sustained growth and market leadership.

North America Logistics Durable Manufacturing Market Segmentation

-

1. Solution Type

-

1.1. Hardware

- 1.1.1. Mobile R

- 1.1.2. Automate

- 1.1.3. Conveyor (Belt, Roller, Pallet and Overhead)

- 1.1.4. Palletiz

- 1.1.5. Sortation System

- 1.2. Software

-

1.3. Other Solutions

- 1.3.1. Transportation Management Solutions

- 1.3.2. Others (

-

1.1. Hardware

-

2. Industry

- 2.1. General Merchandise

- 2.2. Apparel

- 2.3. Food and Beverages

- 2.4. Groceries

- 2.5. Post & Parcel

- 2.6. Manufacturing (Durable and Non-Durable)

- 2.7. Other Industries

North America Logistics Durable Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Logistics Durable Manufacturing Market Regional Market Share

Geographic Coverage of North America Logistics Durable Manufacturing Market

North America Logistics Durable Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased E-commerce Activity

- 3.3. Market Restrains

- 3.3.1. Growing Production Costs and Vendor Consolidation Cited as the Key Reasons for Slow Growth Forecast; Given that the Market is on the Verge of Reaching Maturity

- 3.4. Market Trends

- 3.4.1 Among Hardware

- 3.4.2 Sortation System is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Logistics Durable Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Hardware

- 5.1.1.1. Mobile R

- 5.1.1.2. Automate

- 5.1.1.3. Conveyor (Belt, Roller, Pallet and Overhead)

- 5.1.1.4. Palletiz

- 5.1.1.5. Sortation System

- 5.1.2. Software

- 5.1.3. Other Solutions

- 5.1.3.1. Transportation Management Solutions

- 5.1.3.2. Others (

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. General Merchandise

- 5.2.2. Apparel

- 5.2.3. Food and Beverages

- 5.2.4. Groceries

- 5.2.5. Post & Parcel

- 5.2.6. Manufacturing (Durable and Non-Durable)

- 5.2.7. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jungheinrich AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Swisslog Holdings AG (KUKA AG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Viastore Systems GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vanderlande Industries BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daifuku Co Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Murata Machinery Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Witron Logistik

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TGW Logistics Group GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kardex Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kion Group AG (including Dematic)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Honeywell Intelligrated

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Beumer Group GMBH & Co KG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SSI SCHAEFER AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mecalux SA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Jungheinrich AG

List of Figures

- Figure 1: North America Logistics Durable Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Logistics Durable Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Logistics Durable Manufacturing Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: North America Logistics Durable Manufacturing Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: North America Logistics Durable Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Logistics Durable Manufacturing Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 5: North America Logistics Durable Manufacturing Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: North America Logistics Durable Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Logistics Durable Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Logistics Durable Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Logistics Durable Manufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Logistics Durable Manufacturing Market?

The projected CAGR is approximately 16.01%.

2. Which companies are prominent players in the North America Logistics Durable Manufacturing Market?

Key companies in the market include Jungheinrich AG, Swisslog Holdings AG (KUKA AG), Viastore Systems GmbH, Vanderlande Industries BV, Daifuku Co Limited, Murata Machinery Limited, Witron Logistik, TGW Logistics Group GmbH, Kardex Group, Kion Group AG (including Dematic), Honeywell Intelligrated, Beumer Group GMBH & Co KG, SSI SCHAEFER AG, Mecalux SA.

3. What are the main segments of the North America Logistics Durable Manufacturing Market?

The market segments include Solution Type, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased E-commerce Activity.

6. What are the notable trends driving market growth?

Among Hardware. Sortation System is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Growing Production Costs and Vendor Consolidation Cited as the Key Reasons for Slow Growth Forecast; Given that the Market is on the Verge of Reaching Maturity.

8. Can you provide examples of recent developments in the market?

February 2021 - Kardex Group signed up for a global partnership agreement with Autostore AS which is a high-performance and space-saving storage and picking solution for the rapid processing of small parts orders with the help of autonomous robots. As a global partner of AutoStore and Kardex will in the future sell, project-manage, and install AutoStore solutions worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Logistics Durable Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Logistics Durable Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Logistics Durable Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Logistics Durable Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence