Key Insights

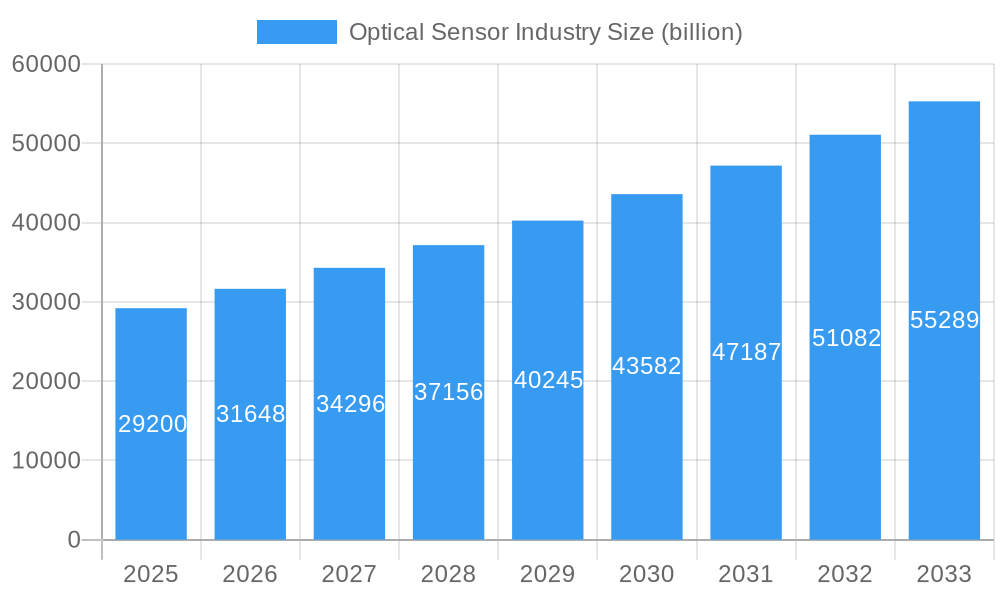

The global Optical Sensor market is poised for significant expansion, projected to reach $29.2 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 8.3% over the forecast period. This impressive growth trajectory is fueled by the increasing adoption of optical sensors across a multitude of burgeoning applications, including industrial automation, advanced medical diagnostics, sophisticated biometric identification systems, and the rapidly evolving automotive sector, particularly in the realm of autonomous driving and driver-assistance systems. The expanding consumer electronics market, with its demand for smarter and more integrated devices, also plays a crucial role. Furthermore, advancements in sensor technology, leading to enhanced accuracy, miniaturization, and lower power consumption, are continuously expanding the potential use cases for optical sensors, making them indispensable components in modern technology.

Optical Sensor Industry Market Size (In Billion)

The market's dynamism is further shaped by key trends such as the increasing integration of AI and machine learning with optical sensor data for advanced analytics and decision-making, and the growing demand for high-performance optical sensors in challenging environmental conditions. Emerging technologies like LiDAR and advanced imaging sensors are unlocking new possibilities, especially in industrial inspection and robotics. While the market demonstrates strong growth potential, certain factors can influence its pace. Supply chain complexities and the rising cost of raw materials can pose moderate restraints. However, continuous innovation, strategic collaborations among leading players such as ROHM Co Ltd, Vishay Intertechnology Inc, and Honeywell International Inc, and a growing focus on miniaturization and energy efficiency are expected to mitigate these challenges, ensuring a favorable outlook for the optical sensor industry.

Optical Sensor Industry Company Market Share

Optical Sensor Industry: Market Analysis, Trends, and Forecast 2019–2033

Dive deep into the dynamic world of optical sensors with this comprehensive report. Explore market concentration, cutting-edge technological advancements, and key growth drivers shaping the future of optical sensor applications across industrial automation, medical devices, automotive safety, and consumer electronics. Understand the strategic landscape, identify emerging opportunities, and gain actionable insights to navigate this rapidly evolving market. This report provides a crucial outlook for sensor manufacturers, technology providers, investors, and industry stakeholders seeking to capitalize on the burgeoning demand for intelligent sensing solutions.

Optical Sensor Industry Market Concentration & Dynamics

The global optical sensor market exhibits a moderately concentrated landscape, characterized by a blend of large, established players and agile, innovative challengers. Key companies like ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, Keyence Corporation, SICK AG, IFM Efector Inc, Rockwell Automation Inc, Pepperl+Fuchs GmbH, STMicroelectronics NV, and On Semiconductor Corporation hold significant market share, driven by their extensive product portfolios, robust R&D investments, and strong distribution networks. The innovation ecosystem is vibrant, with continuous advancements in CMOS image sensors, LiDAR technology, and fiber optic sensors fueling product differentiation. Regulatory frameworks, while generally supportive of technological adoption for safety and efficiency, can vary by region, influencing product certification and market entry strategies. Substitute products, such as other sensing modalities, pose a minor threat due to the unique advantages offered by optical sensors in specific applications like non-contact measurement and high-resolution imaging. End-user trends are increasingly focused on miniaturization, increased accuracy, and integration with AI and IoT platforms, driving demand for smarter, more versatile optical sensors. Merger and acquisition (M&A) activities are observed, with strategic acquisitions aimed at expanding technological capabilities, market reach, and product offerings. For instance, the past few years have seen several strategic collaborations and smaller acquisitions focused on specialized optical sensing technologies.

Optical Sensor Industry Industry Insights & Trends

The optical sensor industry is poised for substantial growth, projected to reach a global market size of over $XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is fueled by a confluence of powerful market growth drivers, including the relentless pursuit of industrial automation and smart manufacturing, where photoelectric sensors and image sensors are integral to process control, quality inspection, and robotic guidance. The burgeoning healthcare sector's demand for advanced diagnostic and monitoring equipment, utilizing medical optical sensors for everything from blood analysis to patient monitoring, further bolsters market expansion. Furthermore, the automotive industry's rapid adoption of advanced driver-assistance systems (ADAS) and the push towards autonomous vehicles are creating unprecedented demand for sophisticated automotive optical sensors, including LiDAR and vision sensors. Consumer electronics, driven by advancements in smartphones, wearables, and smart home devices, also represent a significant growth avenue for ambient light and proximity sensors and biometric sensors. Technological disruptions are at the forefront of this growth. The development of higher resolution, lower power consumption, and more compact optical sensors, coupled with advancements in signal processing and AI integration, are enabling new applications and enhancing existing ones. Evolving consumer behaviors, such as the increasing demand for personalized experiences and convenience, are also influencing product development, pushing for sensors that can seamlessly integrate into daily life and provide intuitive interactions. The shift towards Industry 4.0 and the Internet of Things (IoT) ecosystems further amplifies the need for reliable and intelligent optical sensing solutions that can collect and transmit critical data for analysis and decision-making.

Key Markets & Segments Leading Optical Sensor Industry

The Industrial segment is currently the most dominant market for optical sensors, representing a substantial portion of the global market share. This dominance is driven by the widespread adoption of automation, robotics, and quality control across manufacturing industries worldwide. The increasing implementation of Industry 4.0 principles necessitates sophisticated sensing capabilities for efficient and precise operations.

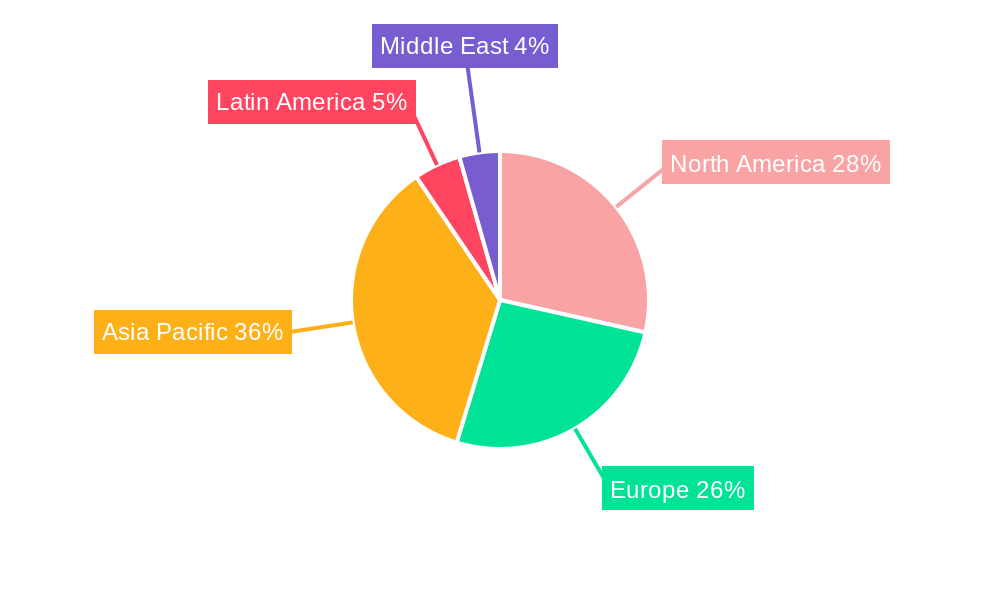

- Dominant Region: Asia Pacific

- Drivers: Robust manufacturing base, significant government initiatives promoting industrial automation and smart cities, and a burgeoning automotive sector contribute to the strong demand for optical sensors in countries like China, Japan, and South Korea. Rapid technological adoption and extensive infrastructure development further fuel this growth.

- Dominant Segment: Image Sensors

- Drivers: The ever-increasing demand for higher resolution imaging in surveillance, automotive, medical imaging, and consumer electronics makes image sensors a key growth area. Advancements in CMOS technology are enabling smaller, more power-efficient, and feature-rich image sensors.

- Dominant Segment: Photoelectric Sensors

- Drivers: Widely used in industrial automation for presence detection, counting, and sorting, photoelectric sensors are essential components of automated manufacturing processes. Their reliability, cost-effectiveness, and versatility ensure their continued market leadership.

- Dominant Segment: Automotive Applications

- Drivers: The rapid evolution of ADAS and the pursuit of autonomous driving are creating massive demand for various optical sensors, including LiDAR, radar, and vision sensors. Increasing safety regulations and consumer expectations for advanced safety features are accelerating this trend.

- Dominant Segment: Extrinsic Optical Sensors

- Drivers: These sensors, which rely on changes in external parameters to alter light properties, are widely used across various applications. Their ability to detect a broad range of physical phenomena makes them highly versatile and in demand.

Other significant segments contributing to market growth include Medical applications, driven by the need for advanced diagnostic and therapeutic devices, and Consumer Electronics, fueled by the proliferation of smart devices and wearables. Biometric sensors are also experiencing rapid growth, driven by the increasing demand for enhanced security and authentication solutions.

Optical Sensor Industry Product Developments

Recent product developments in the optical sensor industry highlight a strong focus on enhancing performance, enabling new functionalities, and expanding application scope. Innovations in 3D LiDAR sensors, as exemplified by the Lumotive and Gpixel partnership, are paving the way for next-generation autonomous navigation in robotics and mobility. These advancements in indirect time-of-flight imaging offer improved precision and flexibility for medium to long-range 3D applications. Simultaneously, Sony Corporation's announcement of the IMX675 CMOS image sensor for security cameras, offering simultaneous full-pixel output and high-speed area production, showcases advancements in image sensor technology that cater to demanding surveillance needs. These developments underscore a trend towards miniaturization, increased resolution, and integrated intelligence within optical sensor solutions, providing manufacturers with significant competitive advantages in a rapidly evolving market.

Challenges in the Optical Sensor Industry Market

Despite robust growth, the optical sensor industry faces several challenges that could impede its progress. High R&D costs associated with developing cutting-edge technologies like advanced LiDAR and high-resolution image sensors can be a significant barrier, particularly for smaller players. Supply chain disruptions, as experienced globally in recent years, can lead to material shortages and increased lead times, impacting production volumes and project timelines. Intense competition from both established giants and emerging innovators puts pressure on pricing and margins. Furthermore, the need for stringent quality control and rigorous testing, especially for applications in automotive and medical fields, adds complexity and cost to product development and manufacturing.

Forces Driving Optical Sensor Industry Growth

Several powerful forces are propelling the optical sensor industry forward. The widespread adoption of Industry 4.0 and the Internet of Things (IoT) mandates enhanced sensing capabilities for smart manufacturing, predictive maintenance, and efficient resource management. The automotive sector's relentless push towards advanced driver-assistance systems (ADAS) and autonomous driving is a significant catalyst, requiring a sophisticated array of optical sensors for perception and navigation. The increasing demand for advanced medical imaging and diagnostic tools, driven by an aging global population and advancements in healthcare technology, is creating substantial opportunities. Furthermore, the continuous innovation in consumer electronics, from smartphones to smart home devices, fuels the demand for miniaturized, high-performance optical sensors.

Challenges in the Optical Sensor Industry Market

While significant growth is anticipated, the optical sensor industry must navigate several long-term growth catalysts to fully realize its potential. The ongoing miniaturization trend demands innovative approaches to packaging and integration, enabling sensors to fit into increasingly compact devices. The integration of artificial intelligence (AI) and machine learning (ML) capabilities directly within sensor hardware will unlock new levels of intelligence and autonomy for optical sensing solutions. Strategic partnerships and collaborations between sensor manufacturers, software developers, and end-users will be crucial for developing comprehensive solutions tailored to specific industry needs. Market expansion into emerging economies, coupled with the development of cost-effective solutions for developing regions, will also be a key driver for sustained global growth.

Emerging Opportunities in Optical Sensor Industry

The optical sensor industry is ripe with emerging opportunities, driven by evolving technologies and consumer preferences. The expansion of the metaverse and augmented reality (AR)/virtual reality (VR) applications presents a significant opportunity for high-fidelity optical sensors that can accurately capture and replicate real-world environments. The growing demand for sustainable and energy-efficient solutions is driving the development of low-power optical sensors for various applications. Furthermore, the increasing focus on personalized medicine and wearable health monitoring devices will spur innovation in advanced optical sensing technologies for non-invasive diagnostics and continuous health tracking. The development of smart agriculture solutions, utilizing optical sensors for crop monitoring, soil analysis, and disease detection, also represents a burgeoning market.

Leading Players in the Optical Sensor Industry Sector

- ROHM Co Ltd

- Vishay Intertechnology Inc

- Honeywell International Inc

- Keyence Corporation

- SICK AG

- IFM Efector Inc

- Rockwell Automation Inc

- Pepperl+Fuchs GmbH

- STMicroelectronics NV

- On Semiconductor Corporation

Key Milestones in Optical Sensor Industry Industry

- October 2022: Lumotive and Gpixel partnered to launch a reference design platform comprising 3D lidar and CMOS image sensors. This platform enables companies to adopt next-generation 3D lidar sensors in mobility and industrial applications, such as autonomous navigation of robots in logistics environments. Gpixel's GTOF0503 indirect time-of-flight image sensor paired with Lumotive's LM10 beam steering chip provides a suitable solution for medium to long-range 3D applications, highlighting both precision and flexibility.

- July 2022: Sony Corporation announced the upcoming release of the IMX675, a 1/3-type CMOS image sensor for security cameras with approximately 5.12 megapixels. This sensor simultaneously delivers both full-pixel output of the captured image and high-speed production of areas of interest, catering to the demanding needs of modern surveillance systems.

Strategic Outlook for Optical Sensor Industry Market

The strategic outlook for the optical sensor industry remains exceptionally positive, driven by a continuous stream of technological innovation and expanding application frontiers. Future growth will be significantly accelerated by the widespread adoption of AI-powered optical sensors that offer enhanced data processing and decision-making capabilities at the edge. The increasing demand for miniaturized, power-efficient, and highly accurate sensors will foster further advancements in materials science and semiconductor manufacturing. Strategic opportunities lie in deepening integration with 5G networks to enable real-time data transmission and control for autonomous systems. Furthermore, focusing on niche markets such as advanced medical diagnostics, environmental monitoring, and smart agriculture will unlock substantial revenue streams. Continued investment in R&D, coupled with strategic partnerships across the value chain, will be paramount for companies aiming to maintain a competitive edge and capitalize on the transformative potential of optical sensing technologies.

Optical Sensor Industry Segmentation

-

1. Type

- 1.1. Extrinsic Optical Sensor

- 1.2. Intrinsic Optical Sensor

-

2. Sensor Type

- 2.1. Fiber Optic Sensor

- 2.2. Image Sensor

- 2.3. Photoelectric Sensor

- 2.4. Ambient Light and Proximity Sensor

-

3. Application

- 3.1. Industrial

- 3.2. Medical

- 3.3. Biometric

- 3.4. Automotive

- 3.5. Consumer Electronics

Optical Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of the Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of the Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of the Middle East

Optical Sensor Industry Regional Market Share

Geographic Coverage of Optical Sensor Industry

Optical Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Market Penetration of Smartphones; Increasing Demand for Power-saving Devices Across Industries; Increasing Market Penetration of Automation Techniques Across Various Industries

- 3.3. Market Restrains

- 3.3.1. Adoption of Power Transistors is Analyzed Pose a Challenge for the Market

- 3.4. Market Trends

- 3.4.1. Photoelectric Sensor is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Extrinsic Optical Sensor

- 5.1.2. Intrinsic Optical Sensor

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Fiber Optic Sensor

- 5.2.2. Image Sensor

- 5.2.3. Photoelectric Sensor

- 5.2.4. Ambient Light and Proximity Sensor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial

- 5.3.2. Medical

- 5.3.3. Biometric

- 5.3.4. Automotive

- 5.3.5. Consumer Electronics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Extrinsic Optical Sensor

- 6.1.2. Intrinsic Optical Sensor

- 6.2. Market Analysis, Insights and Forecast - by Sensor Type

- 6.2.1. Fiber Optic Sensor

- 6.2.2. Image Sensor

- 6.2.3. Photoelectric Sensor

- 6.2.4. Ambient Light and Proximity Sensor

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Industrial

- 6.3.2. Medical

- 6.3.3. Biometric

- 6.3.4. Automotive

- 6.3.5. Consumer Electronics

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Extrinsic Optical Sensor

- 7.1.2. Intrinsic Optical Sensor

- 7.2. Market Analysis, Insights and Forecast - by Sensor Type

- 7.2.1. Fiber Optic Sensor

- 7.2.2. Image Sensor

- 7.2.3. Photoelectric Sensor

- 7.2.4. Ambient Light and Proximity Sensor

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Industrial

- 7.3.2. Medical

- 7.3.3. Biometric

- 7.3.4. Automotive

- 7.3.5. Consumer Electronics

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Extrinsic Optical Sensor

- 8.1.2. Intrinsic Optical Sensor

- 8.2. Market Analysis, Insights and Forecast - by Sensor Type

- 8.2.1. Fiber Optic Sensor

- 8.2.2. Image Sensor

- 8.2.3. Photoelectric Sensor

- 8.2.4. Ambient Light and Proximity Sensor

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Industrial

- 8.3.2. Medical

- 8.3.3. Biometric

- 8.3.4. Automotive

- 8.3.5. Consumer Electronics

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Extrinsic Optical Sensor

- 9.1.2. Intrinsic Optical Sensor

- 9.2. Market Analysis, Insights and Forecast - by Sensor Type

- 9.2.1. Fiber Optic Sensor

- 9.2.2. Image Sensor

- 9.2.3. Photoelectric Sensor

- 9.2.4. Ambient Light and Proximity Sensor

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Industrial

- 9.3.2. Medical

- 9.3.3. Biometric

- 9.3.4. Automotive

- 9.3.5. Consumer Electronics

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Extrinsic Optical Sensor

- 10.1.2. Intrinsic Optical Sensor

- 10.2. Market Analysis, Insights and Forecast - by Sensor Type

- 10.2.1. Fiber Optic Sensor

- 10.2.2. Image Sensor

- 10.2.3. Photoelectric Sensor

- 10.2.4. Ambient Light and Proximity Sensor

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Industrial

- 10.3.2. Medical

- 10.3.3. Biometric

- 10.3.4. Automotive

- 10.3.5. Consumer Electronics

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Extrinsic Optical Sensor

- 11.1.2. Intrinsic Optical Sensor

- 11.2. Market Analysis, Insights and Forecast - by Sensor Type

- 11.2.1. Fiber Optic Sensor

- 11.2.2. Image Sensor

- 11.2.3. Photoelectric Sensor

- 11.2.4. Ambient Light and Proximity Sensor

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Industrial

- 11.3.2. Medical

- 11.3.3. Biometric

- 11.3.4. Automotive

- 11.3.5. Consumer Electronics

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Rest of the Europe

- 14. Asia Pacific Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Rest of the Asia Pacific

- 15. Latin America Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Mexico

- 15.1.3 Rest of the Latin America

- 16. Middle East Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. United Arab Emirates Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Saudi Arabia

- 17.1.2 Rest of the Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 ROHM Co Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Vishay Intertechnology Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Honeywell International Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Keyence Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 SICK AG

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 IFM Efector Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Rockwell Automation Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Pepperl+Fuchs GmbH

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 STMicroelectronics NV*List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 On Semiconductor Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 ROHM Co Ltd

List of Figures

- Figure 1: Global Optical Sensor Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 3: North America Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Europe Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Latin America Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: Middle East Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: United Arab Emirates Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: North America Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: North America Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 17: North America Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 18: North America Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: North America Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: North America Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: North America Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: Europe Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 25: Europe Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 26: Europe Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Europe Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Europe Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 29: Europe Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Asia Pacific Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 31: Asia Pacific Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 32: Asia Pacific Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 33: Asia Pacific Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 34: Asia Pacific Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 35: Asia Pacific Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Asia Pacific Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 39: Latin America Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 40: Latin America Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 41: Latin America Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 42: Latin America Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 43: Latin America Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 44: Latin America Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 45: Latin America Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 46: Middle East Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 47: Middle East Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 48: Middle East Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 49: Middle East Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 50: Middle East Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 51: Middle East Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 52: Middle East Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 53: Middle East Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 54: United Arab Emirates Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 55: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 56: United Arab Emirates Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 57: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 58: United Arab Emirates Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 59: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 60: United Arab Emirates Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 61: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 4: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Optical Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of the Europe Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: China Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: India Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of the Asia Pacific Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Brazil Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of the Latin America Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of the Middle East Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 30: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: United States Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Canada Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 36: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Germany Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: France Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of the Europe Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 43: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 44: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 45: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Japan Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of the Asia Pacific Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 51: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 52: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 53: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 54: Brazil Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: Mexico Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of the Latin America Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 58: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 59: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 60: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 61: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 62: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 63: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 64: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 65: Saudi Arabia Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of the Middle East Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Sensor Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Optical Sensor Industry?

Key companies in the market include ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, Keyence Corporation, SICK AG, IFM Efector Inc, Rockwell Automation Inc, Pepperl+Fuchs GmbH, STMicroelectronics NV*List Not Exhaustive, On Semiconductor Corporation.

3. What are the main segments of the Optical Sensor Industry?

The market segments include Type, Sensor Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Market Penetration of Smartphones; Increasing Demand for Power-saving Devices Across Industries; Increasing Market Penetration of Automation Techniques Across Various Industries.

6. What are the notable trends driving market growth?

Photoelectric Sensor is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Adoption of Power Transistors is Analyzed Pose a Challenge for the Market.

8. Can you provide examples of recent developments in the market?

October 2022 - Lumotiveand Gpixelpartnered to launch a reference design platform comprising 3D lidar and CMOS image sensors to enable companies to adopt next-generation 3D lidar sensors in mobility and industrial applications like autonomous navigation of robots in logistics environments. Gpixel'sGTOF0503 indirect time-of-flight image sensor pairing with Lumotive'sLM10 beam steering chip provides a suitable solution for medium to long-range 3D applications. It highlights both the precision and flexibility offered by Gpixel'ssensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Sensor Industry?

To stay informed about further developments, trends, and reports in the Optical Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence