Key Insights

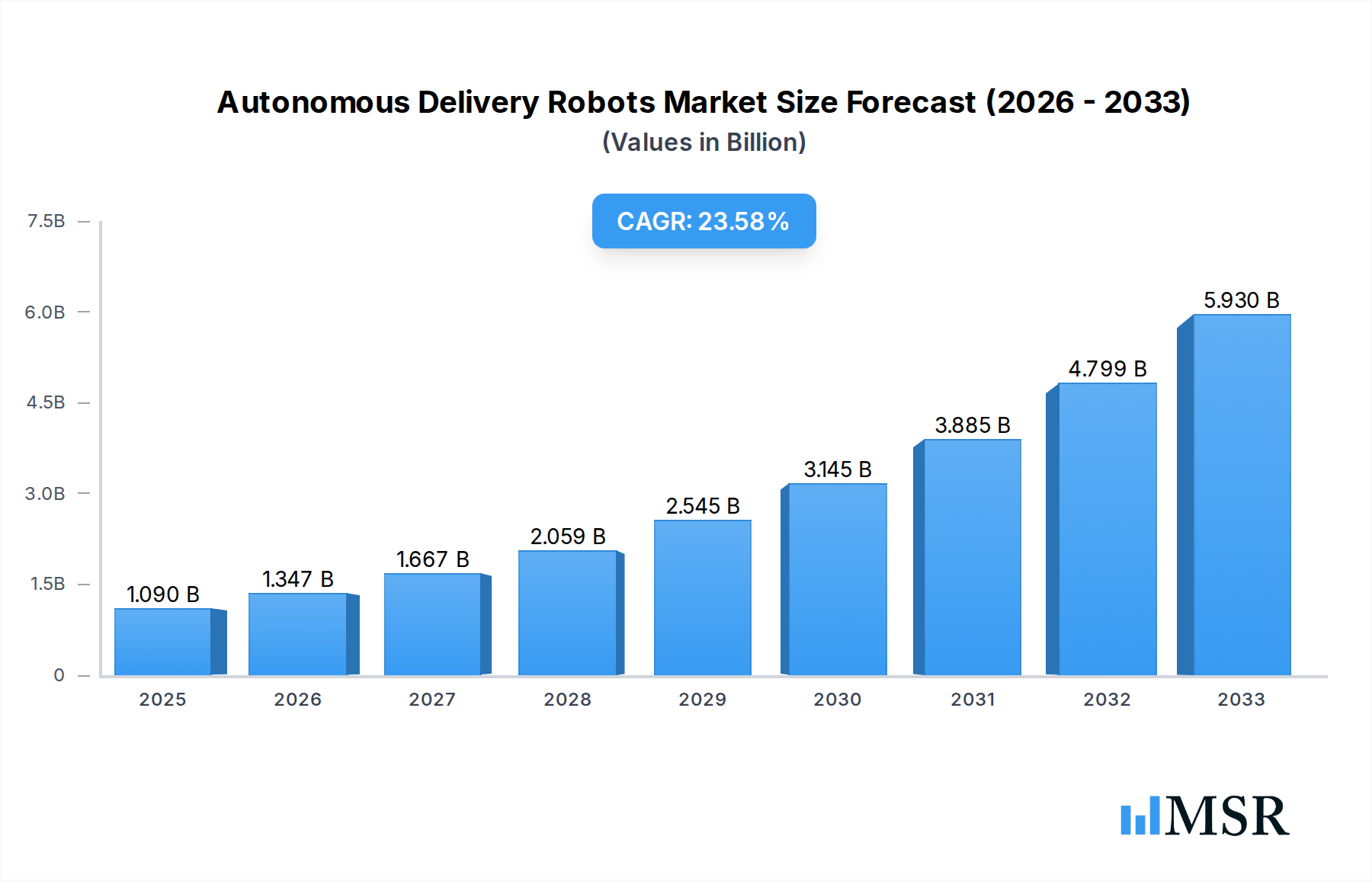

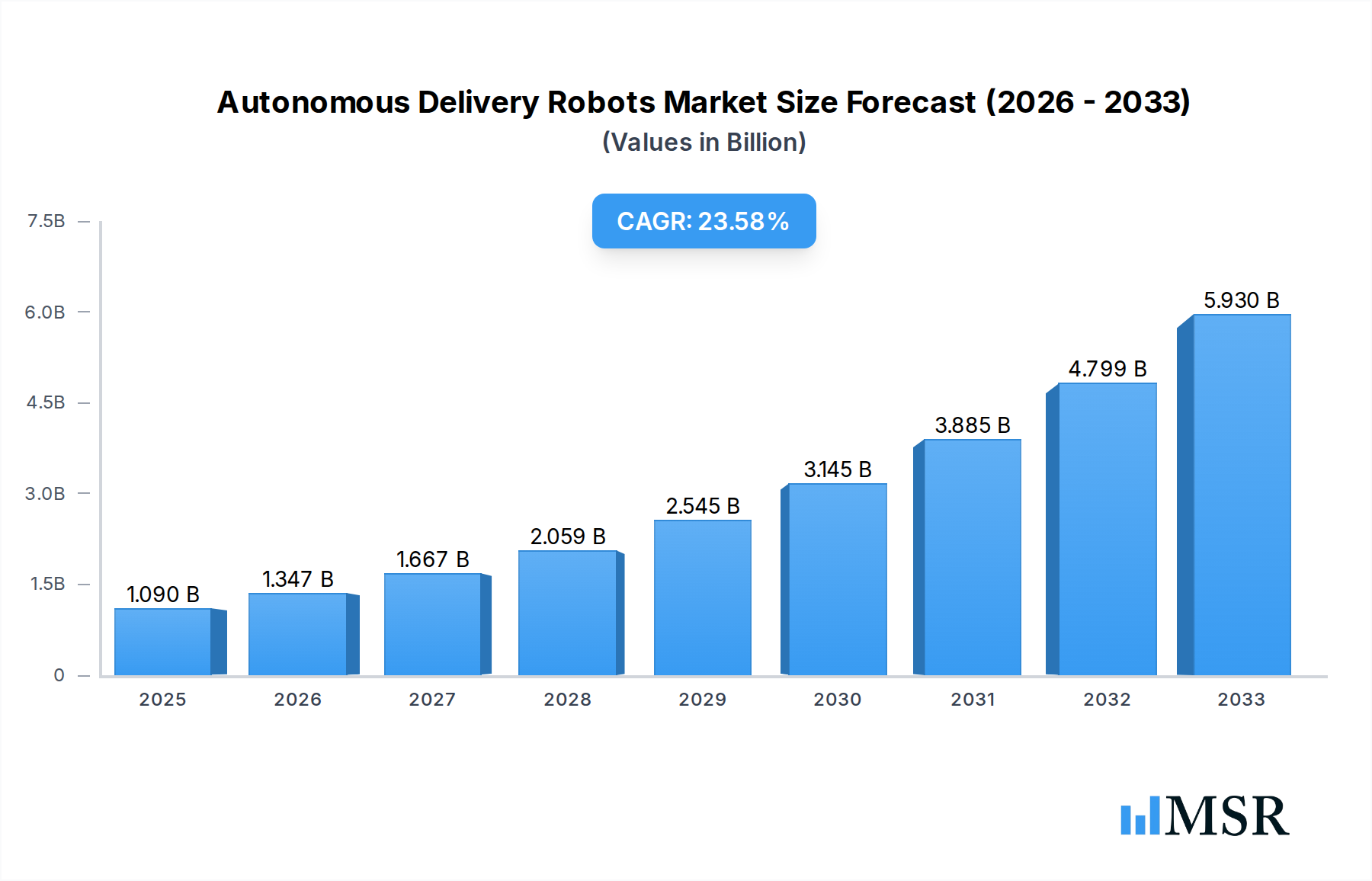

The global Autonomous Delivery Robots Market is poised for significant expansion, with an estimated market size of 1090 Million in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 23.61% through 2033. This impressive growth trajectory is fueled by a confluence of factors, including escalating demand for faster and more efficient last-mile delivery solutions across diverse sectors. Key drivers of this surge include the increasing adoption of e-commerce, the need for contactless delivery in light of public health concerns, and advancements in artificial intelligence and robotics technology that enhance the capabilities and affordability of autonomous delivery robots. The market's expansion is also significantly influenced by evolving consumer expectations for convenience and speed, pushing businesses to invest in innovative logistics solutions. Furthermore, a growing emphasis on operational efficiency and cost reduction within industries like healthcare, hospitality, and retail logistics presents a fertile ground for the widespread deployment of these advanced robotic systems.

Autonomous Delivery Robots Market Market Size (In Billion)

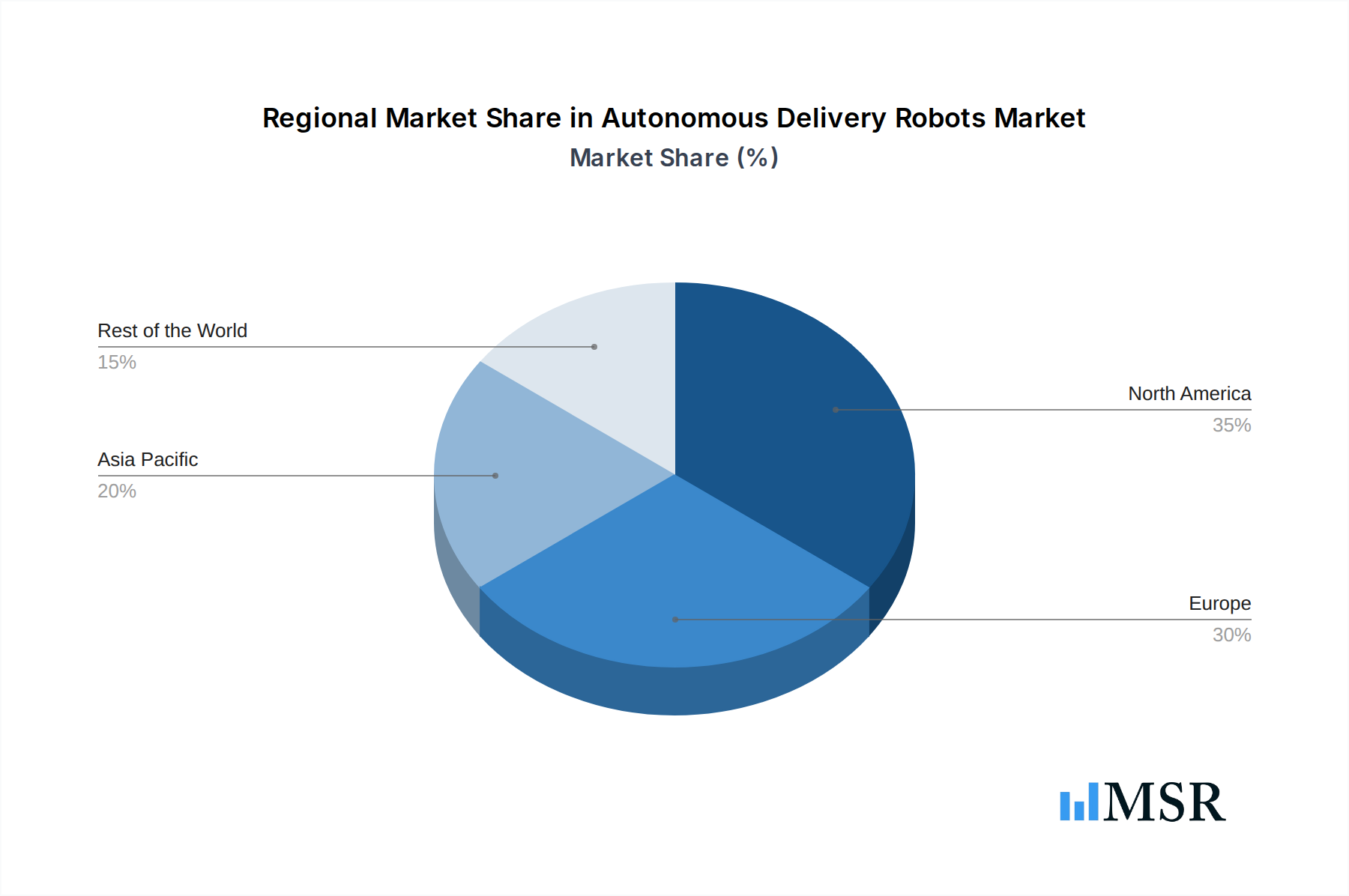

The market is segmented by end-users, with Healthcare, Hospitality, and Retail & Logistics standing out as major beneficiaries and adopters. The Healthcare sector is leveraging autonomous robots for the secure and timely transport of medications, lab samples, and medical supplies, improving patient care and operational workflows. In Hospitality, these robots are streamlining services by delivering food, beverages, and amenities directly to guest rooms, enhancing guest experience and reducing staff workload. The Retail & Logistics sector is witnessing a revolutionary shift, with autonomous robots optimizing inventory management, last-mile delivery of goods, and warehouse operations, leading to substantial improvements in speed and cost-effectiveness. While the market presents immense opportunities, potential restraints such as regulatory hurdles, public perception, and the initial investment costs for widespread adoption need to be strategically addressed. Leading companies like Nuro Inc., Starship Technologies, and Serve Robotics Inc. are at the forefront, driving innovation and shaping the future of automated delivery. Regionally, North America and Europe are expected to lead the market adoption due to their advanced technological infrastructure and strong e-commerce penetration, with Asia Pacific showing rapid growth potential.

Autonomous Delivery Robots Market Company Market Share

Autonomous Delivery Robots Market: Revolutionizing Last-Mile Delivery & Logistics (2025-2033)

Unlock the future of efficient and sustainable delivery with our comprehensive report on the Autonomous Delivery Robots Market. This in-depth analysis provides unparalleled insights into the burgeoning autonomous delivery solutions sector, exploring technological advancements, market dynamics, and strategic opportunities shaping this transformative industry. Discover how autonomous robots are redefining last-mile delivery across healthcare, hospitality, and retail & logistics, driving significant growth and innovation. Our report, covering the historical period of 2019-2024 and projecting to 2033 with a base year of 2025, delivers actionable intelligence for stakeholders, investors, and industry leaders.

Autonomous Delivery Robots Market Market Concentration & Dynamics

The Autonomous Delivery Robots Market is characterized by a dynamic blend of innovation and strategic consolidation, exhibiting moderate market concentration with a significant number of emerging players alongside established technology firms. The innovation ecosystem is thriving, fueled by substantial investment in AI, sensor technology, and navigation systems. Regulatory frameworks are evolving globally, with some regions actively promoting pilot programs while others maintain cautious oversight. Substitute products, such as traditional delivery vans and human couriers, are facing increasing pressure from the cost-effectiveness and efficiency of autonomous solutions. End-user trends reveal a strong adoption curve in sectors demanding rapid, on-demand deliveries, particularly healthcare for medical supplies and retail for e-commerce fulfillment. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to acquire innovative technologies and market share, indicating a maturing market landscape. Key M&A deals and partnerships are expected to further consolidate the market in the coming years.

Autonomous Delivery Robots Market Industry Insights & Trends

The Autonomous Delivery Robots Market is poised for exponential growth, driven by escalating demand for efficient and cost-effective last-mile delivery solutions. The global market size for autonomous delivery robots is projected to reach an estimated $25,000 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This significant expansion is underpinned by several key trends: the rapid growth of e-commerce, the increasing need for contactless delivery options, and advancements in artificial intelligence and robotics. Technological disruptions, including enhanced AI-powered navigation, improved battery life, and sophisticated sensor arrays, are making autonomous delivery robots more viable and scalable for diverse applications. Evolving consumer behaviors, such as a preference for faster delivery times and the convenience of on-demand services, are further accelerating adoption. The integration of these robots into urban logistics networks promises to reduce traffic congestion, lower carbon emissions, and enhance the overall efficiency of supply chains. As the technology matures and regulatory landscapes become more favorable, the autonomous delivery robots market is set to become a cornerstone of future logistics operations.

Key Markets & Segments Leading Autonomous Delivery Robots Market

The Retail & Logistics segment is a dominant force in the Autonomous Delivery Robots Market, spearheading adoption and innovation. This dominance is fueled by the massive growth of e-commerce, demanding rapid and efficient last-mile delivery solutions. The economic growth in developed and emerging economies, coupled with increasing urbanization, further bolsters the need for streamlined logistics.

- Drivers for Retail & Logistics Dominance:

- E-commerce Boom: The persistent rise in online shopping necessitates faster, more cost-effective delivery.

- Labor Shortages & Costs: Autonomous robots offer a solution to increasing labor costs and a shortage of delivery personnel.

- Last-Mile Efficiency: Robots are optimized for short-distance, high-frequency deliveries, improving last-mile efficiency significantly.

- Customer Expectations: Consumers demand quicker delivery times, pushing businesses to adopt advanced solutions.

- Infrastructure Readiness: Urban areas with well-developed road networks and accessible sidewalks are ideal for robot deployment.

While Healthcare is a rapidly growing segment, driven by the critical need for timely medical supply and prescription deliveries, and Hospitality is emerging with potential for in-room and on-premise delivery services, the sheer volume and existing infrastructure of retail and logistics operations currently position it as the leading market. The scalability and immediate return on investment opportunities within retail and logistics are driving substantial investment and deployment, solidifying its leading position in the Autonomous Delivery Robots Market.

Autonomous Delivery Robots Market Product Developments

Product development in the Autonomous Delivery Robots Market is rapidly advancing, focusing on enhancing robot capabilities, payload capacity, and operational efficiency. Innovations include improved obstacle avoidance, advanced mapping and localization technologies, and extended battery life for longer operational ranges. Many robots are now designed with modular compartments to cater to diverse delivery needs, from groceries and pharmaceuticals to restaurant meals. The emphasis is on creating robust, weather-resistant designs that can navigate various urban terrains, including sidewalks and pedestrian pathways. Competitive edges are being sharpened through AI-driven route optimization, secure package delivery mechanisms, and user-friendly interfaces for both senders and recipients.

Challenges in the Autonomous Delivery Robots Market Market

- Regulatory Hurdles: Navigating a patchwork of evolving local and national regulations concerning autonomous vehicle operation, especially on public sidewalks.

- Public Acceptance & Safety Concerns: Overcoming public apprehension regarding the safety and integration of robots in public spaces, and addressing potential vandalism.

- Infrastructure Limitations: Reliance on predictable infrastructure, with potential issues arising from uneven terrain, construction zones, or poorly maintained sidewalks.

- Cybersecurity Threats: Protecting sensitive data and ensuring the secure operation of robots against hacking and unauthorized access.

- Scalability & Cost-Effectiveness: Achieving widespread adoption requires significant upfront investment and proving long-term cost-effectiveness compared to traditional methods, estimated at a barrier of $500 Million for initial large-scale deployments.

Forces Driving Autonomous Delivery Robots Market Growth

The growth of the Autonomous Delivery Robots Market is propelled by a confluence of powerful forces. Technologically, advancements in AI, machine learning, sensor fusion, and battery technology are enabling more capable and reliable robots. Economically, the surge in e-commerce and the demand for faster, cheaper delivery options are creating a compelling business case. Furthermore, the rising labor costs and the persistent shortage of delivery personnel globally make autonomous solutions increasingly attractive. Regulatory bodies are beginning to establish frameworks that support pilot programs and eventual widespread deployment, recognizing the potential for reduced traffic congestion and emissions. The increasing focus on sustainability and environmental consciousness also favors the adoption of electric-powered autonomous robots.

Challenges in the Autonomous Delivery Robots Market Market

Long-term growth catalysts for the Autonomous Delivery Robots Market hinge on continuous innovation and strategic market penetration. The development of advanced AI for complex urban navigation, including handling unpredictable pedestrian behavior and diverse weather conditions, will be crucial. Strategic partnerships between robot manufacturers, logistics companies, and retailers are essential for scaling operations and optimizing delivery networks. Market expansion into new geographical regions and vertical industries, such as manufacturing and industrial site deliveries, presents significant growth potential. Furthermore, the integration of autonomous delivery robots with smart city infrastructure and IoT devices will unlock new efficiencies and service possibilities, paving the way for a truly connected logistics ecosystem.

Emerging Opportunities in Autonomous Delivery Robots Market

Emerging opportunities in the Autonomous Delivery Robots Market are vast and varied. The expansion into specialized delivery niches, such as pharmacy deliveries for prescription drugs and medical supplies, represents a high-value market. The integration of robots with drone technology for multi-modal delivery solutions offers further efficiency gains. The development of robots capable of handling heavier payloads or specialized goods, like refrigerated items, will unlock new commercial avenues. Furthermore, the growing demand for sustainable logistics solutions presents an opportunity for companies to position their autonomous robots as an environmentally friendly alternative. Exploring partnerships with smart city initiatives and leveraging data analytics for predictive delivery and route optimization will also be key to capitalizing on future growth.

Leading Players in the Autonomous Delivery Robots Market Sector

- Nuro Inc

- TeleRetail (Aitonomi AG)

- Segway Robotics Inc

- Relay Robotics Inc

- Serve Robotics Inc

- Starship Technologies

- Ottonomy IO

- Neolix

- Eliport

- Aethon Inc

- Kiwibot

- Postmates Inc

Key Milestones in Autonomous Delivery Robots Market Industry

- January 2023: Ottonomy launched autonomous delivery robots at Cincinnati/Northern Kentucky, Rome Fiumicino International Airport, and Pittsburgh. In addition, Ottonomy robots are utilized by Posten Norge in Norway, Oslo, and Goggo in Madrid, Spain, for automating first-mile and last-mile deliveries. Ottonomy is also working with industry partners in Canada and Saudi Arabia, with more launches planned for 2023 in Europe, the USA, and Asia.

- September 2022: Magna, an international mobility technology firm, and Cartken, a San Francisco-based autonomous robotics firm, announced a partnership in which Magna will produce Cartken's autonomous delivery robot fleet to address the growing demand for last-mile deliveries.

Strategic Outlook for Autonomous Delivery Robots Market Market

The strategic outlook for the Autonomous Delivery Robots Market is exceptionally positive, driven by accelerating technological maturity and increasing market demand. Future growth accelerators include the wider adoption of standardized charging infrastructure, the development of more robust cybersecurity protocols to ensure secure operations, and enhanced AI algorithms for complex urban environments. Strategic opportunities lie in forming synergistic partnerships across the supply chain, from manufacturers to end-users, to streamline deployment and service. The market will likely see increased investment in research and development, focusing on miniaturization, increased payload capacity, and multi-terrain capabilities. Companies that can effectively navigate regulatory landscapes and demonstrate clear ROI will be best positioned for sustained success and significant market share gains in this rapidly evolving sector.

Autonomous Delivery Robots Market Segmentation

-

1. End Users

- 1.1. Healthcare

- 1.2. Hospitality

- 1.3. Retail & Logistics

Autonomous Delivery Robots Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Autonomous Delivery Robots Market Regional Market Share

Geographic Coverage of Autonomous Delivery Robots Market

Autonomous Delivery Robots Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need to Manage Last-mile Deliveries; Growing Automation in the Logistics Industry

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation

- 3.4. Market Trends

- 3.4.1. Healthcare Segment is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Users

- 5.1.1. Healthcare

- 5.1.2. Hospitality

- 5.1.3. Retail & Logistics

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End Users

- 6. North America Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End Users

- 6.1.1. Healthcare

- 6.1.2. Hospitality

- 6.1.3. Retail & Logistics

- 6.1. Market Analysis, Insights and Forecast - by End Users

- 7. Europe Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End Users

- 7.1.1. Healthcare

- 7.1.2. Hospitality

- 7.1.3. Retail & Logistics

- 7.1. Market Analysis, Insights and Forecast - by End Users

- 8. Asia Pacific Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End Users

- 8.1.1. Healthcare

- 8.1.2. Hospitality

- 8.1.3. Retail & Logistics

- 8.1. Market Analysis, Insights and Forecast - by End Users

- 9. Rest of the World Autonomous Delivery Robots Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End Users

- 9.1.1. Healthcare

- 9.1.2. Hospitality

- 9.1.3. Retail & Logistics

- 9.1. Market Analysis, Insights and Forecast - by End Users

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nuro Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TeleRetail (Aitonomi AG)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Segway Robotics Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Relay Robotics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Serve Robotics Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Starship Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ottonomy IO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Neolix*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Eliport

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aethon Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kiwibot

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Postmates Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Nuro Inc

List of Figures

- Figure 1: Global Autonomous Delivery Robots Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Delivery Robots Market Revenue (Million), by End Users 2025 & 2033

- Figure 3: North America Autonomous Delivery Robots Market Revenue Share (%), by End Users 2025 & 2033

- Figure 4: North America Autonomous Delivery Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Autonomous Delivery Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Autonomous Delivery Robots Market Revenue (Million), by End Users 2025 & 2033

- Figure 7: Europe Autonomous Delivery Robots Market Revenue Share (%), by End Users 2025 & 2033

- Figure 8: Europe Autonomous Delivery Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Autonomous Delivery Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Autonomous Delivery Robots Market Revenue (Million), by End Users 2025 & 2033

- Figure 11: Asia Pacific Autonomous Delivery Robots Market Revenue Share (%), by End Users 2025 & 2033

- Figure 12: Asia Pacific Autonomous Delivery Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Autonomous Delivery Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Autonomous Delivery Robots Market Revenue (Million), by End Users 2025 & 2033

- Figure 15: Rest of the World Autonomous Delivery Robots Market Revenue Share (%), by End Users 2025 & 2033

- Figure 16: Rest of the World Autonomous Delivery Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Autonomous Delivery Robots Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 2: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 4: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 6: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 8: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Autonomous Delivery Robots Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 10: Global Autonomous Delivery Robots Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Delivery Robots Market?

The projected CAGR is approximately 23.61%.

2. Which companies are prominent players in the Autonomous Delivery Robots Market?

Key companies in the market include Nuro Inc, TeleRetail (Aitonomi AG), Segway Robotics Inc, Relay Robotics Inc, Serve Robotics Inc, Starship Technologies, Ottonomy IO, Neolix*List Not Exhaustive, Eliport, Aethon Inc, Kiwibot, Postmates Inc.

3. What are the main segments of the Autonomous Delivery Robots Market?

The market segments include End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Need to Manage Last-mile Deliveries; Growing Automation in the Logistics Industry.

6. What are the notable trends driving market growth?

Healthcare Segment is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation.

8. Can you provide examples of recent developments in the market?

January 2023: Ottonomy launched autonomous delivery robots at Cincinnati/Northern Kentucky, Rome Fiumicino International Airport, and Pittsburgh. In addition, Ottonomy robots are utilized by Posten Norge in Norway, Oslo, and Goggo in Madrid, Spain, for automating first-mile and last-mile deliveries. Ottonomy is also working with industry partners in Canada and Saudi Arabia, with more launches planned for 2023 in Europe, the USA, and Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Delivery Robots Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Delivery Robots Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Delivery Robots Market?

To stay informed about further developments, trends, and reports in the Autonomous Delivery Robots Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence