Key Insights

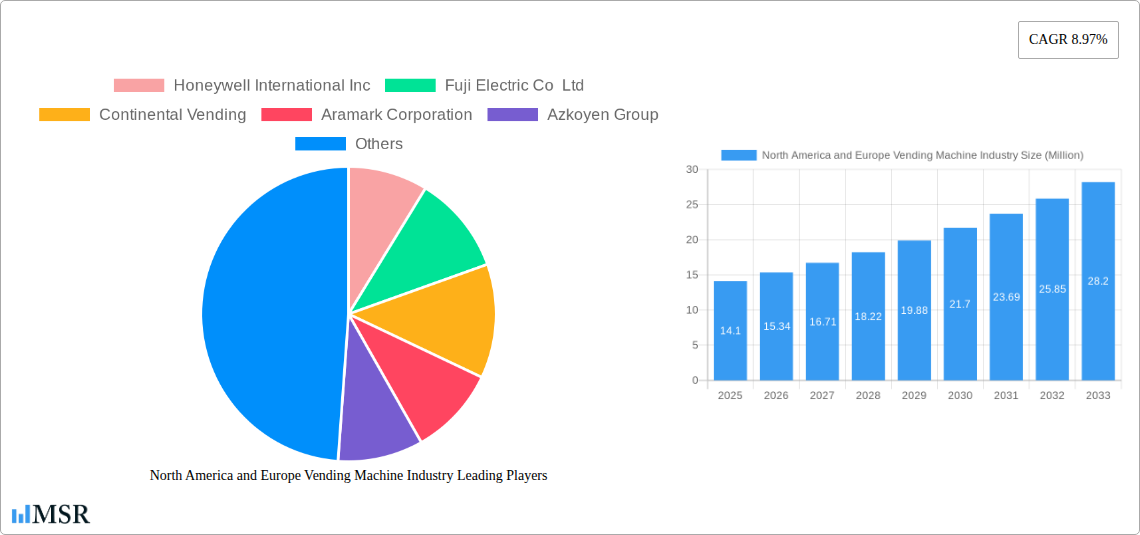

The North America and Europe vending machine industry is poised for significant expansion, driven by a robust market size of USD 14.10 Billion and an impressive Compound Annual Growth Rate (CAGR) of 8.97%. This growth is propelled by several key factors. The increasing demand for convenience and on-the-go consumption, particularly for beverages and packaged foods, is a primary driver. Technological advancements, such as cashless payment options, smart inventory management, and interactive touchscreens, are enhancing the user experience and operational efficiency for vending operators. Furthermore, the expanding presence of vending machines in diverse locations, including offices, commercial spaces, and institutional settings like hospitals and educational facilities, is broadening the market reach. The trend towards healthier snack and beverage options is also gaining traction, with operators adapting their offerings to cater to evolving consumer preferences, contributing to sustained market development.

North America and Europe Vending Machine Industry Market Size (In Million)

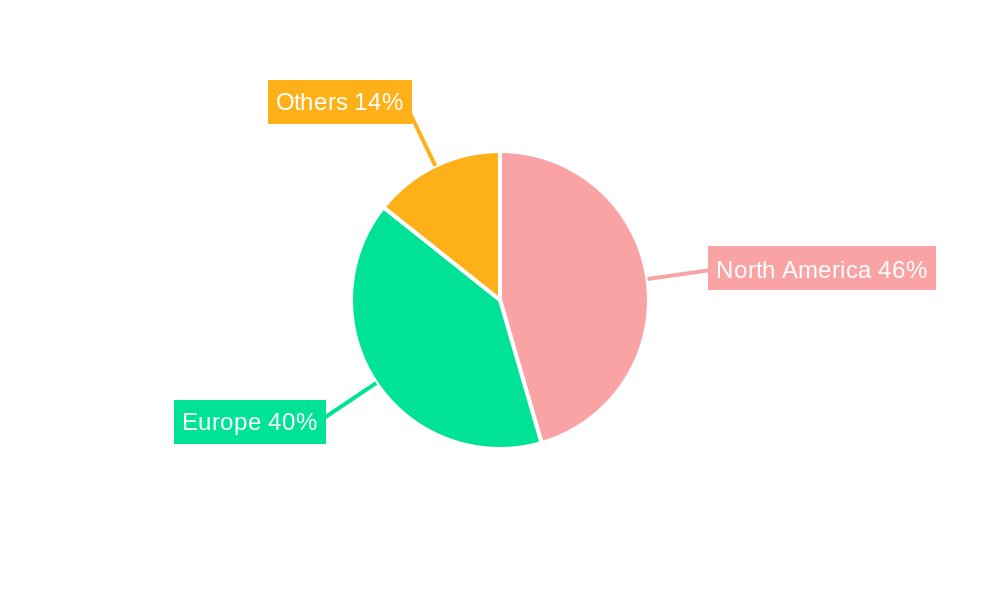

Despite the promising growth trajectory, certain restraints could influence the market's pace. These include the high initial investment costs for modern vending machines, potential maintenance challenges, and the ongoing competition from traditional retail channels and online food delivery services. However, the industry is actively mitigating these challenges through innovation and strategic partnerships. The market is segmented into key types like Beverages, Packaged Foods, and Others, with a significant focus on convenience and ready-to-consume items. Geographically, North America, led by the United States, and Europe, with major economies like Germany, the United Kingdom, and France, represent the dominant regions. The projected growth over the forecast period from 2025 to 2033 indicates a dynamic and evolving market, where companies like Honeywell International Inc., Fuji Electric Co. Ltd., and Aramark Corporation are key players investing in smart vending solutions to capitalize on emerging opportunities.

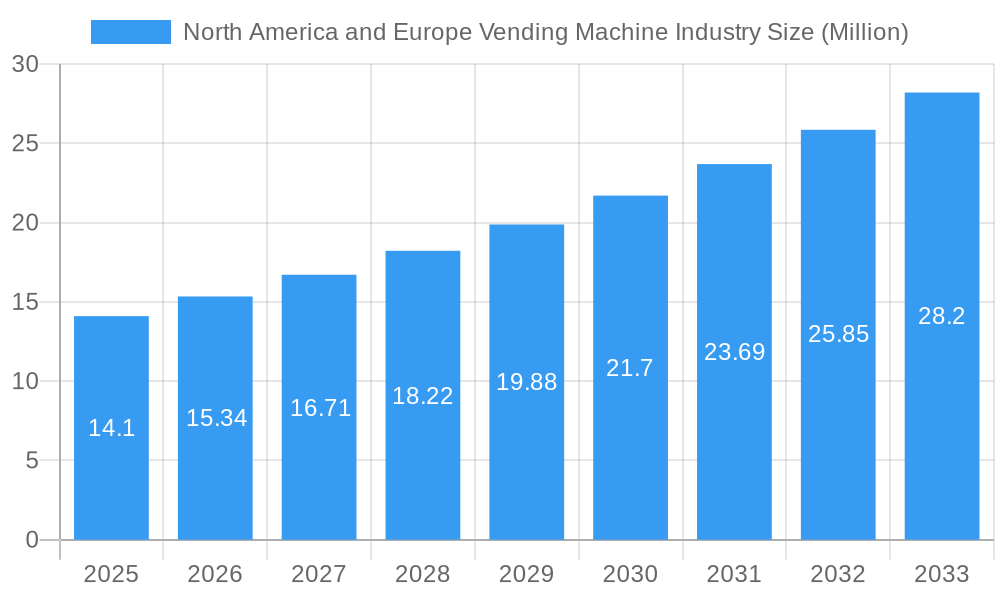

North America and Europe Vending Machine Industry Company Market Share

This comprehensive report delves into the dynamic North America and Europe vending machine industry, providing an in-depth analysis of market trends, growth drivers, challenges, and competitive landscapes. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers crucial insights for industry stakeholders, including manufacturers, operators, investors, and technology providers seeking to capitalize on the evolving vending solutions market. Our detailed forecast period (2025-2033) and historical analysis (2019-2024) equip you with the data to make informed strategic decisions in this rapidly advancing sector.

North America and Europe Vending Machine Industry Market Concentration & Dynamics

The North America and Europe vending machine industry exhibits a moderate level of market concentration, with key players like Honeywell International Inc., Fuji Electric Co Ltd., and Crane Merchandising Systems Inc. holding significant market share. The innovation ecosystem is robust, fueled by advancements in IoT, cashless payments, and smart vending technologies. Regulatory frameworks are generally supportive, though varying regional standards for food safety and data privacy can influence deployment. Substitute products, such as convenience stores and online food delivery, pose a competitive challenge, but the convenience and accessibility of vending machines continue to drive end-user adoption, particularly in high-traffic locations. M&A activities are strategically focused on acquiring innovative technologies and expanding market reach, with several notable deals in the historical period. The market share distribution among major players is expected to see shifts driven by technological adoption and expansion into new service verticals.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized providers.

- Innovation Ecosystem: Flourishing, driven by contactless payment solutions, AI-powered inventory management, and personalized consumer experiences.

- Regulatory Frameworks: Evolving to accommodate smart technologies and data security, with a focus on consumer protection and public health.

- Substitute Products: Convenience stores, cafes, and online retail present ongoing competition, necessitating differentiation through convenience and unique offerings.

- End-User Trends: Increasing demand for healthy options, personalized experiences, and immediate gratification.

- M&A Activities: Key strategies include technology acquisition, market consolidation, and expansion into new geographic territories and product categories.

North America and Europe Vending Machine Industry Industry Insights & Trends

The North America and Europe vending machine industry is poised for significant growth, projected to reach an estimated market size of USD XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This expansion is primarily driven by the escalating demand for convenience and immediate access to a diverse range of products, from beverages and packaged foods to innovative non-food items. Technological disruptions, including the integration of Internet of Things (IoT) capabilities, advanced telemetry, cashless payment systems, and AI-powered personalization, are revolutionizing the vending solutions market. These innovations enable operators to optimize inventory management, reduce downtime, and offer enhanced customer experiences through interactive touchscreens and mobile app integration. Evolving consumer behaviors, such as a growing preference for healthier snack options and specialty drinks, coupled with the increased need for contactless transactions, further fuel market growth. The proliferation of smart vending machines in various locations like office/commercial spaces, institutional settings, and public areas is a key trend. The industry is witnessing a rise in specialized vending machines catering to niche markets, such as fresh produce, pharmaceuticals, and personal care items. The ongoing digitization of retail is creating new avenues for vending machine deployment, transforming them into sophisticated retail touchpoints. The base year value for the North America and Europe vending machine industry stands at an estimated USD XX Million.

Key Markets & Segments Leading North America and Europe Vending Machine Industry

The Beverage segment is a dominant force within the North America and Europe vending machine industry, consistently outperforming other categories due to the universal and frequent demand for drinks, ranging from soft drinks and water to coffee and specialty beverages. Within the Office/Commercial location segment, vending machines have become indispensable, offering convenient refreshment and snack options for employees, thus boosting productivity and employee satisfaction. The strong economic growth in key markets like the United States, Germany, and the United Kingdom, coupled with a well-established infrastructure for retail and service delivery, underpins the market's robust performance.

- Dominant Segment (Type): Beverage

- Drivers:

- High consumer demand for on-the-go refreshment.

- Wide variety of product offerings, from traditional sodas to healthier alternatives and premium coffee.

- Impulse purchasing behavior.

- Technological advancements in refrigeration and dispensing for various beverage types.

- Drivers:

- Dominant Segment (Location): Office/Commercial

- Drivers:

- Need for convenient access to refreshments and snacks in workplaces.

- Enhancement of employee benefits and well-being programs.

- High foot traffic and captive audience.

- Integration with corporate wellness initiatives promoting healthier choices.

- Drivers:

- Emerging Segments & Future Potential: The Packaged Food segment is rapidly gaining traction, driven by consumer demand for convenient and ready-to-eat meals and snacks. Innovations in food preservation and packaging are enabling a wider range of perishable items to be vended. The Institutional location segment, encompassing schools, hospitals, and public transportation hubs, presents substantial growth opportunities due to the consistent need for accessible vending services. The "Others" category, including electronics, personal care items, and even apparel, is also expanding as manufacturers explore novel vending applications.

North America and Europe Vending Machine Industry Product Developments

Product innovation in the North America and Europe vending machine industry is a key differentiator. Companies are heavily investing in smart vending machines equipped with interactive touchscreens, cashless payment options (including mobile wallets and contactless cards), and IoT capabilities for remote monitoring and management. These advancements enable personalized consumer experiences, offering tailored product recommendations based on purchase history and even real-time data. The integration of AI and machine learning is further enhancing inventory management, predictive maintenance, and dynamic pricing strategies. These product developments are crucial for maintaining a competitive edge, increasing operational efficiency, and meeting the evolving demands of today's consumers for convenience and customization.

Challenges in the North America and Europe Vending Machine Industry Market

The North America and Europe vending machine industry faces several challenges that impact its growth trajectory. Regulatory hurdles, particularly concerning food safety standards and data privacy, can create complex compliance landscapes for operators. Supply chain issues, including the availability and cost of components, can disrupt production and increase operational expenses. Furthermore, intense competitive pressures from traditional retail channels and the growing demand for personalized online services necessitate continuous innovation and strategic adaptation. The significant capital investment required for implementing advanced smart vending solutions can also be a barrier for smaller operators.

Forces Driving North America and Europe Vending Machine Industry Growth

Several powerful forces are propelling the growth of the North America and Europe vending machine industry. The undeniable demand for convenience and immediate access to products remains a primary driver, especially in urban and high-traffic areas. Technological advancements, particularly in IoT integration, cashless payment systems, and data analytics, are transforming vending machines into smart, efficient retail points. The increasing consumer preference for healthy and specialized food and beverage options is opening up new product categories. Furthermore, the growing adoption of contactless payment solutions aligns perfectly with modern consumer habits, enhancing the user experience and security.

Challenges in the North America and Europe Vending Machine Industry Market

Long-term growth catalysts in the North America and Europe vending machine industry are multifaceted. The ongoing trend towards urbanization and increased population density in cities creates a consistent demand for convenient vending solutions. Strategic partnerships between vending operators and technology providers are crucial for driving innovation in areas like AI-powered personalization and predictive maintenance. Market expansions into underserved areas and niche sectors, such as airports, healthcare facilities, and educational institutions, represent significant growth opportunities. Furthermore, the development of sustainable and eco-friendly vending machine designs is becoming increasingly important for consumer appeal and regulatory compliance.

Emerging Opportunities in North America and Europe Vending Machine Industry

Emerging opportunities within the North America and Europe vending machine industry are abundant and diverse. The rise of autonomous retail presents a significant avenue, with smart vending machines evolving into micro-stores offering a wider array of products. The growing interest in personalized consumer experiences allows for tailored product offerings and loyalty programs delivered through vending machines. Expanding into emerging markets within Europe and North America with unique consumer needs, such as specialized dietary products or local artisanal goods, offers untapped potential. Furthermore, the integration of vending machines with e-commerce platforms for pre-ordering and collection points creates a seamless omnichannel experience.

Leading Players in the North America and Europe Vending Machine Industry Sector

- Honeywell International Inc.

- Fuji Electric Co Ltd.

- Continental Vending

- Aramark Corporation

- Azkoyen Group

- Crane Merchandising Systems Inc.

- Bulk Vending Systems

- Sanden Holdings Corporation

- Compass Group Plc

- Evoca Group

- Automated Merchandising Systems

- Azkoyen Vending Systems

- Selecta Compass Group

- American Vending Machines

Key Milestones in North America and Europe Vending Machine Industry Industry

- April 2022: Lush, the British cosmetics company, established a 24-hour vending machine in London's Coal Drop's Yard, offering customers 24/7 access to its products, highlighting the expansion of vending into non-traditional retail.

- September 2021: Global technology company Glory launched an IoT-enabled vending solution with Deutsche Bahn, Germany's largest railway operator. Passengers at Munich-area stations can pre-select fresh, locally sourced produce via a web app, with detailed ingredient and allergen information displayed, showcasing the trend towards transparency and digital integration in food vending.

Strategic Outlook for North America and Europe Vending Machine Industry Market

The strategic outlook for the North America and Europe vending machine industry is highly positive, driven by sustained technological innovation and evolving consumer demands. Growth accelerators include the continued adoption of smart vending technologies, such as AI-driven personalization and contactless payment integration, which enhance operational efficiency and customer engagement. The increasing focus on health and wellness will spur the development of vending machines offering a wider range of nutritious and specialized products. Strategic opportunities lie in expanding into new sectors like healthcare and education, and in forging partnerships with e-commerce platforms to create hybrid retail models. The industry's ability to adapt to changing consumer preferences for convenience, speed, and unique experiences will be critical for future market leadership.

North America and Europe Vending Machine Industry Segmentation

-

1. Type

- 1.1. Beverage

- 1.2. Packaged Food

- 1.3. Others

-

2. Location

- 2.1. Office/Commercial

- 2.2. Institutional

- 2.3. Others

North America and Europe Vending Machine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

North America and Europe Vending Machine Industry Regional Market Share

Geographic Coverage of North America and Europe Vending Machine Industry

North America and Europe Vending Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Cost of Maintenance

- 3.4. Market Trends

- 3.4.1. Food Vending Machines are Expected to Witness a High Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beverage

- 5.1.2. Packaged Food

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Office/Commercial

- 5.2.2. Institutional

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beverage

- 6.1.2. Packaged Food

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Location

- 6.2.1. Office/Commercial

- 6.2.2. Institutional

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe North America and Europe Vending Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beverage

- 7.1.2. Packaged Food

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Location

- 7.2.1. Office/Commercial

- 7.2.2. Institutional

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Honeywell International Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Fuji Electric Co Ltd

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Continental Vending

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Aramark Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Azkoyen Group

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Crane Merchandising Systems Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Bulk Vending Systems

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Sanden Holdings Corporation

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 CompassGroupPlc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Evoca Group

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Automated Merchandising Systems

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Azkoyen Vending Systems

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Selecta Compass Group

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 American Vending Machines

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America and Europe Vending Machine Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America and Europe Vending Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: North America and Europe Vending Machine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America and Europe Vending Machine Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 4: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 5: North America and Europe Vending Machine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America and Europe Vending Machine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: North America and Europe Vending Machine Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 10: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 11: North America and Europe Vending Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: North America and Europe Vending Machine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: North America and Europe Vending Machine Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 22: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 23: North America and Europe Vending Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America and Europe Vending Machine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe North America and Europe Vending Machine Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe North America and Europe Vending Machine Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America and Europe Vending Machine Industry?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the North America and Europe Vending Machine Industry?

Key companies in the market include Honeywell International Inc, Fuji Electric Co Ltd, Continental Vending, Aramark Corporation, Azkoyen Group, Crane Merchandising Systems Inc, Bulk Vending Systems, Sanden Holdings Corporation, CompassGroupPlc, Evoca Group, Automated Merchandising Systems, Azkoyen Vending Systems, Selecta Compass Group, American Vending Machines.

3. What are the main segments of the North America and Europe Vending Machine Industry?

The market segments include Type, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

Food Vending Machines are Expected to Witness a High Market Growth..

7. Are there any restraints impacting market growth?

; High Initial Investment and Cost of Maintenance.

8. Can you provide examples of recent developments in the market?

April 2022 - Lush, the British cosmetics company, established a 24-hour vending machine where customers can buy its goods anytime or at night. The vending machine is located in London's Coal Drop's Yard, just a ten-minute walk from King's Cross Station, one of the city's busiest rail stations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America and Europe Vending Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America and Europe Vending Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America and Europe Vending Machine Industry?

To stay informed about further developments, trends, and reports in the North America and Europe Vending Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence